0% found this document useful (0 votes)

191 views3 pagesPayroll Computation for January 2023

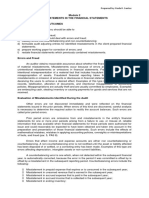

This document contains payroll computations for three employees - Alexander Menlo, Haydee Flores, and Marie Sarmiento - for the periods of January 1 to 15 and January 16 to 31. It shows their basic pay, overtime pay, deductions for SSS, PHIC, PAG-IBIG, and taxes. Marie Sarmiento's monthly salary is the highest at 50,000 pesos while Alexander Menlo and Haydee Flores' monthly salaries are 30,000 pesos and 25,000 pesos respectively. The document also contains notes on calculating daily and hourly rates from monthly salaries.

Uploaded by

USD 654Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

191 views3 pagesPayroll Computation for January 2023

This document contains payroll computations for three employees - Alexander Menlo, Haydee Flores, and Marie Sarmiento - for the periods of January 1 to 15 and January 16 to 31. It shows their basic pay, overtime pay, deductions for SSS, PHIC, PAG-IBIG, and taxes. Marie Sarmiento's monthly salary is the highest at 50,000 pesos while Alexander Menlo and Haydee Flores' monthly salaries are 30,000 pesos and 25,000 pesos respectively. The document also contains notes on calculating daily and hourly rates from monthly salaries.

Uploaded by

USD 654Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd