Professional Documents

Culture Documents

DALAL STREET Aug

DALAL STREET Aug

Uploaded by

Alpesh Shah0 ratings0% found this document useful (0 votes)

162 views136 pagesOriginal Title

DALAL STREET aug

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

162 views136 pagesDALAL STREET Aug

DALAL STREET Aug

Uploaded by

Alpesh ShahCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 136

INDIA'S NO.1 INVESTMENT MAG

AZINE SINCE 1986

DALAL STREET

UE

DEMOCRATIZING Te CREATION

sisin 120

eT aCe

Attractive Despite

be Fe (eta t zeny

~

Sarees

Alo

1000

Companies

usa ea)

ores

Analysis

Pere ae i ac)

ul

35€

INVESTING IS

ALL ABOUT PLAYING

ALONG INNINGS.

‘Stay invested for the ong term, to make the most of your investments.

INVEST RIGHT

\ssueo mm punuic wrrencst ay THe wseimvesrons:prorecvonruxe TOH FUTURE BRIGHT

‘NTS

'

ttractive

hallenges

tecommendations

LZ 13

Low Priced Scrip Hot Chips

Laurus Labs Limited

In A Healthy Space

Regulars

06 Editor’s Keyboard

07 Company Index

08 Market View

14 Technicals

116 Query Board

120 Reviews

121 Kerbside

‘Communication Feature sections

are advertorials provided by the

company & carried on “as is” basis.

{ET JOURNAL

sin

FOREX SERVICES

sFormcarency demand cat

OTHER SERVICES

Banking on Relationship forever

‘www dhanbank

Getting Over the Hiccups

ith the current situation’s uncertainty mostly factored in, markets are

Wisin itdifficult to retrace any part of the post March rally In spite ofthe

virus cases continuing to rise globally, most countries now appear to be

well-prepared to handle the crisis. A majority have raised their health infrastructure,

thereby alleviating the panic thet existed couple of months back. This is leading to

bolder opening of economies with few ‘on and off” hiccups. Alongside, news about

the development of a vaccine appears to be promising, providing fodder to the bulls.

Ifthe record stimulus package announced so far globally was not enough to cheer

fovetoe eb mt Incline wth US porte’ wecingon chugs

stimulus in the course ofthis week. Internationally, the FAANG (Facebook, Apple,

Amazon, Netflix and Google) stocks have dominated 2020. Back home, Reliance

Industries Limited (RIL) mimicked the performance of FANG stocks and

dominated the Indian bourses.

In our cover story we have discussed how the markets have done so far in 2020 and

which sectorsare expected to do well. We have explained why in spite of the

challenging environment, equity will still emerge victorious. An interesting point to

note is that despite 2020 being one of the worst hit years, it has had more than 1,400

stocks hitting their 52-week highs so far. Several stocks have doubled on YTD basis.

‘This suggests that recovery is taking place even though many would argue that any

recovery on ground is invisible. Do go through our cover story and mail us your

feedback.

“This isue isa special edition as we bring you the “Top 1,000" companies by market

capitalisation. The lst should come handy for long-term investors such as yourself in

identifying the potential inclusions to your portfolio. Along withthe list you will find

sectoral reports and data of at least 24 sectors. The trends in profitability, net sales

and net profit margins is analysed and presented in a crisp format for the readers to

digest the information and take appropriate investment decisions. | am sure you will

enjoy reading this very exclusive issue.

Going ahead, the market rally may get narrow and hence investors will have to adopt

a bottom-up approach to identify lucrative stocks. Include only quality stocks with

higher safety net. For the moment one may sacrifice growth and focus on

sustainability and hence strong belance-sheet stocks with comfortable cash flows

situation should be more desirable than flashy super-growing stocks with ed

balance-sheets and uncertain cash flows. Invest in a diversified manner and

towards a mix of high beta and defensive stocks in the portfolio because the market

rally does not appear to be waning, It has taken a breather. Buying on dipsis highly

recommended.

a

RAJESH V PADODE

Managing Director & Editor

6

DALALSTREET INVESTMENT JOURNAL | AUG.

stain

Vol 35.No. 18+ 2

Founder empha

LeteVB Pade Vpeiioie

ManagingDiretor Edit Subciption&Casomer Service

uj Pabte (ant Smale

Dept tors Cupane and tata Aut

‘eet apr ‘eon Ma

Schon Sgh aT

Copy tos Fad Khan AVP

‘sedkia Pay Mayank Dit - AVP Dig

aed Corns :

Recah ‘rl Chine Manger

ae owen bane

Apu Lakes Shaema Se Manager

posters

Nihon

oie Doman ape

Prk Shas Hemant

Vira age Jo Din

DSI) Private Limited

enter

Momentum-Based Trading Strategies

| found coverage on momentum trading strategies in the previous issue to

be highly informative for retail investors like me. I would like to know what

{s the typical timeframe for trade if one uses momentum. based strategies?

~ Gagan Valimbe

Editor Responds: Thank you jor writing tous. Momentum trading strategies

are usually focused on short-term market movements, but the duration of te

trade can depend on how long the trend maintains its strength. Typically, the

‘more volatile the market, the more advarage a momentum trader cas take of

short-term rises and falls in an asset’ value. Momentum: trading can be suitable

Jor traders who employ longer-term styles suc as position trading, as well as

‘thase who prefer short-term styles, such as day trading and scalping. We hope

this helps! Do keep writing tous with your queries.

Recommendations

Q Forcustomer Service

Maral Ofice

419-4. ath Foor Arun Chambers, Tadeo, Netto AC Market

‘Mambet-400034 022-434 76012/1617

Pane Ofc

(©1055 Flos, Thad Ceer North Main Road, Near Aus Bank,

‘Oppose ane na 6 Koregacn Prk, Pane 11001

‘B oxo 1072500

Dai © 907679278

‘Printer and Pblicer: iin Sevan. Rr Reh V Pde for DS) Pt

1d on behalf of Achievements Marchandie Prt 4 red st MOSS

Prine Pre. Ld. CJ, MIDC Fovans TIC Ars, New Mapur Col

‘Storage Tue, Nov lamb 100708 and pied ren 49, th

Foon Arun Chuan, Tarde, Nett» AC Maret, Mara DDO

IMAI rights cred. While all efit are made o cnvue tat he

‘ent publ icone al upto ate Daal eet Lene

Inurl hole no respons for any crore Ha eaghtocrurAll

ator cantina erin bed on undamantaland th alps

‘hdc howe methods whch though rable arent ini, The

eel erates eerie aie ener

(sheeltocobullapetsbetre hig any sven sas al Dll

‘Se osm ods esponsbty fr any oes that sy te de

lnvesumcnt devine radeon the us of inet given ma the

agai No reodacton ws pertednwhee orpar Wh

‘een! fom Dalal Set Journal @ All dupes ape naj 1 the

‘Schoo jarkdiion of cempetnt court and arn in Mamba oy

Dal Set essen Jura e member of TNSABCs

Adan cas * By 15610 Low Priced Scip 12

Aster OM Heatare ° By 13635 ertside nt

Bai Becticals * By 43780 Hot Chips B

(aon PointLaboratis By 38435 Kerbside m1

{achin shipyard by 32350 etnias 5

Fre etl Hid 10035 Queybord 119

a * By 9400 QueryBrard 119

Hvels nis * sal 57625 Tectials 5

am = tie 19625 Reviews 10

Kajra Cras * By 47380 Hot Chips B

KireskrBroters ° by 1136 fertside ma

Laws Labs = tid 76400 sis 6

PrINOUSTIES ° by 177805 Cheep 0

rcindia = Ho 487 Qveybrard 116

fall vik Wig = tie 1920 Queyord = 118

seelifrsrctreFinance = ‘Hod 7A Queyfoard 118

Tatas * by 57265 Kerbside m

Torrent Power = tid 31725 evens 10

United Dring Tos * by 13050 Queybord 116

BP 200% Profit» BPP - cok Portal Profits BL - Bo

stsia

20 | DALAL STREET INVESTMENT JOURNAL

7

ver the last few weeks the

markets have remained

‘volatile as the world

‘economy tries to get back to

normalcy despite rise in

COVID-19 cases. Also, fears existed in

the minds of investors as tensions

between US-China rose.

During the week. domestic markets

‘witnessed bull sessions as lockdown was

‘eased. Sensex and Nifty rose by 6.83 per

cent and 6.54 per cent respectively.

SmallCap and MidCap index gained by

1.99 per cent and 2.95 per cent

respectively. Amongst sectoral indices, IT

index zoomed by 15.90 per cent during

the fortnight as the impact of COVID-19

‘was less than expected and most of the

‘companies have strong project orders to

beable to sustain through the current

challenging situation.

Following Auto index,

‘Metal index, Bankex and

Power index inched up

higher by 7.25 per cent,

4.47 per cent, 3.47 per

cent and 2.50 percent,

respectively

FMCG and Healthcare

indices reported a

relatively lower growth of

0.20 per cent and 1.86 per

cent respectively. Realty

index:is the only index to

end the fortnight in

negative down by 0.70

percent

‘On the global front, global indices

‘underperformed compared to domestic

indices asin the American indices such as

DJIA and NASDAQ declined by 0.99 per

cent and 0.82 per cent respectively while

S&P 500 registered a mere gain of 0.65

-rcent. Amongst European indices,

FISE 100and CAC 40 fell by 0.82 per

scent and 1.57 per cent respectively

‘whereas DAX rose by 1.09 per cent. As

data from China showed a positive

sowth trend post the pandemic,

investors feared that the government

might soon tighten its eased out financial

Market Watch

Mixed Data Keeps Investors Guessing!

environment, thus further adding to the

belief that there may not be more bull

runs in the respective market. As a result

Shanghai index tanked by 5.47 per cent

while Hong Kong’ Hang Seng index

‘which is dominated by Chinese stocks

also witnessed a decline by 2.77 per cent

during the fortnight. Japan's Nikkei index

gained by 0:31 per cent

Looking atthe trading data, Flls were net

buyers to the tune of 29,4284 crore while

Dils were net sellers to the tune of

¥907687 crove in the last few weeks

Gold prices have been on a run globally,

with the prices in India hitting a new

high. The yellow metal surged by almost

6.78 per cent to%54,300 for l0gof

24-carat gold in the lat few weeks and it

is up by 7.19 per cent since the beginning

of this month.

errs

el ee end ar

mK BOISE

ys HSS

wie Ko

wie ia

ho Swe

mer 30K Se

mG ey musta

fete 1S) TS

' ut mE

ee eee)

me Kk

my as aT

‘The Brent crude ol in the last couple of

weeks was up by 2.75 per cent to USD

41.40. Since the beginning of the month

Brent crude oil has gone up by 3.6 per

cent. Oil demand has improved from the

deep trough of the second quarter,

although the recovery path is uneven as

the resumption of lockdowns in the

United States and other parts of the

world has capped consumption.

masa | BoM eaeY Pee

Deen Ma nS

oe yt ie te

oo eA

mem imme

x kee ms in

we om ‘eam

ee

tie ea

oes ue

num = M1138

nam 164779 m8

mum | MN 15

mum | eRB ma

rsa S9157 337

Maan 3407 $87

‘wal gana 907587

psuin

NURTURING BRANDS

‘CO No.LisHaneeTPLceterst

“AMBULATONER? Opp Scdbu Brava, Sadhu Bhavan Road, Boda, Ta Ahmedabec «88058 (jrt ka

htoGambefagroup.com Webete ww anbujagrup com

v GUJARAT AMBUJA EXPORTS LIMITED

Well diversified and yet focused

acl

Recommendations}

PLINDUSTRIES

ADAPTING AN INVIGORATING aa

| Industries currently operates,

Jin the domestic agricultural

inputsand custom synthesis

and contract manufacturing

(CSM) segments. tis leading

player in the domestic agricultural inputs

sector, primarily dealing in agrochemicals

and plant nutrients. In the CSM.

its business interests include dealing in

custom synthesis and contract

‘manufacturing of chemicals. This

constitutes techno-commercial evaluation

of chemical processes, process

development, lab and pilot scale-up as

well as commercial production.

Considering that manufacturing of crop

protection products hasbeen exempted

from lockdown, the company will see

revenue and healthy numbers even in

Fv2L

In December 2019, PL industries

completed the acquisition of Isagro (Asia)

‘Agrochemicals Private Limited. The

acquisition provides Pl access to

additional manufacturing capacities to

‘meet growing demand and also

strengthen its position in the domestic

‘market by leveraging complementary

product portfolio and distribution

channel of JAPL. PI Industries is aso

expected to benefit from synergy benefits

oes

1 YEAR INVESTMENT HORIZON

eae

2

Ce)

mms omin

we BK

wm KM aut

of adjacent manufacturing site while

de-risking the supply chain of afew

products. Going ahead this acquisition

will add to the top-line.

‘The CSM export segment provides

healthy revenue and stable profitability. PL

Group is one ofthe pioneers of CSM in

the agrochemical space in India. Ithas

builta strong reputation based on its

sound research capabilites. The clientele

includes some ofthe largest agrochemical

innovator companies in the world. The

Equity

‘group hes invested significantly in

‘enhancing manufacturing capacities over

the past five years.

‘With the growth in population in India,

there isa rise in production of erops.

which in turn enhances demand for

agrochemicals. The company has shown

‘good growth in sales, PBITD and PAT in

the ast three years. Gross sales have

increased by 20.76 per cent CAGR from

FY18to FY20, PBITD and PAT also saw a

‘growth of 20.59 per cent and 11.35 per

‘cent inthis period. Thus the company has

posted noteworthy past performance and

‘growth visibility due to acquisition and a

growing market

For the quarter ended March 2020, the

‘company’s gross sales increased 6.26 per

‘ent to 8855.20 crore in Q4FY20 from

2804.80 crore in QUFY1S. Total

expenditure for QaFY20 stood at

2668.90 crore 2s against 8681.30 crore in

QUFY19, showing an increase of 5.96 per

cent PBIDTE excluding other income,

showed an increase of 738 per cent to

186,30 crore in QUEY20 from?173.50

‘crore in the same quarter lst year. PBIDT

‘margin, excluding other income, for

QUFY20 stood at 21.78 per cent as against

21.56 percent in the same quarter last

year

PAT for Q4FY20 stood at 2109.90 crore as

against 2125.70 crore inthe same quarter

ist year showinga decease of 1257 per

cent. PAT margin for Q4FY20 stood at

12.85 per cent as against 15.62 per cent in

the same quarter last year. The stock is

tradingat a PE multiple of $8x. ROCE for

FY20 stood at 25.10 percent. The

‘company has shown increase in sles and

profit over the last three yeas along with

‘consistent margin (PBIDTM and PATM)..

By virtue ofthese factors, we recommend

‘our reader-investors to BUY this tock,

Shareholding Pattern

oe

roe ——

ter ae

lc S216 Orting ft

10

DALALSTREET INVESTMENT JOURNAL |

m0

nao

pstin

&) TradeAnywheve

End to End Online Trading Solutions

for Indian Capital Market

NSE has decided to discontinue

Market Alert! New) trading platform so what next?

Dion is offering multiple

frontend cutting edge

technology solutions

which caters entire

transaction life cycle of

financial services and

online trading business!

For Cost Effective and

High End Trading Solutions

Please Contact Us!

Vera PCr erie

www.dionglobal.com connect@dionglobal.com 91204149672, 97118 67505

ADANIGAS

INTHE RIGHT SPACE AT T

dani Gas Limited is

engaged in developing city

gas distribution (CGD)

networks to supply piped

natural gas (PNG) to the

industrial, commercial, domestic

(residential) segments and compressed

natural gas (CNG) to the transport

sector. The company has already set up

city gas distribution networks in

Ahmedabad and Vadodara in Gujarat,

Faridabad in Haryana and Khurja in

Uttar Pradesh.

Atpresent, natural gas accounts for just

about 6 percent inthe total energy mix

of the country due to its low per capita

consumption. The government is aiming

to increase this share and wants to take it

to 15 per cent by 2030. Even without

increase in total energy consumption asa

nation, this can translate into 150 per

cent increase in revenue for natural gas

players. Moreover, with favourable

government policies and reforms, the per

Capita consumption of natural gas is

expected to also rise, Simultaneously, the

population of India is expected to grow

to 1.4 billion by 2024, thereby aiding

increased demand for energy. Hence, the

demand side will be strong, There is a

oes ea ad

12

DDALALSTREET INVESTMENT JOURNAL | 5

Recommendations

HE RIGHT TIME

vetttaten

1 +9 6/1 2

set oa

LOW

PRICED SCRIP

1 YEAR INVESTMENT HORIZON

ese

m4

Niralfet 6130 7800 302

deta «SSD MATa

dmatioed TS $675 SALSA

Wt = 00 0) 2

Annet OO HOD 181267

growing preference for natural gas for its

convenience, safety and cost-effective

properties.

‘The infusion by TOTAL Group for 37.4

percent equity stake in AGL is the largest

foreign direct investment in India city

gas distribution sector. This investment

aims at strengthening infrastructure

across the supply chain. It will also result

in access to global expertise and supply

network, which will help in better gas

sourcing, Investment by TOTAL Group

helps give the growth story of Indi

natural gas company a kind of validation,

Peery

eed

Toa mame

Promotes OTE) eatpaac

hic 5m Osan Pte

‘aia Ines

‘

er

Cm ..

Equity

‘Thecity gas distribution business is

stillan untapped market with alot of

potential to grow. This makes it a unique

space with good growth prospects and at

profitable level with good ROCE and.

profit margins, as can be seen from the

past three years’ performance.

For the quarter ended March 2020, the

‘company’s gross sales decreased by 0.78,

per cent to 490.32 crore in Q4FY20

from $494.17 crore in Q4FY19. Total

expenditure for QAFY20 stood at

322.37 crore as against 2354.58 crore in

QUFYI9, showing a decrease of 9.08 per

cent. Thereby, PBIDT, excluding other

income, showed an increase of 20,32 per

cent to 8167.95 crore in Q4FY20 from

139.59 crore in the same quarter last

yeat. PBIDT margin, excluding other

income, for Q4FY20 stood at 34.25 per

cent as against 28.25 per cent in the same

quarter last year.

PAT for Q4FY20 stood at €122.07 crore

as against 75.68 crore in the same

‘quarter last year, showing a significant

increase of 61.3 per cent. PAT margin for

Q4FY20 stood at 24.90 per cent as.

against 15.31 per cent in the same

{quarter last year. The stock is trading at a

PE multiple of 36x. ROCE for FY20

stood at 36.54 per cent whereas the

RONW ior the same period stood at

33.91 per cent. The company has shown

increase in sales and profit over the last

three years along with margin

improvements (PBIDTM and PATM).

By virtue of these factors, we

recommend our reader-investors to

BUY this stock

a

eee

i877 93 8417

ins et nt Oe

TH MM 59 SL

ns 398 HB UM MD

mo 1 me mM se

1958 198 198 eH

stain

The scrips in this

column have been

recommended

with a 15-day investment

horizon in mind and

carry high risk. Therefore,

investors are advised to

take into account their risk

appetite before investing,

as fundamentals may

or may not back the

recommendations.

(Ching price af uly 28 209)

stsia

BAJAJ ELECTRICALS CMP - 8437.80

BSE CODE Volume Face Value ‘Target ‘Stoploss

500031 70,069 2 2475405 (CLS)

aja) Electricals is engaged in

engineering and projects, power

distribution, illumination and

consumer durables businesses. On a

consolidated quarterly front, the company

reported net sales of 81,293.27 crore in

QAFY20, down by 26.55 per cent from

$1,760.83 crore in the same quarter for the

previous fiscal year. Operating profit

declined by 40.47 per cent from 291.12

«crore in QUFY19 to%54.24 crore in

QUFY20. The company reported a net loss

(oF 80.12 crore in Q4FY20 against a net

profit of &24.98 crore in Q4FYI9. There has

been an improvement in balance sheet

position with leverage rato reducing from

Loxin FY19 to 0.6xin FY20. This

reduction in debt will lad to a significant

decline in interest outgo going forward.

‘Companies with a strong balance sheet

position like Bajaj Electricals are likely to

recover faster post lockdown. Thus, we

BSE CODE

500233

Volume | Face Value

25,241 Est

(No. of Shares)

= and

aaa 2518

2am an

2a) 1a

haa sats

athe ss

2h 9s

Bhdame 2241

|AUGO3- 16, 2020 | DALALSTREET INVESTMENT JOURNAL

enor n ety

(No. of Shares)

2 hy. 200 708

21 oy 200 Ix)

jay 20 rs

By 3a ee

ny 300 08

Pay 100 vaca

hy 200 70

recommend a BUY on this crip.

(CMP - 2423.80

Target ‘Stoploss

2455 395(CLS)

Ceramics Limited isa tile

‘company engaged in the manufac-

and of ceramics,

Polished and glazed vitrited es and offers

products, including ceramic wall and floor

tiles, polished vitrified tiles, glazed vitrified

tiles, and sanitary ware and faucets. On the

consolidated financial front, the net sales for

QUFY20 declined by 20.03 percent 10

2652.04 crore from 815.31 crore reported.

for Q4FY19, PBDT for QSFY20 contracted

by 23.57 per cent to be £95.36 crore

compared to 2124.77 crore for Q4FY19, The

company gained a net profit of 48.82 crore

for Q4FY20, decreasing by 26:98 per cent

‘when compared to the net profit of %66.86

crore gained in Q4FY19. Despitea challeng-

ing year, Kajaria Ceramics is expected to

benefit from its leadership position in the

industry and strong execution capabilities.

‘Additionally, the company also has a

healthy cash balance aiding its long-term

ag prospects Hence, we recommenda

p a

13

Technicals |

NIFTY Index Chart Analysis

REMAIN WITH THE TREND

he bull on D-Street seems

‘unstoppable as Nifty

extended its northward

journey forthe sixth

successive week, making it

thelongest winning streak post April

2019, Further, every critical resistance is

bbeing dispatched to the casualty ist and

thelist continues to grow as Nifty has

‘managed to overcome the bearish gap

(11,035-11,244) of March 6. This buoyant

move can be accredited to the news on

COVID-19 vaccines and treatments and

‘on the domestic front, a pleasant surprise

ess ity Levels ‘Action tobe tated Probab Targets

‘rading ae 1 00 ova wey sg bs

Assure treme 113771140 parte ene nonenm ee i, Rett)

‘dese ton 1.200 ne eet ca woud

Sisoatrtenetumiem 1120011210 BREN mbm wey oe 1080

‘with Fils turning net buyers to the tune

‘of ®3,594.15 crore month till date, while

for the same period Dils have been net

sellers to the tune of €9,557.75 crore. The

‘worry for the markets would beon the

domestic flows front as they have been

‘consistently in the negative zone for

some time now. The

Nifty has retraced

© | almost 78 per cent of

= | the down move which

started from January

and aso it has gained

‘almost 50 percent

from the March lows.

Let’ revisit history

and check how the

‘current V-shaped

recovery has fared in

‘comparison with the

ast

FE

= | We have categorized

from the earning season as the corporate

carnings havent been as bed as analysts

expected. In fat, the earnings season has

added some visibility that was missing.

‘Meanwhile, the Bank Nifty has been quite

volatile over the concern that banks are

likely to face the brunt post the end of the

EMI moratorium period, However, itis

also finding its mojo and is seen prepared

for a big move. After spending nearly five

trading sessions in the consolation range

‘of 11,058-11,240, finally on Tuesday Nifty

broke its shackle and ascended higher to

«lose atthe 11,300 mark for the first time

ever since March 3. The bull once again

displayed strength and every opportunity

presented in the form of shallow dips has

been bought.

‘The institutional participants are tepid

14, DALALSTREET INVESTMENT JOURNAL | 5

severe falls where the

index has corrected over 35 per cent

from the top and there are total four

instances when these criteria have been

‘met. With the fourth being the recent

‘COVID-19 pandemic fall, the other

three have been from the past. Following

are the details in the year 1992 and

2000 when we saw a severe fall of 53 per

erence

on ue to the ongoit

Virus anemic 7s

‘While there cannot be divergent views

‘on the impact ofthe pandemic globally,

itisalso evident thatthe financial sector

fn general has taken a huge beating. With

the lockdown continuing and economic

activities coming toa halt, bank earnings

are directly impacted. With

‘manufacturing, SME and retail business,

‘except the essential consumable items,

‘non-functioning for quite a few months

ina row the impact on GDP is likely to

be severe. Hopefully, economic activities

‘may resume over a period of 6-9 months

‘which will possibly improve the asset

quality too, Due to the virus pandemic,

there isa sharp decline in the purchasing

power of iouseholds where discretionary

spending has reduced to half.

‘Banks, in particular, may facea

‘mammoth task to protect their lending

book and will have to resort toadequate

‘measures. The RBI has offered

‘moratorium to ll borrowers asa relief

yet repayment of overdue amounts will

put pressure on borrowers who are

already reeling under a severe financial

crunch, With the present crisis bringing

GDP growth toa negative region, the

levels of NPAs are likely to move

northwards. As for our bank, though we

are expecting some deterioration ina few

‘SME accounts, no major impact in asset

quality is expected on account of the

pandemic. We continue to maintain a

Conservative approach on large-value

advances and are also keeping a healthy

provision coverage ratio to immune

‘ourselves.

‘What percentage of your borrowers

has availed of the EMI deferment

facility?

‘Moratorium on loan repayment facility

20

announced by the RBIs o the tune of 30

per cent of the loan portfolio of our bank

which is in line with the industry

average.

‘What isthe bank’s position when it

comes to liquidity?

‘The ascet lability management (ALM) of

Dhanlaxmi Bank is comfortable with no

negative cumulative mismatches in any

‘of the time buckets and has quite

‘comfortable liquidity coverage ratio

(LCR) as of June 30, 2020 against

tory requirement. Moreover, the

bank has liquidity backup in the form of

‘excess SLR investments. In addition, the

term deposit rollover rate of above 80 per

cent and core savings deposits of above

85 per cent provide additional liquidity

‘comfort, We are, on the contrary,

Increasing our lending to agriculture and

MEI segments and providing gold loans.

Investors at this point are risk-averse

and fear a spike in NPAs for the

financials. }ow would you address

‘The apprehension of a spike in NPAS

stems from the foreboding over what will

happen tothe financial sector once the

six months’ moratorium on repayment of

loans ends by August 2020. When the

time to resume repayment comes, there

are likely to be some defaults by

borrowers, which may cause sharp rise in

NPA levels. Our bank has proactively

done some spadework and we do not

foresee an unexpected spike in NPAs as

faras we are concerned, Our bank will be

able to curtal the fresh NPAs with

suitable rehabilitation and recovery

strategies in accounts that need special

care or attention. We have beefed up the

monitoring mechanism at all levels to

censure our asset quality remains

unaffected

Meanwhile, green shoots in the form of

‘opening of economic activities gradually

across India and the likelihood of

‘vaccine reaching the market soon will

surely help bring things back to normal

‘The bright spot in this otherwise bleak

scenario isan upbeat rural India. A good.

start to the monsoon season has

encouraged sowing, thereby holding the

promise ofa good kharif crop. The

‘government has announced several key

reform measures forthe agricultural

sector which have improved sentiments

across the entire agricultural supply chain.

‘Domestic tractor sales growth isa chief

[proxy to gauge the health of rural

‘economy which shall bolster the revival

endeavours.

‘What are the growth chall faced

bby your bank going forwa

‘With sentiments improving across India,

‘we shall continue to focus on social

impact banking with lending focused on

rural, microfinance, agricultureand

‘SMEs to create liquidity and then

sustainable businesses. Largely

concentrated in the southern part of the

country, our hank shall continue to

‘explore growth potential with focus on

‘merging business opportunities. We are

‘ofthe belie that every crisis brings along

‘unprecedented opportunities. Therefore,

‘with small base, we shall beable to move

swifily and capture the potential. Retail

penetration through gold loans and

hhousing, business loans will add

substantially to our growth. A

technology-based risk model shal fuel

‘our aspirations and help mitigate the risk.

‘Do you have any plan to expand the

barkbranch network in the future?

‘Wedb foresee an opportunity to expand

‘our businesses in South India fist and

shall be exploring the possibility of

creating new footprints in afew

prosperous urban pockets across other

gions. s

Ms. Apurva Purohit

Presiden, agran Prakashan Limited

mn wellok at how the year

19-20 panned out, Covid

andi shoxk is ike to

overshadow everything that

happened hitherto; however the fact

remains that for the entre year, a weak

macro-economic environment continued to

impact consumption in India. This directly

caused advertisers to lower or withhold

‘marketing spends. And of cours, the

situation got hugely ageravated with the

sudden lockdown announced by the

Government of India when the economy

‘came wo a screeching halt in March 2020

‘Advertisers had already started canceling

‘ongoing ad campaigns from the middle of

March and as weal are aware, continue to

remain off grid with most agencies and

offices still closed down, especially in the

‘two largest advertising markets ~ Mumbai

and Dei, Asthe opening and closing of

cities continues well into Jul. the impact on

the economy is not only going tobe huge

Dut also sustained over alonger period.

Increasingly pundits and forecasters are

already delaying their expectation ofan

‘economic bounce back from March 21 to

the middle of FY 22.

‘Atan organization level, the businesses that

‘will survive and prosper are those who have

consciously been watching their bottom

Tines, have believed that cash isking and

have been judicious in cost management

Whilea crisis is often an opportunity to

bstsin

(@e)annlelaesiaeya) Feature

A Journey Of Resurgence

tighten our purse sings forcing us to

improve efficiency and productivity which

‘may have got compromised during the days

of plenty, this pruning and tightening helps

only ifthe businesses are able to tide over

the crisis Since no crisis comes witha

‘or allows usa practice session, the

better approach Ihave always strongly

believed, is to be consistently prudent and

‘margin focused rather than topline driven

alone.

‘Therefore, the leaning here would be to

concentrate on margin and cash low and

not look at buying marketshare or doing

expensive customer acquisition but focus

‘more on customer engagement and

retention and thus consistent bottom line at

all points in time ~both ina benign as well

asa dificult economic environment.

AtMBL, this philosophy of being discret is

‘ot something that is new to us. As far back

as 2015-16 when ll FM players were given

‘one more opportunity to expand their foot

print by bidding for new radio stations,

“MBL chose to be extremely selective and

«expanded by acquiring stations which could

give usa geographical advantage at efficient

bid prices. Most of our competitors however

chose to increase depth of coverage by

Duyingextremely expensive frequencies in

the same metros where they already had one

frequency. Asa consequence, the impact on

for them hasbeen significantly negative

and continues tobe erosive, whereas this

prudent strategy helped MBL actually

2018-19 by 673 basis point. Today MBL has

the best in clas profit and margins as

compared to allit national peers. Inthe

year 19-20, MBLS revenue was 22478

Crores with an EBITDA of 266.6 crores

excluding one-time charges of ®9.5 crore

made on account of Covid impact. To

‘minimize the financial impact of Covid, we

«continued with our cost rationalization

initiatives which have resulted in total cost

saving of 30.2 cores on an annual basis

thus far

‘tide over the current crisis the radio

industry association has requested the

Government to waive of regulatory

‘payments including license fee for the entire

‘year, clear overdue payments by various

Government agencies, which have

significantly added to our net outstandings,

and restore advertising to earlier levels

hich accounted for 12% of the FM

Industry revenue.

‘On the balance sheet front, we have been

able to reduce our non-government

‘outstanding from 114 daysas on March 31,

2019 to 109 days ason March 31,2020

Daring the quarter, we have repaid 69.24

‘crores comprising NCDs and other

borrowing, Fost the repayment, our balance

sheet is debt-free and we havea strong cash

reserve of 220 Crores which will larly go

allong way in helping us weather out the

‘current testing times to emerge even

stronger than earlier

Recently the Association of Radio

Operators for India (ARO commissioned

an independent survey toundersiand the

impact on media consumption during

COVID-19 lockdown which I would like to

share with you.

‘© Radio listenership has increased from

48 milion to reach 51 million, second

only to TV's reach of 6 million

a= Average time spent listening toradio

grew 30 minutes or 239% from 2

hours and 7 minutes to 2 hours and

36 minutes

= Time pent on radio has

increased in all SEC segments

= Total daily hoursof radio

consumption are at 131 million, up

from 102 million

1= Theresearch showed that radio is

considered asone of the most reliable

sources of information and the mode

oflistening is mostly on the mobile

‘The road to revivals going tobe hard for

the world and for every business but if we

stay focussed and keep working at

strengthening our relationships with all our

stakeholders-our customers, our clients, our

‘employees, and our investors, Lam sure we

will emerge from these dificult times with

‘our businesses finely honed and stronger. gy

AUSOD 16,2020 | BALALSTREETINVESTMENT JOURNAL — 21

Fennec Feature

Company Has Plans To Increase

its Revenue/turnover from

799 (Pat 52.5 CR) to 1500 Cr

(Pat 120 Cr) in Next 3 Years

‘What were the logistic challenges that the company

had to overcome to remain operational during the

lockdown?

For essential commoxiities operation of trucks, road and rail

transport was resumed after about 15 days of lockdown, so the

supply mainly happened in the International market

‘uninterrupted,

‘What has been the impact on the export of Basmati Rice

taking into consideration that shipments to countries such as

tran and Saudi Arabia, large buyers of India Basmati rice,

have been affected?

The company is not exporting to Iran for the last 07 years due

to ever increase inthe sanctions, The exports to Saudi Arabia

and other parts of the world remained normal and even higher

{in some regions due to panic buying during Covid

22 DALALSTREET NVESTMENT JOURNAL

- Sankesh Setia

Director, Chaman Lal Setia Exports Ltd

‘With further relaxations anticipated by the central and state

governments, are improvements expected in the operational

performance in the quarters ahead?

The rice is a GST free product, except branded sales in India,

Now the central government, by the President of India order

made entire India a single market for the farmers and for the

rice industry.

Market fees/ Mandi samiti of 4% has been brought down to

zero. this development augurs well for us, We expect good.

business in the times to come.

‘What plans do the company have in store for the future?

‘Company has plans to sell Maharani brand on several online

portals like Amazon, Big basket and so on. Itsalways the

endeavor of the company to promote the business in every

region, India or abroad

stain

|our research-backed recommendations have been our greatest strength

Cover the past so many years. infact, helping investors book profits has

U l a fac e |been the very essence of our existence. Here isa detailed guide on the

| recommendations readers to get a quick insight on what to do next.

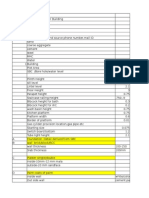

LOW PRICED SCRIP

RECOMMENDATIONS UPDATE FOR THE LAST ONE YEAR

cl ore Lieu) aire Exit toa

Po gol! ie A (%)

Novs,2018 Trident ad. 6 | Decl6,2019 835

Nov 22,2018 | Oricon Enterprises Lid 3225 Nor22,2019 1820 4357

Dec06,2018 Jain Irgation Systems Lid 65 julo4.2019 2720 “127

ec 20,2018 Flatex India Ld. 62.00 Jun22,2020 2800 4.88

Ja03,2019 Prism johnson Ld 805 Apeig,2019 $870 nauo

Jan 17,2019 BC Power Contos Ltd 3650 Jan 24,2019 280 1599

Jan 31,2019 Jay Shree Tea Industries Led 7670 Ape30,2020 384s 4987

Feb 14,2019 Jammu & Kashmir Bank Lid. 3840 Mar06, 2019 41985 2982

Feb 28,2019 Prakash Industrie Lad 9125 645

Mar 14.2019 | Masic Broadcast i 48.49 66.96

Mar 28,2019 Federal Bank Lid $0.80 Juno4,2019 10920 20.28

‘Apr 11,2019 Indiabulls RealEstate Lid. sas 13,2000 4500 2

‘Apr 25,2019 ‘Tata Power Company Lid 75 am

May 09,2019 South Indian Bank Ltd. 1545 53.40

May 23,2019 Aaya Bila Capital ad 95.5 3815

Jun 06,2019 National Aluminium Company Lid 5025 “3373

Jun20,2019 ET Foods Ld. 24.00. Sep1,2019 us7

Jal04,2019 Granules India Lad 950 0424,2019 11435 97

Jul 18,2019 Bharat Heavy Electrical Lad uss Eo 1292

‘Aug01, 2019 _ India Cements Lad. 8785 Feb26,2020 wor

‘Aug 14,2019 SIVN Lid. 24.40 aa) 9.02

‘Aug29, 2019 Housing and Urban Development Corporation Li 3695 Nov4,2019 aun

Sep 12,2019 NHPCLid 2430 Jan20,2000 ae 1938

Sep 26,2019 alma Bhart Sagar and Industries Le 9065 Jano1, 2020 11335 2508

ct 10,2019 Prism Johnson Led 7750 407

Oct 24,2019 Welspun Enterprises Lud as 3.68

Nov67.2019 Gujrat Pipsnaw Port Ld 8840 882

Nov 21,2019 | Hindustan Oil Exploration Company Lid sas 25.80

Dects,2019 | Himadr Spectalty Chemical I. 6195 2055

Dec 19,2019 Jamin Aso Industries Ld 4045 538

Jan 02,2020 _| Housing and Urban Development Corporation Lid. a0 245

Jan 16,2020 Birlasoft Ltd. 73.05 Feb 03, 2020 22.25

Jan 30,2020 Rall Vikas Nigam Lad 2850 32

Feb 13,2020 GAIT (india) Lu 13030 23.56

Feb 27,2020 JK Paper Lx 121485 “1817

‘Mar 12,2020 _R Systems International Lid 90.00 Juno2, 2020 11220

Mar 26,2020 Fistsource Solutions id 2595 Apr 16,2020 3765

‘Apr 09,2020 fythy Labs Lid. 10035 Jun24. 2020 120270

‘4pr23,2020 | NMDC Ld a0 oe oo

May 07,2020 Philips Carbon Black Lid 7350 Juni, 2020 3375

May 21,2020 | Newgen Software Technologies Lx 15075 jul22,2020 203.90

Jun03,2020 | Marksans Pharma Lid 2890 jun23,2020 37.0

Jun 18,2020 Hindalco Industries Lid 48.00

Jul 02,2020 Meghmani Organics Ltd. 52.65

Jul 16,2020 Star Cement Lid 85.00

pasta AGO}. 16.2020 DALALSTREETINVESTMENT JOURNAL 23

o4 @

quity To Remain Attractive

Despite Challenges

Even as the corona virus shock dictates how global economies perform in the near and medium term, it is fundamentally

reshaping the investment landscape for global investors. There are accelerating structural trends in inequality,

globalisation, sustainability and macroeconomic policies triggered by the virus shock. Amidst heightened uncertainty,

strategic asset allocation becomes the most crucial investment decision. Yogesh Supekar discusses the outlook for

the equities with the help of industry experts while Anthony Fernandes highlights the YTD performance of various

global indices and asset classes

24 OALALSTREETINVESTMENT JOURNAL | 4.50

stain

he Sensex is up by almost 46 per cent from its corona virus-pushed

market lows in March, 2020. This sudden, sharp and smooth

recovery has not only surprised market participants but has also

Jed to some confusion in their minds, Usually stock markets are

leading indicators of economic reality and stock prices often

reflect the optimism seen in businesses in real terms. But the stark.

contrast in stock prices and ground realities have pushed several

‘market commentators to conclude that there is less or no

correlation between stock prices and the economic realities ~ atleast in the near term,

‘There is also a raging debate on whether the financial crisis of 2008 has done more

‘damage or whether the virus-led disruption has led to larger disruptions in the

‘market. The comparison, many believe, wll help us understand how and by when will

the global economies start operating at full capacities. Taken at face value it does look

like the initial pandemic contraction is larger than the great financial crisis (GFC).

However, the manner in which the policy response has been executed and the

‘curmulative impact on the economy will likely be much les in the current crisis when

‘compared to the GFC situation. The strong policy response will cushion the blow

‘much better than it did during the financial crisis of 2008.

‘The US Federals attitude todo ‘whatever it takes'to bring normalcy in the markets has

appeased investors globally In fact, the US Federal has used its full ange of tools and

al times created new ones ina far shorter timeframe than in 2008. These policy actions

have fuelled the current stunning record-breaking rally. As of now, the global nancial

system is flush with liquidity and the dilemma faced by global institutional equity

investors is whether to chase growth or value. Emerging markets (EMs) have always

been looked at as ‘growth markets’ by the developed world.

‘What the virus crisis has done is given a generational shock to EMs. The long-standing

pillars of EMs have been superlative growth, strong balance-sheets and fiscal

discipline. All these three pillars are now challenged due to the ongoing crisis. Each.

‘country will be studied with a microscopic view and the country with Best

fundamentals and fastest recovery from the current crisis may attract maximum

investments. China, ince it restarted its economy fastest, has a clear advantage over its

EM peers. India is struggling with its infection rate now being the fastest in the world.

‘Thus. if investors want to know ifthe recovery in the equity markets both global and

locals sustainable the following signposts need to be tacked clos:

How successfully the economies are restarting themselves while controlling the

virus spread.

What steps are being taken by policy makers to minimise the economic damage

with stimulus packages to support industries.

Whether there are any signs of permanent scarring of productive capacity.

stsia auco3- 6

DALAL STREETINvESTMENT JOURNAL — 25

Cover Story

Long-Term Impact of Pandemic

With the dynamics of business and economies changing itis

expected that the fundamentals will be impacted for industries,

across countries due to macro changes. Some ofthe expected

long-term impacts across world economies include:

Lower interest rates will prevail for much longer than.

expected.

Globalisation may reduce to unprecedented levels.

Huge debt may get piled up, both by the government and,

the corporates while the share of governments in

respective economies may increase

Low intlation exists right now but there is risk of higher

inflation going forward, and in some ofthe economies

there might be stagflation. This is situation where

inflation increases with overall growth in the economy

‘being mated.

Corporate profitability. one would argue, may increase

duc to increased use of technology on account of

lockdowns generating cost-savings and productivity

improvements. However, slower economic growth,

‘inefficient capital allocation, higher taxes and labour

Issues can be expected to impact the profitability

negatively

Market Outlook

Rahul Sharma

ver the last few days, Fllsareon

Ja buying spree in the cash

segment, especially ater

crossing the 11,000 mark, which is

either a sign of FOMO or pethaps they

are eyeing something which we are not

aware of. However, traders are advised

tostay light on longs and stay close to

the door ast seems like the party may

end in the near future. Technically, Nifty

faces multiple resistances around the

11,200 ~ 11,400 2one and ifthe support

zone of 11,000-10:900 i breached this

time it may attract a lot of shortin

interes Gr the bear =

—

Indian Market Performance

‘With the kind of challenges faced by the markets and the

economy one would have expected a very different kind of

performance from equity markets. Instead, what we have are at

least 45 stocks from the lst of 500 stocks that are BSE 500

‘components doubling on YTD basis so far. Over 1,000 stocks

across market capitalisation gained more than 50 per cent since

‘March 23 when the Sensex hit the bottom and as many as 318

stocks gained more than 100 per cent. Up to 715 stocks have hit

fresh 52-week highs since March 23 and as many as 1,497

stocks have touched their respective 52-week highs in 2020 so

far. In 2019, a total of 1621 stocks were seen making 52-week

highs. This goes to show the momentum in stock prices in 2020

despite being faced by a deep crisis,

‘The highlight of the 2020 market so far has been the retail

investors’ participation which is close to all-time highs, inching.

close to the performance of the year 2000 when retail

participation was at its peak. Flis and Dis were net sellers

‘while retail participation was on the rise since March 2020.

Also, the performance of penny stocks took many by surprise

‘with several of them proving to be multibaggers. This goes to

show that the risk appetite ofthe investors has increased across

Associate Director and Head (Technical and Derivatives Research), JM Financial Services Ltd.

\ ye

|

ut siimdntac bifve:

=

“Major long.term support levels are seen at 10,350 and 9,800. A correction from here, fit happens, will only make the uptrend

healthier. [Phistory has to rhyme with the 1987 crash and the recovery thereafter, we may see corrections getting bought into

and eventually markets getting over this year’s crash, which may be triggered by the US’ elections or possibly a vaccine

development. Volatility has been a hallmark of 2020 due to which it has been a trader’ paradise so far and we hope the rest of

2020 will be no less. .

26 DALALSTREETINVESTMENT JOURNAL | 4503-1 psuin

Viram Shah, ceo andco-ounce vested inane.

CB iexiy ‘we are witnessing a new wave of Indian investors entering the global markets for the first time. Led by

‘young and aspirational investors who want to own global technology brands, indian investors are increasingly reserving

10-15 per cent of their portfolio allocation to international markets. Even during the lockdown quarter, deposits on our

platform that allows Indians to invest in the US markets grew 50 per cent as compared to the January-March quarter. coo)

the board over the past few months. thus eading to higher

participation.

“The liquidity-driven rally has pushed Indian markets further

into ‘ich valuation’ territory. Says Vinod Nair, Head

(Research), Geojit Financial Services: “In terms of valuation,

they are ahead of fundamentals. In PE terms we are already

above the pre-pandemic level. § & P 500 is at 22x on 12-month

forward basis compared to 18x. And Nifty 50 one year forward

PEs at 20.5x, which is higher than 18.5x before the onset of the

pandemic. Itmay be high due to low actual earnings of FY20

398

431

“10

“363

“347

408)

1756

553

“168

“41

“Bs

361

“195

ars

1801

755

333

ns

Zt

2006

27

2412

7569

20

706

a

1823

385,

id

671

08

052

1360

8a

a5,

peste

Nek 25°

Sou

162

m8

and lack of growth in FY21. It isalso due to the performance of

a few sets of stocks with high weightage. Stll,ona historical

basis, we are in the bubble range in valuation and itis advisable

to be cautious and place assets in safe categories and sectors”

India in terms of valuation (PE) remains one of the most

expensive markets in the world. With PE greater than 26 for

Sensex. only Nasdaq and Brasilian Bovespa are the other

indices trading at higher earnings multiple. The table below

highlights Indias relative performance and the expected

contraction in GDP as compared to other countries.

100)

060,

159,

130,

a)

610,

z an

MF Wr amc tlk tre 2005 ke 225 ets 5 0f 2207 2020

Outlook on Small-Caps and Mid-Caps

Rohan Patil, technical anayst, Bonanza Porto.

From a technical point of view, the small-cap index is moving

strongly on an absolute basis. In fact. the Nifty Small-Cap

100 price has moved above the previous week’ swing high

decisively, which indicates arise in optimism. At the same

time, ithas neglected its bearish ABCD pattern and this gives

double confirmation that more upside is due in mid-cap. On

a relative basis for the last seven weeks, itis consistently

outperforming the border index (Nifty) and so one can

definitely expect a continuation of further retracement of fall

from the high of February 2020. In the case of mid-cap, the

charts are indicating strength in the current move on an

absolute basis. The stronger buying has pushed the Nifty

‘Mid-cap 100 index above 50 EMA and theres a bullish

golden cross on.a smaller timeframe moving average. All this

indicates a bullish outlook but on a relative basis itis not able

to outperform the broader index. o

27

|AUGOS- 16,2020 DALALSTREET INVESTMENT JOURNAL

Cover Story

Commoxities have rallied in 2020 with bullion |

markets doing the best on YTD basis so far On.

YTD basis the following commodities

Ct)

ee age a Ce me TT

beer Baers

CLI

OX Gald 1g 3043

Naive 3106

{cx Alin mn

Cx oper 1571

Mawel 585

Meta 237

Main 331

S260 “168

NY ait

HB Deepak Jasani, ead rai researc, wore secures

What strategy may work the best in the current market

situation?

‘The difference between the macros (which are worrying) and

stock market values (which are soaring) creates doubts in the

‘minds of investors to keep participating in the bounce. On the

other hand, FOMO is also bothering them. Investors can relook

at their asset allocation and bring down the equity portion fit

has exceeded the intended allocation as planned by the investor.

In case the equity portion has not been exceeded, investors can,

Keep reshuifling their portfolio by part booking profits on

stocks that have run up much more than the markets and

parking that sum into sectors that are currently neglected and.

within that sector look for the best 1-2 companies to invest. For

investors who are woefully short of the intended asset allocation

as far a equities are concerned, they can shortlist 35 stocks for

staggered investing over the next 5-8 months.

‘What is your outlook on IT stocks?

The IT sector can be looked upon asa truly defensive sector

currently. The pandemic will have minimal impact on deliveries

by IT companies through a combination of work from home

and on-site work. Although there may be doubts about

spending by key industries globally resulting in their revenue

Visibility getting impacted diue to the slowdown, IT sector's

importance has risen late due to the urgency by the cents to

digitize their operations with a view to compete effectively and

keep operating in tough times. Within IT, both the large-cap

and small-cap have their oven strengths. While the arge-caps

provide stability in order bookings and execution along with

visibility in revenue growth despite the pandemic, the mid-caps

2B DALALSTREET INVESTMENT JOURNAL | 5 0

have their own niche areas of speciality. These niches help

‘mid-cap companies perform well in certain periods. These

niches ae also valuable to some investors as was seen in the

recent buyout of Majesco US,

‘What are the key risks faced by the markets? Will Fils park

‘more money into Indian equities?

“The risks include irregular monsoon, rupee coming under

pressure, local interest rates starting to rise, emengi

‘markets going out of favour, political setback for Pr

Minister Narendra Modi, geopolitical troubles for India

including the China front, US presidential elections

«creating some turmoil globally stress inthe financial sector

spreading to the real sector, the pandemic having second and

third round of infections, etc Ifthe global or local situation

deteriorates and liquidity taps start to run dry. a sharper fall

‘could ensue,

Pls have a choice to invest across the globe. Some of them try

to arbitrage by borrowing cheap abroad and investing in

‘markets, including emerging markets, keeping in mind the

currency depreciation possibilty. Currently we ae witnessing a

virtuous cycle with a feeling of FOMO present in quite afew

FPls despite their belief that valuations are not conducive for

fresh investment. Hence, the turnaround in economy and in

‘corporate earnings or continued easy money policy or risk on

sentiments across the globe due to no large geopolitical issues

‘or inter-country conflict (even economic) can lead to continued

flow into India by FPIs. Any reversal in these can lead to

‘outflows though their quantum will depend on the intensity of

the negative trigger. .

stain

Sankar Cha

‘How is the indian economy expected to grow in FY21?

‘Given the severe impact of the pandenaic and intermaiticat

hockdowns actos the county that ar likely to continue across

2, we ar expecting real GDP to contract by 10 per cent in the

‘current financial year (FY21). While QI is expected to contract

by over 30 per cent, we reckon that the economy will continme

tw contract even in Q2- What this means is that chances of a

Veahaped reeinery are rather alim. Instead. the recewery will be

more gradual ower the next few quarters and culminate

somewhere in FY22.

‘What are the key risks facing Indian at this

‘are the key risks facing Indian economy

Households postponing consumption isto our mind the single

biggest risk faced by the Indian econoeny. This is because

‘consumption i the engine of Indias economic virtuous cycle

and al! operational as well as capital expenditure is dependent

‘on it The negative credit off-take as well as contraction seen in

‘other macro vartables is ultimately reflection of weak domestic

demand. We note that poor ccanomic performance not just a

fection ofthe carveat oclslown end the apply donation

thereof but the increasing economic uncertainty that is

Cover Story

1, Group £0, Acuité Ratings & Research

translating wlracr spending and a propensity to save despite a

low interest rate environment. A consumption: inducing policy

is therefore the key at this juncture and it must precede all else.

‘Why can’t india print money and inject cash in the economy

the way western economy does?

Unlike the USD and Euro, the Indian rupee lacks a reserve

status in the world and the excess money supply

created by merely printing cash has to be absorbed

domestically. thas been observed historically that deficit

financing by the central bank (printing money) isften

inflationary (lasting a least a quarter depending upon the

magnitude) ifnot utilised productively. In any case, deficit

Financing is a window of last resort and a consensus between

the RBI and the Indian government will be critical. If and when

the RBI decides to monetize the government debt om a lange

scale, a formal plan must be in place much in advance. Itis

recommended that this money, if created. should be used for

capital expenditure instead of bouschold handouts. We believe

that there isa possibility of a second fiscal package. if any, to be

partially financed via this window. .

Conclusion

As of now, markets lack the sklvantage of value they had when

‘we witnessed the fastest market correction ever ata time when

there was fall by nearly 0 per cent. The market looked cheap

‘with its PE being close to 16 after the correction pushed Sensex

‘to sub 26,000 levels. With Sensex trading at above 38,000, the

PE multiple of 26 suggests the valisbons are not very attractive.

“That sad, the ‘known unknowns’ are already factored in and it

‘will bea mistake to have a negative outlook on the equity

markets, Cautious optimism is required more than anything

‘lsc in the current markets

“The recovery will continue as more efforts are being made by

[policy-makers actoss the globe to bring economies to normalcy.

‘What matters for equities isthe onger-term impact on

cearningy For long-term equity returns, itis important to access

the time taken for earnings and dividends to recover to the

‘pre-panemic levels. With the stimuli packages announced

‘worldwide the recovery is expected to be fast-tracked and some

of the economies may see a V- recovery: India may show

relatively dow recovery due to lack of stimulus ax compared to

some of the developed economies.

India is opening up rather gradually and may recover taster

swith more focused stimulus. The market will tke cues from

fresh news expected this week. Chances are that i will correct

‘with every hint of negative news. The market outlook is neutral

{to positive in the near term to medium term with expectations

‘of more stimmulss packages to hit the markets even as an

increasing number of countries are reopening quite fat. A

JO OALAL stmcey mvestient soURNAL

positive development on the vaccine front will also keep the

‘markets from falling, And even though the high-frequency

‘economic indicators are pointing toa slowdown, it may prox

the US Federal to continue with its dovish guidance. This may

keep the interest rates lower fora longer period and that augurs

veel for equities.

[Equity investors should remember that recor level of fiscal

stimulus, sustained lower interest rates and low inflationary

‘environment together create a supportive environment for risky

‘asset outperformance such as equity. The US dollar is siding

‘and it should weaken as the global economy recovers given its

‘counter cyclical behaviour. Its observed that the dollar

typically gains during global downturns and declines inthe

recovery phase. A Jower US dollar could keep gold prices

higher. While shining gold prices is pleasing the trend often

‘means that the market participants are not confident about the

‘economic growth prospects.

Jn such uncertain times when the direction is not clear on

many fronts, quality always fetches a Those

businesses with strong balance-sheet, steady cash flow and

‘quality growth will be chased by both institutional and HIN

investors. Thus, it makes sense to strictly stick to quality stocks

the rally may get narrow until further clarity emerges on the

‘yaccine front. Its advisable to have a stock -specihic view rather

than taking a blanket call on the market. Investors can take long

‘bets on sectors that show promise such as chemicals, specialty

‘chemicals, IT, pharmaceuticals, insurance and FMCG. Buying

‘on dips could be the most profitable strategy in such market

conditions.

Cover Story

Sankar Chakraborti, cous eo,aciteratings Research

How Is the Indian economy expected to grow in FY212

Given the severe impact ofthe pandemic and intermittent

lockdowns across the country that ae likely to continue across

Q2, we are expecting real GDP to contract by 10 per ent in the

current financial year (FY21). While Ql is expected to contract

by over 30 per cent, we reckon that the economy will continue

tocontract even in Q2. What this means is that chances of a

‘V-shaped recovery are rather slim. Instead, the recovery will be

more gradual over the next few quarters and culminate

somewhere in FY22.

What are the key risks facing Indian economy at this

Houscholds postponing consumption isto our mind the single

biggest risk faced by the Indian economy. This is because

consumption is the engine of India's economic virtuous cycle

and all operational as well as capital expenditure is dependent

‘nit. The negative credit off-take as well as contraction seen in

‘other macro Variables is ultimately a reflection of weak domestic

demand, We note that poor economic performance is not just a

function of the current lockdown and the supply disruption

thereof butthe increasing economic uncertainty that is

Conclusion

As of now, markets lack the advantage of value they had when.

‘we witnessed the fastest market correction ever at atte when

there wasa fall by nearly 40 per cent. The market looked cheap,

wit its PE being close to 16 afer the correction pushed Sensex

to sub 26,000 levels. With Sensex trading at above 38,000, the

PE multiple of 26 suggests the valuations are not very attractive.

‘That said, the “known unknowns’ are already factored in and it

will bea mistake to have a negative outlook on the equity

‘markets. Cautious optimism is required more than anything

else in the current markets.

“The recovery will continue as more efforts are being made by

policy-makers across the globe to bring economies to normalcy.

‘What matters for equities isthe ‘longer-term impact on

earnings Forlong-term equity returns, itis important to access

the time taken for earnings and dividends to recover to the

pre-pandemiclevels. With the stimuli packages announced

‘worldwide the recovery is expected to be fast-tracked and some

‘of the economies may see a V-shaped recovery. India may show

relatively slow recovery due to ack of stimulus as compared to

some of the developed economies.

India is opening up rather gradually and may recover faster

‘with more focused stimulus. The market will take cues from

fresh news expected this week. Chances are that it will correct

with every hint of negative news. The market outlook is neutral

10 positive in the near term to medium term with expectations,

‘of more stimulus packages to hit the markets even as an

increasing number of countries ae reopening quite fast. A

30 DALALSTREET INVESTMENT JOURNAL ( 4.5 03-1

translating to lower spending and a propensity to save despite a

low interest rate environment. A consumption-inducing policy

is therefore the key at this juncture and it must precede all else

‘Why can't india print money and inject cash in the economy

‘the way western economy does?

Unlike the USD and Euro, the Indian rupee lacksa reserve

status in the world and consequently the excess money supply

created by merely printing cash has to be absorbed

‘domestically. Ithas been observed historically that deficit

financing by the central bank (printing money) is often

inflationary (lasting at east a quarter depending upon the

magnitude) ifnot utilised productively. In any case, deficit

Financing isa window of last resort and a consensus between

the RBI and the Indian government will be critical. and when

the RBI decides to monetize the government debt on a large

scale, a formal plan must be in place much in advance. tis

recommended that this money, if created, should be used for

‘capital expenditure instead of household handouts. We believe

that there isa possibility of a second fiscal package, ifany, to be

partially financed via this window. .

positive development on the vaccine front will also keep the

markets from falling, And even though the high-frequency

‘economic indicators ae pointing toa slowdown, it may prod

the US Federal to continue with its dovish guidance. This may

keep the interest rates lower for a longer period! and that augurs

well for equities.

Equity investors should remember that record level of fiscal

stimulus, sustained lower interest rates and low inflationary

‘environment together create a supportive environment for risky

asset outperformance such as equity. The US dollar is sliding

and it should weaken as the global economy recovers given its

‘counter-cycical behaviour. Its observed that the dollar

typically gains during global downturns and declines inthe

recovery phase. A lower US dollar could keep gold prices

higher. While shining gold prices is pleasing, the trend often

‘means that the market participants are not confident about the

‘economic growth prospects.

In such uncertain times when the direction is not clear on,

‘many fronts, quality always fetches a premium. Those

businesses with strong balance-sheet, steady cash flow and

quality growth will be chased by both institutional and HNT

investors. Thus, it makes sense to strictly stick to quality stocks

asthe rally may get narrow until further clarity emerges on the

‘vaccine front. Itis advisable to have a stock-specific view rather

than taking blanket call on the market. Investors can take long

‘bets on sectors that show promise such as chemicals, specialty

‘chemicals, IT, pharmaceuticals, insurance and FMCG, Buying

‘on dips could be the most profitable strategy in such market

conditions. a

VV 23]

Ste

Ory yt

Financial Review ForFy2o <

CONTENTS is

Agriculture.

Electrical Equipment

Engineering,

Entertainment.

Miscellaneous ..

We bring you te vital financial data of TOP 1000 companies by market capitalisation. We constantly get requests from our valued

reader-investors for fiancial data and keeping our promise. we lay down for you the nancial data for Top 1000 companies by 24

sectors in easy readable format. We are sure tha ftancial data by sectors along with the detailed view on sector dynamics wil be an

imerestng read for you! We have sourced our financial data from Ace Equity

PS. Companies having year ending as Tune, eptember and December are ao included inthe financial data with data flowing under

Fx20.

(Compiled by - Amir Staikh, Anthony Fernandes, Apurva Josh, Geyatee Deshpande. Nidhi nk Pratik Shasirt, Rishikesh Gatkwad. Yogesh Supekar

32_BALALSTREET nVESTMENT JOURNAL

stain

) (

Arming you to reach your investment target

* Easy to view your portfolio on your fingertips.

BCU W

Be id Portfolio Advisory Service (PAS) is DSIJ's premier wealth

creation service that provides personalised stock

ae recommendations to investors.

Dire mea See ORO TR ae Rem

Pee a ce ee

Agriculture "

BA Ficinse contend beshebachione ofthe

wo

Indian economy. Since the country has bi

proportion of fertile and cultivable land supported by

diverse agro-climatic conditions. farming is extensively

practised. Itis the largest producer of spices, pulses, milk, tea,

cashew and jute, and the second-largest producer of wheat,

rice, fruits and vegetables, sugarcane, cotton and cilseeds

‘Additionally it also is second in the global production of fruits

and vegetables and is the largest producer of mango and

banana. Food grain production was estimated to reach 295,67

million tons (MT) during 2019-2020.

Production of horticulture crops in India was estimated to be

at 320.48 million metric tons (MMT) in FY20 while milk

luction in the country is expected to increase to 208 MT in

FY21 from 198 MT in FY20, thus docking a growth of 10 per

cent YoY. Despite the virus-triggered pandemic, the

agriculture sector has witnessed a silver lining by experiencing

ENTS ro oe Rear) oo)

aon Pea 15 sii9 | ane | 5026

none arn aby oman teu] 17902 [13798 | 127790 erst | a8 | S168

ei. Pay (ne S675 wit] ara | simak

ae Sed orn 198 25991 ai7al

Pes). 713800 594

fang On 007? SLs

[sree tea ops “e630

(ujzat andj aio

ia oe 150132

[Wen (nia) Utd 2686.21

ven Engng nr ies

[sama mS i. 1us667

tania Balu tnt amass

thn Sar 39501

[oj asa Sa 571

[Nath Bio-Genes (ina) Let. 419165

i

Dwar spans

|Awadh Sugar & Energy Lid. $8.16

[ree 1138

an Si i

selina. 026

noi stron aa 58

Sree ae ra Li 106 330

[gi Spr meri ia 21

[Ucar Swear Werks Lid. 158.51 813

[rare Naan im as

34 «DALAL STREETINVESTMENT JOURNAL | UGC 1 sisin

ppeamennereaiy

ei CS

or FY20

7 percent YoY to

ined net profit of

antly compared

\-For FY20,,

°€3816.59 crore

184 crore forthe

registrations in the country dived to alm

May due to the complete lockdown

However, there have been improvement

‘of the lockdown in some regions, leading

vehicle sales. The automotive and auto

tead of further sectors are major contributors to Indias

for better pricing, product (GDP), accounting for more t

cological total

‘to sustain shocks

'siness Councils Acconding to the Society of Indian Auto

arendra Modi (SIAM), the automotive industry mann

idia beinga land ‘etnies including passenger vehicles, co

sing the key three-whecters,rwo-wheelers and quadri

athe near future, 2020 as against 7,213,045 in Apel-hune 24

beakey sharp dedine of 794 per cent. During:

vill bolster the wheeler sexenen! was mest affected 35 ts

for farmersas pearly 91.5 per cent YoY in QUFY21 to 12.7

ay. ‘commercial vehicles which recorded nearly

plunge in domestic sales to 31,636 units.

Segments of passenger vehicles and two ¥

sant nearly 7844 per cent and 74.2 per cent YoY

1395 sales inthe first quarter of FY21 to 153,73

1770

ne

1,293,113 units, respectively: The BSE Aut

neatly 45 per cent in March 2020 from Jat

et inno ret that iheoutea forma viushas | atid clown contain he spre

J[sesotecmmicnyios stn hr anne |e wine asaya en

indoary so capone pandas darued nt | tow when econo cvs wate

jut oeephy ceanbetdonandaswe dutoste | paued manee Flowing the oan!

Cero) Coon

Tov | esa] aebeao| weer [seuss [e128 55920,

inist| aierzs| rsomse| — sanzi| esa0n0| ssi] eon

Tammt| 951m orm | onse77] — Desss fie [oes | pease

ssasai|— masa] win] ees] — ome] sos] sour] mien

sana] —enss] sa] sms] — mae] aoa on] Ins

Task | aac [Ponsa sh | Dv 25 | — Towa [ren [sis [a5 75

said] we mine] 7s | pmem | ne] eae aS

sins] 2a] wn) rnD] Is] soso] ee] seat

tana] — sno] eam] aes] — nam) nies] oasr] ore

smo] smn] suis] ase] an] sya] son] 37

zm35 | 0st san] m6 | son Skat

nines] — sas ms] an] 956 1800

saa] ans ast] san] as se

zn] nm 335] 8] 2 1873

NvsounaL 35, 3G SALAL svaEET vvesrent JoURNAL

Special Supplement

Automobile

registrations in the country dived to almost zero in early

May due to the complete lackdown imposed nationwide.

However, there have been improvements with the easing.

ofthe lockdown in some regions, leading to pick-up in

vehicle sales. The automotive and automotive ancillary

sectors are major contributors to India’ gross domestic

product (GDP), accounting for more than 7 per cent of the

total.

According to the Society of indian Automotive Manufacture

(SIAM) the automotive indastry manufactured nearly 1,486,594

vehicles including passenger vehicles, commercial vehicles,

{hree-wheders, two-wheelers and quadricycles in April-June