Professional Documents

Culture Documents

Ifrs 15 Case Study Questions

Uploaded by

Prudent0 ratings0% found this document useful (0 votes)

63 views2 pagesOriginal Title

IFRS 15 CASE STUDY QUESTIONS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

63 views2 pagesIfrs 15 Case Study Questions

Uploaded by

PrudentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

IFRS 15 CASE STUDY QUESTIONS

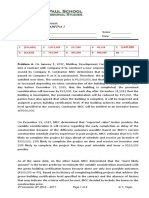

The following Transaction took place at Ogun ltd:

1. On 5 March 2017, Ogun ltd sold goods to Ibadan ltd

for N18m cash and agreed to repurchase the goods

for N19m cash on 5th July 2017. The goods will be

shifted to a storage facility under Ibadan control and

security

2. On 31st March Ogun Ltd car manufacturing division

consigned several vehicles to independent dealer for

sale to third parties. The sales price to the dealer is

Ogun list price at the date of sales to third parties. If

a vehicle is unsold after six months the dealer has

the right to return the vehicle to Ogun Ltd within

next 15 days.

Required:

Discuss how the above transactions should be

accounted for in the books of Account of Ogun Ltd

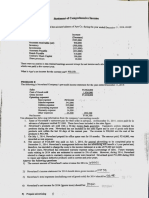

2 Gladstone ltd a company commenced a four-year

contract early in 2013. the price was initially agreed

at N12,000,000.

Profit, which was reasonably foreseeable from the

year ended 31 Dec. 2013 is to be taken on a costs

basis and revenue is to be taken on a consistent

basis.

Relevant figures are as follows:

2013 2014 2015 2016

N,000 N,000 N,000 N,000

Cost incurred in year 2,750 3,000 4,200 1,150

Anticipated future cost 7,750 7,750 1,550 -

Work certified and invoice to date 3,000 5,000 11,000 12,500

Required:

show how the above would be disclosed in the

statement of Profit or Loss and Statement of

Financial Position for each of the four years ended

31 dec. 2016.

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Audit of Shareholders EquityDocument6 pagesAudit of Shareholders EquityMark Lord Morales Bumagat71% (7)

- Revenue recognition for installment sales and long-term contractsDocument6 pagesRevenue recognition for installment sales and long-term contractsnaserNo ratings yet

- Audit of LiabilityDocument8 pagesAudit of LiabilityMark Lord Morales Bumagat50% (2)

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- p1 ADocument8 pagesp1 Aincubus_yeahNo ratings yet

- AFAR - Revenue Recognition, JointDocument3 pagesAFAR - Revenue Recognition, JointJoanna Rose DeciarNo ratings yet

- Accounting For Correction of Errors Problem 1: QuestionsDocument8 pagesAccounting For Correction of Errors Problem 1: QuestionshfjhdjhfjdehNo ratings yet

- Chapter 9Document13 pagesChapter 9Yenelyn Apistar Cambarijan75% (4)

- AdditionalDocument18 pagesAdditionaldarlene floresNo ratings yet

- Basic Accounting ReviewerDocument11 pagesBasic Accounting ReviewerandreamrieNo ratings yet

- Calculating Consolidated Net IncomeDocument18 pagesCalculating Consolidated Net IncomeFleo GardivoNo ratings yet

- Financial LiabilitiesDocument22 pagesFinancial LiabilitiesPeter Banjao100% (1)

- Finac3 FinalsDocument6 pagesFinac3 FinalsGloria BeltranNo ratings yet

- Unit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - Final - t31516Document9 pagesUnit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - Final - t31516mimi96No ratings yet

- GET 511 Financial Management and Accounting MethodsDocument51 pagesGET 511 Financial Management and Accounting MethodsChinedu ChukwukereNo ratings yet

- 25511764Document8 pages25511764JessaNo ratings yet

- Advance Accounting 1 Final Exam ReviewDocument13 pagesAdvance Accounting 1 Final Exam ReviewTina LlorcaNo ratings yet

- Quiz Audit of Shareholders Equity-2Document10 pagesQuiz Audit of Shareholders Equity-2Moi Escalante100% (1)

- Business Combi - SubsequentDocument5 pagesBusiness Combi - Subsequentnaser100% (2)

- AdvaccDocument3 pagesAdvaccAlyssa CamposNo ratings yet

- Audit Liabilities Current NoncurrentDocument6 pagesAudit Liabilities Current Noncurrentnikkibausa100% (1)

- Advance AccountingDocument5 pagesAdvance AccountingChristopher PriceNo ratings yet

- AFARicpaDocument23 pagesAFARicpaRegine YbañezNo ratings yet

- Installment Sales RecognitionDocument12 pagesInstallment Sales RecognitionAGNES CASTILLONo ratings yet

- AP Problems 2015Document20 pagesAP Problems 2015Rodette Adajar Pajanonot100% (1)

- Installment Sales & Long-Term ConsDocument6 pagesInstallment Sales & Long-Term ConsSirr JeyNo ratings yet

- Lecture 5 Events After The Reporting Period Multiple ChoiceDocument7 pagesLecture 5 Events After The Reporting Period Multiple ChoiceJeane Mae Boo0% (1)

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenNo ratings yet

- PA1 Mock ExamDocument18 pagesPA1 Mock Examyciamyr67% (3)

- PFRS 15 Revenue Recognition ProblemsDocument2 pagesPFRS 15 Revenue Recognition ProblemsArlyn A. Zuniega0% (1)

- AS 9 - Problems.docxDocument4 pagesAS 9 - Problems.docxvishalsingh9669No ratings yet

- Cash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Document3 pagesCash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Christine BNo ratings yet

- AS Financial Corporate Reporting May Jun 2016Document5 pagesAS Financial Corporate Reporting May Jun 2016swarna dasNo ratings yet

- QuizDocument2 pagesQuizAlyssa CamposNo ratings yet

- Installment SalesDocument5 pagesInstallment SalesMarianne LanuzaNo ratings yet

- ACFrOgDZ7Mb1kEnd0SWTabZ8VTNHoE2URvhT8DhCJGcSZcROTUArMhbEM93WzGm2kI1BwFxq0 x1Pf-HKvzBDZ5dplRt2Zs - hEPqbAFI0Fc3z2m0dtyYdxz8KJGo8dJYsrypTjAUs2oYzuZ - TDDocument38 pagesACFrOgDZ7Mb1kEnd0SWTabZ8VTNHoE2URvhT8DhCJGcSZcROTUArMhbEM93WzGm2kI1BwFxq0 x1Pf-HKvzBDZ5dplRt2Zs - hEPqbAFI0Fc3z2m0dtyYdxz8KJGo8dJYsrypTjAUs2oYzuZ - TDTwish BarriosNo ratings yet

- SheDocument2 pagesShemaiaaaaNo ratings yet

- Final Exam in Advanced Financial Accounting IDocument6 pagesFinal Exam in Advanced Financial Accounting IYander Marl BautistaNo ratings yet

- Prac One Final Pre BoardDocument7 pagesPrac One Final Pre BoardJose Stanley B. MendozaNo ratings yet

- ReceivablesDocument9 pagesReceivablesJerric CristobalNo ratings yet

- Applied Auditing Report (Audit of Receivables)Document7 pagesApplied Auditing Report (Audit of Receivables)mary louise magana100% (1)

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeMitzi CatemprateNo ratings yet

- LiabilityDocument28 pagesLiabilityJzjzkxmxkkxklNo ratings yet

- Disclaimer: © The Institute of Chartered Accountants of IndiaDocument35 pagesDisclaimer: © The Institute of Chartered Accountants of IndiajaimaakalikaNo ratings yet

- Problems Solving in AccountingDocument6 pagesProblems Solving in AccountingRonald McRonald67% (6)

- Mock Test Paper 2Document7 pagesMock Test Paper 2FarrukhsgNo ratings yet

- Audit of Liabilities QuizDocument2 pagesAudit of Liabilities QuizCattleyaNo ratings yet

- Franchise Accounting Multiple Choice Problems: On December 31, 2014Document5 pagesFranchise Accounting Multiple Choice Problems: On December 31, 2014Jason BautistaNo ratings yet

- AP Long Test 1 - CHANGES&ERROR, CASH ACCRUAL, SINGLE ENTRYDocument12 pagesAP Long Test 1 - CHANGES&ERROR, CASH ACCRUAL, SINGLE ENTRYjasfNo ratings yet

- Comprehensive LiabilitiesDocument5 pagesComprehensive LiabilitiesYnnas ModiongNo ratings yet

- 91 - Final Preaboard Afar (Weekends)Document18 pages91 - Final Preaboard Afar (Weekends)Joris YapNo ratings yet

- A1 Installment SalesDocument3 pagesA1 Installment SalesMae0% (1)

- Qualifying Exam ReviewerDocument11 pagesQualifying Exam ReviewerJohn Oliver OcampoNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Investment PropertyDocument10 pagesInvestment PropertyPrudentNo ratings yet

- International Tax Law and Double Tax ReliefDocument8 pagesInternational Tax Law and Double Tax ReliefPrudentNo ratings yet

- Loss Relief - Safe 2019Document4 pagesLoss Relief - Safe 2019PrudentNo ratings yet

- Capital Allowance PDFDocument11 pagesCapital Allowance PDFPrudentNo ratings yet

- Other Financial Management ToolsDocument4 pagesOther Financial Management ToolsPrudentNo ratings yet