Professional Documents

Culture Documents

Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Pref Shares. Practice Questions

Uploaded by

Mercy GamingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Pref Shares. Practice Questions

Uploaded by

Mercy GamingCopyright:

Available Formats

Chapter 4: Redemption of Pref Share & Debentures

Topic: Redemption of Pref Shares.

Practice Questions

Question 1.

The balance sheet of Nilakanta Limited is it the beginning of financial year, inter alia, include the

following:

₹

50,000 8% preference shares of ₹ 100 each ₹ 70 paid up 35,00,000

1,00,000 equity shares of ₹ 100 each fully paid up 1,00,00,000

Securities premium 5,00,00

Capital redemption reserve 20,00,000

General reserve 50,00,000

Under the terms of their issue, the preference shares are redeemable at the end of the year at a

premium of 5%. In order to finance the redemption, the company makes rights issue of 50,000

equity shares of ₹100 each at ₹ 110 per share, ₹ 20 Being payable on application, ₹ 35 (including

Premium) on allotment and the balance to be called in the next financial year. The issue was

fully subscribed and allotment made on 1st December. The moneys due on allotment were

promptly received by the end of the year.

The preference shares were redeemed after fulfilling the necessary conditions of the Companies

Act. The company decided to make the minimum utilisation of general reserve. Assume that

securities premium A/c is usable for providing the premium on redemption of preference

shares. You are asked to pass the necessary journal entries and show the relevant extracts from

the balance sheet as at the end of the year with corresponding figures of the previous year.

Solution:

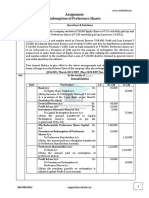

1. Journal entries in the books of Nilakanta Limited (in ₹ 000’s)

Particulars Dr. Cr.

1. 8% preference shares final call A/c Dr. 15,00

To 8% preference share capital A/c 15,00

(Being final call made on 50,000 preference shares

at ₹ 30 each to make them fully paid up prior to

Redemption)

Contact - 9228446565 www.konceptca.com info@konceptca.com

2. Bank A/c Dr. 15,00

To 8% Preference share final call A/c 15,00

(Being final call amount received on 50,000

preference shares at ₹ 30 each)

3. Bank A/c Dr. 10,00

To Equity share application A/c 10,00

(Bring the application money received on 50,000

equity shares at ₹ 20 per share)

4. Equity share application A/c Dr. 10,00

To Equity share capital A/c 10,00

(Being the application money on 50,000 equity

shares transferred to equity share capital A/c vide

Board’s resolution no. ……. Dated …….)

5. Equity share allotment A/c Dr. 17,50

To Equity share capital A/c 12,50

To Securities premium A/c 5,00

(Being the amount due on allotment of 50,000

equity shares at ₹ 35 per share including premium ₹

10, vide Board’s resolution no. ……. Dated……)

6. Bank A/c Dr. 17,50

To Equity share allotment A/c 17,50

(Being allotment money received on 50,000 equity

shares at ₹ 35 per share)

7. 8% preference share capital A/c Dr. 50,00

Premium on redemption of preference shares A/c Dr. 2,50

To Preference shareholders A/c 52,50

(Being the amount payable to preference

shareholders on redemption at 5% premium)

8. Securities premium A/c 2,50

To premium on redemption of preference 2,50

shares A/c

(Being premium payable on redemption of

preference shares provided out of securities

premium A/c)

9. General reserve A/c Dr. 27,50

To Capital redemption reserve A/c 27,50

(Being amount transferred to CRR on redemption of

preference shares for the balance not covered by

proceeds of fresh issue of shares, that is face value

of PSC redeemed ₹ 50 lacs

Less face value of fresh issue ₹ 22.5 lacs, excluding

securities premium)

Contact - 9228446565 www.konceptca.com info@konceptca.com

10. Preference shareholders A/c Dr. 52,50

To bank A/c 52,50

(Being payment made to preference shareholders)

2. Extract of B/sheet of Neelakanta Ltd as at …… (after redemption of preference shares)

(₹ in 000’s)

Particulars Note This Year Prev. Yr.

I EQUITY AND LIABILITIES:

1. Shareholders’ funds :

a. Share capital 1 122,50 1,35,00

b. Reserves and surplus 2 77,50 75,00

Note 1 :Share capital

Particulars This Year Prev. Yr.

Authorised :

. . . . . . . Equity shares of . . . . each

. . . . . . . Preference shares of . . . . . . each

Issued, subscribed and paid up :

1,00,000 equity shares of ₹ 100 each fully paid up 1,00,00 1,00,00

50,000 equity shares of ₹ 100 is ₹ 45 called up and paid up 22,50 -

8% 50,000 redeemable preference shares of ₹ 100 each - 35,00

₹ 70 called up and paid up ( redeemed during the year )

Total 1,22,50 1,35,00

Reconciliation of number and amount of shares (all figures for this year)

Particulars ESC ₹ 100 each ESC ₹ 100 ₹ 45 paid up Preference. Shares of ₹

100 each

Number Amt. ₹ 000’s Number Amt ₹ 000’s Number Amt ₹ 000’s

Opening balance 1,00,000 1,00,00 - - 50,000 @ ₹70 = 35,00

Add : fresh issue - - 50,000 @ 45 = 22,50 Final @ Rs 30 = 15,00

call

Less : redemption/ - - - - 50,000 (50,00)

buyback

Closing balance 1,00,000 1,00,00 50,000 @ 45 = 22,50 - -

Note 2: Reserves and surplus

Particulars This year Prev. Yr.

Capital redemption reserve 47,50 20,00

Security streaming A/c 7,50 5,00

Other reserves. - General reserve 22,50 50,00

Total 77,50 75,00

Contact - 9228446565 www.konceptca.com info@konceptca.com

Reserves and surplus (showing appropriations and transfers) (all figures for this year)

Particulars Opg. Bal. Additions Deductions Clg. Bal.

Capital redemption 20,00 From gen res. - 47,50

reserve = 27,50

Securities premium A/c 5,00 Fresh issue = 5,00 Prem. on PSC 7,50

redemption = 2,50

Other Reserves (Gen. 50,00 - Tfr to CRR = 27,50 22,50

Res.)

Total 75,00 32,50 30,00 77,50

Question 2.

Following is the balance sheet of Ms Nataraja Limited as on 31st March

Equity and liabilities ₹ Assets ₹

80,000, 6% red. pref. shares of ₹ 10 7,20,000 Sundry assets 16,80,000

each ₹ 9 paid up

40,000 equity shares of ₹ 10 each 4,00,000 Cash 5,20,000

fully paid up

Securities premium 1,00,000

Profit and loss A/c 5,00,000

General reserve 60,000

Sundry creditors 4,20,000

Total 22,00,000 Total 22,00,000

By the terms of their issue, the preference shares were redeemable at a premium of ₹ 50 paise

per share on 1st April, and it was decided to arrange for this, out of the company's resources

subject to leaving a credit balance of ₹ 24,000 in the P&L A/c. It was also decided to raise the

balance of funds required by the issue of sufficient number of equity shares at a premium of

10%. Assume that securities premium A/c is usable for providing the premium on redemption

of preference shares.

Show the journal entries giving effect to the above transaction & balance sheet thereafter.

Solution:

1. Computation of Minimum Number of Equity shares to be issued

Particulars ₹

Face value of redeemable preference shares 8,00,000

Less: General reserve 60,000

Profit and loss A/c ( 5,00,000 - 24,000 to be retained) 4,76,000 (5,36,000)

Face value of equity shares to be issued 2,64,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

Number of equity shares be issued (Face value = ₹ 10 per share) 26,400 shares

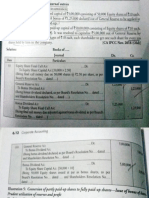

2. Journal entries in the books of Nataraja Ltd.

Particulars Dr.(₹) Cr.(₹)

1. Redeemable preference share final call A/c Dr. 80,000

To 6% redeemable preference share capital A/c 80,000

(Being final call due on 80,000 shares at ₹ 1 each, so that

preference shares can be made fully paid and eligible for

Redemption)

2. Bank A/c Dr. 80,000

To 6 % redeemable preference shares final call A/c 80,000

(Being call money received from all preference shareholders)

3. Bank A/c Dr. 2,90,400

To Equity share application and allotment A/c 2,90,400

(Being amount received on issue of 26400 shares × 10 + 10

premium)

4. Equity share application and allotment A/c Dr. 2,90,400

To equity share capital A/c (WN 1) 2,64,000

To securities premium A/c 26,400

( Being 26,400 equity shares of ₹ 10 each issued at a premium

of 10%)

5. 6% redeemable preference capital A/c Dr. 8,00,000

Premium on redemption of preference shares A/c 40,000

To preference shareholders A/c 8,40,000

(Being amount due to preference shareholders on redemption

incl. 5% premium)

6. Securities premium A/c Dr. 40,000

To premium on redemption of preference shares A/c 40,000

(Being Premium on PSC redemption at 5% provided out of

securities premium A/c)

7. Preference shareholders A/c Dr. 8,40,000

To bank A/c 8,40,000

(Being payment made to preference shareholders)

8. Profit and loss A/c Dr. 4,76,000

General reserve A/c Dr. 60,000

To Capital redemption reserve A/c 5,36,000

(Being revenue profit transferred to Capital redemption

reserve)

Contact - 9228446565 www.konceptca.com info@konceptca.com

3. Cash Account

Receipts ₹ Payments ₹

To Balance b/d 5,20,000 By Preference Shareholders A/c 8,40,000

To 6 % Red. Pref. Shares final call 80,000 By Balance c/d 50,400

A/c

To Equity share appl. & Allot. A/c 2,90,400

(Fresh issue)

Total 8,90,400 Total 8,90,400

4. Balance sheet of Nataraja Limited as at 1st April (after Redemption)

Particulars Note This Year Prev. Yr.

I EQUITY AND LIABILITIES :

1. Shareholders’ funds :

a. Share capital 1 6,64,000

b. Reserves and surplus 2 6,46,000

2. Current liabilities :

- trade payables(sundry creditors) 4,20,000

Total 17,30,400

II ASSETS

1. Non-current assets : 16,80,000

-sundry assets

2. Current assets : 50,400

- cash and cash equivalents(WN 3)

Total 17,30,400

Note 1: Share capital

Particulars This year Prev. Year.

Authorised:

. . . . . equity shares of. . . . . Each and . . . . . . Preference

shares of . . . . each

Issued, subscribed & paid up : 6,64,000

66,400 equity shares of ₹ 10 each fully paid up

Total 6,64,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

Reconciliation of number and the amount of shares (all figures for this year)

Particulars Equity shares of Preference shares of

₹ 10 each ₹ 10 each

Number Amt ₹ Number Amt ₹

Opening balance (assumed) 40,000 4,00,000 80,000 @ ₹ 9 = 7,20,000

Add: fresh issue 26,400 2,64,000 Final call @ ₹ 1 = 80,000

Less: redemption / buyback - - 80,000 (8,00,000)

Closing balance 66,400 6,64,000 - -

Note 2: Reserves and surplus (showing appropriations and transfers) (all figures of this year)

Particulars Opg. Bal. Additions Deductions Clg. Bal.

Capital redemption reserve From P&L - 5,36,000

= 4,76,000

From gen res

= 60,000

Securities premium A/c 1,00,000 Fresh issue Prem. On PSC 86,400

= 26,400 redemption = 40,000

Other Reserves (gen. Res.) 60,000 - Transfer to CRR Nil

= 60,000

Surplus ( P&L A/c ) 5,00,000 - Transfer to CRR 24,000

= 4,76,000

Total 6,60,000 5,62,400 5,76,000 6,46,400

Question 3.

The provisional balance sheet of Lavanya Limited as at 31st March was as under:

Equity and liabilities ₹ Assets ₹

Share capital :

50,000 E.S of ₹ 10 each ,

₹ 7 per sh called up 3,50,000

Less: calls in arrears on

10,000 sh at ₹ 2 (20,000) Fixed assets (net block) 7,00,000

Add: calls in advance on

40,000 sh at ₹ 3 per sh 1,20,000 4,50,000

20,000 10% redeemable Pref

sh of ₹ 10 each 2,00,000

Reserves and surplus : Cash and Bank balances 2,00,000

General reserve 3,00,000 Other current assets 6,00,000

Profit and loss A/c 2,70,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

Current liabilities 2,80,000

Total 15,00,000 Total 15,00,000

Calls in arrears are outstanding for 6 months. Calls in advance were received 6 months back.

Interest at 10% per annum on calls in advance and 12% per annum on calls in arrears are

allowed / charged.

The Board of Directors have recommended that-

1. Dividend for the year be allowed at 20% on equity shares and paid immediately.

2. Calls in advance be refunded and partly paid equity shares be converted as fully paid up

by declaring bonus dividend to shareholders.

3. Preference shares, which are redeemable at a premium of 10%, may be redeemed by

issue of 10% debentures of ₹100 each. Preference dividend is paid immediately and

prior to Redemption.

Show journal entries to give effect to the above proposals including payment and receipt of cash

and redraft the profit and loss A/c and balance sheet of the company. (Ignore taxation)

Solution:

1. Journal entries in the books of Lavanya Ltd.

Particulars Dr.(₹) Cr.(₹)

1. Interest on calls in arrears A/c Dr. 1,200

To profit and loss A/c 1,200

(Being interest charged on calls in arrears at 12% p.a ₹ 20,000

× 12% × 6/12 )

2. Bank A/c Dr. 21,200

To calls in arrears A/c 20,000

To interest on calls in arrears A/c 1,200

(Being calls in arrears and the interest due thereon received)

3. Profit and loss A/c Dr. 6,000

To Interest on calls in advance A/c 6,000

(Being interest payable at 10% on calls in advance ₹ 1,20,000 ×

10% × 6/12)

Contact - 9228446565 www.konceptca.com info@konceptca.com

4. Profit and loss A/c Dr. 90,000

To preference dividend payable A/c 20,000

To equity dividend payable A/c (on equity capital before 70,000

bonus issue)

(Being dividend at 10% on preference share capital and 20% on

equity share capital proposed). Note : declaration of equity

dividend automatically means that preference dividend should

have been declared first. It is assumed that 20% dividend on

equity shares has been proposed before the equity shares are

made fully paid by way of Bonus dividend.

5. Equity share final call A/c Dr. 1,50,000

To Equity share capital A/c 1,50,000

(Being final call due at ₹ 3 on 50,000 shares)

6. Profit and loss A/c Dr. 1,50,000

To bonus to equity shareholders A/c 1,50,000

(Being bonus for converting ₹ 7 paid up into ₹ 10 shares for

50,000 shares)

7. Bonus to equity shareholders A/c Dr. 1,50,000

To Equity share final call A/c 1,50,000

(Being adjustment of Bonus dividend against final call)

8. Calls in advance A/c Dr. 1,20,000

Interest on calls in advance A/c Dr. 6,000

To bank A/c 1,26,000

(Being amount of calls in advance along with interest refunded)

9. 10% preference share capital A/c Dr. 2,00,000

Premium on redemption of preference shares A/c Dr. 20,000

To preference shareholders A/c 2,20,000

(Being amount due on redemption of preference shares,

including 10% premium)

10. Bank A/c Dr. 2,20,000

To 10% debentures A/c 2,20,000

(Being 2,200 debentures of ₹ 100 each issued in cash)

11. Profit and loss A/c Dr. 20,000

To premium on redemption of preference shares A/c 20,000

(Being premium payable on redemption of preference shares,

charge to P & L A/c)

Contact - 9228446565 www.konceptca.com info@konceptca.com

12. Profit and loss A/c ( balance available in P&L A/c) (refer WN 2) Dr. 5,200

General reserve A/c ( balancing figure )

To Capital redemption reserve A/c Dr. 1,94,800

( Being transferred to Capital redemption Reserve upon 2,00,000

redemption of preference shares )

13. Preference dividend payable A/c Dr. 20,000

Equity dividend payable A/c Dr. 70,000

To bank A/c 90,000

( Being equity and preference dividend paid to shareholders )

14. Preference shareholders A/c Dr. 2,20,000

To bank A/c 2,20,000

( Being amount paid to preference shareholders final statement)

2. Profit and Loss Appropriation A/c of Lavanya Ltd for the year ended 31st March

Particulars ₹ Particulars ₹

To interest on calls in advance 6,000 By balance b/d (given) 2,70,000

To balance c/d 2,65,000 By interest on calls in arrears 1,200

Total 2,71,200 Total 2,71,200

To premium on redemption of 20,000 By balance b/d 2,65,200

preference shares

To Preference Dividend 20,000

To Equity Dividend 70,000

To Bonus to Eq. Sh. 1,50,000

To C.R.R. A/c ( bal. figure ) 5,200

2,65,200 2,65,200

Note:

1. It is assumed that the calls in arrears has been fully received, together with interest

thereon , and calls in advance has been duly repaid, along with interest thereon.

₹ 70,000

2. Dividend per share = = ₹ 1.40

50,000 shares

3. As per schedule III requirements, appropriations are to be shown in the notes i.e.

Schedule of reserves and surplus. However, in the above solution, these are shown in the

P& L A/c itself, for ease of computation.

3. Cash and Bank Balances as on 31st March

Contact - 9228446565 www.konceptca.com info@konceptca.com

Receipts ₹ Payments ₹

To balance b/d 2,00,000 By payment of calls in Adv. and 1,26,000

Int. thereon

To recovery of calls in arrears 21,200 By pref. share Redemption (incl. 2,20,000

and Int. thereon Premium)

To proceed from issue of 2,20,000 By preference dividend paid 20,000

debentures

By equity dividend paid 70,000

By balance c/d (balancing 5,200

figure)

Total 4,41,200 Total 4,41,200

4. Balance Sheet of Lavanya Ltd. As on 31st March (after above transactions)

Particulars Note This year Prev. Yr.

I EQUITY AND LIABILITIES :

1. Shareholders’ funds :

a. Share capital 1 5,00,000

b. Reserves and surplus 2 3,05,200

2. Non-current liabilities :

Long term borrowings

-secured loans - 10% debentures 2,20,000

3. Current liabilities:.

- other current liabilities 2,80,000

Total 13,05,200

II ASSETS

1. Non-current assets

- Fixed assets 7,00,000

2. Current Assets :

a. Cash and cash equivalents 5,200

b. Other current assets 6,00,000

Total 13,05,200

Note 1: Share capital

Particulars This Year Prev. Yr.

Authorised:

. . . . . equity shares of . . . . . Each and . . . . . . Preference

shares of . . . . each

Issued, subscribed & paid up :

50,000 equity shares of ₹ 10 each fully paid up 5,00,000

(of the above equity shares ₹ 3 per share has not been received in

cash, but has been capitalised by issuing bonus dividend out of

profits)

Total 5,00,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

Note 2: Reserves and surplus (showing appropriations and transfers) (all figures of this year)

Particulars Opg. Bal. Additions Deductions Clg. Bal.

Tfr from P&L = 5,200 - 2,00,000

Capital redemption - Tfr from gen res =

reserve 1,94,800

Other Reserves (gen. Res.) 3,00,000 - Tfr to CRR = 1,05,200

1,94,800

Surplus ( P&L A/c ) (note) 2,70,000 Details in WN 2 = 1,200 Details in WN 2 Nil

= 2,71,200

Total 5,70,000 2,01,200 4,66,000 3,05,200

Question 4.

The following is the balance sheet of Maheshwar Limited at the beginning of a financial year -

Equity and liabilities ₹ Assets ₹

Share capital : Fixed assets

Authorised capital: Gross block 3,00,000

10,000 10% redeemable 1,00,000 Less : Depreciation (1,00,000)

preference shares of ₹ 10 each

90,000 equity shares of ₹ 10 each 9,00,000 Net block 2,00,000

10,00,000 Investments 1,00,000

Issued, subscribed and paid up Current assets , Loans

capital : and advances:

10,000 10% redeemable 1,00,000 Inventory 25,000

preference shares of ₹ 10 each

10,000 equity shares of ₹ 10 each 1,00,000 Debtors 25,000

2,00,000 Cash and bank 50,000

balances

Reserves and surplus : Misc. Exp. To the extent 20,000

not written off

General reserve 1,20,000

Securities premium 70,000

Profit and loss A/c 18,500

Current liabilities & provisions 11,500

Total 4,20,000 Total 4,20,000

For the current financial year, the company made a net profit of ₹ 15,000 after providing ₹

20,000 depreciation and writing off miscellaneous expenditure of ₹ 20,000.

The following additional information is available with regard to company's operations-

1. Preference dividend for the current year ended 31st March was paid before the end of the

year.

2. Except cash and Bank, other current assets and current liabilities as at the end of the year

was the same as at the beginning of the Year.

Contact - 9228446565 www.konceptca.com info@konceptca.com

3. The company redeemed the preference shares at a premium of 10%. Assume that securities

premium A/c is usable for providing the premium on redemption of preference shares.

4. The company issued bonus shares of one share for every equity share held as at the end of

the year.

5. To meet the cash requirements of redemption, the company sold a portion of the

Investments, so as to leave a minimum balance of ₹ 30,000 after such Redemption.

6. Investments was sold at 90% of cost as at the end of the year.

You are required to :

1. Prepare necessary journal entries to record redemption and issue of Bonus shares.

2. Prepare the cash & bank A/c.

3. Prepare the balance sheet as at the end of the year incorporating the above transactions.

Solution:

1. Cash and bank A/c

Receipts ₹ Payments ₹

To balance b/d 50,000 By preference dividend 10,000

(opening balance) ( paid ) ( 1,00,000 × 10% )

To cash from operations: By preference shareholders 1,10,000

( redemption )

Profit for the year 15,000 By balance c/d 30,000

( required balance ) ( given )

Add: depreciation 20,000

Misc. Exp. written off 20,000 55,000

To investments 45,000

(balancing fig)

Total 1,50,000 Total 1,50,000

Note: To maintain a minimum balance of ₹ 30,000 , the company has to realise ₹ 45,000 from

sale of investments.

2. Computation of Investments

Particulars ₹

Book value of total investments ( before considering sale of Investments ) at year 1,00,000

beginning

Less : cost of investments sold ( sale proceeds = 90% of cost = to ₹ 45,000, hence cost = (50,000)

Cost of investments on hand at the end of the year 50,000

Market value ( 90% of 50,000 ) 45,000

3. Journal entries in the books of Maheshwar Ltd.

Particulars Dr.(₹) Cr.(₹)

1. 10% redeemable preference share capital A/c Dr. 1,00,000

Premium on redemption of preference shares A/c Dr. 10,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

To preference shareholders A/c 1,10,000

(Being the balance outstanding in 10% preference share

capital and 10% premium on redemption transferred to

preference shareholders A/c)

2. General reserve A/c Dr. 1,00,000

To Capital redemption reserve A/c 1,00,000

( Being capital redemption reserve created , to the extent of

redemption not financed through proceeds of equity issue )

3. Bank A/c Dr. 45,000

Profit and loss A/c Dr. 5,000

To investments A/c 50,000

( Being amount realised on sale of investments and loss

thereon adjusted. Loss = Sale of value ₹ 45,000 less cost of

investments sold ₹ 50,000) (refer WN 1,2)

4. Profit and loss A/c Dr. 10,000

To preference dividend A/c 10,000

( Being preference dividend payable of the Year )

5. Preference dividend A/c Dr. 10,000

To bank A/c 10,000

(Being preference dividend paid to preference shareholders )

6. Securities premium A/c Dr. 10,000

To premium on redemption of preference shares A/c 10,000

(Being premium on redemption of preference shares, provided

out of securities premium )

7. Preference shareholders A/c Dr. 1,10,000

To bank A/c 1,10,000

(Being payment made to preference shareholders, on

redemption )

8. Capital redemption reserve A/c Dr. 1,00,000

To bonus to equity shareholders A/c 1,00,000

(Being amount appropriated for issuing bonus shares in the

ratio 1: 1 )

9. Bonus to equity shareholders A/c Dr. 1,00,000

To equity share capital A/c 1,00,000

(Being allotment of 10,000 equity shares of ₹ 10 each, by way

of Bonus shares )

4. Profit and loss A/c of Maheshwar Ltd for the year ended 31st March

Contact - 9228446565 www.konceptca.com info@konceptca.com

Particulars ₹ Particulars ₹

To loss on sale of Investments 5,000 By balance b/d (Operating 18,500

balance)

To preference dividend paid 10,000 By profit for the year 15,500

To balance c/d (balancing figure) 18,500

Total 33,500 Total 33,500

Note: as per schedule III requirements, appropriations are to be shown in the notes , i.e.

schedule of reserves and surplus. However , in the above situation , these are shown in the P&L

A/c itself, for ease of computation.

5. Balance sheet of Maheshwar Limited as at the end of the year (after Redemption)

Note This year Prev. Yr.

I EQUITY AND LIABILITIES :

1. Shareholders’ funds :

a. Share capital 1 2,00,000

b. Reserves and surplus 2 98,500

2. Current liabilities : - Trade payables 11,500

Total 3,10,000

II ASSETS

1. Non-current assets

a. Fixed assets 3 1,80,000

b. Non-current investments ( Market value ₹ 50,000

45,000)

2. Current Assets :

a. Inventories (same as at beginning) 25,000

b. Trade receivables (same as at beginning) 25,000

c. Cash and cash equivalents 30,000

Total 3,10,000

Note 1: Share capital

Particulars This year Prev. Yr.

Authorised: . . . . . . . . Equity shares of . . . . . . . each & . . . . . . . . References

of . . . . . . . . . each

Issued, subscribed and paid up : 20000 equity shares of ₹ 10 each 2,00,000

( incl. 10,000 shares allotted as bonus shares by capitalising Capital

redemption reserve )

Total 2,00,000

Reconciliation of number and amount of shares (all figures for this year)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Particulars Equity shares of ₹ 10 each Pref. Shares of ₹ 10 each

Number Amt ₹ Number Amt ₹

Opening balance 10,000 2,00,000 10,000 1,00,000

Add : fresh issue 10,000 2,00,000

Less : - - (10,000) (1,00,000)

redemption /

buyback

Closing balance 20,000 4,00,000 - -

Note 2: Reserves and surplus (showing appropriations and transfers)( all figures for this year )

Particulars Opg. Bal. Additions Deductions Clg. Bal.

Capital redemption reserve - Tfr from Gen. Res Bonus to shareholders = Nil

= 1,00,000 1,00,000

Securities premium A/c 70,000 PSC Redemption premium 60,000

= 10,000

Other reserves (gen. res.) 1,20,000 Tfr to CRR = 1,00,000 20,000

Surplus (P&L A/c) 18,500 Details in WN 4 = Details in WN 4 = 15,000 18,500

15,000

Total 2,08,500 1,15,000 2,25,000 98,500

Note 3 : Fixed assets

Item Gross block / Cost Depreciation Net block / WDV

Opg. Addns/ Clg Bal Opg. Curre Clg. Bal. As at Yr As at Yr

Bal. (dedns) Bal. nt beginning end

year

dep.

Column 1. 2. 3 = 1±2 4. 5 6 = 4±5 7 = 1-4 8 = 3-6

Fixed 3,00,000 - 3,00,000 1,00,000 20,000 1,20,000 2,00,000 1,80,000

assets

Question 5.

Contact - 9228446565 www.konceptca.com info@konceptca.com

The following is the balance sheet of Mrida Limited as at 31st March:

Equity and liabilities ₹ Assets ₹

Authorised capital: Fixed assets ( net ) 7,80,000

50,000 equity shares of ₹ 10 each 5,00,000 Investments ( market value ₹ 4,90,000

5,80,000)

10,000 preference shares of ₹ 100 10,00,000 Deferred tax assets 3,40,000

each

Issued subscribed and paid up : 15,00,000 Sundry debtors 6,20,000

30,000 equity shares of ₹ 10 each 3,00,000 Cash and Bank balances 2,80,000

5,000 redeemable 8%preference 5,00,000 Preliminary expenses 1,40,000

shares of ₹ 100 each

Reserves and surplus :

Securities premium 6,00,000

General reserve 6,50,000

Profit and loss A/c 1,80,000

2,500 9 % debentures of ₹ 100 each 2,50,000

Sundry creditors 1,70,000

Total 26,50,000 Total 26,50,000

In the Annual General Meeting held on 20th June, the company was the following resolution:

1. To split equity shares of ₹ 10 each into 5 equity shares of ₹ 2 each from 1st July.

2. To redeem 8 % preference shares at a premium of 5%.

3. To redeem 9% debentures by making offer to debenture holders to convert their Holdings

into equity shares at ₹ 10 per share or accept cash on Redemption.

4. To issue fully paid bonus shares in the ratio of one equity share for every three shares held

on record date.

On 10th July, investments were sold for ₹ for 55,000 and preference shares were redeemed.

40% of debenture holders exercise their option to accept cash and their claims for settled on 1st

August. The company fixed 5th September as record date and bonus issue was concluded by

12th September. You are requested to journalise the above transactions including cash

transactions and prepare a summary balance sheet as a 30th September. Assume that securities

premium A/c is usable for providing the premium on redemption of preference shares.

Solution:

1. Journal entries in the books of Mrida Limited

Date Particulars Dr.(₹) Cr.(₹)

1st July Equity share capital A/c ( ₹ 10 ) Dr. 3,00,000

To equity share capital A/c ( ₹ 2 ) 3,00,000

(Being existing 30,000 equity shares of ₹ 10 is split

into 30,000 × 5 = 1,50,000 Equity shares of ₹ 2

each )

10th July Cash and bank A/c Dr. 5,55,000

To Investments A/c 4,90,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

To profit on sale of investments A/c 65,000

(Being investment sold at a profit )

10th July Redeemable 8% preference share capital A/c Dr. 5,00,000

Premium on redemption of preference shares A/c Dr. 25,000

To preference shareholders A/c 5,25,000

(Being share value and 5% premium on

redemption transferred to shareholders )

10th July Securities premium A/c Dr. 25,000

To premium on redemption of preference 25,000

shares A/c

(Being premium on redemption provided out of

securities premium A/c )

10th July Preference shareholders A/c Dr. 5,25,000

To bank A/c 5,25,000

(Being preference shareholders paid )

10th July Profit and loss A/c Dr. 1,80,000

General reserve A/c Dr. 3,20,000

To capital redemption reserve A/c 5,00,000

( Being transferred to CRR out of profits, an

amount equal to the nominal value of preference

shares redeemed )

1st Aug 9% debentures A/c Dr. 2,50,000

To debenture holders A/c 2,50,000

( Being amount payable transfer to debenture

holders )

1st Aug Debenture holders A/c Dr. 2,50,000

To cash and bank A/c (₹ 2,50,000 × 40%) 1,00,000

To equity share capital A/c ( ₹ 2 ) 30,000

To securities premium A/c 1,20,000

( Being settlement made to debenture holders by

way of cash 40% and allotment of equity shares for

balance 60% ) [Note: number of shares allotted = ₹

1,50,000 ÷ ₹ 10 per share (issue price) = 15,000

equity shares of face value of ₹ 2 . The split of

equity shares is applicable for all the potential

equity shares]

12th Sept Capital redemption reserve A/c Dr. 1,50,000

To bonus to equity shareholders A/c 1,50,000

(Being amount appropriated for issue of Bonus

shares )

12th Sept Bonus to equity shareholders A/c. ( 75,000 × 2) Dr. 1,50,000

To equity share capital A/c ( ₹ 2 ) 1,50,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

(Being 75,000 bonus shares allotted in the ratio of

1:3 )(2,25,000 shares ÷ 3)

30th Sept Profit and loss A/c Dr. 1,40,000

To preliminary expenses 1,40,000

(Being preliminary expenses written off )

Note: Alternatively, the balance in preliminary expenses A/c can be retained without Being

written off , and shown on the assets side, but it is not recommended since it does not constitute

an “Asset” as such. So, it is fully written off in the above solution.

2. Summary balance sheet of Mrida Ltd. as at 30th September (after above transactions)

Particulars Note This year Prev. Yr.

I EQUITY AND LIABILITIES :

1. Shareholders’ funds :

a. Share capital 1 4,80,000

b. Reserves and surplus 2 13,00,000

2. Current liabilities :

Trade payables. - sundry creditors 1,70,000

Total 19,50,000

II ASSETS

1. Non-current assets

a. Fixed assets 7,80,000

b. Deferred tax asset ( net ) 3,40,000

2. Current assets :

a. Trade receivables 6,20,000

b. Cash and cash equivalents (₹ 2,80,000 + ₹ 2,10,000

5,55,000 - ₹ 5,25,000 - ₹ 1,00,000)

Total 19,50,000

Note 1 : Share capital

Particulars This year Prev. Yr.

Authorised

2,50,000 equity shares of ₹ 2 each 5,00,000

…….preference shares of …… each

Issued ,subscribed & paid up :

2,40,000 equity shares of Rs 2 each 4,80,000

(Of the above 7,500 shares of ₹ 2 are issued as bonus shares for

non-cash consideration )

Total 4,80,000

Reconciliation of Number and Amount of Shares (all figures for this year)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Particulars Equity shares of ₹ 2 each Pref. Shares of ₹ 100 each

Number Amt ₹ Number Amt ₹

Opening balance (Note) 1,50,000 3,00,000 5,000 5,00,000

Add: fresh issue (bonus) 15,000 30,000

Conversion of debentures 75,000 1,50,000

Less: Redemption/buyback - - (5,000) (5,00,000)

Closing balance 2,40,000 4,80,000 - -

Note: During the, equity shares of ₹ 10 split have been into 5 equity shares of ₹ to each ( 30,000

shares × 5 )

Note 2: Reserves and Surplus (showing appropriations and transfers) (all figures for this year )

Particulars Opg. Bal. Additions Deductions Clg.Bal.

Tfr to P&L = Bonus to 3,50,000

Capital Redemption - 1,80,000 shareholders =

reserve 1,50,000

Tfr to GR =

3,20,000

Securities premium 6,00,000 1,20,000 PSC Redemption 6,95,000

A/c premium = 25,000

General reserve 6,50,000 - Tfr to CRR = 3,30,000

3,20,000

Surplus (P&L A/c) 1,80,000 Invts sold at Pft = Tfr to CRR =

65,000 1,80,000 (75,000)

Prelim. Exps w/off

= 1,40,000

Total 14,30,000 6,85,00 8,15,000 13,00,000

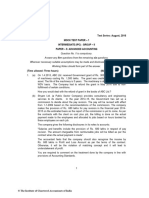

Question 6.

Hinduja Company Ltd. had 5,000, 8% Redeemable Preference Shares of `100 each, fully paid up.

The company decided to redeem these preference shares at par by the issue of sufficient

number of equity shares of `10 each fully paid up at par. You are required to pass necessary

Journal Entries including cash transactions in the books of the company.

Solution:

In the books of Hinduja Company Ltd.

Journal Entries

Particulars Dr. (`) Cr. (`)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Bank A/c Dr. 5,00,000

To Equity Share Capital A/c 5,00,000

(Being the issue of 50,000 Equity Shares of `10 each at par for the

purpose of redemption of preference shares, as per Board

Resolution No ……..dated……..)

8% Redeemable Preference Share Capital A/c Dr. 5,00,000

To Preference Shareholders A/c 5,00,000

(Being the amount payable on redemption of preference shares

transferred to Preference Shareholders Account)

Preference Shareholders A/c Dr. 5,00,000

To Bank A/c 5,00,000

(Being the amount paid on redemption of preference shares)

Question 7.

C Ltd. had 10,000, 10% Redeemable Preference Shares of `100 each, fully paid up. The company

decided to redeem these preference shares at par, by issue of sufficient number of equity shares

of `10 each at a premium of `2 per share as fully paid up. You are required to pass necessary

Journal Entries including cash transactions in the books of the company.

Solution:

In the books of C Ltd.

Journal Entries

Particulars Dr. (`) Cr. (`)

Bank A/c Dr. 12,00,000

To Equity Share Capital A/c 10,00,000

To Securities Premium A/c 2,00,000

(Being the issue of 1,00,000 Equity Shares of `10 each at a

premium of ` 2 per share as per Board’s Resolution No…..

dated……….)

10% Redeemable Preference Share Capital A/c Dr. 10,00,000

To Preference Shareholders A/c 10,00,000

(Being the amount payable on redemption of preference

shares transferred to Preference Shareholders A/c)

Preference Shareholders A/c Dr. 10,00,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

To Bank A/c 10,00,000

(Being the amount paid on redemption )

Note: Amount required for redemption is `10,00,000. Therefore, face value of equity shares to

be issued for this purpose must be equal to `10,00,000. Premium received on new issue cannot be

used to finance the redemption.

Question 8.

The Board of Directors of a Company decide to issue minimum number of equity shares of `9 to

redeem `5,00,000 preference shares. The maximum amount of divisible profits available for

redemption is `3,00,000. Calculate the number of shares to be issued by the company to ensure

that provisions of Section 55 are not violated. Also determine the number of shares if the

company decides to issue shares in multiples of `50 only.

Solution:

Nominal value of preference shares = `5,00,000

Maximum possible redemption out of profits = `3,00,000

Minimum proceeds of fresh issue = `5,00,000 - 3,00,000 =`2,00,000

Proceed of one share = `9

2,00,000

Minimum Number of Shares = 9

= 22,222.22 shares

As fractional shares are not permitted, the minimum number of shares to be issued is 22,223

shares.

If shares are to be issued in multiples of 50, then the next higher figure which is a multiple of 50

is 22,250. Hence, minimum number of shares to be issued in such a case is 22,250 shares.

Question 9.

The Balance Sheet of X Ltd. as on 31st March, 20X3 is as follows:

Contact - 9228446565 www.konceptca.com info@konceptca.com

Particulars Amount

EQUITY AND LIABILITIES

1. Shareholders’ funds

a Share capital 2,90,000

b Reserves and Surplus 48,000

2. Current liabilities

Trade Payables 56,500

3,94,500

Total

ASSETS

1. Fixed Assets

Tangible asset 3,45,000

Non-current investments 18,500

2. Current Assets

Cash and cash equivalents (bank) 31,000

3,94,500

Total

The share capital of the company consists of `50 each equity shares of `2,25,000 and `100 each

Preference shares of `65,000(issued on 1.4.20X1). Reserves and Surplus comprises Profit and

Loss Account only.

In order to facilitate the redemption of preference shares at a premium of 10%, the Company

decided:

(a) to sell all the investments for `15,000.

(b) to finance part of redemption from company funds, subject to, leaving a bank balance

of `12,000.

(c) to issue minimum equity share of `50 each at a premium of `10 per share to raise the

balance of funds required.

You are required to pass:

The necessary Journal Entries to record the above transactions and prepare the balance sheet as

on completion of the above transactions.

Solution:

Particulars Dr. (`) Cr. (`)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Bank A/c Dr. 37,500

To Share Application A/c 37,500

(For application money received on 625 shares @ ` 60 per share)

Share Application A/c Dr. 37,500

To Equity Share Capital A/c 31,250

To Securities Premium A/c 6,250

(For disposition of application money received)

Preference Share Capital A/c Dr. 65,000

Premium on Redemption of Preference Shares A/c Dr. 6,500

To Preference Shareholders A/c 71,500

(For amount payable on redemption of preference shares)

Profit and Loss A/c Dr. 6,500

To Premium on Redemption of Preference Shares A/c 6,500

(For writing off premium on redemption out of profits)

Bank A/c Dr. 15,000

Profit and Loss A/c (loss on sale) A/c Dr. 3,500

To Investment A/c 18,500

(For sale of investments at a loss of `3,500)

Profit and Loss A/c Dr. 33,750

To Capital Redemption Reserve A/c 33,750

(For transfer to CRR out of divisible profits an amount equivalent

to excess of nominal value of preference shares over proceeds (face

value of equity shares) i.e., ` 65,000 - ` 31,250)

Preference Shareholders A/c Dr. 71,500

To Bank A/c 71,500

(For payment of preference shareholders)

Balance Sheet (after redemption)

Da Particulars Notes (`)

te No.

EQUITY AND LIABILITIES

1. Shareholders’ funds

a) Share capital 1 2,56,250

b) Reserves and Surplus 2 44,250

Current liabilities

2. Trade Payables 56,500

Total 3,57,000

ASSETS

Contact - 9228446565 www.konceptca.com info@konceptca.com

1. Fixed Assets

Tangible asset 3,45,000

2. Current Assets

Cash and cash equivalents (bank) 3 12,000

Total 3,57,000

Notes to accounts

Particulars Amount

1. Share Capital

Equity share capital (2,25,000 + 31,250) 2,56,250

2. Reserves and Surplus

Capital Redemption Reserve 33,750

Profit and Loss Account (48,000 – 6,500 – 3,500 – 33,750) 4,250

Security Premium 6,250

44,250

3. Cash and cash equivalents

Balances with banks (31,000 + 37,500 +15,000 – 71,500) 12,000

Working Note:

Calculation of number of shares:

Amount payable on redemption 71,500

Less: Sale price of investment (15,000)

56,500

Less: Available bank balance (31,000 – 12,000) 19,000

Funds from fresh issue 37,500

No. of shares = 37,500 / 60 = 625 shares

Question 10.

The following are the extracts from the Balance Sheet of ABC Ltd. as on 31st December, 20X1.

Share capital:

40,000 Equity shares of `10 each fully paid – `4,00,000;

1,000 10% Redeemable preference shares of `100 each fully paid – `1,00,000.

Reserve & Surplus:

Contact - 9228446565 www.konceptca.com info@konceptca.com

Capital reserve – `50,000;

Securities premium – `50,000;

General reserve –`75,000;

Profit and Loss Account – `35,000

On 1st January 20X2, the Board of Directors decided to redeem the preference shares at par by

utilisation of reserve.

You are required to pass necessary Journal Entries including cash transactions in the books of

the company.

Solution:

In the books of ABC Limited Journal Entries

Date Particulars Dr. (`) Cr. (`)

20X2

Jan 1 10% Redeemable Preference Share Capital A/c Dr. 1,00,000

To Preference Shareholders A/c 1,00,000

(Being the amount payable on redemption transferred to

Preference Shareholders Account)

Preference Shareholders A/c Dr. 1,00,000

To Bank A/c 1,00,000

(Being the amount paid on redemption of preference

shares)

General Reserve A/c Dr. 75,000

Profit & Loss A/c Dr. 25,000

To Capital Redemption Reserve A/c 1,00,000

(Being the amount transferred to Capital Redemption

Reserve Account as per the requirement of the Act)

Note: Securities premium and capital reserve cannot be utilised for transfer to Capital

Redemption Reserve.

Question 11.

C Limited had 3,000, 12% Redeemable Preference Shares of `100 each, fully paid up. The company

had to redeem these shares at a premium of 10%.

It was decided by the company to issue the following:

(i) 25,000 Equity Shares of `10 each at par,

(ii) 1,000 14% Debentures of `100 each.

The issue was fully subscribed and all amounts were received in full .The payment was duly

made. The company had sufficient profits. Show Journal Entries in the books of the company.

Contact - 9228446565 www.konceptca.com info@konceptca.com

Solution:

In the books of C Limited

Journal Entries

Particulars Dr. (`) Cr. (`)

Bank A/c Dr. 2,50,000

To Equity Share Capital A/c 2,50,000

(Being the issue of 25,000 equity shares of `10 each at par as

per Board’s resolution No……dated…..)

Bank A/c Dr. 1,00,000

To 14% Debenture A/c 1,00,000

(Being the issue of 1,000 Debentures of ` 100 each as per

Board’s Resolution No…..dated……)

12% Redeemable Preference Share Capital A/c Dr. 3,00,000

Premium on Redemption of Preference Shares A/c Dr. 30,000

To Preference Shareholders A/c 3,30,000

(Being the amount payable on redemption transferred to

Preference Shareholders Account)

Preference Shareholders A/c Dr. 3,30,000

To Bank A/c 3,30,000

(Being the amount paid on redemption of preference

shares)

Profit & Loss A/c Dr. 30,000

To Premium on Redemption of Preference Shares A/c 30,000

(Being the adjustment of premium on redemption against

Profits & Loss Account)

Profit & Loss Dr. 50,000

To Capital Redemption Reserve A/c 50,000

(Being the amount transferred to Capital Redemption Reserve

Account as per the requirement of the Act)

Question 12.

The capital structure of a company consists of 20,000 Equity Shares of `10 each fully paid up

and 1,000 8% Redeemable Preference Shares of `100 each fully paid up (issued on 1.4.20X1).

Undistributed reserve and surplus stood as: General Reserve `80,000; Profit and Loss Account

`20,000; Investment Allowance Reserve out of which `5,000, (not free for distribution as

dividend) `10,000; Securities Premium `2,000, Cash at bank amounted to `98,000. Preference

shares are to be redeemed at a Premium of 10% and for the purpose of redemption, the

directors are empowered to make fresh issue of Equity Shares at par after utilising the

undistributed reserve and surplus, subject to the conditions that a sum of `20,000 shall be

retained in general reserve and which should not be utilised.

Contact - 9228446565 www.konceptca.com info@konceptca.com

Pass Journal Entries to give effect to the above arrangements and also show how the relevant

items will appear in the Balance Sheet of the company after the redemption carried out.

Solution:

In the books of ……….

Journal Entries

Particulars Dr. (`) Cr. (`)

Bank A/c Dr. 25,000

To Equity Share Capital A/c 25,000

(Being the issue of 2,500 Equity Shares of ` 10 each at a premium of

Re. 1 per share as per Board’s Resolution No….. dated…….)

8% Redeemable Preference Share Capital A/c Dr. 1,00,000

Premium on Redemption of Preference Shares A/c Dr. 10,000

To Preference Shareholders A/c 1,10,000

(Being the amount paid on redemption transferred to Preference

Shareholders Account)

Preference Shareholders A/c Dr. 1,10,000

To Bank A/c 1,10,000

(Being the amount paid on redemption of preference shares)

Profit & Loss A/c Dr. 10,000

To Premium on Redemption of Preference Shares A/c 10,000

(Being the premium payable on redemption is adjusted against

Profit & Loss Account)

General Reserve A/c Dr. 60,000

Profit & Loss A/c Dr. 10,000

Investment Allowance Reserve A/c Dr. 5,000

To Capital Redemption Reserve A/c 75,000

(Being the amount transferred to Capital Redemption Reserve

Account as per the requirement of the Act)

Balance sheet as on….[extracts]

Date Particular Notes No. (₹)

EQUITY AND LIABILITIES

1. Shareholders’ funds

(a) Share Capital 1 2,25,000

(b) Reserve and surplus 2 1,02,000

Total ?

Assets

2. Current assets

Cash and Cash equivalanets 13,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

(98,000+25,000-1,10,000)

Total ?

Notes to accounts:

1. Share Capital

22,500 Equity shares (20,000+25,000) of ₹ 10 each fully paid up 2,25,000

2. Reserves and Surplus 20,000

General reserve 2,000

Securities Premium 75,000

Capital redemption reserve 5,000

Investment allowance reserve 1,02,000

Working Note:

No. of Shares to be issued for redemption of preference Shares :

Face value of share redeemed ₹1,00,000

Less: Profit available for Distribution as dividend:

General reserve: ₹ (80,000-20,000) ₹60,000

Profit & Loss (20,000-10,000 set aside for adjusting Premium ₹10,000

payable on redemption of preference shares)

Investment allowance reserve: (₹ 10,000-5,000) ₹ 5,000 (₹ 75,000)

₹ 25,000

Therefore, no. of shares to be issued = 25,000/ 10 =2,500 shares

Question 13.

The books of B Ltd. showed the following balance on 31st December, 20X3:

30,000 Equity shares of ₹ 10 each fully paid; 18,000 12% redeemable preference shares of ₹ 10

each fully paid, ; 4,000 10% redeemable Preference shares of ₹ 10 each, ₹ 8 paid up (all shares

issued on 1st April 20X2)

Undistributed reserve and surplus stood as: profit and Loss account ₹ 80,000; General Reserve ₹

1,20,000; securities Premium account ₹ 15,000 and Capital Reserve ₹ 21,000.

Preference shares are redeemed on 1st January, 20X1 at a Premium of ₹ 2 per share. The

whereabouts of the holders of 100 shares of 10 each fully paid are not known.

For redemption, 3000 equity shares of ₹ 10 each are issued at 10% Premium. At the same time,

a bonus issue of equity shares was made at par, two shares being issued for the every five held

on that date out of the capital redemption reserve Account.

Show the necessary journal entries to record the transactions.

Contact - 9228446565 www.konceptca.com info@konceptca.com

Solution:

In The Books of B Limited Journal Entries

Date Particulars Dr. (₹) Cr. (₹)

20X1

Jan

12% redeemable Preference share capital A/c Dr. 1,80,000

Premium on redemption of preference shares A/c Dr. 36,000

To Preference Share Holder A/c 2,16,000

(Being the amount payable on redemption of 18,000

12% Redeemable preference shares transferred to

shareholders account)

Preference shareholders A/c Dr. 2,14,800

To Bank A/c 2,14,800

(Being the amount paid on redemption of 17,900

preference share)

Bank a/c Dr. 33,000

To Equity share Capital A/c 30,000

To Securities Premium A/c 3,000

(Being the issue of 3,000 equity shares of ₹ 10 each at a

premium of 10% as per board’s Resolution No. ….Dates)

General reserve A/c Dr. 1,20,000

Profit & Loss A/c Dr. 30,000

To capital redemption Reserve A/c 1,50,000

(Being the amount transferred to capital redemption

Reserve A/c as per the requirement off the act.)

Capital redemption Reserve A/c Dr. 1,20,000

To Bonus to shareholders A/c 1,20,000

(Being the amount appropriated for issue of bonus

share in the ratio of 5:2 as per shareholders Resolution

No….dated…)

Bonus to shareholders A/c Dr. 1,20,000

1,20,000

To Equity share Capital A/c

(Being the utilization of bonus dividend for issue of

12,000 equity shares of ₹ 10 each fully paid)

Profit & Loss A/c Dr. 36,000

To Premium on Redemption of Preference shares 36,000

(Being premium on redemption of preference shares

adjusted against to profit & Loss account)

Working Note:

(1) Partly paid-up preference shares cannot be redeemed.

(2) Amount to be transferred to capital redemption Reserve Account.

Contact - 9228446565 www.konceptca.com info@konceptca.com

Face Value of share to be redeemed ₹ 1,80,000

Less: Proceeds from fresh issue (excluding premium) (₹ 30,000)

₹ 1,50,000

(3) No bonus shares on 3,000 equity shares issued for redemption.

Question 14.

The following is the summarized Balance sheet of Bumbum Limited as at 31st March, 20X1:

₹

Source of Fund

Authorized capital

50,000 equity shares of ₹ 10 each 5,00,000

10,000 preference shares of ₹ 100 each (8% redeemable) 10,00,000

15,00,000

Issued, Subscribed and paid up

30,000 equity shares of ₹ 10 each 3,00,000

5,000, 8% Redeemable Preference shares of ₹ 100 each 5,00,000

Reserve & surplus

Securities Premium 6,00,000

General Reserve 6,50,000

Profit and Loss A/c 40,000

2,500, 9% Debentures of ₹ 100 each 2,50,000

Trade payables 1,70,000

25,10,000

Application of Funds

Fixed assets (net) 7,80,000

Investments (Market Value ₹ 5,80,000) 4,90,000

Deferred Tax Assets 3,40,000

Trade receivables 6,20,000

Cash & bank balance 2,80,000

25,10,000

In annual General Meeting held on 20th June, 20X1 the company passed the following

resolutions:

(i) To split Equity share of ₹ 10 each into 5 equity shares of ₹ 2 each from 1st July.

(ii) To redeem 8% preference shares at a Premium of 5%

(iii) To redeem 9% debentures by making offer to debenture Holders to convert their

holdings into equity shares at ₹ 10 per share or accept cash on redemption.

(iv) To issue fully paid Bonus shares in the ratio of one equity share for every 3 shares

held on record date.

On 10th July, 20X1 investments were sold for ₹ 5,55,000 and preference shares were

redeemed.

40% of Debenture Holders exercised their option to accept cash and their claims were

settled on 1st august, 20X1.

You are requested to journalize the above transactions including cash transactions and

prepare Balance sheet as at 30th September, 20X1. All working notes should form part of

your answer.

Contact - 9228446565 www.konceptca.com info@konceptca.com

Solution:

Bumbum Limited

Journal Entries

Date Particulars Dr. (₹) Cr. (₹)

20X1

June 1 Equity Share Capital A/c (₹ 10 each) Dr. 3,00,000

To Equity share Capital A/c (₹ 2 each) 3,00,000

(Being equity share of ₹ 10 each splitted into 5 equity

shares of ₹ 2 each) {1,50,000×2}

July 10 Cash & Bank balance A/c Dr. 5,55,000

To Investment A/c 4,90,000

To Profit & Loss A/c 65,000

(being investment sold out and profit on sale credited to

profit & Loss A/c)

July 10 8% redeemable Preference share capital A/c Dr. 5,00,000

Premium on redemption of preference share A/c Dr. 25,000

To Preference shareholders A/c 5,25,000

(being amount payable to preference shareholders on

redemption) (Refer W.N. 1)

July 10 Preference shareholders A/c Dr. 5,25,000

To Cash & Bank A/c 5,25,000

(Being amount paid to preference shareholders on

redemption)(refer w.n. 1)

July 10 General reserve A/c Dr. 5,00,000

To capital redemption reserve A/c 5,00,000

(Being amount equal to nominal value of preference

shares transferred to capital Redemption Reserve A/c on

its redemption as per the law)

Aug 1 9% debentures a/c Dr. 2,50,000

Interest on Debentures A/c (2,50,000 × 9% × 4/12) Dr. 7,500

To Debenture holders A/c 2,57,500

(being claims of debenture holders along with interest

payable)

Aug 1 Debenture holders A/c Dr. 2,57,500

To cash & Bank A/c (1,00,000 + 7,500) 1,07,500

To Equity share capital A/c (15,000×2) 30,000

To Security Premium A/c (15,000×8) 1,20,000

(Being claims of debenture holders satisfied) refer W.N.2)

Sep. 5 Capital Redemption Reserve A/c Dr. 1,10,000

To bonus to shareholders A/c 1,10,000

(Being balance in capital redemption reserve capitalized

to issue bonus shares)(refer W.N.3)shares of ₹

Contact - 9228446565 www.konceptca.com info@konceptca.com

Sep.12 Bonus to shareholders a/c Dr. 1,10,000

To equity share capital A/c 1,10,000

(being 55,000 fully paid equity shares of ₹ 2 each issued

as bonus in ratio of 1 share for every 3 shares held)

Sep. General reserve a/c Dr. 25,000

30

To Premium on redemption of preference shares A/c 25,000

(being premium on preference shares adjusted from

general reserve)

Sep. Profit & Loss A/c Dr. 7,500

30

To interest on debentures A/c 7,500

(Being interest on debentures transferred to profit and

loss account)

Balance sheet as at 30th September, 20X1

Particulars Notes ₹

Equity & Liabilities

1 Shareholders’ funds

a Share Capital 1 4,40,000

b Reserves and Surplus 2 13,32,500

2 Current Liabilities

Trade payable 1,70,000

Total 19,42,500

Assets

1 Non-current assets

a Fixed assets

Tangible assets 7,80,000

b Deferred tax assets 3,40,000

2 Current assets -

Trade receivables 6,20,000

Cash and Bank balances (W.N. 4) 2,02,500

Total 19,42,500

Notes to accounts

1. Share capital ₹ ₹

Authorised share capital

2,50,000 Equity shares of ₹ 2 each 5,00,000

10,000 Preference shares of ₹ 100 each 10,00,000 15,00,000

Issued, subscribed and paid up

2,20,000 Equity shares of ₹ 2 each 4,00,000

[(30,000×5)+15,000+55,000]

2. Reserves and surplus

Securities premium a/c

Balance as per balance sheet 6,00,000

Add: Premium on equity shares issued on conversion of 1,20,000 7,20,000

debentures (15,000×8)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Capital Redemption Reserve (5,00,000-1,10,000) 3,90,000

General Reserve (6,50,000-5,00,000-25,000) 1,25,000

Profit & Loss A/c 40,000

Add: Profit on sale of investment 65,000

Less: Interest on debentures (7,500) 94,500

Total 13,32,500

Working Note:

Particulars ₹

1. Redemption of preference share:

5,000 preference shares of ₹ 100 each 5,00,000

Premium on redemption @5% 25,000

Amount payable 5,25,000

2. Redemption of debentures

2,500 debentures of ₹ 100 each 2,50,000

Less: cash option exercised by 40% holders (1,00,000)

Conversion option exercised by remaining 60% 1,50,000

Equity shares issued on conversion = 1,50,000/10=15,000 shares

3. Issue of Bonus shares

Existing Equity shares after split (30,000×5) 1,50,000

shares

Equity shares issued on conversion 15,000 shares

Equity shares entitled for bonus 1,65,000

shares

Bonus shares (1 share for every 3 shares held) to be issued 55,000 shares

4. Cash and Bank Balance

Balance as per balance sheet 2,80,000

Add: Realization on sale of investment 5,55,000

8,35,000

Less: Paid to preference share holders (5,25,000)

Paid to Debenture holders (7,500+1,00,000) (1,07,500)

Balance 2,02,500

5. Interest of ₹ 7,500 paid to debenture holders have been debited to

profit & Loss Account.

Contact - 9228446565 www.konceptca.com info@konceptca.com

You might also like

- Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice QuestionsDocument26 pagesChapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice Questionsnikhil diwan75% (4)

- 5 Internal ReconstructionDocument31 pages5 Internal ReconstructionHariom PatidarNo ratings yet

- 9 Bonus and Right IssueDocument4 pages9 Bonus and Right IssueRohith KumarNo ratings yet

- 616806cf0cf2b988fbcdbd97 OriginalDocument20 pages616806cf0cf2b988fbcdbd97 OriginalTM GamingNo ratings yet

- College Test 09-05-2011Document2 pagesCollege Test 09-05-2011naeem_abidNo ratings yet

- Financial Accounting and Analysis (FIN 1101) Area: Accounts and Finance Program: PGDM Term: I (June - September, 2019) Session 12: EquityDocument21 pagesFinancial Accounting and Analysis (FIN 1101) Area: Accounts and Finance Program: PGDM Term: I (June - September, 2019) Session 12: EquityYASH BATRANo ratings yet

- 3526 - 25114 - Textbooksolution - PDF 3Document108 pages3526 - 25114 - Textbooksolution - PDF 3dhanuka jiNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedNo ratings yet

- Problems On Redemption of Pref SharesDocument7 pagesProblems On Redemption of Pref SharesYashitha CaverammaNo ratings yet

- Internal ReconstructionDocument8 pagesInternal Reconstructionsmit9993No ratings yet

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDocument4 pagesDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNo ratings yet

- UNIT 2 & 4 MergedDocument41 pagesUNIT 2 & 4 MergedRich ManNo ratings yet

- Accounting 2 - Chapter 14 - Notes - MiuDocument4 pagesAccounting 2 - Chapter 14 - Notes - MiuAhmad Osama MashalyNo ratings yet

- Accounting-Bonus Issue and Right-Issue-1653399117076303Document17 pagesAccounting-Bonus Issue and Right-Issue-1653399117076303Badhrinath ShanmugamNo ratings yet

- Board of Studies Academic Capital Structure Questions 1649402823Document6 pagesBoard of Studies Academic Capital Structure Questions 1649402823Arundhathi MNo ratings yet

- Bonus ShareDocument2 pagesBonus ShareArpan CHATTERJEENo ratings yet

- Corporation Is An Artificial Being Created by Operation of LawDocument9 pagesCorporation Is An Artificial Being Created by Operation of Lawhakdogdog432No ratings yet

- Company Account SuggestionDocument34 pagesCompany Account SuggestionAYAN DATTANo ratings yet

- Accounting Redemption of Debentures 1642416359Document19 pagesAccounting Redemption of Debentures 1642416359Shashank SikarwarNo ratings yet

- Corporate Accounts - Entire - IIDocument347 pagesCorporate Accounts - Entire - IIManjunath R IligerNo ratings yet

- CMA Volume 2 MergedDocument153 pagesCMA Volume 2 MergedShyaambhavi NsNo ratings yet

- Accounting For Bonus and Right Issue: Topic - 4Document12 pagesAccounting For Bonus and Right Issue: Topic - 4Naga ChandraNo ratings yet

- 9 Bonus & Right IssueDocument9 pages9 Bonus & Right Issueanilrj14pc8635jprNo ratings yet

- CA Inter Accounts A MTP 1 Nov 2022Document13 pagesCA Inter Accounts A MTP 1 Nov 2022smartshivenduNo ratings yet

- 19013comp Sugans Pe2 Accounting Cp8 5Document12 pages19013comp Sugans Pe2 Accounting Cp8 5Ubaidulla MachingalNo ratings yet

- Chapter-2 - Dividend DecisionsDocument54 pagesChapter-2 - Dividend DecisionsRaunak YadavNo ratings yet

- Sub: Outcome of Board MeetingDocument34 pagesSub: Outcome of Board MeetingarivarasuNo ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- Advanced Financial Accounting-Part 2Document4 pagesAdvanced Financial Accounting-Part 2gundapola83% (6)

- Module 2 Shareholders Equity Students ReferenceDocument7 pagesModule 2 Shareholders Equity Students ReferencecynangelaNo ratings yet

- As 20Document6 pagesAs 20Rajiv JhaNo ratings yet

- Partnership OperationDocument20 pagesPartnership OperationNicole Gole CruzNo ratings yet

- Redemption of Preference Shares IllustrationsDocument6 pagesRedemption of Preference Shares IllustrationsManya GargNo ratings yet

- Corporate AccountingDocument25 pagesCorporate Accountingrakshithaparimala100No ratings yet

- Forfeiture of Shares Cancellation of Shareholders Name From Register of Company Due To Non - Payment of First and Final Call Money On 200 SharesDocument3 pagesForfeiture of Shares Cancellation of Shareholders Name From Register of Company Due To Non - Payment of First and Final Call Money On 200 SharesAarya KhedekarNo ratings yet

- 17269pe2 Sugg June09 1 PDFDocument22 pages17269pe2 Sugg June09 1 PDFSahil GoyalNo ratings yet

- TrailDocument6 pagesTrailNaman agrawalNo ratings yet

- Semester V (Finance) 2018-19Document51 pagesSemester V (Finance) 2018-19anurag chaurasiaNo ratings yet

- AmalDocument7 pagesAmalAkki GalaNo ratings yet

- 12 Accountancy Notes CH07 Company Accounts Issue of Shares 01Document20 pages12 Accountancy Notes CH07 Company Accounts Issue of Shares 01zainab.xf77No ratings yet

- Cost Ofcapital NumericalsDocument6 pagesCost Ofcapital NumericalsKunal GargNo ratings yet

- Internal ReconsrtuctionDocument33 pagesInternal ReconsrtuctionRenuNo ratings yet

- Chapter 1 - Buyback of SecuritiesDocument13 pagesChapter 1 - Buyback of SecuritiesKitrakleog 03052002No ratings yet

- Redemption of Preference SharesDocument15 pagesRedemption of Preference SharesVasu JainNo ratings yet

- Compound Financial Instrument PDFDocument28 pagesCompound Financial Instrument PDFleneNo ratings yet

- Company Acc B.com Sem Iv...Document8 pagesCompany Acc B.com Sem Iv...Sarah ShelbyNo ratings yet

- 19684ipcc Acc Vol2 Chapter2Document0 pages19684ipcc Acc Vol2 Chapter2kevalcharlaNo ratings yet

- Valuation of SharesDocument52 pagesValuation of Sharesarupghosh8090No ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingDocument16 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingPraveen Reddy DevanapalleNo ratings yet

- Journal Entries For The Issue of Bonus SharesDocument2 pagesJournal Entries For The Issue of Bonus Sharesananthu p santhoshNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- Compound Financial Instruments Pas 32 Pfrs 9Document14 pagesCompound Financial Instruments Pas 32 Pfrs 9SamNo ratings yet

- Session 3c Share Capital & Reserves: HI5020 Corporate AccountingDocument29 pagesSession 3c Share Capital & Reserves: HI5020 Corporate AccountingFeku RamNo ratings yet

- Class XII Acc PB HC Mock 2021-22Document15 pagesClass XII Acc PB HC Mock 2021-22Satinder SandhuNo ratings yet

- Adv Acc Q.P 2Document7 pagesAdv Acc Q.P 2Swetha ReddyNo ratings yet

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshNo ratings yet

- Internal Reconstruction PQ SolDocument17 pagesInternal Reconstruction PQ SolKaran MokhaNo ratings yet

- ACT1106-Midterm Quiz No. 3 With AnswerDocument6 pagesACT1106-Midterm Quiz No. 3 With AnswerPj Dela VegaNo ratings yet

- According To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions ThatDocument26 pagesAccording To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions Thataneesh arvindhanNo ratings yet

- VNO LetterDocument15 pagesVNO LetterZerohedgeNo ratings yet

- Diagnosis of Financial DistressDocument51 pagesDiagnosis of Financial DistressYASI SUNo ratings yet

- Hero Moto Corp Financial Analysis 2012Document10 pagesHero Moto Corp Financial Analysis 2012Amar NegiNo ratings yet

- Account Assignmeent SajjalDocument30 pagesAccount Assignmeent Sajjalsuraj banNo ratings yet

- Ashish Srivastava ProjectDocument112 pagesAshish Srivastava ProjectSachin LeeNo ratings yet

- 8.2.1 Fixed Capital Investment (Fci)Document4 pages8.2.1 Fixed Capital Investment (Fci)eze josephNo ratings yet

- © The Institute of Chartered Accountants of India: ST ST STDocument14 pages© The Institute of Chartered Accountants of India: ST ST STRITZ BROWNNo ratings yet

- Tumelo Matjekane Finance 2009 RevisedDocument12 pagesTumelo Matjekane Finance 2009 RevisedMoatasemMadianNo ratings yet

- Book AnalysisofFinancialStatementsDocument208 pagesBook AnalysisofFinancialStatementsusamamalik0915No ratings yet

- Assignment Leverage and Capital StructureDocument6 pagesAssignment Leverage and Capital StructureCristopherson PerezNo ratings yet

- DocumentDocument2 pagesDocumentMaynardMiranoNo ratings yet

- SIP Is A Method of Investing A Fixed Sum SynopsisDocument23 pagesSIP Is A Method of Investing A Fixed Sum SynopsisPochender vajrojNo ratings yet

- Siri Project On Working-Capital FinalDocument57 pagesSiri Project On Working-Capital FinalBillu GurunadhamNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingDocument97 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingSujit DasNo ratings yet

- Fundamentals of Abm 1Document24 pagesFundamentals of Abm 1Rosa Divina ItemNo ratings yet

- AccountingDocument57 pagesAccountingReynaldo Jose Alvarado RamosNo ratings yet

- Rce Online TradingDocument85 pagesRce Online TradingGangadhara Rao100% (1)

- Determinants of Capital Structure in Financial Institutions: Evidence From Selected Micro Finance Institutions of EthiopiaDocument24 pagesDeterminants of Capital Structure in Financial Institutions: Evidence From Selected Micro Finance Institutions of Ethiopiaiaset123No ratings yet

- Apple Inc. Ratio and Financial AnalysisDocument23 pagesApple Inc. Ratio and Financial AnalysisZarnail RazaNo ratings yet

- New Microsoft Word DocumentDocument7 pagesNew Microsoft Word DocumentShakikNo ratings yet

- Toward A More Complete Model of Optimal Capital StructureDocument17 pagesToward A More Complete Model of Optimal Capital StructureIsabel BNo ratings yet

- Financial Accounting Sem 2 (2019-2020) Lecturer: Mr. Vu Tuan Anh, CMA, MSA Email: (Preferred) Tutor: Ms. Tran My HaDocument73 pagesFinancial Accounting Sem 2 (2019-2020) Lecturer: Mr. Vu Tuan Anh, CMA, MSA Email: (Preferred) Tutor: Ms. Tran My HaTrâm PhạmNo ratings yet

- Preference SharesDocument3 pagesPreference SharesDipti AryaNo ratings yet

- International Business: by Charles W.L. HillDocument32 pagesInternational Business: by Charles W.L. Hillzakria100100No ratings yet

- Study of Working Capital ManagementDocument54 pagesStudy of Working Capital ManagementVipin KushwahaNo ratings yet

- Final All Important Question of Mba IV Sem 2023Document11 pagesFinal All Important Question of Mba IV Sem 2023Arjun vermaNo ratings yet

- 1.1 History of The Organization & Its ObjectivesDocument42 pages1.1 History of The Organization & Its ObjectivesJaiHanumankiNo ratings yet

- Paper11 Syl22 Dec23 Set2 SolDocument16 pagesPaper11 Syl22 Dec23 Set2 Solajithsm39No ratings yet

- Raju Research Paper 28Document10 pagesRaju Research Paper 28Sanju ChopraNo ratings yet