Professional Documents

Culture Documents

M-Investment Planning Corporation of The Phil Vs SSS - Digest

M-Investment Planning Corporation of The Phil Vs SSS - Digest

Uploaded by

Reynier Molintas Clemens0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

M-Investment Planning Corporation of the Phil vs SSS_digest.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageM-Investment Planning Corporation of The Phil Vs SSS - Digest

M-Investment Planning Corporation of The Phil Vs SSS - Digest

Uploaded by

Reynier Molintas ClemensCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

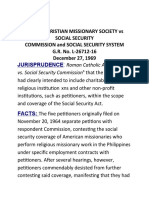

INVESTMENT PLANNING CORPORATION OF THE PHILIPPINES, PETITIONER-

APPELLANT, VS. SOCIAL SECURITY SYSTEM, RESPONDENT-APPELLEE.

G.R. No. L-19124, November 18, 1967

CHATI A. TONOG, JD 2

FACTS:

Petitioner is a domestic corporation engaged in business management and the sale of

securities. It has two classes of agents who sell its investment plans: (1) salaried employees

who keep definite hours and work under the control and supervision of the company; and (2)

registered representatives who work on commission basis.

On August 27, 1960 petitioner, through counsel, applied to respondent Social

Security Commission for exemption of its so-called registered representatives from the

compulsory coverage of the Social Security Act. The application was denied in a letter

signed by the Secretary to the Commission on January 16, 1961. A motion to reconsider was

filed and also denied, after hearing, by the Commission itself in its resolution dated

September 8, 1961. The matter was thereafter elevated to this Court for review.

ISSUE:

Whether or not petitioner's registered representatives are employees within the

meaning of the Social Security Act (R.A. No. 1161 as amended).

HELD:

No.Section 8 (d) thereof defines the term "employee" - for purposes of the Act - as

"any person who performs services for an 'employer' in which either or both mental and

physical efforts are used and who receives compensation for such services, where there is an

employer-employee relationship." (As amended by Sec. 4, R.A. No. 2658 and Sec. 2, P.D.

No. 1636, S-1979).

The representatives are in reality commission agents. They cannot be considered

employees for they were just paid not by the investor but in a form of a commission based on

a certain percentage of their sales, their service maybe terminated at certain time, and there is

no element of control for they do not devote their time exclusively to or solely to petitioner,

the time and the effort they spend in their work depend upon entirely upon their own will and

initiative. The record also reveals that the commission earned by an agent on his sales is

directly deducted by him from the amount he receives from the investor and turns over to the

company the amount invested after such deduction is made. The majority of the agents are

regularly employed elsewhere - either in the government or in private enterprises. Even if an

agent of petitioner should devote all of his time and effort trying to sell its investment plans

he would not necessarily be entitled to compensation therefor. His right to compensation

depends upon and is measured by the tangible results he produces.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- IAS 16 by ACCAGLOBAL With Practice QuestionsDocument7 pagesIAS 16 by ACCAGLOBAL With Practice QuestionsAdeel Shoukat100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quiz 2 - With AnswersDocument16 pagesQuiz 2 - With Answerszshaz64% (22)

- IBM Infosphere Datastage and QualityStage Parallel Job Advanced Developer Guide v8 7Document861 pagesIBM Infosphere Datastage and QualityStage Parallel Job Advanced Developer Guide v8 7cantheNo ratings yet

- V. SOCIAL SECURITY SYSTEM v. GLORIA DE LOS SANTOSDocument1 pageV. SOCIAL SECURITY SYSTEM v. GLORIA DE LOS SANTOSReynier Molintas ClemensNo ratings yet

- Demetrio P. Sira, SR., Guardson Siao and Demetrio G. Sira, JR., For Petitioners. Tomas A. Garcillano, Jr. For Private RespondentsDocument6 pagesDemetrio P. Sira, SR., Guardson Siao and Demetrio G. Sira, JR., For Petitioners. Tomas A. Garcillano, Jr. For Private RespondentsReynier Molintas ClemensNo ratings yet

- Amendment V Substitution (Complaint or Information) R.C NotesDocument11 pagesAmendment V Substitution (Complaint or Information) R.C NotesReynier Molintas ClemensNo ratings yet

- P. Reynaldo Cano Chua V CA SSS, GR NO 125837, October 6,2004Document2 pagesP. Reynaldo Cano Chua V CA SSS, GR NO 125837, October 6,2004Reynier Molintas ClemensNo ratings yet

- Republic V. Asiapro Cooperative (G.R. No. 172101) ClemensDocument1 pageRepublic V. Asiapro Cooperative (G.R. No. 172101) ClemensReynier Molintas ClemensNo ratings yet

- V. SOCIAL SECURITY SYSTEM v. GLORIA DE LOS SANTOSDocument1 pageV. SOCIAL SECURITY SYSTEM v. GLORIA DE LOS SANTOSReynier Molintas ClemensNo ratings yet

- U. SSS vs. VDA DE BAILON, GR. NO 165545, MARCH 24, 2008, SINGZONDocument2 pagesU. SSS vs. VDA DE BAILON, GR. NO 165545, MARCH 24, 2008, SINGZONReynier Molintas ClemensNo ratings yet

- SSC Vs BayonaDocument1 pageSSC Vs BayonaReynier Molintas Clemens0% (1)

- CTK College - Syllabus (Natural Resources & Enviromental Laws)Document36 pagesCTK College - Syllabus (Natural Resources & Enviromental Laws)Reynier Molintas ClemensNo ratings yet

- Philippine Blooming Mills Co. vs. Social Security System (GR No. L-21229, Aug 31, 1966)Document1 pagePhilippine Blooming Mills Co. vs. Social Security System (GR No. L-21229, Aug 31, 1966)Reynier Molintas ClemensNo ratings yet

- T. Signey v. SSS, GR No. 173582, Jan.28, 2008Document1 pageT. Signey v. SSS, GR No. 173582, Jan.28, 2008Reynier Molintas ClemensNo ratings yet

- O. SSS Vs CA and CONCHITA AYALDE G.R. No. 100388. December 14, 2000. JUSTINIANO, AJDocument1 pageO. SSS Vs CA and CONCHITA AYALDE G.R. No. 100388. December 14, 2000. JUSTINIANO, AJReynier Molintas ClemensNo ratings yet

- JOSE P. TECSON, Petitioner-Security SYSTEM, Respondent-: JurisprudenceDocument3 pagesJOSE P. TECSON, Petitioner-Security SYSTEM, Respondent-: JurisprudenceReynier Molintas ClemensNo ratings yet

- SSS V DAVAC ClemensDocument2 pagesSSS V DAVAC ClemensReynier Molintas ClemensNo ratings yet

- Jurisprudence On Finality of Administrative Action Philippine American Life Insurance Co. vs. Social Security System GR No. L-20383 May 24, 1967Document1 pageJurisprudence On Finality of Administrative Action Philippine American Life Insurance Co. vs. Social Security System GR No. L-20383 May 24, 1967Reynier Molintas ClemensNo ratings yet

- Roman Catholic Archbishop of Manila V Social Security CommissionDocument2 pagesRoman Catholic Archbishop of Manila V Social Security CommissionReynier Molintas ClemensNo ratings yet

- SINGZON J.UNITED CHRISTIAN MISSIONARY SOCIETY Vs SOCIAL SECURITYDocument3 pagesSINGZON J.UNITED CHRISTIAN MISSIONARY SOCIETY Vs SOCIAL SECURITYReynier Molintas ClemensNo ratings yet

- Economic GrowthDocument29 pagesEconomic GrowthReynier Molintas ClemensNo ratings yet

- Machuca Tile Co Vs SSS 30 SCRA 256 JurisprudenceDocument2 pagesMachuca Tile Co Vs SSS 30 SCRA 256 JurisprudenceReynier Molintas ClemensNo ratings yet

- F. Philippine Blooming Mills VS SSS Case DigestDocument2 pagesF. Philippine Blooming Mills VS SSS Case DigestReynier Molintas Clemens100% (1)

- Acct Statement - XX7767 - 03072023Document9 pagesAcct Statement - XX7767 - 03072023Devaj BajajNo ratings yet

- 1Z0-1073-22 Oracle Inventory Cloud 22 Implementation AlfabeticoDocument52 pages1Z0-1073-22 Oracle Inventory Cloud 22 Implementation AlfabeticoDavid LopezNo ratings yet

- Transformasi Metode Penjualan Melalui Workshop Digital Marketing Pada Umkm Di Desa HarjawinangunDocument11 pagesTransformasi Metode Penjualan Melalui Workshop Digital Marketing Pada Umkm Di Desa Harjawinangun2017202068No ratings yet

- Iowa Coach Fran McCaffery Contract 2017Document28 pagesIowa Coach Fran McCaffery Contract 2017Scott DochtermanNo ratings yet

- SAP Workflow Interview Questions and AnswersDocument1 pageSAP Workflow Interview Questions and AnswersatoztargetNo ratings yet

- The Asia-Pacific Centre For ResearchDocument17 pagesThe Asia-Pacific Centre For ResearchAj BautistaNo ratings yet

- Characteristics of ADIDAS AGDocument5 pagesCharacteristics of ADIDAS AGJaziel Alejandro Morales ValdepeñasNo ratings yet

- Dumaran v. LlamedoDocument3 pagesDumaran v. LlamedoJay jogs100% (2)

- Principles of Accounts SyllabusDocument12 pagesPrinciples of Accounts SyllabusOyebamiji OlukayodeNo ratings yet

- Ebook #4Document12 pagesEbook #4ANo ratings yet

- 5RST Assessment GuidanceDocument10 pages5RST Assessment GuidanceIsraa Hani100% (1)

- 2Q 2018 ICBP Indofood+CBP+Sukses+Makmur+TbkDocument131 pages2Q 2018 ICBP Indofood+CBP+Sukses+Makmur+TbkARJUNA RAMADHANNo ratings yet

- Implementing Enterprise Structures and General LedgerDocument602 pagesImplementing Enterprise Structures and General LedgerErikaNo ratings yet

- Unit 23: Regulating The Financial Sector: Lead inDocument3 pagesUnit 23: Regulating The Financial Sector: Lead inMinh Châu Tạ ThịNo ratings yet

- Method Statement FOR Flooring: 10 M - T A&Bc EV - F & Mep WDocument8 pagesMethod Statement FOR Flooring: 10 M - T A&Bc EV - F & Mep WTariq KhattakNo ratings yet

- Aec-44 - Course Outline (Strategic-Cost-Management)Document6 pagesAec-44 - Course Outline (Strategic-Cost-Management)Hyacinth FNo ratings yet

- Sonus Faber Price List Valid From October 2018 PDFDocument21 pagesSonus Faber Price List Valid From October 2018 PDFVOLCOVNo ratings yet

- Internship Report Mohammed Ababakar at R&K Consulting LTDDocument49 pagesInternship Report Mohammed Ababakar at R&K Consulting LTDmohammedababakarNo ratings yet

- FSM Aman ResortsDocument3 pagesFSM Aman ResortsAishwarya M 2027152No ratings yet

- Activity 8 (KYSSER VILLARUZ)Document3 pagesActivity 8 (KYSSER VILLARUZ)Kysser VillaruzNo ratings yet

- Organization Chart 20200625 PDFDocument9 pagesOrganization Chart 20200625 PDFsiti rochmah abdul rachmanNo ratings yet

- Fluids HandbookDocument330 pagesFluids HandbookJoe Wu100% (1)

- Management AuditDocument4 pagesManagement AuditSATHURI VANSHIKA 1923271No ratings yet

- Schedule of Charges General Banking 2022Document18 pagesSchedule of Charges General Banking 2022Shohag MahmudNo ratings yet

- The Effect of Digitalization On Business Performance An Applied StudyDocument8 pagesThe Effect of Digitalization On Business Performance An Applied StudyFrank MendozaNo ratings yet

- Hansen 1965 - The Structure and Determinants of Local Public Investment ExpendituresDocument14 pagesHansen 1965 - The Structure and Determinants of Local Public Investment ExpendituresPabloNeudörferNo ratings yet

- Addendum To Application Form - TW (Apr'23)Document1 pageAddendum To Application Form - TW (Apr'23)LuckyNo ratings yet