Professional Documents

Culture Documents

D

Uploaded by

LEONARDO BAÑAGAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

D

Uploaded by

LEONARDO BAÑAGACopyright:

Available Formats

1. D.

Hospital under health services whether it is a private, non-profit or government hospital are not

subjected to business tax. Services rendered by the professionals and pharmaceuticals are only

subjected to VAT.

2. A. Purely employed professional is not subjected to business tax because employment is not a

business and compensation income is exempt from business tax.

3. D. Employee is not subjected to business tax as I mentioned in number 2 employment is not a

business and compensation income is exempted in business tax. What is included in business tax is

their professional fees.

4. A. Regional operating headquarters are operating in the Philippines which are assumed to have

profit hence subjected to business tax.

5. D Only hospital services are exempt from medical service. Services in practice of their

professionalism are subjected to VAT.

6. A Medicines are part of pharmaceuticals and sale of drugs are vatable hence subjected to business

tax.

7. D Education is a necessity for every individual. Whether the school is a private, public or non-profit

they are exempted from business tax giving considerations of the government requirements.

8. D Rent income is not necessarily part of education hence part of business tax.

9. C Sale of ballpen and notebooks is part of earning profit hence it is vatable. Other than the choices,

they are necessities so exempt from business tax.

10. B DOH is not an accrediting agency of school so is not part of exempting from business tax.

11. D All of the choices are part of the activities related to books which are exempted from business

tax. Printing, sale and publication is related to education which are exempted to business tax.

12. B General rule sales by persons not engaged in business is not subject to business tax.

13. C Property held for use may not be subject to business tax when they are not engaged in

businesses.

14. C Realty dealers, developers or lessors are usually registered as vat taxpayers because they are

normally engage in the real estate business.

15. A Properties classified as ordinary assets is vatable for the property is used in business which

made the dealer a VAT taxpayer.

16. D All of the following are exempt under certain price condition as they are all necessity to

individual and used in residential properties.

17. D Motels is not part of necessity so it does not apply on the rent limit on residential dwellings.

18. B International carrier is exempted in business tax because of the territoriality concept.

19. A International carrier is involved only in air carriers and sea carriers, it does not apply in land

transport for non-traffic purposes.

20. B International carrier is owned by a foreign corporation which they are doing business here in the

Philippines. They are shipping goods or services here in our country.

You might also like

- A Math Assistant Always at HandDocument2 pagesA Math Assistant Always at HandLEONARDO BAÑAGANo ratings yet

- Fossil Fuels Coal Oil Gas Industrial Society: SyntheticDocument1 pageFossil Fuels Coal Oil Gas Industrial Society: SyntheticLEONARDO BAÑAGANo ratings yet

- PhotoDocument1 pagePhotoLEONARDO BAÑAGANo ratings yet

- What Is PhotomathDocument1 pageWhat Is PhotomathLEONARDO BAÑAGANo ratings yet

- Photomath Is A Free App That Can Solve Equations Through Smartphone CamerasDocument2 pagesPhotomath Is A Free App That Can Solve Equations Through Smartphone CamerasLEONARDO BAÑAGANo ratings yet

- LDM Course 2 (Module 2)Document6 pagesLDM Course 2 (Module 2)LEONARDO BAÑAGANo ratings yet

- PoertkldfDocument1 pagePoertkldfLEONARDO BAÑAGANo ratings yet

- SdasdqweDocument1 pageSdasdqweLEONARDO BAÑAGANo ratings yet

- LDM Course 2 (Module 3)Document10 pagesLDM Course 2 (Module 3)LEONARDO BAÑAGANo ratings yet

- Individual Development PlanDocument3 pagesIndividual Development PlanLEONARDO BAÑAGA50% (2)

- Attendance: Ldm2 Beta Test Participants Lac Session #1Document1 pageAttendance: Ldm2 Beta Test Participants Lac Session #1LEONARDO BAÑAGANo ratings yet

- Chapter 2 - An Introduction To Linear Programming: Cengage Learning Testing, Powered by CogneroDocument22 pagesChapter 2 - An Introduction To Linear Programming: Cengage Learning Testing, Powered by CogneroLEONARDO BAÑAGANo ratings yet

- Colegio de Dagupan Chapter: JPIA Vice-President For MembershipDocument1 pageColegio de Dagupan Chapter: JPIA Vice-President For MembershipLEONARDO BAÑAGANo ratings yet

- Name: - Score: - Block: - DateDocument8 pagesName: - Score: - Block: - DateLEONARDO BAÑAGANo ratings yet

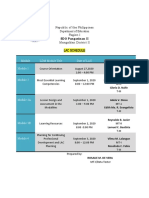

- Lac Schedule: LDM Module Title Date of LAC Facilitator & DocumenterDocument1 pageLac Schedule: LDM Module Title Date of LAC Facilitator & DocumenterLEONARDO BAÑAGANo ratings yet

- Rapid Assessment of Learning Resources (For Non-Deped) Is The LR Material... Yes No Cannot Be DeterminedDocument2 pagesRapid Assessment of Learning Resources (For Non-Deped) Is The LR Material... Yes No Cannot Be DeterminedLEONARDO BAÑAGANo ratings yet

- Ly Anne Cereno BanagaDocument3 pagesLy Anne Cereno BanagaLEONARDO BAÑAGANo ratings yet

- Ly Anne's Room Renovation! Let's G!!: (Phase I)Document5 pagesLy Anne's Room Renovation! Let's G!!: (Phase I)LEONARDO BAÑAGANo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Subhashri - M P No. 11 of 2013Document29 pagesSubhashri - M P No. 11 of 2013mechgokulNo ratings yet

- USAID-Funded Nepal Hydropower Development Project (NHDP)Document27 pagesUSAID-Funded Nepal Hydropower Development Project (NHDP)gtfhgNo ratings yet

- WTO & Its Importance For Indian Business: Prof. Arun MishraDocument25 pagesWTO & Its Importance For Indian Business: Prof. Arun MishraArun MishraNo ratings yet

- Your Electric BillDocument2 pagesYour Electric BillFirst Marcel PropertiesNo ratings yet

- Section 80EEB of Income Tax Act - Electric Vehicle Tax Exemption, Benefits and DeductionDocument10 pagesSection 80EEB of Income Tax Act - Electric Vehicle Tax Exemption, Benefits and DeductionnavdeepdecentNo ratings yet

- Mepco BillDocument2 pagesMepco BillRao M. YasirNo ratings yet

- DT CTFP 1 - Basic Concepts ExtendedDocument22 pagesDT CTFP 1 - Basic Concepts ExtendedMonalisa BagdeNo ratings yet

- Analysis of GST: Jamia Millia IslamiaDocument15 pagesAnalysis of GST: Jamia Millia IslamiaSandeep ChawdaNo ratings yet

- Evolution of Taxation in The PhilippinesDocument16 pagesEvolution of Taxation in The Philippineshadji montanoNo ratings yet

- Full Solution Manual For Practical Problems in Groundwater Hydrology Scott Bair Terry D Lahm PDF Docx Full Chapter ChapterDocument36 pagesFull Solution Manual For Practical Problems in Groundwater Hydrology Scott Bair Terry D Lahm PDF Docx Full Chapter Chapteruproll.curst.s5csd100% (16)

- TAXATIONDocument15 pagesTAXATIONNameles WaranNo ratings yet

- Kalol 17 01 2020Document1 pageKalol 17 01 2020Chirag SiddhpuraNo ratings yet

- Summer Project Report: "A Comparative Study of GST Return "Document60 pagesSummer Project Report: "A Comparative Study of GST Return "Aditya DaswaniNo ratings yet

- Understanding Your BillDocument5 pagesUnderstanding Your Billfarooq ahmedNo ratings yet

- Vistara Free Ticket Voucher TC FinalDocument3 pagesVistara Free Ticket Voucher TC FinalEr Mohit RajputNo ratings yet

- Invoice: Zoom W-9 Question About Your Billing?Document2 pagesInvoice: Zoom W-9 Question About Your Billing?Thomas MartiNo ratings yet

- Certificate of Ownership Template 09Document1 pageCertificate of Ownership Template 09RichardwilsonNo ratings yet

- Pakistan Renewable Energy Policy 2019Document20 pagesPakistan Renewable Energy Policy 2019Rao ARSLANNo ratings yet

- Form Ai: Preferential Tariff Certificate of OriginDocument1 pageForm Ai: Preferential Tariff Certificate of OriginIpons PonaryoNo ratings yet

- Impact of GST On Supply ChainDocument1 pageImpact of GST On Supply ChainMithunNo ratings yet

- International Economics I Distance ModuleDocument336 pagesInternational Economics I Distance ModuleBereket DesalegnNo ratings yet

- Passenger Customs Guide - Dubai CustomsDocument10 pagesPassenger Customs Guide - Dubai CustomsMorgan PalmaNo ratings yet

- Related: BBA From Amity University, Ranchi (Graduated 2022)Document4 pagesRelated: BBA From Amity University, Ranchi (Graduated 2022)Shy DyNo ratings yet

- Trade PolicyDocument2 pagesTrade PolicySarthakparesh PatelNo ratings yet

- Prelim Exam Tm3 Summer ClassDocument4 pagesPrelim Exam Tm3 Summer ClassPrincess Mendoza SolatorioNo ratings yet

- Amaron Battery Change InvoiceDocument2 pagesAmaron Battery Change InvoiceShivam MishraNo ratings yet

- RPR WhatsappDocument1 pageRPR WhatsappLalit Kumar SunariNo ratings yet

- BU2103 - IBM G2 International Trade Law - S20 - Quiz #2 - TonyDocument7 pagesBU2103 - IBM G2 International Trade Law - S20 - Quiz #2 - TonyRajvi ChatwaniNo ratings yet

- Samuel Project2Document69 pagesSamuel Project2John EzewuzieNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)IT MalurNo ratings yet