Professional Documents

Culture Documents

Excel Budget Problem Template

Uploaded by

api-302636031Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel Budget Problem Template

Uploaded by

api-302636031Copyright:

Available Formats

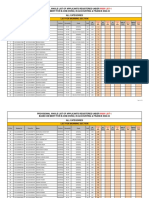

MORRISSEY MANUFACTURING

Master Budget

NOTE: Cells highlighted in blue contain static numbers (inputs) and not formulas.

Sales Budget

December January February March April May

Unit sales 8,444 8,900 9,900 9,200 9,500 8,600

Unit selling price $ 9 $ 9 $ 9 $ 9 $ 9 $ 9

Total sales Revenue $ 76,000 $ 80,100 $ 89,100 $ 82,800 $ 85,500 $ 77,400

Req. 1

Cash Collections Budget

January February March Quarter

Cash sales $ 20,025 $ 22,275 $ 20,700 $ 63,000

Credit sales $ 57,000 $ 60,075 $ 66,825 $ 183,900

Total collections $ 77,025 $ 82,350 $ 87,525 $ 246,900

Req. 2

Production Budget

January February March Quarter

Unit sales 8,900 9,900 9,200 28,000

Plus: Desired ending inventory 1,485 1,380 1,425 1,425

Total needed 10,385 11,280 10,625 29,425

Less: Beginning inventory 1,335 1,485 1,380 1,335

Units to produce 9,050 9,795 9,245 28,090

Req. 3

Direct Materials Budget

January February March Quarter

Units to be produced 9,050 9,795 9,245 28,090

Multiply by: Quantity of DM needed per unit 2 2 2 2

Quantity of DM needed for production 18,100 19,590 18,490 56,180

Plus: Desired ending inventory of DM 1,959 1,849 1,873 1,873

Total quantity of DM needed 20,059 21,439 20,363 58,053

Less: Beginning inventory of DM 1,810 1,959 1,849 1,810

Quantity of DM to purchase 18,249 19,480 18,514 56,243

Multiply by: Cost per pound $ 1.50 $ 1.50 $ 1.50 $ 1.50

Total cost of DM purchases $ 27,374 $ 29,220 $ 27,771 $ 84,365

April May

Unit Sales 9,500 8,600

Plus: Desired End Inventory 1,290

Total Needed 10,790

Less: Beginning Inventory 1,425

Units to produce 9,365

DM needed per unit 2

Quantity of DM needed for production 18,730

Req. 4

Cash Payments for Direct Material Purchases Budget

January February March Quarter

December purchases (From AP) $ 22,000 $ 22,000

January purchases $ 8,212 $ 19,161 $ 27,374

February purchases $ 8,766 $ 20,454 $ 29,220

March purchases $ 8,331 $ 8,331

Total disbursements $ 30,212 $ 27,927 $ 28,785 $ 86,925

Req. 5

Cash Payments for Direct Labor Costs

January February March Quarter

Units Produced 9,050 9,795 9,245 28,090

Multiply by: Hours per unit 0.03 0.03 0.03 0.03

Direct Labor Hours 272 294 277 843

Multiply by: Direct Labor rate per hour $ 13 $ 13 $ 13 $ 13

Direct Labor Cost $ 3,530 $ 3,820 $ 3,606 $ 10,955

Req. 6

Cash Payments for Manufacturing Overhead Budget

January February March Quarter

Rent (fixed) $ 6,500 $ 6,500 $ 6,500 $ 19,500

Other MOH (fixed) $ 2,100 $ 2,100 $ 2,100 $ 6,300

Variable manufacturing overhead $ 12,670 $ 13,713 $ 12,943 $ 39,326

Total disbursements $ 21,270 $ 22,313 $ 21,543 $ 65,126

Req. 7

Cash Payments for Operating Expenses Budget

January February March Quarter

Variable operating expenses $ 10,680 $ 11,880 $ 11,040 $ 33,600

Fixed operating expenses $ 1,400 $ 1,400 $ 1,400 $ 4,200

Total disbursements $ 12,080 $ 13,280 $ 12,440 $ 37,800

Req. 8

Combined Cash Budget

January February March Quarter

Cash balance, beginning $ 6,000 $ 4,933 $ 5,143 $ 6,000

Plus: cash collections (req. 1) $ 77,025 $ 82,350 $ 87,525 $ 246,900

Total cash available $ 83,025 $ 87,283 $ 92,668 $ 252,900

Less cash payments:

DM purchases (req. 4) $ 30,212 $ 27,927 $ 28,785 $ 86,925

Direct labor (req. 5) $ 3,530 $ 3,820 $ 3,606 $ 10,955

MOH costs (req 6) $ 21,270 $ 22,313 $ 21,543 $ 65,126

Operating expenses (req 7) $ 12,080 $ 13,280 $ 12,440 $ 37,800

Tax payment $ 10,800 $ 10,800

Equipment purchases $ 15,000 $ 6,000 $ 4,000 $ 25,000

Total cash payments $ 82,092 $ 84,141 $ 70,374 $ 236,606

Ending cash before financing $ 933 $ 3,143 $ 22,294 $ 16,294

Financing:

Borrowings $ 4,000 $ 2,000 $ 6,000

Repayments $ (6,000) $ (6,000)

Interest $ (270) $ (270)

Total financing $ 4,000 $ 2,000 $ (6,270) $ (270)

Cash balance, ending $ 4,933 $ 5,143 $ 16,024 $ 16,024

Req. 9

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit $ 3.00

Direct labor cost per unit $ 0.39

Variable MOH cost per unit (given data) $ 1.40

Fixed MOH per unit (given data) $ 0.60

Cost of manufacturing each unit $ 5.39

Req. 10

Wasatch Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales $ 252,000

Cost of goods sold $ 150,920

Gross profit $ 101,080

Operating expenses $ 37,800

Depreciation expense (given data) $ 5,200

Operating income $ 58,080

Less: interest expense $ (270)

Less: provision for income tax $ 16,186.80

Net income $ 41,623

You might also like

- Art AgentDocument6 pagesArt Agentapi-302636031No ratings yet

- Reflection PaperDocument2 pagesReflection Paperapi-302636031No ratings yet

- Personal Ethics and Financial ReportingDocument2 pagesPersonal Ethics and Financial Reportingapi-302636031No ratings yet

- Van GoghDocument5 pagesVan Goghapi-302636031No ratings yet

- Civil DisobedienceDocument3 pagesCivil Disobedienceapi-302636031No ratings yet

- Molecules Around MeDocument8 pagesMolecules Around Meapi-302636031No ratings yet

- English 1010Document4 pagesEnglish 1010api-302636031No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assuming Dell Sales Will Grow 50% in 1997, How Might The Company Fund Its Growth Internally?Document1 pageAssuming Dell Sales Will Grow 50% in 1997, How Might The Company Fund Its Growth Internally?DivyaNo ratings yet

- Sunzi Art of War AssignmentDocument11 pagesSunzi Art of War AssignmentEveliaNo ratings yet

- A) Chart of Accounts: 1. On March 1, 2020, Tahir Muktar, A Famous Businessman in Addis, Opened A BusinessDocument12 pagesA) Chart of Accounts: 1. On March 1, 2020, Tahir Muktar, A Famous Businessman in Addis, Opened A Businessrediet solomonNo ratings yet

- TATA Motors EVDocument24 pagesTATA Motors EVKarthick FerruccioNo ratings yet

- Answers Chapter 5 Quiz.s13Document3 pagesAnswers Chapter 5 Quiz.s13Aurcus JumskieNo ratings yet

- Group 1 (Cost Accounting Midterm) .Document33 pagesGroup 1 (Cost Accounting Midterm) .Bright VegaNo ratings yet

- Frozen Fruit & Juice Production: Brain Freeze: Low Demand For Frozen Juice Is Expected To Limit Revenue GrowthDocument47 pagesFrozen Fruit & Juice Production: Brain Freeze: Low Demand For Frozen Juice Is Expected To Limit Revenue GrowthArnu Felix CamposNo ratings yet

- Final Report Sarang Ujawane NicmarDocument79 pagesFinal Report Sarang Ujawane NicmarMayank GhaiwatkarNo ratings yet

- LCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Apr-2018Document17 pagesLCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Apr-2018Aung Zaw HtweNo ratings yet

- InvoiceDocument1 pageInvoiceying yingNo ratings yet

- Multinational StrategyDocument2 pagesMultinational StrategyThị Ninh DươngNo ratings yet

- Credit Repair Business Plan ExampleDocument50 pagesCredit Repair Business Plan ExampleJoseph QuillNo ratings yet

- International Business 16th Edition Daniels Test BankDocument24 pagesInternational Business 16th Edition Daniels Test BankCynthiaWangeagjy100% (31)

- COBECON Practice Exercise 4 - #S 1, 2, 3, 13Document3 pagesCOBECON Practice Exercise 4 - #S 1, 2, 3, 13Van TisbeNo ratings yet

- Fall Term 2021: Academic CalendarDocument2 pagesFall Term 2021: Academic CalendarZeeshan AhmadNo ratings yet

- Quiz 7 (HRM 2022)Document6 pagesQuiz 7 (HRM 2022)Sandipan DawnNo ratings yet

- ICICI Bank Letter of OfferDocument5 pagesICICI Bank Letter of OfferHighline Hotel100% (2)

- Acg5205 Solutions Ch.11 - Christensen 12eDocument8 pagesAcg5205 Solutions Ch.11 - Christensen 12eRyan NguyenNo ratings yet

- Working: Lunch Dinner Sales Units 7800 20280 Sales Price 12 25 93600 507000Document8 pagesWorking: Lunch Dinner Sales Units 7800 20280 Sales Price 12 25 93600 507000kudkhanNo ratings yet

- Catalogo 2012-2013 BFT IcaroDocument368 pagesCatalogo 2012-2013 BFT IcaroJose SarmientoNo ratings yet

- Goenka 2022 MORNING WISH List 01 FINAL PUBLISHDocument99 pagesGoenka 2022 MORNING WISH List 01 FINAL PUBLISHAditya AgarwalNo ratings yet

- Accorhotels' Digital TransformationDocument11 pagesAccorhotels' Digital TransformationRitik Maheshwari100% (1)

- Data Moneycontrol - Com - Company Info - Print FinancialsDocument2 pagesData Moneycontrol - Com - Company Info - Print FinancialsshreyasNo ratings yet

- Dmart: Disrupting Food RetailingDocument4 pagesDmart: Disrupting Food RetailingShubham ThakurNo ratings yet

- 1 ch07 Cash - Warren Reeve WajibDocument40 pages1 ch07 Cash - Warren Reeve WajibAdilaNo ratings yet

- Human Resource ManagementDocument16 pagesHuman Resource ManagementPriyanka Pandey100% (6)

- p5 2012 Jun QDocument12 pagesp5 2012 Jun QIftekhar IfteNo ratings yet

- Resit Examinations For 2004 - 2005 / Semester 2: Module: Financial AccountingDocument6 pagesResit Examinations For 2004 - 2005 / Semester 2: Module: Financial AccountingBasilio MaliwangaNo ratings yet

- Mission VisionDocument3 pagesMission VisionVibhor Jain50% (2)

- ObjectivesDocument2 pagesObjectivesAdiza BaduaNo ratings yet