Professional Documents

Culture Documents

Chapter 8

Chapter 8

Uploaded by

Trisha Taruc0 ratings0% found this document useful (0 votes)

18 views2 pagesThis document contains the answers to two exercises from a Philippine taxation course. Exercise 8-1 lists true/false questions and their answers. Exercise 8-2 classifies different types of income and indicates whether each type can avail the 8% income tax rate. The document provides concise responses to the exercises but no additional context or explanation.

Original Description:

INCOME TAX AMPONGAN

Original Title

CHAPTER 8

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains the answers to two exercises from a Philippine taxation course. Exercise 8-1 lists true/false questions and their answers. Exercise 8-2 classifies different types of income and indicates whether each type can avail the 8% income tax rate. The document provides concise responses to the exercises but no additional context or explanation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesChapter 8

Chapter 8

Uploaded by

Trisha TarucThis document contains the answers to two exercises from a Philippine taxation course. Exercise 8-1 lists true/false questions and their answers. Exercise 8-2 classifies different types of income and indicates whether each type can avail the 8% income tax rate. The document provides concise responses to the exercises but no additional context or explanation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Taruc, Trisha Mae T.

BSA1202 – 2T

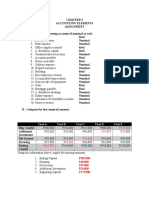

EXERCISE 8 – 1

1. T

2. F

3. T

4. T

5. F

6. T

7. T

8. T

9. T

10. F

11. F

12. T

13. T

14. T

15. F

16. T

17. T

18. F

19. F

20. T

EXERCISE 8 – 2

I. Classify the following income into:

A. Self – Employment

Rent income of apartment

Gain on sale of a commercial building

Gain on sale of residential house

Income as street vendor

Income as junk shop owner

B. Passive subject to final withholding tax

Interest on peso deposit with Bank of the Philippine Islands

Royalty as book author

Interest income on Euro deposit with Metrobank

Share in the net income of a partnership in trade

Gain on sale of shares of stock (not traded)

Winnings in a lottery sponsored by Philip Morris Philippines

Dividend received as stockholder of a corporation

Lotto winnings

C. Compensation

Night differential pay

Honorarium of a CPA as speaker in a Continuing Professional

Development (CPD) seminar

Income received by a CPA as an independent auditor

13th month pay

Honorarium received as President and Director of a corporation

Travel allowance

Productivity incentive pay

II. On the following income, write (Y) if the taxpayer can avail 8% income

tax rate, and (N) if the taxpayer cannot avail of the 8% income tax rate.

1. Y

2. Y

3. Y

4. Y

5. Y

6. N

7. N

8. N

9. N

10. N

11. Y

12. Y

13. N

14. Y

15. N

16. Y

17. N

18. N

19. N

20. N

You might also like

- Exercises - Capital Gains TaxDocument12 pagesExercises - Capital Gains TaxElla Marie Lopez83% (6)

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- Individual Income TaxDocument13 pagesIndividual Income TaxDaniel Dialino100% (1)

- TEST I: MCQ - THEORY: (1 Point Each) : B. Resident Citizen D. C. Tax Laws Shall Prevail Over GAAPDocument1 pageTEST I: MCQ - THEORY: (1 Point Each) : B. Resident Citizen D. C. Tax Laws Shall Prevail Over GAAPJoe Mari100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Test - Income Tax For IndividualsDocument9 pagesTest - Income Tax For IndividualsNikka Nicole Arupat100% (5)

- Final Exam Tax - SpecialDocument9 pagesFinal Exam Tax - SpecialKenneth Bryan Tegerero Tegio100% (5)

- Philippine Association of Certified Tax TechniciansDocument3 pagesPhilippine Association of Certified Tax Techniciansucc second yearNo ratings yet

- Educated REIT Investing: The Ultimate Guide to Understanding and Investing in Real Estate Investment TrustsFrom EverandEducated REIT Investing: The Ultimate Guide to Understanding and Investing in Real Estate Investment TrustsNo ratings yet

- Assignment No. 2: Part 1: Determination of Income Tax Due/PayableDocument4 pagesAssignment No. 2: Part 1: Determination of Income Tax Due/PayableKenneth Pimentel100% (1)

- Dealings in PropertiesDocument12 pagesDealings in PropertiesJane Tuazon50% (2)

- 8.1 Assignment - Regular Income TaxDocument3 pages8.1 Assignment - Regular Income TaxCharles Mateo0% (1)

- Income Tax TestbankanssssDocument17 pagesIncome Tax TestbankanssssAirille Carlos67% (3)

- Answer Key To Quiz 2 MidtermsDocument2 pagesAnswer Key To Quiz 2 MidtermsRyan Christian Balanquit100% (1)

- Instruction: Write The Letter of Your Choice On The Space Provided Before The NumberDocument4 pagesInstruction: Write The Letter of Your Choice On The Space Provided Before The NumberASDDD100% (2)

- TaxationDocument10 pagesTaxationSteven Mark MananguNo ratings yet

- QUIZ 2 MKM v.23Document3 pagesQUIZ 2 MKM v.23Ronnalene Cerbas Glori0% (1)

- Tax Act ProblemDocument1 pageTax Act ProblemMervidelleNo ratings yet

- Income Tax Midterm Quiz 2Document1 pageIncome Tax Midterm Quiz 2Wycliffe Luther RosalesNo ratings yet

- Tax 1st Preboard A LUDocument9 pagesTax 1st Preboard A LUAnonymous 7HGskNNo ratings yet

- Individual Taxpayers - Sample ProblemsDocument4 pagesIndividual Taxpayers - Sample ProblemsBpNo ratings yet

- Individual Taxpayers (Tabag2021)Document14 pagesIndividual Taxpayers (Tabag2021)Veel Creed100% (1)

- Tax 2 Finals Exam Problem 1Document3 pagesTax 2 Finals Exam Problem 1Ces0% (1)

- Quiz Tax On IndividualsDocument2 pagesQuiz Tax On IndividualsAirah Shane B. DianaNo ratings yet

- Summative TestDocument5 pagesSummative TestRichard de Leon0% (1)

- Midterm Exam Tax1Document4 pagesMidterm Exam Tax1ZanderNo ratings yet

- Aquino Angelito R. BAPE 2 2 Correspondence MacroeconomicsDocument6 pagesAquino Angelito R. BAPE 2 2 Correspondence MacroeconomicsKae HannahNo ratings yet

- Chapter 7-12 PDFDocument4 pagesChapter 7-12 PDFmEOW SNo ratings yet

- Individual Taxation Assignment 2 - 1868900521Document2 pagesIndividual Taxation Assignment 2 - 1868900521Jaylyn BacolonNo ratings yet

- Chapter 4 Sources of Income PDFDocument5 pagesChapter 4 Sources of Income PDFkimberly tenebroNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- Tax 321 Prelim Quiz 1 Key PDFDocument13 pagesTax 321 Prelim Quiz 1 Key PDFJeda UsonNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Income Tax Solution ManualDocument32 pagesIncome Tax Solution ManualAnne RNo ratings yet

- BA 126 Preliminary ExaminationDocument6 pagesBA 126 Preliminary ExaminationKitagawa, Misia Sophia Jan B.No ratings yet

- Midterm Exam Principles of Taxation and Income TaxationDocument6 pagesMidterm Exam Principles of Taxation and Income TaxationKitagawa, Misia Sophia Jan B.No ratings yet

- Taxation TaxpayerSitus BSA Review 2019Document6 pagesTaxation TaxpayerSitus BSA Review 2019Jhullian Frederick Val VergaraNo ratings yet

- PDF Income Tax TestbankanssssDocument17 pagesPDF Income Tax TestbankanssssMark Emil Barit100% (1)

- Tax Sem OuputDocument43 pagesTax Sem OuputAshlley Nicole VillaranNo ratings yet

- Income Taxation 2015 Edition Solman PDFDocument53 pagesIncome Taxation 2015 Edition Solman PDFPrincess AlqueroNo ratings yet

- Fabm 2 Endterm ExaminationDocument4 pagesFabm 2 Endterm Examinationreverewh ouyNo ratings yet

- INCOME TAXATION, 2015 Edition: Chapter 1 Principles of TaxationDocument53 pagesINCOME TAXATION, 2015 Edition: Chapter 1 Principles of TaxationPrincess AmberNo ratings yet

- MASTERY TAXATION October-2019 PDFDocument12 pagesMASTERY TAXATION October-2019 PDFJuvelyn Gregorio100% (1)

- Mendoza - UNIT 1 - Statement of Comprehensive IncomeDocument9 pagesMendoza - UNIT 1 - Statement of Comprehensive IncomeAim RubiaNo ratings yet

- BLT 101Document14 pagesBLT 101NIMOTHI LASENo ratings yet

- Let's Practice: Exercise Drill No. 1Document2 pagesLet's Practice: Exercise Drill No. 1Madonna LuisNo ratings yet

- Business Tax - VATable Transactions PracticeDocument2 pagesBusiness Tax - VATable Transactions PracticeDrew BanlutaNo ratings yet

- Income Tax Finals Sample Questions Final ExamDocument19 pagesIncome Tax Finals Sample Questions Final ExamAnie P. Martinez0% (1)

- VATable Transaction Practice PDFDocument2 pagesVATable Transaction Practice PDFJester LimNo ratings yet

- FIRST PB Tax Solutions PDFDocument21 pagesFIRST PB Tax Solutions PDFStephanie Joy NogollosNo ratings yet

- Law & TaxDocument13 pagesLaw & TaxrylNo ratings yet

- Case A Case B Case C Case D Case E: P175,000 P24,000 P55,000 P48,000 P305,000Document1 pageCase A Case B Case C Case D Case E: P175,000 P24,000 P55,000 P48,000 P305,000Ice Voltaire B. GuiangNo ratings yet

- Answer Key Tax 501 by AmponganDocument37 pagesAnswer Key Tax 501 by AmponganRegina Dela RosaNo ratings yet

- Business Tax - Applicable Business Tax PracticeDocument3 pagesBusiness Tax - Applicable Business Tax PracticeDrew BanlutaNo ratings yet

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Getting Started in Real Estate Investment TrustsFrom EverandGetting Started in Real Estate Investment TrustsRating: 3 out of 5 stars3/5 (1)

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Property Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksFrom EverandProperty Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksNo ratings yet

- 2-7-22 DWDocument32 pages2-7-22 DWTrisha TarucNo ratings yet

- Prescriptive - Analytics - PPT - Group 3Document14 pagesPrescriptive - Analytics - PPT - Group 3Trisha TarucNo ratings yet

- Taruc AssignmentDocument3 pagesTaruc AssignmentTrisha TarucNo ratings yet

- Comparison of ApproachesDocument24 pagesComparison of ApproachesTrisha TarucNo ratings yet

- Minimum Requirements of MoralityDocument6 pagesMinimum Requirements of MoralityTrisha TarucNo ratings yet

- 10 Most Heroic ActsDocument55 pages10 Most Heroic ActsTrisha TarucNo ratings yet

- Phenomenology of FeelingsDocument25 pagesPhenomenology of FeelingsTrisha TarucNo ratings yet

- Miriam Defensor SantiagoDocument1 pageMiriam Defensor SantiagoTrisha TarucNo ratings yet

- Cllasification of Human ActsDocument10 pagesCllasification of Human ActsTrisha TarucNo ratings yet

- LiteratureDocument5 pagesLiteratureTrisha TarucNo ratings yet