Professional Documents

Culture Documents

For Item Nos. 20 To 21

For Item Nos. 20 To 21

Uploaded by

dagohoy kennethOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

For Item Nos. 20 To 21

For Item Nos. 20 To 21

Uploaded by

dagohoy kennethCopyright:

Available Formats

For item nos.

20 to 21

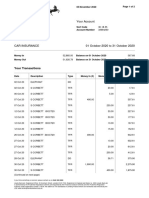

RR, SS and TT decided to dissolve the partnership on November 30, 2011. their capital balances and profit ratio on

this date, follow:

Capital Balances Profit Ratio

RR P50, 000 40%

SS 60, 000 30%

TT 20, 000 30%

The net income from January 1, to November 30, 2011 is P45, 000. also, on this date, cash and liabilities

are P40, 000 and P90, 000 respectively. For RR to receive P55, 000 in full settlement of his interest in the

firm,

18. How much must be realized from the sale of the firm’s non-cash assets?

19. How much cash receive by SS and TT upon liquidation?

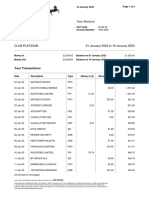

20. As of December 31, 2011, the books of Ton Partnership showed capital balances of: T P40, 000; O, P25, 000;

N, P5, 000. The partners profit and loss ratio was 3:2:1, respectively. The partners decided to liquidate and they

sold all non-cash assets for P38, 000. after settlement of all liabilities amounting P12, 000, they still have cash

of P30, 000 left for distribution. Assuming that any capital debit balance is uncollectible, the share of T in the

distribution of the P30, 000 cash would be:

You might also like

- Solutions For Midterm Exam Part 2 Selected RroblemsDocument10 pagesSolutions For Midterm Exam Part 2 Selected RroblemsJeane Mae BooNo ratings yet

- Hola Kola Solution Base AbhinavDocument17 pagesHola Kola Solution Base Abhinavnisha0% (2)

- Feasibility Study of Establishing Siberian Frowyow Parlour Villarosa Trial FcaDocument185 pagesFeasibility Study of Establishing Siberian Frowyow Parlour Villarosa Trial Fcadagohoy kennethNo ratings yet

- Statement 2023 1Document2 pagesStatement 2023 1GustavoNo ratings yet

- Seco Company Was Incorporated On January 1Document1 pageSeco Company Was Incorporated On January 1dagohoy kennethNo ratings yet

- Advanced Financial Accounting and Reporting: Ash - . - . - . - . - . - . - . - . P48, OOO Ccounts Receivable - 92,000Document54 pagesAdvanced Financial Accounting and Reporting: Ash - . - . - . - . - . - . - . - . P48, OOO Ccounts Receivable - 92,000Pricia AbellaNo ratings yet

- B.) CC, P25,000: PP, P21,000 Aa, P38,000Document22 pagesB.) CC, P25,000: PP, P21,000 Aa, P38,000Wendelyn TutorNo ratings yet

- RPT Pay SlipDocument1 pageRPT Pay SlipAllia sharmaNo ratings yet

- Rose, Sase and Tina Decided To Dissolve The Partnership On NovemberDocument1 pageRose, Sase and Tina Decided To Dissolve The Partnership On NovemberMayuki TakizawaNo ratings yet

- M02 CILO13 WK07to12 Partnership DissolutionDocument7 pagesM02 CILO13 WK07to12 Partnership DissolutionHoney Faith Dela CruzNo ratings yet

- Formation of Partnership 1. 1-JanDocument23 pagesFormation of Partnership 1. 1-Janhae1234100% (1)

- Adg8kk1) r8 Fq7''uDocument6 pagesAdg8kk1) r8 Fq7''uThe makas AbababaNo ratings yet

- F6 IhtDocument7 pagesF6 IhtSooraj p.mNo ratings yet

- Rev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeDocument6 pagesRev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeCM Lance100% (2)

- LASALA Partnership Formation SWDocument2 pagesLASALA Partnership Formation SWLizzeille Anne Amor MacalintalNo ratings yet

- Suzuki Task (Girdhari Lal)Document1 pageSuzuki Task (Girdhari Lal)Gîř Dh AřîNo ratings yet

- Master Question (Foreign) SOFP SOCIDocument2 pagesMaster Question (Foreign) SOFP SOCIShaheryar ShahidNo ratings yet

- Revenue Memorandum Order No. 4-2022 1Document2 pagesRevenue Memorandum Order No. 4-2022 1joy rellosoNo ratings yet

- Set. 2. Test No.1 Answer KeyDocument5 pagesSet. 2. Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Activity 1 Acc311Document3 pagesActivity 1 Acc311Aidreil LeeNo ratings yet

- 2020-21 - HYE - QP - Accountancy - SET A - XII - PDFDocument3 pages2020-21 - HYE - QP - Accountancy - SET A - XII - PDFLakshay SethNo ratings yet

- Assignment AnswerDocument2 pagesAssignment AnswerMims ChiiiNo ratings yet

- Partnership Dissolution and LiquidationDocument4 pagesPartnership Dissolution and Liquidationkat kaleNo ratings yet

- Acctg13 Midterm Exam TQ 2021 2022 2nd SemDocument6 pagesAcctg13 Midterm Exam TQ 2021 2022 2nd SemGarp BarrocaNo ratings yet

- Partnership Operation Problem SolvingDocument1 pagePartnership Operation Problem Solvinglebronanthony.jaena-17No ratings yet

- ARTS CPA Review Practical Accounting 2 Multiple Choice Problems 1Document3 pagesARTS CPA Review Practical Accounting 2 Multiple Choice Problems 1Ruffa Mae MaldoNo ratings yet

- Partnership and Corporation AccountingDocument2 pagesPartnership and Corporation AccountingEmman S NeriNo ratings yet

- Practice - Exercise Consolidated - Balance - Sheet 17 06 2014Document7 pagesPractice - Exercise Consolidated - Balance - Sheet 17 06 2014Deepika PadukoneNo ratings yet

- Partnership - Installment Liquidation Joint Ventures: Roxas, Soto, and TodaDocument27 pagesPartnership - Installment Liquidation Joint Ventures: Roxas, Soto, and TodamarieieiemNo ratings yet

- Midterm HahaDocument33 pagesMidterm HahaCarl Elmo Bernardo MurosNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Quiz 1 Partnership 09 10Document3 pagesQuiz 1 Partnership 09 10Aldyn Jade GuabnaNo ratings yet

- Coi 23-24Document2 pagesCoi 23-24info.capifutureNo ratings yet

- WP CHP 6Document11 pagesWP CHP 6chrisdtfsNo ratings yet

- Adv MTP A20Document14 pagesAdv MTP A20Pawan AgrawalNo ratings yet

- The Following Information Will Be Used For Question Nos. 8 and 9Document5 pagesThe Following Information Will Be Used For Question Nos. 8 and 9jenieNo ratings yet

- MC KinseyDocument2 pagesMC KinseyChandan KumarNo ratings yet

- MODULE 3 Partnership and Corp 1Document14 pagesMODULE 3 Partnership and Corp 1dcatheeeNo ratings yet

- Statement 10 2020-1Document2 pagesStatement 10 2020-1jamalazoz05No ratings yet

- Schedule of General Provident Fund DeductionsDocument1 pageSchedule of General Provident Fund DeductionsJitendra DebbarmaNo ratings yet

- Exam On ch.13Document3 pagesExam On ch.13kareem abozeedNo ratings yet

- Assets: Name: Date: Professor: Section: ScoreDocument2 pagesAssets: Name: Date: Professor: Section: ScoreAndrea Florence Guy VidalNo ratings yet

- Balance Sheet 1st Year 2nd Year Rs. RsDocument1 pageBalance Sheet 1st Year 2nd Year Rs. Rsjayesh janiNo ratings yet

- Partnership Dissolution and Liquidation DrillsDocument6 pagesPartnership Dissolution and Liquidation DrillsMa. Yelena Italia TalabocNo ratings yet

- Partnership Liquidation 1Document17 pagesPartnership Liquidation 1Shoyo HinataNo ratings yet

- Estado de Cuenta Cayman 2Document3 pagesEstado de Cuenta Cayman 2Alejandro LiraNo ratings yet

- 1ST GRADING EXAM For StudentsDocument12 pages1ST GRADING EXAM For StudentsAndrea Florence Guy VidalNo ratings yet

- Important Questions For Accountancy 12th ComDocument17 pagesImportant Questions For Accountancy 12th ComAnkit RoyNo ratings yet

- J. P. Morgan Chase: Tax CalculatorDocument1 pageJ. P. Morgan Chase: Tax Calculatoranon-930095No ratings yet

- Same-Mdz-Doz Mendoza (El Plumerillo) 2213Document24 pagesSame-Mdz-Doz Mendoza (El Plumerillo) 2213Adrian RyserNo ratings yet

- Tanjiro:Inosuke & Nezuko:ZenitsuDocument4 pagesTanjiro:Inosuke & Nezuko:ZenitsuJaimellNo ratings yet

- TT3.50, KimDocument2 pagesTT3.50, KimKim KuysNo ratings yet

- A 4. LiquidationDocument3 pagesA 4. LiquidationAngela DucusinNo ratings yet

- Cash Received by Individual PartnersDocument1 pageCash Received by Individual PartnersMayuki TakizawaNo ratings yet

- Supersonic Invoice 26553417Document1 pageSupersonic Invoice 26553417findlexiNo ratings yet

- PDF Partnership Liquidation Alynna Joy P Ibanezdocx DLDocument32 pagesPDF Partnership Liquidation Alynna Joy P Ibanezdocx DLKrizia Mae Uzielle PeneroNo ratings yet

- Tax Receipt Transport Department, Government of West Bengal Registration Authority Paschim Midnapore RTO, West BengalDocument1 pageTax Receipt Transport Department, Government of West Bengal Registration Authority Paschim Midnapore RTO, West BengalMd EkramNo ratings yet

- Cash Flow Statement Illu 11-20Document16 pagesCash Flow Statement Illu 11-20E20PA063 MAHALAKSHMI.BNo ratings yet

- Escon Industries e PL-2023Document1 pageEscon Industries e PL-2023ansm businessNo ratings yet

- Graphic OrganizerDocument1 pageGraphic Organizerdagohoy kennethNo ratings yet

- The Advantages of ABM Strands That You Need To KnowDocument2 pagesThe Advantages of ABM Strands That You Need To Knowdagohoy kennethNo ratings yet

- Chapter 9 Conversion Investigation MethodsDocument21 pagesChapter 9 Conversion Investigation Methodsdagohoy kennethNo ratings yet

- Chapter 2 Why People Commit FraudDocument16 pagesChapter 2 Why People Commit Frauddagohoy kennethNo ratings yet

- Basic Earnings Per ShareDocument2 pagesBasic Earnings Per Sharedagohoy kennethNo ratings yet

- YryryrDocument2 pagesYryryrdagohoy kennethNo ratings yet

- 11123Document2 pages11123dagohoy kennethNo ratings yet

- The Balance Sheet For The Partnership of JJ CC and TTDocument1 pageThe Balance Sheet For The Partnership of JJ CC and TTdagohoy kennethNo ratings yet

- Blah Blah BlahDocument1 pageBlah Blah Blahdagohoy kennethNo ratings yet

- Sanderson Company Manufactures CustomDocument1 pageSanderson Company Manufactures Customdagohoy kennethNo ratings yet

- D. Disclosure of P200,000Document2 pagesD. Disclosure of P200,000dagohoy kennethNo ratings yet

- The Term Relevant Cost Applies To All of The Following Decision Situations Except The ADocument1 pageThe Term Relevant Cost Applies To All of The Following Decision Situations Except The Adagohoy kennethNo ratings yet

- During The Current YearDocument1 pageDuring The Current Yeardagohoy kennethNo ratings yet

- M & N Partnership Balance Sheet - July 1, 2021Document1 pageM & N Partnership Balance Sheet - July 1, 2021dagohoy kennethNo ratings yet

- Aaa 333Document1 pageAaa 333dagohoy kennethNo ratings yet

- Global CompanyDocument1 pageGlobal Companydagohoy kennethNo ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- What Is The Effect of The Declaration of Scrip Dividends On Total Liabilities and ShareholdersDocument1 pageWhat Is The Effect of The Declaration of Scrip Dividends On Total Liabilities and Shareholdersdagohoy kennethNo ratings yet

- Kiara Company Provided The Following DataDocument1 pageKiara Company Provided The Following Datadagohoy kennethNo ratings yet