Professional Documents

Culture Documents

Docx

Uploaded by

Shaneen Angelique MoralesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Docx

Uploaded by

Shaneen Angelique MoralesCopyright:

Available Formats

Chapter 3 (4,7,12, P6)

4) Explain the following statement: While the balance sheet can be thought of as a snapshot of

a firm’s financial position at a point in time, the income statement reports on operations over a

period of time.

The balance sheet is motionless, it is a snapshot of what the company owns and owes,

and it is motionless. The income statement shows the profitability, sales and costs of a firm

over a period of time. The period of income statement may differ from company to company.

This is why the heading for the income statement is “income statement for the year ending.”

The income statement reports on operations over a period of time rather than a particular

point of time like the Balance Sheet. For example, the income statement represents the

company’s financial performance over a period like a fiscal year.

7) What is free cash flow? If you were an investor, why might you be more interested in free

cash flow than net income?

Free cash flow is the net income –depreciations – capital expenditure. It is the available

cash for distribution among all security holders of an organization. Being an investor I would

favor Free cash flow over net income because it is very difficult to manipulate free cash flows

because it is subject to the accounting practices and principles. Secondly, there is a possibility

that net income is positive, and free cash flow is negative, which is highly valued by all types of

investors.

12) How does the deductibility of interest and dividends by the paying corporations affect the

choice of financing?

Interest is the income paid to the debenture holders of a company. Debentures have no

voting rights, but they have the right to get fixed interests on loans or debt. Dividend is the

income paid to the shareholders of the company. Dividends are not taxed exempt, while

interest paid to debenture holders is taxed exempt. This encourages the use of debt rather than

equity because interest paid is tax deductible but dividend payments are not. The after tax cost

of debt is lower than that of equity.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Quiz 2 Final TallyDocument1 pageQuiz 2 Final TallyShaneen Angelique MoralesNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Armada, Weanne Leigh Avinado, Fred Cargo, Angelica Chavez, Shanadine Macaludos, Edris Ryan Morales, Shaneen Angelique Waya, Nisreen AmerahDocument41 pagesArmada, Weanne Leigh Avinado, Fred Cargo, Angelica Chavez, Shanadine Macaludos, Edris Ryan Morales, Shaneen Angelique Waya, Nisreen AmerahShaneen Angelique MoralesNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Workshop - Risk and Rates of Return SolutionDocument9 pagesWorkshop - Risk and Rates of Return SolutionShaneen Angelique MoralesNo ratings yet

- Operations Management MGT 657A: Rohitbhai Dahyabhai PatelDocument4 pagesOperations Management MGT 657A: Rohitbhai Dahyabhai PatelShaneen Angelique MoralesNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Human Resource Planning, Recruitment and SelectionDocument82 pagesHuman Resource Planning, Recruitment and SelectionShaneen Angelique MoralesNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Morales, Shaneen Angelique P. - Midterm-Exam-BA-303-1st-Sem-2020 PDFDocument4 pagesMorales, Shaneen Angelique P. - Midterm-Exam-BA-303-1st-Sem-2020 PDFShaneen Angelique MoralesNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Quanti Eco - Order QuantityDocument11 pagesQuanti Eco - Order QuantityShaneen Angelique MoralesNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Q1) Dell Computers Purchases Integrated Chips at $350 Per Chip. The Holding Cost Is $35 Per UnitDocument3 pagesQ1) Dell Computers Purchases Integrated Chips at $350 Per Chip. The Holding Cost Is $35 Per UnitShaneen Angelique MoralesNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Selamat Pagi Kawan, Selamat Datang Di Indonesia: Good Morning Friends, Welcome To Indonesia!Document22 pagesSelamat Pagi Kawan, Selamat Datang Di Indonesia: Good Morning Friends, Welcome To Indonesia!Shaneen Angelique MoralesNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

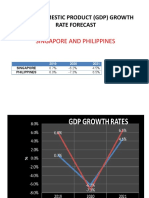

- Singapore and Philippines: Gross Domestic Product (GDP) Growth Rate ForecastDocument5 pagesSingapore and Philippines: Gross Domestic Product (GDP) Growth Rate ForecastShaneen Angelique MoralesNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Capacity Planning AnswerDocument105 pagesCapacity Planning AnswerShaneen Angelique MoralesNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Stocks and Their Valuation: Features of Common Stock Determining Common Stock Values Efficient Markets Preferred StockDocument44 pagesStocks and Their Valuation: Features of Common Stock Determining Common Stock Values Efficient Markets Preferred StockShaneen Angelique MoralesNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Group3 Vietnam FinallDocument15 pagesGroup3 Vietnam FinallShaneen Angelique MoralesNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Bione EnterprisesDocument20 pagesBione EnterprisesShaneen Angelique MoralesNo ratings yet

- Shaneen Angelique P. Morales - Exam in Business EconDocument1 pageShaneen Angelique P. Morales - Exam in Business EconShaneen Angelique MoralesNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- This Study Resource Was: Assignment: 2, 3, 6, 7, and 9Document2 pagesThis Study Resource Was: Assignment: 2, 3, 6, 7, and 9Shaneen Angelique MoralesNo ratings yet

- Valuation of Bonds and Stocks Learning ObjectivesDocument19 pagesValuation of Bonds and Stocks Learning ObjectivesShaneen Angelique MoralesNo ratings yet

- Asean Comparisons: Philippines and ThailandDocument8 pagesAsean Comparisons: Philippines and ThailandShaneen Angelique MoralesNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Analysis of Financial Statements: Please Respond To The FollowingDocument1 pageA Analysis of Financial Statements: Please Respond To The FollowingShaneen Angelique MoralesNo ratings yet

- 04 ForecastingDocument41 pages04 ForecastingShaneen Angelique MoralesNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Z= 2.05 for 98 % Daily demand = 1000 Standard Deviation () = 100 ROP = Daily demand * lead time + σ*Z ROP = 1000*2 + 100 * 2.05 ROP = 2205 Safety stock = σ*Z = 100*2.05 =205Document1 pageZ= 2.05 for 98 % Daily demand = 1000 Standard Deviation () = 100 ROP = Daily demand * lead time + σ*Z ROP = 1000*2 + 100 * 2.05 ROP = 2205 Safety stock = σ*Z = 100*2.05 =205Shaneen Angelique MoralesNo ratings yet

- What Is Free Cash Flow? If You Were An Investor, Why Might You Be More Interested in Free Cash Flow Than Net Income?Document1 pageWhat Is Free Cash Flow? If You Were An Investor, Why Might You Be More Interested in Free Cash Flow Than Net Income?Shaneen Angelique MoralesNo ratings yet

- Strategic Audit of Boombastic Balloons and Party NeedsDocument25 pagesStrategic Audit of Boombastic Balloons and Party NeedsShaneen Angelique MoralesNo ratings yet

- 2 × Annual Demand ×ordering CostDocument2 pages2 × Annual Demand ×ordering CostShaneen Angelique MoralesNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Solution: D 12,500/year, D (12,500/250) 50/day, P 300/day, S $30/order, H $2/unit/yearDocument2 pagesSolution: D 12,500/year, D (12,500/250) 50/day, P 300/day, S $30/order, H $2/unit/yearShaneen Angelique Morales100% (3)

- 1-8 What Are The Conflicts Between Stockholders and Managers? How Can These Conflicts Be Alleviated?Document2 pages1-8 What Are The Conflicts Between Stockholders and Managers? How Can These Conflicts Be Alleviated?Shaneen Angelique MoralesNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)