Professional Documents

Culture Documents

Child2006 (2015 - 08 - 03 05 - 36 - 57 UTC)

Uploaded by

namitaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Child2006 (2015 - 08 - 03 05 - 36 - 57 UTC)

Uploaded by

namitaCopyright:

Available Formats

Preface Contents

Money Financial planning for your children is probably

something that takes up a lot of your 'worrying' time.

Why plan for your child's future? ------------------------------------------------------- 3

Simplified You know that you need to start setting aside money

for your child's needs. But what you do not know is the

Case Study: Planning for child's education -------------------------------------------- 4

Planning your ideal way to go about doing the same. Add to that the Child Plans: Securing your child's future ----------------------------------------------- 8

child’s future 'noise' about the various investment products designed

to meet a child's needs and you are left grappling with Child Plans: A comparative analysis -------------------------------------------------- 11

Copyright: more than you can handle.

Mutual funds for your child ------------------------------------------------------------ 16

At Personalfn, our experiences with parents who wish

to plan for their child's needs are wide and varied. In Evaluating child funds ------------------------------------------------------------------ 19

Quantum Information most cases we find that the parent has already embarked

Services Pvt. Ltd. on a financial plan by setting aside some money for Equities and Your kid(s) - Do's and Don'ts ------------------------------------------- 22

his/her child. However, usually this money is invested

Websites: in avenues that are not the most suited for such a "Assure" your child's future ----------------------------------------------------------- 23

www.personalfn.com financial plan. Moreover, the allocation of these

www.equitymaster.com savings to various asset classes tends to be lopsided. 5 steps to plan for child's future ------------------------------------------------------- 30

In short, few parents can be said to have planned well

Contact Information: for their children.

Quantum Information

Services Pvt. Ltd., At the other extreme are parents, who are yet to start

404, Damji Shamji planning for their child's needs. If the parents have

Vidyavihar (W), time on their side, the entire financial planning exercise

Mumbai - 86 India becomes a lot more manageable; else, it becomes a

financial burden, which is difficult to do away with.

Email:

info@personalfn.com In this issue of the Money Simplified, we handhold

you through the entire process of financial planning

Contact No.: for your child. We also discuss the various investment

022 - 6799 1234 options available to you. We are sure that once you

have read this issue, you will be able to plan a lot smarter

Fax No.: for your child! Help us improve. Take part in our Reader Survey. Click here!

022 - 2202 8550

Download previous issues of Money Simplified. Click here!

Happy investing!

Content:

Abhijit Shirke Team Personalfn DISCLAIMER

Himanshu Srivastava 20th July, 2006 This booklet a) is for Private Circulation only and not for sale. b) is only for information purposes and Quantum Information Services

Private Limited (Personalfn) is not providing any professional/investment advice through it and Personalfn disclaims warranty of any

Irfan Husain Rupani kind, whether express or implied, as to any matter/content contained in this booklet, including without limitation the implied warranties

of merchantability and fitness for a particular purpose. Personalfn will not be responsible for any loss or liability incurred by the user

Janet Thomas as a consequence of his taking any investment decisions based on the contents of this booklet. Use of this booklet is at the user’s own

Vicky Mehta risk. The user must make his own investment decisions based on his specific investment objective and financial position and using

such independent advisors as he believes necessary. Information contained in this Report is believed to be reliable but Personalfn does

Rahul Goel not warrant its completeness or accuracy.

Copyright: Quantum Information Services Private Limited.

1 visit us at www.personalfn.com visit us at www.personalfn.com 2

Why Plan? Why MidStudy

Case Caps?

Importance of planning for your child's future Case Study: Planning for child's education

The dynamics of planning for the child's can pursue his higher education, the next

future have changed radically over the step is to make investments to meet that As a parent, you generally plan from the 1. Provide funds both for graduation

years. The conventional method of target. Let us assume that investments perspective of making funds available (let's say engineering) and post-

providing for the child was to simply set are made in well-managed diversified to your child for - graduation expenditure (a management

aside some money in a savings bank equity funds or ULIPs (which are a. Education course)

account. These funds would then be predominantly invested in equity) which b. Marriage 2.You wish to provide for not just the

utilised for the child's life stages. At best, yield a return of 12% CAGR c. Seed capital for business course fee but also the living expenses

parents would make investments in fixed (compounded annualised growth rate) during the 5 - 7 years of study

deposits with the intention of providing over the 15-Yr period. This would entail While the need for education is 3.Your child is expected to study in India

from the maturity proceeds. However, it investing around Rs 4,400 per month. universal, the desire to provide for and therefore no need to factor in

would be safe to say that such an That doesn't seem too tough, does it? marriage-related expenditure and seed currency risk

approach is not only outdated, but also capital to your child for business is 4.You expect the course fee and the

inadequate in the present scenario. Even if your objective is to provide for perhaps more relevant in the Indian living expenditure to inflate on an

your child's marriage, property or seed context. In this note, we will focus our average by 10% pa (per annum) over the

Inflation or a general rise in prices can capital for a business venture for your discussion on how you, a parent, can years

be credited as the single largest child, the above approach holds good. go about planning for your child's

contributor for this situation. None of education needs, since it is the most Given this information and also some

the areas like education, marriage or The key lies in identifying each objective critical of the three objectives we have more regarding any monies that you have

even one's lifestyle are left unscathed that you wish to provide for in an outlined above. already invested for the purpose of your

by rising prices. Hence it is imperative unambiguous manner and then child's education, one can help draw up

that parents account for this quantifying it. You should have multiple Before venturing any further, it is a financial plan that will help you fulfill

phenomenon while providing for their investment portfolios, each catering to pertinent to note that financial planning, this objective.

children. an earmarked objective. The next step is be it for your child or for your retirement

to engage the services of an expert or for any other need, is a very As mentioned earlier, financial planning

An example should help us explain this investment advisor who can help you personalised activity. It will work best is a very personalised activity. The

better. Assume that a 2-year MBA manage the investments and achieve the for you only if there is customisation to reason is that each individual's needs

program in a leading business school goals defined by you. suit your exact needs and profile. Also are to be seen in the context of his risk

costs Rs 500,000 at present. Your child to be noted is the fact that financial appetite, expectation of returns, cash

is 5 years old now and will pursue the Children and their well-being often rank planning is not a one-time activity. In flows and other financial commitments.

management degree at the age of 20 as the highest "priorities" for parents fact it will be fair to say that making of In our case study, we have provided

years. This gives you a time frame of 15 and words like "only the best for my the plan is only the start of what is going solutions for broadly three types of

years. Assuming that the inflation rate child" are rather common. However just to be an ongoing activity for many years parents - one, who can take considerable

is 10% per annum, the education would having your heart in the right place isn't to come. risk; two, who have a moderate risk

cost Rs 2,088,624. Now that seems a sufficient. Instead what you need is a profile and three, the risk averse parent.

handful, doesn't it? practical approach to ensure that you Let's say you wish to plan for your

work towards providing your child with child's education needs; your child is Naturally, the parent, who is willing to

However, if you have an investment plan a financially secure future. likely to go to college 15 years from take higher risk, should ideally be

in place, this target can be easily now. The following is what you desire compensated by a higher return, the

achieved. Now that you are aware of the And that just might be the best present and/or expect - assumption being the investments are

sum required to ensure that your child you will ever gift your child! made wisely (irrationally investing in

risky assets will get you nowhere). Such

3 visit us at www.personalfn.com visit us at www.personalfn.com 4

Case Study Case Study

a parent's portfolio will have a higher assets should ideally be higher; the The solution actually is very Financial planning for your children is

concentration of risky assets like equity exact allocation will depend on the manageable. For a parent with a high not a difficult task. If you are disciplined

mutual funds or Unit linked Insurance parent. We have assumed that a risk appetite, the money that needs to in executing your financial plan,

Plans (ULIPs) with high equity exposure. moderate risk portfolio can yield about be set aside every month is just Rs reviewing it from time-to-time and making

The portfolio will also have an exposure 12% CAGR. 11,042! Of course, this money needs to adjustments whenever necessary, there

to assets that carry lower risk, which will be invested in a portfolio that comprises is little reason that you will miss your

in effect reduce the overall volatility of For the sake of simplicity we have various asset classes in a predetermined target. But this is easier said than done.

the portfolio. Such a portfolio, we assumed that these portfolios are owned proportion as discussed earlier. As a parent you will need to block out a

believe, can earn a return of about 15% till the day the money is needed. Ideally, Naturally, the parent with the lowest risk lot of the noise out there pertaining to

CAGR (Compounded Annual Growth there needs to be de-risking of the appetite will need to set aside more this new investment opportunity or that;

Rate). portfolio as the investment tenure money to accumulate the same sum. remember your child's future is at stake.

comes to an end. About three years prior

At the other extreme is a risk-averse to when the money is needed one

parent, who is investing only in schemes should, in our view, take measures to

that are backed by the Government of de-risk the portfolio. And then again, all

India like the Public Provident Fund the money will not be withdrawn at one

(PPF) and the National Savings point in time; so part of it that is not

Certificate (NSC). Alternatively one can withdrawn will continue to earn a return.

invest in mutual funds and ULIPs, which This will have an impact on the overall

invest in Government of India debt financial plan (though partially these

instruments. In case of PPF the return two points will offset each other). Ensure

(presently 8% pa) is reset every year and that your financial planner factors these

there is a limit to how much one can points in.

invest in a year; but then all income is

tax-free. In the case of NSC or other Another factor that a parent needs to

deposits the rate of return is locked, but keep in mind is that he/she needs to

the income earned is taxable (post tax allocate monies to various asset classes

rate is about 5.3% for the parent in the in a predetermined ratio to ensure that

highest tax bracket). A portfolio of these the objectives of the portfolio are met.

schemes (some tax-free, some not) can Any solution where all the money is

in our view earn a return of about 5.5% invested in one asset class is not an

CAGR over the investment horizon. Any advisable proposition.

change in taxation laws will definitely

have an impact on these returns (there Coming to the solution, the first number

is a proposal pending for making interest that hits you in our table is the 'inflated'

income from the PPF taxable). cost of education and living expenses

The parent with a moderate risk appetite 15 years from now. Indeed, if seen in

should have a combination of risky isolation, you might almost give up in

assets like equity funds (or stocks) and terms of ever having enough money to

less risky assets like deposits and bonds. provide for your child's education need.

Since the tenure of investment is usually However, what appears impossible is not

over ten years, the allocation to riskier really so.

5 visit us at www.personalfn.com visit us at www.personalfn.com 6

Case Study Child Insurance

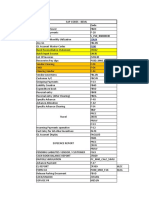

Solution for Child Planning - Education Child Plans: Securing your child's future

Case 1 Case 2 Case 3

Life insurance plays an important role in that the individual will have to pay for

Aggressive Moderate Govt Sch. an individual's financial planning the plan is approximately Rs 34,750 per

exercise. Insurance can assist annum (pa). In case of an eventuality to

Cost of College Education today* Rs 2,000,000 2,000,000 2,000,000 individuals in planning for their own life the individual, his nominee will receive

Time to College yrs 15 15 15

stages as well as provide for their child's the sum assured (i.e. Rs 500,000) plus

future. Various types of child insurance declared bonuses if any.

Expected inflation in fee % 10.0 10.0 10.0

products are available in the market In case of survival, as per the terms of

Expected Cost of College Education Rs 8,354,496 8,354,496 8,354,496 today. Individuals need to understand the money back policy, the parent will

these products better so they can make receive an amount of Rs 125,000 pa when

Money you have already set aside… Rs 200,000 200,000 200,000 an informed decision.

Table 2

Existing assets will grow at…(Post tax) % 15.0 11.5 5.5

Child insurance plans help in addressing End Guaranteed Bonus Total

Value of existing assets then Rs 1,627,412 1,023,654 446,495 of year amount amount amount

the child's future needs such as

Therefore, net to be accumulated Rs 6,727,084 7,330,843 7,908,001 (Rs) (Rs) (Rs)

education, marriage or even building

15 125,000 0 125,000

seed capital for future business

16 125,000 0 125,000

Solution purposes. They do this by way of

helping parents build a corpus for their 17 125,000 0 125,000

Case 1 Case 2 Case 3

children. An illustration will help in 18 125,000 225,000/ 350,000/

Aggressive Moderate Govt Sch.

understanding this better. 360,000* 485,000*

Monies to be accumulated… Rs 6,727,084 7,330,843 7,908,001 *Amounts are calculated at 6% & 10% returns.

Assumed Return (Pre tax) % 15.0 12.0 8.0 Table 1

Age Sum Tenure Premium his son attains 18 years, 19 years, 20

Assumed Return (Post tax) % 15.0 11.5 5.5

(Yrs) assured (Rs) (Yrs) (Rs) years and 21 years of age. This plan will

Tenure yrs 15 15 15

35 500,000 18 34,750 help the individual take care of his child's

Annual Saving Required Rs 141,383 204,709 352,899

education expenses. As subsequent

Or simply, Monthly investment of Rs 11,042 16,221 28,692 Let us consider a 35-year old parent who proceeds mature, they can fund the

Or a one-time investment of Rs 826,722 1,432,290 3,542,255 has a 3-year old child. The individual child's education on an ongoing basis.

wants to insure himself for a sum of Rs

500,000 so that when his son is 21 years In addition, on maturity of the policy

* Includes combined fee and monies for living for an Engineering and an MBA course old he can avail of the maturity (which will coincide with the son

from a rated institute in India proceeds. He selects a policy with an attaining 21 years of age), the parent will

Tax Rate assumed at 30% plus applicable surcharge 18-year tenure. In addition to the amount also receive the declared bonuses

at maturity, the individual also wants to alongwith the regular payout. In our

receive fixed amounts at regular intervals example, he will receive approximately

from his insurance plan to take care of Rs 225,000 (calculated @ 6%) or Rs

his son's education. For this reason, he 360,000 (calculated @ 10%) as bonus

opts for a money back plan. additions on maturity.

As Table 1 shows, the insurance premium This is how money back plans work.

7 visit us at www.personalfn.com visit us at www.personalfn.com 8

Child Insurance Child Insurance

Broadly speaking, money-back equities, their importance in a portfolio sum of money is being invested towards

insurance plans are variants of the The lumpsum receivable on maturity of (mutual funds, ULIP) cannot be your own child's future and not towards

endowment plan. Parents can also opt the policy in case the individual survives understated. the future of your insurance agent's

for regular endowment child plans, the tenure is approximately Rs 316,848 child.

which offer a lumpsum amount on (assuming returns @ 6%) or Rs 497,474 ULIPs have several important features

maturity as opposed to regular payouts (assuming returns @ 10%). The that should make parents sit up and take 4. ULIPs often disclose their portfolios

under the money-back type of child lumpsum payout will help the individual notice: at regular intervals (monthly, quarterly),

plans. in funding say, his daughter's marriage so you have a fairly good idea about

when she is 21 years old. 1. They are very flexible; most ULIPs where your money is being invested.

Child plans come in two broad variants - (including child ULIPs) offer several

regular endowment child plans and unit Parents have a choice; they can either options to parents with varying risk Parents should consider taking on some

linked insurance plans (ULIPs). The opt for a regular endowment plan which profiles. Parents can shift across options risk (by investing in equities) to beat

primary difference between the two lies carries relatively lower risk since it is depending on their view on debt and inflation, which is the main reason the

in the way they invest their premium invested mainly in corporate bonds and equity markets. For instance, if equity cost of everything right from your child's

monies. Regular endowment plans government securities. The bonuses are markets appear over-heated, a portion education to his marriage is forever

invest a major portion of their money in stable and give the parent considerable of the ULIP money can be switched to spiralling. Over a 15-20 year time frame,

debt instruments like corporate bonds comfort knowing roughly how much he the debt/lower equity option. if wisely selected, a ULIP even with

and government securities (as specified can expect. Regular endowment plans moderate equity allocations could add

by the regulator). Conversely, ULIPs can are suited for parents with a low risk 2. If you have got a large sum of money considerably to your child's corpus. In

invest across equity and debt markets appetite. (annual bonus, for instance) that you our case study 'Planning for child's

in varying proportions. Table 1 was an wish to set aside for your child's future, education', we have outlined how the

example of a conventional endowment Parents with some risk appetite can opt you can invest it in the ULIP. This amount presence of equities in the portfolio for

child plan. Now let us consider the for a ULIP child plan that invests across is over and above the annual premium your child's future, can help you achieve

working of a ULIP child plan. equity and debt markets. The reason why on ULIP. It's referred to as the top-up that magic figure for your child's

ULIP child plans can prove to be premium and is specific to that year only; education.

Let us take the case of a parent aged 33 significant is because over the long-term you don't have to necessarily

years who has 4-month daughter today. (15-20 years), equities can add match that amount next year. Life insurance has much to offer to

The parent has opted for a ULIP child considerably to the corpus you plan to parents looking to accumulate wealth

plan with a sum assured of Rs 50,000 for build for your child's needs. In our view, 3. ULIPs generally incur lower expenses for their child's future. There are several

a 20-Yr tenure. This plan gives him a equities are best placed to beat inflation than regular endowment plans. In most plans offering enough flexibility to help

lumpsum on maturity. The annual over the long term. However, to achieve cases the sales and marketing costs of a parents with the same. It all boils down

premium payable for the same is Rs this one must invest wisely. Debt on the ULIP are lower than of endowment plans. to making the right choice in

10,000. As Table 3 shows, in case of an other hand brings stability to a portfolio. Lower ULIP expenses means that a larger consultation with your financial advisor.

eventuality, the nominees stand to While the returns for debt at times may

receive Rs 50,000 (i.e. the sum assured). seem unattractive as compared to

Table 3

Age of parent Sum assured Tenure Annual premium Death benefit Maturity Benefit

(Yrs) (Rs) (yrs) (Rs) (Rs) (Rs)

33 50,000 20 10,000 50,000 316,848/ 497,474*

*Amounts are calculated at 6% & 10% returns.

9 visit us at www.personalfn.com visit us at www.personalfn.com 10

ITC

Comparing Child Plans Comparing Child Plans

Child Plans: A comparative analysis 4. Aviva (Young Achiever) three choices to cover the individual in

Young Achiever is a unit linked child plan a single plan- they differ primarily with

Child insurance plans have traditionally 2. ICICI PruLife (SmartKid New Unit- from Aviva life. It is available in three respect to the 'benefits' in case of an

played an important role in securing the linked Regular Premium) options ranging from 0%-85% in equities. eventuality. Under the 'Accelerated

child's future. However, with a plethora SmartKid is a flexible education This child plan affords individuals with Benefit' option, in case of an eventuality,

of children insurance plans available in insurance ULIP from ICICI PruLife. It is a low minimum premium amount (Rs the sum assured (SA) alongwith

the market, it becomes difficult for available with four fund options ranging 6,000) and a low minimum withdrawal bonuses if any, are paid out to the

individuals to evaluate them objectively. from 0%-100% equity. A noteworthy amount (Rs 5,000). The top-up amount nominees and the policy terminates

We have done an overview of children point is that while its 'most aggressive' too at Rs 1,500 is the lowest as compared immediately; under the 'Maturity Benefit'

plans from leading life insurance option can invest in the range of 75%- to the other plans in the table. However, option, the policy continues in case of

companies. 100% in equities, the 'next best' option for individuals with a high-risk appetite, an eventuality but the nominees do not

(in terms of aggression) i.e. the 'Balancer this plan puts a cap on its equity have to pay any further premiums; under

Unit-linked child plans II' option can invest only upto a investments at 85% in its most the 'Double Benefit' option the SA is

maximum of 40% in equities. The monthly aggressive fund option. On the flipside, paid to the nominees and the policy also

1. HDFC (Young Star Plus) charges (at Rs 60 pm) are on the higher this can help the fund in 'limiting' its continues in the insured' absence. The

The Young Star Plus from HDFC side, but are offset by low premium losses during a bear phase. minimum premium for this plan at Rs

Standard Life is a flexible unit-linked allocation charges of 18%-20% in the 1,800 is also on the lower side.

children's plan. There are six fund first year going down to 1% after ten Regular Endowment-based Child Plans

options available to the policyholder years. Also, the minimum withdrawal 3. ICICI PruLife (SmartKid Regular

under this plan. The plan is designed to amount at Rs 2,000 is the lowest in our 1. Life Insurance Corporation-LIC Premium Plan)

give the individual the flexibility to select sample, which gives that much more (Jeevan Anurag) The regular premium child plan from

an option with anywhere between 0% flexibility to the parent. The plan is the Jeevan Anurag is a regular child plan ICICI PruLife is based on the money-

to 100% equity allocation depending only one to offer an income benefit rider, from LIC based on the money-back back platform in that it offers payouts at

upon his risk appetite. which pays 10% of the rider sum assured platform and offers payouts at regular regular intervals. Two payout options

to the child, every year till maturity, in intervals (i.e. money-back policy). The are made available to the individual - one

In terms of initial policy expenses, ULIPs the event of the parent's death. payouts begin in the last four policy option gives the individual payouts

from HDFC Standard Life are expensive/ years- 20% of the sum assured is paid over the last five years of the policy;

cheap depending on the premium 3. Tata-AIG (Invest Assure II) out in each of the three years preceding the second option allows the individual

amount. The range varies from 10%-60% The ULIP offers flexibility in terms of the year of maturity. In addition, 40% of to receive payouts at specific intervals,

of first year's premiums. However, in allowing investments in equities in the the basic sum assured alongwith which may coincide with the

terms of fund management charges 0%-100% range. However, the fund bonuses if any, are paid out in the last educational needs of the child. The

(FMC) it is among the most cost effective management charges are relatively steep year i.e. on maturity. In case of an minimum premium at Rs 8,400 is on the

at 0.80% per annum (pa) across all fund - as high as 1.60% for the 'Aggressive eventuality, the sum assured is paid out higher side as compared to the other

options; likewise even the monthly Growth' option and 1.75% for the 'Equity to the nominee and the plan continues plans in the table.

charges are competitive at Rs 20 per Fund'. Also, the tenures available are with the regular payout benefits intact.

month (pm). Another positive is that it limited; only 3 tenure options are The minimum sum assured at Rs 50,000 4. Bajaj Allianz (ChildGain)

allows upto 24 free switches across available - 15 years, 20 years and 30 years. is low for this plan thereby making it an The ChildGain plan from Bajaj Allianz is

options in a year. It also permits the Individuals cannot opt for say an 18- affordable one for individuals. a child plan based on the money-back

individual to make a maximum of 6 free year or a 25-year tenure. platform and which offers payouts at

withdrawals pa. 2. HDFC (Children's Plan) regular intervals. The tenure in this plan

The regular child plan from HDFC is 21 minus age of child at entry (for

StanLife is a flexible plan in that it offers ChildGain 21 and ChildGain 21 Plus) and

11 visit us at www.personalfn.com visit us at www.personalfn.com 12

Comparing Child Plans Comparing Child Plans

Child ULIPs: How they face off

HDFC ICICI PruLife Tata-AIG Aviva

HDFC ICICI PruLife Tata-AIG Aviva (YoungStar Plus Plan) (SmartKid New ULRP) (InvestAssureII) (Young Achiever)

(YoungStar Plus Plan) (SmartKid New ULRP) (InvestAssureII) (Young Achiever)

Min. 10,000 2,000 10,000 5,000

Minimum 10,000 10,000 - 6,000 withdrawal

Premium (Rs) amt. (Rs)

How is Sum Annual premium X Annual premium X Multiple of annual 6-21 times

Assured (term/2)(subject to (term/2)(subject to premium. Varies as annual

Calculated min. 100,000) min. 100,000) per age & term premium Initial years' 10-60% in the 18-20% in yr 1 17.50%-50.00% in 10% of initial units

expenses first year (depends upon annual yr 1; 12.50-25.00% + 5-8% of annual

Fund Option Liquid Fund ,Secure Preserver, Protector II, Short-term, Fixed Protector Fund (depends uponthe premium amt); in yr 2 (exact premium (exact

available Fund,Defensive Fund, Balancer II, Maximiser II Income Fund, Balanced Fund, annual premium amt) 5% in yrs 2-5; %age depends %age depends

Balanced Fund, Stable Growth Fund, Growth Fund. 2% in yrs 6-10 upon age of individual upon annual

Equity Fund, Growth Aggressive Growth & tenure of plan) premium)

Fund Fund, Income Fund,

Equity Fund.

Allocation to 0% in Liquid Fund & 0% in Preserver & 0% in Short-term 0-20% in Prot. Expenses 1 1 1 -

Equities Secure fund, 15-30% Protector II, 0-40% fixed income Fund, Fund, 0-45% in after initial

in Defensive Fund, in Balancer II, 30-50% in Stable Bal. Fund, years (%)

30-60% in Balanced Fund, 75-100% growth Fund, 75-100%

60-100% in Equity Fund, in Maximiser II 50-80% in Aggressive 30-85% in Fund Mgmt. 0.80% across 0.75% for Preserver 0.90% for Short 1.00% for Protector;

100% in Growth Fund Growth Fund, 0% in Growth Charges funds & Protector II;1.00% for term fixed income; 1.25% for

Income Fund, Fund Balancer;

100% in Equity Fund Balancer II;1.50% for 1.25% for Income; 1.50% for Growth

Maximiser II 1.40% for Stable

Minimum 5,000 - 10,000 1,500 growth; 1.60% for

Top-up Aggressive growth;

amt (Rs) 1.75% for Equity

Min-Max 10-25 10-25 3 tenures 8-21

tenure (Yrs) 15/20/30 yrs

Administration 20 60 38 55

Min-Max 18-65 20-60 30 days - 21-55 Charges per

age at Entry (for the parent) (for the parent) 45/55/60 years month (Rs)

(Yrs)

Switch details 24 free switches Upto 4 free switches per Upto 4 free Upto 2 free

Max. age 75 75 - 65 per annum. annum. Rs 100 switches per Switches

at maturity Rs 100 per per switch thereafter annum. Rs 250 per annum

(Yrs) switch thereafter per switch thereafter 0.50% of the

switch amt

Settlement Maturity value can Maturity value can be Maturity value can be Will be settled thereafter

Option be withdrawn either as withdrawn either as withdrawn either as per the rules

lumpsum or in lumpsum or in lumpsum or in prevailing during Partial Upto 6 Max. 5 w/d Upto 4 w/d Only 1

'installments' for upto 'installments' for upto 'installments' for upto maturity withdrawals(w/d) w/d allowed during the allowed per annum w/d

5 yrs after maturity 5 yrs after maturity 5 yrs after maturity details free per annum. entire policy term allowed in

Rs 250 per w/d a policy year.

Surrender/ Yes. After min. Yes. After min. Yes. After min. Yes. After min. thereafter

Withdrawal 3 completed 3 completed 3 completed 3 completed

allowed years from having years from having years from havingyears from having Who is Parent Parent Child Parent

bought the plan bought the plan bought the plan bought the plan insured?

13 visit us at www.personalfn.com visit us at www.personalfn.com 14

Comparing Child Plans ITC

Mutual Funds

Endowment ULIPs: How they face off

Mutual funds for your child

LIC HDFC ICICI PruLife Aviva

(Jeevan Anurag) (Children's plan) (SmartKid - (Young Rarely have we seen a time when parents retirement, an overseas trip, parking

Regular Prem) Achiever) were overwhelmed with so many surplus money. For parents, this

investment options to help them plan for objective can be 'planning for child's

Type Money-back Regular Money-back Money-back

their children's future. It is equally true education or marriage or seed capital for

of Plan endowment plan endowment plan endowment plan endowment plan

that often parents find themselves so his/her business'.

Minimum - 1,800 8,400 5,000 preoccupied that they can't seem to find

Premium (Rs) time to manage their own commitments, Parents must note some peculiar feature

let alone plan for their children's of child funds. These features tell

Minimum Sum 50,000 100,000 100,000 100,000 education and marriage among other parents exactly what makes these funds

Assured (Rs)

events. That is why it is important that tick. It gives them a reason to consider

Tenure (Yrs) 10-25 10-25 10-25 *Depends upon they get some professional help. This is these plans for building a corpus for their

plan type where mutual funds come in. children's future.

Min-Max age 20-60 (parent) 18-60 (parent) 20-60 (parent); 20-50 (parent); Put simply, mutual funds hire the 1. Investment objective

at entry (Yrs) 0-12 (child) 0-13 (child)

services of a professional money The good news for parents is that there

Max. age 70 75 70 - manager to invest on behalf of a group is common ground between their

at maturity (Yrs) of individuals. The individuals pool in objectives and the objectives of child

their savings and leave it to the fund funds. Child funds are launched with the

Who is insured? Parent Parent Parent Child manager to manage their money in an explicit objective of helping parents

*21 minus age of child at entry or 24 minus age of child at entry optimal manner. Individuals can go about build a corpus. Sample this - Principal

their work as usual, content in the Child Benefit's investment objective

24 minus age of child at entry (for on the child attaining 18-Yrs, 20-Yrs, 22- knowledge that there is professional reads - 'To generate regular returns and/

ChildGain 24 and ChildGain 24 Plus). Yrs And 24-Yrs respectively. help at hand. or capital appreciation/accretion with the

Also, the regular payouts under the aim of giving lumpsum capital growth at

ChildGain 21 and ChildGain 21 Plus take The information here is sourced from Mutual funds have much to offer to the end of the chosen target period or

place following the child completing 18- company websites and product parents. Consider this - you have office otherwise to the Beneficiary (child).'

Yrs, 19-Yrs, 20-Yrs and 21-Yrs of age literature. Individuals are advised to work to complete, household work to do,

respectively. For the ChildGain 24 and contact the company for further details. children's homework to help with and Even more explicit is UTI Children Career

ChildGain 24 Plus, the payouts happen whole lot of other social and personal Plan's investment objective - 'to provide

commitments to take care of. In the children after they attain the age of 18

middle of all this, where is the time to years a means to receive scholarship to

invest for your child's education or meet the cost of higher education and/

marriage or business? or to help them in setting up a

profession, practice or business or

Say hello to child plans/funds. We enabling them to set up a home or

mentioned that mutual funds invest on finance the cost of other social

behalf of individuals to achieve a pre- obligation.'

determined objective. For many investors

this objective is planning for a house,

15 visit us at www.personalfn.com visit us at www.personalfn.com 16

Mutual Funds Mutual Funds

2. Asset allocation that he enters low and exits high, the For parents who want to build a corpus As parents will appreciate, child funds

Although most child funds take on a cornerstone of a successful investment for their children over the long-term, a have a lot of features working for them.

degree of risk by investing in stock strategy lock-in must be seen as an ally for two Even if some of these features appear

markets, they are relatively less risky reasons. One, it enables the fund restrictive in nature (cap on equity

compared to diversified equity funds 3. Lock-in manager to make investments that are in investments, lock-in period) remember

that can invest upto 100% of their assets We mentioned that fund houses make the investor's long-term interests. over the long-term they work to the

in equities. They are relatively less risky provisions to ensure that the risk Second, it acts as a deterrent for the parent's benefit. They instill discipline

because fund houses have taken associated with child funds is controlled. parent from making premature and have the potential to generate a

adequate measures to ensure that child One way to lower the risk of equities is withdrawals. corpus for the child and in the final

funds are managed conservatively. to make long-term investments. Over the analysis that is all that matters.

short-term equities are the riskiest

The most important measure adopted by assets; over the long-term, if you tread

fund houses is to cap the equity wisely, they can generate the best risk

investments at a reasonable level. Most adjusted returns for you. That is just

of them have capped the equity what fund houses do; they give the fund

weightage of the portfolio at varying manager the time and flexibility to make

levels, usually not exceeding 70% of the really long-term investments in the child

net assets. These funds have the fund. For that, they have what is

flexibility to invest in equity and debt commonly referred to as a lock-in period.

markets depending on the fund

manager's view on these markets. These If you are an investor in PPF (Public

funds work like asset allocation plans Provident Fund) and NSC (National

allowing the fund manager to shift across Savings Certificate) then you already

asset classes so as to maximise returns know what a lock-in period means. In

for the investor. For instance, in an equity fact, fixed deposit (FDs) investors are

fund the fund manager is usually equally aware of this term. Only

compelled to remain completely invested difference is that child funds have an

in equities even when stock markets equity flavour, while NSC, PPF and FDs

appear overvalued and therefore poised are debt instruments. Reason why it

for a correction. But a child fund with a makes imminent sense for equities to

cap on the equity component can always have a lock-in is because they

shift a portion of its assets in debt when demonstrate their potential over the long

the going gets rough. term (at least 3 years in our view). When

the fund manager is certain that he can

On the same lines when equity markets invest the money for a longer period of

are overvalued, the fund manager can time without being concerned about the

shift a portion of his assets to debt so investor standing outside his office

as to capture gains. When equity demanding his money, he can make more

markets decline, he can add to the equity prudent investments that stand a good

component. By smartly allocating assets chance of making money over the long-

across debt and equities, he can ensure term.

17 visit us at www.personalfn.com visit us at www.personalfn.com 18

ITC

Evaluating Child Funds Evaluating Child Funds

Evaluating child funds your child's education) you must Volatility

consider adding a bit of equities to your The fund with the best track record on

As we mentioned in the previous article, fluctuations in your investments you portfolio to accumulate a sizeable curtailing volatility is Tata Young Citizen

mutual funds could easily rank as the can allocate a portion of your assets to amount. To that end, in our examples, Fund (Standard Deviation 4.22). One

most convenient way to accumulate equities. Equities may be volatile in the we have considered child funds that can reason for a better performance on

wealth for your child's future. But that short-term, but over the long-term (3-5 invest upto 70% of assets in equities. volatility is undoubtedly the lower equity

in itself is not a sure-fire way to make years) they stand a better chance of Parents who are not comfortable with a allocation (46.3%). HDFC Children Gift -

great money. You still have to make the outperforming other investment avenues higher equity weightage, can invest in Investment Plan (5.78%) is a distant

right choices and select the right child like fixed deposits (FDs), National the 'lower equity' (usually 20-40% of net second. Clearly, PruICICI Child Care

funds. In other words, you are still a step Savings Certificate (NSC) and Public assets) options of these child funds. (6.48%) has paid the price for pursuing

away from getting your child the best Provident Fund (PPF). Since saving for an aggressive equity allocation strategy.

education. After reading this note, you your child is a long-term commitment (as

will have bridged that gap. long as 20 years if you start when your Child Funds: Slow and steady

child is 1 year old), you can add a Child Fund NAV 1-Yr 3-Yr SD SR Equity Exp

Given the emotional appeal associated significant amount of equities to your

(Rs) (%) (%) (%) (%) Ratio (%) Ratio (%)

with child funds, a lot of AMCs (Asset child's portfolio.

Management Companies) have a child Pruicici Child Care (GP) 32.65 25.9 34.6 6.48 0.30 64.6 2.00

fund in their portfolios. So parents have However, if you have lower tolerance for Principal Child Benefit (CB)42.37 29.1 30.9 6.01 0.31 61.3 2.50

adequate options over there. But investment fluctuations, we recommend HDFC Children Gift (IP) 21.67 19.6 27.5 5.78 0.30 70.4 2.25

adequate options bring with it the that you go in for lower equity

Tata Young Citizen 19.23 21.2 25.4 4.22 0.33 46.3 2.41

responsibility to make the right choice. allocations. We urge you not to snub

equities as over the long-term (over 5 Crisil Balanced Fund 27.6 25.1

NAV data as on July13, 2006. Growth over 1-Yr is on CAGR basis. Expense ratio as on September 2005.

For parents, making the right choice is a years) perhaps no other asset can match SD - Standard Deviation. Net Assets as on June 30, 2006. Equity component as percentage of net assets

two-fold process. The first step does not up to the demands of the spiralling costs as on June 30, 2006, the debt weightage is arrived at by subtracting the equity weightage from 100 .

have so much to do with the mutual fund, of higher education, marriage, property

as it has to do with them. Essentially, for your child. Studies have shown that

investors have varying risk appetites. over the long-term (over 20 years) FDs, Performance Risk-adjusted Return

Some investors can take a very sharp bonds and gold do not even beat Over 3-Yr (an ideal time frame to evaluate Put simply, risk-adjusted returns are a

drop in their investments in their stride, inflation, let alone give a return to provide a long-term investment), PruICICI Child measure of the fund's ability to clock

secure in the knowledge that over the for education and marriage. The same Care (Gift Plan) is the leader of the pack growth compared to a risk-free

long-term their investments will do just studies give the thumbs up to equities with an NAV (Net Asset Value) benchmark return. The higher the Sharpe

fine. Another group of investors may when it comes to going one up on appreciation of 34.6% CAGR Ratio (which calculates the

have a slightly different take on this - inflation over the long-term. So if you (compounded annualised growth rate). outperformance) the better is its ability

they do not like to see too much want to go one up on rising engineering/ The fund was helped in no small to clock growth per unit of risk.

fluctuation in their investments; for this MBA/medical education costs, equities measure by its 64.6% equity allocation

they are willing to earn a slightly lower are your best bet over the long term. (as on June 30, 2006). Principal Child Tata Young Citizen Fund (0.33%) is the

return. Benefit (Career Builder) with 30.9% best fund on this parameter. Principal

While as financial advisors we can't CAGR is also a beneficiary of a relatively Child Benefit (0.31%) emerges as second

If you belong to the first category, it make this decision for you, our view is high equity component (61.3%). best.

means that you have a higher risk that when you have a long-term

appetite. Since you can absorb investment objective (like saving for

19 visit us at www.personalfn.com visit us at www.personalfn.com 20

Evaluating child funds ITC

Equities

What you need to look at before 3. While comparing child funds across Equities and Your kid(s) - Do's and Don'ts

investing in a child fund: AMCs, make sure you are comparing

apples to apples. Across AMCs, child How does one decide an equity portfolio decide. In the overall equity portfolio,

1. More equities should not be looked funds have varying equity components. to meet future financial needs of one's since child's future should have a larger

at with apprehension even if you are Over the long-term, it is primarily the child and how different can that be from weightage because the needs are more

risk-averse. Remember this is an equity component that propels the a regular long-term equity portfolio? Both immediate than retirement planning. For

investment for your child and not for returns of the child fund. So make sure these portfolios have an investment instance, for a 30 year old, having a small

you. While we do not recommend that you are comparing returns of child funds horizon of five to fifteen years and in both child, the child's higher education and

you go all out in equities, a 30% (debt) - with comparable equity components so cases, one has to choose a company with marriage is 20 to 25 years down the line

70% (equity) allocation is advisable as to make an intelligent decision. immense scrutiny because the business whereas retirement planning is 30 years

(depending on your risk appetite). model of the company has to be robust down the line.

You have taken the first step if you have to withstand ups and downs in the

2. The child plan's track record is identified mutual funds as a means to economy over that long a time horizon. Now, the Do's while planning an equity

important. Evaluate the NAV Returns, accumulate wealth for your child over Here is our 'Do's' and 'Don'ts' when it portfolio for your child's future…

Volatility (Standard Deviation) and Risk- the long-term. Having read this article, comes to building an equity portfolio to

adjusted Return (Sharpe Ratio) of child hopefully you now know what to look at fund your child's education/marriage/ 1. Cost of living and equities

funds before making a choice. Since while evaluating child funds. Mutual house. As it is known, in the long-term, the cost

investments in child funds are for the funds can prove to be an ally for you of living is likely to increase. Education

long-term, evaluate their performance and your children. Once you have First, the foundation stone… costs, across grades, have been

from a long-term perspective of 3-5 years selected the right funds, you are well on Given the fact that there are many things spiraling upwards in the last five years

and not 6-12 months. your way to building a corpus for your that an individual has to plan for, and are likely to maintain the momentum

child's future. including buying a property, saving for in the long-term. The same is the case

the post-retirement phase and funding with property and other needs. Given

child's education/marriage/property, it is the fact that equities tend to be more

pertinent to arrive at an appropriate rewarding in the long-term as compared

equity allocation. This is critical because to other asset classes (after adjusting

the child's future cannot be compromised for inflation), we believe that there is a

for one's immediate financial needs i.e., compelling case to invest in equities for

one should not sell the part of equities one's child future. Consult your equity

that is allocated for your child to meet advisor to draw a list of stocks for the

your immediate financial expenses. long-term and invest only if you are

Otherwise, the entire purpose will be convinced about the company (not just

diluted. It is pertinent to identify your based on what your equity advisor

goals and build your equity portfolio thinks is right).

accordingly. This is the foundation of

financial planning for your child. 2. Foreign education - Foreign Stocks

India, being a developing economy, will

Of course, how much to allocate towards depend on foreign capital to grow and

child's future in one's equity portfolio is to that extent, the Rupee is expected to

dependent on individuals. But we have depreciate against the greenback (the US

drawn a plan to make it simpler for one to dollar). As such, say after fifteen years,

21 visit us at www.personalfn.com visit us at www.personalfn.com 22

Equities Equities

you will definitely need more Rupees to start of with. Companies like HDFC, September 11, Iraq war, SARS and portfolio and/or maybe, a portion of the

buy one US Dollar than what you need Gujarat Ambuja, Asian Paints and SBI interest rate movements). 'retirement planning' portfolio.

now. So, in case you wish to give quality are names that have managed business

overseas education to your child, cycles in the past very well. Yes, mid- 2. Never take a short-term view Like 4. Review portfolio

investing in US Dollar denominated caps can be rewarding but in our view, Rome was not built in a day, it takes The blue chips of the 1990s like Bombay

assets can be a rewarding option in the one has to tread with caution. Since mid- decades for companies like Infosys and Dyeing, Century Textiles, ACC and BPL

long-term. As we go forward, we believe caps, by nature, are relatively marginal HDFC to implement their vision. Yes, are no longer in the limelight. As the

that the doors will be open much wider players or niche players, they are more there will be short-term gyrations in terms Indian economy grows, there will be

for Indian investors to invest abroad (not susceptible to shocks, be it external of financial performance but in the long- many new companies from new sectors

just the US). (global and domestic economy) or term, stock prices will track earnings like logistics, transportation, pharma,

internal (management depth and growth and cash flow generation, media, and software to invest. So, it is

3. Identify the surplus execution capabilities). provided the management is good at pertinent to review one's portfolio every

It is pertinent to approach equities like execution. We suggest investors not to year critically. As it is commonly said,

the way we pay premium on a child The Don'ts while planning an equity involve in short-term trading or investing do not get married to your stocks.

policy, with at least a fifteen-year portfolio for your child's future… with a six months horizon when it comes

perspective. Invest only that portion of to planning for your child. It is better to We hope that the do's and don'ts will

your surplus in equities that you do not 1. Equities are a risky asset class stay away completely. enable you to plan your savings in a

need in the future. This is perhaps one Just investing for ten to fifteen years do optimum manner to achieve desired

of the major factors that influence the not mean returns will be higher or there 3. Switching portfolios long-term goals. Happy investing!

final outcome. are no risks. The period between 1992 We suggest investors do not dilute that

By Equitymaster.com, an independent

and 2002 was a classic example that part of the portfolio allocated for the

research initiative. Equitymaster offers

4. Large-caps or mid-caps? investing in stocks need not be child's future. In case of a compelling subscription based research services for

In our view, this is an individual decision. rewarding in the long-term as well. Also, need, we suggest they dilute the 'others' individuals and institutions.

But since you are investing with a long as the Indian economy becomes more

horizon, it is desirable to have relatively globalised, companies will be highly

higher exposure towards large-caps to vulnerable to external developments (like

WHAT IS YOUR OBJECTIVE?

WHAT YOU HAVE TO PLAN? HOW ONE CAN PLAN YOUR

EQUITY PORTFOLIO?

Others - 20%

MY FIRST PROPERTY Retirement - 35%

POST-RETIREMENT NEEDS

CHILD'S FUTURE

EDUCATION MARRIAGE PROPERTY

Child's future - 45%

OTHER FINANCIAL COMMITMENTS

23 visit us at www.personalfn.com visit us at www.personalfn.com 24

Fixed Income

Interview Fixed Income

"Assure" your child's future PPF doesn't score too well on the liquidity circumstances such as death of the

front. Withdrawals are permitted on holder, forfeiture by the pledgee or

Having discussed the importance of least 5 years) tenure should be completion of the 6 years from the end of under court's order.

mutual funds and insurance products considered. Small savings schemes like the financial year when the first deposit

while building a portfolio for the child's Public Provident Fund (PPF) and was made. Also the amount which can Kisan Vikas Patra (KVP)

future needs, we now put assured return National Savings Certificate (NSC) rank be withdrawn is dependent on the Kisan Vikas Patra operates on the

products under the scanner. As the name among the most popular assured return balance in the PPF account. Hence it is premise of 'doubling' the amount

suggests, investments in assured return schemes. Similarly variants of imperative that parents utilise the scheme invested over a period of 8 years and 7

avenues (or fixed income instruments as conventional fixed deposits like for "truly" long-term savings. months. Hence the scheme offers a

they are commonly referred to) yield a "variable" rate deposits can also prove return of approximately 8.50% per

fixed income. Hence investors are handy. National Savings Certificate (NSC) annum. Given that the returns are fully

unambiguously aware of the returns Apart from the investment tenure (6 taxable, the effective return would be

which their investments will generate at Public Provident Fund (PPF) years), NSC varies from PPF on a vital lower i.e. approximately 5.90% for an

the end of the designated investment With a 15-Yr time frame, PPF is designed parameter i.e. the returns are assured. The investor whose income is chargeable to

tenure. This is in stark contrast to to promote long-term savings. interest rate at which investments are tax at the highest rate. The minimum

equities and mutual fund schemes Contributions to the scheme presently made is locked-in for the entire tenure. investment amount is Rs 100, while there

wherein the returns generated are a yield a return of 8.00% per annum. Effectively the investment is insulated is no upper limit for investing in the

factor of the performance of markets. However the same is subject to revision; from any external changes. Presently scheme.

hence while the returns are assured, investments in NSC fetch a return of

As regards, why assured return schemes they are not fixed. About 6 years ago, 8.00% per annum with half-yearly Unlike peers, PPF & NSC, investments

should feature in the portfolio. The the scheme offered a return of 11.00% compounding. However unlike PPF, the in KVP are not eligible for any tax

answer to that lies in the concept of asset per annum. As a result a review in line interest income is fully taxable. As a result benefits. However the scheme does

allocation. Simply put, asset allocation with market rates cannot be ruled out. for an investor who falls in the highest score on the liquidity front vis-à-vis its

is the process of building a portfolio tax bracket, the effective return would be peers. Premature encashments are

comprising of various assets like Investors are required to invest at least 5.55% (8.00% less 30.60% i.e. 30.00% plus permitted after a period of 2.50 years;

equities, fixed income instruments, gold Rs 500 every year to keep the PPF 2.00% for education cess). however a loss of interest has to borne

and property among others in line with account active; the upper limit for annual on the same.

the investor's risk appetite to achieve contributions has been set at Rs 70,000. The minimum amount for making an

his financial goals. Investing in diverse Contributions to the scheme are eligible investment in NSC is Rs 100; there is no Fixed Deposits (FDs)

asset classes provides the benefits of for a deduction under Section 80C of upper limit. Akin to PPF, investments in FDs represent assured return

diversification. Hence a downside in one the Income Tax Act. Also interest income NSC (subject to a limit of Rs 100,000) are instruments in their simplest and most

asset class can be offset by the presence from the scheme is tax free under Section eligible for deduction under Section 80C conventional form. However they have

of another, thereby ensuring that the 10 of the Income Tax Act. of the Income Tax Act. typically been prone to the same

portfolio is unaffected. shortcomings as other assured return

The scheme's 15-Yr time frame is truly NSC can be best used for gainfully instruments. For example, in a rising rate

In the present case, the objective is to the clincher. Parents can use the scheme investing one-time surpluses and making scenario, the locked-in interest rate can

build a corpus which will ensure that for making regular contributions lump sum investments. lead to an opportunity loss when fresh

the child has a financially secure future. towards their children's higher education offerings offer higher returns.

Hence, typically investors should have or to build a corpus for their children's Like PPF, NSC scores poorly on the

sufficient time at their disposal. As a marriage. liquidity front. Premature encashment is The solution in present times lies in

result, investments with a long-term (at only allowed under specific investing in variable rate deposits. As

25 visit us at www.personalfn.com visit us at www.personalfn.com 26

Fixed

Retirees

Income Fixed Income

the name suggests, the coupon rate on of AAA or equivalent quality, the credit As can be seen from the table, the FMP available to investors, we now shift our

these instruments is not fixed. Instead, risk is minimised. This translates into a can deliver a return of 9.20% per annum focus to the process of building the

it is reset in line with the change in a sort of capital protection for investors. over the 5-Yr time frame. Since the portfolio. Broadly speaking, the schemes

benchmark rate. Hence in a rising interest intention is to build a corpus for the short-listed are of the 'assured and fixed'

rate scenario, the FD would yield higher An interesting variant in FMPs is the i.e. NSC and KVP and 'only assured' i.e.

returns; on a flipside, when interest rates one which invests a smaller portion FMPs: Combining risk with safety PPF and variable rate deposits variety.

are on the decline, the investment will (about 30.00%) of the corpus in equities. Asset Expected Allocation Return FMPs with their unique market-linked

earn lower returns. The idea is to combine the power of Class return (%) (%) (%) yet assured nature complete the

equities with the stability of debt. For Equity 8.5 20.0 6.8 triumvirate. The key lies in building a

Another factor which needs to be example, the fund might invest at least Debt 12.0 80.0 2.4 portfolio comprising of the above

Total 100.0 9.2

considered while investing in FDs is the 80% of the corpus in debt. The debt schemes in the right proportions.

risk borne. Small saving schemes like PPF, portfolio is then designed in such a

NSC and KVP have a sovereign manner that the amount of money child's future needs, the growth option At a time when interest rates are on the

guarantee, and offer the highest degree invested is equivalent to the original should be chosen over the dividend rise, allocating a higher portion to only

of safety. Similarly, investors would do investment in the scheme i.e. 100%, on option. The scheme being a debt fund, assured (PPF and variable FDs) category

well to invest in FDs with an 'AAA' or maturity. This leaves the balance (20%) the returns will attract long-term capital would be a prudent choice. Such

equivalent rating which signifies high of the initial corpus for making gains tax at 10.00%. This translates into investments would be equipped to

safety levels. Akin to NSC and KVP, investments in equities. Thus while the a post-tax return of 8.28% for the investor. benefit from any further uptick in interest

interest income from FDs is taxable as debt component attempts to preserve The impressive post-tax returns vis-à- rates. Conversely, in a situation when

well. investors' capital, the fund can expect vis conventional avenues like NSC and interest rates are softening, holding a

to clock growth from the equity KVP notwithstanding, investors would higher portion of the corpus in avenues

Fixed Maturity Plans (FMPs) investment. do well to understand that the projected like NSC and KVP would be the right

Strictly speaking, FMPs don't fall in the returns and the proposition of capital strategy.

domain of assured return instruments; At Personalfn, we believe FMPs of the preservation are at best sound estimates

instead they are offerings from the latter variety can emerge as preferred and not explicit guarantees. The availability of FMPs would largely

mutual funds segment. However they investment avenues for investors with depend on the market conditions and

are reasonably similar to fixed income moderate risk-appetite going forward. How to build a portfolio? the access to attractive debt paper.

instruments in their structure. FMPs are An example will help us better Having discussed the various options Investors on their part must ensure that

close-ended debt funds (investments understand the kind of returns an FMP from the assured return segment a part of their investible surplus is held

can only be made during the new fund launched in the present scenario can

offer stage) with a fixed maturity horizon. deliver. We shall assume that the fund The assured return avenues face-off

with a 5-Yr investment horizon will hold Scheme Return Term Min Investment Premature Effective

FMPs target a given yield (return) at the an 80:20 allocation in debt and equity Encashment Return

time of investment and stay invested in instruments respectively. The debt Public Provident Fund 8.00%^ 15 yrs Rs 500 Yes 8.00%

those debt instruments till maturity. component will clock a growth of 8.50% National Savings Certificate 8.00% 6 yrs Rs 100 No 5.55%

Effectively, investors are assured of per annum while equity component will Kisan Vikas Patra 8.50%* 8.6 yrs Rs 100 With penalty 5.90%

clocking the designated return if they appreciate by 12.00% CAGR over a 5 year

HDFC Fixed Deposit 7.75% 5 yrs Rs 5,000 With penalty 5.38%

stay invested for the entire investment period. Given the present scenario in the

HDFC Variable Rate Deposit 7.75%^ 5 yrs Rs 5,000 With penalty 5.38%

horizon. However some minor debt and equity markets, these returns

deviations in the returns on account of are feasible. Fixed Maturity Plans 9.20%** 5 yrs Rs 10,000 With an exit load 8.28%

market factors cannot be ruled out. * Approximately ^ Subject to revision ** Not assured

Effective return computed assuming a 30% tax bracket and 2% education cess.

Similarly if the fund is invested in paper Apart from PPF investments which are capped at Rs 70,000, there is no upper limit on any investment.

27 visit us at www.personalfn.com visit us at www.personalfn.com 28

Fixed Income Interview

5 Steps

in cash or other liquid assets. This will advice. A good investment advisor 5 steps to plan for child's future

enable them to gain from an attractive whose forte is quality advice and prompt

investment opportunity, as and when it service would be equipped to help you One of the most important concerns in investment advisor or a financial planner

emerges. build and manage your fixed income the life cycle of a parent is his/her child's comes into play, as it is he who has to

portfolio. And the importance of such future. Starting with the education of the draw the investment plan for you. Your

This brings us to the importance of an individual at a time when the interest child upto his marriage, the responsibility role will be limited to providing him with

having access to sound investment rate scenario is uncertain cannot be of parents towards their children seems inputs in terms of your investment

overstated. endless. As children, we all would have objective, risk appetite, investment time-

seen our parents working hard to fulfill frame, cash flows and the like.

our aspirations, and as parents we

would like to do the same for our Since your investment advisor has to

children. It's a continuous process, but play a vital role in helping you achieve

what can make it a bit different is the your objectives, it's important that you

approach. We all want our children to connect with the right advisor. There are

have a bright future, and can help them instances wherein advisors have

to achieve this by planning for them misguided their clients by making them

early and systematically. This involves invest in unsuitable investments only

making the investment plan, executing to boost their own commissions. Such

it and tracking it regularly. If this sounds instances can prove to be detrimental

a bit complicated, don't worry, we have for your investment plan and can make

simplified the process for you. your plan go haywire. Thus one has to

be extra cautious while identifying the

Step 1: Define your objective consultant because he has to play an

The most important thing to do while integral part in your child's financial

you get down to planning your finances planning.

is to ask yourself why you want to invest

(ask yourself - "Who am I?"). The Few things that you should look for in

answer could be your child's education your investment advisor are - firstly he

or marriage or both. Also, nowadays it's should be a qualified investment

common for parents to accumulate seed advisor. Secondly you should check

capital for their children to start a whether he offers investment solutions

business venture. So you could have a instead of just dropping application

variety of objectives in your mind about forms. Most importantly, he should be

what you want to do for your child's objective and unbiased in his advice

future. and should be equipped to offer value

added services.

Step 2: Identify the investment advisor

Once you have your objective in place, Step 3: Prepare and execute the

the next step is to prepare an investment investment plan

plan to achieve the objectives that you After zeroing on your investment

have set for your child. Here the role of consultant, you must get down to

29 visit us at www.personalfn.com visit us at www.personalfn.com 30

5 Steps 5 steps

need to be adjusted. One of such

actually implementing the investment your child's life. Remember that the and utilising them with the highest

reasons, which can normally dislodge

plan in line with your objectives. You funds are being set aside to provide degree of caution and for the purpose

your asset allocation, is when stock

should keep in mind that here you are your child with a financially secure future which they are intended is vital.

markets change their course over a

planning for your child's future, which

period of time. As a result you may have

includes his primary education, higher/

to redeem some of your equity

professional education, marriage or even

investments or buy more of them

starting a business. Thus you could

depending on how much risk you are

require sums of money at various points

ready to take.

in time. Hence you should make all these

aspects explicitly known to your advisor.

As you approach the milestones (like

Effectively, you need to bare your

child's professional education or his

financial soul and tell him exactly what

marriage), you have to redeem the

you aim to achieve and the time frames

investments made for that specific

over which you want to achieve your

purpose. One important aspect to be

objectives.

considered while investing for your

child's future is that the monetary

After preparing the investment plan,

requirement will be in phases. This

your investment advisor should help you

means that you will require large chunks

in executing it. This may involve, for

of money normally when your child joins

instance, taking an insurance plan for

a professional course or when he/she is

your child or investing in diversified

getting married. This in turn

equity funds. Though your advisor will

necessitates the need to book profits.

largely handle the investment part, it

Again, all this may sound very

always pays if you personally involve

complicated, but your investment

yourself in the process.

consultant is the one who will keep an

eye on such events and will make

Step 4: Tracking your investments

necessary adjustments to your

Setting your investment plan in action

investment plans. On your part it helps

is the most important step towards

to be informed since it's your money,

achieving your financial goals. But at the

which is being invested for the benefit

same time it is equally important to keep

of your child's future

a regular track of your investments.

Though your consultant will keep a track

Step 5: Don't dip into your child's

of it, but it's also essential for you to be

savings

aware of where your investments are

Your child is precious and so are the

headed. Since the success or otherwise

savings that you have made for him.

of the investment plan will have a

Therefore you should treat the savings

significant bearing on your child's

as sacrosanct and not dip into them for

financial future, it will pay to keep track

meeting your present needs. If you do

of your investments and ensure that they

so, it could result in a monetary crunch

don't go astray. There are several

while meeting some important event in

reasons why your investment plan could

31 visit us at www.personalfn.com visit us at www.personalfn.com 32

Personalised Services from Personalfn

Who are we?

www.personalfn.com is one of India's leading financial planning

initiatives.

We are a part of Quantum Information Services Pvt. Ltd., which is

one of India's most experienced research houses (set up in 1990).

Quantum also offers equity research via its online initiative,

www.equitymaster.com.

Our offerings

• Personalfn helps individuals plan their investments so that

they can meet their financial commitments (like retirement,

marriage and child's education)

• Research on mutual funds and debt instruments

• Tools like the Asset Allocator and MyPlanner which empower

individuals to plan and track their finances

Our publication

• Personalfn also publishes the Money Simplified, a free-to-down-

load monthly guide to help you plan your finances better.

Contact information

To benefit from Personalfn's services, please call us at

Mumbai - 6799 1234 / 7536 New Delhi - 6450 5302/5303

Bangalore - 6535 9899 / 9900 Pune - 6602 9448 / 9732

Hyderabad - 6591 8423 / 8435 Chennai - 6526 2621 / 2622

Ahmedabad - 6450 5215 / 5216

Alternatively, write to us at info@personalfn.com or visit

www.personalfn.com

visit us at www.personalfn.com visit us at www.personalfn.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Policy Brief - Transition Plan For Thermal Power Plants in IndiaDocument4 pagesPolicy Brief - Transition Plan For Thermal Power Plants in IndianamitaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Advertisement20210118 121300Document23 pagesAdvertisement20210118 121300namitaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Total LockdownDocument5 pagesTotal LockdownnamitaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Gujarat Electricity Regulatory Commission Supply Code 2015Document87 pagesGujarat Electricity Regulatory Commission Supply Code 2015Yazhisai SelviNo ratings yet

- India Rising: Realising Atmanirbhar BharatDocument20 pagesIndia Rising: Realising Atmanirbhar BharatnamitaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- TManual Chapter 01 PDFDocument22 pagesTManual Chapter 01 PDFJay Rameshbhai ParikhNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Wpi Series 201112Document23 pagesWpi Series 201112namitaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Msulip07 (2015 - 08 - 03 05 - 36 - 57 UTC)Document15 pagesMsulip07 (2015 - 08 - 03 05 - 36 - 57 UTC)namitaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Financial Markets: A Beginners' Module: Work BookDocument1 pageFinancial Markets: A Beginners' Module: Work Booka7118683No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Finplan (2015 - 08 - 03 05 - 36 - 57 UTC)Document19 pagesFinplan (2015 - 08 - 03 05 - 36 - 57 UTC)namitaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Rules (1) (2015 - 08 - 03 05 - 36 - 57 UTC)Document40 pagesRules (1) (2015 - 08 - 03 05 - 36 - 57 UTC)namitaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Investment Basics PDFDocument90 pagesInvestment Basics PDFRahul MaliNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Radar Level Recorder Operations ManualDocument47 pagesRadar Level Recorder Operations ManualnamitaNo ratings yet

- 2007 - RadarLevelRecorder (2015 - 08 - 03 05 - 36 - 57 UTC) PDFDocument1 page2007 - RadarLevelRecorder (2015 - 08 - 03 05 - 36 - 57 UTC) PDFnamitaNo ratings yet