Professional Documents

Culture Documents

Equity Questions

Uploaded by

Akshat JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Questions

Uploaded by

Akshat JainCopyright:

Available Formats

Q1.

You have been provided the following information on CEL Inc, a manufacturer of

highend stereo systems. In the most recent year, which was a bad one, the company made

only Rs. 40 million in net income. It expects next year to be more normal. The book value

of equity at the company is Rs. 1 billion, and the average return on equity over the

previous 10 years (assumed to be a normal period) was 10%. The company expects to

make Rs. 80 million in new capital expenditures next year. It expects depreciation, which

was Rs. 60 million this year, to grow 10% next year. The company had revenues of Rs.

1.5 billion this year, and it maintained a non-cash working capital investment of 10% of

revenues. It expects revenues to increase 20% next year and working capital to decline to

9.5% of revenues. The firm expects to maintain its existing debt policy (in market value

terms). The market value of equity is Rs. 1.5 billion and the book value of equity is 500

million. The debt outstanding (in both book and market terms) is Rs. 500 million.

2. The following are projected free cash flows to equity for a company that is

expected to be in high growth for the next 3 years. The firm's beta is also expected

to change over the 3-year period:

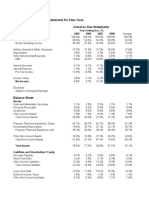

Year 1 2 3 4

Expected Growth Rate 12% 10% 8% 6%

Beta 1.5 1.3 1.1 1.0

Revenues $ 22.40 $ 24.64 $ 26.61 $28.21

EPS $ 2.24 $ 2.46 $ 2.66 $2.82

(Cap Ex - Deprec'n) (1-DR) $ 0.90 $ 0.75 $ 0.60 $0.45

Change in WC (1 - DR) $ 0.36 $ 0.33 $ 0.29 $0.24

FCFE $ 0.98 $ 1.38 $ 1.77 $2.13

Assume that after year 3, the beta will stay at 1.00, and that the growth rate will remain 6%

forever. The riskfree rate is 5%, and you can assume a risk premium of 5.5%.a. Estimate the

price at the end of the third year.

b. Estimate the value per share today.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Worksheet 1Document17 pagesWorksheet 1Akshat JainNo ratings yet

- Ratio Analysis of BajajDocument9 pagesRatio Analysis of BajajAkshat JainNo ratings yet

- Worksheet 6Document26 pagesWorksheet 6Akshat JainNo ratings yet

- Bajaj Allianz 2017-18Document96 pagesBajaj Allianz 2017-18Akshat JainNo ratings yet

- AF Study Material and Practice Questions - Pre Mid TermDocument71 pagesAF Study Material and Practice Questions - Pre Mid TermAkshat Jain100% (1)

- Business Valuation (FCFF)Document5 pagesBusiness Valuation (FCFF)Akshat JainNo ratings yet

- ACF - End Term PaperDocument4 pagesACF - End Term PaperAkshat JainNo ratings yet

- Frequencies VariablesDocument21 pagesFrequencies VariablesAkshat JainNo ratings yet

- AkshatJain 0008 ACFDocument5 pagesAkshatJain 0008 ACFAkshat JainNo ratings yet

- Chap 001Document21 pagesChap 001Akshat JainNo ratings yet

- Investments, 8 Edition: Learning About Return and Risk From The Historical RecordDocument38 pagesInvestments, 8 Edition: Learning About Return and Risk From The Historical RecordAkshat JainNo ratings yet

- Asset Classes and Financial InvestmentsDocument32 pagesAsset Classes and Financial InvestmentsAkshat JainNo ratings yet

- Investments, 8 Edition: Risk Aversion and Capital Allocation To Risky AssetsDocument34 pagesInvestments, 8 Edition: Risk Aversion and Capital Allocation To Risky AssetsAkshat JainNo ratings yet

- The-Ribbon-Exercise - UnsolvedDocument2 pagesThe-Ribbon-Exercise - UnsolvedAkshat JainNo ratings yet

- Overview-of-Excel-Exercise-UnsolvedDocument2 pagesOverview-of-Excel-Exercise-UnsolvedAkshat JainNo ratings yet

- CH 13 Mod 2 Common Size StatementsDocument2 pagesCH 13 Mod 2 Common Size StatementsAkshat JainNo ratings yet

- CH 13 Mod 3 Financial IndicatorsDocument2 pagesCH 13 Mod 3 Financial IndicatorsAkshat JainNo ratings yet

- Cross TabsDocument35 pagesCross TabsAkshat JainNo ratings yet

- Airtel: Territory Sales Manager (TSM, Mobility) - Rural/ UrbanDocument1 pageAirtel: Territory Sales Manager (TSM, Mobility) - Rural/ UrbanAkshat JainNo ratings yet

- Study ON Consumer Behavior For Over The Top Media: (BATCH 2019-21)Document6 pagesStudy ON Consumer Behavior For Over The Top Media: (BATCH 2019-21)Akshat JainNo ratings yet

- Part-D: Sentence Building. A Jumbled Sentence Will Come Up and You Will To Re-ArrangeDocument3 pagesPart-D: Sentence Building. A Jumbled Sentence Will Come Up and You Will To Re-ArrangeAkshat Jain100% (1)

- All RatiosDocument6 pagesAll RatiosAkshat JainNo ratings yet

- Airtel - Store Manager (SM, JDDocument2 pagesAirtel - Store Manager (SM, JDAkshat JainNo ratings yet

- Private Healthcare Quality: Applying A SERVQUAL Model: ArticleDocument17 pagesPrivate Healthcare Quality: Applying A SERVQUAL Model: ArticleAkshat JainNo ratings yet

- Asian Paints - Sales Officer - JDDocument3 pagesAsian Paints - Sales Officer - JDAkshat JainNo ratings yet

- Consonant Clusters OO OH AW AH AY EE OW IDocument2 pagesConsonant Clusters OO OH AW AH AY EE OW IAkshat Jain100% (1)

- Job Description - Moody's AnalyticsDocument1 pageJob Description - Moody's AnalyticsAkshat JainNo ratings yet

- Guidelines For Candidates For The Pre-Placement TalkDocument1 pageGuidelines For Candidates For The Pre-Placement TalkAkshat JainNo ratings yet

- ABFRL - JD - Assistant Store Manager (ASM)Document3 pagesABFRL - JD - Assistant Store Manager (ASM)Akshat JainNo ratings yet

- Financial Ratios - Financial Sector - July 2019Document7 pagesFinancial Ratios - Financial Sector - July 2019Akshat JainNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)