Professional Documents

Culture Documents

Gobi Case Quiz

Gobi Case Quiz

Uploaded by

samiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gobi Case Quiz

Gobi Case Quiz

Uploaded by

samiaCopyright:

Available Formats

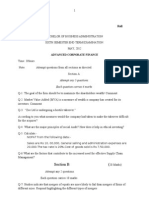

GOBI QUIZ

Answers

1. Gobi Partners invest in diversified portfolio like in technology sector and many more.

2. Gobi invested in diversified industries to minimize its risk.

3. The main LPS investing in GOBI are CSDN, Hansun Technologies and more.

4. The two main stock exchanges in China are Shanghai Stock Exchange (SSE) and the Shenzhen

Stock Exchange (SZSE).

5. They avoid U.S listings because of the growing U.S Exchange commission rules and

regulations.

6. Advantages of listing in the New York exchanges include are lower listing fees and lower

requirements for listing.

7. The challenges include uncertainties like globalization and other economic problems like

coronavirus.

8. The GOBI raised about $500 in 2006. It took about 3 years to raise this.

9. Factors contributing to VC gold rush in China is that it is comparatively cheaper than other

countries.

10. The VC market in china was attractive in 2006 because there was no direct control over the

venture capitalists.

11. The private equity market in China in 1990s was a more market-oriented system.

12. The value that Gobi can provide to its portfolio companies is its growth and competitive

advantages.

13. Gobi GPs plan to harvest sponsoring programs and incubating for early stage companies.

14. The most significant point for Gobi was its insignificant growth and contributions.

15. Yes, its scalable. The size of the Gobi Fund I was about 20%.

16. The partners decided about the amount that would be required to manage the business and

about the terms of the business.

You might also like

- Financing The Mozal Project Case SolutionDocument4 pagesFinancing The Mozal Project Case SolutionSebastian100% (2)

- Team Angela: Catfish Catfish AR01F Q04Document3 pagesTeam Angela: Catfish Catfish AR01F Q04samiaNo ratings yet

- The Indiana School of Sociology: .025 Points, at Least 10 WordsDocument5 pagesThe Indiana School of Sociology: .025 Points, at Least 10 Wordssamia0% (2)

- Research Methods Course Article ReviewDocument3 pagesResearch Methods Course Article Reviewsamia100% (1)

- Locating Facts in The 21st Century: .025 Points, at Least 25 Words, Note The Word Count ChangeDocument2 pagesLocating Facts in The 21st Century: .025 Points, at Least 25 Words, Note The Word Count ChangesamiaNo ratings yet

- Prada Case3Document18 pagesPrada Case3neoss119No ratings yet

- Confounding Assignment DropboxDocument1 pageConfounding Assignment DropboxsamiaNo ratings yet

- Jun18l1-S02am QaDocument23 pagesJun18l1-S02am QajuanNo ratings yet

- Aluminium Bahrain (ALBA) : The Pot Line 5 Expansion ProjectDocument23 pagesAluminium Bahrain (ALBA) : The Pot Line 5 Expansion ProjectRishi BajajNo ratings yet

- Term V: Private Equity and Venture CapitalDocument3 pagesTerm V: Private Equity and Venture CapitalJitesh ThakurNo ratings yet

- BarrierDocument5 pagesBarrierMa Jean Baluyo CastanedaNo ratings yet

- Ifm AssignmentDocument4 pagesIfm AssignmentKanupriya Kohli100% (2)

- OM - Kulicke and Soffa Industries Inc. - Group 5Document5 pagesOM - Kulicke and Soffa Industries Inc. - Group 5Mohit JainNo ratings yet

- NestleDocument28 pagesNestlewazirsadiqNo ratings yet

- Questions For Preparation Macr 2019Document4 pagesQuestions For Preparation Macr 2019Abhay PrakashNo ratings yet

- IPODocument53 pagesIPOvj_gupta9100% (5)

- Case Study Pain and Pain MedicationsDocument7 pagesCase Study Pain and Pain MedicationssamiaNo ratings yet

- Introduction To World Religions Mid-Term Exam Know Your World ReligionDocument4 pagesIntroduction To World Religions Mid-Term Exam Know Your World ReligionsamiaNo ratings yet

- Description: Remaining TimeDocument6 pagesDescription: Remaining TimesamiaNo ratings yet

- International Business: TheoryDocument24 pagesInternational Business: TheoryThùy DươngNo ratings yet

- International Business MidtermDocument32 pagesInternational Business MidtermNewlib92No ratings yet

- Investment Theories.Document28 pagesInvestment Theories.Sapna KumariNo ratings yet

- 12Fall-PE Deal Summary-Mengyan WangDocument5 pages12Fall-PE Deal Summary-Mengyan WangMengyan WangNo ratings yet

- Case Study Global Crossing Services Assignment 1 GDSDocument5 pagesCase Study Global Crossing Services Assignment 1 GDSGaurav DuttNo ratings yet

- Nishit Desai PEDocument59 pagesNishit Desai PEmehulNo ratings yet

- Types of International InvestmentDocument9 pagesTypes of International InvestmentWasim KhanNo ratings yet

- Roll No .: Section B (Document4 pagesRoll No .: Section B (Charu AroraNo ratings yet

- ALBA Pot Line 5 Expansion ProjectDocument9 pagesALBA Pot Line 5 Expansion ProjectRishi Bajaj100% (1)

- Global Investment SchemeDocument3 pagesGlobal Investment SchemerahulsiyalNo ratings yet

- International Finance Homework SolutionDocument34 pagesInternational Finance Homework SolutionRichard WestNo ratings yet

- Section 2 - CH 1 - Part 2Document11 pagesSection 2 - CH 1 - Part 2Jehan OsamaNo ratings yet

- Alternative Investments Become Part of MainstreamDocument1 pageAlternative Investments Become Part of MainstreamGanesh KumarNo ratings yet

- FINS 3616 Tutorial Questions-Week 1Document5 pagesFINS 3616 Tutorial Questions-Week 1Alex WuNo ratings yet

- Foreign Direct InvestmentDocument12 pagesForeign Direct Investmentashoo khoslaNo ratings yet

- 1.1 VC Industry Profile in IndiaDocument11 pages1.1 VC Industry Profile in Indiakrunal joshiNo ratings yet

- Important Business Considerations For Successful Entry Into The China MarketDocument18 pagesImportant Business Considerations For Successful Entry Into The China MarketphilirlNo ratings yet

- A Study On IlopDocument55 pagesA Study On Ilopaurorashiva1No ratings yet

- Joint Ventures in Construction FirmsDocument28 pagesJoint Ventures in Construction FirmsmailmevipulNo ratings yet

- RBC Case StudyDocument2 pagesRBC Case StudyPedro HacheNo ratings yet

- SynopsisDocument3 pagesSynopsisimsajitNo ratings yet

- FDI SolutionsDocument5 pagesFDI SolutionsSam MadzokereNo ratings yet

- The Potential of The Bangladesh Capital MarketDocument6 pagesThe Potential of The Bangladesh Capital MarketMd. Ashraf Hossain SarkerNo ratings yet

- The Choice of Market Entry Mode: Cross-Border M&A or Greenfield InvestmentDocument7 pagesThe Choice of Market Entry Mode: Cross-Border M&A or Greenfield InvestmentAnoop KrishnanNo ratings yet

- "Investment in Ipo: An Analysis": Project OnDocument79 pages"Investment in Ipo: An Analysis": Project OnvishalkalagiNo ratings yet

- LO 7-1) Companies Choose International Markets For CompetingDocument12 pagesLO 7-1) Companies Choose International Markets For Competingumesh pradhanNo ratings yet

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentSijo JacobNo ratings yet

- SFM Super 30 TheoryDocument37 pagesSFM Super 30 TheorySahil SharmaNo ratings yet

- JFCDocument27 pagesJFCJedidiah Danae AlvarezNo ratings yet

- Final IPO3 RajDocument67 pagesFinal IPO3 RajVinod RajNo ratings yet

- J.P. Morgan Depositary Receipts: Asia-Pacific Year in Review 2010Document20 pagesJ.P. Morgan Depositary Receipts: Asia-Pacific Year in Review 2010morningstar3898No ratings yet

- Jollibee (Almost) FinalDocument13 pagesJollibee (Almost) FinallivinsaintNo ratings yet

- EM 19-14 InternationalizationDocument20 pagesEM 19-14 InternationalizationMikkel GramNo ratings yet

- The Potential of The Bangladesh Capital MarketDocument14 pagesThe Potential of The Bangladesh Capital MarketMd. Ashraf Hossain SarkerNo ratings yet

- Topics - International Business - Definition - Internationalizing Business-AdvantagesDocument157 pagesTopics - International Business - Definition - Internationalizing Business-AdvantagesPravitha SajeeNo ratings yet

- Delisting From Stock Exchanges On Initial VentureDocument2 pagesDelisting From Stock Exchanges On Initial VenturebublusNo ratings yet

- Ch4 Globalisation Practice QP 2022-23Document5 pagesCh4 Globalisation Practice QP 2022-23ARSHAD JAMILNo ratings yet

- International BusinessDocument128 pagesInternational BusinessManoj Yadav100% (1)

- Mock IbDocument3 pagesMock IbcarolorhurNo ratings yet

- Case 6 - JCB in IndiaDocument3 pagesCase 6 - JCB in IndiaMauricio Bedon100% (1)

- Oe Case FinalestDocument17 pagesOe Case FinalestAhmed HassanNo ratings yet

- Sri Sivani MBA 2008Document10 pagesSri Sivani MBA 2008madapanaNo ratings yet

- MGT3580: Global Enterprise Management (Simulation Questions)Document3 pagesMGT3580: Global Enterprise Management (Simulation Questions)Chan JohnNo ratings yet

- Unit 1: International Trade: B. VocabularyDocument39 pagesUnit 1: International Trade: B. VocabularyKhánh Linh Mai TrầnNo ratings yet

- Marketing Mix of LLoydsDocument8 pagesMarketing Mix of LLoydsAmit SrivastavaNo ratings yet

- Corporate Governance, Firm Profitability, and Share Valuation in the PhilippinesFrom EverandCorporate Governance, Firm Profitability, and Share Valuation in the PhilippinesNo ratings yet

- Dubai: the grand deception?: Yes, without proper preparationFrom EverandDubai: the grand deception?: Yes, without proper preparationNo ratings yet

- ADB International Investment Agreement Tool Kit: A Comparative AnalysisFrom EverandADB International Investment Agreement Tool Kit: A Comparative AnalysisNo ratings yet

- Regulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActFrom EverandRegulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActNo ratings yet

- Creativity AssignmentDocument2 pagesCreativity AssignmentsamiaNo ratings yet

- Video Lecture Transcript - America in The SixtiesDocument16 pagesVideo Lecture Transcript - America in The SixtiessamiaNo ratings yet

- Performance: 5G Networks Are Digital Cellular Network, in Which The Service Area Covered by Providers Is DividedDocument9 pagesPerformance: 5G Networks Are Digital Cellular Network, in Which The Service Area Covered by Providers Is DividedsamiaNo ratings yet

- Management 330: Principles of Management: Basic InformationDocument12 pagesManagement 330: Principles of Management: Basic InformationsamiaNo ratings yet

- I Wonder and Worry About People Who Are Refugees Everyday: .05 Points, at Least 25 WordsDocument2 pagesI Wonder and Worry About People Who Are Refugees Everyday: .05 Points, at Least 25 WordssamiaNo ratings yet

- The Phenomenon Whereby Firms From The Same Industry Gather Together in Close ProximityDocument2 pagesThe Phenomenon Whereby Firms From The Same Industry Gather Together in Close ProximitysamiaNo ratings yet

- BUS 240 Cluster Rubric 200 PointsDocument2 pagesBUS 240 Cluster Rubric 200 PointssamiaNo ratings yet

- Case StudyDocument6 pagesCase StudysamiaNo ratings yet

- Why Netflix Raised Its PricesDocument1 pageWhy Netflix Raised Its PricessamiaNo ratings yet