Professional Documents

Culture Documents

Months: Sales Purchases Wages Expenses

Uploaded by

pranay639Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Months: Sales Purchases Wages Expenses

Uploaded by

pranay639Copyright:

Available Formats

CASH BUDGET

Q1) Prepare a cash budget of a company for April, May and June 2001 in a columnar form using the following

information:

Months Sales Purchases Wages Expenses

2001 Rs. Rs. Rs. Rs.

Jan (actual) 80,000 45,000 20,000 5,000

Feb (actual) 80,000 40,000 18,000 6,000

March (actual) 75,000 42,000 22,000 6,000

April (Budgeted) 90,000 50,000 24,000 7,000

May (Budgeted) 85,000 45,000 20,000 6,000

June (Budgeted) 80,000 35,000 18,000 5,000

You are further informed that:

a) 10% of the purchases and 20% of the sales are for cash.

b) The average collection period of the company is ½ month and the credit purchases are paid off regularly

after one month.

c) Wages are paid half monthly and the rent of Rs 500 included in expenses is paid monthly.

d) Cash and bank balances as on April 1 was Rs 15,000 and the company wants to keep it on the end of

every month below this figure the excess cash being put in fixed deposits in multiples of 1000.

Q2) Gold Stone Ltd has given the following particulars you are required to prepare a cash budget for 3 months

ending 31st Dec 2003

Month Sales Materials Wages Overheads

Aug 40,000 20,400 7,600 3,800

Sept 42,000 20,000 7,600 4,200

Oct 46,000 19,600 8,000 4,600

Nov 50,000 20,000 8,400 4,800

Dec 60,000 21,600 9,000 5,000

Credit Terms are:

i) Sales/Debtors – 10% sales are on cash basis; 50% of the Credit Sales are collected next month and the

balance in the following months.

Creditors - Materials 2 months, wages 1/5 month, overheads ½ month.

ii) Cash balance on 1st oct 2003 is expected to be Rs. 8,000

iii) A machinery will be installed in Aug 03 at a cost of Rs 1, 00,000. The monthly installment of Rs 5,000 is

payable from October onwards.

iv) Dividend at 10% on preference shares capital of Rs 3,00,000 will be paid on 1st Dec 03.

v) Advance to be received for sale of vehicle Rs. 20,000 in December.

vi) Income Tax (advance) to be paid in December Rs. 5,000

Q3) A firm adopts a six – monthly time span, subdivided into monthly intervals for its cash budget.

A) The foll information is available in respect of its operation (Rs. Lakh)

1 2 3 4 5 6

1 Sales 40 50 60 60 60 60

2 Purchases 1 1.5 2 2 2 1

3 D. Lab 6 7 8 8 8 6

4 Mfg OH 13 13.5 14 14 14 13

5 Adv Exp 2 2 2 2 2 2

6 Dist Exp 2 3 4 4 4 2

7 Raw mat - 30 days credit 14 15 16 16 16 15

B) Assume the foll financial flows during the period: -

(1) Inflows :

1) Int recd in month 1 and month 6 Rs 1 lakh each.

2) Dividend recd during month’s 3 and 6, Rs 2 lakh each.

3) Sales of shares in month 6, Rs 160 lakh.

(2) Outflows:

1) Interest paid during month 1, Rs 0.4 lakh

2) Dividends paid during months 1 & 4, Rs. 2 lakh each.

3) Installment payment on machine in month 6, Rs 20 lakh

4) Repayment of loan in month 6, Rs 80 lakhs.

C) Assume that 10% of each month sales are for cash; the balance 90% are on credit. The terms and credit

experience of the firm are:-

1) No cash discount

2) 1% of credit sales is returned by the customers.

3) 1% of total accounts receivable in bad debt.

4) 50% of all accounts that are going to pay, do so within 30 days.

5) 100% of all accounts that are going to pay, do so within 60 days.

You might also like

- Non Current Asset Questions For ACCADocument11 pagesNon Current Asset Questions For ACCAAiril RazaliNo ratings yet

- Philip Kotler's Marketing Management SummaryDocument238 pagesPhilip Kotler's Marketing Management SummaryOmar Hasan100% (3)

- Apollo Shoes Trial BalanceDocument1 pageApollo Shoes Trial Balancebabar zahoorNo ratings yet

- Month Sales (Credit) Purchase (Credit) Wages Manufacturing Expenses Administrative Expenses Selling ExpensesDocument3 pagesMonth Sales (Credit) Purchase (Credit) Wages Manufacturing Expenses Administrative Expenses Selling Expensesaishwarya raikar100% (2)

- Maria Martinez Organized Manhattan Transport Company in January 2008 TheDocument1 pageMaria Martinez Organized Manhattan Transport Company in January 2008 Thetrilocksp Singh0% (1)

- Alternate Demonstration Problem MerchandisingDocument5 pagesAlternate Demonstration Problem MerchandisingmoNo ratings yet

- DebitCreditAnalysisComparesAccountsYear"TITLE "CashflowStatementAnalyzesPrimeSportsGearCashFlows2013" TITLE "RatioAnalysisComparesGlobalTechFinancialsSalesProfit201213Document7 pagesDebitCreditAnalysisComparesAccountsYear"TITLE "CashflowStatementAnalyzesPrimeSportsGearCashFlows2013" TITLE "RatioAnalysisComparesGlobalTechFinancialsSalesProfit201213shineneigh00No ratings yet

- Three Column Cash BookDocument3 pagesThree Column Cash Bookahmad381No ratings yet

- Week 8 (Prior To Tutorial) QsDocument10 pagesWeek 8 (Prior To Tutorial) Qsalexandra0% (1)

- Analysis: Company DescriptionDocument24 pagesAnalysis: Company DescriptionPham Huu Loc HoNo ratings yet

- Diploma in Accountancy Exams Level 1 Financial AccountingDocument236 pagesDiploma in Accountancy Exams Level 1 Financial AccountingMusonda Mwape100% (1)

- Income Tax: General Principles: Module No. 4Document4 pagesIncome Tax: General Principles: Module No. 4Jay Lord Floresca100% (1)

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- U.S. Individual Income Tax Return: Duarte 685-42-6438 LarissaDocument7 pagesU.S. Individual Income Tax Return: Duarte 685-42-6438 LarissaLarissa Alene Soares67% (3)

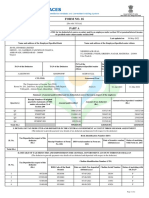

- FORM 16 CERTIFICATEDocument8 pagesFORM 16 CERTIFICATENidhish AgrawalNo ratings yet

- Exercises Budgeting ACCT2105 3s2010Document7 pagesExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Cash Management NumericalsDocument5 pagesCash Management NumericalsAnjali Jain100% (1)

- Review Questions Final Accounts For A Sole TraderDocument3 pagesReview Questions Final Accounts For A Sole TraderdhanyasugukumarNo ratings yet

- CAF 1 IA Autumn 2020Document5 pagesCAF 1 IA Autumn 2020Qasim Hafeez KhokharNo ratings yet

- Financial Accounting I: Accruals, Prepayments, Adjustments & Financial StatementsDocument4 pagesFinancial Accounting I: Accruals, Prepayments, Adjustments & Financial Statements小仙女哈哈哈No ratings yet

- Journal Entry.Document45 pagesJournal Entry.CHARAK RAYNo ratings yet

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- Review Questions Volume 1 - Chapter 28Document2 pagesReview Questions Volume 1 - Chapter 28YelenochkaNo ratings yet

- Depreciation AssignmentDocument13 pagesDepreciation AssignmentfarisktsNo ratings yet

- Bad Debts and Pfbd..Document6 pagesBad Debts and Pfbd..rizwan ul hassanNo ratings yet

- Chapter 5 Control AccountsDocument40 pagesChapter 5 Control AccountsAlfred MakonaNo ratings yet

- Solutions To Text Book Exercises: Non-Trading ConcernsDocument12 pagesSolutions To Text Book Exercises: Non-Trading ConcernsM JEEVARATHNAM NAIDUNo ratings yet

- Important Points of Our Notes/Books:: TH THDocument42 pagesImportant Points of Our Notes/Books:: TH THpuru sharmaNo ratings yet

- Pearson LCCI 2021 Examination TimetableDocument9 pagesPearson LCCI 2021 Examination TimetableKhin Zaw HtweNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Advanced Accounts 1 PDFDocument304 pagesAdvanced Accounts 1 PDFJohn Louie NunezNo ratings yet

- Stevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsDocument2 pagesStevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsAmit PandeyNo ratings yet

- Past Papers For Single Entry and Incomplete RecordsDocument2 pagesPast Papers For Single Entry and Incomplete RecordsMahreena IlyasNo ratings yet

- Tutorial 6Document4 pagesTutorial 6Muntasir AhmmedNo ratings yet

- ACC For Stock IssuesDocument9 pagesACC For Stock IssuesJasonSpringNo ratings yet

- Examples of Trading and Profit and Loss Account and Balance SheetDocument5 pagesExamples of Trading and Profit and Loss Account and Balance SheetSaad Arshad Mughal83% (6)

- Absorption vs Marginal Costing: Worked ExamplesDocument5 pagesAbsorption vs Marginal Costing: Worked ExamplesSUHRIT BISWASNo ratings yet

- Final Accounts QuestionsDocument6 pagesFinal Accounts QuestionsGandharva Shankara Murthy100% (1)

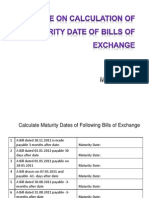

- Calculation of Maturity DateDocument4 pagesCalculation of Maturity Dateyogeshdhuri22No ratings yet

- BudgetDocument15 pagesBudgetJoydip DasguptaNo ratings yet

- Principles of Accounting PDFDocument2 pagesPrinciples of Accounting PDFfrank mutale0% (1)

- Master Budget Assignment CH 9Document4 pagesMaster Budget Assignment CH 9api-240741436No ratings yet

- Partnership Changes... Goodwill and RevaluationDocument5 pagesPartnership Changes... Goodwill and Revaluationtafadzwa tandawaNo ratings yet

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- Paper - 1: AccountingDocument18 pagesPaper - 1: AccountingJerry HuffmanNo ratings yet

- Work Book Unit 2 Proforma Variation - SolvedDocument12 pagesWork Book Unit 2 Proforma Variation - SolvedZaheer SwatiNo ratings yet

- F3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Document31 pagesF3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Md Enayetur Rahman100% (1)

- Cash BudgetDocument6 pagesCash BudgetSalahuddin ShahNo ratings yet

- ManufacturingDocument6 pagesManufacturingapi-3034896990% (1)

- Assignment-2 CmaDocument8 pagesAssignment-2 CmaAYESHA BOITAINo ratings yet

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- Suggested Answer Paper CAP III Dec 2019Document142 pagesSuggested Answer Paper CAP III Dec 2019Roshan PanditNo ratings yet

- Chapter 11 Partnership DissolutionDocument19 pagesChapter 11 Partnership DissolutionAira Nhaire Cortez MecateNo ratings yet

- Pearly Co Cleared Funds ForecastDocument8 pagesPearly Co Cleared Funds ForecastPutin Phy0% (1)

- Issue of SharesDocument11 pagesIssue of SharesRamesh KumarNo ratings yet

- Unit 3: Trial Balance: Learning OutcomesDocument13 pagesUnit 3: Trial Balance: Learning Outcomesviveo23No ratings yet

- Autonomous Branches.Document7 pagesAutonomous Branches.Axam Ndawula100% (1)

- Adjusting Entries & Questions PDFDocument18 pagesAdjusting Entries & Questions PDFshahroz QadriNo ratings yet

- Accounting Irrecoverable Debts. 30/06/2021/ Wednesday Homework. Resource Pack Questions, Question # 1Document4 pagesAccounting Irrecoverable Debts. 30/06/2021/ Wednesday Homework. Resource Pack Questions, Question # 1taiba sajjadNo ratings yet

- Self Balancing Ledger Question BankDocument4 pagesSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- Cash Management: ProblemsDocument4 pagesCash Management: ProblemsPoojitha ReddyNo ratings yet

- Budgetary ControlDocument5 pagesBudgetary ControlJasdeep Singh DeepuNo ratings yet

- Assignment QuestionsDocument3 pagesAssignment QuestionsmaheeshNo ratings yet

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Document7 pagesBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarNo ratings yet

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Unit 6 Synchronization zI19Fykx5PDocument37 pagesUnit 6 Synchronization zI19Fykx5Ppranay639No ratings yet

- Unit 6 Synchronization zI19Fykx5PDocument37 pagesUnit 6 Synchronization zI19Fykx5Ppranay639No ratings yet

- EDIFACTDocument31 pagesEDIFACTanon_895486951No ratings yet

- Unit 6 Synchronization zI19Fykx5PDocument37 pagesUnit 6 Synchronization zI19Fykx5Ppranay639No ratings yet

- Unit 6 Synchronization zI19Fykx5PDocument37 pagesUnit 6 Synchronization zI19Fykx5Ppranay639No ratings yet

- Unit3 - Legal and Ethical IssuesDocument49 pagesUnit3 - Legal and Ethical Issuesnancy bhatiaNo ratings yet

- Payment System: Refer Chapter - 11 From Book Gary P. Schneider SoftDocument37 pagesPayment System: Refer Chapter - 11 From Book Gary P. Schneider Softpranay639No ratings yet

- Inventory ManagementDocument2 pagesInventory Managementpranay639No ratings yet

- Quark CityDocument6 pagesQuark Citypranay639No ratings yet

- Decision Making - Marginal CostingDocument19 pagesDecision Making - Marginal Costingpranay639No ratings yet

- ALOHADocument26 pagesALOHApranay639No ratings yet

- Unit 6 - Inventory ManagementDocument1 pageUnit 6 - Inventory Managementpranay639No ratings yet

- Theories of PersonalityDocument63 pagesTheories of Personalitypranay639100% (1)

- CorrelationDocument21 pagesCorrelationpranay639No ratings yet

- Chapter 1 Ratio AnalysisDocument48 pagesChapter 1 Ratio Analysispranay639No ratings yet

- Computer NetworkDocument10 pagesComputer NetworkSimmi JoshiNo ratings yet

- ANALOG AND DIGITAL COMMUNICATION: FM RECEIVERS AND DETECTIONDocument48 pagesANALOG AND DIGITAL COMMUNICATION: FM RECEIVERS AND DETECTIONpranay639No ratings yet

- ER Diagram ExamplesDocument2 pagesER Diagram Examplespranay639100% (1)

- Linear Block Coding: Presented byDocument12 pagesLinear Block Coding: Presented bypranay639No ratings yet

- Relational Database DesignDocument76 pagesRelational Database Designpranay639No ratings yet

- TransactionsDocument41 pagesTransactionspranay639No ratings yet

- SQLDocument142 pagesSQLpranay639No ratings yet

- Calculate EMF of Daniell Cell Using Nernst EquationDocument3 pagesCalculate EMF of Daniell Cell Using Nernst Equationpranay639No ratings yet

- Maths 3-GV Kumbhojkar PDFDocument195 pagesMaths 3-GV Kumbhojkar PDFpranay63967% (3)

- Single Phase TransformerDocument31 pagesSingle Phase Transformerpranay639100% (1)

- Indexing and HashingDocument4 pagesIndexing and Hashingpranay639No ratings yet

- Fuels LiquidDocument25 pagesFuels Liquidpranay639100% (1)

- Water TechnologyDocument47 pagesWater Technologypranay639No ratings yet

- DR CR Le LeDocument7 pagesDR CR Le LeKANGOMA FODIE MansarayNo ratings yet

- Solved Indicate Whether The Following Statements Are True or False ADocument1 pageSolved Indicate Whether The Following Statements Are True or False AAnbu jaromiaNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS CertificateKesava KesNo ratings yet

- DTAA AnnexureDocument1 pageDTAA AnnexureNaresh KewalramaniNo ratings yet

- Weekly and Fortnightly PAYE Deduction Tables: Tax Tables For Pay Periods Between 1 April 2023 and March 2024Document410 pagesWeekly and Fortnightly PAYE Deduction Tables: Tax Tables For Pay Periods Between 1 April 2023 and March 2024Ray WeiNo ratings yet

- BAC 111 Final Exams With QuestionsDocument8 pagesBAC 111 Final Exams With Questionsjanus lopezNo ratings yet

- Web Kalvisolai It Form 2022 - Version - 1.1Document26 pagesWeb Kalvisolai It Form 2022 - Version - 1.1manivasagam subbianNo ratings yet

- Common Size Income Statement ExcelDocument4 pagesCommon Size Income Statement ExceljobsgrandNo ratings yet

- QFS - Afghan Tax SummaryDocument3 pagesQFS - Afghan Tax SummaryAhmad Nadeem MohammadiNo ratings yet

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Chapter 1 - Principles of Taxation: Solutions Manual-Income Taxation (2016 Edition) by Tabag & GarciaDocument40 pagesChapter 1 - Principles of Taxation: Solutions Manual-Income Taxation (2016 Edition) by Tabag & GarciaMicko Lagundino50% (2)

- CAPE Accounting 2018 U1 P2Document9 pagesCAPE Accounting 2018 U1 P2Kimberly MNo ratings yet

- Income Tax Proof Guidelines FY. 2022-23Document11 pagesIncome Tax Proof Guidelines FY. 2022-23Ghousia BegumNo ratings yet

- Final PPT of Income From House PropertyDocument33 pagesFinal PPT of Income From House PropertyAzhar Ali100% (1)

- Payslip 2023 2024 6 200000000029454 IGSLDocument1 pagePayslip 2023 2024 6 200000000029454 IGSLMohit SagarNo ratings yet

- Table No 75Document1 pageTable No 75ssfinservNo ratings yet

- Form 15CADocument4 pagesForm 15CAManoj MahimkarNo ratings yet

- RR No. 8 2018Document35 pagesRR No. 8 2018zul fanNo ratings yet

- Venture Capital and Startup StructuresDocument20 pagesVenture Capital and Startup Structuresjuan felipe MosqueraNo ratings yet

- Budgeting Assessment - 2Document3 pagesBudgeting Assessment - 2Ariel KedemNo ratings yet

- Financial Planning ( Fish Farming Business)Document12 pagesFinancial Planning ( Fish Farming Business)Nabeel AhmadNo ratings yet

- LyftPayStatement 2019 12 30 PDFDocument2 pagesLyftPayStatement 2019 12 30 PDFEnos LewisNo ratings yet

- Waypine Enterprises Reported A Pretax Operating Loss of 84 000 inDocument1 pageWaypine Enterprises Reported A Pretax Operating Loss of 84 000 inMuhammad ShahidNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearrandhawagurbirkaurNo ratings yet

- Revenue: A. Revenue - Construction / Long-Term Contracts (Construction)Document7 pagesRevenue: A. Revenue - Construction / Long-Term Contracts (Construction)SALSABILLA ZAHRANo ratings yet