Professional Documents

Culture Documents

Sweeney GDFGDF PDF

Sweeney GDFGDF PDF

Uploaded by

kathirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sweeney GDFGDF PDF

Sweeney GDFGDF PDF

Uploaded by

kathirCopyright:

Available Formats

Stocks & Commodities V15:9 (423-425): The Relative Strength Index (RSI) by John Sweeney

INDICATORS

For the record, Wilder also felt that support and resistance

The Relative were more apparent on the RSI line than in price charts and

that RSI’s failure swings were strong signals of price rever-

sals. I think these two characteristics are included in those

Strength Index above, as we’ll see later.

In addition, one characteristic of RSI that Wilder didn’t

mention is its simple direction: If it’s going up, so are prices.

(RSI) If it’s going down, look south. Therefore, heeding the direc-

tion of the RSI should alert you to the trend, depending on the

lookback period that you’ve chosen.

X-RAY

Price charts should cause ideas to percolate in your observant

Here, one of the most popular indicators found in most brain. Often, they cause too many ideas or, worse, too many

analytical software packages is explained. questions. RSI helps with this problem by tossing out all the

highs, lows, gaps, excursions to strange price levels and

by John Sweeney formations to leave you with a single line constrained be-

tween two limits.

hen the relative strength index In fact, in the days when I cut my teeth on my weekly

(RSI) became popular in the delivery of daily price charts, before the blessing of personal

1980s, it was touted as the indi- computers, I often covered up the prices just to look at the RSI

W cator that led every turn in the

market. Indeed, for certain fu-

tures contracts, financials and

currencies, it could be prescient:

In those markets, it had the pe-

graph without preconceptions. Thus, the Figure 1 seen here

scrunches the bars down to innocuous size while emphasiz-

ing the movement of RSI.

Working backward by looking at the RSI line first, we can

easily see the salient points of action: A, B, C, D and E. In

culiar ability to turn just as the each case, we see in hindsight that RSI turned at or around the

financials would find a level of support or resistance before top or bottom of the intermediate-term movement (28, 30, 26

taking off to another price level. and 15 days). Dropping point D, since it never got close to the

On other items, say, pork bellies or corn or cocoa, it would target level of 30, we see admirable consistency in the length

ape the price swings precisely. However, on trending prices, of the bond market swings, half of which is nicely close to the

it would go up the limits of its excursion and bounce around 14 days’ length I’ve used for RSI here. These values haven’t

there for weeks or months until the trend finally reversed. For changed perceptibly since 1982.

stocks, its performance could be all over, depending on the Retreats from RSI extremes match price extremes well.

trading characteristics of the stock in question. The RSI X-ray gives a nice confirmation or even a clear signal

Clearly, this was an indicator with promise but tricky that a change in direction has come.

implementation.

ONE OF A CLASS

J. Welles Wilder’s relative strength index is one of a class of

indicators known as oscillators. These indicators bounce

around (or oscillate) between fixed extreme values based on

price movement or position of close in range or change in

price over time. In the case of RSI, the values can range from

zero to 100 but typically fall between 20 and 80.

Like many mainstays, the RSI was introduced in Wilder’s

New Concepts in Technical Trading Systems. There, Wilder

SUPERCHARTS (OMEGA RESEARCH)

outlined its strengths, including three that I think make it the

best overall indicator:

1 Excursions beyond 70 and 30 are setups for tops and

bottoms.

2 Chart formations that aren’t apparent on the price chart are

clear in RSI’s line format.

FIGURE 1: BOND ACTION. An RSI set for 14 days ably picks off bond market

3 Divergence between RSI and price is a clear warning of turnarounds. The actual value chosen for RSI isn’t magical — your eye will adjust

imminent reversal. to how any value distills price charts into definitive pictures.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V15:9 (423-425): The Relative Strength Index (RSI) by John Sweeney

FIGURE 2: SUPPORT AND DIVERGENCE. Zooming in on Figure 1, as bonds hit FIGURE 3: INTEL TAKES RSI FOR A RIDE. Intel’s September 1996 breakout drives

support above 106, prices press downward as RSI’s lows start to rise. As the RSI to 82, but the oscillator recedes steadily during INTC’s advance, a good

number of ups and downs starts to equalize during a spell around a given price level, example of any oscillator’s inability to handle trend well.

RSI will head back toward a neutral value of 50.

Points C and D illustrate the strength of RSI’s divergence instantaneous jumps to other levels. Thus, fluctuations even

feature. Figure 2 inspects this more closely. From point C, within major moves fit the design of an indicator created to

points b and c rise on the RSI graph, while the commensurate pick up price oscillations. Inspection of the coincident price

b and c decline on price. Nevertheless, RSI is correct; we’re and RSI movement over some years is the only way to get a

not continuing downward but have hit support and even move feel for this.

to the upside some days later. Here, RSI is telling you the downward

movement has come to an end, not that a reversal is necessarily ON THE DOWNSIDE

imminent. The odds have shifted from down to flat or up. Point D If RSI is effective in trading swings, it must be ineffective in

portends similar news to the downside in May of the same chart. trends, right? That’s true; it’s not great at trend-trading . That

Of course, this sort of indication is not infallible. Part of its said, it’s not a bad indicator, as it does confirm when you’re

effectiveness is the instrument selected. In the case of bonds in a trend, valuable knowledge by itself. Some tradables

(or interest rates in general), the size of the markets precludes swing well even while trending, but a resolute advance or

CALCULATING RSI The next day, smoothing the result, you multiply the

Though the formulation can be made complex, the basic average up close by 13, add today’s up change (if any) and

idea of the RSI is straightforward. Considering the last 14 divide by 14. For the downs, you multiply yesterday’s average

days, let’s compare the strength of the upward moves to the down close by 13, add today’s downward change (if any), and

downward ones. That should tell us if the price, on average, divide by 14. Then compute relative strength and RSI as before.

is stronger in the bull’s direction or the bear’s. If there are Since 1978, many other algebraic formulations have

more and bigger upmoves than downmoves, the ratio of the made this simpler; more complex; more flexible; or more

two should increase. If the reverse, it should decrease. convenient, but this formulation is the essential idea. This

In practice, looking at the past 14 days, you average the way, the idea can be maintained by hand (as Wilder origi-

day-to-day upward changes (from close to close) and then nally did) or easily programmed in a worksheet or inter-

the day-to-day downward changes. There don’t need to be preted computer language.

the same number of each. Then you divide the average of the Wilder is reported to have selected the averaging period

upward changes by the average of the downward changes to of 14 through personal experience. I’ve found that the

get what’s called the relative strength, or RS. period is indeed experience-related: whatever period you

Since the relative strength ratio could be all over the lot, Wilder pick, you’ll soon be experienced with it and interpret its

arranged to keep it in the corral by using the following formula fluctuations appropriately. Theoretically, at least, the pe-

riod should be the half cycle of the tradable, so truly

100

RSI = 100 –

1 + RS outlandish numbers should be avoided, but 14 isn’t a bad

number for most futures and 21 isn’t bad for most equities.

where RSI is the relative strength index.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V15:9 (423-425): The Relative Strength Index (RSI) by John Sweeney

decline will find RSI pegged above or below its signal for 15 years (the other two being moving averages and on-

boundaries of 30 and 70. (See sidebar, “Calculating RSI.”) balance volume), but its limitations must be understood.

Figure 3 shows such a situation in Intel [INTC]. Here, RSI Given that, you can reliably use RSI in tradables that swing

maxed out in the very first runup, then drifted around the well, futures contracts being the best bets. Hesitate before

signal boundary with declining highs even as INTC roared up invoking RSI on a trending equity, but pay attention to its hitting

another $45 per share. RSI’s role here was that, in going to 82 extreme values: that’s usually a clue to trend-sustaining strength.

in the first place, it portended extraordinary strength, the

probable onset of trending. Had you been using RSI as an John Sweeney is Technical Editor for STOCKS & COMMODITIES.

oscillator here, only your experience-based stop would have

protected you from the inevitable loss of going short. REFERENCE

Of course, there were few places to go short, since there are Wilder, J. Welles [1978]. New Concepts in Technical Trad-

higher highs and higher lows throughout the advance. ing Systems, Trend Research.

SUMMARY S&C

RSI is a great indicator, one of only three I’ve used religiously

Copyright (c) Technical Analysis Inc.

You might also like

- FE Design of Concrete StructuresDocument300 pagesFE Design of Concrete StructuresAnca Fofiu100% (2)

- MTA Educational Web Series: Using Cycles in TradingDocument20 pagesMTA Educational Web Series: Using Cycles in TradingArchati ZNo ratings yet

- Isuzu D Max Owners Manual Combined 12 17myDocument578 pagesIsuzu D Max Owners Manual Combined 12 17myMauricio Gonzalez100% (1)

- Trend and Momentum Anyone?: EMA5 EMA10Document5 pagesTrend and Momentum Anyone?: EMA5 EMA10trungNo ratings yet

- Dan Zanger Trader's Log1Document1 pageDan Zanger Trader's Log1LNo ratings yet

- Leon Wilson - Trading SuccessDocument20 pagesLeon Wilson - Trading Successmanastha100% (1)

- Refined MacdDocument17 pagesRefined Macdapolodoro7No ratings yet

- Trading Journal TemplateDocument19 pagesTrading Journal TemplateVijeshcNo ratings yet

- William's %R - Ultilmate OsciallatorDocument2 pagesWilliam's %R - Ultilmate OsciallatorMian Umar RafiqNo ratings yet

- Signs of Strength in A Reversal: by Al BrooksDocument4 pagesSigns of Strength in A Reversal: by Al Brooksrufao086No ratings yet

- Trading Logic Technical Indicators v1Document26 pagesTrading Logic Technical Indicators v1myturtle gameNo ratings yet

- TD Rei PDFDocument12 pagesTD Rei PDFzameerp73No ratings yet

- What Is Technical Analysis?Document3 pagesWhat Is Technical Analysis?Jonhmark AniñonNo ratings yet

- Dynamic ExampleDocument90 pagesDynamic ExampleAnton Husen PurboyoNo ratings yet

- MACD-Histogram: MACD: (12-Day EMA - 26-Day EMA)Document11 pagesMACD-Histogram: MACD: (12-Day EMA - 26-Day EMA)kunsridhar8901No ratings yet

- Wyckoff Trading Course (WTC) : March 11Document14 pagesWyckoff Trading Course (WTC) : March 11MtashuNo ratings yet

- Ucc2017-135-0170-3 Reg Complaint Sec - Comunicaz LegaleDocument19 pagesUcc2017-135-0170-3 Reg Complaint Sec - Comunicaz LegalealbtrosNo ratings yet

- 192verv 1 PDFDocument5 pages192verv 1 PDFcasierraNo ratings yet

- Ratio AnalysisDocument12 pagesRatio AnalysisMrunmayee MirashiNo ratings yet

- Cremona Diagram For Truss AnalysisDocument14 pagesCremona Diagram For Truss AnalysisAnton Husen PurboyoNo ratings yet

- Polymedicure TIADocument28 pagesPolymedicure TIAProton CongoNo ratings yet

- Serviceability in The Design of Bridge FoundationsDocument11 pagesServiceability in The Design of Bridge FoundationsAnton Husen PurboyoNo ratings yet

- Best Practice For Road Tunnel Emergency ExercisesDocument50 pagesBest Practice For Road Tunnel Emergency ExercisesAnton Husen PurboyoNo ratings yet

- Detrended Price OscillatorDocument15 pagesDetrended Price Oscillatorsagarmkale4395100% (1)

- Barbara Star - PresentationDocument51 pagesBarbara Star - PresentationKenneth Anderson100% (1)

- RSI CalcDocument2 pagesRSI CalcregdddNo ratings yet

- Bollinger Band® Definition: Standard Deviations Simple Moving AverageDocument3 pagesBollinger Band® Definition: Standard Deviations Simple Moving AverageSandeep MishraNo ratings yet

- BankingTSN Complete TanDocument114 pagesBankingTSN Complete TanJose Gerfel GeraldeNo ratings yet

- Computer Analysis of The Futures MarketDocument34 pagesComputer Analysis of The Futures Marketteclas71No ratings yet

- Cut LossDocument3 pagesCut LossAnonymous sDnT9yuNo ratings yet

- "Daily 3" Stochastic Position Trading System: Member Home Workshops Forum Edit Profile Logout ContactDocument33 pages"Daily 3" Stochastic Position Trading System: Member Home Workshops Forum Edit Profile Logout ContactSoo Pl100% (1)

- Link Slab Deck JointsDocument20 pagesLink Slab Deck JointsAnton Husen PurboyoNo ratings yet

- Srs Trend Rider Complete CourseDocument75 pagesSrs Trend Rider Complete CourseNilay Gajiwala100% (1)

- Baeyens, Walter - RSI Logic, Signals & Time Frame Correlation-Đã Nén (PDF - Io) PDFDocument66 pagesBaeyens, Walter - RSI Logic, Signals & Time Frame Correlation-Đã Nén (PDF - Io) PDFthang d100% (1)

- The Art and Science Behind Successful Risk WorkshopsDocument10 pagesThe Art and Science Behind Successful Risk WorkshopsAcumenNo ratings yet

- Channel Breakouts: Part 1: EntriesDocument5 pagesChannel Breakouts: Part 1: EntriesdavyhuangNo ratings yet

- TRD !!!appreciating The Risk of Ruin - Nauzer Basara (S&C Mag)Document6 pagesTRD !!!appreciating The Risk of Ruin - Nauzer Basara (S&C Mag)cesarx2No ratings yet

- Relative Strength Index, or RSI, Is A Popular Indicator Developed by A Technical AnalystDocument2 pagesRelative Strength Index, or RSI, Is A Popular Indicator Developed by A Technical AnalystvvpvarunNo ratings yet

- Chapter 5 - Rate of ChangeDocument37 pagesChapter 5 - Rate of ChangeNAJWA SYAKIRAH MOHD SHAMSUDDINNo ratings yet

- BS 5266-2Document10 pagesBS 5266-2Anton Husen PurboyoNo ratings yet

- Cable Loss Analyses and Collapse Behavior of Cable Stayed Bridges (Wolff-Starossek)Document8 pagesCable Loss Analyses and Collapse Behavior of Cable Stayed Bridges (Wolff-Starossek)Anton Husen PurboyoNo ratings yet

- Edition 25 - Chartered 4th March 2011Document8 pagesEdition 25 - Chartered 4th March 2011Joel HewishNo ratings yet

- Manual For 3D Nls PDFDocument73 pagesManual For 3D Nls PDFmark100% (1)

- 02-Using Moving Averages On RSI To Trade Short Term (March 7, 2019)Document12 pages02-Using Moving Averages On RSI To Trade Short Term (March 7, 2019)Manoj Kumar MauryaNo ratings yet

- G5-T6 How To Use RSIDocument4 pagesG5-T6 How To Use RSIThe ShitNo ratings yet

- Planned Independent Requirement NotesDocument34 pagesPlanned Independent Requirement NotesNiraj KumarNo ratings yet

- Inside Bar Trading StrategiesDocument8 pagesInside Bar Trading StrategiesUtkarshNo ratings yet

- Chapter 5 Part 1 - RSIDocument15 pagesChapter 5 Part 1 - RSIAjay KhadkaNo ratings yet

- Bollinger Bands - Using Volatility by Matthew ClaassenDocument5 pagesBollinger Bands - Using Volatility by Matthew ClaassenTradingTheEdgesNo ratings yet

- TSHpart5 Application Final PDFDocument21 pagesTSHpart5 Application Final PDFancutzica2000No ratings yet

- How To Use RSI (Relative Strength Index)Document3 pagesHow To Use RSI (Relative Strength Index)paoloNo ratings yet

- Sovrenn Times 18 Mar 2024Document29 pagesSovrenn Times 18 Mar 2024KSKrishNo ratings yet

- Yt How To Use Technical Analysis For Option Trading 7 23 20 Facebook PostDocument16 pagesYt How To Use Technical Analysis For Option Trading 7 23 20 Facebook Postapi-519129906No ratings yet

- The Relative Volatility IndexDocument4 pagesThe Relative Volatility IndexmjmariaantonyrajNo ratings yet

- D3 SpotterDocument5 pagesD3 SpotterMariafra AntonioNo ratings yet

- ISM - IsM Report - September 2010 Manufacturing ISM Report On BusinessDocument9 pagesISM - IsM Report - September 2010 Manufacturing ISM Report On BusinessHåkan RolfNo ratings yet

- Is It Possible To Write A ThinkScript Script To Make Time-Based Buy - Sell Orders - ThinkorswimDocument9 pagesIs It Possible To Write A ThinkScript Script To Make Time-Based Buy - Sell Orders - ThinkorswimAlan PetzoldNo ratings yet

- A Tale of Two TradersDocument4 pagesA Tale of Two Tradersmayankjain24inNo ratings yet

- MTA JournalDocument9 pagesMTA Journaltaylor144100% (10)

- SM2246XT Datasheet - v07 - 20150827Document54 pagesSM2246XT Datasheet - v07 - 20150827Anonymous 16WzJT2zgt50% (4)

- Prashant Shah - RSIDocument5 pagesPrashant Shah - RSIIMaths PowaiNo ratings yet

- V32C02718PRPHDocument4 pagesV32C02718PRPHsomeonestupid1969No ratings yet

- Hidden DivergenceDocument5 pagesHidden Divergencesharvan003No ratings yet

- Swami ChartsDocument5 pagesSwami Chartscyrus68No ratings yet

- Rating TDocument9 pagesRating TMehul J VachhaniNo ratings yet

- ValueDocument6 pagesValuemeranaamfakeNo ratings yet

- Bisnews Technical AnalysisDocument33 pagesBisnews Technical AnalysisWings SVNo ratings yet

- The Monthly Chart.: Sunday, January 19, 2014Document6 pagesThe Monthly Chart.: Sunday, January 19, 2014analyst_anil14No ratings yet

- Edition 23 - Chartered 2nd February 2011Document8 pagesEdition 23 - Chartered 2nd February 2011Joel HewishNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Wayne A. Thorp - Measuring Internal Strength - Wilders RSI Indicator PDFDocument5 pagesWayne A. Thorp - Measuring Internal Strength - Wilders RSI Indicator PDFSrinivasNo ratings yet

- Tunnel Chronology Cisumdawu Toll Road Phase II: Date Meeting Subject and Requirements Status PicturesDocument3 pagesTunnel Chronology Cisumdawu Toll Road Phase II: Date Meeting Subject and Requirements Status PicturesAnton Husen PurboyoNo ratings yet

- Draft ToR Immersed Tunnel D2B15RI01 05042019 RvoDocument19 pagesDraft ToR Immersed Tunnel D2B15RI01 05042019 RvoAnton Husen PurboyoNo ratings yet

- 5$/$7 6hpxod 7HPSDW5XDQJ9,3/W G8WDPD 0Hqmdgl 7Hpsdw5Xdqj6Huedjxqd/W G8WdpdDocument13 pages5$/$7 6hpxod 7HPSDW5XDQJ9,3/W G8WDPD 0Hqmdgl 7Hpsdw5Xdqj6Huedjxqd/W G8WdpdAnton Husen PurboyoNo ratings yet

- Grant Arrangement D2B D2B15RI01Document27 pagesGrant Arrangement D2B D2B15RI01Anton Husen PurboyoNo ratings yet

- RAL Colour Chart PDFDocument4 pagesRAL Colour Chart PDFAnton Husen PurboyoNo ratings yet

- Magnetotelluric Method Vozoff PDFDocument68 pagesMagnetotelluric Method Vozoff PDFAnton Husen Purboyo100% (1)

- Konstruksi Baja (Oentoeng) PDFDocument169 pagesKonstruksi Baja (Oentoeng) PDFAnton Husen PurboyoNo ratings yet

- Jembatan Musi Iii: Juli 2013 Juli 2013Document30 pagesJembatan Musi Iii: Juli 2013 Juli 2013Anton Husen PurboyoNo ratings yet

- A Unique Bridge SystemDocument65 pagesA Unique Bridge SystemAnton Husen PurboyoNo ratings yet

- Level 2 Earthquake MotionsDocument1 pageLevel 2 Earthquake MotionsAnton Husen PurboyoNo ratings yet

- Elastomeric Bearing Pads and Strips Brochure 2010Document4 pagesElastomeric Bearing Pads and Strips Brochure 2010Anton Husen PurboyoNo ratings yet

- Cisco Aci Multi Site Configuration Guide 311Document284 pagesCisco Aci Multi Site Configuration Guide 311Manjeet SinghNo ratings yet

- Five Functions of ManagementDocument2 pagesFive Functions of ManagementMariecris CharolNo ratings yet

- ANNEXES K TUPAD Teamplate Memorandum of AgreementDocument5 pagesANNEXES K TUPAD Teamplate Memorandum of AgreementMetal WeebNo ratings yet

- Management Direction and Project Location: File Code: DateDocument4 pagesManagement Direction and Project Location: File Code: DateSinclair Broadcast Group - EugeneNo ratings yet

- Competition Between Huawei Switches and Cisco SwitchesDocument6 pagesCompetition Between Huawei Switches and Cisco SwitchesElizabeth RichNo ratings yet

- Carma Parrish Cover LetterDocument1 pageCarma Parrish Cover LetterCParrishNo ratings yet

- Module 3 - GOVERNMENTS AND CITIZENS IN A GLOBALLY INTERCONNECTED WORLD OF STATESDocument8 pagesModule 3 - GOVERNMENTS AND CITIZENS IN A GLOBALLY INTERCONNECTED WORLD OF STATESMark Alvin S. BaterinaNo ratings yet

- Advanced Accounting PDFDocument14 pagesAdvanced Accounting PDFYvette Pauline JovenNo ratings yet

- The Fundamental Marcom Decisions:: PositioningDocument72 pagesThe Fundamental Marcom Decisions:: PositioningibahrineNo ratings yet

- Machine Design AssignmentDocument9 pagesMachine Design AssignmentMuhammad Fahad Khan 51-FET/BSCMET/F19No ratings yet

- Gas Turbine DetailsDocument54 pagesGas Turbine DetailsMasab QadirNo ratings yet

- MBA 502 Supply Chain Management Lesson 2Document44 pagesMBA 502 Supply Chain Management Lesson 2smsishaNo ratings yet

- Altivar Process ATV900 - VW3A7732Document5 pagesAltivar Process ATV900 - VW3A7732juandomingo.diazNo ratings yet

- International Journal of Wireless & Mobile Networks (IJWMN)Document2 pagesInternational Journal of Wireless & Mobile Networks (IJWMN)John BergNo ratings yet

- 0414868761Document4 pages0414868761henry delgadoNo ratings yet

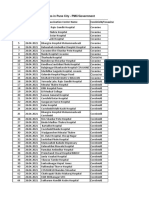

- Vaccination Centres in Pune City - PMC/GovernmentDocument4 pagesVaccination Centres in Pune City - PMC/GovernmentNachiket D SakinalNo ratings yet

- C++ GuidDocument22 pagesC++ GuidAamir WattooNo ratings yet

- CHQP PiqcDocument3 pagesCHQP PiqcShehzad Muhammad KhanNo ratings yet

- Individual Assignment 6Document2 pagesIndividual Assignment 6AISYAH FARAH YASIRA FITRINo ratings yet

- C Purlin Design Calculation: y 2 3 3 3 3 3 6 4 Y-Y X-XDocument6 pagesC Purlin Design Calculation: y 2 3 3 3 3 3 6 4 Y-Y X-XSalvatore ShwNo ratings yet

- Battery Datasheet2Document2 pagesBattery Datasheet2Laurindo SilveiraNo ratings yet

- Using Design S-N Curves and Design Stress Spectra For Probabilistic Fatigue Life Assessment of Vehicle ComponentsDocument12 pagesUsing Design S-N Curves and Design Stress Spectra For Probabilistic Fatigue Life Assessment of Vehicle ComponentsEnijad ArnautNo ratings yet

- Chanrobles Lawnet, Inc.: de La Salle University (Dlsu) - College of LawDocument3 pagesChanrobles Lawnet, Inc.: de La Salle University (Dlsu) - College of LawMary Heide H. AmoraNo ratings yet

- Peninsula Plaza, SingaporeDocument6 pagesPeninsula Plaza, SingaporeZaw AungNo ratings yet