Professional Documents

Culture Documents

SPECIAL PROCEEDINGS | Judge Cinco EH 403

Uploaded by

Chezka Bianca Torres0 ratings0% found this document useful (0 votes)

45 views2 pages(1) This document discusses the special proceeding of reprobate, which establishes the validity and allowance of a will proved in a foreign country.

(2) There are two types of estate proceedings - domiciliary (principal) administration in the jurisdiction of the decedent's last residence, and ancillary administration where the decedent left property in a country other than their last domicile.

(3) For a will allowed in a foreign country to be recognized in the Philippines, it must undergo reprobate, which involves filing documents authenticating the foreign probate and notifying interested parties and a hearing to prove the will meets the legal requirements.

Original Description:

Original Title

Rule 77 - Repobrate Notes CBPT.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document(1) This document discusses the special proceeding of reprobate, which establishes the validity and allowance of a will proved in a foreign country.

(2) There are two types of estate proceedings - domiciliary (principal) administration in the jurisdiction of the decedent's last residence, and ancillary administration where the decedent left property in a country other than their last domicile.

(3) For a will allowed in a foreign country to be recognized in the Philippines, it must undergo reprobate, which involves filing documents authenticating the foreign probate and notifying interested parties and a hearing to prove the will meets the legal requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views2 pagesSPECIAL PROCEEDINGS | Judge Cinco EH 403

Uploaded by

Chezka Bianca Torres(1) This document discusses the special proceeding of reprobate, which establishes the validity and allowance of a will proved in a foreign country.

(2) There are two types of estate proceedings - domiciliary (principal) administration in the jurisdiction of the decedent's last residence, and ancillary administration where the decedent left property in a country other than their last domicile.

(3) For a will allowed in a foreign country to be recognized in the Philippines, it must undergo reprobate, which involves filing documents authenticating the foreign probate and notifying interested parties and a hearing to prove the will meets the legal requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

SPECIAL PROCEEDINGS | Judge Cinco

EH 403 (2019 – 2020)

SPECIAL PROCEEDING – REPROBATE (c) Authentication of requisites of (a) and (b)

RULE 77 above

(3) Notice of time and place of hearing

Reprobate is a special proceeding to establish the validity (4) Hearing

and allowance of a will proved in a foreign country. (5) Certificate of Allowance

Rule. A will allowed or probated in a foreign country, must

be RE-PROBATED in the Philippines. MATTERS TO BE PROVEN

• If the decedent owns properties in different (1) Foreign court must have jurisdiction over the

countries, separate administration proceedings proceeding

must be had in said countries. (2) Domicile of the testator in the foreign country

and not in the Philippines

(3) The will has been admitted to probate in such

2 TYPES OF ESTATE PROCEEDINGS country

(1) Domiciliary (Principal) Administration – the (4) It was made with the formalities prescribed by

proceeding instituted in the last residence of the law of the place in which the decedent resides,

decedent OR according to the formalities observed in his

(2) Ancillary Administration – the administration of country, OR in conformity with the formalities

proceedings where he left his estate prescribed by our Civil Code

(5) Due execution of the will in accordance with

foreign laws

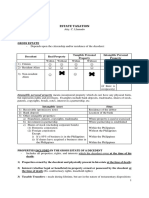

PRINCIPAL ADMINSITRATION vs

ANCILLARY ADMINSITRATION

It is often necessary to have more than one administration of EFFECTS

an estate. When a person dies intestate owning property (1) The will shall have the same effect as if originally

in the country of his domicile as well as in a foreign proved and allowed in court of the Philippines

country, administration is had in both countries. (2) Letters testamentary or administration with a will

annexed shall extend to all estates of the

PRINCIPAL ANCILLARY Philippines

ADMINISTRATION ADMINISTRATION (3) Residue of estate after payment of debts, etc. shall

Granted in the jurisdiction Proper whenever a person be disposed of as provided by law in cases of

of decedent’s last domicile dies, leaving in a country estates in Philippines belonging to persons who

other than that of his last are inhabitants of another state or country

Also known as domiciliary domicile, property to be

administration administered in the nature of The rule provides that wills proved and allowed in a foreign

assets of the deceased liable country, according to the laws of such country, may be

for his individual debts or to allowed, filed, and recorded by the proper court in the

be distributed among his Philippines.

heirs

Reason: grant of The general rule universally recognized is the

administration does not ex administration extends only to the assets of a decedent

proprio vigore have any found within the state or country where it was granted,

effect beyond the limits of so that an administrator appointed in one state or country

the country in which it is has no power over property in another state or country.

granted. Hence, an (Leon vs Manufacturers Life Insurance Co. 90 Phil 459)

administrator appointed

in a foreign state has no

authority in the

Philippines.

Note: No one could dispute the power of an ancillary

administrator to gain control and possession of all assets of

the decedent within the jurisdiction of the Philippines. Such

power is inherent in his duty to settle decedent’s estate and

satisfy the claims of local creditors. (Tayag vs Benguet

Consolidated Inc 26 SCRA 242)

REQUISITES OF ANCILLARY ADMINISTRATION

(1) There must be a will

(2) Filing of:

(a) Copy of the will executed in a foreign

country

(b) Order or Decree of foreign court allowing

such will; and

Sources: Bernardo, Oscar B. (2006) Special Proceedings Annotated, San Beda MemAid 2011 Page 1 of 2 | CBPTorres

SPECIAL PROCEEDINGS | Judge Cinco

EH 403 (2019 – 2020)

LETTERS OF TESTAMENTARY AND OF

ADMINISTRATION, WHEN AND TO WHOM

ISSUED – RULE 78

RULE 77

Persons who may administer the estate of a deceased

person:

(1) Executor – appointed or named by the testator in

his will

(2) Administrator – appointed by the probate court

where there is no will

(3) Administrator with the will annexed – appointed

by the court where there is a will but testator did

not appoint or name an executor, or said

appointed or named executor failed to qualify

Persons Disqualified to Serve as Executor or

Administrator

(1) Minor

(2) Non-Resident of the Philippines

(3) Person is unfit to execute the duties of the trust by

reason of:

(a) Drunkenness

(b) Improvidence – lack of care or foresight in

the management and care of the estate

(c) Want of understanding – lack of intelligence

(d) Want of Integrity – lack of soundness of

moral pinrciples and character

(e) Moral Turpitude – everything which is done

contrary to justice, modesty, or good morals.

It is an act of baseness, vileness, or depravity

in the private and social duties which a man

owes his fellowmen or to society in general,

contrary to the accepted and customary rule

of right and duty between man and man, or

conduct contrary to justice, honesty, modesty

or good morals.

Qualifications

(1) Must be competent

(2) Accept the trust

(3) Give bond (Section 4, Rule 78)

Sources: Bernardo, Oscar B. (2006) Special Proceedings Annotated, San Beda MemAid 2011 Page 2 of 2 | CBPTorres

You might also like

- Wills Trusts Estates Outline ClipanDocument42 pagesWills Trusts Estates Outline Clipancrlstinaaa100% (6)

- Auditing Case 3Document12 pagesAuditing Case 3Kenny Mulvenna100% (6)

- BROC Mackam Dab en v1.0Document2 pagesBROC Mackam Dab en v1.0jangri1098No ratings yet

- Rsa Netwitness Endpoint: Detect Unknown Threats. Reduce Dwell Time. Accelerate ResponseDocument8 pagesRsa Netwitness Endpoint: Detect Unknown Threats. Reduce Dwell Time. Accelerate ResponseRaghavNo ratings yet

- Simulation of Dehydration - Regeneration Plant For Natural Gas Processing Using Aspen HysysDocument7 pagesSimulation of Dehydration - Regeneration Plant For Natural Gas Processing Using Aspen HysyseduryuNo ratings yet

- Rule 77 Remrev 2 ReportDocument1 pageRule 77 Remrev 2 Reportangelli45No ratings yet

- Specpro A01 MidtermsDocument5 pagesSpecpro A01 MidtermsEmmanuel YrreverreNo ratings yet

- AGED SHARC SETTLEMENTDocument10 pagesAGED SHARC SETTLEMENTCrystal KateNo ratings yet

- Step by Step Guide To Inheriting in The PhilippinesDocument3 pagesStep by Step Guide To Inheriting in The PhilippinesJean PradoNo ratings yet

- Wills and Succession 2Document22 pagesWills and Succession 2lex omniaeNo ratings yet

- Spec - Pro TranscriptDocument46 pagesSpec - Pro Transcriptram ambolarioNo ratings yet

- UCebu Law Special Proceedings NotesDocument70 pagesUCebu Law Special Proceedings NotesSamantha Amielle CanilloNo ratings yet

- Civil Law NotesDocument3 pagesCivil Law NotesJj MejiaNo ratings yet

- SETTLEMENT OF ESTATESDocument10 pagesSETTLEMENT OF ESTATESEMMANUEL GALLONo ratings yet

- Special Proceedings RianoDocument31 pagesSpecial Proceedings RianoBab LyNo ratings yet

- Spec Pro ReviewerDocument32 pagesSpec Pro ReviewerAllana NacinoNo ratings yet

- Notes On Special Proceedings: de Leon, 2020 EditionDocument14 pagesNotes On Special Proceedings: de Leon, 2020 EditionNorjanisa DimaroNo ratings yet

- Special Proceeding RanaoDocument49 pagesSpecial Proceeding RanaoirvinsabandejabagasNo ratings yet

- Special Proceedings RianoDocument31 pagesSpecial Proceedings RianoVincent TanNo ratings yet

- Tax-2-Recits Estate Tax Donors TaxDocument5 pagesTax-2-Recits Estate Tax Donors TaxEmmanuel MabolocNo ratings yet

- Quantum LeapDocument76 pagesQuantum LeapJennica Charlene De VeraNo ratings yet

- Estate Settlement Venue JurisdictionDocument94 pagesEstate Settlement Venue JurisdictionFirenze PHNo ratings yet

- Special Proceedings Memory AidDocument21 pagesSpecial Proceedings Memory AidSui100% (1)

- Chapter 1-General Provisions: Title Iv-SuccessionDocument22 pagesChapter 1-General Provisions: Title Iv-Successiondolf lincolnNo ratings yet

- At The Time of DeathDocument4 pagesAt The Time of DeathPAMELA PARCENo ratings yet

- Rules in special proceedings may apply where possibleDocument21 pagesRules in special proceedings may apply where possibleAndrew M. AcederaNo ratings yet

- Special Proceeding - Rule 98-107Document3 pagesSpecial Proceeding - Rule 98-107PAMELA PARCENo ratings yet

- Special Proceedings: ReprobrateDocument19 pagesSpecial Proceedings: Reprobratedrew barNo ratings yet

- Making a Will vs Extrajudicial SettlementDocument21 pagesMaking a Will vs Extrajudicial SettlementRoentgen Djon Kaiser IgnacioNo ratings yet

- Spec Pro-Pros. CentenoDocument24 pagesSpec Pro-Pros. CentenoFlorence Paul PortezaNo ratings yet

- Settlement of Estate of Deceased PersonsDocument5 pagesSettlement of Estate of Deceased PersonsN CNo ratings yet

- Table On Jurisdiction - SpecproDocument12 pagesTable On Jurisdiction - SpecproEloisa Salitrero0% (1)

- COL Report WillsDocument21 pagesCOL Report WillsJane CuizonNo ratings yet

- Special Proceedings: (Rules 72 - 109)Document3 pagesSpecial Proceedings: (Rules 72 - 109)Perla Viray0% (1)

- Vdocuments - MX Special Proceedings RianoDocument31 pagesVdocuments - MX Special Proceedings RianoAve EyasNo ratings yet

- COL Quick NotesDocument6 pagesCOL Quick NotesWinston Mao TorinoNo ratings yet

- Special Proceedings SettlementDocument7 pagesSpecial Proceedings SettlementVincent Jan Tudayan100% (1)

- Special ProceedingsDocument43 pagesSpecial Proceedingsmtabcao100% (1)

- Specpro CodalDocument10 pagesSpecpro CodalStephanie SerapioNo ratings yet

- Memory Aid Civil Law: San Beda College of Law 2000 Centralized Bar OperationsDocument54 pagesMemory Aid Civil Law: San Beda College of Law 2000 Centralized Bar OperationslegalavatarNo ratings yet

- ESCHEAT, TRUSTEES and HOSPITALIZATION OF INSANE PERSONSDocument7 pagesESCHEAT, TRUSTEES and HOSPITALIZATION OF INSANE PERSONSMae NiagaraNo ratings yet

- Venue and Process in Special ProceedingsDocument9 pagesVenue and Process in Special ProceedingsApril IsidroNo ratings yet

- Remedial Law REV Priv Class NotesDocument3 pagesRemedial Law REV Priv Class Notespaingco.oz99No ratings yet

- Vi. Special Proceedings: Remedial Notes For 2019 Bar 1Document18 pagesVi. Special Proceedings: Remedial Notes For 2019 Bar 1Dang GVNo ratings yet

- Conflicts - SuccessionDocument14 pagesConflicts - SuccessionAnthea Louise RosinoNo ratings yet

- Property, Marriage, DivorceDocument5 pagesProperty, Marriage, DivorceLemuel Angelo M. EleccionNo ratings yet

- Affidavit of Self Adjudication - Handout and SampleDocument6 pagesAffidavit of Self Adjudication - Handout and SampleJuan VillanuevaNo ratings yet

- Settlement of Estate of Deceased Persons: Special Proceedings CCDC Ruth BawayanDocument50 pagesSettlement of Estate of Deceased Persons: Special Proceedings CCDC Ruth BawayanrickyNo ratings yet

- SpecPro Midterms NotesDocument77 pagesSpecPro Midterms NotesLEE JAIRUS LACABANo ratings yet

- SpecPro ReviewerDocument83 pagesSpecPro ReviewerShanon Cristy Gaca100% (2)

- Wills, Succession, Contracts, and Marriage LawsDocument2 pagesWills, Succession, Contracts, and Marriage LawsfcnrrsNo ratings yet

- Rem Law 2008 Specpro FinalDocument43 pagesRem Law 2008 Specpro Finalcmv mendozaNo ratings yet

- Noveras vs. NoverasDocument14 pagesNoveras vs. NoverasAnonymous 1g3biQNOCENo ratings yet

- Tayag vs. Benguet ConsolidatedDocument17 pagesTayag vs. Benguet ConsolidatedisaaabelrfNo ratings yet

- Spec ProDocument31 pagesSpec ProWindy Awe MalapitNo ratings yet

- Search Result: ReferenceDocument24 pagesSearch Result: ReferenceAnonymous 1g3biQNOCENo ratings yet

- Special Proceedings Report (Allowance and Disallowance)Document12 pagesSpecial Proceedings Report (Allowance and Disallowance)xz wyNo ratings yet

- Special Proceedings: (Pacific Banking Corporation Employees' Organization v. CA, 242 SCRA 493)Document25 pagesSpecial Proceedings: (Pacific Banking Corporation Employees' Organization v. CA, 242 SCRA 493)Nasheya InereNo ratings yet

- Special Proceedings RianoDocument31 pagesSpecial Proceedings RianoRon Christian Jayson LibunaoNo ratings yet

- CPAR Estate Tax (Batch 89) HandoutDocument18 pagesCPAR Estate Tax (Batch 89) HandoutlllllNo ratings yet

- Making a Will is CrucialDocument4 pagesMaking a Will is CrucialRoentgen Djon Kaiser IgnacioNo ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]From EverandNew York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]No ratings yet

- PROPERTY - Co-Ownersip CasesDocument36 pagesPROPERTY - Co-Ownersip CasesChezka Bianca TorresNo ratings yet

- PNB forecloses on sugar mill assets during ARCAM liquidationDocument63 pagesPNB forecloses on sugar mill assets during ARCAM liquidationChezka Bianca TorresNo ratings yet

- Law On Trademark - Case List XDocument65 pagesLaw On Trademark - Case List XChezka Bianca TorresNo ratings yet

- SRC - Case ListDocument76 pagesSRC - Case ListChezka Bianca TorresNo ratings yet

- Law On Patents - Case ListDocument28 pagesLaw On Patents - Case ListChezka Bianca Torres0% (1)

- SpecPro - Jan 21 TuesDocument1 pageSpecPro - Jan 21 TuesChezka Bianca TorresNo ratings yet

- Chapter 2-List CasesDocument1 pageChapter 2-List CasesChezka Bianca TorresNo ratings yet

- Copyright Law - Case ListDocument39 pagesCopyright Law - Case ListChezka Bianca TorresNo ratings yet

- Chapter 2 Ownership: Possession Which Is Not Necessarily .. (?) - Forcible Entry Here Is Not A RemedyDocument4 pagesChapter 2 Ownership: Possession Which Is Not Necessarily .. (?) - Forcible Entry Here Is Not A RemedyChezka Bianca TorresNo ratings yet

- 009 EH 403 WWW v2 PDFDocument7 pages009 EH 403 WWW v2 PDFChezka Bianca TorresNo ratings yet

- SPECIAL PROCEEDING March 10Document1 pageSPECIAL PROCEEDING March 10Chezka Bianca TorresNo ratings yet

- Palaganas Vs PalaganasDocument2 pagesPalaganas Vs PalaganasChezka Bianca TorresNo ratings yet

- SpecPro - Jan 21 TuesDocument1 pageSpecPro - Jan 21 TuesChezka Bianca TorresNo ratings yet

- Nuguid CaseDocument5 pagesNuguid CaseChezka Bianca TorresNo ratings yet

- 011 Eh 403 WWW PDFDocument5 pages011 Eh 403 WWW PDFChezka Bianca TorresNo ratings yet

- SPECIAL PROCEEDING March 10Document1 pageSPECIAL PROCEEDING March 10Chezka Bianca TorresNo ratings yet

- 012 Eh 403 WWWDocument5 pages012 Eh 403 WWWChezka Bianca TorresNo ratings yet

- 6 Partnership 403 WWW Sep 16Document5 pages6 Partnership 403 WWW Sep 16Chezka Bianca TorresNo ratings yet

- 010 Eh 403 WWW V2 PDFDocument6 pages010 Eh 403 WWW V2 PDFChezka Bianca TorresNo ratings yet

- 14 Agency Nov 11Document4 pages14 Agency Nov 11Chezka Bianca TorresNo ratings yet

- 13 Agency Nov 9Document1 page13 Agency Nov 9Chezka Bianca TorresNo ratings yet

- 17 Agency Nov 25 MonDocument2 pages17 Agency Nov 25 MonChezka Bianca TorresNo ratings yet

- 8 PARTNERSHIP 403 WWW Sep 23 MDocument8 pages8 PARTNERSHIP 403 WWW Sep 23 MChezka Bianca TorresNo ratings yet

- 12 Agency Nov 4Document5 pages12 Agency Nov 4Chezka Bianca TorresNo ratings yet

- 7 Partnership 403 WWW Sep 21 PDFDocument2 pages7 Partnership 403 WWW Sep 21 PDFChezka Bianca TorresNo ratings yet

- 18 Agency Dec 2 MonDocument2 pages18 Agency Dec 2 MonChezka Bianca TorresNo ratings yet

- 5 Partnership 403 WWW Sept 14 SaDocument3 pages5 Partnership 403 WWW Sept 14 SaChezka Bianca TorresNo ratings yet

- 4 Partnership 403 WWW 403 Sep 7Document2 pages4 Partnership 403 WWW 403 Sep 7Chezka Bianca TorresNo ratings yet

- 3 PARTNERSHIP 403 WWW Sep 2Document4 pages3 PARTNERSHIP 403 WWW Sep 2Chezka Bianca TorresNo ratings yet

- Pengembangan Lembar Kegiatan Siswa Berbasis Online Berbantuan Geogebra Book Untuk Siswa SMA Kelas X Pada Materi TrigonometriDocument15 pagesPengembangan Lembar Kegiatan Siswa Berbasis Online Berbantuan Geogebra Book Untuk Siswa SMA Kelas X Pada Materi TrigonometriNovita Rizki YustianiNo ratings yet

- HW1Document1 pageHW1mohsenanNo ratings yet

- 20-Sdms-02 (Overhead Line Accessories) Rev01Document15 pages20-Sdms-02 (Overhead Line Accessories) Rev01Haytham BafoNo ratings yet

- Mayne Pharma Annual Report 2012Document78 pagesMayne Pharma Annual Report 2012Deepa DevanathanNo ratings yet

- Auditing Theory - Audit ReportDocument26 pagesAuditing Theory - Audit ReportCarina Espallardo-RelucioNo ratings yet

- Azbil - SS2 DEO412 0010 02Document12 pagesAzbil - SS2 DEO412 0010 02Magoroku D. YudhoNo ratings yet

- CRAPAC Monthly JanDocument4 pagesCRAPAC Monthly JanJasonMortonNo ratings yet

- Pulse of Fintech h2 2020Document72 pagesPulse of Fintech h2 2020OleksandraNo ratings yet

- LTE Data Analysis - Project Proposal N.2Document22 pagesLTE Data Analysis - Project Proposal N.2Syed SafwanNo ratings yet

- Ict OhsDocument26 pagesIct Ohscloyd mark cabusogNo ratings yet

- Psychrometrics Drying Problems SEODocument5 pagesPsychrometrics Drying Problems SEOStephanie Torrecampo Delima100% (2)

- One SheetDocument1 pageOne Sheetadeel ghouseNo ratings yet

- Lucsuhin National High School Daily Lesson Plan on Accounting ConceptsDocument6 pagesLucsuhin National High School Daily Lesson Plan on Accounting ConceptsALMA ACUNANo ratings yet

- New Product Introduction Process: August 16, 2016Document30 pagesNew Product Introduction Process: August 16, 2016JuliaChenNo ratings yet

- Vargas V YapticoDocument4 pagesVargas V YapticoWilfredo Guerrero IIINo ratings yet

- Monographie BtttyrtIPM-5 Tables Vol7Document246 pagesMonographie BtttyrtIPM-5 Tables Vol7arengifoipenNo ratings yet

- Macalintal v. PETDocument5 pagesMacalintal v. PETJazem AnsamaNo ratings yet

- Simple Problem On ABC: RequiredDocument3 pagesSimple Problem On ABC: RequiredShreshtha VermaNo ratings yet

- Benetton CaseDocument23 pagesBenetton CaseNnifer AnefiNo ratings yet

- Truespace For DarkBASIC ProfessionalDocument13 pagesTruespace For DarkBASIC ProfessionalclaudefrancisNo ratings yet

- Pilkington Profilit Techn Info enDocument12 pagesPilkington Profilit Techn Info enSalmonelo Abdul RamosNo ratings yet

- WheelHorse Power Take Off Manual 8-3411Document4 pagesWheelHorse Power Take Off Manual 8-3411Kevins Small Engine and Tractor ServiceNo ratings yet

- Big Kaiser2019 PDFDocument624 pagesBig Kaiser2019 PDFGoto SamNo ratings yet

- SPE Estimating Fracture Gradient in Gulf of Mexico Deepwater, Shallow, Massive Salt SectionsDocument9 pagesSPE Estimating Fracture Gradient in Gulf of Mexico Deepwater, Shallow, Massive Salt SectionsTHiago LOpesNo ratings yet

- Communicate With S7-1200 Via EhernetDocument6 pagesCommunicate With S7-1200 Via EhernetRegisNo ratings yet

- Operating Instructions MA 42 - Maico Diagnostics PDFDocument28 pagesOperating Instructions MA 42 - Maico Diagnostics PDFJuan PáezNo ratings yet

![New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]](https://imgv2-1-f.scribdassets.com/img/word_document/661176503/149x198/6cedb9a16a/1690336075?v=1)