Professional Documents

Culture Documents

Apportionment - of - OverheadsApportionment of Overheads

Uploaded by

Sneha Elizabeth Vivian0 ratings0% found this document useful (0 votes)

14 views3 pagesOriginal Title

Apportionment_of_OverheadsApportionment of Overheads.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views3 pagesApportionment - of - OverheadsApportionment of Overheads

Uploaded by

Sneha Elizabeth VivianCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

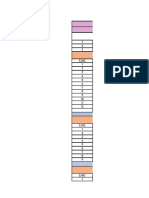

Q1

What basis would you follow for distribution

of the following overhead expenses to

departments

Expenses Basis of Apportionment

1 Stores Services Expenses Value of materials consumed by each dept

2 ESI No.of Employees /wages paid by each dept.

3 Factory Rent Floor area

4 Municipal Rent, Rate & taxes Floor area

5 Insurance on Building & Machinery Value of the assets

6 Wefare department expenses No.of Employees

7 Creche expenses No.of Female employees/Moms

8 Steam Floor area/machinery

9 Electric Light no. of light points

10 Fire Insurance value of assets

Q 2.The Modern Ltd. is divided into 4

departments: A, B, C are production The following

departments & D is a service dept. information is

the actual costs for a period is as available in respect of

follows 4 departments.

Particulars Rs.

Rent 1000

Repairs to Plant 600 Area (sq.metres)

Depreciation of plant 450 No.of Employees

Employer's liabilty for Insurance 150 Total wages

Supervision 1500 Value of plant

Fire Insurance in respect of stock 500 Value Stock

Power 900 H P of Plant

Light 120

OVERHEADS DISTRIBUTION SUMMARY

Basis of

ITEM TOTAL AMOUNT Apportionment

1 Rent 1000 Area (sq.metres)

2 Repairs to Plant 600 Value of plant

3 Depreciation of plant 450 Value of plant

4 Employer's liabilty for Insurance 150 No.of Employees

5 Supervision 1500 No.of Employees

6 Fire Insurance in respect of stock 500 Value Of Stock

7 Power 900 H P of Plant

8 Light 120 Area (sq.metres)

TOTAL 5220

Apportio

n the

costs to

the

various

departme

nts on the

most

equitable

basis

Dept.A Dept.B Dept.C Dept.D Propotionate Equation

1500 1100 900 500 15:11:9:5

20 15 10 5 4:3:2:1

6000 4000 3000 2000

24000 18000 12000 6000 4:3:2:1

15000 9000 6000 0 5:03:02

24 18 12 6 4:3:2:1

N SUMMARY

Production Departments Service Department

A B C D

375 275 225 125

240 180 120 60

180 135 90 45

60 45 30 15

600 450 300 150

250 150 100 0

360 270 180 90

45 33 27 15

2110 1538 1072 500

You might also like

- WINSEM2021-22 CCA2707 TH VL2021220501052 Reference Material I 21-03-2022 1 OverheadsDocument70 pagesWINSEM2021-22 CCA2707 TH VL2021220501052 Reference Material I 21-03-2022 1 OverheadsvodatNo ratings yet

- Audel Guide to the 2005 National Electrical CodeFrom EverandAudel Guide to the 2005 National Electrical CodeRating: 4 out of 5 stars4/5 (1)

- Chapter 7 - Manufacturing Overhead - DepartmentalizationDocument77 pagesChapter 7 - Manufacturing Overhead - DepartmentalizationJiko GuintoNo ratings yet

- European Electronics Directory 1994: Systems and ApplicationsFrom EverandEuropean Electronics Directory 1994: Systems and ApplicationsC.G. WedgwoodNo ratings yet

- SodapdfDocument9 pagesSodapdfSARANYANo ratings yet

- Overhead Distribution and DepartmentalizationDocument91 pagesOverhead Distribution and Departmentalizationkhalid1173No ratings yet

- CA Naresh Aggarwal's Academy Overheads Distribution Rate CalculationDocument15 pagesCA Naresh Aggarwal's Academy Overheads Distribution Rate CalculationDevesh BahetyNo ratings yet

- MAS1Document48 pagesMAS1ryan angelica allanicNo ratings yet

- Management Advisory Services: Costs and Cost ConceptsDocument46 pagesManagement Advisory Services: Costs and Cost ConceptsLayla MainNo ratings yet

- MAS1Document46 pagesMAS1Frances Bernadette BaylosisNo ratings yet

- MASDocument46 pagesMASKyll Marcos0% (1)

- Intro To Accounting Ch. 3Document5 pagesIntro To Accounting Ch. 3Bambang HasmaraningtyasNo ratings yet

- MAS ReviewerDocument46 pagesMAS ReviewerjustjadeNo ratings yet

- MasDocument36 pagesMasClareng Anne57% (7)

- Management Advisory Services: Costs and Cost ConceptsDocument45 pagesManagement Advisory Services: Costs and Cost ConceptsChristine PabalanNo ratings yet

- C1 2021PGP010 AdishDocument6 pagesC1 2021PGP010 AdishSHARMISTHA DAS PGP 2021-23 BatchNo ratings yet

- Direct Expenses and Overhead Solution To Self Evaluation Problems Solution 1Document15 pagesDirect Expenses and Overhead Solution To Self Evaluation Problems Solution 1Megha Munshi ShahNo ratings yet

- Foh DistributionDocument91 pagesFoh Distributionakj_co82No ratings yet

- OverheadsDocument7 pagesOverheadsshobhit chaturvediNo ratings yet

- 06 Overhead (OH) Costs - Allocations, Apportionment, Absorption CostingDocument34 pages06 Overhead (OH) Costs - Allocations, Apportionment, Absorption CostingAyushNo ratings yet

- ACMA Unit 6 Problems - Overheads PDFDocument4 pagesACMA Unit 6 Problems - Overheads PDFPrabhat SinghNo ratings yet

- OVERHEAD Control ProblemDocument7 pagesOVERHEAD Control Problemmuttakin106No ratings yet

- MAS 25 27TH BATCH With AnswersDocument15 pagesMAS 25 27TH BATCH With AnswersSarah Jane GanigaNo ratings yet

- JobDocument4 pagesJobNeha SmritiNo ratings yet

- Management Advisory Services: Costs and Cost ConceptsDocument46 pagesManagement Advisory Services: Costs and Cost ConceptsKlomoNo ratings yet

- Management Advisory Services: Costs and Cost ConceptsDocument45 pagesManagement Advisory Services: Costs and Cost ConceptsUnknown 01No ratings yet

- Complete Busniess Model For Telecom Sector Modified PlaneDocument14 pagesComplete Busniess Model For Telecom Sector Modified PlaneFaraz FaiziNo ratings yet

- MAS 25 27TH BATCH With Answers 1Document15 pagesMAS 25 27TH BATCH With Answers 1cpacpacpaNo ratings yet

- Mas - 3Document36 pagesMas - 3AzureBlazeNo ratings yet

- Accounting for Dickinson CompanyDocument38 pagesAccounting for Dickinson CompanyPhương NguyễnNo ratings yet

- Management Advisory Services: BudgetedDocument26 pagesManagement Advisory Services: Budgetedi hate youtubersNo ratings yet

- 21st - OCTOBER - 2022-TODAY CLASS - DotDocument23 pages21st - OCTOBER - 2022-TODAY CLASS - DotPalesaNo ratings yet

- UntitledDocument3 pagesUntitledVatsal ChangoiwalaNo ratings yet

- Over Heads Additional Sums PDFDocument40 pagesOver Heads Additional Sums PDFShiva AP100% (1)

- Mas (Topic1 10)Document9 pagesMas (Topic1 10)ROMAR A. PIGANo ratings yet

- Chapter 4 Overhead ProblemsDocument5 pagesChapter 4 Overhead Problemsthiluvnddi100% (1)

- MULTIPLE CHOICEDocument6 pagesMULTIPLE CHOICEMirasolNo ratings yet

- Cma Final 2018 19Document3 pagesCma Final 2018 19BrijmohanNo ratings yet

- COST ACCOUNTING: OVERHEADS DISTRIBUTIONDocument9 pagesCOST ACCOUNTING: OVERHEADS DISTRIBUTIONShubhamNo ratings yet

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyMarilou GabayaNo ratings yet

- MA - ExcelDocument7 pagesMA - ExcelKushal KaushikNo ratings yet

- Am & Scap - End Term - Group 6Document12 pagesAm & Scap - End Term - Group 6priyaNo ratings yet

- Direct Material CostDocument29 pagesDirect Material CostRaj DharodNo ratings yet

- Mas Test Bank QuestionDocument20 pagesMas Test Bank QuestionAsnor RandyNo ratings yet

- TYBCOM - Cost - OverheadsDocument8 pagesTYBCOM - Cost - Overheadsmkbooks4uNo ratings yet

- Management Advisory Services: Number 1 (Costs and Cost Concepts)Document3 pagesManagement Advisory Services: Number 1 (Costs and Cost Concepts)Angel Keith MercadoNo ratings yet

- BudgetsDocument8 pagesBudgetsBarack MikeNo ratings yet

- Unit 3 Worksheet: AnswerDocument23 pagesUnit 3 Worksheet: AnswerMingxNo ratings yet

- Project at A GlaceDocument20 pagesProject at A GlaceRajat NaiduNo ratings yet

- MAS ReviewerDocument22 pagesMAS ReviewerBeverly HeliNo ratings yet

- 2021 UTS JawabanDocument8 pages2021 UTS JawabanAdam FitraNo ratings yet

- Q1. Cadila Co. Has Three Production Departments A, B and C and Two ServiceDocument5 pagesQ1. Cadila Co. Has Three Production Departments A, B and C and Two Servicemedha surNo ratings yet

- Financial AccountingDocument7 pagesFinancial AccountingHudson Frank ShararaNo ratings yet

- Costs and Cost ConceptsDocument4 pagesCosts and Cost ConceptsGhaill CruzNo ratings yet

- Answers Chapter 7 & 8Document5 pagesAnswers Chapter 7 & 8Inanda ErvitaNo ratings yet

- Overhead DistributionDocument73 pagesOverhead DistributionJenny BernardinoNo ratings yet

- 1) Answer Any Two From The Following: 10X2 20Document2 pages1) Answer Any Two From The Following: 10X2 20Alvarez StarNo ratings yet

- Cash Flow Assignment 1Document9 pagesCash Flow Assignment 1Ramakrishna J RNo ratings yet

- 2021 Dec Ijthap TemplateDocument5 pages2021 Dec Ijthap TemplateSneha Elizabeth VivianNo ratings yet

- Astudyontheproblemsandprospectsof Smallrubbercultivatorsinpattambitaluk AreaDocument4 pagesAstudyontheproblemsandprospectsof Smallrubbercultivatorsinpattambitaluk AreaSneha Elizabeth VivianNo ratings yet

- Astudyontheproblemsandprospectsof Smallrubbercultivatorsinpattambitaluk AreaDocument4 pagesAstudyontheproblemsandprospectsof Smallrubbercultivatorsinpattambitaluk AreaSneha Elizabeth VivianNo ratings yet

- Do Natural Rubber Price Bubbles Occur?: Lu LiuDocument7 pagesDo Natural Rubber Price Bubbles Occur?: Lu LiuSneha Elizabeth VivianNo ratings yet

- Vizhinjam Port Project Threatens Environment, LivelihoodsDocument14 pagesVizhinjam Port Project Threatens Environment, LivelihoodsSneha Elizabeth VivianNo ratings yet

- Qty Cost (RS) Breakfast: Transpotation Charge of INR500 Will Be Appplicable Taxes As ApplicableDocument1 pageQty Cost (RS) Breakfast: Transpotation Charge of INR500 Will Be Appplicable Taxes As ApplicableSneha Elizabeth VivianNo ratings yet

- Easychair Preprint: Shakti Chaturvedi, Nisha Goyal and Raghava Reddy VaraprasadDocument24 pagesEasychair Preprint: Shakti Chaturvedi, Nisha Goyal and Raghava Reddy VaraprasadSneha Elizabeth VivianNo ratings yet

- Ijms 48 (1) 137-142Document6 pagesIjms 48 (1) 137-142Sneha Elizabeth VivianNo ratings yet

- Adaptation of digital apps at cafes in new normal eraDocument13 pagesAdaptation of digital apps at cafes in new normal eraDimas NugrohoNo ratings yet

- Easychair Preprint: Shakti Chaturvedi, Nisha Goyal and Raghava Reddy VaraprasadDocument24 pagesEasychair Preprint: Shakti Chaturvedi, Nisha Goyal and Raghava Reddy VaraprasadSneha Elizabeth VivianNo ratings yet

- Utilization of Animal Resources at Vizhinjam, Kerala: A Study Based On Faunal RemainsDocument20 pagesUtilization of Animal Resources at Vizhinjam, Kerala: A Study Based On Faunal RemainsSneha Elizabeth VivianNo ratings yet

- A Case Study On Domino's Business Survival Strategy During The Covid-19 PandemicDocument14 pagesA Case Study On Domino's Business Survival Strategy During The Covid-19 PandemicSneha Elizabeth VivianNo ratings yet

- A Case Study On Domino's Business Survival Strategy During The Covid-19 PandemicDocument14 pagesA Case Study On Domino's Business Survival Strategy During The Covid-19 PandemicSneha Elizabeth VivianNo ratings yet

- Adaptation of digital apps at cafes in new normal eraDocument13 pagesAdaptation of digital apps at cafes in new normal eraDimas NugrohoNo ratings yet

- 2021 Dec Ijthap TemplateDocument5 pages2021 Dec Ijthap TemplateSneha Elizabeth VivianNo ratings yet

- 19ubbi53 - Cadl Ratio AnalysisDocument11 pages19ubbi53 - Cadl Ratio AnalysisSneha Elizabeth VivianNo ratings yet

- Online Exam Management SystemDocument26 pagesOnline Exam Management SystemSneha Elizabeth VivianNo ratings yet

- Admission Management SystemDocument12 pagesAdmission Management SystemSneha Elizabeth VivianNo ratings yet

- Guerrilla Marketing: Presented By: Sneha Elizabeth Vivian 19UBB153Document12 pagesGuerrilla Marketing: Presented By: Sneha Elizabeth Vivian 19UBB153Sneha Elizabeth VivianNo ratings yet

- Identify Business Opportunities by Observing ChangesDocument8 pagesIdentify Business Opportunities by Observing ChangesSneha Elizabeth VivianNo ratings yet

- Vizhinjam Port Project Threatens Environment, LivelihoodsDocument14 pagesVizhinjam Port Project Threatens Environment, LivelihoodsSneha Elizabeth VivianNo ratings yet

- M Z Plus Auto: Tax Invoice (Workshop Credit)Document20 pagesM Z Plus Auto: Tax Invoice (Workshop Credit)mzplus chikhliNo ratings yet

- Research 1 QuestionDocument7 pagesResearch 1 Questiondoom zy100% (1)

- Test - Income Tax For IndividualsDocument9 pagesTest - Income Tax For IndividualsNikka Nicole Arupat100% (5)

- Determination of Retention Fees For Dev-Asstd HL Accts and Transfer or Reg Fees For Retail HL AcctsDocument2 pagesDetermination of Retention Fees For Dev-Asstd HL Accts and Transfer or Reg Fees For Retail HL AcctsJonniel De GuzmanNo ratings yet

- Dealer Application FormDocument18 pagesDealer Application Formshivalk3No ratings yet

- Foundations of Financial Management 17th Edition Block Test BankDocument43 pagesFoundations of Financial Management 17th Edition Block Test BankDeniseOsbornefpexj100% (14)

- Persuasive Essay Sport Stadium Paper 2Document5 pagesPersuasive Essay Sport Stadium Paper 2Knkighthaw0% (1)

- ABEJARON V.nabasaDocument2 pagesABEJARON V.nabasairis_irisNo ratings yet

- Brief in Support of Notice For Dismissal For Lack of JurisdictionDocument27 pagesBrief in Support of Notice For Dismissal For Lack of Jurisdictiondbush2778No ratings yet

- BataDocument104 pagesBatasherazhassannNo ratings yet

- Fiscal PolicyDocument16 pagesFiscal Policyvivek.birla100% (2)

- Dir of Lands V Funtilar G.R. No. L-68533Document5 pagesDir of Lands V Funtilar G.R. No. L-68533Jade Palace TribezNo ratings yet

- SMIETANKA v. FIRST TRUST & SAV BANK - FindLawDocument4 pagesSMIETANKA v. FIRST TRUST & SAV BANK - FindLawPatricia BenildaNo ratings yet

- CHAPTER 5. Types of StrategiesDocument23 pagesCHAPTER 5. Types of StrategiesAiralyn RosNo ratings yet

- NarrationsDocument9 pagesNarrationskaran nikamNo ratings yet

- Digest RR 13-2018Document9 pagesDigest RR 13-2018Maria Rose Ann BacilloteNo ratings yet

- 04Document28 pages04Aaron Brooke100% (1)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- Tax Exempt FormsDocument2 pagesTax Exempt Formsapi-251018730No ratings yet

- Financial Performance Analysis of Steel Re-Rolling MillsDocument33 pagesFinancial Performance Analysis of Steel Re-Rolling MillsNurul KabirNo ratings yet

- Internship Report On ZTBLDocument87 pagesInternship Report On ZTBLShabnam Naz100% (3)

- Cash Flow EstimationDocument9 pagesCash Flow EstimationCassandra ChewNo ratings yet

- 1 REPUBLIC VS COCOFED G.R. No. 147062-64 PDFDocument29 pages1 REPUBLIC VS COCOFED G.R. No. 147062-64 PDFJanMarkMontedeRamosWongNo ratings yet

- Charitable Gift Annuities - Gift It and Earn BenefitDocument1 pageCharitable Gift Annuities - Gift It and Earn BenefitPerttoh MusyimiNo ratings yet

- Inflation in Pakistan3Document31 pagesInflation in Pakistan3Rajput Ahmed MujahidNo ratings yet

- Form No. 16A: From ToDocument1 pageForm No. 16A: From ToShail MehtaNo ratings yet

- For Corporate Social Responsibility - Cs P SriramDocument45 pagesFor Corporate Social Responsibility - Cs P SriramThe First AlertNo ratings yet

- SLSP RRDocument2 pagesSLSP RRBrian AlmeriaNo ratings yet

- Chap 019Document11 pagesChap 019dbjnNo ratings yet

- BIR Form 2303 Registration GuideDocument2 pagesBIR Form 2303 Registration Guidejennifer alianzaNo ratings yet