Professional Documents

Culture Documents

Deductions of Gross Estate

Uploaded by

Christine NionesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deductions of Gross Estate

Uploaded by

Christine NionesCopyright:

Available Formats

ESTATE TAX: DEDUCTIONS FROM GROSS ESTATE

I. Ordinary Deductions

Casualty Losses

- Losses of properties of the estate which arises from casualties such as fires, storms, shipwreck, robbery, theft

or embezzlement that are not compensated by insurance

- Requisites:

1. The loss must be a sustained casualty loss

2. The loss must occur during the settlement of the estate up to the deadline of the estate tax return

3. The loss must not be concurrently claimed in the income tax return

Claims against insolvent persons

- A form of loss but are presented separately in the estate return

- The deductible amount is the unrecoverable amount of claim

Claims against the estate

- May arise out of contract, torts or operations of law

- Requisites:

1. The liability represents a personal obligation of the deceased existing at the time of his death

2. The liability was contracted in good faith and for adequate and full consideration for money

3. The claim must be a debt or claim which is valid and enforceable

4. The claim must not have been condoned by the creditor or must not have been prescribed

- Classification rules:

1. Family benefit rule

o The claim shall be classified as deduction against the common property if the obligation was

incurred or contracted for the benefit of the family.

2. Property classification rule

o Claims follow the classification of the relevant property.

Unpaid mortgages

- A form of claim against the estate but are presented separately in the estate return.

- Includes mortgage upon, or any indebtedness, with respect to property where the value of the decedent's

interest therein, undiminished by such mortgage or indebtedness, is included in the gross estate.

- To be deductible, it must be incurred before death and remain unpaid at the point of death

Property previously taxed [Vanishing Deduction]

- Can be claimed only if there is an incidence of double taxation

- Its purpose is to minimize the burden of double taxation

- Requisites:

1. The present decedent must have died within 5 years from the date of death of the prior precedent or date

of gift

2. The property must have been previously subjected to a transfer tax

3. The property must have been identified as the same property received from prior decedent or donor

4. The estate taxes on the transmission of the prior estate or the donor's tax on gift must have been finally

determined or paid

Transfer for public use

- Includes all bequests, legacies, devices, or transfer to or for the use of the government for public purposes

- Must be indicated in the decedent's last will and testament

Others

A. Unpaid taxes

- A form of claim against the estate presented under the category "others" in the estate return

- Includes taxes such as income tax, business tax, and property tax which have accrued as of the death of

the decedent and which were unpaid as of the time of death

II. Special deductions

Family home

- Includes dwelling house and the land on which it is situated

- Can be claimed by married decedents and by a single decedent who is a head of a family

- Requisites:

1. Must be the actual residential home of the decedent and his family at the time of his death

2. The value of the family home must be included as part of the gross estate of the decedent; and

3. The allowable deduction must not exceed the lowest fair market value of the family home

declared, the extent of the decedent's interest therein, or P10,000,000

Standard deduction

- Standard P5,000,000 allowable deduction in lieu of the funeral, judicial and medical expenses under the

TRAIN Law without the need of substantiation

Others

III. Share of surviving Spouse

- One-half of the net conjugal or community properties of the spouses.

- Only married decedents have this deduction

You might also like

- Ordinary DeductionDocument6 pagesOrdinary Deductionar calasangNo ratings yet

- Transfer TaxesDocument25 pagesTransfer Taxeselvira bolaNo ratings yet

- Estate TaxDocument18 pagesEstate TaxLindbergh Sy67% (3)

- Reviewer On Intro To TaxDocument7 pagesReviewer On Intro To Taxjulius art maputiNo ratings yet

- In-House Cpa Review Taxation Estate Tax (Notes) : E.A.Dg - MateoDocument4 pagesIn-House Cpa Review Taxation Estate Tax (Notes) : E.A.Dg - MateoMina ValenciaNo ratings yet

- Module 1 Estate TaxationDocument7 pagesModule 1 Estate TaxationKirstein Hammet DionilaNo ratings yet

- Tax Quick Reviewer - Edward Arriba PDFDocument70 pagesTax Quick Reviewer - Edward Arriba PDFDanpatz GarciaNo ratings yet

- Estate TaxDocument10 pagesEstate TaxKwinie Corpuz0% (1)

- Module 3 - Deductions On Gross Estate - v.3Document7 pagesModule 3 - Deductions On Gross Estate - v.3John Vincent ManuelNo ratings yet

- Estate Tax and Donors Tax With TrainDocument12 pagesEstate Tax and Donors Tax With TrainEspregante RoselleNo ratings yet

- Transfer Taxation: Estate Taxation: CDD In-House CPA Review Rex B. Banggawan, CPA, MBA TaxationDocument14 pagesTransfer Taxation: Estate Taxation: CDD In-House CPA Review Rex B. Banggawan, CPA, MBA TaxationAnonymous l13WpzNo ratings yet

- The Law That Governs The Impos Ition of Estate TaxDocument22 pagesThe Law That Governs The Impos Ition of Estate TaxAmy Olaes DulnuanNo ratings yet

- Deductions From Gross EstateDocument46 pagesDeductions From Gross EstateARC SVIORNo ratings yet

- Module 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 1Document35 pagesModule 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 1Venice Marie ArroyoNo ratings yet

- Booklet 1 Introduction To Transfer Tax - Estate TaxDocument51 pagesBooklet 1 Introduction To Transfer Tax - Estate Taxsunkist0091No ratings yet

- Tax Estate TaxDocument13 pagesTax Estate TaxAlbert Baclea-an100% (1)

- HQ11 - Estate TaxationDocument18 pagesHQ11 - Estate TaxationJane Oblena100% (1)

- Transfer Taxes (Estate)Document5 pagesTransfer Taxes (Estate)Kurtney Valles RuleNo ratings yet

- Gross Estate The Value of All The Property, Real or Personal, TangibleDocument40 pagesGross Estate The Value of All The Property, Real or Personal, TangibleRomz NuneNo ratings yet

- Definition of Estate TaxDocument16 pagesDefinition of Estate TaxCessBacunganNo ratings yet

- Estate Tax: Difference With Income Tax (Ter)Document7 pagesEstate Tax: Difference With Income Tax (Ter)Equi TinNo ratings yet

- Tax LECTURE TRANSFER TAXES AND VALUE ADDED TAX-2011Document58 pagesTax LECTURE TRANSFER TAXES AND VALUE ADDED TAX-2011Rena Mae Laput UyNo ratings yet

- Taxation Law 2 ReviewerDocument34 pagesTaxation Law 2 ReviewerMa. Cielito Carmela Gabrielle G. Mateo100% (1)

- Business Tax ReviewerDocument86 pagesBusiness Tax ReviewerJhoren RemolinNo ratings yet

- Tax II Reviewer (Midterms)Document43 pagesTax II Reviewer (Midterms)Charmaine MejiaNo ratings yet

- Property Relationship Between SpousesDocument39 pagesProperty Relationship Between SpousesAlmeera KalidNo ratings yet

- Estate TaxDocument10 pagesEstate TaxKaye Alyssa Enriquez100% (1)

- Transfer Taxes and Value Added Tax: Atty. Vic C. MamalateoDocument61 pagesTransfer Taxes and Value Added Tax: Atty. Vic C. MamalateoyotatNo ratings yet

- AEC 215 Week 3 HandoutsDocument7 pagesAEC 215 Week 3 HandoutsKeith Chea Pace CobradorNo ratings yet

- Taxation On Estates and Trusts - REVISED 2022Document16 pagesTaxation On Estates and Trusts - REVISED 2022rav danoNo ratings yet

- Tax2 Reviewer NotesDocument57 pagesTax2 Reviewer NotescardeguzmanNo ratings yet

- Deductions From Gross EstateDocument3 pagesDeductions From Gross EstateMarc Eric Redondo100% (5)

- TRANSFER TAXES - UpdatedDocument33 pagesTRANSFER TAXES - UpdatedBogs QuitainNo ratings yet

- Tax Lectures TranscribeDocument29 pagesTax Lectures TranscribeNeri DelfinNo ratings yet

- Module 1 ESTATE TAXATIONDocument7 pagesModule 1 ESTATE TAXATIONArj Sulit Centino DaquiNo ratings yet

- Gross EstateDocument11 pagesGross EstateBiboy GSNo ratings yet

- Allowable Deduction NRCDocument1 pageAllowable Deduction NRCJessirie VillanuevaNo ratings yet

- TRANSFER TAX-burden Imposed Upon The Right To Gratuitously Transfer or TransmitDocument2 pagesTRANSFER TAX-burden Imposed Upon The Right To Gratuitously Transfer or TransmitJohn Lester LantinNo ratings yet

- Taxation Law 2 ReviewerDocument44 pagesTaxation Law 2 ReviewerShi MartinezNo ratings yet

- Module 1.4.2 - Computation of Gross Estate StudentsDocument13 pagesModule 1.4.2 - Computation of Gross Estate StudentsJames R JunioNo ratings yet

- Mobilia Sequuntur Personam-Applies To Intangible Property. Movables Follow The Person. Where The Owner Resides/domicilesDocument11 pagesMobilia Sequuntur Personam-Applies To Intangible Property. Movables Follow The Person. Where The Owner Resides/domicilesMary Joy NavajaNo ratings yet

- Estate Tax PDFDocument35 pagesEstate Tax PDFRhea Mae Sa-onoyNo ratings yet

- M5 - Deductions From Gross Estate - Students'Document33 pagesM5 - Deductions From Gross Estate - Students'micaella pasionNo ratings yet

- A. in Case of Resident Citizens, Nonresident Citizens and Resident AliensDocument2 pagesA. in Case of Resident Citizens, Nonresident Citizens and Resident AlienschosNo ratings yet

- Deductions From Gross EstateDocument34 pagesDeductions From Gross Estatesmosaldana.cvtNo ratings yet

- Estate TaxDocument11 pagesEstate TaxIsabela Thea TanNo ratings yet

- General Provisions and ReciprocityDocument29 pagesGeneral Provisions and ReciprocityIo AyaNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document19 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Lesson 3Document4 pagesLesson 3Iris Lavigne RojoNo ratings yet

- Gross Estate-Tax2Document73 pagesGross Estate-Tax2Harry Jericho DemafilesNo ratings yet

- 02 - Estate TaxesDocument27 pages02 - Estate TaxesShiela MeiNo ratings yet

- Tax2 - Estate TaxDocument29 pagesTax2 - Estate TaxMelady Sison CequeñaNo ratings yet

- Transfer TaxesDocument101 pagesTransfer TaxesAngelo IvanNo ratings yet

- BusTax - Chapter 3 MODULEDocument8 pagesBusTax - Chapter 3 MODULETimon CarandangNo ratings yet

- Module 2 - Estate TaxDocument14 pagesModule 2 - Estate TaxHaidee Flavier SabidoNo ratings yet

- MaterialityDocument27 pagesMaterialityChristine NionesNo ratings yet

- Auditing Theory: Audit Planning: An OverviewDocument31 pagesAuditing Theory: Audit Planning: An OverviewChristine NionesNo ratings yet

- Chapter 1 TaxDocument13 pagesChapter 1 TaxChristine NionesNo ratings yet

- MANSCI Final Exam QuestionnaireDocument10 pagesMANSCI Final Exam QuestionnaireChristine NionesNo ratings yet

- MANSCI Pre-MidtermsDocument57 pagesMANSCI Pre-MidtermsChristine NionesNo ratings yet

- Gantt Chart: HistoryDocument3 pagesGantt Chart: HistoryChristine NionesNo ratings yet

- Case StudyDocument2 pagesCase StudyChristine NionesNo ratings yet

- What Is The Critical Path? 2. What Is The Expected Duration For The Whole Project?Document2 pagesWhat Is The Critical Path? 2. What Is The Expected Duration For The Whole Project?Christine Niones100% (1)

- Preliminary Discussion Assurance Engagements 5 Elements of Assurance EngagementDocument3 pagesPreliminary Discussion Assurance Engagements 5 Elements of Assurance EngagementChristine NionesNo ratings yet

- University of San Carlos School of Business and Economics Department of Accountancy AC 1103 3rd Long Exam Name: - Schedule: - CourseDocument7 pagesUniversity of San Carlos School of Business and Economics Department of Accountancy AC 1103 3rd Long Exam Name: - Schedule: - CourseChristine NionesNo ratings yet

- Multiple Choice Questions Descriptive Statistics Summary Statistics - CompressDocument15 pagesMultiple Choice Questions Descriptive Statistics Summary Statistics - CompressChristine NionesNo ratings yet

- Ac 3103 Business Tax Mock ExamDocument14 pagesAc 3103 Business Tax Mock ExamChristine NionesNo ratings yet

- ACAS Taxation 2 (Income Tax - Full Midterm Coverage)Document15 pagesACAS Taxation 2 (Income Tax - Full Midterm Coverage)Steven OrtizNo ratings yet

- Chapter 5 - Corporate Income Tax A. Corporations Subject To Income TaxDocument2 pagesChapter 5 - Corporate Income Tax A. Corporations Subject To Income TaxPJDNo ratings yet

- Sub: Appointment As "Storekeeper": Salary Break-UpDocument2 pagesSub: Appointment As "Storekeeper": Salary Break-UpNivesh AgarwalNo ratings yet

- 2.3 Taxation Coverage For Performance Task 1Document33 pages2.3 Taxation Coverage For Performance Task 1?????No ratings yet

- S V Gaba 1981 (3) SA 745 (O)Document51 pagesS V Gaba 1981 (3) SA 745 (O)Waseela AdamNo ratings yet

- Sachin Labour Law Assignment 2001090Document15 pagesSachin Labour Law Assignment 2001090Sachin ShuklaNo ratings yet

- TAX First Preboard 2021Document10 pagesTAX First Preboard 2021Ser Crz JyNo ratings yet

- Mortgage Calculator Excel TemplateDocument13 pagesMortgage Calculator Excel TemplateHamid MansouriNo ratings yet

- TAX - Quiz 1Document6 pagesTAX - Quiz 1KriztleKateMontealtoGelogo100% (1)

- BCom - Income Tax PDFDocument193 pagesBCom - Income Tax PDFAbhishek singhNo ratings yet

- Tax Audit Checklist For The Revised Form 3CD: Part ADocument36 pagesTax Audit Checklist For The Revised Form 3CD: Part AKoolmindNo ratings yet

- Income Tax Basic Questions and SolutionsDocument28 pagesIncome Tax Basic Questions and SolutionsbamberoNo ratings yet

- Estate TaxDocument23 pagesEstate TaxJonard Godoy100% (4)

- Assignment - 1 1. What Do You Mean by "Gross Annual Value"? How To Calculate The Income Under The Head "Income From House Property"?Document11 pagesAssignment - 1 1. What Do You Mean by "Gross Annual Value"? How To Calculate The Income Under The Head "Income From House Property"?Khushi ChadhaNo ratings yet

- Oecd Vs Un Model ConventionDocument4 pagesOecd Vs Un Model ConventionnilanjanaNo ratings yet

- st2112040843 deDocument31 pagesst2112040843 desujaydas00123No ratings yet

- Learning Task Week 3 & 4 AccountingDocument7 pagesLearning Task Week 3 & 4 AccountingMariane Gale SuaNo ratings yet

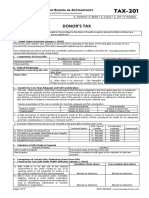

- TAX-201 (Donor's Tax)Document7 pagesTAX-201 (Donor's Tax)Edith DalidaNo ratings yet

- STFCS 2022-11-05 1667702284229Document7 pagesSTFCS 2022-11-05 1667702284229Charles GoodwinNo ratings yet

- RR 6-2024Document2 pagesRR 6-2024Lady Lynn PosadasNo ratings yet

- Tax Presentation Capital and Revenue ReceiptsDocument16 pagesTax Presentation Capital and Revenue Receiptslloyd madanhire100% (1)

- Quizzes SolutionDocument10 pagesQuizzes SolutionHerzeila BernardoNo ratings yet

- T4032-NL, Payroll Deductions Tables - CPP, EI, and Income Tax Deductions - Newfoundland and LabradorDocument12 pagesT4032-NL, Payroll Deductions Tables - CPP, EI, and Income Tax Deductions - Newfoundland and LabradorclaokerNo ratings yet

- Standard vs. Itemized Deduction 2021Document2 pagesStandard vs. Itemized Deduction 2021Finn KevinNo ratings yet

- Income From Other SourcesDocument16 pagesIncome From Other SourcesMohd YasinNo ratings yet

- 36 Loss Disallowance Slides and ExamplesDocument51 pages36 Loss Disallowance Slides and ExamplesCourt RobertsNo ratings yet

- Tax Liability of A Firm and PartnersDocument28 pagesTax Liability of A Firm and PartnersRohitNo ratings yet

- Aljpn5103d Partb 2022-23Document3 pagesAljpn5103d Partb 2022-23Md shamirNo ratings yet

- Limited Partnership AgreementDocument24 pagesLimited Partnership AgreementNash CastanaresNo ratings yet

- Notes - TAXDocument18 pagesNotes - TAXAkhil BaijuNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Tax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfFrom EverandTax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfRating: 5 out of 5 stars5/5 (1)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.From EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No ratings yet

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesFrom EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNo ratings yet

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Using Successful and Proven Strategies of Credit and Finance, Grants, and Taxation Principles to Obtain Multiple Lines of Credit to Build Your Home-Based Business OpportunityFrom EverandUsing Successful and Proven Strategies of Credit and Finance, Grants, and Taxation Principles to Obtain Multiple Lines of Credit to Build Your Home-Based Business OpportunityRating: 1 out of 5 stars1/5 (1)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Beyond Frontiers: U.S. Taxes for International Self-Published AuthorsFrom EverandBeyond Frontiers: U.S. Taxes for International Self-Published AuthorsRating: 1 out of 5 stars1/5 (1)

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)