Professional Documents

Culture Documents

Chapter 1 Business Combination Part 1 PDF

Uploaded by

Shane CharmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 Business Combination Part 1 PDF

Uploaded by

Shane CharmedCopyright:

Available Formats

Module 1.

1

Computing goodwill arising from a business combination

Business Combination (Part 1)

Related Standards:

PFRS 3 Business Combination

Section 19 of the PFRS for SMEs

Learning Objectives:

1. Define a business combination

2. Explain briefly the accounting requirements for a business combination

Introduction

A business combination occurs when one company acquires another or when two or more companies merge into one. After the

combination, one company gains control over the other.

The company that obtains control over the other is referred to as the parent or acquirer. The other company that is controlled is the

subsidiary or acquiree.

Business combinations are carried out either through:

1. Asset acquisition; or

2. Stock acquisition

Asset Acquisition

- The acquirer purchases the assets and assumes the liabilities of the acquire in exchange for cash or other non-cash consideration

(which may be the acquirer’s own shares). After the acquisition, the acquired entity normally ceases to exist as a separate legal or

accounting entity. The acquirer records the assets acquired and liabilities assumed in the business combination in its books of

accounts.

Under the Corporation Code of the Philippines, a business combination effected through asset acquisition may be either:

a. Merger – occurs when two or more companies merge into a single entity which shall be one of the combining companies.

For example: A Co. + B Co. = A Co. or B Co.

b. Consolidation – occurs when two or more companies consolidate into a single entity which shall be the consolidated

company. For example: A Co. + B Co. = C Co.

Stock Acquisition

- Instead of acquiring the assets and assuming the liabilities of the acquiree, the acquirer obtains control over the acquire by

acquiring a majority ownership interest (e.g., more than 50%) in the voting rights of the acquire.

In a stock acquisition, the acquirer is known as the parent while the acquire is known as the subsidiary. After the business

combination, the parent and the subsidiary retain their separate legal existence. However, for financial reporting purposes, both

the parent and the subsidiary are viewed as a single reporting entity.

After the business combination, the parent and subsidiary continue to maintain their own separate accounting books, recording

separately their assets, liabilities and the transactions they enter into.

The parent records the ownership interest acquired as “investment in subsidiary” in its separate accounting books. However, the

investment is eliminated when the group prepared consolidated financial statements.

A business combination may also be described as:

1. Horizontal combination – a business combination of two or more entities with similar businesses, e.g., a bank acquires another

bank.

2. Vertical combination – a business combination of two or more entities operating at different levels in a marketing chain, e.g., a

manufacturer acquires its supplier of raw materials.

3. Conglomerate – a business combination of two or more entities with dissimilar businesses, e.g., a real estate developer

acquires a bank.

Advantages of a business combination

a. Competition is eliminated or lessened – competition between the combining constituents with similar businesses is eliminated

while the threat of competition from other market participants is lessened.

b. Synergy – synergy occurs when the collaboration of two or more entities results to greater productivity that the sum of the

productivity of each constituent working independently. Synergy is most commonly described as “the whole is greater than the

sum of its parts.” It can be simplified by the expression “1 plus 1 = 3”

c. Increased business opportunities and earnings potential – business opportunity and earnings potential may be increased

through:

i. An increased variety of products or services available and a decreased dependency on limited number of products

and services;

ii. Widened dispersion of products or services and better access to new markets;

iii.

Access to either of the acquirer’s or acquiree’s technological know-hows, research and development, secret

processes, and other information;

iv. Increased investment opportunities due to increased capital; or

v. Appreciation in worth due to an established trade name by either one of the combining constituents.

d. Reduction of operating costs of the combined entity may be reduced.

i. Under a horizontal combination, operating costs may be reduced by the elimination of unnecessary duplication of

costs (e.g., cost of information systems, registration and licenses, some employee benefits and costs of outsourced

services.

ii. Under a vertical combination, operating costs may be reduced by the elimination of costs of negotiation and

coordination between the companies and mark-ups on purchases.

e. Combination utilized economies of scale- economies of scale refer to the increase in productive efficiency resulting from the

increase in the scale of production. An entity that achieves economies of scale decreases its average cost per unit as

production is increased because fixed costs are allocated over an increased number of units produced.

f. Cost savings on business expansion – by acquiring another company rather that creating a new one, an entity can save on

start-up costs, research and developments costs, cost of regulation and licenses, and other similar costs. Moreover, a

business combination may be effected through exchange of equity instruments rather than the transfer of cash or other

resources.

g. Favorable tax implications – deferred tax assets may be transferred in a business combination. Also, business combination

effected without transfers of considerations may not be subjected to taxation.

Disadvantages of a business combination

a. Business combination brings monopoly in the market which may have a negative impact to the society. This could result to

impediment to healthy competition between market participants.

b. The identity of one or both of the combining constituents may cease, leading to loss of sense of identity for existing employees

and loss of goodwill.

c. Management of the combined entity may become difficult due to incompatible internal cultures, systems and policies.

d. Business combination may result in over capitalization, which in turn, may result to diffusion in market price per share and

attractiveness of the combined entity’s equity instruments to potential investors.

e. The combined entity may be subjected to stricter regulation and scrutiny by the government, most especially if the business

combination poses threat to consumers’ interests.

Business Combination

A “business combination” is a transaction or other event in which an acquirer obtains control of one or more businesses. Transactions

referred to as “true mergers” or “mergers of equals” are also business combination under PFRS 3.

Essential elements in the definition of a business combination

1. Control

2. Business

Control

An investor controls an investee when the investor has the power to direct the investee’s relevant activities (i.e., operating and

financing policies), thereby affecting the variability of the investor’s investment returns from the investee.

Control is normally presumed to exist when the acquirer holds more than 50% (or 51% or more) interest in the acquiree’s voting rights.

However, this is only a presumption because control can be obtained in some other ways, such as when:

a. The acquirer has the power to appoint or remove the majority of the board of directors of the acquire; or

b. The acquirer has the power to cast the majority of votes at board of meetings or equivalent bodies within the acquire; or

c. The acquirer has power over more than half of the voting rights of the acquire because of an agreement with other investors;

or

d. The acquirer controls the acquiree’s operating and financial policies because of a law or an agreement.

An acquirer may obtain control of an acquiree in a variety of ways, for example:

a. By transferring cash or other assets;

b. By incurring liabilities;

c. By issuing equity interests;

d. By providing more than one type of consideration; or

e. Without transferring consideration, including by contract alone

Illustration: Determining the existence of control

Example 1: ABC Co. acquires 51% ownership interest in XYZ, Inc.’s ordinary shares.

Analysis: ABC is presumed to have obtained control over XYZ because of the ownership interest acquired in the voting rights

of XYZ is more than 50%.

Example 2 ABC Co. acquires 100% of XYZ, Inc.’s preference shares.

Analysis: ABC does not obtain control over XYZ because preference shares do not give the holder voting rights over the

financial and operating policies of the investee.

You might also like

- Business Com Part 1Document39 pagesBusiness Com Part 1Peter GonzagaNo ratings yet

- ABC-01 Business CombinationDocument19 pagesABC-01 Business CombinationJoshuji LaneNo ratings yet

- Chapter 1-Business Combination (Part 1)Document9 pagesChapter 1-Business Combination (Part 1)May JennNo ratings yet

- ABC Chapter 5 Accounting For Business Combinations by Millan 2020Document25 pagesABC Chapter 5 Accounting For Business Combinations by Millan 2020Nayoung LeeNo ratings yet

- Business Combination - Statutory MergerDocument7 pagesBusiness Combination - Statutory Mergerma.soledad san diegoNo ratings yet

- Chapter 14 Business Combinations Part 1Document23 pagesChapter 14 Business Combinations Part 1Marvel Keg-ay Polled75% (8)

- Chapter 1 - Accounting For Business CombinationsDocument6 pagesChapter 1 - Accounting For Business CombinationsLyaNo ratings yet

- Profe03 - Chapter 3 Business Combinations Special Accounting TopicsDocument7 pagesProfe03 - Chapter 3 Business Combinations Special Accounting TopicsSteffany RoqueNo ratings yet

- Chapter 14 - Bus. Combination Part 2Document16 pagesChapter 14 - Bus. Combination Part 2PutmehudgJasdNo ratings yet

- Business Combinations Accounting QuestionsDocument5 pagesBusiness Combinations Accounting QuestionsAndy LaluNo ratings yet

- Chapter 17 Consolidated FS - Part 1Document29 pagesChapter 17 Consolidated FS - Part 1Erwin Labayog Medina100% (1)

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- Profe03 - Chapter 1 Business Combinations Recognition and MeasurementDocument19 pagesProfe03 - Chapter 1 Business Combinations Recognition and MeasurementSteffany Roque100% (1)

- Business Combination - Stock AcquisitionDocument6 pagesBusiness Combination - Stock AcquisitionEmma Mariz GarciaNo ratings yet

- Accounting for Business CombinationsDocument4 pagesAccounting for Business CombinationsAbraham Chin67% (3)

- Accounting for Business CombinationsDocument12 pagesAccounting for Business CombinationsSteffany RoqueNo ratings yet

- 4 Revenue 30 QuestionsDocument5 pages4 Revenue 30 QuestionsEzer Cruz BarrantesNo ratings yet

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading ExaminationNhel AlvaroNo ratings yet

- Consolidated FS Chapter 4Document16 pagesConsolidated FS Chapter 4Charlene Bolandres100% (1)

- Assignment For Accounting Policies, Estimate and Errors: Problem 3Document3 pagesAssignment For Accounting Policies, Estimate and Errors: Problem 3Fria Mae Aycardo AbellanoNo ratings yet

- 8 - PFRS 15 Five Step Model PDFDocument6 pages8 - PFRS 15 Five Step Model PDFDarlene Faye Cabral RosalesNo ratings yet

- Accounting Information System ReviewerDocument9 pagesAccounting Information System ReviewerRose Anne Bautista100% (2)

- Company A and Company B - Full and Partial Goodwill: RequiredDocument3 pagesCompany A and Company B - Full and Partial Goodwill: RequiredKristine Esplana ToraldeNo ratings yet

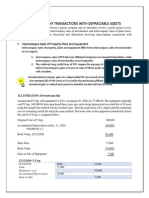

- Intercompany Sale of Depreciable AssetsDocument2 pagesIntercompany Sale of Depreciable AssetsTriechia LaudNo ratings yet

- Abc Chapter 6 Accounting For Business Combinations by Millan 2020Document14 pagesAbc Chapter 6 Accounting For Business Combinations by Millan 2020Nayoung LeeNo ratings yet

- Chapter 4 (Salosagcol)Document4 pagesChapter 4 (Salosagcol)Lauren Obrien100% (1)

- Business CombinationDocument2 pagesBusiness CombinationMarie GonzalesNo ratings yet

- Consolidated Financial Statement Classroom Discussion Part 2Document6 pagesConsolidated Financial Statement Classroom Discussion Part 2Sunshine KhuletzNo ratings yet

- Afar04 Business Combinations Mergers ReviewersDocument17 pagesAfar04 Business Combinations Mergers ReviewersPam G.100% (6)

- National College Business Combination ExamsDocument9 pagesNational College Business Combination ExamsheyNo ratings yet

- Sol. Man. Chapter 12 Acctg For Derivatives Hedging Transactions Part 2 Acctg For Bus. CombinationsDocument11 pagesSol. Man. Chapter 12 Acctg For Derivatives Hedging Transactions Part 2 Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial Statementsmaria isabella100% (1)

- Business Combination Midterm ExamDocument12 pagesBusiness Combination Midterm Examcharlene lizardoNo ratings yet

- Mas by Cabrera Chapter 1 Management Accounting An OverviewDocument18 pagesMas by Cabrera Chapter 1 Management Accounting An OverviewDeeNo ratings yet

- This Study Resource Was Shared Via: Financial AssetsDocument2 pagesThis Study Resource Was Shared Via: Financial AssetsMichael Brian TorresNo ratings yet

- Business Combi Quiz (Part1)Document9 pagesBusiness Combi Quiz (Part1)Rica Joy RuzgalNo ratings yet

- Audit theory pre-testDocument12 pagesAudit theory pre-testKaila SalemNo ratings yet

- editedQUIZ CHAPTER-9 INVESTMENT-PROPERTYDocument3 pageseditedQUIZ CHAPTER-9 INVESTMENT-PROPERTYanna mariaNo ratings yet

- Business Combinations - Part 1 Recognition and MeasurementDocument54 pagesBusiness Combinations - Part 1 Recognition and MeasurementJOANNE PEÑARANDANo ratings yet

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- Psa 315Document6 pagesPsa 315arianasNo ratings yet

- Module 9 - Earnings and Market Approach ValuationDocument46 pagesModule 9 - Earnings and Market Approach Valuationnatalie clyde matesNo ratings yet

- Profe03 - Chapter 5 Consolidated FS Intercompany TopicsDocument8 pagesProfe03 - Chapter 5 Consolidated FS Intercompany TopicsSteffany RoqueNo ratings yet

- Accounting for Business Combinations RestatementDocument5 pagesAccounting for Business Combinations Restatementeloisa celisNo ratings yet

- SpoilageDocument17 pagesSpoilageBhawin DondaNo ratings yet

- Consolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryDocument24 pagesConsolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryKeith Alison ArellanoNo ratings yet

- Methods of Accounting: Cash vs Accrual BasisDocument22 pagesMethods of Accounting: Cash vs Accrual BasisMaeNo ratings yet

- Introduction To Business Combination - Lesson1Document37 pagesIntroduction To Business Combination - Lesson1Eunice MiloNo ratings yet

- Chapter 2: Asset-Based Valuation Asset-Based ValuationDocument6 pagesChapter 2: Asset-Based Valuation Asset-Based ValuationJoyce Dela CruzNo ratings yet

- Homework 2 AuditingDocument5 pagesHomework 2 AuditingLeah Mae NolascoNo ratings yet

- Chapter 1 Business Combinations - Part 1Document24 pagesChapter 1 Business Combinations - Part 1Kathlyn Tajada0% (1)

- editedQUIZ CHAPTER-6 FINANCIAL-ASSETSDocument3 pageseditedQUIZ CHAPTER-6 FINANCIAL-ASSETSanna mariaNo ratings yet

- Business CombinationDocument8 pagesBusiness CombinationEvita Ayne Tapit0% (1)

- Consolidated FinancialsDocument6 pagesConsolidated FinancialsNiña YastoNo ratings yet

- Accounting For Business CombinationsDocument29 pagesAccounting For Business CombinationsAmie Jane MirandaNo ratings yet

- Chapter 11 Intagible AssetsDocument5 pagesChapter 11 Intagible Assetsmaria isabellaNo ratings yet

- Quiz - Chapter 10 - Installment Sales Method - 2021 EditionDocument5 pagesQuiz - Chapter 10 - Installment Sales Method - 2021 EditionYam SondayNo ratings yet

- Chapter 14 (Business Combination)Document6 pagesChapter 14 (Business Combination)Kerr John GuilaranNo ratings yet

- Book AccountingDocument220 pagesBook Accountingcunbg vubNo ratings yet

- Modules1 20 MergedDocument84 pagesModules1 20 MergedClaw MarksNo ratings yet

- 2023-03-20 Godin, Karen 310072 - Installment Schedule PDFDocument3 pages2023-03-20 Godin, Karen 310072 - Installment Schedule PDFKarenNo ratings yet

- Chapter 2 Gross EstateDocument4 pagesChapter 2 Gross EstateMary Anne KazuyaNo ratings yet

- Acting Pricey: Some Stocks' Rich Valuations Are Sticky, Irrespective of The Market's Exuberance or TurmoilDocument92 pagesActing Pricey: Some Stocks' Rich Valuations Are Sticky, Irrespective of The Market's Exuberance or TurmoilhariNo ratings yet

- Advantages of GlobalizationDocument8 pagesAdvantages of GlobalizationKen Star100% (1)

- Exercise 1: Supplier Cost Per Valve ($) Percent Large Percent Medium Percent SmallDocument4 pagesExercise 1: Supplier Cost Per Valve ($) Percent Large Percent Medium Percent SmallShital GuptaNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountAmanNo ratings yet

- Discontinued OperationsDocument15 pagesDiscontinued OperationsEjaz AhmadNo ratings yet

- Case 1 For PrintDocument8 pagesCase 1 For PrintRichardDinongPascualNo ratings yet

- A Study On Responsibility Accounts On StakeholdersDocument6 pagesA Study On Responsibility Accounts On StakeholdersresearchparksNo ratings yet

- 5 - Spa To Transfer TitleDocument2 pages5 - Spa To Transfer TitleAntonio AlfelorNo ratings yet

- Mayank Ahuja 19021321063 IbfsDocument4 pagesMayank Ahuja 19021321063 IbfsMayank AhujaNo ratings yet

- Business 12th Edition Pride Test Bank 1Document46 pagesBusiness 12th Edition Pride Test Bank 1sonia100% (34)

- Knaster, R., & Leffingwell, D. (2017) - SAFe 4.0 Distilled. Applying The Scaled Agile Framework For Lean Software and Systems EngineeringDocument429 pagesKnaster, R., & Leffingwell, D. (2017) - SAFe 4.0 Distilled. Applying The Scaled Agile Framework For Lean Software and Systems EngineeringMarco Antonio Jimenez Cervantes100% (1)

- ACC reports 74% rise in Q1 profit, Ambuja Cement to benefitDocument7 pagesACC reports 74% rise in Q1 profit, Ambuja Cement to benefitShivansh RawatNo ratings yet

- Case StudyDocument5 pagesCase StudyTrân LêNo ratings yet

- Chinh 8defgDocument6 pagesChinh 8defgThục Chinh TrầnNo ratings yet

- Introduction IFRS17Document9 pagesIntroduction IFRS17Ruben Perez Espinoza100% (1)

- T3 2004 - Dec - QDocument8 pagesT3 2004 - Dec - QVinh Ngo NhuNo ratings yet

- Assignment - NCAP - Analysis of Impact On The Aviation SectorDocument8 pagesAssignment - NCAP - Analysis of Impact On The Aviation SectorkalutheaceNo ratings yet

- Tour Costing and QuotationDocument2 pagesTour Costing and Quotation21Ni Made Dinda Puan Maharani100% (1)

- Framework For Mobile Money Implementation in NigerDocument9 pagesFramework For Mobile Money Implementation in Nigernocode pulseNo ratings yet

- Assignment February 2021:: There Is One (1) Page of Question, Excluding This PageDocument17 pagesAssignment February 2021:: There Is One (1) Page of Question, Excluding This PageSujeewa LakmalNo ratings yet

- Tram Grooved Rails New Catalog January 2018Document12 pagesTram Grooved Rails New Catalog January 2018Szabolcs Attila KöllőNo ratings yet

- AralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Document14 pagesAralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Jaiz Cadang100% (1)

- Zenith Steel BrochureDocument4 pagesZenith Steel BrochurefebousNo ratings yet

- To Prosperity: From DEBTDocument112 pagesTo Prosperity: From DEBTمحمد عبدﷲNo ratings yet

- The Eight Components of Supply Chain ManagementDocument4 pagesThe Eight Components of Supply Chain ManagementEmma AlexandersNo ratings yet

- Payment Commitment Letter FormatDocument1 pagePayment Commitment Letter FormatScribdTranslationsNo ratings yet

- Financial Management Tutorial QuestionDocument3 pagesFinancial Management Tutorial QuestionDâmDâmCôNươngNo ratings yet

- Seminar 2 Presentation QuestionsDocument17 pagesSeminar 2 Presentation QuestionsJennifer YoshuaraNo ratings yet