Professional Documents

Culture Documents

IBP Finds Lawyer Guilty of Misconduct for Borrowing Money from Clients

Uploaded by

ervingabralagbonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IBP Finds Lawyer Guilty of Misconduct for Borrowing Money from Clients

Uploaded by

ervingabralagbonCopyright:

Available Formats

EN BANC

[A.C. No. 10681. February 3, 2015.]

SPOUSES HENRY A. CONCEPCION and BLESILDA S. CONCEPCION ,

complainants, vs . ATTY. ELMER A. DELA ROSA , respondent.

DECISION

PERLAS-BERNABE , J : p

This is an administrative case that stemmed from a Veri ed Complaint 1 led by

complainants Spouses Henry A. Concepcion (Henry) and Blesilda S. Concepcion

(Blesilda; collectively complainants) against respondent Atty. Elmer A. dela Rosa

(respondent), charging him with gross misconduct for violating, among others, Rule

16.04 of the Code of Professional Responsibility (CPR).

The Facts

In their Veri ed Complaint, complainants alleged that from 1997 2 until August

2 0 0 8 , 3 respondent served as their retained lawyer and counsel. In this capacity,

respondent handled many of their cases and was consulted on various legal matters,

among others, the prospect of opening a pawnshop business towards the end of 2005.

Said business, however, failed to materialize. 4

Aware of the fact that complainants had money intact from their failed business

venture, respondent, on March 23, 2006, called Henry to borrow the amount of

P2,500,000.00, which he promised to return, with interest, ve (5) days thereafter.

Henry consulted his wife, Blesilda, who, believing that respondent would be soon

returning the money, agreed to lend the aforesaid sum to respondent. She thereby

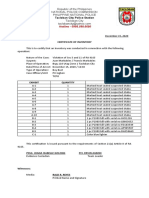

issued three (3) EastWest Bank checks 5 in respondent's name: 6

Check No. Date Amount Payee

0000561925 03-23-06 P750,000.00 Elmer dela Rosa

0000561926 03-23-06 P850,000.00 Elmer dela Rosa

0000561927 03-23-06 P900,000.00 Elmer dela Rosa

––––––––––––

Total: P2,500,000.00

===========

Upon receiving the checks, respondent signed a piece of paper containing: (a)

photocopies of the checks; and (b) an acknowledgment that he received the originals

of the checks and that he agreed to return the P2,500,000.00, plus monthly interest of

ve percent (5%), within ve (5) days. 7 In the afternoon of March 23, 2006, the

foregoing checks were personally encashed by respondent. 8

On March 28, 2006, or the day respondent promised to return the money, he

failed to pay complainants. Thus, in April 2006, complainants began demanding

payment but respondent merely made repeated promises to pay soon. On July 7, 2008,

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

Blesilda sent a demand letter 9 to respondent, which the latter did not heed. 10 On

August 4, 2008, complainants, through their new counsel, Atty. Kathryn Jessica dela

Serna, sent another demand letter 11 to respondent. 12 In his Reply, 13 the latter denied

borrowing any money from the complainants. Instead, respondent claimed that a

certain Jean Charles Nault (Nault), one of his other clients, was the real debtor.

Complainants brought the matter to the O ce of the Lupong Tagapamayapa in

Barangay Balulang, Cagayan de Oro City. The parties, however, failed to reach a

settlement. 14

On January 11, 2010, the IBP-Misamis Oriental Chapter received complainants'

letter-complaint 15 charging respondent with violation of Rule 16.04 of the CPR. The

rule prohibits lawyers from borrowing money from clients unless the latter's interests

are fully protected by the nature of the case or by independent advice. 16

In his Comment, 17 respondent denied borrowing P2,500,000.00 from

complainants, insisting that Nault was the real debtor. 18 He also claimed that

complainants had been attempting to collect from Nault and that he was engaged for

that specific purpose. 19

In their letter-reply, 20 complainants maintained that they extended the loan to

respondent alone, as evidenced by the checks issued in the latter's name. They

categorically denied knowing Nault and pointed out that it de es common sense for

them to extend an unsecured loan in the amount of P2,500,000.00 to a person they do

not even know. Complainants also submitted a copy of the Answer to Third Party

Complaint 21 which Nault led as third-party defendant in a related collection case

instituted by the complainants against respondent. 22 In said pleading, Nault explicitly

denied knowing complainants and alleged that it was respondent who incurred the

subject loan from them. 23

On November 23, 2010, the IBP-Misamis Oriental Chapter endorsed the letter-

complaint to the IBP-Commission on Bar Discipline (CBD), 24 which was later docketed

as CBD Case No. 11-2883. 25 In the course of the proceedings, respondent failed to

appear during the scheduled mandatory conferences. 26 Hence, the same were

terminated and the parties were directed to submit their respective position papers. 27

Respondent, however, did not submit any. aHTEIA

The IBP Report and Recommendation

On April 19, 2013, the IBP Investigating Commissioner, Jose I. de La Rama, Jr.

(Investigating Commissioner), issued his Report 28 nding respondent guilty of

violating: (a) Rule 16.04 of the CPR which provides that a lawyer shall not borrow

money from his clients unless the client's interests are fully protected by the nature of

the case or by independent advice; (b) Canon 7 which states that a lawyer shall uphold

the integrity and dignity of the legal profession and support the activities of the IBP;

a n d (c) Canon 16 which provides that a lawyer shall hold in trust all monies and

properties of his client that may come into his possession. 29

The Investigating Commissioner observed that the checks were issued in

respondent's name and that he personally received and encashed them. Annex "E" 30 of

the Veri ed Complaint shows that respondent acknowledged receipt of the three (3)

EastWest Bank checks and agreed to return the P2,500,000.00, plus a pro-rated

monthly interest of five percent (5%), within five (5) days. 31

On the other hand, respondent's claim that Nault was the real debtor was found

to be implausible. The Investigating Commissioner remarked that if it is true that

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

respondent was not the one who obtained the loan, he would have responded to

complainants' demand letter; however, he did not. 32 He also observed that the

acknowledgment 33 Nault allegedly signed appeared to have been prepared by

respondent himself. 34 Finally, the Investigating Commissioner cited Nault's Answer to

the Third Party Complaint which categorically states that he does not even know the

complainants and that it was respondent alone who obtained the loan from them. 35

In ne, the Investigating Commissioner concluded that respondent's actions

degraded the integrity of the legal profession and clearly violated Rule 16.04 and

Canons 7 and 16 of the CPR. Respondent's failure to appear during the mandatory

conferences further showed his disrespect to the IBP- CBD. 36 Accordingly, the

Investigating Commissioner recommended that respondent be disbarred and that he

be ordered to return the P2,500,000.00 to complainants, with stipulated interest. 37

Finding the recommendation to be fully supported by the evidence on record and

by the applicable laws and rule, the IBP Board of Governors adopted and approved the

Investigating Commissioner's Report in Resolution No. XX-2013-617 dated May 11,

2013, 38 but reduced the penalty against the respondent to inde nite suspension from

the practice of law and ordered the return of the P2,500,000.00 to the complainants

with legal interest, instead of stipulated interest.

Respondent sought a reconsideration 39 of Resolution No. XX-2013-617 which

was, however, denied in Resolution No. XXI-2014-294 40 dated May 3, 2014.

The Issue Before the Court

The central issue in this case is whether or not respondent should be held

administratively liable for violating the CPR.

The Court's Ruling

The Court concurs with the IBP's ndings except as to its recommended penalty

and its directive to return the amount of P2,500,000.00, with legal interest, to

complainants.

I.

Respondent's receipt of the P2,500,000.00 loan from complainants is amply

supported by substantial evidence. As the records bear out, Blesilda, on March 23,

2006, issued three (3) EastWest Bank Checks, in amounts totalling to P2,500,000.00,

with respondent as the payee. 41 Also, Annex "E" 42 of the Veri ed Complaint shows

that respondent acknowledged receipt of the checks and agreed to pay the

complainants the loan plus the pro-rated interest of ve percent (5%) per month within

ve (5) days. 43 The dorsal sides of the checks likewise show that respondent

personally encashed the checks on the day they were issued. 44 With respondent's

direct transactional involvement and the actual benefit he derived therefrom, absent too

any credible indication to the contrary, the Court is thus convinced that respondent was

indeed the one who borrowed the amount of P2,500,000.00 from complainants, which

amount he had failed to return, despite their insistent pleas.

Respondent's theory that Nault is the real debtor hardly inspires belief. While

respondent submitted a document purporting to be Nault's acknowledgment of his

debt to the complainants, Nault, in his Answer to Third Party Complaint, categorically

denied knowing the complainants and incurring the same obligation.

Moreover, as correctly pointed out by complainants, it would be illogical for them

to extend a P2,500,000.00 loan without any collateral or security to a person they do

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

not even know. On the other hand, complainants were able to submit documents

showing respondent's receipt of the checks and their encashment, as well as his

agreement to return the P2,500,000.00 plus interest. This is bolstered by the fact that

the loan transaction was entered into during the existence of a lawyer-client

relationship between him and complainants, 45 allowing the former to wield a greater

in uence over the latter in view of the trust and con dence inherently imbued in such

relationship.

Under Rule 16.04, Canon 16 of the CPR, a lawyer is prohibited from borrowing

money from his client unless the client's interests are fully protected: DAEcIS

CANON 16 — A lawyer shall hold in trust all moneys and properties of his

clients that may come into his possession.

Rule 16.04 — A lawyer shall not borrow money from his client unless the

client's interests are fully protected by the nature of the case or by independent

advice. Neither shall a lawyer lend money to a client except, when in the interest

of justice, he has to advance necessary expenses in a legal matter he is handling

for the client."

The Court has repeatedly emphasized that the relationship between a lawyer and

his client is one imbued with trust and con dence. And as true as any natural tendency

goes, this "trust and con dence" is prone to abuse. The rule against borrowing of

money by a lawyer from his client is intended to prevent the lawyer from taking

advantage of his in uence over his client. 46 The rule presumes that the client is

disadvantaged by the lawyer's ability to use all the legal maneuverings to renege on his

obligation. 47 In Frias v. Atty. Lozada 48 (Frias) the Court categorically declared that a

lawyer's act of asking a client for a loan, as what herein respondent did, is unethical, to

wit:

Likewise, her act of borrowing money from a client was a violation of [Rule]

16.04 of the Code of Professional Responsibility:

A lawyer shall not borrow money from his client unless the client's interests

are fully protected by the nature of the case and by independent advice.

A lawyer's act of asking a client for a loan, as what respondent

did, is very unethical. It comes within those acts considered as abuse of

client's con dence . The canon presumes that the client is disadvantaged by

the lawyer's ability to use all the legal maneuverings to renege on her obligation.

49 (Emphasis supplied)

As above-discussed, respondent borrowed money from complainants who were

his clients and whose interests, by the lack of any security on the loan, were not fully

protected. Owing to their trust and con dence in respondent, complainants relied

solely on the former's word that he will return the money plus interest within ve (5)

days. However, respondent abused the same and reneged on his obligation, giving his

previous clients the runaround up to this day. Accordingly, there is no quibble that

respondent violated Rule 16.04 of the CPR.

In the same vein, the Court nds that respondent also violated Canon 7 of the

CPR which reads:

CANON 7 — A LAWYER SHALL AT ALL TIMES UPHOLD THE INTEGRITY

AND DIGNITY OF THE LEGAL PROFESSION AND SUPPORT THE ACTIVITIES OF

THE INTEGRATED BAR.

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

In unduly borrowing money from the complainants and by blatantly refusing to

pay the same, respondent abused the trust and con dence reposed in him by his

clients, and, in so doing, failed to uphold the integrity and dignity of the legal profession.

Thus, he should be equally held administratively liable on this score.

That being said, the Court turns to the proper penalty to be imposed and the

propriety of the IBP's return directive.

II.

The appropriate penalty for an errant lawyer depends on the exercise of sound

judicial discretion based on the surrounding facts. 50

In Frias, the Court suspended the lawyer from the practice of law for two (2)

years after borrowing P900,000.00 from her client, refusing to pay the same despite

court order, and representing con icting interests. 51 Considering the greater amount

involved in this case and respondent's continuous refusal to pay his debt, the Court

deems it apt to suspend him from the practice of law for three (3) years, instead of the

IBP's recommendation to suspend him indefinitely.

The Court also deems it appropriate to modify the IBP's Resolution insofar as it

orders respondent to return to complainants the amount of P2,500,000.00 and the

legal interest thereon. It is settled that in disciplinary proceedings against lawyers, the

only issue is whether the o cer of the court is still t to be allowed to continue as a

member of the Bar. 52 In such cases, the Court's only concern is the determination of

respondent's administrative liability; it should not involve his civil liability for money

received from his client in a transaction separate, distinct, and not intrinsically linked to

his professional engagement. In this case, respondent received the P2,500,000.00 as a

loan from complainants and not in consideration of his professional services. Hence,

the IBP's recommended return of the aforementioned sum lies beyond the ambit of this

administrative case, and thus cannot be sustained.

WHEREFORE , respondent Atty. Elmer A. dela Rosa is found guilty of violating

Canon 7 and Rule 16.04, Canon 16 of the Code of Professional Responsibility.

Accordingly, he is hereby SUSPENDED from the practice of law for a period of three

(3) years effective upon nality of this Decision, with a stern warning that a commission

of the same or similar acts will be dealt with more severely. This Decision is

immediately executory upon receipt.

Let a copy of this Decision be furnished the O ce of the Bar Con dant, the

Integrated Bar of the Philippines, and the O ce of the Court Administrator for

circulation to all the courts. EIaDHS

SO ORDERED .

Sereno, C.J., Carpio, Velasco, Jr., Leonardo-de Castro, Peralta, Bersamin, Del

Castillo, Villarama, Jr., Perez, Mendoza, Reyes, Leonen and Jardeleza, JJ., concur.

Brion, * J., is on leave.

Footnotes

* On leave.

1. Rollo, pp. 78-93. See also complainants' letter-complaint to the Integrated Bar of the

Philippines (IBP)-Misamis Oriental Chapter filed on January 11, 2010; id. at 3-5.

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

2. See Retainer Contract dated October 9, 1997; id. at 84-87.

3. See letter of termination of legal service dated August 20, 2008; id. at 93.

4. Id. at 3 and 78-79.

5. See id. at 88.

6. Id. at 3 and 79.

7. Id. at 89.

8. Id. at 88.

9. Id. at 90.

10. Id. at 80.

11. Id. at 91.

12. Id. at 80.

13. Dated August 7, 2008. Id. at 36-39.

14. Id. at 92.

15. Id. at 3-5.

16. Id. at 5.

17. Dated March 10, 2010. Id. at 17-68.

18. As evidenced by the Acknowledgment dated March 23, 2006. See id. at 40.

19. Id. at 19.

20. Id. at 69-70.

21. Dated February 26, 2010. Id. at 71-75.

22. Id. at 70.

23. Id. at 73.

24. See 1st Endorsement dated November 23, 2010; id. at 2.

25. See id. at 95.

26. Id. at 214.

27. See Order dated December 12, 2011 issued by Commissioner Jose I. De La Rama, Jr.; id. at

125.

28. Id. at 209-221.

29. Id. at 219-220.

30. Id. at 89.

31. Id. at 215.

32. Id.

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

33. Id. at 35.

34. Id. at 216.

35. Id. at 219.

36. Id. at 220.

37. Id. at 220-221.

38. Signed by National Secretary Nasser A. Marohomsalic. Id. at 208.

39. See Motion for Reconsideration with Prayer to Re-Open Investigation and/or Admit Evidence

dated September 6, 2013; id. at 224-234.

40. Id. at 283-284.

41. Id. at 88.

42. Id. at 89.

43. Id.

44. Id. at 88, see dorsal portion.

45. Id. at 22.

46. Junio v. Atty. Grupo, 423 Phil. 808, 816 (2001).

47. Frias v. Atty. Lozada, 513 Phil. 512, 521-522 (2005).

48. Id.

49. Id.

50. Sps. Soriano v. Atty. Reyes, 523 Phil. 1, 16 (2006).

51. Supra note 47, at 522.

52. Roa v. Atty. Moreno, 633 Phil. 1, 8 (2010). See also Suzuki v. Atty. Tiamson, 508 Phil. 130,

142 (2005).

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

You might also like

- Circulatory System QuestionsDocument4 pagesCirculatory System QuestionsJohn Vincent Gonzales50% (2)

- Petition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261From EverandPetition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261No ratings yet

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyFrom EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyNo ratings yet

- Judicial AdmissionsDocument20 pagesJudicial AdmissionsPaolo EvangelistaNo ratings yet

- Last Will TestamentDocument3 pagesLast Will TestamentIELTS75% (4)

- Costa, António Pedro, Luís Paulo Reis, António Moreira. 2019. (Advances in Intelligent Systems and Computing 861) Computer Supported Qualitative Research - New Trends On Qualitative Research-SpringerDocument330 pagesCosta, António Pedro, Luís Paulo Reis, António Moreira. 2019. (Advances in Intelligent Systems and Computing 861) Computer Supported Qualitative Research - New Trends On Qualitative Research-SpringerClarisse ReinfildNo ratings yet

- Leyte Department of Education Personal Development DocumentDocument2 pagesLeyte Department of Education Personal Development DocumentMaricar Cesista NicartNo ratings yet

- Credit Management Overview and Principles of LendingDocument44 pagesCredit Management Overview and Principles of LendingTavneet Singh100% (2)

- Group-5-Chapter-IV - Abstract, Summary, Conclusion, and ReccomendationDocument38 pagesGroup-5-Chapter-IV - Abstract, Summary, Conclusion, and Reccomendationjelian castroNo ratings yet

- Certificate of Coordination: Area(s) of OperationDocument3 pagesCertificate of Coordination: Area(s) of OperationervingabralagbonNo ratings yet

- Blues A La Machito - CongasDocument2 pagesBlues A La Machito - CongasDavid ScaliseNo ratings yet

- Quest 4Document33 pagesQuest 4AJKDF78% (23)

- 02-13. Catimbuhan V CruzDocument5 pages02-13. Catimbuhan V CruzOdette JumaoasNo ratings yet

- Legal & Judicial Ethics & Practical Exercises SyllabusDocument8 pagesLegal & Judicial Ethics & Practical Exercises Syllabuservingabralagbon100% (1)

- San Pedro Vs MendozaDocument2 pagesSan Pedro Vs Mendozaryusuki takahashiNo ratings yet

- Third Division: Notice NoticeDocument3 pagesThird Division: Notice NoticeervingabralagbonNo ratings yet

- Marketing Plan For RESUVADocument31 pagesMarketing Plan For RESUVAMohammad Shaniaz Islam75% (4)

- Memorial On Behalf of The Respondent: Participant Code-C-86Document18 pagesMemorial On Behalf of The Respondent: Participant Code-C-86Aishna SinghNo ratings yet

- 157 Adelfa - Properties - Inc. - v. - MendozaDocument7 pages157 Adelfa - Properties - Inc. - v. - MendozaKevin DegamoNo ratings yet

- Report of Lost, Stolen, Damaged or Destroyed Property: Appendix 75Document3 pagesReport of Lost, Stolen, Damaged or Destroyed Property: Appendix 75Knoll Viado100% (1)

- Case Digest 101 113Document35 pagesCase Digest 101 113kayeNo ratings yet

- Spouses Concepcion Vs Atty Dela RosaDocument7 pagesSpouses Concepcion Vs Atty Dela Rosamondaytuesday17No ratings yet

- Sps Concepcion Vs Dela Rosa Full TextDocument6 pagesSps Concepcion Vs Dela Rosa Full TextRanrave Marqueda DiangcoNo ratings yet

- Cases (Legal Etics)Document30 pagesCases (Legal Etics)Rose Ann CalanglangNo ratings yet

- Concepcion v. Atty. Dela Rosa, A.C. No. 10681, Feb. 3, 2015Document8 pagesConcepcion v. Atty. Dela Rosa, A.C. No. 10681, Feb. 3, 2015Martin SNo ratings yet

- Sps Conception vs. Atty. Elmer Dela Rosa, A.C. No. 10681, February 3, 2015Document6 pagesSps Conception vs. Atty. Elmer Dela Rosa, A.C. No. 10681, February 3, 2015Apr CelestialNo ratings yet

- Sps Concepcion vs. Atty Dela RosaDocument5 pagesSps Concepcion vs. Atty Dela RosaSamiha TorrecampoNo ratings yet

- Sps. Concepcion vs. Atty Elmer Dela Rosa - CPR - Rule 16.04Document2 pagesSps. Concepcion vs. Atty Elmer Dela Rosa - CPR - Rule 16.04Franchette Kaye Lim0% (1)

- CA upholds dismissal of loan collection caseDocument12 pagesCA upholds dismissal of loan collection caseAnonymous 6Xc2R53xNo ratings yet

- G.R. No. 173227 SIGAAN Vs VILLANUEVADocument5 pagesG.R. No. 173227 SIGAAN Vs VILLANUEVAPatrick LawrenceNo ratings yet

- Siga-An vs. Villanueva With DigestDocument20 pagesSiga-An vs. Villanueva With DigestRommel P. AbasNo ratings yet

- ADELITA B. LLUNAR, Complainant, v. ATTY. ROMULO RICAFORT, Respondent. Decision Per CuriamDocument3 pagesADELITA B. LLUNAR, Complainant, v. ATTY. ROMULO RICAFORT, Respondent. Decision Per CuriamhayleyNo ratings yet

- Canon 7 9 DigestsDocument44 pagesCanon 7 9 DigestsAngelica MaquiNo ratings yet

- Court rules on loan dispute and interest paymentsDocument15 pagesCourt rules on loan dispute and interest paymentsNaomi CartagenaNo ratings yet

- Lilany Yulo Y Billones Vs PEOPLEDocument5 pagesLilany Yulo Y Billones Vs PEOPLEMariel D. PortilloNo ratings yet

- 7.ting Ting Pua vs. Spouses Benito Lo Bun Tiong, GR. No. 198660, October 23, 2013Document12 pages7.ting Ting Pua vs. Spouses Benito Lo Bun Tiong, GR. No. 198660, October 23, 2013BJMP NATIONAL EPAHPNo ratings yet

- Dela Cruz V ConcepcionDocument5 pagesDela Cruz V ConcepcionGlads SarominezNo ratings yet

- Siga-An V Villanueva GR173227Document8 pagesSiga-An V Villanueva GR173227Jesus Angelo DiosanaNo ratings yet

- G.R. No. 198660Document5 pagesG.R. No. 198660Hp AmpsNo ratings yet

- CasesDocument164 pagesCasesgleeNo ratings yet

- ADELITA B. LLUNAR, Complainant, vs. ATTY. ROMULO RICAFORT, RespondentDocument5 pagesADELITA B. LLUNAR, Complainant, vs. ATTY. ROMULO RICAFORT, RespondentVener Angelo MargalloNo ratings yet

- Siga-An v. Villanueva, G.R. No. 173227, January 30, 2009Document8 pagesSiga-An v. Villanueva, G.R. No. 173227, January 30, 2009noemi alvarezNo ratings yet

- M5 Llunar v. Ricafort HLDocument6 pagesM5 Llunar v. Ricafort HLPre PacionelaNo ratings yet

- GR 167641 Spouses - Dela - Cruz - v. - ConcepcionDocument9 pagesGR 167641 Spouses - Dela - Cruz - v. - ConcepcionCassieNo ratings yet

- Quasi Cntracts ReviewerDocument19 pagesQuasi Cntracts ReviewerlexxNo ratings yet

- Nego B CasesDocument11 pagesNego B CasesbcarNo ratings yet

- Complainant Respondent: Aurora Aguilar-Dyquiangco, Atty. Diana Lynn M. ArellanoDocument13 pagesComplainant Respondent: Aurora Aguilar-Dyquiangco, Atty. Diana Lynn M. ArellanoJakie CruzNo ratings yet

- 4 Pua Vs Sps Bun Tiong and TengDocument11 pages4 Pua Vs Sps Bun Tiong and TengtheresagriggsNo ratings yet

- Moster vs. PeopleDocument6 pagesMoster vs. PeopleArmie MedinaNo ratings yet

- Court of Appeals upholds ruling on loan repayment disputeDocument86 pagesCourt of Appeals upholds ruling on loan repayment disputeJohn Carlo DizonNo ratings yet

- Petitioners Vs Vs Respondent: Third DivisionDocument8 pagesPetitioners Vs Vs Respondent: Third DivisionMichaella Claire LayugNo ratings yet

- Pua V Spouses TiongDocument12 pagesPua V Spouses TiongClement del RosarioNo ratings yet

- 04Siga-An V VillanuevaDocument7 pages04Siga-An V VillanuevaDonald Dwane ReyesNo ratings yet

- Ting Ting Pua Vs Sps. Benito Case DigestDocument12 pagesTing Ting Pua Vs Sps. Benito Case DigestRob ClosasNo ratings yet

- Yulo V People GR142762Document4 pagesYulo V People GR142762Jesus Angelo DiosanaNo ratings yet

- CA Affirms Estafa Conviction of Anthony NgDocument23 pagesCA Affirms Estafa Conviction of Anthony NgGada AbdulcaderNo ratings yet

- Sigaan vs. VillanuevaDocument9 pagesSigaan vs. VillanuevaVanessa Claire PleñaNo ratings yet

- Supreme CourtDocument8 pagesSupreme CourtMadelaine Soriano PlaniaNo ratings yet

- PUA Vs Spouses Tiong and Caroline Teng - AlbinoDocument3 pagesPUA Vs Spouses Tiong and Caroline Teng - AlbinoAileen PeñafilNo ratings yet

- G.R. No. 172825 Delacruz vs. ConcepcionDocument4 pagesG.R. No. 172825 Delacruz vs. Concepcionmondaytuesday17No ratings yet

- G.R. No. 149353 June 26, 2006 JOCELYN B. DOLES, Petitioner, MA. AURA TINA ANGELES, RespondentDocument11 pagesG.R. No. 149353 June 26, 2006 JOCELYN B. DOLES, Petitioner, MA. AURA TINA ANGELES, RespondentKimberly MNo ratings yet

- 9 - Spouses Dela Cruz v. ConcepcionDocument8 pages9 - Spouses Dela Cruz v. ConcepcionJo AlcantaraNo ratings yet

- G.R. No. 173227 January 20, 2009 SEBASTIAN SIGA-AN, Petitioner, vs. ALICIA VILLANUEVA, RespondentDocument13 pagesG.R. No. 173227 January 20, 2009 SEBASTIAN SIGA-AN, Petitioner, vs. ALICIA VILLANUEVA, RespondentKyle Virgil HernandezNo ratings yet

- Nego DigestDocument6 pagesNego DigestLau NunezNo ratings yet

- Siga-An v. Villanueva, G.R. No. 173227Document11 pagesSiga-An v. Villanueva, G.R. No. 173227sophiaNo ratings yet

- Supreme Court: Page 1 of 3Document3 pagesSupreme Court: Page 1 of 3MaLizaCainapNo ratings yet

- Siga-An v. VillanuevaDocument10 pagesSiga-An v. VillanuevaEnzoNo ratings yet

- Court Affirms Bank's Liability for Lost CheckDocument5 pagesCourt Affirms Bank's Liability for Lost CheckRoseNo ratings yet

- Sison Vs Atty ValdezDocument4 pagesSison Vs Atty ValdezCaleb Josh PacanaNo ratings yet

- CF Sharp Vs TorresDocument4 pagesCF Sharp Vs TorresRegine LangrioNo ratings yet

- Yulo v. PeopleDocument4 pagesYulo v. PeopleDelia PeabodyNo ratings yet

- China Bank Vs CADocument4 pagesChina Bank Vs CACarlo ImperialNo ratings yet

- Judgment Harriet Mushega & Others V Kashaya WilsonDocument6 pagesJudgment Harriet Mushega & Others V Kashaya Wilsonsamurai.stewart.hamiltonNo ratings yet

- Bpi V Sps Royeca: Bank of The Philippine Islands, Petitioner, Spouses Reynaldo and Victoria Royeca, RespondentsDocument5 pagesBpi V Sps Royeca: Bank of The Philippine Islands, Petitioner, Spouses Reynaldo and Victoria Royeca, Respondentsjetski loveNo ratings yet

- A.C. No. 9880Document6 pagesA.C. No. 9880Elmar AnocNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- People Vs MarbabiesDocument3 pagesPeople Vs MarbabieservingabralagbonNo ratings yet

- Outline of Topics Taxation Law Review IvDocument6 pagesOutline of Topics Taxation Law Review IvervingabralagbonNo ratings yet

- Certificate of Inventory Tacloban CityDocument2 pagesCertificate of Inventory Tacloban CityervingabralagbonNo ratings yet

- Office of The Court Administrator v. TormisDocument20 pagesOffice of The Court Administrator v. TormiservingabralagbonNo ratings yet

- Ethics - FINALS - Additional CasesDocument12 pagesEthics - FINALS - Additional CaseservingabralagbonNo ratings yet

- Outline of Topics Taxation Law Review IvDocument6 pagesOutline of Topics Taxation Law Review IvervingabralagbonNo ratings yet

- Caronan v. CaronanDocument8 pagesCaronan v. Caronancarla_cariaga_2No ratings yet

- D. Villahermosa v. Caracol, A.C. No. 7325, Jan. 21, 2015Document6 pagesD. Villahermosa v. Caracol, A.C. No. 7325, Jan. 21, 2015TrudgeOnNo ratings yet

- A. Plumptre v. RiveraDocument6 pagesA. Plumptre v. RiveraervingabralagbonNo ratings yet

- Office of The Court Administrator V.Document21 pagesOffice of The Court Administrator V.ervingabralagbonNo ratings yet

- Aguirre vs. Rana PDFDocument7 pagesAguirre vs. Rana PDFCazzandhra BullecerNo ratings yet

- 2015 Yu - Kimteng - v. - Young20190320 5466 1y9r6ix PDFDocument13 pages2015 Yu - Kimteng - v. - Young20190320 5466 1y9r6ix PDFShiurabelle ApuraNo ratings yet

- Attorney Disbarred for Deceiving and Impregnating Young WomanDocument8 pagesAttorney Disbarred for Deceiving and Impregnating Young WomanDuffy DuffyNo ratings yet

- 46 Gaw Jr. v. Commissioner of Internal Revenue20210428-11-1x0n8q5Document16 pages46 Gaw Jr. v. Commissioner of Internal Revenue20210428-11-1x0n8q5ervingabralagbonNo ratings yet

- in - Re - Order - Dated - October - 27 - 2016 - Issued - By20201127-9-123x8ouDocument5 pagesin - Re - Order - Dated - October - 27 - 2016 - Issued - By20201127-9-123x8ouervingabralagbonNo ratings yet

- In Re Benjamin DacanayDocument4 pagesIn Re Benjamin Dacanayjeesup9No ratings yet

- 8 Zafra III V PagatpatanDocument5 pages8 Zafra III V PagatpatanJinnelyn LiNo ratings yet

- AA - Total - Learning - Center - For - Young - Achievers20200916-9-1hx1arfDocument8 pagesAA - Total - Learning - Center - For - Young - Achievers20200916-9-1hx1arfervingabralagbonNo ratings yet

- Complainants vs. vs. Respondents: Second DivisionDocument6 pagesComplainants vs. vs. Respondents: Second DivisionervingabralagbonNo ratings yet

- Court Suspends Lawyer for 5 Years and Imposes Fine for Repeated Disobedience of Court OrdersDocument4 pagesCourt Suspends Lawyer for 5 Years and Imposes Fine for Repeated Disobedience of Court OrderservingabralagbonNo ratings yet

- 46 Gaw Jr. v. Commissioner of Internal Revenue (NOTICE)Document9 pages46 Gaw Jr. v. Commissioner of Internal Revenue (NOTICE)ervingabralagbonNo ratings yet

- 44 Commissioner - of - Internal - Revenue - v. - Univation20210505-11-1a1tm6xDocument10 pages44 Commissioner - of - Internal - Revenue - v. - Univation20210505-11-1a1tm6xervingabralagbonNo ratings yet

- 42 Allied Banking Corporation v. Commissioner Of20210505-12-Fno6kpDocument10 pages42 Allied Banking Corporation v. Commissioner Of20210505-12-Fno6kpervingabralagbonNo ratings yet

- 45 Commissioner of Internal Revenue v. La Flor20210505-11-RpbhzrDocument11 pages45 Commissioner of Internal Revenue v. La Flor20210505-11-RpbhzrervingabralagbonNo ratings yet

- Anapath - Dr. Saad Khairallah - Session 1Document5 pagesAnapath - Dr. Saad Khairallah - Session 1Nagham BazziNo ratings yet

- History of Anglo Saxon Literature English Assignment NUML National University of Modern LanguagesDocument15 pagesHistory of Anglo Saxon Literature English Assignment NUML National University of Modern LanguagesMaanNo ratings yet

- Sorting Lesson PlanDocument4 pagesSorting Lesson PlanStasha DuttNo ratings yet

- 2018 AACPM Curricular Guide PDFDocument327 pages2018 AACPM Curricular Guide PDFddNo ratings yet

- MOC 20487B: Developing Windows Azure and Web Services Course OverviewDocument9 pagesMOC 20487B: Developing Windows Azure and Web Services Course OverviewMichaelsnpNo ratings yet

- Case Nizar SummaryDocument3 pagesCase Nizar SummaryShahera Zainudin100% (1)

- Lesson Plan and ProductDocument4 pagesLesson Plan and Productapi-435897192No ratings yet

- How To Prepare General Awareness For SSC CGLDocument7 pagesHow To Prepare General Awareness For SSC CGLreshmaNo ratings yet

- Reading Lesson 1 - Matching Paragraph Headings: Strategies To Answer The QuestionsDocument4 pagesReading Lesson 1 - Matching Paragraph Headings: Strategies To Answer The QuestionsNgọc Anh Nguyễn LêNo ratings yet

- AsianJPharmHealthSci 2-3-428Document5 pagesAsianJPharmHealthSci 2-3-428KkanuPriyaNo ratings yet

- Why Eye Is The Important Sensory Organ in Our LifeDocument3 pagesWhy Eye Is The Important Sensory Organ in Our LifeAljhon DelfinNo ratings yet

- Curriculum Vitae: About MyselfDocument5 pagesCurriculum Vitae: About MyselfRahat Singh KachhwahaNo ratings yet

- Darood e LakhiDocument5 pagesDarood e LakhiTariq Mehmood Tariq80% (5)

- Mononobe OkabeDocument11 pagesMononobe Okabe24x7civilconsultantNo ratings yet

- Organization Theory and Design Canadian 2Nd Edition Daft Solutions Manual Full Chapter PDFDocument35 pagesOrganization Theory and Design Canadian 2Nd Edition Daft Solutions Manual Full Chapter PDFadeliahuy9m5u97100% (7)

- Bentley Continental GTC 2013 Workshop Manual Wiring DiagramsDocument22 pagesBentley Continental GTC 2013 Workshop Manual Wiring Diagramsericwilson060590yjk100% (118)

- AQ CHILDHOOD LITERATURE 2 MALAYSIAN FOLKTALES MargaretDocument8 pagesAQ CHILDHOOD LITERATURE 2 MALAYSIAN FOLKTALES MargaretMarcia PattersonNo ratings yet

- A Review of the Literature on Job Stress and its Impact on Public and Private Sector Employees (39 charactersDocument13 pagesA Review of the Literature on Job Stress and its Impact on Public and Private Sector Employees (39 charactersNeethu DilverNo ratings yet

- Meaning of Population EducationDocument28 pagesMeaning of Population Educationanon_896879459No ratings yet

- Illanun PeopleDocument2 pagesIllanun PeopleLansingNo ratings yet