Professional Documents

Culture Documents

The Valuation of A Real Investment Project - Analyzing Inputs, Scenarios, Sensitivity, and Timing - 8 Coursera

Uploaded by

வரலாறு காண்போம்Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Valuation of A Real Investment Project - Analyzing Inputs, Scenarios, Sensitivity, and Timing - 8 Coursera

Uploaded by

வரலாறு காண்போம்Copyright:

Available Formats

Explore What do you want to learn?

Nikil ukram T

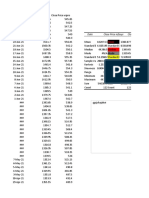

Principles of Corporate Finance – A Tale of Value Week 6 The valuation of a real investment project – analyzing Prev Home

made on a now or never basis, but can be delayed, (ii) 1 pt

when a decision can be changed once it has been made, Yes

Lectures

or (iii) when there are opportunities to exploit in the

Reading future contingent on an initial project being undertaken.

Therefore, where an organisation has some flexibility in

Assignments

the decision that has been, or is going to be made, an

Discussion Prompt: option exists for the organisation to alter its decision at

Open Question 6 a future date and this choice has a value.With

5 min conventional NPV, risks and uncertainties related to the

project are accounted for in the cost of capital, through

Quiz: Final Test

attaching probabilities to discrete outcomes and/or

14 questions

conducting sensitivity analysis or stress tests. Options,

Peer-graded on the other hand, view risks and uncertainties as

Assignment: The opportunities, where upside outcomes can be exploited,

valuation of a real but the organisation has the option to disregard any

investment project –

downside impact.Real options methodology takes into

analyzing inputs,

account the time available before a decision has to be

scenarios, sensitivity, and

timing made and the risks and uncertainties attached to a

Grading in progress project. It uses these factors to estimate an additional

value that can be attributable to the project.Estimating

Review Your Peers: The the value of real optionsAlthough there are numerous

valuation of a real

types of real options, in Advanced Financial

investment project –

analyzing inputs,

Management, candidates are only expected to explain

scenarios, sensitivity, and and compute an estimate of the value attributable to

timing three types of real options:(i) The option to delay a

decision to a future date (which is a type of call option)

(ii) The option to abandon a project once it has

commenced if circumstances no longer justify the

continuation of the project (which is a type of put

option), and(iii) The option to exploit follow-on

opportunities which may arise from taking on an initial

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Part B - Question 4 - : What Do You Want To Learn?Document1 pagePart B - Question 4 - : What Do You Want To Learn?வரலாறு காண்போம்No ratings yet

- Part B - Question 5 - : What Do You Want To Learn?Document1 pagePart B - Question 5 - : What Do You Want To Learn?வரலாறு காண்போம்No ratings yet

- What Do You Want To Learn?: (150 Words Maximum)Document1 pageWhat Do You Want To Learn?: (150 Words Maximum)வரலாறு காண்போம்No ratings yet

- Part B - Question 3 - : What Do You Want To Learn?Document1 pagePart B - Question 3 - : What Do You Want To Learn?வரலாறு காண்போம்No ratings yet

- Refugee Health Assignment - 1 Coursera PDFDocument1 pageRefugee Health Assignment - 1 Coursera PDFவரலாறு காண்போம்No ratings yet

- 161299.html: Virtual Machine Installation StepsDocument8 pages161299.html: Virtual Machine Installation Stepsவரலாறு காண்போம்No ratings yet

- Part A - Question 2 - : What Do You Want To Learn?Document1 pagePart A - Question 2 - : What Do You Want To Learn?வரலாறு காண்போம்No ratings yet

- I Need To See Some Example Before Submitting To Get Some Inspiration. So, Sorry, You Can Give Me ZeroDocument1 pageI Need To See Some Example Before Submitting To Get Some Inspiration. So, Sorry, You Can Give Me Zeroவரலாறு காண்போம்No ratings yet

- Part B - Question 6 - : What Do You Want To Learn?Document1 pagePart B - Question 6 - : What Do You Want To Learn?வரலாறு காண்போம்No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- United India Insurance Company Limited: M/S Neeraj KumarDocument3 pagesUnited India Insurance Company Limited: M/S Neeraj KumarB&R HSE BALCO SEP SiteNo ratings yet

- Using Nigem in Uncertain Times: Introduction and Overview of Nigem Arno Hantzsche, Marta Lopresto and Garry YoungDocument14 pagesUsing Nigem in Uncertain Times: Introduction and Overview of Nigem Arno Hantzsche, Marta Lopresto and Garry YoungeconstudentNo ratings yet

- Documento de Transporte PDFDocument4 pagesDocumento de Transporte PDFAnderson VascoNo ratings yet

- Course Outline-Finance TheoryDocument5 pagesCourse Outline-Finance TheorymuzammalNo ratings yet

- Simple Gifts For Women in PhilippinesDocument4 pagesSimple Gifts For Women in PhilippinesLumi candlesNo ratings yet

- Statistics The Second.Document8 pagesStatistics The Second.Oliyad KondalaNo ratings yet

- Order Final MO Posting 05.02 .2020Document107 pagesOrder Final MO Posting 05.02 .2020scNo ratings yet

- JafariDocument19 pagesJafariSalma MoudyNo ratings yet

- 1 Lesson 1 of Module 1 Man - EconDocument6 pages1 Lesson 1 of Module 1 Man - EconGERALYN SALATANNo ratings yet

- Financial Times Europe - 6.10.2022Document24 pagesFinancial Times Europe - 6.10.2022Tihomir RajčićNo ratings yet

- Annual Report 2073-74-2074-2075Document116 pagesAnnual Report 2073-74-2074-2075Aayush ChauhanNo ratings yet

- Sale Tax Brief ExerciseDocument3 pagesSale Tax Brief Exerciseسید رض وانNo ratings yet

- SHRM Henkel Group2Document16 pagesSHRM Henkel Group2ssagr123100% (1)

- TG - Applied EconomicsDocument4 pagesTG - Applied EconomicsKaye HongayoNo ratings yet

- An Optimum Modern Spinning Methods Achieving Physiological Comfort in Circular Weft Knitting Fabrics.Document12 pagesAn Optimum Modern Spinning Methods Achieving Physiological Comfort in Circular Weft Knitting Fabrics.Hadir DeyabNo ratings yet

- ds11 SpecsheetDocument4 pagesds11 Specsheet13421301508No ratings yet

- Accounting Practices The New Zealand Context 3rd Edition Mcintosh Solutions Manual Full Chapter PDFDocument36 pagesAccounting Practices The New Zealand Context 3rd Edition Mcintosh Solutions Manual Full Chapter PDFEdwardBishopacsy100% (11)

- Materials Inc Tabu Features and BenefitsDocument1 pageMaterials Inc Tabu Features and BenefitsPratik SavlaNo ratings yet

- Chapter 3Document100 pagesChapter 3HayamnotNo ratings yet

- Exercise Demand and Supply 1Document6 pagesExercise Demand and Supply 1Sholeha Tri AsihNo ratings yet

- Dixon Inc: Case Study: S Y MMS Prof Bharat NadkarniDocument2 pagesDixon Inc: Case Study: S Y MMS Prof Bharat NadkarniPranit Auti100% (1)

- Starbox PDFDocument2 pagesStarbox PDFAdrian SetyadharmaNo ratings yet

- ACC 101 Chapter 4 - Part 1 (Closing Entires)Document5 pagesACC 101 Chapter 4 - Part 1 (Closing Entires)Qais KhaledNo ratings yet

- T-5 Specification FormDocument4 pagesT-5 Specification FormMukta AktherNo ratings yet

- QSM EXTRUDER 2019 09 - WebDocument6 pagesQSM EXTRUDER 2019 09 - WebNgọc Trần MinhNo ratings yet

- Challan PrintDocument2 pagesChallan PrintshraddhaNo ratings yet

- Kotters 8 Steps-Short and TextDocument11 pagesKotters 8 Steps-Short and Textweqaqoo11No ratings yet

- Data Analysis 5aDocument4 pagesData Analysis 5aAndemariamNo ratings yet

- Bs ProjectDocument5 pagesBs ProjectVaibhav ThakkarNo ratings yet

- C-AJ-2834 - Through-Penetration Firestop Systems - UL Product IqDocument3 pagesC-AJ-2834 - Through-Penetration Firestop Systems - UL Product Iqchatgpt MohitNo ratings yet