Professional Documents

Culture Documents

37993-2012-Further Amendments To Revenue Regulations20180309-6791-Rt5edm PDF

Uploaded by

Aleezah Gertrude Raymundo0 ratings0% found this document useful (0 votes)

29 views2 pagesOriginal Title

37993-2012-Further_Amendments_to_Revenue_Regulations20180309-6791-rt5edm.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views2 pages37993-2012-Further Amendments To Revenue Regulations20180309-6791-Rt5edm PDF

Uploaded by

Aleezah Gertrude RaymundoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

May 11, 2012

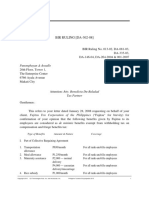

REVENUE REGULATIONS NO. 08-12

SUBJECT : Further Amendments to Revenue Regulations Nos. 2-98 and 3-98, as

Last Amended by Revenue Regulations Nos. 5-2008 and 5-2011,

with Respect to "De Minimis Benefits"

TO : All Internal Revenue Officials and Others Concerned

Pursuant to Sections 4 and 244 in relation to Section 33 of the Tax Code of 1997

and the FY 2012 General Appropriations Act, these Regulations are hereby promulgated

to further amend Revenue Regulations (RR) No. 2-98, as last amended by RR Nos. 5-

2008 and 5-2011, with respect to "De Minimis" bene ts which are exempt from income

tax on compensation as well as from fringe benefit tax. EIASDT

SECTION 1. Section 2.78.1 (A) (3) (e) of RR 2-98, as last amended by RR 5-

2008, is hereby further amended to read as follows:

"Sec. 2.78.1. Withholding Tax on Compensation Income. —

(A) ...

xxx xxx xxx

(3) Facilities and privileges of relatively small value. —

xxx xxx xxx

(e) Uniform and Clothing allowance not exceeding P5,000 per annum;

xxx xxx xxx"

SECTION 2. Section 2.33 (C) (e) of RR 3-98, as last amended by RR 5-2008, is

hereby further amended to read as follows:

"Sec. 2.33. Special Treatment of Fringe Benefits. —

xxx xxx xxx

(C) Fringe Benefits Not Subject to Fringe Benefit Tax. —

xxx xxx xxx

(e) Uniform and Clothing allowance not exceeding P5,000 per annum;

xxx xxx xxx"

SECTION 3. Repealing Clause. — All existing rules and regulations and other

issuances or parts thereof which are inconsistent with the provisions of these

Regulations are hereby modified, amended or revoked accordingly.

SECTION 4. Effectivity. — These Regulations shall take effect starting

January 1, 2012. cHDAIS

(SGD.) CESAR V. PURISIMA

Secretary of Finance

CD Technologies Asia, Inc. 2018 cdasiaonline.com

Recommending Approval:

(SGD.) KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

Published in Manila Bulletin on May 14, 2012.

CD Technologies Asia, Inc. 2018 cdasiaonline.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BIR Ruling 302-08 - Funeral AssistanceDocument13 pagesBIR Ruling 302-08 - Funeral AssistanceJerwin DaveNo ratings yet

- Baguilat vs. Alvarez DigestDocument1 pageBaguilat vs. Alvarez DigestAli67% (3)

- Bir Ruling (Da 146 04)Document4 pagesBir Ruling (Da 146 04)cool_peachNo ratings yet

- Consti - I - Case List - SY 2018-2019 (Fin) Ao16oct2018 - BML (63pp)Document63 pagesConsti - I - Case List - SY 2018-2019 (Fin) Ao16oct2018 - BML (63pp)Aleezah Gertrude RaymundoNo ratings yet

- Appellee Vs Vs Appellant: en BancDocument13 pagesAppellee Vs Vs Appellant: en BancAleezah Gertrude RaymundoNo ratings yet

- Criteria For The Creation of LGUs PDFDocument7 pagesCriteria For The Creation of LGUs PDFAleezah Gertrude RaymundoNo ratings yet

- Implementing Rules PD 957Document68 pagesImplementing Rules PD 957Austin CharlesNo ratings yet

- Fernandez Vs HRETDocument2 pagesFernandez Vs HRETSteve Rojano Arcilla100% (4)

- 17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFDocument3 pages17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFAleezah Gertrude RaymundoNo ratings yet

- 28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFDocument2 pages28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFAleezah Gertrude RaymundoNo ratings yet

- Plaintiff-Appellee Vs Vs Accused-Appellant Solicitor General Public Attorney's OfficeDocument11 pagesPlaintiff-Appellee Vs Vs Accused-Appellant Solicitor General Public Attorney's OfficeAleezah Gertrude RaymundoNo ratings yet

- 20282-2011-Implementing The Tax Provisions of Republic20180406-1159-Ay5snx PDFDocument12 pages20282-2011-Implementing The Tax Provisions of Republic20180406-1159-Ay5snx PDFAleezah Gertrude RaymundoNo ratings yet

- 20168-2000-Amending Sections of Revenue Regulations No.20180312-6791-1o08lh4 PDFDocument4 pages20168-2000-Amending Sections of Revenue Regulations No.20180312-6791-1o08lh4 PDFAleezah Gertrude RaymundoNo ratings yet

- Lucero v. Comelec DigestDocument4 pagesLucero v. Comelec DigestMosarah AltNo ratings yet

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFDocument2 pages2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoNo ratings yet

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFDocument2 pages2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoNo ratings yet

- 39460-2015-Further Amendments To Revenue Regulations20200331-8825-1f0hvog PDFDocument2 pages39460-2015-Further Amendments To Revenue Regulations20200331-8825-1f0hvog PDFAleezah Gertrude RaymundoNo ratings yet

- 20168-2000-Amending Sections of Revenue Regulations No.20180312-6791-1o08lh4 PDFDocument4 pages20168-2000-Amending Sections of Revenue Regulations No.20180312-6791-1o08lh4 PDFAleezah Gertrude RaymundoNo ratings yet

- Government of The Philippine Islands Vs SpringerDocument1 pageGovernment of The Philippine Islands Vs SpringerKristell FerrerNo ratings yet

- 20139-2011-Further Amendments To Revenue Regulations20180310-6791-Pxdsa1 PDFDocument3 pages20139-2011-Further Amendments To Revenue Regulations20180310-6791-Pxdsa1 PDFAleezah Gertrude RaymundoNo ratings yet

- 28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFDocument2 pages28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFAleezah Gertrude RaymundoNo ratings yet

- 17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFDocument3 pages17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFAleezah Gertrude RaymundoNo ratings yet

- 20139-2011-Further Amendments To Revenue Regulations20180310-6791-Pxdsa1 PDFDocument3 pages20139-2011-Further Amendments To Revenue Regulations20180310-6791-Pxdsa1 PDFAleezah Gertrude RaymundoNo ratings yet

- Screenshot 2020-09-15 at 3.51.01 PM PDFDocument1 pageScreenshot 2020-09-15 at 3.51.01 PM PDFAleezah Gertrude RaymundoNo ratings yet

- 37993-2012-Further Amendments To Revenue Regulations20180309-6791-Rt5edm PDFDocument2 pages37993-2012-Further Amendments To Revenue Regulations20180309-6791-Rt5edm PDFAleezah Gertrude RaymundoNo ratings yet

- 39460-2015-Further Amendments To Revenue Regulations20200331-8825-1f0hvog PDFDocument2 pages39460-2015-Further Amendments To Revenue Regulations20200331-8825-1f0hvog PDFAleezah Gertrude RaymundoNo ratings yet

- Gertrude Consti Notes PDFDocument47 pagesGertrude Consti Notes PDFAleezah Gertrude RaymundoNo ratings yet

- Compilation 1.01 - Articles I and II.v1 PDFDocument60 pagesCompilation 1.01 - Articles I and II.v1 PDFAleezah Gertrude RaymundoNo ratings yet

- 20282-2011-Implementing The Tax Provisions of Republic20180406-1159-Ay5snx PDFDocument12 pages20282-2011-Implementing The Tax Provisions of Republic20180406-1159-Ay5snx PDFAleezah Gertrude RaymundoNo ratings yet

- 0 Baselines Presentation.Document31 pages0 Baselines Presentation.Aleezah Gertrude RaymundoNo ratings yet

- TAXREV D2019 Reviewer Transcript PDFDocument193 pagesTAXREV D2019 Reviewer Transcript PDFAleezah Gertrude Raymundo100% (1)

- Rule: Income Taxes: Widely Held Fixed Investment Trusts Reporting RequirementsDocument6 pagesRule: Income Taxes: Widely Held Fixed Investment Trusts Reporting RequirementsJustia.comNo ratings yet

- 4.2 BIR Ruling No. 001-07Document5 pages4.2 BIR Ruling No. 001-07IanRaissaPenaNo ratings yet

- De Minimis Benefits: An Update On The Salary-And-Benefits' Mini-Me'sDocument3 pagesDe Minimis Benefits: An Update On The Salary-And-Benefits' Mini-Me'sMNo ratings yet

- De Minimus Non Curat LexDocument8 pagesDe Minimus Non Curat LexSimran JaiswalNo ratings yet

- RR 5-2011Document5 pagesRR 5-2011RB BalanayNo ratings yet

- Balongis Taxable de Minimis BenefitsDocument3 pagesBalongis Taxable de Minimis BenefitsKrizah Marie CaballeroNo ratings yet

- GBER Frequently Asked QuestionsDocument35 pagesGBER Frequently Asked QuestionsOrtansa ONo ratings yet

- Bir Ruling Da 469 06Document6 pagesBir Ruling Da 469 06juliusNo ratings yet

- What Do You Understand by de Minimis Non Curat Lex - IpleadersDocument13 pagesWhat Do You Understand by de Minimis Non Curat Lex - IpleadersSoumya Ranjan BarikNo ratings yet

- Buy American Webinar 20100906Document25 pagesBuy American Webinar 20100906Daniel GiblettNo ratings yet

- De Mgginimis Benefit in The PhilippinesDocument3 pagesDe Mgginimis Benefit in The PhilippinesSlardarRadralsNo ratings yet

- Goods Declaration For Consumption Under Informal EntryDocument21 pagesGoods Declaration For Consumption Under Informal Entryanjelica pajoNo ratings yet

- US Internal Revenue Service: n-89-110Document3 pagesUS Internal Revenue Service: n-89-110IRSNo ratings yet

- Customs Clearance Lecture 10 - de Minimis ImportationDocument57 pagesCustoms Clearance Lecture 10 - de Minimis ImportationHarrenNo ratings yet

- Tax Exempt de Minimis Benefits Under TRAIN RA 10963 Philippines - Tax and Accounting Center, Inc.Document7 pagesTax Exempt de Minimis Benefits Under TRAIN RA 10963 Philippines - Tax and Accounting Center, Inc.Nicale JeenNo ratings yet

- Bir Ruling (Da 561 07)Document10 pagesBir Ruling (Da 561 07)cool_peachNo ratings yet

- Triviality As A General DefenseDocument3 pagesTriviality As A General DefenseMarco MauriziNo ratings yet

- 03 BAINCTAX - Individual de Minimis and FringeDocument15 pages03 BAINCTAX - Individual de Minimis and FringeCarmela PeducheNo ratings yet

- State Aid Rules for European Territorial Cooperation ProgrammesDocument18 pagesState Aid Rules for European Territorial Cooperation ProgrammesliviutfyNo ratings yet

- IT Compensation NotesDocument33 pagesIT Compensation NotesWinnie GiveraNo ratings yet

- RR 05-11 (Further Amendments To RR2-98 and RR3-98) de MinimisDocument5 pagesRR 05-11 (Further Amendments To RR2-98 and RR3-98) de MinimisMatthew TiuNo ratings yet

- BIR Ruling 293-2015 - Productivity Incentive (De Minimis)Document5 pagesBIR Ruling 293-2015 - Productivity Incentive (De Minimis)Jerwin DaveNo ratings yet

- Harm Is Not Defined in The IPCDocument11 pagesHarm Is Not Defined in The IPCAbhishek KumarNo ratings yet

- Micro Invest: Incentive GuidelinesDocument18 pagesMicro Invest: Incentive Guidelinesirena34No ratings yet

- RR 10-00Document3 pagesRR 10-00matinikkiNo ratings yet

- Ipc Chap16-20.final ProvisionsDocument7 pagesIpc Chap16-20.final Provisionsprmsusecgen.nfjpia2324No ratings yet

- De Minimis BenefitsDocument3 pagesDe Minimis BenefitsanneNo ratings yet

- Annex II Declaration On de MinimisDocument5 pagesAnnex II Declaration On de MinimisȘtiri din BanatNo ratings yet