Professional Documents

Culture Documents

Secondary Market

Uploaded by

Perbielyn BasinilloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Secondary Market

Uploaded by

Perbielyn BasinilloCopyright:

Available Formats

English Auction- Prospective buyers submit an initial bid price.

Other interested bidders could bid higher than the initial bid price.

Bidding stops when no other bidders want to top the last bid.

Descending price sealed auction (first-price sealed auction)- All

the bidders will submit sealed bids to seller. The bids are ranked

from highest to lowest. Highest priced bids receive full allocation

while lower bids receive allocations distributed pro rata.

Tap Issue

- Occurs when issuers are open to receive bids for their securities at all

times.

Secondary Market

Refers to the market where securities issued in the primary market are subsequently

traded, resold, and repurchased.

Participants in the market include household, business and government who have excess

funds and household, business, and government who need funds.

Transaction usually occurs with the help of securities broker which acts as a facilitator

between the seller and the buyer of the security.

Economic functions

Price Discovery

- Secondary market provides information about prices of the securities

traded which can influence economic decisions. The higher the price of

the security, the higher the price that issuing companies can set on new

securities they will issue.

Liquidity and Reduction in Borrowing Cost

- Secondary market allows active trading which improves liquidity and

marketability of the securities. A liquid market also reduces interest rates

as liquidity premium can be removed.

Support to the primary market

- Price discovery helps in giving information that can be helpful in:

Setting prices for the new issuances executed in the primary

market, and

Assessing receptiveness of the market for the new issuances.

Implementation of monetary policy

- Allows regulators such as the BSP to trade securities to influence liquidity

and interest rates set in the financial system.

Point of View of the Investors

Secondary markets are beneficial as it gives them the opportunity to sell securities

at fair market value if they need cash or purchase additional securities that have

differing risk and return characteristics to diversify their portfolio.

It provides liquidity to them.

Provides information on the market value of the investments.

Point of View of the Issuing Company

Although they are not involved, it gives the issuing company an idea how much is

the fair market value if they need cash or purchase additional securities.

It gives them an idea on how well they are using the funds obtained from the

securities issuance.

Securities easily tradeable in the secondary market is perceived to be more liquid.

Classification of secondary market based on market structure

Order-Driven Market Structure

- Auction Market

- The buyers and sellers propose their price through their brokers who

conveys the bid in a centralized location.

- Types of Orders

Market Orders (At-best orders)

o Orders are placed with broker-dealer

o The client relies on the expertise and integrity of the

broker-dealer

Limit Orders

o Orders are placed when clients set a price or price range

that may be above/below the existing price

Day Orders

o Orders placed that only valid until the end of the business

day

You might also like

- Investment Chapter 4 Organizing SecuritiesDocument15 pagesInvestment Chapter 4 Organizing SecuritiesEsraa TarekNo ratings yet

- Market Chapter OneDocument11 pagesMarket Chapter Onehaifa.s.mansourNo ratings yet

- Chap 4-fmDocument89 pagesChap 4-fmYeshiwork GirmaNo ratings yet

- The Secondary MarketDocument13 pagesThe Secondary MarketDhushor SalimNo ratings yet

- Derivative As An Investment Option KARVYDocument10 pagesDerivative As An Investment Option KARVYcmkkaranNo ratings yet

- What Is MarketDocument19 pagesWhat Is MarketHussain khawajaNo ratings yet

- FNM 104 Finals LectureDocument19 pagesFNM 104 Finals LectureNovelyn DuyoganNo ratings yet

- Resume Webinar MKDocument4 pagesResume Webinar MKayeshaNo ratings yet

- Inv Lectures FinalsDocument5 pagesInv Lectures FinalsShiela Mae Gabrielle AladoNo ratings yet

- ACFN 615 - CH 2 - SDocument62 pagesACFN 615 - CH 2 - Sselamawit AdmasuNo ratings yet

- Lesson MGTDocument15 pagesLesson MGTSohail Liaqat AliNo ratings yet

- How Securities Are TradedDocument15 pagesHow Securities Are TradedRazafinandrasanaNo ratings yet

- Online Trading Futures and OptionsDocument61 pagesOnline Trading Futures and OptionsRajesh BathulaNo ratings yet

- MTH103 Lec2Document9 pagesMTH103 Lec2stanleyNo ratings yet

- Functions of Secondary MarketDocument7 pagesFunctions of Secondary MarketshugugaurNo ratings yet

- Chapter - 4 Organization and Functioning of Securities MarketsDocument9 pagesChapter - 4 Organization and Functioning of Securities MarketsFarah NazNo ratings yet

- Zaky Zaljuhdi 1401103010148Document5 pagesZaky Zaljuhdi 1401103010148Zaky ZaljuhdiNo ratings yet

- Financial DerivativesDocument12 pagesFinancial DerivativesNony BahgatNo ratings yet

- Market MakerDocument11 pagesMarket MakerDJUNAH MAE ARELLANONo ratings yet

- Assumptions of CAPM: Rate of Return Asset Portfolio DiversifiableDocument10 pagesAssumptions of CAPM: Rate of Return Asset Portfolio Diversifiableখালেদ কায়ছার রনিNo ratings yet

- Fundamentals of Corporate Finance 3rd Edition by Parrino Kidwell Bates ISBN Solution ManualDocument8 pagesFundamentals of Corporate Finance 3rd Edition by Parrino Kidwell Bates ISBN Solution Manualmary100% (20)

- Chapter 7 FinmarDocument2 pagesChapter 7 FinmarNathalie GetinoNo ratings yet

- Securities MarketsDocument8 pagesSecurities Marketspiepkuiken-knipper0jNo ratings yet

- Trading PracticalitiesDocument3 pagesTrading PracticalitiesAzwan AyopNo ratings yet

- Lecture 2 - Financial MKTSDocument18 pagesLecture 2 - Financial MKTSEmmanuel MwapeNo ratings yet

- Chapter 3 NotesDocument1 pageChapter 3 Notesazhar80malikNo ratings yet

- Fin MarDocument3 pagesFin MarnhbNo ratings yet

- 1.1) Introduction To The IndustryDocument51 pages1.1) Introduction To The IndustryneetliNo ratings yet

- Money MarketDocument27 pagesMoney MarketAkhil UchilNo ratings yet

- Chapter - 10Document11 pagesChapter - 10sonal2901No ratings yet

- Quote Driven MarketDocument2 pagesQuote Driven Marketkurdiausha29No ratings yet

- Technical and Fundamental AnalysisDocument75 pagesTechnical and Fundamental Analysiseuge_prime2001No ratings yet

- SSRN Id1729408Document73 pagesSSRN Id1729408jesus penaNo ratings yet

- Example of Cash Settled: Futures On Stock IndicesDocument5 pagesExample of Cash Settled: Futures On Stock IndicesKhanh Do KieuNo ratings yet

- 12 Business Studies CH 10 Financial MarketsDocument11 pages12 Business Studies CH 10 Financial MarketsRiyasat khanNo ratings yet

- Business Adm4Document6 pagesBusiness Adm4MUNEEBA GULNo ratings yet

- 4b Notes PDFDocument9 pages4b Notes PDFIrriz MadriagaNo ratings yet

- Chapter 1 FINANCIAL MARKET STRUCTURE AND ROLE IN THE FINANCIAL SYSTEMDocument2 pagesChapter 1 FINANCIAL MARKET STRUCTURE AND ROLE IN THE FINANCIAL SYSTEMBrandon LumibaoNo ratings yet

- Work 1Document2 pagesWork 1Nova Trixia BangquiaoNo ratings yet

- NISM XB Invt Advisor 2 Short NotesDocument32 pagesNISM XB Invt Advisor 2 Short NotesAnchal100% (1)

- FD Unit 1 AjayDocument6 pagesFD Unit 1 AjaySweety BansalNo ratings yet

- Secondary MarketDocument13 pagesSecondary MarketKanchan GuptaNo ratings yet

- Chapter 2 Fin645Document33 pagesChapter 2 Fin645Natasha AzzariennaNo ratings yet

- Derivatives: Types of Derivative ContractsDocument20 pagesDerivatives: Types of Derivative ContractsXandarnova corpsNo ratings yet

- Derivative MarketsDocument19 pagesDerivative Marketsanon_596812086No ratings yet

- FM 2Document14 pagesFM 2Castor DamasoNo ratings yet

- Financial Asset Valuation IntroductionDocument7 pagesFinancial Asset Valuation IntroductionGiga Kutkhashvili100% (1)

- Business PlanDocument11 pagesBusiness PlansonydhondphodeNo ratings yet

- Q. 10 Benefits of DerivativesDocument2 pagesQ. 10 Benefits of DerivativesMAHENDRA SHIVAJI DHENAK100% (1)

- Assignment#3Document6 pagesAssignment#3Lorraine CaliwanNo ratings yet

- Lesson 1-Overview of Financial Instruments and MarketsDocument6 pagesLesson 1-Overview of Financial Instruments and MarketsHans DizonNo ratings yet

- Tutorial 1: 1. What Is The Basic Functions of Financial Markets?Document6 pagesTutorial 1: 1. What Is The Basic Functions of Financial Markets?Ramsha ShafeelNo ratings yet

- 1 Overview of Financial Instruments and MarketsDocument6 pages1 Overview of Financial Instruments and MarketsKiro ParafrostNo ratings yet

- L2 - MS International Finance 2023 - DerivativeDocument18 pagesL2 - MS International Finance 2023 - DerivativeAli HasanovNo ratings yet

- MK Pertemuan 3Document7 pagesMK Pertemuan 3Livia BelaNo ratings yet

- Capital MarketsDocument16 pagesCapital MarketsChowdary PurandharNo ratings yet

- Accounting For Derivatives GovernDocument3 pagesAccounting For Derivatives GovernMA ValdezNo ratings yet

- Chapter 12 - Derivative MarketsDocument28 pagesChapter 12 - Derivative MarketsFrancis GumawaNo ratings yet

- Chapter Two Financial Markets and InstrumentsDocument61 pagesChapter Two Financial Markets and InstrumentsKume MezgebuNo ratings yet

- Variables Are The Characteristics of The: Distinction Between Qualitative and Quantitative VariablesDocument3 pagesVariables Are The Characteristics of The: Distinction Between Qualitative and Quantitative VariablesPerbielyn BasinilloNo ratings yet

- 3.1 What Is An Argument?Document1 page3.1 What Is An Argument?Perbielyn BasinilloNo ratings yet

- About The Ultimate Questions of Life. Philosophers Ask Questions Like "Why Accept or Reject Free Will?" orDocument2 pagesAbout The Ultimate Questions of Life. Philosophers Ask Questions Like "Why Accept or Reject Free Will?" orPerbielyn BasinilloNo ratings yet

- Nature and Importance of Financial System The Financial SystemDocument2 pagesNature and Importance of Financial System The Financial SystemPerbielyn BasinilloNo ratings yet

- Primary Market vs. Secondary MarketDocument2 pagesPrimary Market vs. Secondary MarketPerbielyn BasinilloNo ratings yet

- Capital Happens When Funds Are Invested in Productive Investments That Yield Returns ForDocument3 pagesCapital Happens When Funds Are Invested in Productive Investments That Yield Returns ForPerbielyn BasinilloNo ratings yet

- Nature and Importance of Financial Market The Financial MarketDocument4 pagesNature and Importance of Financial Market The Financial MarketPerbielyn BasinilloNo ratings yet

- My Dear Friend: I Felt Happy Doing This Routines Because This Is The Way I Enjoy My LifeDocument5 pagesMy Dear Friend: I Felt Happy Doing This Routines Because This Is The Way I Enjoy My LifePerbielyn BasinilloNo ratings yet

- Primary SchoolerDocument9 pagesPrimary SchoolerPerbielyn BasinilloNo ratings yet

- A Price Action Traders Guide To Supply and DemandDocument17 pagesA Price Action Traders Guide To Supply and Demandmohamed100% (2)

- StratCost CVP 1Document65 pagesStratCost CVP 1Vrix Ace MangilitNo ratings yet

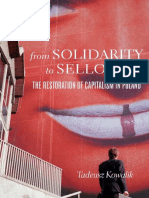

- 13 Kowalik, From Solidarity To Sellout PDFDocument367 pages13 Kowalik, From Solidarity To Sellout PDFporterszucsNo ratings yet

- Chapter 12 CVP RelationshipDocument4 pagesChapter 12 CVP RelationshipGe-ann CaniedoNo ratings yet

- Theory and Practice 08 04 PDFDocument100 pagesTheory and Practice 08 04 PDFHạng VũNo ratings yet

- BBMP1103 OUM Mathematics For Management September 2023Document9 pagesBBMP1103 OUM Mathematics For Management September 2023KogiNo ratings yet

- Cyber Attacks Implications For UkDocument79 pagesCyber Attacks Implications For UkAlex Andra MurariuNo ratings yet

- SYJCECOLMRDocument61 pagesSYJCECOLMRAvni S. PatilNo ratings yet

- A3 - Time Value of MoneyDocument33 pagesA3 - Time Value of MoneyNoel GatbontonNo ratings yet

- Unit 5: Check Your Progress (Page 35)Document3 pagesUnit 5: Check Your Progress (Page 35)Juan Francisco Hidalgo ReinaNo ratings yet

- Handouts Contemporary PDFDocument5 pagesHandouts Contemporary PDFNelzen GarayNo ratings yet

- Connolly - The Rotten Heart of Europe The Dirty War For Europe's Money (1995) PDFDocument450 pagesConnolly - The Rotten Heart of Europe The Dirty War For Europe's Money (1995) PDFCliff100% (1)

- Alan Ware (Auth.) - The Logic of Party Democracy-Palgrave Macmillan UK (1979)Document219 pagesAlan Ware (Auth.) - The Logic of Party Democracy-Palgrave Macmillan UK (1979)NicolasEvaristoNo ratings yet

- Archive of SID: Analyzing of The Economic Equilibrium of Tourism Contracts in The Context of General Economic OrderDocument33 pagesArchive of SID: Analyzing of The Economic Equilibrium of Tourism Contracts in The Context of General Economic OrderlyesNo ratings yet

- Managerial Accounting and Cost ConceptsDocument14 pagesManagerial Accounting and Cost ConceptsWaseem ChaudharyNo ratings yet

- RSP ReportDocument9 pagesRSP Reportapi-377043568No ratings yet

- Chapter 7 - Consumerism - Norton AugustDocument20 pagesChapter 7 - Consumerism - Norton AugustaanillllNo ratings yet

- Does Business Ethics Make Economi SencdeDocument11 pagesDoes Business Ethics Make Economi Sencdemaarghe87No ratings yet

- Money SupplyDocument15 pagesMoney Supplyhasan jamiNo ratings yet

- Cost, Revenue, and Profit Function Estimates by Kutlu, Liu, and Sickles - Oct-15-2018Document66 pagesCost, Revenue, and Profit Function Estimates by Kutlu, Liu, and Sickles - Oct-15-2018Faizan MazharNo ratings yet

- JLL Asia Pacific Property Digest 2q 2014Document72 pagesJLL Asia Pacific Property Digest 2q 2014maywayrandomNo ratings yet

- Henri Pesch, OverviewDocument24 pagesHenri Pesch, OverviewAndre SetteNo ratings yet

- Costbenefit Analysis 2015Document459 pagesCostbenefit Analysis 2015TRÂM NGUYỄN THỊ BÍCHNo ratings yet

- The Goods Market and The: IS RelationDocument20 pagesThe Goods Market and The: IS RelationIbrohim JunaediNo ratings yet

- Sd16 Hybrid p4 QDocument12 pagesSd16 Hybrid p4 QQasim AliNo ratings yet

- EFM College NotesDocument178 pagesEFM College Notesrahul100% (1)

- Applied Economics 2nd Periodic ExamDocument4 pagesApplied Economics 2nd Periodic ExamKrisha FernandezNo ratings yet

- Difference Between Hedging and ArbitrageDocument2 pagesDifference Between Hedging and Arbitrageshreya_rachh1469No ratings yet

- Syllabus International FinanceDocument1 pageSyllabus International FinanceRabin JoshiNo ratings yet

- CHAPTER 2 - Investment AppraisalDocument19 pagesCHAPTER 2 - Investment AppraisalMaleoaNo ratings yet

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseFrom EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNo ratings yet

- How to Win Your Case In Traffic Court Without a LawyerFrom EverandHow to Win Your Case In Traffic Court Without a LawyerRating: 4 out of 5 stars4/5 (5)

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterFrom EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterNo ratings yet

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowFrom EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowRating: 1 out of 5 stars1/5 (1)

- Law of Contract Made Simple for LaymenFrom EverandLaw of Contract Made Simple for LaymenRating: 4.5 out of 5 stars4.5/5 (9)

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersFrom EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- The Certified Master Contract AdministratorFrom EverandThe Certified Master Contract AdministratorRating: 5 out of 5 stars5/5 (1)

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreFrom EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreRating: 3.5 out of 5 stars3.5/5 (2)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignFrom EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignRating: 3.5 out of 5 stars3.5/5 (3)

- Contracts: The Essential Business Desk ReferenceFrom EverandContracts: The Essential Business Desk ReferenceRating: 4 out of 5 stars4/5 (15)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetFrom EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNo ratings yet

- How to Win Your Case in Small Claims Court Without a LawyerFrom EverandHow to Win Your Case in Small Claims Court Without a LawyerRating: 5 out of 5 stars5/5 (1)