Professional Documents

Culture Documents

RCBC V CIR

RCBC V CIR

Uploaded by

Brent TorresOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RCBC V CIR

RCBC V CIR

Uploaded by

Brent TorresCopyright:

Available Formats

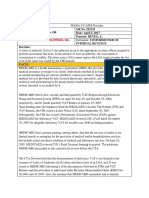

RCBC v CIR

G.R 168498

April 24, 2007

Facts: Petitioner Rizal Commercial Banking Corporation received a Formal Letter of Demand

dated May 25, 2001 from the respondent Commissioner of Internal Revenue for its tax liabilities

particularly for Gross Onshore Tax in the amount of P53,998,428.29 and Documentary Stamp

Tax.

The petitioner filed a protest but the respondent failed to act upon the same. So, the

petitioner filed a Petition for Review with the CTA for the cancellation of the above-mentioned

assessments.

The respondent filed a motion to resolve first the issue of CTA’s jurisdiction, which was

granted by the CTA. The petition for review was dismissed because it was filed beyond the 30-

day period following the lapse of 180 days from petitioner’s submission of documents in

support of its protest, as pursuant to Section 228 of the NIRC and R.A. No. 1125. The same

became final and executory due to the negligence of the petitioner’s counsel.

Hence, this petition

Issue: Whether or not the petitioner was denied the opportunity to be heard?

Whether or not the petitioner can still file the appeal despite the lapse of the 30-day period?

Held: No, the Court held that he "essence of due process is a hearing before conviction and

before an impartial and disinterested tribunal" but due process as a constitutional precept does

not, always and in all situations, require a trial-type proceeding. The essence of due process is

to be found in the reasonable opportunity to be heard and submit any evidence one may have

in support of one’s defense. In this case, the petitioner’s counsel was present on the scheduled

hearing and in fact orally argued its petition and that is sufficiently complies with the right to be

heard.

In exceptional cases, when the mistake of counsel is so palpable that it amounts to gross

negligence, this Court affords a party a second opportunity to vindicate his right. But this

opportunity is unavailing in the case at bar, especially since petitioner had squandered the

various opportunities available to it at the different stages of this case.

Regarding the 30-day period, the petitioner can no longer file an appeal. Assessment

may be protested administratively by filing a request for reconsideration or reinvestigation

within thirty (30) days from receipt of the assessment in such form and manner as may be

prescribed by implementing rules and regulations. Within sixty (60) days from filing of the

protest, all relevant supporting documents shall have been submitted; otherwise, the

assessment shall become final. In this case, the failure to comply with the 30-day statutory

period bars the appeal and deprives the Court of Tax Appeals of its jurisdiction to entertain and

determine the correctness of the assessment.

You might also like

- Primer On Injunctions and TroDocument10 pagesPrimer On Injunctions and Tro83jjmackNo ratings yet

- 001 Tirazona vs. Phil Eds Techno ServiceDocument1 page001 Tirazona vs. Phil Eds Techno Servicemiss.escoberNo ratings yet

- CIR Vs Seagate, GR 153866Document3 pagesCIR Vs Seagate, GR 153866Mar Develos100% (1)

- CIVIL LAW by Dean AlbanoDocument140 pagesCIVIL LAW by Dean AlbanoPJ Hong100% (4)

- 26 Contex Vs CIRDocument2 pages26 Contex Vs CIRIvan Romeo100% (1)

- GR 220835 CIR vs. Systems TechnologyDocument2 pagesGR 220835 CIR vs. Systems TechnologyJoshua Erik Madria100% (1)

- Asian Transmission Corp. vs. CIRDocument2 pagesAsian Transmission Corp. vs. CIRRhea Caguete50% (2)

- Fishwealth Canning v. CIRDocument1 pageFishwealth Canning v. CIRRia Kriselle Francia PabaleNo ratings yet

- Eric Michael Schuster Order Dismissing CaseDocument15 pagesEric Michael Schuster Order Dismissing CaseWCPO WebNo ratings yet

- Alcantara vs. Republic (Digest)Document1 pageAlcantara vs. Republic (Digest)Kristofer AralarNo ratings yet

- Part C 1 - CIR Vs Avon Products ManufacturingDocument4 pagesPart C 1 - CIR Vs Avon Products ManufacturingCyruz Tuppal75% (4)

- Motion For Extension of Time Proposal For Settlement FloridaDocument4 pagesMotion For Extension of Time Proposal For Settlement Floridadrk99No ratings yet

- Medicard Philippines, Inc. v. CIRDocument3 pagesMedicard Philippines, Inc. v. CIRFlorence Rosete100% (1)

- Allied Banking Vs The Quezon City Government, Et Al. (G.R. No. 154126, OCTOBER 11, 2005) FactsDocument1 pageAllied Banking Vs The Quezon City Government, Et Al. (G.R. No. 154126, OCTOBER 11, 2005) FactsHonorio Bartholomew Chan100% (1)

- 05 CIR v. Metro Star Superama Inc.Document2 pages05 CIR v. Metro Star Superama Inc.Rem SerranoNo ratings yet

- CIR Vs CTA and CitysuperDocument3 pagesCIR Vs CTA and CitysuperEllaine BernardinoNo ratings yet

- Liu vs. Loy: G.R. No. 145982, September 13, 2004Document3 pagesLiu vs. Loy: G.R. No. 145982, September 13, 2004Nicole SantoallaNo ratings yet

- St. Stephen's Association V CIRDocument3 pagesSt. Stephen's Association V CIRPatricia GonzagaNo ratings yet

- CIR vs. Systems Technology InstituteDocument2 pagesCIR vs. Systems Technology InstituteMaria100% (3)

- Declaration Against InterestDocument6 pagesDeclaration Against Interestcmv mendoza0% (1)

- Strahlenfolter Electronic Harassment Us Government TortureDocument66 pagesStrahlenfolter Electronic Harassment Us Government TortureZombieland6375100% (1)

- Commissioner of Internal Revenue Vs Philippine Daily InquirerDocument2 pagesCommissioner of Internal Revenue Vs Philippine Daily Inquireranon100% (1)

- Medicard Phil Inc. vs. CIRDocument2 pagesMedicard Phil Inc. vs. CIRhigoremso giensdks100% (1)

- CIR Vs CA Fortune Tobacco CaseDocument1 pageCIR Vs CA Fortune Tobacco CaseAlexylle Garsula de ConcepcionNo ratings yet

- Contex Corp vs. CirDocument3 pagesContex Corp vs. CirKath Leen100% (1)

- CIR Vs Cebu Toyo CorporationDocument2 pagesCIR Vs Cebu Toyo Corporationjancelmido1100% (2)

- Case #38 - CIR vs. United Cadiz SugarDocument2 pagesCase #38 - CIR vs. United Cadiz SugarJeffrey Magada100% (2)

- Pre Bar Labor Standards 1Document165 pagesPre Bar Labor Standards 1PJ HongNo ratings yet

- Contex Corp vs. CIRDocument3 pagesContex Corp vs. CIRKayelyn LatNo ratings yet

- Fishwealth Canning Corporation Vs CirDocument2 pagesFishwealth Canning Corporation Vs CirKateBarrionEspinosaNo ratings yet

- 6 CIR vs. Next Mobile, GR No. 212825Document2 pages6 CIR vs. Next Mobile, GR No. 212825Joshua Erik Madria100% (1)

- Termination LEtterDocument3 pagesTermination LEtterCatherine Naria AycardoNo ratings yet

- Cir V Pascor RealtyDocument3 pagesCir V Pascor RealtyCharmaine MejiaNo ratings yet

- CIR v. Univation, GR 231581, 10 Apr 2019Document4 pagesCIR v. Univation, GR 231581, 10 Apr 2019Dan Millado100% (2)

- RCBC Vs CIR, GR No. 168498, April 24, 2007Document1 pageRCBC Vs CIR, GR No. 168498, April 24, 2007Vel June De LeonNo ratings yet

- Samar-I Electric Cooperative vs. CirDocument2 pagesSamar-I Electric Cooperative vs. CirRaquel DoqueniaNo ratings yet

- CD - 56. CIR v. Union ShippingDocument1 pageCD - 56. CIR v. Union ShippingCzarina Cid100% (1)

- Lascona Land Vs CIRDocument2 pagesLascona Land Vs CIRJOHN SPARKSNo ratings yet

- CIR Vs Sony DigestDocument2 pagesCIR Vs Sony DigestPre Avanz83% (6)

- CIR v. Fitness by DesignDocument4 pagesCIR v. Fitness by DesignJesi CarlosNo ratings yet

- CIR V Fitness by DesignDocument3 pagesCIR V Fitness by Designsmtm06100% (4)

- Eastern Telecommunications Philippines Inc Vs CirDocument4 pagesEastern Telecommunications Philippines Inc Vs CirAerwin AbesamisNo ratings yet

- CIR V Liquigaz Philippines CorporationDocument3 pagesCIR V Liquigaz Philippines CorporationAya BaclaoNo ratings yet

- Tax Rev Digest Mindanao II Geothermal Partnership V CirDocument4 pagesTax Rev Digest Mindanao II Geothermal Partnership V CirCalypso75% (4)

- Lascona Land Co., Inc. v. CIRDocument2 pagesLascona Land Co., Inc. v. CIRAron Lobo100% (1)

- RHOMBUS Vs CIRDocument3 pagesRHOMBUS Vs CIRMarife MinorNo ratings yet

- PRULIFE OF UK v. CIRDocument2 pagesPRULIFE OF UK v. CIREJ PajaroNo ratings yet

- CIR Vs Fisher Case DigestDocument1 pageCIR Vs Fisher Case Digestjodelle11No ratings yet

- Cir vs. Pascor Realty and Development CorporationDocument2 pagesCir vs. Pascor Realty and Development Corporationmaki Amancio100% (1)

- Disability BenefitsDocument65 pagesDisability BenefitsPJ HongNo ratings yet

- Herarc Realty Corporation vs. The Provincial Treasurer of Batangas DigestDocument2 pagesHerarc Realty Corporation vs. The Provincial Treasurer of Batangas DigestEmir MendozaNo ratings yet

- CIR v. Cadiz Sugar FarmersDocument6 pagesCIR v. Cadiz Sugar Farmersamareia yap100% (1)

- RCBC V CirDocument4 pagesRCBC V CirleighsiazonNo ratings yet

- CIR vs. Smart CommunicationsDocument1 pageCIR vs. Smart Communicationscorky01No ratings yet

- Asia Trust V CIRDocument2 pagesAsia Trust V CIRReena Ma100% (1)

- PAL v. CIR (GR 198759)Document2 pagesPAL v. CIR (GR 198759)Erica Gana100% (1)

- Bantillo - CIR Vs PNBDocument3 pagesBantillo - CIR Vs PNBAto TejaNo ratings yet

- G.R. No. 170257 September 7, 2011 Rizal Commercial Banking Corporation, vs. Commissioner of Internal RevenueDocument1 pageG.R. No. 170257 September 7, 2011 Rizal Commercial Banking Corporation, vs. Commissioner of Internal RevenueEdmerson Prix Sanchez CalpitoNo ratings yet

- Alcantara Vs RepublicDocument2 pagesAlcantara Vs RepublicRachel Leachon100% (1)

- NPC V Provincial Treasurer of Benguet GR No 209303Document3 pagesNPC V Provincial Treasurer of Benguet GR No 209303Trem GallenteNo ratings yet

- Pagcor Vs BirDocument2 pagesPagcor Vs BirTonifranz SarenoNo ratings yet

- Affidavit of LossDocument3 pagesAffidavit of LossPJ HongNo ratings yet

- Finals SCADocument26 pagesFinals SCAPJ HongNo ratings yet

- Angeles City v. Angeles Electric CorporationDocument4 pagesAngeles City v. Angeles Electric CorporationOmsimNo ratings yet

- Rizal Commercial Banking vs. CIRDocument3 pagesRizal Commercial Banking vs. CIRMarife MinorNo ratings yet

- CIR vs. Enron Subic Power CorporationDocument1 pageCIR vs. Enron Subic Power CorporationArthur Archie TiuNo ratings yet

- Atlantic Vs Herbal Cove DigestedDocument2 pagesAtlantic Vs Herbal Cove DigestedJaniceNo ratings yet

- CIR vs. Isabela Cultural Corporation 135210Document1 pageCIR vs. Isabela Cultural Corporation 135210magenNo ratings yet

- Advertising Associates v. CADocument1 pageAdvertising Associates v. CACristelle Elaine Collera100% (2)

- Lascona Land Co vs. CIRDocument2 pagesLascona Land Co vs. CIRAnneNo ratings yet

- CIR V. TRANSITIONS OPTICAL PHILIPPINES, INC. (G.R. No. 227544, November 22, 2017)Document2 pagesCIR V. TRANSITIONS OPTICAL PHILIPPINES, INC. (G.R. No. 227544, November 22, 2017)Digna LausNo ratings yet

- CIR VS. Sekisui Jushi Philippines, Inc.Document1 pageCIR VS. Sekisui Jushi Philippines, Inc.Abdulateef SahibuddinNo ratings yet

- Taxrev2 - RCBC VS CirDocument3 pagesTaxrev2 - RCBC VS CirCayen Cervancia CabiguenNo ratings yet

- RCBC and Kudos PDFDocument26 pagesRCBC and Kudos PDFJohn Paul Pagala AbatNo ratings yet

- Letter of Complaint - EstoestaDocument2 pagesLetter of Complaint - EstoestaPJ HongNo ratings yet

- The Local Government Code of 1991 Otherwise Known As RA7061 Provides The QualificationsDocument2 pagesThe Local Government Code of 1991 Otherwise Known As RA7061 Provides The QualificationsPJ HongNo ratings yet

- Party Signs Memorandum of Association Pledges Buy SharesDocument11 pagesParty Signs Memorandum of Association Pledges Buy SharesPJ HongNo ratings yet

- SBD - KW - 1406001 (KC Cavite Royals)Document18 pagesSBD - KW - 1406001 (KC Cavite Royals)PJ HongNo ratings yet

- Comrev FinalsDocument3 pagesComrev FinalsPJ HongNo ratings yet

- Bill 23 April 6 - May 5Document4 pagesBill 23 April 6 - May 5PJ HongNo ratings yet

- Garcia vs. FranciscoDocument6 pagesGarcia vs. FranciscoTia RicafortNo ratings yet

- Mercado Vs CHEDDocument11 pagesMercado Vs CHEDkatherine magbanuaNo ratings yet

- Disciplinary ActionDocument270 pagesDisciplinary Actionffc_jr1084No ratings yet

- Lagula, Et Al. vs. Casimiro, Et AlDocument2 pagesLagula, Et Al. vs. Casimiro, Et AlMay RMNo ratings yet

- File 000011Document25 pagesFile 000011Jf LarongNo ratings yet

- G.R. No. 143340Document12 pagesG.R. No. 143340Henson MontalvoNo ratings yet

- Gan Vs Reyes - GR No. 145527, May 28, 2002 (Digested)Document2 pagesGan Vs Reyes - GR No. 145527, May 28, 2002 (Digested)Jane MaribojoNo ratings yet

- STATE INVESTMENT HOUSE, INC. and STATE FINANCING CENTER, INC., petitioners, vs. CITIBANK, N.A., BANK OF AMERICA, NT & SA, HONGKONG & SHANGHAI BANKING CORPORATION, and the COURT OF APPEALS, respondents.Document44 pagesSTATE INVESTMENT HOUSE, INC. and STATE FINANCING CENTER, INC., petitioners, vs. CITIBANK, N.A., BANK OF AMERICA, NT & SA, HONGKONG & SHANGHAI BANKING CORPORATION, and the COURT OF APPEALS, respondents.Anjanette MangalindanNo ratings yet

- Canon 16 Pale Cases Part1Document16 pagesCanon 16 Pale Cases Part1JenMarlon Corpuz AquinoNo ratings yet

- Pastor v. CA, G.R. No. L-56340, June 24, 1983 (122 SCRA 85)Document10 pagesPastor v. CA, G.R. No. L-56340, June 24, 1983 (122 SCRA 85)ryanmeinNo ratings yet

- Rabadilla Vs CA 334 SCRA 522Document16 pagesRabadilla Vs CA 334 SCRA 522Ghee MoralesNo ratings yet

- AAA V CarbonellDocument27 pagesAAA V Carbonellchey_anneNo ratings yet

- Nordock v. Systems - Appellate BriefsDocument235 pagesNordock v. Systems - Appellate BriefsSarah BursteinNo ratings yet

- United States Court of Appeals, Third CircuitDocument7 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Sandles v. USA - Document No. 3Document2 pagesSandles v. USA - Document No. 3Justia.comNo ratings yet

- LCR Answer Motion AttachmentsDocument512 pagesLCR Answer Motion AttachmentsKathleen PerrinNo ratings yet

- Isip Vs GonzalezDocument2 pagesIsip Vs GonzalezKingNoeBadongNo ratings yet

- 6 Santiago Vs FojasDocument4 pages6 Santiago Vs FojasHomer SimpsonNo ratings yet

- Nevada Reports 1922-1924 (47 Nev.) PDFDocument377 pagesNevada Reports 1922-1924 (47 Nev.) PDFthadzigsNo ratings yet

- Case Digest Spec. ProcDocument7 pagesCase Digest Spec. ProcAmy Catolico AgarNo ratings yet

- Bargainable IssuesDocument76 pagesBargainable IssuesKirby HipolitoNo ratings yet