Professional Documents

Culture Documents

November - 2015 - 1447761370 - 44 Foster

Uploaded by

MEERA JOSHY 1927436Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

November - 2015 - 1447761370 - 44 Foster

Uploaded by

MEERA JOSHY 1927436Copyright:

Available Formats

Volume-4, Issue-11, Nov-2015 • ISSN No 2277 - 8160

Commerce

Research Paper Management

“Payment Banks” – A Newer Form of Banks to Foster

Financial Inclusion in India

Visiting Faculty, Birla Institute of Technology, Sector- 1, Noida

Dr. J.C. Pande -201301, India. Contact Address: H-45, Sector-XI, Noida, Distt.-

Gautam Budh Nagar, UP-201301.

ABSTRACT Innovation and enterprise form the essence of opportunities and find reflection in every facet of our functions. With

ethos of innovation the bankers have constantly endeavoured to develop new products which are suitable for their

clients/ prospective clients’ base and conditions. The evolving economic landscape and aspirations of the people

have driven the Govt to plan seamlessly for inclusive banking for realising the opportunities that lie within. Considering the long outstanding

need for reaching out to the far flung non-banked areas of the country, the Reserve Bank of India has done well to introduce more competition

among banks by authorising, in principle, a new kind of bank. On 19th Aug 2015, the RBI announced eleven approvals for Payment Banks,

a stripped down version of a full service bank which is designed to reach people outside the span of formal banking services. In the present

highly competitive banking; which demands evolving strategies to promote interest of all stakeholders, the need to cut costs in its product &

services; opening of more new full-service bank’s structure in far flung off areas have proved unviable. The solution therefore has been to operate

banks through diverse set of players--- such as Postal Department, Telecom Companies, which promise to reach people more effectively through

technological advancements. This paper focuses on the likely banking revolution in the country as a result of clearance for establishment of 11

Payment Banks in India.

Key words : Payment banks, Economic landscape, Evolving strategies, Stakeholders,

Technological- advancements.

Biographical notes: ated banks serving niche interests, local area banks, payment banks

Dr. J.C. Pande is presently a Visiting Faculty with Birla Institute of Tech- etc. are contemplated to meet credit and remittance needs of small

nology, Noida. He has also been a Visiting and Guest Faculty to var- businesses, unorganized sector, low income households, farmers and

ious Management Institutes. Earlier he had served as Chief Manager migrant work force”.

with Allahabad Bank; one of the premier nationalised banks in India;

for over 30 years. He has completed PGDPM from FMS, Delhi Universi- Setting up of Payments Banks

ty, is an MBA and PhD in Management. The Reserve Bank of India accordingly formulated and released for

public comments draft-guidelines for licensing of payments banks in

Introduction: the private sector on July 17, 2014. Final guidelines were subsequent-

Payments banks are niche banks set up by the Reserve Bank of India ly issued by the RBI and the process of inviting applications for setting

to further the agenda of financial inclusion. These banks will provide up of Payments Banks and Small Banks was initiated after receiving

small savings accounts and payments /remittance services mainly to feedback, comments and suggestions on the draft guidelines.

migrant labour workforce, low-income households, small businesses,

etc. by enabling high volume-low value transactions in deposits and Both, Payments Banks and Small Banks are ‘niche’ or ‘differentiated’

payments / remittance services in a secured technology-driven envi- banks, with the common objective of furthering financial inclusion.

ronment. They can accept demand deposits — current deposits and While small banks will provide a whole suite of basic banking prod-

savings bank deposits — from individuals, small businesses and other ucts, such as, deposits and supply of credit, but in a limited area of

entities, but there is an upper limit of Rs 1 lac per customer. Custom- operation; payments banks will provide a limited range of products,

ers will earn interest on their savings account balance. The payments such as, acceptance of demand deposits and remittances of funds,

banks can accept and send remittances. They are also allowed to but will have a widespread network of access points particularly to

undertake utility bill payments and can distribute MF, Insurance and remote areas, either through their own branch network or through

Pension products. However, they cannot lend to customers or issue Business Correspondents (BCs) or through networks provided by oth-

credit cards. ers. They will add value by adapting technological solutions to lower

costs.

The Payments Bank will be registered as a public limited company

under the Companies Act, 2013, and licensed under Section 22 of The entities eligible to set up a Payments Bank include existing non-

the Banking Regulation Act, 1949, with specific licensing conditions bank Pre-paid Instrument Issuers (PPIs), Non-Banking Finance Compa-

restricting its activities to acceptance of demand deposits and provi- nies (NBFCs), corporate BCs, mobile telephone companies, super-mar-

sion of payments and remittance services. It will be governed by the ket chains, companies, real sector cooperatives, and public sector

provisions of the Banking Regulation Act, 1949, Reserve Bank of India entities. The entities eligible to set up a Small Bank include resident

Act, 1934, Foreign Exchange Management Act, 1999, Payment and individuals with ten years of experience in banking and finance, com-

Settlement Systems Act, 2007, other relevant Statutes and Directives, panies and societies, NBFCs, Micro Finance Institutions and Local Area

Prudential Regulations and other Guidelines/Instructions issued by Banks.

RBI and other regulators from time to time, including the regulations

of SEBI regarding public issues and other guidelines applicable to list- The other conditions are that:

ed banking companies. The operations of the bank should be fully networked and technology

driven from the beginning, conforming to generally accepted stand-

Background ards and norms.

It may be recalled that in the Union Budget for 2014-15 presented on

July 10, 2014, the Hon’ble Finance Minister had announced that: The bank should have a high powered Customer Grievances Cell to

handle customer complaints.

“After making suitable changes to current framework, a structure will

be put in place for continuous authorization of universal banks in pri- The minimum paid up capital requirement for both Payments Banks

vate sector in the current financial year. RBI will create a framework and Small Banks has been kept at Rs. 100 crore, of which the pro-

for licensing small banks and other differentiated banks. Differenti- moters’ initial minimum contribution will be at least 40 per cent, to

GJRA - GLOBAL JOURNAL FOR RESEARCH ANALYSIS X 133

Volume-4, Issue-11, Nov-2015 • ISSN No 2277 - 8160

be locked in for a period of five years. Shareholding of the promot- need not be marked to market and there may not be any need for

ers should be brought down to 40 per cent within three years, 30 per capital for market risk. However, the Payments Bank will be exposed

cent within a period of 10 years, and to 26 per cent within 12 years to operational risk. The Payments Bank will also be required to invest

from the date of commencement of business of the bank. heavily in technological infrastructure for its operations. The capital

will be utilized for creation of such fixed assets. Therefore, the mini-

On 19th Aug 2015, the Reserve Bank of India ‘in principle’ cleared 11 mum paid up capital of the Payments Bank shall be Rs. 100 crore.

entities to set-up ‘payment banks’. These are:

The foreign shareholding in the bank would be as per the extant FDI

Aditya Birla Nuvo, ii. Airtel M Commerce Services, iii. Cholaman- policy.

dalam Distribution Services, iv. Department of Posts, v. Fino Pay

Tech, vi. National Securities Depository, vii. Reliance Industries, Since, the Payments Bank will be set up as a differentiated bank and

viii. Dilip Shantilal Shanghvi, the Sun Pharma promoter, ix. Vijay shall confine its activities to further the objectives for which it is set

Shekhar Sharma, Paytm founder, x. Tech Mahindra, xi. Vodafone up, this Bank would be permitted to undertake only certain restricted

M- Pesa. activities permitted to banks under the Banking Regulation Act, 1949,

as given below:

These Payment Banks have differentiated license with limitations on

what they can do. For example, payment banks can accept depos- Acceptance of demand deposits, i.e., current deposits,

its upto only Rs 1 lac and cannot grant loans. They can only deposit and savings bank deposits:- The eligible deposits mobilized by

their money in government bonds. They can issue debit cards but not the Payments Bank would be covered under the deposit insurance

credit cards. Payment banks will largely depend on mobile and ATM scheme of the Deposit Insurance and Credit Guarantee Corporation

infrastructure to provide banking services. Opening an account is ex- of India (DICGC). Given that their primary role is to provide payments

pected to be like acquiring a pre-paid mobile number. and remittance services and demand deposit products to small busi-

nesses and low-income households, Payments Banks will initially be

The Reliance-SBI payments bank has an ambitious plan to cov- restricted to holding a maximum balance of Rs.1,00,000 per custom-

er 2,50,000 villages and 5,000 towns in three years. While it plans er. After gauging the performance of the Payments Banks by the RBI,

to start with Rs 100-crore capital base, this will be ramped up to Rs the maximum balance limit may be raised. If the transactions in the

400 crore in three-four years, depending on business volumes. “This accounts conform to the “small accounts” transactions, simplified KYC/

partnership brings together the combined strengths of two of India’s AML/CFT norms will be applicable to such accounts as defined under

Fortune 500 corporations committed to making a transformative im- the Rules framed under the Prevention of Money-laundering Act,

pact on India’s financial inclusion landscape. We see this licence as an 2002.

opportunity to promote financial inclusion,” SBI Chairman Arundhati

Bhattacharya has said. Payments and remittance services through various chan-

nels including branches, BCs and mobile banking:- The pay-

The Department of Posts and Aditya Birla Nuvo, both unsuccessful in ments/ remittance services would include acceptance of funds at one

race for universal bank licences last year, succeeded this time. Ana- end through various channels including branches and BCs and pay-

lysts therefore, expect tough competition to drive down charges for ments of cash at the other end through branches, BCs, and Automat-

fund transfers and other transactions. ed Teller Machines (ATMs). Cash-out can also be permitted at Point-

of-Sale terminal locations as per extant instructions issued under the

These entities, which are required to have an initial capital of Rs 100 PSS Act. In the case of walk-in customers, the bank should follow the

crore each, will have to start operations within 18 months. The pro- extant KYC guidelines issued by the RBI.

moter’s minimum initial contribution to equity capital will have to be

at least 40 per cent for the first five years. This is for the first time in Internet banking - The RBI is also open to applicants transacting

the history of India’s banking sector that differentiated licences are primarily using the Internet. The Payments Bank is expected to lev-

being given out by the central bank for undertaking specific activities. erage technology to offer low cost banking solutions. Such a bank

should ensure that it has all enabling systems in place including busi-

On 16th Sep 2015, the RBI came out with a second set of such licenc- ness partners, third party service providers and risk managements

es - for Small Finance Banks - 10 entities, including Ujjivan Financial systems & controls to enable offering transactional services on the

Services and Equitas Holdings, have got RBI’s approval to set up Small internet. While offering such services, the Payments Bank will be re-

Finance Banks to provide basic banking services to small farmers and quired to comply with RBI instructions on information security, elec-

micro industries. Other entities to get the Reserve Bank’s nod are Au tronic banking, technology risk management and cyber frauds.

Financiers (Jaipur), Capital Local Area Bank (Jalandhar), Disha Microf-

in (Ahmedabad), ESAF Microfinance (Chennai), Janalakshmi Financial Functioning as Business Correspondent (BC) of other banks

(Bengaluru), RGVN (North East) Microfinance (Guwahati), Suryoday – A Payments Bank may choose to become a BC of another bank for

Micro Finance (Mumbai) and Utkarsh Micro Finance (Varanasi). credit and other services, which it cannot offer.

The “in-principle” approval will be valid for 18 months to enable these The Payments Bank cannot set up subsidiaries to undertake

entities comply with the guidelines on Small Finance Banks, RBI said non-banking financial services activities. The other financial and

in a statement. These banks can provide basic banking services like non-financial services activities of the promoters, if any, should be

accepting deposits and lending to the unbanked sections such as kept distinctly ring-fenced and not co-mingled with the banking and

small farmers, micro business enterprises, micro and small industries financial services business of the Payments Bank.

and unorganised sector entities. Incidentally, the RBI had received 72

applications for setting up Small Finance Banks. The Payments Bank will be required to use the word “Payments” in its

name in order to differentiate it from other banks.

Since the Payments Bank will not be allowed to assume any cred-

it risk, and if its investments are held to maturity, such investments For ease of understanding and easy assimilation, features of these

prospective banks are given in a tabular form:

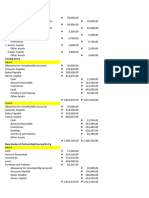

PAYMENT BANKS SMALL BANKS

Who Can Prepaid card issuers, Telecom companies, NBFCs, Bussiness Correspondents, Individuals/ professionals with 10 years experience in

Pro-mote Supermarket Chains, Corporates, Realty sector co-ops & PSUs. finance, NBFCs, Microfinance Cos, Local area banks.

Have a min capital of Rs 100 Cr Maintain 75% of dep in Govt bonds Have a min capital of Rs 100 Cr Extend 75% of loans

What Maintain 25% of dep in other banks Have atleast 26% investment by Indian to priority sector Have 25% of brs in unbanked

They Get listed if net worth crosses Rs 500 cr Have 25% of brs in unbanked areas areas Maintain reserve requirements Cap loans to

Must Do Be fully networked and tech driven Have Rs 1 lakh cap for deposits in one a/c. individuals and groups at 10% and 15% of net worth

Have a business correspondent network.

GJRA - GLOBAL JOURNAL FOR RESEARCH ANALYSIS X 134

Volume-4, Issue-11, Nov-2015 • ISSN No 2277 - 8160

What Offer internet banking Sell mutual funds, insurance, pensions Offer bill Sell forex to customers Sell mutual funds, insurance,

They Can payment service for customers Have ATMs and Business Correspondents(BC pensions Can convert into a full-fledged bank Expand

Do Can function as BC of another bank across the country

What Offer credit cards Extend loans Handle cross-border remittances Accept NRI Extend large loans Float subsidiaries Cannot deal in

They

Can’t Do Deposits sophisticated financial products.

The in-principle approval granted will be valid for a period of 18

months, during which time the applicants have to comply with the re-

quirements under the guidelines and fulfil all other conditions as may

be stipulated by RBI. After the selected applicants have complied

with all the requisite conditions as laid down by RBI in its ‘in-principle’

approval, the RBI would grant a banking licence to them.

Conclusion:

The introduction of Payment Banks in India is a major positive disrup-

tion to the banking sector and would certainly see the cost associated

with transfer of money or settlements reduce dramatically for end us-

ers. Payment banks have been restricted in banking operations, as

they will not be allowed to carry out normal lending activities. It does

raise questions about who will serve credit needs of the unbanked.

RBI suggests that Payment Banks will serve as a bridge to allow peo-

ple to eventually migrate to full-service banks, which is quite likely.

When seen in the background of limited access to the formal banking

system, however, the need to introduce newer forms of banks is the

way to go, in the correct perspective.

Payments banks will face competition from the existing lenders. Be-

sides, profitability will also remain a challenge as they will be work-

ing on narrow margins. To this end, due to ever-growing customers’

expectations for faster-easier-simpler banking facilities what will drive

the bankers is to work with creativity and passion, which contributes

to growth of cross sections of our society, and so the challenges.

REFERENCES • News Papers – The Economic Times, Business Line, and The Times of India. • Articles. Websites • http://articles.economictimes.indiatimes.com

• http://www.rbi.org.in

GJRA - GLOBAL JOURNAL FOR RESEARCH ANALYSIS X 135

You might also like

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Frequently Asked Questions Frequently Asked Questions Frequently Asked QuestionsDocument9 pagesFrequently Asked Questions Frequently Asked Questions Frequently Asked QuestionsPavan Kalyan J PspkNo ratings yet

- Small Banks and Payment Banks ExplainedDocument12 pagesSmall Banks and Payment Banks ExplainedAakash JainNo ratings yet

- Final Project On Financial InclusionDocument33 pagesFinal Project On Financial InclusionUtkarsh SinghNo ratings yet

- ARTICLEDocument4 pagesARTICLEAmit MaliNo ratings yet

- Bhavesh Jhala 1 PDFDocument42 pagesBhavesh Jhala 1 PDFAniket AutkarNo ratings yet

- Acknowledgement: Sunil Kumar Tyagi Under Whose Guidance and Supervision Project ReportDocument75 pagesAcknowledgement: Sunil Kumar Tyagi Under Whose Guidance and Supervision Project Reportsheery_ank007899No ratings yet

- Course Outline _ Banking Services and Operations DM 22107 _Term-IV_STC-Union BankDocument173 pagesCourse Outline _ Banking Services and Operations DM 22107 _Term-IV_STC-Union BankPRO FilmmakerNo ratings yet

- Payments BankDocument14 pagesPayments BankDurjoy BhattacharjeeNo ratings yet

- Standard Chartered BankDocument28 pagesStandard Chartered BankRajni YadavNo ratings yet

- A STUDY ON CUSTOMER AWARENESS ON E BankingDocument50 pagesA STUDY ON CUSTOMER AWARENESS ON E BankingKarthicselvam Kandavel IasNo ratings yet

- Report On Banking SectorDocument8 pagesReport On Banking SectorSaurabh Paharia100% (1)

- Differential Banking Licenses ExplainedDocument8 pagesDifferential Banking Licenses ExplainedSakshiNo ratings yet

- Guidelines For Summer Report - Experienced Research-BasedDocument17 pagesGuidelines For Summer Report - Experienced Research-Basedanon_652657732No ratings yet

- A Project Report ON Role of Financial Services in India: AcknowledgementDocument79 pagesA Project Report ON Role of Financial Services in India: AcknowledgementPreeti Vijay ManchandaNo ratings yet

- Payment and Small BanksDocument27 pagesPayment and Small BanksDr.Satish RadhakrishnanNo ratings yet

- Shiv RamDocument71 pagesShiv RamaanandmathurNo ratings yet

- BK Swain DocumentDocument11 pagesBK Swain DocumentSatyashil RangareNo ratings yet

- Marketing Practices of Public Sector Banks - 2Document4 pagesMarketing Practices of Public Sector Banks - 2nitinsule64No ratings yet

- Sarang LLM NewDocument32 pagesSarang LLM NewSarangNo ratings yet

- "Mobile Banking" SBI by Komal Sawant: A Project Report ONDocument27 pages"Mobile Banking" SBI by Komal Sawant: A Project Report ONsanket yelaweNo ratings yet

- Financial Inclusion-Role of Payment Banks in India: IRA-International Journal of Management & Social SciencesDocument6 pagesFinancial Inclusion-Role of Payment Banks in India: IRA-International Journal of Management & Social Sciencesmonica niroliaNo ratings yet

- 2nd ChapterDocument30 pages2nd ChapterAnantha KrishnaNo ratings yet

- Banking: Industries in IndiaDocument41 pagesBanking: Industries in IndiaManavNo ratings yet

- Introduction of Banking Industry - Draft 1Document1 pageIntroduction of Banking Industry - Draft 1Rajdeep RoyNo ratings yet

- A Study On Customer Awareness On e BankiDocument81 pagesA Study On Customer Awareness On e Bankitushar vatsNo ratings yet

- Final Project On Financial InclusionDocument33 pagesFinal Project On Financial InclusionPriyanshu ChoudharyNo ratings yet

- JK Bank Project ReportDocument74 pagesJK Bank Project ReportSurbhi Nargotra43% (7)

- Indian Banking SectorsDocument4 pagesIndian Banking SectorsAamir KhanNo ratings yet

- NischayDocument51 pagesNischaybiltu majiNo ratings yet

- Bank of India Retail Banking ProductsDocument107 pagesBank of India Retail Banking ProductsPooja Mathur100% (1)

- Recent Devt BankingDocument29 pagesRecent Devt BankingshivaNo ratings yet

- Research Parer On Payment Banks and Small Finance BanksDocument9 pagesResearch Parer On Payment Banks and Small Finance BanksKrushna TaurNo ratings yet

- Indian BankingDocument4 pagesIndian Bankingrahul vatsyayanNo ratings yet

- Differentiated Banking in India-Is India Really PreparedDocument32 pagesDifferentiated Banking in India-Is India Really PreparedApurva JhaNo ratings yet

- Banking IndustryDocument4 pagesBanking Industrygurjeetkaur1991No ratings yet

- India Banking Industry OverviewDocument6 pagesIndia Banking Industry OverviewBhavik LathiaNo ratings yet

- Financial Services Report on BanksDocument73 pagesFinancial Services Report on BanksVishalSawantNo ratings yet

- Universal Banking LatestDocument189 pagesUniversal Banking LatestSony Bhagchandani50% (2)

- Finance UbiDocument36 pagesFinance UbiRanjeet RajputNo ratings yet

- Marketing of Banking-ServicesDocument25 pagesMarketing of Banking-ServicesImran ShaikhNo ratings yet

- UTI BankDocument69 pagesUTI BankSnehal RunwalNo ratings yet

- Project Report On Comparative Analysis of Private Sector Bank On Basis of Current Account, Saving Account & Fixed DepositDocument14 pagesProject Report On Comparative Analysis of Private Sector Bank On Basis of Current Account, Saving Account & Fixed DepositJamar WebbNo ratings yet

- Bank of IndiaDocument94 pagesBank of IndiaOm Prakash Singh100% (2)

- Financial Services Offered by BankDocument52 pagesFinancial Services Offered by BankIshan Vyas100% (2)

- Banking Industry: September 23, 2010 Npa - Non-Performing Assets, Roa - Return On AssetsDocument11 pagesBanking Industry: September 23, 2010 Npa - Non-Performing Assets, Roa - Return On Assets9725196979No ratings yet

- Punjab National Bank 1-Amit Kumar SrivastavaDocument66 pagesPunjab National Bank 1-Amit Kumar SrivastavaAwanish Kumar MauryaNo ratings yet

- Bank SynopsisDocument7 pagesBank SynopsisNiro ThakurNo ratings yet

- A Project On Banking SectorDocument81 pagesA Project On Banking SectorAkbar SinghNo ratings yet

- A Report OnDocument26 pagesA Report OnNihar HindochaNo ratings yet

- HDFC BankDocument20 pagesHDFC Bankmohd.irfanNo ratings yet

- Commercial Bank Loan ManagementDocument13 pagesCommercial Bank Loan ManagementBinod PoudelNo ratings yet

- Smfgu271114 PDFDocument10 pagesSmfgu271114 PDFHarsh JainNo ratings yet

- Summer Internship Project On BankDocument76 pagesSummer Internship Project On BankReema Negi100% (3)

- 1.3 Current Scenario:-: Repayable On Demand or Otherwise and Withdrawal by Cheque, Draft or Otherwise"Document7 pages1.3 Current Scenario:-: Repayable On Demand or Otherwise and Withdrawal by Cheque, Draft or Otherwise"balenappasNo ratings yet

- Formidable Challenges Facing by The Banking Sector in IndiaDocument3 pagesFormidable Challenges Facing by The Banking Sector in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Indian Banking System by Swapnil Chavan in Banking and Insurance Category On ManagementParadise - 13Document66 pagesIndian Banking System by Swapnil Chavan in Banking and Insurance Category On ManagementParadise - 13Sonu SharmaNo ratings yet

- Indian Banking System by Swapnil Chavan in Banking and Insurance Category On ManagementParadise - 13Document66 pagesIndian Banking System by Swapnil Chavan in Banking and Insurance Category On ManagementParadise - 13Sonu SharmaNo ratings yet

- Project Report on Banking System and Credit Schemes in IndiaDocument9 pagesProject Report on Banking System and Credit Schemes in IndiamanishteensNo ratings yet

- Problems in Overhead AllocationDocument2 pagesProblems in Overhead AllocationMEERA JOSHY 1927436No ratings yet

- Case 2Document2 pagesCase 2MEERA JOSHY 1927436No ratings yet

- Hospital Supply Inc Cost AnalysisDocument5 pagesHospital Supply Inc Cost AnalysisMEERA JOSHY 192743633% (3)

- Calculating Cost of Goods Sold and Net IncomeDocument12 pagesCalculating Cost of Goods Sold and Net IncomeUmair AliNo ratings yet

- AI Basics Pages 1 - 50 - Flip PDF Download - FlipHTML5 PDFDocument196 pagesAI Basics Pages 1 - 50 - Flip PDF Download - FlipHTML5 PDFMEERA JOSHY 1927436No ratings yet

- Cost Accounting Class XI PDFDocument173 pagesCost Accounting Class XI PDFKaushal guptaNo ratings yet

- COVID-19: The Many Shades of A Crisis: A Media and Entertainment Sector PerspectiveDocument16 pagesCOVID-19: The Many Shades of A Crisis: A Media and Entertainment Sector Perspectiveraj_adityaNo ratings yet

- TAX CHANGES IN INDIA AND MOROCCO: A COMPARISONDocument20 pagesTAX CHANGES IN INDIA AND MOROCCO: A COMPARISONMEERA JOSHY 1927436No ratings yet

- AI: A Game-Changer For Financial InclusionDocument13 pagesAI: A Game-Changer For Financial InclusionMEERA JOSHY 1927436No ratings yet

- The Strategic Alliance Is A Cooperation Form That Is Not Commonly Defined in The Academic LiteratureDocument2 pagesThe Strategic Alliance Is A Cooperation Form That Is Not Commonly Defined in The Academic LiteratureMEERA JOSHY 1927436No ratings yet

- FinalPublishedPaper CatalystDocument7 pagesFinalPublishedPaper CatalystMEERA JOSHY 1927436No ratings yet

- Research Proposal ReportDocument5 pagesResearch Proposal ReportMEERA JOSHY 1927436No ratings yet

- Awareness and Usage of Payment Banks Among College StudentsDocument21 pagesAwareness and Usage of Payment Banks Among College StudentsMEERA JOSHY 1927436No ratings yet

- 24Document9 pages24tik tripathiNo ratings yet

- Awareness and Usage of Payment Banks Among College StudentsDocument21 pagesAwareness and Usage of Payment Banks Among College StudentsMEERA JOSHY 1927436No ratings yet

- Understanding BusinessDocument12 pagesUnderstanding BusinessSandhesh Mohandas50% (4)

- AI: A Game-Changer For Financial InclusionDocument13 pagesAI: A Game-Changer For Financial InclusionMEERA JOSHY 1927436No ratings yet

- Role of Payments BankDocument16 pagesRole of Payments BankAstik TripathiNo ratings yet

- Financial Inclusion-Role of Payment Banks in India: IRA-International Journal of Management & Social SciencesDocument6 pagesFinancial Inclusion-Role of Payment Banks in India: IRA-International Journal of Management & Social Sciencesmonica niroliaNo ratings yet

- Accounting Basics: For Beginners Dr. P. SreelakshmiDocument19 pagesAccounting Basics: For Beginners Dr. P. SreelakshmiridhiNo ratings yet

- HADM 2250 Prelim Review QuestionsDocument52 pagesHADM 2250 Prelim Review QuestionsPrithvi BhushanNo ratings yet

- Project Work Report On Channel Management - in Mutual Fund SalesDocument104 pagesProject Work Report On Channel Management - in Mutual Fund Salesramesh100% (2)

- Polaris Software Acquires Laser Soft Infosystems: Adds 40 New Financial Institutions To Its Customer PortfolioDocument2 pagesPolaris Software Acquires Laser Soft Infosystems: Adds 40 New Financial Institutions To Its Customer Portfolioindia nesanNo ratings yet

- Illustrative Financial Statements: Private Equity & Venture CapitalDocument36 pagesIllustrative Financial Statements: Private Equity & Venture CapitalCreative MarqetingNo ratings yet

- Payslip January 2023Document4 pagesPayslip January 2023Mohit ChahalNo ratings yet

- HDFC SLIC OverviewDocument40 pagesHDFC SLIC Overviewprinceramji90No ratings yet

- Opening and Closing of Accounts Fin 4Document13 pagesOpening and Closing of Accounts Fin 4Enitan MustaphaNo ratings yet

- Prac ReviewDocument3 pagesPrac ReviewYannah RebogioNo ratings yet

- Topic IV - Cash Flow Statement - Jianne's FABM NotesDocument5 pagesTopic IV - Cash Flow Statement - Jianne's FABM NotesJianne Ricci GalitNo ratings yet

- Bancassurance: Isha Chugh Assistant Professor Gargi College University of DelhiDocument29 pagesBancassurance: Isha Chugh Assistant Professor Gargi College University of Delhipallavi mishraNo ratings yet

- Statement of Account: Summary of Charges and CreditsDocument3 pagesStatement of Account: Summary of Charges and CreditsRye LozadaNo ratings yet

- AirtelDocument2 pagesAirtelShraddha RawatNo ratings yet

- D.2.2. G.R. No. 169407 March 25, 2015 Bank of The Philippine Islands, Petitioner, v. AMADOR DOMINGO, Respondent. FactsDocument2 pagesD.2.2. G.R. No. 169407 March 25, 2015 Bank of The Philippine Islands, Petitioner, v. AMADOR DOMINGO, Respondent. FactsEmmanuel Princess Zia Salomon100% (2)

- Finals Quiz 2Document9 pagesFinals Quiz 2Shane TorrieNo ratings yet

- Group 3 Financial MarketsDocument17 pagesGroup 3 Financial MarketsLady Lou Ignacio LepasanaNo ratings yet

- JP Morgan Guide - To - Mutual - Fund - InvestingDocument12 pagesJP Morgan Guide - To - Mutual - Fund - InvestingAnkit KanojiaNo ratings yet

- Fabm1 Grade-11 QTR1 Module4 Week-4Document6 pagesFabm1 Grade-11 QTR1 Module4 Week-4John anthony CasucoNo ratings yet

- Basic Accounting - Prelim Exam (Preparation) - 2021 VersionDocument2 pagesBasic Accounting - Prelim Exam (Preparation) - 2021 VersionJulienne SulivasNo ratings yet

- Chapter 3 Accounting For Branch Record ADocument14 pagesChapter 3 Accounting For Branch Record Aathirah jamaludinNo ratings yet

- Recruitment and Selection Process of Insurance CompaniesDocument85 pagesRecruitment and Selection Process of Insurance CompaniesAkhtar NawazNo ratings yet

- Annuity CalculatorDocument2 pagesAnnuity CalculatorBlueQuillNo ratings yet

- Issue of Shares and DebenturesDocument11 pagesIssue of Shares and DebenturesNitin JainNo ratings yet

- LK Buku Besar PT Home BycicleDocument7 pagesLK Buku Besar PT Home BycicleFredi Dwi SusantoNo ratings yet

- Audit cash equivalents essentialsDocument108 pagesAudit cash equivalents essentialscarl fuerzasNo ratings yet

- Your M&S Credit Card Statement: %%mail - BarcodeDocument4 pagesYour M&S Credit Card Statement: %%mail - BarcodeColleen McCarthyNo ratings yet

- Treasury Challan No: 0200025706 Treasury Challan No: 0200025706 Treasury Challan No: 0200025706Document1 pageTreasury Challan No: 0200025706 Treasury Challan No: 0200025706 Treasury Challan No: 0200025706Mallikarjuna SarmaNo ratings yet

- Shortlist Axis BankDocument12 pagesShortlist Axis BankPunyak SatishNo ratings yet

- State University - Financial Intermediation SyllabusDocument12 pagesState University - Financial Intermediation SyllabusAndrewNo ratings yet

- Comprehensive Case 2 A201 H3 PDFDocument6 pagesComprehensive Case 2 A201 H3 PDFdini sofiaNo ratings yet

- LinkageDocument1 pageLinkagerasool mehrjooNo ratings yet