Professional Documents

Culture Documents

415-1x L00 Faculty-Intro V03-En

Uploaded by

DaveYepest0 ratings0% found this document useful (0 votes)

5 views3 pagesMIT

Original Title

415-1x_L00_Faculty-Intro_V03-en

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMIT

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pages415-1x L00 Faculty-Intro V03-En

Uploaded by

DaveYepestMIT

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 3

LEONID KOGAN: I am Leonid Kogan.

JIANG WANG: I am Jiang Wang.

Welcome to Foundations of Modern Finance.

We are the instructors for this course.

LEONID KOGAN: In this course, we'll

introduce you to the core principles and some

of the most important techniques in modern finance.

The global financial system is complex

with multiple participants including households,

businesses, financial intermediaries,

and the governments, among others.

Yet, the diverse problems faced by these actors

can be understood and addressed using a unifying

framework and a relatively small set of fundamental principles.

This framework forms the foundation of modern finance,

and it is our purpose in this class

to equip you with the concepts and tools necessary to handle

a wide range of financial problems.

JIANG WANG: Here, we would like to give a brief description

about the structure and content of the course.

Part one of the course has four sections.

Section A provides an introduction to finance.

Sections B, C, and D then cover the basics

of financial market, risk analysis and evaluation,

and corporate finance.

The introductory section provides the foundation

for the whole course.

In lecture 1, we will develop a comprehensive and coherent

analytical framework to formulate

the fundamental financial challenges firms and households

face and lay down the general principles we

will use to tackle them.

In lecture 2, we will establish the key idea

in solving the central problem in finance,

which is how to value assets, cash rolls and projects.

In particular, we will develop a general methodology

for asset valuation, the arbitrage pricing approach,

by using prices of assets traded in the financial market.

We will then further develop this general asset valuation

methodology into powerful tools for the pricing of assets

or cash flows--

in particular, how to use the appropriate discount

rate properly adjusted for timing and risk

to obtain the present value of a cash flow.

LEONID KOGAN: In part B, we introduce

some of the largest and most important financial markets

and securities, fixed income securities and common stocks.

We discuss the main characteristics

of these securities and the markets where they trade.

We then develop valuation techniques

for fixed income assets and for equities.

Although these assets are quite different in their properties,

our approach to their valuation is

based on the same fundamental principle.

We value financial securities relative to other assets,

based on the principle of absence

of arbitrage or no free lunch.

We maintain this common perspective

as we explore some of the topics specific to each asset class,

such as bond duration or forecasting of stock dividends.

By the end of this section, you will learn the principles

and the core valuation methods used in fixed income and equity

markets.

In section C, we explore the notion of risk

which is central to many problems in finance.

In lecture 6, we'll look at how to model investment decisions

under uncertainty and how to measure risk quantitatively.

We introduce modern portfolio theory and risk management

through diversification.

In lecture 7, we introduce the arbitrage pricing theory,

which is a powerful framework for pricing for national assets

based on their risk profile.

This pricing framework is heavily

used across financial markets, including both equity

and fixed-income markets.

In lecture 8, we introduce the fundamental important concept

of market efficiency.

The concept of market efficiency refers

to the ability of markets to incorporate information

into prices.

This concept is central to modern finance

and connects to numerous other topics,

from firm financial policies to asset management.

In this lecture, we define the notion of market efficiency

and discuss its uses and limitations, as well as

relevant empirical evidence.

JIANG WANG: The last section of part 1

lays the foundation for modern corporate finance.

In lecture 9, we will establish value maximization

as the main goal in corporate financial decision making.

We will then apply the general framework

for financial analysis to major corporate financial decisions,

including capital budgeting, financing, payout,

and risk management.

Lecture 10 focuses on the real investment or capital budgeting

decisions of the firm, its most fundamental and important

decisions.

Here, we apply the asset valuation tools developed

earlier in the course to project valuation and capital

budgeting.

LEONID KOGAN: I have received my PhD in finance from MIT,

and I have been teaching here for the past 20 years

in various programs, including the Master of Finance,

the MBA, the Doctoral Program, and Executive Education.

The scope of my teaching at MIT includes

the Foundations course, on which this online class is based,

as well as advanced electives and doctoral courses

on capital markets and financial engineering.

My research spans a range of topics

in asset pricing, macro finance, and financial engineering.

JIANG WANG: Let me say a few words about myself.

I'm the Mizuho Financial Group professor

at MIT, where I have been for over 30 years.

I've taught various finance courses in the MBA,

Master of Finance, PhD, and executive programs

at Sloan, including introductory courses, like this one,

for many years.

My research is mostly in the area

of asset pricing, investment and risk

management, financial regulation,

and international finance.

We will be working together with you throughout this course

and hope you will enjoy it.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Money: Nonfiction Reading TestDocument4 pagesMoney: Nonfiction Reading Testyollana riztyNo ratings yet

- Team-8 ResidencyPPTDocument16 pagesTeam-8 ResidencyPPTsai raoNo ratings yet

- Financial Statement Sample ModelDocument14 pagesFinancial Statement Sample ModelNaomi IrikefeNo ratings yet

- Fundamentals of Taxation 2017 Edition 10Th Edition Cruz Solutions Manual Full Chapter PDFDocument47 pagesFundamentals of Taxation 2017 Edition 10Th Edition Cruz Solutions Manual Full Chapter PDFmarushiapatrina100% (13)

- Question Bank 2Document2 pagesQuestion Bank 2pavan kumar tNo ratings yet

- Aguilar QuizDocument5 pagesAguilar QuizIankyle AguilarNo ratings yet

- The Rationalization VS The Reduction of Real Costs Under The Modern AgricultureDocument11 pagesThe Rationalization VS The Reduction of Real Costs Under The Modern AgricultureIAEME PublicationNo ratings yet

- Piramal SANCTION LETTER02023 07 25 09 11 5858Document2 pagesPiramal SANCTION LETTER02023 07 25 09 11 5858Razzak KathatNo ratings yet

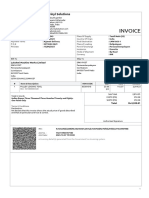

- Invoice: Sakvinyl SolutionsDocument1 pageInvoice: Sakvinyl SolutionsMEENAKSHI IQCSNo ratings yet

- Deal Logic First Data Corp / Fiserv Inc: WHU Finance SocietyDocument6 pagesDeal Logic First Data Corp / Fiserv Inc: WHU Finance SocietySrijanNo ratings yet

- Promissory Note Annex ADocument2 pagesPromissory Note Annex ACarol Ledesma Yap-PelaezNo ratings yet

- How Can Corruption Influence The Work Practice?Document5 pagesHow Can Corruption Influence The Work Practice?Stacy LieutierNo ratings yet

- ReportDocument2 pagesReportMuh ArafaNo ratings yet

- Marathon 9 - Index NumbersDocument112 pagesMarathon 9 - Index NumbersSharda SurekaNo ratings yet

- Flexible Manufacturing SystemDocument12 pagesFlexible Manufacturing Systemfeddy hendriyawanNo ratings yet

- Executive Summery: Page - 1Document7 pagesExecutive Summery: Page - 1Ahsan Habib JimonNo ratings yet

- IFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Document6 pagesIFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Grace MoraesNo ratings yet

- Research Paper - MN559990 - Batch35 - PDFDocument17 pagesResearch Paper - MN559990 - Batch35 - PDFkhushboo sharmaNo ratings yet

- Analisis Hukum Terhadap Prinsip Most Favoured Nations Dalam Sengketa Dagang Impor Produk BesiDocument10 pagesAnalisis Hukum Terhadap Prinsip Most Favoured Nations Dalam Sengketa Dagang Impor Produk BesiAdriansyah PutraNo ratings yet

- 2019 ZBDocument5 pages2019 ZBChandani FernandoNo ratings yet

- Shorter - Strategic Tools - Efe Ife Ie Space BCG QSPMDocument23 pagesShorter - Strategic Tools - Efe Ife Ie Space BCG QSPMUTTAM KOIRALANo ratings yet

- G.R. No. 158805 - Valley Golf & Amp Country Club, Inc. v. Vda. deDocument16 pagesG.R. No. 158805 - Valley Golf & Amp Country Club, Inc. v. Vda. deKaren Gina DupraNo ratings yet

- Answer To The Question From The BookDocument11 pagesAnswer To The Question From The BookCindy KimNo ratings yet

- Export Checklist Expmum009623 24s 28 Aug 2023-10-04 PMDocument4 pagesExport Checklist Expmum009623 24s 28 Aug 2023-10-04 PMiffy11No ratings yet

- Problem Solving Quiz 1Document1 pageProblem Solving Quiz 1Cherry DerramasNo ratings yet

- PAMB Medical Revision-35376814 PDFDocument9 pagesPAMB Medical Revision-35376814 PDFSoon SoonNo ratings yet

- College of Computing and Information Sciences: Midterm Assessment Spring 2021 SemesterDocument3 pagesCollege of Computing and Information Sciences: Midterm Assessment Spring 2021 SemesterSohaib RiazNo ratings yet

- Permanent Transfer ClaimDocument2 pagesPermanent Transfer ClaimdpdohisarNo ratings yet

- KTS Free Ver 2Document16 pagesKTS Free Ver 2Nam NguyenNo ratings yet

- Book 1Document6 pagesBook 1Naveen BishtNo ratings yet