Professional Documents

Culture Documents

SHIPPING PROCESS-Export Declaration PDF

SHIPPING PROCESS-Export Declaration PDF

Uploaded by

SaadAminOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SHIPPING PROCESS-Export Declaration PDF

SHIPPING PROCESS-Export Declaration PDF

Uploaded by

SaadAminCopyright:

Available Formats

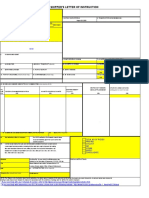

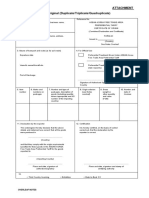

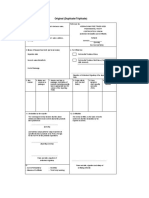

Export declaration

or application under subsection 162A(6A)

Approved Form paragraphs 114(3)(c) and 162AA(3)(a) of the Customs Act 1901.

Notice: We require this information under the Customs Act 1901, so we can ensure that your goods are properly cleared for export.

The information you provide will be given to the Australian Bureau of Statistics and the Australia Taxation Office.

If you are required to hold a permit to export these goods, the permit details will also be given to the relevant permit issuing agency.

Complete this form using a pen and BLOCK LETTERS.

Tick where applicable 3

EDN – System generated number 1. Reference – OFFICIAL USE ONLY 2. Reporting party type

Owner Agent

3. Your reference 4. Reporting party ID 5. Intended date of export

/ /

6. Unique consignment reference number 7. Customable / Excisable indicator 8. Prescribed goods indicator 9. Warehouse Est. ID

Yes No Yes No

10. Goods owner party ID (ABN/CCID) 11. Branch ID – Confirming export only 12. Confirming exporter type (N, Y, C)

N Y C

13. Export goods type 14. Consignee name

ST PO SP AB OP OT

15. Consignee city 16. Port of loading 17. First port of discharge 18. Final destination country code

19. Mode of transport 20. Vessel ID / Flight number 21. Voyage number 22. Cargo type

Air Sea C CO N B

23. Total number packages 24. Total number containers 25. Invoice currency 26. FOB currency 27. Total FOB value

Line details

Complete a separate form B957a Export declaration supplementary 28A. Line number 28. Commodity Classification code (AHECC)

page for each additional export commodity (each line)

29. Goods description

30. Goods origin code 31. Goods origin country code(s) 32. Temporary import number

33. Net quantity – a) Amount b) Unit 34. Gross weight – a) Amount b) Unit

35. Line FOB value 36. Permit prefix Permit number

Declaration

I, the undersigned, make this export declaration (comprising a B957 Export declaration (header page) and .......... B957a Export declaration

supplementary page(s) (insert number of additional supplementary page(s) not including notes pages)) and hereby declare I am the:

owner/authorised principal exporter, or an employee of the owner/authorise principal exporter

authorised agent for the owner or exporter

and that the information provided is complete and correct.

Name of the person making the entry Company name

Position in company Contact address

Contact phone number Contact fax number Contact email address

Signature Date

/ /

B957 (Design date 02/19) – Page 1

Notes for completing an Export declaration

1. D

epartment file reference 22. Cargo type

OFFICIAL USE ONLY. Leave blank. Tick the appropriate box.

2. Reporting party type (mandatory) Containerised: C

Tick either the ‘Owner’ or ‘Agent’ box to identify the reporting party type. Co-Combination: CO

Non-Containerised: N

3. Your reference (mandatory) Bulk: B

This reference must be unique and be used for both your files and to

23. Total number packages (mandatory if ‘Mode of transport’ is ‘Air’

differentiate between consignments.

or if ‘Mode of transport’ is ‘Sea’ and ‘Cargo type’ is ‘N’ or ‘CO’)

4. Reporting party ID (mandatory)

24. Total number containers (mandatory if ‘Mode of transport’ is ‘S’

The identifier of the party lodging the declaration.

and ‘Cargo type’ is ‘C’ or ‘CO’)

The identifier must be either an Australian Business Number (ABN) or

‘Containers’ refers to the sea cargo containers.

Customs Client Identifier (CCID).

25. Invoice currency (mandatory)

5. Intended date of export (mandatory)

Expressed as DD/MM/YYYY. 26. FOB currency (mandatory)

i.e. Australian dollars, etc.

6. Unique consignment reference number (optional)

For use as an alternative release process, where a Contingency 27. Total FOB value (mandatory)

Customs Authority Number (C-CAN) is quoted to the Australian Border The total free on board (FOB) value of the goods, including all costs

Force (ABF). incidental to the sale and delivery of the goods on to the exporting

vessel/aircraft. No discount given is to be deducted from the true value

7. Customable / Excisable indicator (mandatory)

of the goods. The FOB value should be expressed to the nearest

Show whether or not the goods would be subject to Commonwealth

dollar. It should be noted that FOB does not include overseas freight

Excise duty if they were to be delivered into home consumption rather

and insurance. The FOB values of samples must be shown as the

than being exported.

market value of the goods as if they were for sale.

Tick the appropriate box.

28A. Line number (mandatory)

8. Prescribed goods indicator (mandatory)

A supplementary page must be completed for each separate

The code indicating whether or not goods covered by the declaration

commodity as identified by the AHECC code (see Commodity

are prescribed goods under section 102A of the Customs Act 1901.

Classification). If the goods to be exported are minerals requiring an

Tick the appropriate box.

assay, use the B957a Export declaration supplementary page.

9. Warehouse establishment ID (mandatory if

28. Commodity Classification (mandatory)

‘Customable / Excisable indicator’ is ‘Yes’)

Australian Harmonized Export Commodity Classification (AHECC)

Establishment code of the warehouse or excise place from which the

code is a statistical classification for the particular commodity being

goods are to be removed.

exported. This code may be obtained from the Department or the

10. Goods owner party ID (mandatory) Australian Bureau of Statistics.

The owner party ID of the common law owner of the goods. This must

29. Goods description (mandatory)

be either an Australian Business Number (ABN) or a Customs Client

A description of the goods.

Identifier (CCID). If ‘Reporting party type’ is ‘Agent’, the ABN or CCID

for this item cannot be the same as ‘Reporting party ID’. 30. Goods origin code (mandatory)

The code used to identify the Australian (or foreign) state of origin of

11. Branch ID goods, as listed below:

An identifier that is linked to the ‘Goods owner party ID’, used to NSW: AU-NS

further identify the party within that organisation. TAS: AU-TS

12. Confirming exporter type (mandatory) VIC: AU-VI

A code indicating whether the exporter has confirming export status and NT: AU-NT

proposes to rely on that status in relation to goods in the declaration. QLD: AU-QL

Confirming: Y ACT: AU-CT

Non Confirming: N SA: AU-SA

Confirmed: C WA: AU-WA

FOREIGN: YY-FO

13. Export goods type (mandatory)

Tick the appropriate box. 31. Goods origin country code (mandatory if ‘Goods origin code’ is

Stores: ST ‘Foreign’)

Postal: PO The name of the primary country where the goods were manufactured

Spares: SP or produced.

Accompanied Baggage: AB 32. Temporary import number (mandatory if the AHECC is for the

Own Power: OP export of goods originally imported on a temporary basis)

Other: OT A number identifying the export of goods which are temporarily

14. Consignee name (mandatory) imported under section 162 or 162A of the Customs Act 1901.

The name of the person/organisation taking physical possession of the 33. Net quantity (mandatory)

goods. This should be the principal, not a bank, freight forwarder, etc. The net quantity of goods is described in terms of the units prescribed

15. Consignee city (mandatory) in the AHECC (e.g. KG, T, NO). If the unit prescribed by the AHECC

The city/town in which the person/organisation who takes final is ‘NR’, the quantity details are not required, but ‘NR’ must be shown

physical possession of the goods is located. in the units box. Net quantity should not include the weight of any

16. Port of loading (mandatory) additional packaging.

The port in Australia where the goods are loaded on board a vessel to 34. Gross weight (mandatory)

begin their international voyage. The gross weight is, in effect, the shipping weight of the goods. It should

17. First port of discharge (mandatory) include the weight of any immediate packaging but not the weight of the

The name of the first port of discharge overseas. container. Show weight in grams (G), kilograms (KG) or tonnes (T).

18. Final destination country code (mandatory) 35. Line FOB value

The name of the country that is to be the final destination of the goods. The FOB value of the goods quoted on this export declaration line,

(see Item 25). The FOB value should be expressed to the nearest

19. Mode of transport (mandatory unless ‘Export goods type’ is ‘PO’, dollar. (Also see ‘Line FOB value’ of the B957a Export declaration

then leave blank) supplementary page).

Tick the appropriate box.

36. Permit details (Prefix / Permit number)

20. Vessel ID / Flight number (mandatory if ‘Export goods’ is ‘ST’, A wide range of goods are prohibited from exportation unless an

‘SP’ or ‘AB’) export permit is obtained from the appropriate agency. Details of

The Lloyd’s identity number, registration number of the aircraft, or export restrictions are contained in various Commonwealth laws.

identifier.

Further advice can be obtained from your legal adviser, agent, etc, or

21. Voyage number (mandatory if ‘Vessel ID / Flight number’ requires the Department. Input the permit number given by the relevant permit

a ‘Vessel ID’) issuing authority. Each permit issuing authority has its own permit prefix.

A unique voyage number of the vessel carrying the goods. The correct prefix must be included for all permits.

B957 (Design date 02/19) – Page 2

You might also like

- Fillable PDF EPA Hazardous Waste Manifest Front Page Template, EPA Form 8700-22, Fillable, Print, Share, BlankDocument1 pageFillable PDF EPA Hazardous Waste Manifest Front Page Template, EPA Form 8700-22, Fillable, Print, Share, BlankAndrew FletcherNo ratings yet

- CCVO TemplateDocument1 pageCCVO Templatejohnopigo95% (19)

- The Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeFrom EverandThe Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeRating: 5 out of 5 stars5/5 (1)

- INTL729 Mod 02 ActivityDocument6 pagesINTL729 Mod 02 ActivityIshtiak AmadNo ratings yet

- Dock ReceiptDocument2 pagesDock ReceiptKarriem WakkiluddinNo ratings yet

- International Maritime Dangerous Goods (IMDG) Code Dangerous Goods DeclarationDocument1 pageInternational Maritime Dangerous Goods (IMDG) Code Dangerous Goods DeclarationNevin80% (5)

- Export Import DocsDocument47 pagesExport Import DocsAreej Aftab SiddiquiNo ratings yet

- Export Declaration - Australia604715120210721Document1 pageExport Declaration - Australia604715120210721Лена КиселеваNo ratings yet

- INTL729 Mod 02 ExercisesDocument17 pagesINTL729 Mod 02 ExercisesIshtiak AmadNo ratings yet

- Export Declaration Form With SDFDocument12 pagesExport Declaration Form With SDFsandeepgupta29No ratings yet

- Shipper's Letter of Instruction FormatDocument1 pageShipper's Letter of Instruction FormatMohanaNo ratings yet

- China FJ fj3 enDocument7 pagesChina FJ fj3 enjverdugo272015No ratings yet

- Sample: Malawi Customs & Excise DeclarationDocument2 pagesSample: Malawi Customs & Excise DeclarationEmmanuel E. MawangaNo ratings yet

- Dokumen Export&ImportDocument15 pagesDokumen Export&ImportMuhammad Harry FachriNo ratings yet

- Declaration Form For Export of Goods: Annexure - ADocument46 pagesDeclaration Form For Export of Goods: Annexure - AJibran SakharkarNo ratings yet

- (Ban hành kèm theo Thông tư số 42/2014/TT-BCT ngày 18 tháng 11 năm 2014 của Bộ trưởng Bộ Công Thương sửa đổi, bổ sung một số điều của Thông tư số 21/2010/TT-BCT)Document7 pages(Ban hành kèm theo Thông tư số 42/2014/TT-BCT ngày 18 tháng 11 năm 2014 của Bộ trưởng Bộ Công Thương sửa đổi, bổ sung một số điều của Thông tư số 21/2010/TT-BCT)Thao MacNo ratings yet

- Development Specifications For The CN 23 Customs DeclarationDocument11 pagesDevelopment Specifications For The CN 23 Customs DeclarationMaddison Charles JoNo ratings yet

- 8121497951Document40 pages8121497951Sahil JainNo ratings yet

- Revised Form EDocument3 pagesRevised Form EazkaNo ratings yet

- Cusdec InformationDocument11 pagesCusdec InformationlikehemanthaNo ratings yet

- Certificate of Origining Feb WR PDFDocument3 pagesCertificate of Origining Feb WR PDFLucero GonzalesNo ratings yet

- FormeDocument2 pagesFormeBULLY CHANNELNo ratings yet

- Chile Cert Origen ChinaDocument2 pagesChile Cert Origen ChinamiNo ratings yet

- Export DocumentsDocument22 pagesExport DocumentsHarano PothikNo ratings yet

- Shippers Letter of InstructionsDocument1 pageShippers Letter of InstructionsDipesh JainNo ratings yet

- U.S. Customs Form: CBP Form 7501 - InstructionsDocument32 pagesU.S. Customs Form: CBP Form 7501 - InstructionsCustoms FormsNo ratings yet

- Draft Shipping Bill and Bill Export Regulations 2017 Sb1Document19 pagesDraft Shipping Bill and Bill Export Regulations 2017 Sb1Anand Jay100% (1)

- Import Documentation - Do & DontDocument7 pagesImport Documentation - Do & DontAvinashNo ratings yet

- Certificate of Origin: INDIA .Document2 pagesCertificate of Origin: INDIA .Moges TolchaNo ratings yet

- Export Decleration FormDocument2 pagesExport Decleration Formmcz15No ratings yet

- INTERNATIONAL TRADE-Work SheetDocument9 pagesINTERNATIONAL TRADE-Work SheetArun AroraNo ratings yet

- Annex 4-C: Form of Certificate of OriginDocument3 pagesAnnex 4-C: Form of Certificate of OriginWei YeeNo ratings yet

- Documents For ExportDocument26 pagesDocuments For Exportnatrajang100% (1)

- Overleaf IKCEPADocument2 pagesOverleaf IKCEPAsantoso w pratamaNo ratings yet

- Airport SolutionsDocument10 pagesAirport SolutionsFazila KhanNo ratings yet

- Generalized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Document2 pagesGeneralized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Moges TolchaNo ratings yet

- U.S. Customs Form: CBP Form 7514 - Drawback Notice (Lading/FTZ Transfer)Document2 pagesU.S. Customs Form: CBP Form 7514 - Drawback Notice (Lading/FTZ Transfer)Customs FormsNo ratings yet

- Declaration Form enDocument3 pagesDeclaration Form enHet Hongarije NieuwsbladNo ratings yet

- Form 05 Cusdec Ro Blank App p1 p2Document3 pagesForm 05 Cusdec Ro Blank App p1 p2chamith.transcoNo ratings yet

- Scan Teretnice PDFDocument1 pageScan Teretnice PDFTHe Axm1nsterNo ratings yet

- Combined Invoice & Packing List: TotalDocument2 pagesCombined Invoice & Packing List: TotaltaufiqNo ratings yet

- Factura de Exportación 00022222 RUT: 93.333.666-9Document10 pagesFactura de Exportación 00022222 RUT: 93.333.666-9karrrlaNo ratings yet

- Original: Certificate of Origin Form For China-Peru FTADocument2 pagesOriginal: Certificate of Origin Form For China-Peru FTAMuñoz Sanchez EsthefanyNo ratings yet

- Anexa 1 TirDocument1 pageAnexa 1 TirAna DodonNo ratings yet

- IncotermsDocument9 pagesIncotermsImranNo ratings yet

- Form AHKDocument6 pagesForm AHKkatacumiNo ratings yet

- Case Study Booklet of Transportation and Freight ForwardingDocument38 pagesCase Study Booklet of Transportation and Freight Forwardingpocsibence10No ratings yet

- Chapter 2 SVDocument43 pagesChapter 2 SVTM PhụngNo ratings yet

- Export Import DocumentsDocument47 pagesExport Import DocumentssadafshariqueNo ratings yet

- CL FTA Annex I Appendix 3Document9 pagesCL FTA Annex I Appendix 3MaximilianNo ratings yet

- Chapter 4-Key Documents in Import and ExportDocument38 pagesChapter 4-Key Documents in Import and ExportLe Thi Thuy KieuNo ratings yet

- Phu luc 7 Mẫu CO VJ của Nhật BảnDocument2 pagesPhu luc 7 Mẫu CO VJ của Nhật BảnHiền Vũ NgọcNo ratings yet

- Att. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDocument2 pagesAtt. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDINI KUSUMAWATINo ratings yet

- TRAC - Nghiem-TTQT - ĐẠI HỌC NGÂN HÀNG '1Document19 pagesTRAC - Nghiem-TTQT - ĐẠI HỌC NGÂN HÀNG '1Minh Châu NguyễnNo ratings yet

- Export DocmntsDocument60 pagesExport DocmntskanikaNo ratings yet

- Form EDocument2 pagesForm EDoni EdwardNo ratings yet

- Incoterms 2010Document18 pagesIncoterms 2010Römäl NäsëriNo ratings yet

- Airport Terminals: Butterworth Architecture Library of Planning and DesignFrom EverandAirport Terminals: Butterworth Architecture Library of Planning and DesignRating: 4 out of 5 stars4/5 (8)