Professional Documents

Culture Documents

Principles of Valuation

Principles of Valuation

Uploaded by

Bhosx Kim0 ratings0% found this document useful (0 votes)

2K views20 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views20 pagesPrinciples of Valuation

Principles of Valuation

Uploaded by

Bhosx KimCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 20

Cee arenes

FUNDAMENTALS PRINCIPLES OF VALUATION

Assets, individually or collectively, has value. Generally, value pertains to

how much a particular object is worth to a particular set of eyes. Any kind of

asset can be valued, though the degree of effort needed may vary on a case

to case basis. Methods to value for real estate can may be different on how

to value an entire business.

Businesses treat capital as a scarce resource that they should compete to

‘obtain and efficiently manage. Since capital is scarce, capital providers

require users to ensure that will be able to maximize shareholder returns to

justify providing capital to them. Otherwise, capital providers will look and

bring money to other investment opportunities that are more attractive.

Hence, most fundamental principle for all investments and business is to

maximize shareholder value. Maximizing value for businesses consequently

result in a domino impact to the economy. Growing companies provide long-

term sustainability to the economy by yielding higher economic output, better

productivity gains, employment growth and higher salaries. Placing scarce

resources in their most productive use best serves the interest of different

stakeholders in the country

‘The fundamental point behind success in investments is understanding what

is the prevailing value and the key drivers that influence this value. Increase

in value may imply that shareholder capital is maximized, hence, fulfiling the

promise to capital providers. This is where valuation steps in.

VALUATION

According to the CFA Institute, valuation is the estimation of an asset's value

based on variables perceived to be related to future investment returns, on

‘comparisons with similar assets, or, when relevant, on estimates of immediate

liquidation proceeds. Valuation includes the use of forecasts to come up with

reasonable estimate of value of an entity's assets or its equity. At varying

levels, decisions done within a firm entails valuation implicitly. For example,

capital budgeting analysis usually considers how pursuing a specific project

will affect entity value. Valuation techniques may differ across different assets,

but all follows similar fundamental principles that drives the core of these

approaches.

Valuation places great emphasis on the professional judgment that are

associated in the exercise. As valuation mostly deals with projections about

future events, analysts should hone their ability to balance and evaluation

Re ae

s

VALUATION CONCEPTS AND METHODOLOGIES

different assumptions used in each phas

phase of the valuation exer:

validity of available empirical evidence and come up with rational chennnesS

aligns with the ultimate objective of the valuation activity id

INTERPRETING DIFFERENT CONCEPTS OF VALUE

In the corporate setting, the fundamental equation of value is grounded oy

principe that Alfred Marshall popularized — a company creates vale ft oi

only if the return on capital invested exceed the cost of acquiring ca wa |

Vale, in the point of view of corporate shareholders, relates tothe difference

between cash inflows generated by an investment and the cost associated

with the capital invested which captures both time value of money and risk

premium.

The value of a businesses can be basically linked to three major factors:

© Current operations — how is the operating performance of the firm in

recent year?

Future prospects — what is the long-term, strategic direction of the

company?

«Embedded risk — what are the business risks involved in running the

business?

‘These factors are solid concepts; however, the quick turnover of technologies

and rapid globalization make the business environment more dynamic. As a

result, defining value and identifying relevant drivers became more arduous

as time passes by. AS firms continue to quickly evolve and adapt to new

technologies, valuation of current operations becomes more dificut 2s

compared to the past. Projecting future macroeconomic indicators also is

harder because of constant change in the economic environment and the

‘continuous innovation of market players. New risks and competitions also

surface which makes determining uncertainties a critical ingredient to

success,

‘The definition of value may also vary depending on the context and

objective of the valuation exercise.

Intrinsic value — refers to the value of any asset based on the

assumption assuming there is a hypothetically complete

understanding of its investment characteristics. Intrinsic value is the

value that an investor considers, on the basis of an evaluation of

available facts, to be the "true" or “real” value that will become the

market value when other investors reach the same conclusion. AS

2

—

RU eens

Obtaining complete information about the asset is impractical,

investors normally estimate intrinsic value based on their view of the

real worth of the asset. f the assumption is that the true value of asset

is dictated by the market, then intrinsic value equals its market price.

Unfortunately, this is not the case. The Grossman - Stiglitz paradox

States that if the market prices, which can be obtained freely, perfectly

reflect the intrinsic value of an asset, then a rational investor will not

‘spend to gather data to validate the value of a stock. If this is the case,

then no investors analyze information about stocks anymore.

Consequently, how will the market price suggest the intrinsic price if

this process does not happen? The rational efficient markets

formulation of Grossman and Stiglitz acknowledges that investors will

not rationally spend to gather more information about an asset unless

they expect that there is potential reward in exchange of the effort.

AS a result, market price often does not approximate an asset's

intrinsic value. Securities analysts often try to 100k for stocks which are

‘mispriced in the market and based their buy or sell ecommendations

based on these analyses, Intrinsic value is highly relevant in pricing

public shares

Most of the approaches that will be discussed in this book deals with

finding out the intrinsic value of assets. Financial analysts should be

able to come up with accurate forecasts and determine the right

valuation model that will yield a good estimate of a firm’s intrinsic

value. The quality of the forecast, including the reasonableness of

assumptions used, is very critical in coming up with the right valuation

that influences the investment decision.

+ Going Concern Value - firm value is determined under the going

‘concern assumption. The going concern assumption believes that the

entity will continue to do its business activities into the foreseeable

future. It is assumed that the entity will realize assets and pay

obligations in the normal course of business. Chapters 2 and 3 focus

on valuation methodologies dealing with a firm's going concern value.

‘+ Liquidation Value - the net amount that would be realized if the

business is terminated and the assets are sold piecemeal. Firm value

is computed based on the assumption that entity will be dissolved, and

its assets will be sold individually - hence, the liquidation process.

Liquidation value is particularly relevant for companies who are

experiencing severe financial distress. Normally, there is greater value

ae

Rk eaar en master sy

Generated when assets working together are combined with ine

application of human capital (unless the business is continuow

unprofitable) which is the case in the going-concern assumption

liquidation occurs, value often declines because of the assets ot

working together anymore and the absence of human intervention

* Fair Market Value —the price, expressed in terms of cash equivalents,

at which property would change hands between a hypothetical willing

and able buyer and a hypothetical willing and able seller, acting at

arm's length in an open and unrestricted market, when neither is under

‘compulsion to buy or sell and when both have reasonable knowledge

of the relevant facts. Both parties should voluntarily agree with the

Price of the transaction and are not under threat of compulsion. Fair

value assumes that both parties are informed of all material

characteristics about the investment that might influence their

decision. Fair value is often used in valuation exercises involving tax

assessments,

ROLES OF VALUATION IN BUSINESS

Portfolio Management

The relevance of valuation in portfolio management largely depends on the

investment objectives of the investors or financial managers managing the

investment portfolio. Passive investors tend to be disinterested in

understanding valuation, but active investors may want to understand

valuation in order to participate intelligently in the stock market.

* Fundamental analysts — These are persons who are interested in

understanding and measuring the intrinsic value of a. firm.

Fundamentals refer to the characteristics of an entity related to its

financial strength, profitability or risk appetite. For fundamental

analysts, the true value of a firm can be estimated by looking at its

financial characteristics, its growth prospects, cash flows and isk

Profile. Any noted variance between the stock's market price versus

its fundamental value indicates that it might be overvalued of

undervalued,

Typically, fundamental analysts lean towards long:

strategies which encapsulate the following principle

© Relationship between valu

liably measured.

Nero aneeered

Above relationship is stable over an extended period

‘Any deviations from the above relationship can be corrected

within a reasonable time

| Fundamental analysts may include value and growth investors. Value

| investors tend to be mostly interested in purchasing shares that are

| Currently existing and priced at less than their true value. On the other

hand, growth investors lean towards growth assets (expected value

that future investments can create) and purchasing these at a

discount.

Security and investments analysts use valuation techniques to

Support the buy / sell recommendations that they provide to their

clients. Analysts often infer market conditions implied by the market

rice by assessing this against his own expectations. This allows him

to assess reasonableness and adjust future estimates. Market

expectations regarding fundamentals of one fim can be used as

benchmark for other companies which exhibits the same

characteristics,

* Activist investors ~ Activist investors tend to look for companies with

good growth prospects that have poor management. Activities

investors usually do ‘takeovers’ - they use their equity holdings to

push old management out of the company and change the way the

‘company is being run. In the minds of activist investors, itis not about

the current value of the company but its potential value once itis run

properly. Knowledge about valuation is critical for activist investors so

they can reliably pinpoint which firms will create additional value if

‘management is changed. To do this, activities investors should have

‘@ good understanding of the company’s business model and how

implementing changes in investment, dividend and financing policies

can affect its value.

+ Chartists - Chattists relies on the concept that stock prices are

significantly influenced by how investors think and act. Chartists rely

on available trading KPIs such as price movements, trading volume,

short sales - when making their investment decisions. They believe

that these metrics imply investor psychology and will predict future

‘movements in stock prices. Chartists assume that stock price changes

and follow predictable patterns since investors make decisions based

‘on their emotions than by rational analysis. Valuation does not play a

huge ‘ole in charting, but it is helpful when plotting support and

resistance lines,

“

erature eae kets}

Information Traders ~ Traders that react based on new injgy

about firms that are revealed to the stock market. The underiyiny 2%

is that information traders are more adept in guessing or geri

information about firms and they can make predict how the Tarra

react based on this. Hence, information traders correlate vaiye

how information will affect this value. Valuation is importa

information traders since they buy or sell shares based on

assessment on how new information will affect stock price, “*

Under portfolio management, the following activities can be performey

through the use of valuation techniques:

+ Stock selection - Is a particular asset fairly priced, overpriced, g

underpriced in relation to its prevailing computed intrinsic vaiye

and prices of comparable assets?

‘+ Deducing market expectations ~ Which estimates of a firm's futue

performance are in line with the prevailing market price of is

stocks? Are there assumptions about fundamentals that wil juts,

the prevailing price?

Typically, investors do not have a lot of time to scour all available information

in order to make investment decisions. Instead, they seek the help of

professionals to come up with information that they can use to decide ther

investments.

Sell-side analysts that work in the brokerage department of investment fms

issue valuation judgment that are contained in research reports that ae

disseminated widely to their current and potential clients. Buy-side analysis,

on the other hand, look at specific investment options and make valuatin

analysis on these and report to a portfolio manager or investment committee.

Buy-side analysts tend to perform more in-depth analysis of a firm and

engage in more rigorous stock selection methodologies.

In general, financial analysts assist clients to realize their investment goals by

providing them information that will help them make the right decision whether

to buy or sell. They also play a significant role in the financial markets by

Providing the right information to investors which enable the latter to buy 0”

sell shares. As a result, market prices of shares usually better reflect its rea!

values. Since analysts often take a holistic look on businesses, these

somewhat serves a monitoring role to management to ensure that they make

decision that are in line with the creating value for shareholders.

imi ce

VALUATY eres

Analysis of Business Transactions / Deals

Valuation plays @ very big role when analyzing potential deals. Potential

acquirers typically use relevant valuation techniques (whichever is applicable)

estimate value of target firms they are planning to purchase and understand

the synergies they can take advantage from the purchase. They also use

valuation techniques in the negotiation process to set the deal price.

Business deals include the following corporate events:

* Acquisition - An acquisition usually has two parties: the buying

firm and the selling firm. The buying firm needs to determine the

fair value of the target company prior to offering a bid price. On

the other hand, the selling firm (or sometimes, the target

Company) should have a sense of its firm value as well to gauge

reasonableness of bid offers. Selling fims also use this

information to guide which bid offers to accept or reject. On the

downside, bias may be a significant concern in acquisition

analyses. Target firms may show very optimistic projections to

Push the price higher or pressure to make resulting valuation

analysis favorable if target firm is certain to be purchased as a

result of strategic decision.

+ Merger ~ General term which describes the transaction two

companies combined to form a wholly new entity. An example is

the merger of

‘+ Divestiture - Sale of a major component or segment of a business.

(e.g. brand or product line) to another company

+ Spin-off - Separating a segment or component business and

transforming this into a separate legal entity whose ownership will

be transferred to shareholders.

Leveraged buyout - Acquisition of another business by using

significant debt which uses the acquired business as a collateral

Valuation in deals analysis also considers two important, unique factors:

synergy and control

‘+ Synergy ~ potential increase in firm value that can be generated

‘once two firms merge with each other. Synergy assumes that the

combined value of two firms will be greater than the sum of

Reta uaa eres)

separate firms. Synergy can be attributable to more

d oy

‘operations, cost reductions, increased revenues, combin

Producismatkets or coss-scininary teens ofthe gor bt

organization. ned

* Control - change in people managing the organization bye,

about by the acquisition, Any impact to firm value resuting gat

the change in management and resmctuing ofthe eh

company should be included in the valuation exercise. Thy

usually an important matter for hostile takeovers, 5

Corporate Finance

Corporate finance mainly involves managing the firm's capital struct

including funding sources and strategies that the business should pursue g

maximize firm value. Corporate finance deals with priontizing and distrbuti

financial resources to activities that increases firm value. The utimate goai¢

comporate finance is to maximize the firm value by appropriate planning ang

implementation of resources, while balancing profitability and risk appetite

‘Small private businesses that need additional money to expand uses

valuation concepts when approaching private equity investors and ventu

capital providers to show the promise of the business. The ownership stake

that these capital providers will ask from the business in exchange of the

money that they will put in will be based on their estimated value of the smal

private business,

Larger companies who wish to obtain additional funds by offering their shares.

to the public also need valuation to estimate the price they are going to be

offered in the stock market. Afterwards, decision regarding which projects to

invest in, amount to be borrowed and dividend declarations to shareholders

are influenced by company valuation.

Corporate finance ensures that financial outcomes and corporate strategy

drives maximization of firm value. Current business conditions push business

leaders to focus on value enhancement by looking at the business holistically

and focus on key levers affecting value in order to provide some level of return

to shareholders,

Firms that are focused on maximizing shareholder value uses valuation

concepts to assess impact of various strategies to company value. Valuation

methodologies also enable communication about significant corporate

matters between management, shareholders, consultants and investment

analysts.

Mees. uaneecsd

Legal and Tax Purposes

Valuation is also important to businesses because of legal and tax purposes.

For example, if anew partner will join a partnership or an old partner will retire,

the whole partnership should be valued to identify how much should be the

buy-in oF sell-out. This is also the case for businesses that are dissolved or

liquidated when owners decide so. Firms are also valued for estate tax

purposes if the owner passes away.

Other Purposes

(e.g. investment bank)

+ Basis for assessment of potential lending activities by financial

institutions

* Share-based paymenticompensation

VALUATION PROCESS

Generally, the valuation process considers these five steps:

|. Understanding of the business

Understanding the business includes performing industry and

competitive analysis and analysis of publicly available financial

information and corporate disclosures. Understanding the business is

very important as these give analysts and investors the idea about the

following factors that affect the business: economic conditions,

industry peculiarities, company strategy and company's historical

performance. The understanding phase enables analysts to come up

with appropriate assumptions which reasonably capture the business

realities affecting the firm and its value

|

|

|

+ Issuance of a fainess opinion for valuations provided by third party

Frameworks which capture industry and competitive analysis already

exists and are very useful for analysts. These frameworks are more

than @ template that should be filled out: analysts should use these

framework to organize their thoughts about the industry and the

competitive environment and how these relates to the performance of

the firm they are valuing. The industry and competitive analyses

should emphasize which factors affecting business will be most

challenging and how should these be factored in the valuation model.

Wien cae ean

to the inherent technical and ecan

Industy structure refers ’

pd des ‘of an industry and the bial may affect th

Structure, Industry characteristics means that these are true to m

not al, market players participating in that industry. Porter

Fores is the most common tool used to encapsulate indus

structure

restraints.

‘Substitutes and | This refers to the relationships beeen interrelated produ ap

| Complements | services in the industry. Availabilty of substitute products (produce

which can replace the sae ofan existing procuct) or comptes

Broducts (products which can be used together wth another praes |

Btfects industy prottabity. This consicer press of suse)

| procuctslservices, complement productsisenices and’ govemnet|

| limitations. \

Supplier Power [Supple power reer Te fw suppers can regolate Baty Tema}

ther favor. When there is strong supplier power, this tends te rae

industy prfts lower, Svong supplier power exists there ae fer

suppliers that can suppiy a spectic input. Supplier poner ass

censiders suppier concenttaton, prices of atlematve inpus

telatonship-specfic_ investments, supplier swiching cots ans

governmental equations, |

Buyer Power] Buyer power perains to how customers Can negotiate beter TaEw/

thet favor fr the productsiservces they purchase. Typiealy, buy |

power is low if customers are fragmented and concentaion oe |

This means tht market players are not dependent to few customer

to survive. Low buyer power tends to improve industy profs see

they cannot signfcanty negotate for the pnce of the produt. Oe

fectors considered in buyer power include buyer coneervaton, abe

Of substitute products that buyers can purchase, customer sulting

cosls and goverment restraints.

Competitive position refers how the Products, services and the

company itself is set apart from other competing market players.

Competitive position is typically gauged using the prevailing market

share level that the company enjoys. Generally, a firm's value ishighet

iT it can consistently sustain its competitive advantage against fs

ee SSK Nee |

RU eae bees

competitors. According to Michael Porter, there are generic corporate

Strategies to achieve competitive advantage

+ Cost leadership ~ incurring the lowest cost among market

players with quality that is comparable to competitors allow the

firm to be price products around the industry average

+ Differentiation — offering differentiated or unique product or

service characteristics that customers are willing to pay for an

additional premium

* Focus ~ identifying specific demographic segment or category

segment to focus on by using cost leadership strategy (cost

focus) or differentiation strategy (differentiation focus)

Aside from industry and competitive landscape, understanding the

company’s business models also important. Business model pertains

to the method how the company makes money - what are the

products or services they offer, how they deliver and provide these to

customers and their target customers. Knowing the business model

allows analysts to capture the right performance drivers that should be

included in the valuation model

The results of execution of aforementioned strategies will ultimately

be reflected in the company performance results which is reflected in

the financial statements. Analysts typically look at the historical

financial statements to get a sense of how the company performed,

There is no hard rule on how long the historical analysis should be

done. Typically, historical financial statements analysis can be done

for the last two years from up to ten years prior as long as available

information is available. Looking at the past ten years may give an

idea how resilient the company in the past and how they reacted to

the problems they encountered along the way.

‘Analysis of historical financial reports typically use horizontal, vertical

‘and ratio analysis. More than the computation, these numbers should

be related year-on-year to give a sense on how the company

performed over the years. These can be benchmarked against other

‘market players or the industry average to understand how the firm

fare. Some information can also be compared against stated

objectives of the organization — such as sales growth, gross margin

ratios or bottom line targets.

government-mandated disclosures like audited financial statements,

| Typical sources of information about companies can be found in

a

™~

Rote esau mae ofc)

Ifthe fm is publicly listed, regulatory flings, company press reeag,

and financial statements can be easily accessed in the at

exchange. Investor relation materials that can company issues

also be accessed in their ovin websites. Other acceptable sourcac™™

information include news articles, reports from industry OFganization

reports from regulatory agencies and industry researches done

independent fms such as Ne'sen or Euromonitor. Ethcalyanay¢!

should only use information that are made publicly availabe by ne

(via government flings or press releases), Analysts should avoid uss

material inside information as this gives undue disadvantage to othe,

investors that do not have access to the information

og,

In analyzing historical financial information, focus is given to look

the quality of earings. Quality of earnings analysis pertain to the

detailed review of all financial statements and accompanying notes ts

assess sustainability of company performance and validate accura,

of financial information versus economic reality. During the analysis

transactions that are nonrecurring such as financial impact of ltigatin

settiements, temporary tax reliefs or gainsilosses on sales of

nonoperating assets might need to be adjusted to arrive at the

performance of the firm's core business.

Quality of earnings analysis also compares net income against

operating cash flow to make sure reported earnings are actualy

realizable to cash and are not padded only because of significant

accrual entries. Typical observations that analysts can derive fom

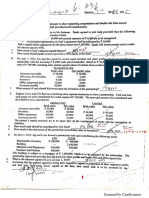

financial statements and should be critical of are listed below:

rie

Revenues and gain

ESS

Early recognition of

revenues (e.g. billand-

hold sales, sales

| recognition prior to

installation and

‘acceptance of customer)

[inclusion of nonoperating

| income or gains as part of

| operating income

|

Possible Interpretatio

Accelerated revenue |

recognition improves

income and can be used to

hide decining

performance |

Nonrecurring gains that 60

not relate to operating

Performance may hide

declining performance.

Expenses and losses

Recognition of too high or

too ttle reserves (e.g,

restructuring, bad debts)

Too litle reserves may

improve current yest

income but might attest)

future income (and we® |

versa) 4

cea ame)

wo aad Possible Observation __ Possible Interpretation

Deferal of expenses | May improve current

suchas customer | income but will reduce

acquisition or produc | future income. May hide

development costs by | decining performance

| capitaizaton

‘Aggressive assumptions | Aggressive estimates m

such as long usefl lives, | imply that there are steps |

lower asset impairment, | taken to improve current

| high assumed ciscount | year income, Sudden

rate for pension labites | changes in estimates may

or high expected return | indicate masking of

on plan assets potential problems in

operating performance.

Balance sheetitems | Offbalance Sheat | Assetsiliabilties may not

financing (those not | be fairy reflected.

reflected in the face of the

| balance sheet) _ lke

| leasing or securitizing

receivables

Operating cashflows [Increase in bank | Potential arifcial inflation

‘overdraft as operating | in operating cash flow.

cash flow

Based on AICPA guidance, other red flags that may indicate

aggressive accounting include the following:

* Poor quality of accounting cisclosures, such as segment

information, acquisitions, accounting policies and

assumptions, and a lack of discussion of negative factors.

+ Existence of related - party transactions or excessive officer,

employee, or director loans.

+ Reported (through regulatory flings) disputes with andlor

changes in auditors.

+ Material nonauit services performed by aucit frm.

+ Management andlor directors ' compensation

| profitability or stock price (through

ownership or compensation plans)

+ Economic, industry, or company - specific pressures on

proftailty, such as loss of market share or declining margins.

+ High management or director turnover

+ Excessive pressure on company personnel to make revenue

of earnings targets, particularly when management team is

aggressive

+ Management pressure to meet debt covenants or earnings

expectations:

xd to

y

RUN eae yn eels}

A history of secures law violations, reporting Volatong

persistent late filings ,

Il Forecasting financial performance

After understancing how the business operates and analysis of itn

financial statements, forecasting financial performance isthe next ge:

Forecasting financial performance can be looked at two lenses, ons

macro perspective viewing the economic environment and indy

where the firm operates in and on a more micro perspective focusne

the firm's financial and operating characteristics. Forecaghs

summarizes the future-ooking view which resuite ftom the assesanc?

Of industry and competitive landscape assessment, business stratey,

and historical financials. This can be surimarized in two approaches

* Top-down forecasting approach - Forecast starts ftom

international or national macroeconomic projections with utmos

consideration to industry specific forecasts. From here, analysis

select which are relevant to the firm and then applies this to the

firm and asset forecast. In top-down forecasting approach, the

most common variables include GDP forecast, consumption

forecasts, inflation projections, foreign exchange currency rates,

industry sales and market share. Usually, one result of top-down

forecasting approach is the forecasted sales volume for the

company. Revenue forecast will be built from this combined with

the company-set sales prices

‘+ Bottom-up forecasting approach — Forecast starts from the lower

levels of the firm and builds the forecast as it captures what wil

happen to the company. For example, store expnasion will be

captured and its corresponding impact to revenues will be

computed until company-level revenues is calculated.

Insights compiled during the industry, competitive and business

strategy analysis about the firm should be considered in this phase

while forecasting for the firm's sales, operating income and cash

flows. Comprehensive understanding of these is critical to forecast

reasonable numbers. Qualitative factors, albeit subjective, 3°

considered in the forecasting process in order to make valuation

approximate the true reality of the firm. Assumptions should be drve"

by informed judgment based on the understanding of the business

TE _

Neyo moaned

Forecasting should be done comprehensively and should include

earning, cash flow and balance sheet forecast. Comprehensive

forecasting approach prevents any inconsistent figures between the

Prospective financial statements and unrealistic assumptions. The

proach considers that analysis should done per line item as each

‘tem can influenced by a different business driver. Similar with short-

term budgeting, forecasting process starts with the determining sales

grows

growth and revenue projections of the business.

Forecasting process should also consider industry financial ratios as

this gives an idea how the industry is operating. From this, analysts

should be able to explain the reasons why firm-specific ratios will

deviate from this. Knowledge of historical financial trends is also

important as this can give guidance how prospective trends will look

like. Similarly, any deviations from noted historical trends should be

carefully explained to ensure reasonableness.

Typically, sales and profit numbers should consistently move in the

future based on current trends if there is no significant information that

will prove otherwise. On the other hand, return on investments will

move closer to cost of capital as competition comes in to play.

The results of forecasts should be compared with the dynamics of the

industry where the business operates and its competitive position to

make sure that the numbers make sense and reflect the most reliable

estimate of how the business operates. Even though general

economic and market trends can be used as reliable benchmark,

analysts should consider that unique factors that affect company

prospects as guidance in the forecasting process.

Typically, forecasts are done on annual basis as most publicly

available financial information are interpreted on an annual basis.

Where applicable, forecasts can be better done on a quarterly basis

to account for seasonality. Seasonality affects sales and earings of

almost all industry. For example, airline companies tend to have peak

sales during summer season and holiday seasons while lean sales

during rainy months. Developing earnings forecast using seasonality

can give a more reasonable estimate.

Selecting the right valuation mode!

‘The appropriate valuation model will depend on the context of the

valuation and the inherent characteristics of the company being

Pn eariarern seats

———

valued, Details of these valuation models and the circumstance

they should be used will be discussed in succeeding chapters

Rol

S When

IV. Preparing valuation model based on forecasts

Once the valuation model is decided, the forecasts should ny,

inputted and converted to the chosen valuation model. This step sr

cnly about manually encoding the forecast to the model to esting

the value (whichis the ob of Microsoft Excel). Moreso, analysts shou

consider whether the resulting value from this process makes senge

based on the knowledge about the business. To do this, two agpecs

should be considered:

Sensitivity analysis — common methodology in valuation

exercises wherein multiple other analyses are done ty

understand how changes in an input or variable will afec

the outcome (ie. firm value). Assumptions that are

commonly used as an input for sensitivity analysis

exercises are sales growth, gross margin rates ang

discount rates. Aside from these, other variables (ite

market share, advertising expense, discounts

differentiated feature, etc.) can also be used depending or

the valuation problem and context at hand,

Situational adjustments — firm-specific issues that affecs

firm value that should be adjusted by analysts since these

are events that are not quantified if analysts only look at

core business operations. This includes control premium,

absence of marketability discounts and liquidity

discounts. Control premium refers to additional valve

considered in a stock investment if acquiring it will ge

controlling power to the investor. Lack of marketabiliy

discount means that the stock cannot be easily sold a

there is no ready market for it (e.g. non-publicly traded

discount). Lack of marketability discount drives down

share value. liquidity discount should be considered when

the price of particular shares has less depth or generally

considered less liquid compared to other active publioy

traded share. llliquidity discounts can also be considered

an investor will sell large portion of stock that is significant

compared to the trading volume of the stock.

iii

Mea ees

Vv, Applying valuation conclusions and providing recommendation

Once the value is calculated based on all assumptions considered,

the analysts and investors use the results to provide

recommendations or make decisions that suits their investment

objective,

KEY PRINCIPLES IN VALUATION

a. The value of a business is defined only at a specific point in time

Business value tend to change every day as transaction happens.

Different circumstances that occur on a daily basis affect earnings,

cash position, working capital and market conditions. Valuation made

a year ago may not hold true and not reflect the current firm value

today. As a result, this is important to give perspective to users of the

information that firm value is based on a specific date.

b. Value varies based on the abilty of business to generate future cash

flows

General concepts for most valuation techniques put emphasis on

future cash flows except for some circumstances where value can be

better derived from asset liquidation

The relevant item for valuation is the potential of the business to

generate value in the future which is in the form of cash flows. Future

cash flows can be projected based on historical results taking into

account future events that may improve or reduce cash flows.

Cash flows is also more relevant in valuation as compared to

‘accounting profits as shareholders are more interested in receiving

cash at the end the day. Cash flows include cash generated from

operations and reductions that are related to capital investments,

working capital and taxes. Cash flows will depend on the estimates of

future performance of the business and strategies in place to support

this growth. Historical information can provide be a good starting point

when projecting future cash flows.

ee ~

STITT oases

cMarket dictates the appropriate rate of return for investors

Market forces are constantly changing and they normally proyg,

Guidance of what rate of return should investors expect from dite

investment vehicles in the market. Interaction of market forces ma

differ based on type of industry and general economic concitions

Understanding the rate of return dictated by the market is importa

for investors so they can capture the right discount rate to be used jg,

valuation. This can influence their decision to buy or sell investmens

d. Firm value can be impacted by underlying net tangible assets

Business valuation principles look at the relationship between

operational value of an entity and net tangible of its assets

Theoretically, firms with higher underlying net tangible asset value ae

more stable and results in higher going concern value. This is a resut

of presence of more assets that can be used as security during

financing acquisitions or even liquidation proceedings in case

bankruptcy occurs. Presence of sufficient net tangible assets can also

‘support the forecasts on future operating plans of the business.

e. Value is influenced by transferability of future cash flows

Transferability of future cash flows is also important especially to

potential acquirers. Business with good value can operate even

without owner intervention. If a firm's survival depends on owners

influence (e.g. owner maintains customer relationship or provides

certain services), this value might not be transfer to the buyer, hence,

this will reduce firm value. In such cases, value will only be limited 19

net tangible assets that can be transferred to the buyer.

f. Value is impacted by liquidity

This principle is mainly dictated by the theory of demand and supply

If there are many potential buyers with less acquisition targets, valve

of the target firms may rise since the buyers will express more interest

to buy the business. Generally, more business interest liquidity ¢@"

translate to more business value. Sellers should be able to attract and

negotiate potential purchases to maximize value they can realize fo™

the transaction.

Cerra uareced

Uncertainty in Valuation

In all valuation exercises, uncertainty will be consistently present. Uncertainty

refers to the possible range of values where the real firm value lies. When

performing any valuation method, analysts will never be sure if they have

accounted and included all potential risks that may affect price of assets.

Some valuation methods also use future estimates which bear the risk that

what will actually happen may be significantly different from the estimate.

Value consequently may be different based on new circumstances.

Uncertainty is captured in valuation models through cost of capital or discount

rate.

Another aspect that contributes to uncertainty is that analysts use their

judgments to ascertain assumptions based on current available facts. Even if

risk adjustments are made, this cannot 100% ascertain the value will be

Perfectly estimated. Constant changes in market conditions may hinder the

investor from realizing any expected value based on the valuation

methodology.

Performance of each industry can also be characterized by varying degrees

of predictability which ultimately fuels uncertainty. Depending on the industry,

they can be very sensitive to changes in macroeconomic climate (investment

goods, luxury products) or not at all (food and pharmaceutical)

Innovations and entry of new businesses may also bring uncertainty to

established and traditional companies. It does not mean that a business has

operated for 100 years will continue to have stable value. If a new company

suddenly arrived and provide a better product that customers will patronize,

this can mean trouble. Typically, businesses manage uncertainty to take

advantage of possible opportunities and minimize impact of unfavorable

events. This influences management style, reaction to changes in economic

environment and adoption of innovative approaches to doing business.

Consequently, these dynamic approaches also contribute to the uncertainty

to all players in the economy.

RT saad uals '

Valuation isthe estimation ofan asses value based on varabes pera,

tobe relate tofture investment reurs, on comparisons vith sions

oF, when relevant, on estimates of immediate liquication proceeds, Degit®

of value may vary depending on the contex. Different defntions of mi

incuce inns value, ging concer value, iuidaton value and far mn

value

Valuation plays significant role in the business world with respect

to portoig

management, business transactions or deals, corporate finance, legal angi

purposes.

Generally, valuation process involves these five steps: understanding of he

business, forecasting financial performance, selecting right valuation mage

Preparing valuation model based on forecasts and applying conclusions ang

providing recommendations.

Key principles in valuation includes the following:

Value is defined at a specific point in time

Value varies based on ability of business to generate future cash fows

Market dictates appropriate rate of return for investors

Value can be impacted by underlying net tangible assets |

Value is influenced by transferability of future cash flows

Value is impact by liquidity

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- I - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Document279 pagesI - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Bhosx KimNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- VCMDocument19 pagesVCMBhosx Kim100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Donors TaxDocument29 pagesDonors TaxBhosx Kim100% (3)

- Other Percentage TaxDocument42 pagesOther Percentage TaxBhosx KimNo ratings yet

- COVID-19 Community Quarantines in The PhilippinesDocument7 pagesCOVID-19 Community Quarantines in The PhilippinesBhosx KimNo ratings yet

- BOI ForDocument5 pagesBOI ForBhosx KimNo ratings yet

- Lecture 5 - Donor - S TaxDocument4 pagesLecture 5 - Donor - S TaxBhosx KimNo ratings yet

- Tax Incentives in Developing Countries - A Case Study-Singapore and PhilippinesDocument29 pagesTax Incentives in Developing Countries - A Case Study-Singapore and PhilippinesBhosx KimNo ratings yet

- Customer Relationship - Business Model CanvasDocument6 pagesCustomer Relationship - Business Model CanvasBhosx KimNo ratings yet

- Effect of Tax Incentives On The Growth of SMEs in RwandaDocument10 pagesEffect of Tax Incentives On The Growth of SMEs in RwandaBhosx KimNo ratings yet

- Idic ModelDocument12 pagesIdic ModelBhosx KimNo ratings yet

- Problem 13Document3 pagesProblem 13Bhosx KimNo ratings yet

- Avoid The Four Perils of CRMDocument14 pagesAvoid The Four Perils of CRMBhosx KimNo ratings yet

- Quiz Par. FRM & OpDocument4 pagesQuiz Par. FRM & OpReymart Castillo HamoNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationBhosx KimNo ratings yet

- Module 2A - CVP AnalysisDocument5 pagesModule 2A - CVP AnalysisBhosx KimNo ratings yet

- Dokumen - Tips Labor Law Memory AidDocument75 pagesDokumen - Tips Labor Law Memory AidBhosx KimNo ratings yet

- Problem 2-1: Pagador, Janelyne CDocument6 pagesProblem 2-1: Pagador, Janelyne CBhosx KimNo ratings yet

- Advac 1 Final Deptal (10-2-16) PDFDocument12 pagesAdvac 1 Final Deptal (10-2-16) PDFBhosx KimNo ratings yet

- Final Deptal (10-14-18)Document5 pagesFinal Deptal (10-14-18)Bhosx KimNo ratings yet

- PFRS 3, Business Combination: A) Formation of A Joint Venture - PFRS 11, Joint ArrangementsDocument7 pagesPFRS 3, Business Combination: A) Formation of A Joint Venture - PFRS 11, Joint ArrangementsBhosx KimNo ratings yet

- Lesson 1 1 PDFDocument14 pagesLesson 1 1 PDFBhosx KimNo ratings yet

- Midterm (08-14-16)Document6 pagesMidterm (08-14-16)Bhosx KimNo ratings yet

- Estate TaxDocument48 pagesEstate TaxBhosx Kim100% (1)

- Donors TaxDocument15 pagesDonors TaxBhosx KimNo ratings yet

- Training and Mentoring: Necessity For Orientation TrainingDocument6 pagesTraining and Mentoring: Necessity For Orientation TrainingBhosx KimNo ratings yet

- GENERAL PRINCIPLES OF TAXATION 5 Files Merged PDFDocument49 pagesGENERAL PRINCIPLES OF TAXATION 5 Files Merged PDFBhosx KimNo ratings yet

- 8.31 - Standard CostingDocument109 pages8.31 - Standard CostingBhosx Kim100% (1)