Professional Documents

Culture Documents

Auditing Topics

Uploaded by

HasanAbdullah0 ratings0% found this document useful (0 votes)

3 views1 pageTopics in auditing

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTopics in auditing

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageAuditing Topics

Uploaded by

HasanAbdullahTopics in auditing

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

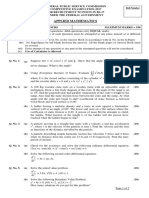

1.

Auditor’s Opinion and Report

True and Fair View,

Reasonable Assurance

Inherent Limitations of an Audit

Audit Assertions (Q3 P20, Q2 P19, Q4 P18,

Q4 P17)

2. Audit Planning and Materiality

(Q4 P20, Q4 P16)

3. Audit Risks (Assessing Risks of material misstatements)

(Q3 P19, Q3 P18)

4. Misstatements & Frauds

(Q4 P20, Q3 P17)

1. Internal VS External Audit

2. Audit Planning

(Q3 P16)

3. Internal Control System and Internal Audit

(Q4 P20, Q2 P18, Q2 P17,

4. Computerized Auditing: Q2 P16)

Auditing in Computer Information System (EDP Systems)

Auditing with Computer-assisted Audit Techniques (CAAT)

(Q2 P20, Q4 P19)

Internal Audit Tests of Control and Substantive Procedures

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Recording Transactions: Using The Method of Journal EntriesDocument50 pagesRecording Transactions: Using The Method of Journal EntriesHasanAbdullah100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Answers/loan Amortization Schedule Personal Finance Problem Joan Messineo Borrowed 20 000 9 Annual q51926905Document7 pagesAnswers/loan Amortization Schedule Personal Finance Problem Joan Messineo Borrowed 20 000 9 Annual q51926905HasanAbdullahNo ratings yet

- Financial Accounting Workbook Version 2Document90 pagesFinancial Accounting Workbook Version 2Honey Crisostomo EborlasNo ratings yet

- Topic 1: Introduction To Gender StudiesDocument6 pagesTopic 1: Introduction To Gender StudiesHasanAbdullahNo ratings yet

- Equality. To The "World System Theory"Document4 pagesEquality. To The "World System Theory"HasanAbdullahNo ratings yet

- Federal Public Service CommissionDocument1 pageFederal Public Service CommissionHumza AltafNo ratings yet

- Topic 1: Introduction To Gender StudiesDocument6 pagesTopic 1: Introduction To Gender StudiesHasanAbdullahNo ratings yet

- Applied Maths-2017 UpdatedDocument2 pagesApplied Maths-2017 UpdatedMuhammad Ishtiaq100% (1)

- Applied Maths SubjectiveDocument2 pagesApplied Maths SubjectiveMuhammad Talha MunirNo ratings yet

- Gender Studies SubjectiveDocument1 pageGender Studies SubjectiveAhsan AfzalNo ratings yet

- "Dependency Theory" To Gender Equality. To" Modernization Theory" and "Dependency Theory"Document5 pages"Dependency Theory" To Gender Equality. To" Modernization Theory" and "Dependency Theory"HasanAbdullahNo ratings yet

- HGFDDocument6 pagesHGFDHasanAbdullahNo ratings yet

- Batterer-Assault, Abuse, Beat Up, Attack PluralisticDocument1 pageBatterer-Assault, Abuse, Beat Up, Attack PluralisticHasanAbdullahNo ratings yet

- Q1Document6 pagesQ1HasanAbdullahNo ratings yet

- 3.1 Direct ViolenceDocument10 pages3.1 Direct ViolenceHasanAbdullahNo ratings yet

- Preparing Financial Statements: There Are Four Common Types of Financial StatementsDocument7 pagesPreparing Financial Statements: There Are Four Common Types of Financial StatementsHasanAbdullahNo ratings yet

- Mod9 LiabilitiesDocument1 pageMod9 LiabilitiesHasanAbdullahNo ratings yet

- Mod 2Document6 pagesMod 2HasanAbdullahNo ratings yet

- Understanding Assets, Liabilities, Shareholders' Equity, Revenues, Expenses and DividendsDocument9 pagesUnderstanding Assets, Liabilities, Shareholders' Equity, Revenues, Expenses and DividendsHasanAbdullahNo ratings yet

- GrumbleDocument8 pagesGrumbleHasanAbdullahNo ratings yet

- Mod-8 (Comparison of Depreciation Methods)Document2 pagesMod-8 (Comparison of Depreciation Methods)HasanAbdullahNo ratings yet

- Auditing Questions To DoDocument2 pagesAuditing Questions To DoHasanAbdullahNo ratings yet

- 1 - Auditing ContentsDocument2 pages1 - Auditing ContentsHasanAbdullahNo ratings yet

- FiancingDocument1 pageFiancingHasanAbdullahNo ratings yet

- Oranizational StructuresDocument9 pagesOranizational StructuresHasanAbdullahNo ratings yet

- Sales Returns and AllowanceDocument2 pagesSales Returns and AllowanceHasanAbdullahNo ratings yet

- Auditing Past Paper QuestionsDocument3 pagesAuditing Past Paper QuestionsHasanAbdullahNo ratings yet

- Transaction AssertionsDocument2 pagesTransaction AssertionsHasanAbdullahNo ratings yet

- Q1Document6 pagesQ1HasanAbdullahNo ratings yet