Professional Documents

Culture Documents

CFA Level II Mock Exam 5 - Questions (AM)

CFA Level II Mock Exam 5 - Questions (AM)

Uploaded by

Sardonna FongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFA Level II Mock Exam 5 - Questions (AM)

CFA Level II Mock Exam 5 - Questions (AM)

Uploaded by

Sardonna FongCopyright:

Available Formats

CFA Level II Mock Exam 5 – Questions (AM)

FinQuiz.com

CFA Level II Mock Exam 5

June, 2016

Revision 1

Copyright © 2010-2016. FinQuiz.com. All rights reserved. Copying, reproduction

or redistribution of this material is strictly prohibited. info@finquiz.com.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

FinQuiz.com – 5th Mock Exam 2016 (AM Session)

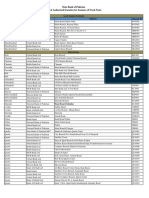

Questions Topic Minutes

1-6 Ethical and Professional Standards 18

7-12 Quantitative Methods 18

13-24 Financial Reporting and Analysis 36

25-36 Equity Investments 36

37-42 Alternative Investments 18

43-54 Fixed Income 36

55-60 Derivatives 18

Total 180

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 1 through 6 relate to Ethical and Professional Standards

Timothy Vaughn Case Scenario

Timothy Vaughn is a portfolio manager at Horizon Asset Management specializing in

real estate securities. He is approached by Sylvia Walters, the manager of a real estate

investment trust (REIT) fund. Walters requests Vaughn to market the REIT index to his

clients and in return offers to pay a small service fee rate of 0.50%. After careful research

he concludes that despite the narrow scope of the fund, there is potential for

diversification as well as attractive risk and returns. He is unsure of the appropriate

course of action to take with respect to the service fees offered.

After consulting with a senior investment officer, Vaughn allocates the REIT fund to

suitable client accounts. A few days later, Walters modifies the policy of the fund. Under

the new policy, the fund is allowed to depart from its normal policies and strategies if

doing so is in the fund’s best interests. This change may include investing in derivatives

or ETFs outside the normal limits but in a manner consistent with fund objectives. She

notifies Walters of the policy change in a detailed email.

Walter’s email is redirected to a ‘spam’ folder in Vaughn’s inbox which he notices thirty

days later while clearing the contents of his inbox. He determines that informing clients is

not necessary as the fund’s allocation decisions will continue to remain consistent with

the objectives.

In an attempt to align the interests of junior portfolio managers with clients, Vaughn

designs a compensation scheme whereby each portfolio manager is required to achieve an

annual return of 5% to satisfy their clients’ minimum return objective. Any excess return

will be subject to evaluation to ensure unreasonable risks were not taken to achieve the

target. Bonuses are awarded to managers who have kept risk and return objectives in

consideration.

Unbeknownst to Vaughn, two managers make allocations to private real estate funds

which, although fall within permissible risk limits, require a significant initial investment

and are thus unaffordable by some clients.

During the course of his employment, Vaughn is offered to serve as the fund manager for

Vital Associates, a global asset management firm. He decides that he will accept the offer

after informing his employer and makes the necessary preparations for his departure.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Using public sources, he contacts clients who have closed their accounts at Horizon and

have moved to other asset managers. He also contacts clients who have received a request

for proposal by Horizon to manage their accounts but have not yet accepted.

On the day of his departure, Vaughn attends an investment conference hosted by Horizon

where Vital’s employees are also present. A research analyst at his new employer

discusses a research report he recently published on Think plc. He rated the manufacturer

as a buy and when asked his reason for doing so, the analyst made the following

justifications:

Justification 1: “I am using the company’s products for quite some time now and they

always manage to deliver superior quality.”

Justification 2: “My aunt serves as a department head at Think plc and she is highly

competent.”

Justification 3: “A client of ours happens to be the chief executive officer of Think plc.”

Upon joining Vital, Vaughn is requested to draft an ethical code of conduct for the

company.

1. With respect to the REIT fund arrangement, Vaughn’s best course of action

would have been to:

A. decline.

B. accept but decline the service fees offered.

C. accept but disclose the service fees received.

2. Is Vaughn in violation of the CFA Institute Standards of Professional Conduct

with respect to his response to the REIT fund policy change?

A. No.

B. Yes, with respect to misconduct as he has demonstrated negligence.

C. Yes, with respect to communication with clients and prospects by failing

to inform clients of the change.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

3. The decision to implement the new compensation policy has led to a violation of

the CFA Institute Standards of Professional Conduct relating to:

A. suitability as it has led to inappropriate investment decisions.

B. responsibility of supervisors due to a failure to detect violations.

C. independence and objectivity as the policy will impair the ability to make

investment decisions in the best interests of firm clients.

4. Which of Vaughn’s departure preparations will most likely lead to a violation of

the CFA Institute Standards of Professional Conduct? Contacting Horizon’s:

A. current clients only.

B. prospective clients only.

C. both current and prospective clients.

5. In context of the justifications provided by the research analyst, which of the

following most likely represents a potential conflict of interest requiring disclosure

under the CFA Institute Standards of Professional Conduct?

A. Justification 1.

B. Justification 2.

C. Justification 3.

6. Which of the following provisions will most likely comply with the CFA Institute

Code of Ethics?

A. Uphold integrity in the workplace and act in a respectful manner towards

fellow colleagues.

B. Exercise reasonable care and judgment to achieve and maintain

independence in professional activities.

C. Providing assistance, either direct or indirect, to others in the violation of

company policies must be avoided.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 7 through 12 relate to Quantitative Methods

Capital Management and Statistical Service Providers Case Scenario

Capital Management and Statistical Service Providers (CMSSP) is a U.S. based entity

that offers investment management firms with macroeconomic and capital market

forecasts, and similar forecasting services. Kelly Cronin is one of the statistical experts at

CMSSP and is presently using internally-developed software to explain the relationship

between a company’s EPS growth and profitable opportunities as measured by the spread

between the equity return on new projects and the firm’s cost of equity capital. After

regressing a sample company’s historical EPS on its return spread for the past ten years,

Cronin presented the results to his superior, Brendan Tracy. Exhibit 1 displays the results

of the regression.

Exhibit 1

Explaining EPS growth by changes in the return spread

Coefficients Standard Error

Intercept 1.207 0.5522

Return spread 22.901 1.992

Regression Statistics

Standard error of estimate 1.120

Observations 62

Mean return spread 0.0943

Variance of the mean return spread 0.007721

Cronin emphasized that the outputs to this regression could be used to predict future EPS

growth given the return spread. Tracy was unsure of the accuracy of predictions produced

by the regression. As a first step, he planned to estimate a confidence interval to perform

a hypothesis test at a 5% level of significance. Tracy tested the significance of the

regression’s slope coefficient to be sure that any predictions based on the regression were

reliable.

As Tracy reviewed Cronin’s regression analysis, he was also not sure how the key inputs

to the regression could affect the ultimate results. When he asked Cronin, she stated that

the analysis was sensitive to a number of key assumptions. As she explained the effects

of some of these inputs and assumptions, Cronin made the following comments:

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Comment 1: “The standard error of estimate is an important input for a hypothesis test.

Small standard errors result in both tighter confidence intervals and tighter

prediction intervals.”

Comment 2: “The estimated value for the variance of the independent variable can also

affect hypothesis testing. The higher the assumed variance, the tighter the

prediction intervals. However, changes in the assumed variance will have

no effect on the confidence interval.”

Comment 3: “Assuming a single independent variable, a smaller sample size would be

reflected in a large prediction interval. If the sample size is increased, not

only with the prediction intervals tighten, the confidence intervals would

also tighten as the critical t-value decreases.”

Comment 4: “As the level of significance is decreased, the confidence interval would

tighten increasing the probability of the Type I error. This is also true for

the prediction interval.”

Tracy had just developed an ANOVA table for distribution to one of the firm’s clients.

The table showed the results of regressing the returns to technology stocks on the returns

to the market index and the market P/E ratio. The regression included 1,000 observations.

The sum of squared errors equaled 1,595.340 and the total sum of squares equaled

3,887.492. Apart from computing the combined significance of the independent

variables, Tracy formulated the following conclusions with respect to the F-statistic:

1. As the regression sum of squares is increased, the probability of the Type I error

is decreased.

2. As the sample size is increased, the probability of the Type II error is increased.

In addition to the above conclusions, Tracy also stated the following:

3. Since the R2 of the regression equals 0.56, the adjusted R2 will also effectively

equal 0.56.

4. In comparing the adjusted R2 or R2 of two models, it is imperative that the sample

sizes used to estimate the models are the same.

Tracy then shared his results with Cronin for further review.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

7. Using the information provided in Exhibit 1, if the return spread equals 15%, the

95 percent prediction interval for EPS growth will be closest to:

A. 2.37% to 6.91%.

B. 2.40% to 6.88%.

C. 2.08% to 7.21%.

8. The confidence interval for the slope coefficient at the 5% significance level is

closest to:

A. 20.66 to 25.14.

B. 18.92 to 26.88.

C. 22.73 to 23.08.

9. Cronin is most accurate with respect to:

A. Comment 1 only.

B. Comment 2 only.

C. Both comments 1 and 2.

10. Cronin is most accurate with respect to:

A. Comment 3 only.

B. Comment 4 only.

C. Both comments 3 and 4.

11. The F-statistic for the regression that Tracy is estimating is closest to:

A. 346.96.

B. 716.23.

C. 1,214,73.

12. Has Tracy most likely based his conclusions on sound financial theory?

A. Only with respect to Points 1 and 3.

B. Only with respect to Points 1, 2 and 3.

C. Only with respect to Points 2 and 4.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 13 through 18 relate to Financial Reporting and Analysis

Investa-Corp Service Providers Case Scenario

Investa-Corp Service Providers (ICSP) is a financial advisory firm established to

exclusively serve large institutional clients, including foundations, endowments and

pension plans. Anna Gunn is the chief research analyst; the person in charge of

supervising and overseeing ICSP’s pension funds. Gunn is particularly interested in the

pension plan offered by Lavender Products (LAPRO), a renowned U.S. based firm in the

cosmetics and fashion industry. To discuss the appropriate asset allocation of LAPRO’s

pension portfolio, Gunn met with Bryan Cranston, a member of LAPRO’s board of

directors. Since Cranston was also a financial expert, he understood the implications of

changes in pension plan assumptions on the reported numbers in the financial statements.

While in conversation with Gunn, Cranston mentioned the following changes:

Change 1: “Due to increased inflation, the board has decided to increase the estimate of

the interest rate applicable to our pension plan.”

Change 2: “Since our pension portfolio has been increasingly investing in equities, our

board has revised upward, the estimate of expected return on our plan

assets.”

In incorporating these revised estimates in his calculations, Gunn tried to determine the

affect they would have on LAPRO’s financial statements. In doing so, she gathered the

following information about the firm’s pension plan.

Exhibit 1

LAPRO’s Pension Plan Status for the year 2010 (in US$ millions)

Beginning Projected Benefit Obligation $3,125

Ending Projected Benefit Obligation $5,520

Beginning plan assets 1,555

Ending plan assets 2,905

Employer Contributions 950

Payments to retirees 1,120

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Reviewing the plan’s history, Gunn established that LAPRO frequently made

contributions to the pension plan in excess of those required by regulation. Around two

years ago, when the firm’s total pension cost for the period equaled $260 million, the

firm also disclosed that it made a contribution of $350 million. Gunn reached the

following conclusion:

“Given LAPRO’s effective tax rate of 23.5%, the firm’s CFO for that year should be

increased by $68.85 million and CFF should be decreased by $68.85 million“.

As Gunn was going through LAPRO’s financial statements, notes to the statements, and

similar disclosures, she found out that, in addition to promised future payments to its

employees, the firm also offered share-based compensation including stock grants and

stock options. An excerpt from Note 3 related to stock compensation plans is provided in

Exhibit 2.

Exhibit 2

Stock-based compensation in Note 3 to the Financial Statements of LAPRO

As of December 31, 2007, the firm had approximately $220

million of total unrecognized compensation cost related to

compensation arrangements granted. The vesting period equals

3.57 years. This cost does not include any future compensation

awards.

Realizing that this expense was considerable relative to the firm’s total assets during the

same period, Gunn called Cranston to discuss the implications of such costs. Gunn made

the following comments:

Comment 1: “During the period under analysis, compensation expense related to options

will approximately equal $62 million for the years 2008 and 2009.”

Comment 2: “This compensation expense will reduce retained earnings, and will thus

reduce the firm’s equity.”

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

As Gunn was working on LAPRO’s pension plan assessments, she received a call from

Todd Willington, a close friend working as an independent consultant. Willington invited

Gunn over to discuss the performance of Austin Steel Company (ASC), a steel giant

operating in the U.S. When Gunn reached Todd’s place, he stated that ASC’s financial

statements included a considerable amount of revaluation surpluses and impairment

charges and he was not sure how this affected ASC’s performance ratios. Todd provided

Gunn with the information given in Exhibit 3.

Exhibit 3

ASC’s Excerpts from Financial Statements as of December 31 (in $ millions)

2010 2011

Total assets 2,500 3,400

Total liabilities 1,450 2,333

Revaluation surplus - 275

Depreciation expense 250 310

*The increase in depreciation expense relates to the revaluation surplus

In addition to the information provided in the Exhibit, Todd also told Gunn that ASC

owns a melting machine with a carrying value of $60,000. However, just recently, ASC’s

management determined that the future cash flows generated from the machine equaled

only $10,500/year for the next six years. As such, the firm has reported an impairment

loss in its financial statements. The firm uses a discount rate of 10%.

As a final favor, Todd inquired about the affects of capitalizing versus expensing the

purchase of a long-lived asset on a firm’s financial statements. Gunn stated that if a firm

continued to purchase assets such, that in a particular year, the depreciation expense

equaled the capital expenditures made by the firm, pretax profits would be reduced by the

same amount regardless of whether the firm capitalized or expensed the purchase. Todd

was intrigued and added that, for a company capitalizing an expenditure, current

profitability would be enhanced and the firm would experience a favorable cash flow

impact. This was because an expenditure that was capitalized appeared as an investing

cash outflow and not as an operating one.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

13. Given the changes in assumptions related to LAPRO’s pension plan, compared to

an identical firm that prepares its financial statements under IFRS and follows

identical revisions, the current pension related expense in the income statement

would be:

A. higher for LAPRO, but the balance sheet effect would be the same.

B. lower for LAPRO, but the balance sheet effect would be the same.

C. lower for the IFRS firm, and the balance sheet effect would differ.

14. Is Gunn most likely correct with respect to her comment about adjusting for

LAPRO’s contributions to the pension plan, and what is the total periodic pension

cost for the year ended 2010 for LAPRO?

A. Yes, and the total periodic pension cost is $95 million.

B. No, and the total periodic pension cost is $1,045 million.

C. Yes, and the total periodic pension cost is $1,995 million.

15. Gunn is most accurate with respect to:

A. Comment 1 only.

B. Comment 2 only.

C. both comments 1 and 2.

16. Using Exhibit 3, ignoring the effect of taxes and considering the revaluation

independent of any other changes, the adjusted leverage for ASC, as of December

31 2011, based on average figures, will be closest to:

A. 2.99.

B. 3.02.

C. 3.74.

17. With regards to the melting machine, the impairment loss under U.S. GAAP and

IFRS will be closest to:

A. $14,270 under U.S. GAAP and $14,270 under IFRS.

B. 0 under U.S. GAAP and $14,270 under IFRS.

C. 0 under IFRS and $14,270 under U.S. GAAP.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

18. With respect to capitalizing vs. expensing, are Gunn and Todd most likely correct?

A. Only Gunn is correct.

B. Both Gunn and Todd are correct.

C. Neither Gunn nor Todd is correct.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 19 through 24 relate to Financial Reporting and Analysis

Portico Enterprises Case Scenario

Michael Norris is a research analyst working for Old Rock Investments (ORIN), a sell-

side investment firm in Oklahoma, USA. Norris has been advised to prepare a report on

Portico Enterprises (PENT), a firm that operates in the residential and commercial

construction industry. Based on a preliminary analysis of the firm, Norris determined that

the firm had considerable investments in the debt and equity securities of other

companies. Realizing that such investments could have a considerable impact on a

company’s financial position, Norris decided to perform a comprehensive analysis of

PENT’s intercorporate investments. He approached Diane Cross, a financial expert at

ORIN, to discuss details regarding the accounting treatments of various categories of

corporate investments. When talking about reclassifications of assets under IFRS and

U.S. GAAP, Cross made the following comments:

Statement 1: “Under U.S. GAAP, if a security is reclassified out of the held for trading

category, or is reclassified as held for trading from another category,

unrealized gains and losses are recognized in profit and loss. Although

under IFRS, reclassification out of held for trading is restricted, if done, the

treatment is similar to that under U.S. GAAP.”

Statement 2: “Under U.S. GAAP if a debt security is reclassified as available for sale

from held to maturity, or as held to maturity from available for sale, the

unrealized gains and losses are amortized over the remaining life of the

security as an adjustment to yield.”

Norris then presented Cross with data on held -for-trading investments made by PENT in

the securities of Spartan Products Inc. (SPInc.). While going through PENT’s notes to

financial statements, Norris found out that SPInc. had not made its currently due principal

and interest payments to PENT. In addition, market information speculated that SPInc.

was at the brink of bankruptcy due to severe financial losses. As Cross heard this

information, she stated that PENT should immediately recognize an impairment loss

related to the securities in its financial statements. Since PENT prepared its statements in

accordance with U.S. GAAP, the cost basis of the securities would be written down and

an impairment loss would be reported in the income statement.

Norris also stated that PENT had invested in the debt securities issued by Spot

Enterprises (SPEN). The securities appeared in the financial statements under held-to-

maturity investments, and amounted to 15% of PENT’s total intercorporate investments.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Norris believed that the investment value was overstated since the securities could no

longer be easily traded due to a disappearance of an active market in them. In addition, a

downgrade of SPEN’s credit rating was anticipated which, if realized, could result in

considerable losses. As a result, Norris reduced the carrying amount of the securities by

an amount equal to the difference between their carrying value and the present value of

their estimated future cash flows discounted at their original effective interest rate. Norris

also recognized this loss in SPEN’s profit and loss.

To bring some numbers to the table, Norris presented the following exhibit displaying

information about the fair value of PENT’s investment in A-Dee Company Limited

(ADCL). PENT invested $550,000 in ADCL on 1 January 2010. The par value of the

securities at the time was $435,000. The stated rate equaled 7.5% and the market interest

rate was 5.0%.

Exhibit 1

PENT’s investment in ADCL

Fair value as of 31 December 2010 $650,000

Fair value as of 31 December 2011 $700,000

Benefiting from her meeting with Norris, Cross mentioned a report she was preparing on

the stock of AXE Associates. AXE, a U.S. based firm, had acquired 35% of the

outstanding shares of BLADE Incorporated, and had accounted for it using the equity

method. AXE paid $350 million in exchange for 35% of BLADE’s net assets that

equaled a book value of $275,000 and a fair value of $300,000. After listening to Cross,

Norris made the following comment:

Comment 1: “AXE would report goodwill on its balance sheet in addition to its

proportionate share of BLADE’s net assets adjusted for fair value. This

goodwill should be tested for impairment at least annually, and adjusted for

any losses. If the impairment loss is greater than the goodwill recognized,

the maximum loss would equal the carrying amount of goodwill.”

He continued with the following comment:

Comment 2: “AXE can choose to account for its equity method investment in BLADE

at fair value. If it does, the investment account on AXE’s balance sheet will

not reflect its proportionate share of BLADE’s profit or loss, dividends and

other distributions. In addition, goodwill is not created.”

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Cross also mentioned the sale of inventory by AXE to BLADE in the year 2011. The

inventory’s cost and sale price equaled $100,000 and $250,000 respectively. BLADE

resold that inventory $150,000 of that inventory during the same y ear. The remainder

was sold in 2012. Exhibit 2 displays some information about BLADE Inc.

Exhibit 2

BLADE Incorporated

Net income 2011 1,300,000

Net income 2012 1,600,000

Excess purchase price attributable 50,000

to property

Property’s remaining life 10 years

Cross was trying to determine the effect of this sale on the reported equity income in

AXE’s balance sheet.

19. Cross is most accurate with respect to:

A. Statement 1 only.

B. Statement 2 only.

C. Neither statement 1 nor statement 2.

20. Is Norris’s treatment of impairment losses on the securities of SPInc. and SPEN

most likely justifiable?

A. Yes.

B. No, because their measurement and reporting of losses is incorrect.

C. No, because their analysis leading to the determination of impairment is

incorrect.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

21. If PENT’s investment in ADCL was initially recognized as either held-to-maturity

or held-for-trading, and the securities were sold on 1 January 2012 for $675,000,

which of the following would best describe the gain/loss to be reported on the

income statement?

A. The amount of realized gain under held-to-maturity would be $135,506,

and the realized loss under held-for-trading would be $25,000.

B. The amount of realized gain under held-for-trading would be $25,000, and

the realized gain under held-to-maturity would be $130,125.

C. The amount of realized gain under held-for-trading would be $25,000, and

the realized loss under held-for-trading would be $125,000.

22. With respect to AXE’s investment in BLADE, Norris is least accurate with

respect to:

A. Comment 1 only.

B. Comment 2 only.

C. neither comment 1 nor comment 2.

23. Ignoring any prior equity income, the reported equity income related to BLADE

on AXE’s balance sheet in 2012 will be closest to:

A. $429,000.

B. $541,000.

C. $579,000.

24. Ignoring any prior equity income, if the sale of inventory was by BLADE to

AXE, the reported equity income on AXE’s balance sheet in 2012 would have

been closest to:

A. $579,000.

B. $615,000.

C. $705,000.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 25 through 30 relate to Equity Investments

Insta-Call Cellular Products Case Scenario

Cynthia Philips is an investment expert at the corporate finance department of Insta-Call

Cellular Products (ICCPInc.), a firm that specializes in manufacturing high-end cellular

devices including smart phones. During their recent meeting, the board of directors at the

firm recognized the portable gaming industry as a profitable segment of the technology

market that the firm could target. As the appointed head of the project’s evaluation team,

Philips planned to estimate future cash flows and apply the NPV criterion for an accurate

capital budgeting decision. While calculating the increase in revenues attributed to the

addition of portable gaming devices to the product mix, Philips determined that such

devices would have a potential substitution effect on the smart phone market. Hence,

Philips accumulated all the relevant data that would aid him with his analysis. Exhibit 1

displays this information.

Exhibit 1

Revenue Projections for fiscal year 2012 and 2013 (in US$ ‘000)

FY 2012 FY2013E

Consolidated Revenue $45,000,000 $54,000,000

COGS 12,000,000 -

Operating Expenses 15,500 -

Total portable gaming device(PGD) - 110,000 units

shipments

% of shipments to individuals - 67%

% of shipments to corporations - 33%

Cannibalization factor, individual - 35%

Cannibalization factor, corporations - 15%

Average selling price of PGD to - $350/unit

individuals

Average selling price of PGD to - $500/unit

corporation

*The revenue figures are pre-cannibalization numbers.

In addition to the above data, Philips also made the following assumptions for

determining expected values:

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Assumption 1: “The $ change in cost of goods sold would be the same as the $ change

in revenue.”

Assumption 2: “The operating expenses would change at half the rate of the change in

revenue.”

Assumption 3: “Cash taxes as a percent of FY2012’s revenue would be the assumed tax

rate.”

Besides estimating the effects on the firm’s financials of investing in the project, Philips

also formulated the following conclusions:

Conclusion 1: “Relative to pre-cannibalization, post-cannibalization numbers would

make the firm look more expensive in terms of the P/E multiple.’

Conclusion 2: “Using post-cannibalization figures, the firm’s return on assets would be

lower than the pre-cannibalization return on assets. However, the

operating margin would be higher.”

Conclusion 3: “Although the effective tax rate, pre and post cannibalization, would be

the same, cash taxes would be lower post cannibalization.”

Conclusion 4: “Relative to the FY2012 values, the gross profit margin would remain the

same whether or not cannibalization is considered.”

The capital budgeting division at ICCPInc. was also evaluating an acquisition of Connect

Networks (CNET), a small, private firm in a similar business. Anne Webb was the

valuation expert involved with writing a feasibility proposal to the firm’s board. Exhibit 2

displays the data gathered by Webb.

Exhibit 2

Connect Networks Operating income

Gross Profit $355,000

Selling, general, and admin expenses $125,500

Depreciation $40,000

Taxes $47,375

Operating income after taxes $142,125

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

To determine the firm’s free cash flow to the firm, Webb made the following

assumptions:

• Revenues would increase by $150,000 and gross profit would be 30% of

revenues.

• Expected total revenues would equal $689,000 and depreciation would be 7.5% of

revenues.

• SG&A expenses are expected to stay at their current normalized level, and the tax

rate is also expected to remain constant.

• Working capital equal to 15% of revenues is required.

• Capital expenditures are expected to equal depreciation expense plus 6.0% of

incremental revenues.

• The required returns on working capital and fixed assets are 6.0% and 12%

respectively.

• The discount rate for intangible assets is found by equating the WACC with the

weighted values of working capital, fixed assets, and intangible assets, and is

equal to 10%.

Webb also determined the following:

• The CEO of CNET’s received compensation for the year was $50,000 less than

the normalized compensation expense for a similar company’s CEO.

• Certain real estate assets for CNET were not used in the core operations of the

firm. Expenses associated with the assets totaled $20,000, including $10,000

reflected in SG&A expenses and the remaining included as depreciation expense.

• CNET’s capital structure has an insignificant amount of debt. Hence, Philips

believes that interest expense should be excluded from calculations.

• A small office was just acquired by CNET for running its operations. Expenses

related to this office equal $30,000 and are reflected in SG&A expenses.

Webb then proceeded with writing the report.

25. Philips is least accurate with respect to:

A. Conclusion 1 only.

B. Conclusion 2 only.

C. Neither conclusion 1 nor conclusion 2.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

26. Philips is most accurate with respect to:

A. Conclusion 3 only.

B. Both conclusions 3 and 4.

C. Neither conclusion 3 nor conclusion 4.

27. Using the numbers in Exhibit 1, the post cannibalization expected cost of goods

sold would be closest to:

A. $9,249 million.

B. $14,801 million.

C. $19,033 million.

28. The normalized earnings for CNET are closest to:

A. $119,625.

B. $127,125.

C. $142,125.

29. Given Webb’s assumptions, the expected residual income associated with CNET

is closest to:

A. $17,263.

B. $47,263.

C. $33,263.

30. Is Webb’s method of estimating the discount rate applicable to intangible most

likely correct?

A. Yes.

B. No, because market return levels must be considered.

C. No, because market return levels and CNET’s borrowing costs must be

considered.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 31 through 36 relate to Equity Investments

Ascend Venture Exploration Case Scenario

Ascend Venture Exploration (AVEX) is an investment firm prominent for its investments

in venture capital and private equity in USA. The key to the above-average success rate

for AVEX’s funds is the extensive research of target companies by a specialized group of

professionals at the firm. Every aspect of the future performance of each company is

analyzed, including financial, operational, and strategic areas as well as the probability of

litigation and other legal issues. Carolyn Pickman is the senior financial executive (SFE)

of AVEX who has been involved with several of AVEX’s successful ventures. Pickman

leads the management team of The AVEX Panorama Fund (APF), a fund with an average

life of 5 years. Pickman is working with Andrew Bean to develop a value indication for

Trust Pharmaceuticals (TPH), a private company operating in Dallas, Texas. Bean

believes that the market value of invested capital to EBITDA multiple would be

appropriate to determine a value estimate for TPH. Following Pickman’s instructions,

Bean obtained financial information of several public companies that he believed could

serve as guidelines for valuing TPH. Bean presented the following results of his research:

• The mean MVIC to EBITDA multiple using multiples of comparable public

companies is 8.5.

• Since most guideline firms were characterized by high growth and high leverage,

an 18% downward adjustment for TPH’s relative risk and growth characteristics

is warranted.

• Normalized EBITDA for TPH equals $14.5 million.

• The face value of debt capital for TPH equals $3.5 million.

• The present state of the pharmaceutical industry is characterized by acquisition

activity involving several public companies. Research on the pricing and

valuation of these transactions indicates an equity control premium of 55%.

• TPH is operating at a debt/equity ratio of 65/35.

• TPH is expected to experience significant volatility in the near future financial

performance.

After reviewing Bean’s research, Pickman made the following comment:

“I believe that similar information could be used for value estimation of a relatively large

minority interest in TPH based on the guideline transaction method.”

Bean agreed and responded with the following comment:

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

“If a small equity interest in TPH is to be calculated, a reduction to value associated with

lack of ready marketability would be necessary. Given my study, a 35% lack of

marketability discount would be needed to accurately measure the value of a small equity

interest in TPH.”

Pickman was skeptical of Bean’s analysis and the accuracy of his accumulated data. To

verify Bean’s reported figures, Pickman obtained a research report written by Stephen

Misek, a private equity analyst at AVEX, on the valuation of TPH. Misek had presented

TPH’s value using both the guideline public company method and the guideline

transaction method. While reading the report, Pickman pinpointed the following:

• The EPS growth rates of comparable public companies averages approximately

7.0% below the average EPS growth rate for TPH.

• The risk level of guideline companies merits a 10% upward adjustment to the

baseline multiple.

• Given information about recent acquisitions of similar companies, the differences

in risk and growth prospects of the acquired companies relative to TPH is similar

to the differences reported under the GPC method.

• The average MVIC to EBITDA pricing multiple of comparable public companies

equals 12.00.

As Pickman approached the conclusion of Misek’s report he read that a multiple of 17.00

was applied to normalized EBITDA to determine value under the GTM method.

Given the contrast in Bean’s valuation relative to Misek’s, Pickman initiated a study on

the appropriateness of various valuation procedures given the unique characteristics of

the private firm under study. After careful investigation, Pickman discovered that the

choice of valuation method depended on the stage of the firm’s life cycle and on whether

a controlling or minority interest is to be valued. Specifically, Pickman studied the

following three cases:

Firm A: A minority interest in a development stage entity.

Firm B: A controlling interest in an early stage company.

Firm C: A minority interest in a later stage entity.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

31. The value of Trust Pharmaceuticals using the guideline public company method is

closest to:

A. $117,020,012.

B. $153,150,750.

C. $163,706,387.

32. The calculation of value for Trust Pharmaceuticals given Bean’s research will

most likely be:

A. Overstated due to the use of normalized EBITDA since actual volatility in

earnings will be greater.

B. Understated given TPH’s debt/equity ratio and volatility in financial

performance.

C. Correctly stated, since the research of guideline companies is correctly

applied under the guideline company method.

33. Assuming the baseline multiple for the GPC and GTM methods are the same, the

value for a large, minority interest in TPH using the GTM method will be closest

to:

A. $41,979,250.

B. $78,109,987.

C. $81,250,582.

34. Using the GTM method, the adjusted multiple to value a small minority interest in

TPH will most likely be:

A. 35% lower than the multiple used to value a large minority interest in

TPH.

B. 54% lower than the multiple used to value a large minority interest in

TPH.

C. 32% lower than the multiple used to value a large minority interest in

TPH.

35. The control premium that Misek is assuming is closest to:

A. 18.90%.

B. 20.36%.

C. 41.67%.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

36. The prior transaction method would be most appropriate for valuing:

A. Firm A.

B. Firm B.

C. Firm C.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 37 through 42 relate to Alternative Investments

Commercial Equity REIT Case Scenario

Jon Olson, a financial expert, has worked in the investment industry for over fifteen years

as a research analyst and money manager. Over the years, Olson has gained substantial

knowledge of the workings of capital markets and has undergone extensive research in

many sectors of the global debt and equity markets. In his attempt to impart this

knowledge to emergent professionals in his field, Olson volunteered to offer his

specialized guidance to a group of young portfolio managers. The group was

predominantly interested in the valuation of alternative investments, especially public and

private real estate. To illustrate the appraisal of a REIT, Olson presented a case study of

Commercial Equity REIT (CER), with the property portfolio comprising of commercial

real estate in and around the state of Illinois. Exhibit 1 displays information that was part

of the case study.

Exhibit 1

Commercial Equity REIT (in thousands of US$ except growth rate)

Last year NOI $550,120

Expected growth in NOI 2.07%

NOI of comparable transactions 575,000

Average value of comparable property 5,950,000

Cash and accounts receivable 167,000

BV of land held for future development 45,000

MV of land held for future development 53,500

Goodwill 75,500

Total debt 1,450,000

Deferred tax liabilities 210,000

*The number of shares outstanding is 100,000 and the current market price for the REIT

is $32.89/share

As Olson talked about the performance of this REIT, he made the following comment:

“Value-oriented investors would be particularly interested in purchasing this REIT for

value-addition.”

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Elaborating on the conceptual basis for the application of NAV-based measures to

determine appropriate investment decisions, Olson made the following comments:

Statement 1: “Investors may be willing to purchase a REIT trading at a premium to

NAV if the management team of the REIT has better opportunities to grow.

As such, the NAV approach implicitly incorporates the going concern

assumption and can be used to value a pool of assets.”

Statement 2: “NAV estimates become particularly useful when markets become illiquid

and public equity investors cannot ascribe an accurate value to businesses.

As such, the NAV reflects the value of a REIT’s assets to a private market

buyer.”

In addition to using NAV as a measure of valuation, Olson also mentioned other relative

value approaches to determine a REIT or REOC’s investment attractiveness. He stated

that price multiples based on FFO and AFFO were appropriate in determining a REIT

stock’s relative value. David Eubanks, one of the group participants, responded to the

discussion with the following question:

“How will the price multiples based on FFO and AFFO behave during economic

downturns? Also, how does a company’s capital structure affect these multiples?”

Eubanks answered with the following comment:

“Although the absolute value of multiples during downturns would be lower, relative

P/FFO and P/AFFO multiples could be higher. Also, since neither FFO nor AFFO take

into account differences in leverage, changing capital structures will not affect valuation

based on these multiples unless used in conjunction with effects of leverage levels.”

Olson then displayed the following exhibit to illustration the calculation of such

multiples.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Exhibit 2

Residential REIT Incorporated (in US$ thousands)

Gross rental revenue $889,450

Estimated vacancy and collection losses 75,650

Property taxes 64,000

Other operating expenses 145,000

Depreciation $55,000

General and administrative expenses $110,000

Maintenance type capital expenditures and

$41,000

leasing commissions

Non-recurring capital expenditures $76,000

Interest expense $23,000

Non-cash rent 53,000

*The market price of the REIT equals $67/share and the no. of shares outstanding is 100,000.

In conclusion, Olson talked about the discounted cash flow approach as it applied to the

valuation of REITs and REOCs. Olson used the example of a REIT with the underlying

portfolio including shopping centers and malls in the busiest areas of Minneapolis. To

explain the estimation of a suitable growth rate for the REIT, Olson stated that the REIT

would experience an increase in growth over the coming few years. He also presented the

following information:

• Leverage is expected to increase by 5-6% over the same period.

• Return from reinvestment is expected to increase by 1%.

• The percentage return from investment activity is also expected to increase by

1.5%.

In addition to the above, Olson included the following data in the analysis covering the

same time period:

1. The company reduced their estimate of depreciable lives, increasing the rate of

depreciation.

2. The going-in cap rates in the future would be slightly lower than the interest rates

on new loans.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

3. The REIT is expected to undergo a repositioning of a material portion of its

portfolio into higher quality properties.

Olson then advised the group to go through the example and write their conclusions on a

piece of paper.

37. As reinforced by Olson, would value-oriented investors most likely be interested

in the commercial equity REIT under analysis?

A. Yes.

B. No, because companies planning IPOs and secondary offerings would be

interested in buying this REIT.

C. No, because sector-focused real estate investors, not value oriented

investors, would purchase this security.

38. Olson is most accurate with respect to:

A. Statement 1 only.

B. Both statements 1 and 2.

C. Neither statement 1 nor statement 2.

39. Will Olson’s answer with regards to price multiples most likely prove helpful to

Eubank?

A. Only with respect to economic downturns.

B. Neither with respect to economic downturns nor with respect to leverage

levels.

C. Both with respect to economic downturns and leverage levels.

40. Using the information provided in Exhibit 2, the P/FFO for the residential REIT is

closest to:

A. 12.50.

B. 14.20.

C. 16.07.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

41. Using the information provided in Exhibit 2, the P/AFFO for the residential REIT

is closest to:

A. 15.16.

B. 17.73.

C. 22.20.

42. With respect to the shopping center REIT, which of the data provided by Olson is

least consistent with the estimated percentage changes provided earlier?

A. 2 only.

B. 1 and 2 only.

C. 2 and 3 only.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 43 through 48 relate to Fixed Income

Ben Sloane Case Scenario

Ben Sloane works as a fixed-income analyst at PiperCoons& Associates (PCA), a U.S.

based financial firm established by two successful entrepreneurs, Michael Coons and

Duncan Piper. Sloan is assessing the credit quality of a few fixed income securities for

inclusion in an endowment fund assisting the health care industry. Due to the dependence

of its beneficiary on the income provided by the fund, Sloane planned to opt for

investments that were investment grade. To further his goal, Sloane read an article about

structural models used by credit rating agencies to assess the quality of corporate debt.

Illustrating the option analogy, the article made the following comments:

Comment 1: “According to the structural model, a company’s equity has the same

payoff as a European call option on the company’s assets with a strike price

equal to the face value of the company’s liabilities and a maturity equal to

the maturity of the company’s liabilities.”

Comment 2: “A company’s debt is equivalent to owning a riskless bond and going short

a European put option on the assets of the company. According to this debt

option analogy, the value of risky debt representing credit risk equals the

value of the sold insurance policy.”

Sloane needed to understand the model’s underlying assumptions and calculations to

accurately apply it to determine credit risk. To explicitly calculate the credit risk

measures, Sloane gathered information about a hypothetical company’s debt and assets.

Exhibits 1 and 2 display this information.

Exhibit 1

Hypothetical Company

Asset value $3,500

Expected return on assets 5.00%

Face value of debt $2,800

Time to maturity of debt 1 year

Risk-free rate 2.00%

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Exhibit 2

N(-d1) 0.1050

N(-d2) 0.1562

N(-e1) 0.0875

N(-e2) 0.1350

Sloane used this information to estimate the credit risk measures for the company. He,

however, knew that the model’s underlying assumptions and their accuracy could greatly

affect the reliability of the calculated measures. He discussed the model’s weaknesses

and limitations with Michael Coons, one of the firm’s founders. Coons stated that the

computations under the structural model assumed that the debt and equity of a company

actively traded in the financial markets. He added that the calculations also depended on

observable variables like a company’s debt-to-equity ratio and asset return volatility.

Sloane agreed and stated that since the model used the riskless rate to discount future

cash flows, the present value of the credit loss did not accurately capture the risks of

those cash flows.

The conversation about the limitations of the structural model led Coons to talk about the

reduced form model. He stated that the credit risk measures for the hypothetical company

that Sloane was analyzing could also be determined using the reduced form model. Coons

provided the following additional information:

• Default intensity equals 0.04.

• Loss given default equals 45%.

Coons recommended Sloane to use the reduced form model to evaluate the securities’

credit risk. He stated that, theoretically, such models would perform better than credit

ratings and structural models due to the flexibility of their estimation procedures.

43. The article is most accurate with respect to:

A. Comment 1.

B. Comment 2.

C. both comments 1 and 2.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

44. Assuming the data provided in Exhibits 1 and 2 is accurate, the present value of

the expected loss is closest to:

A. $56.05.

B. $55.19.

C. $61.20.

45. For the hypothetical company that Sloane is assessing, the:

A. risk premium dominates the time value discount.

B. time value discount dominates the risk premium.

C. risk premium balances the time value discount.

46. Do Coons and Sloane most likely capture the limitations of the structural model

accurately?

A. Only Coons does.

B. Only Sloane does.

C. Neither of them does.

47. Using the reduced form model, with regards to the hypothetical company, the:

A. time value of money is dominated by the risk premium.

B. probability of default over the life of the debt is 5.0%.

C. risk premium is dominated by the time value of money.

48. Coons preference of the credit risk analysis approach is most likely correct

because:

A. the reduced form model helps incorporate changes in the business cycle

regardless of the estimation approach of the model’s parameters; the

structural approach does not provide this flexibility.

B. Even though credit ratings provide a cardinal ranking, they are inherent

with a conflict between stability and accuracy.

C. In the event of default, reduced form models allow a company’s different

liabilities to have different loss rates.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 49 through 54 relate to Fixed Income

RoseDeco Case Scenario

Matt Curtis, a research analyst, is writing a research report on Rosemary Decorations

(RoseDeco), an event planning firm that specializes in handling corporate events. Curtis

is assessing the growth potential of RoseDeco’s stock and the income stability of its debt

securities. To establish the default probability for RoseDeco, Curtis requested the credit

department at his firm to provide him with the inputs to the regression model for

estimating the firm’s one-year default probability. Exhibit 1 displays the information

supplied to Curtis.

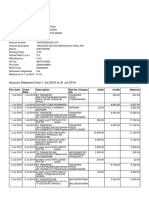

Exhibit 1

Logistic Regression

Coefficient Name Coefficient Value Input Value

Alpha -3

B1 1.12 0.0787

B2 -2.30 0.0560

B3 0.981 0.8700

B4 -0.425 0.1530

Before issuing a buy recommendation for the firm’s fixed-income securities, Curtis

planned to use credit spreads to estimate the credit risk measures for RoseDeco to ensure

that investment risk is properly accounted for. Curtis is particularly interested in a 10%

coupon bond issued by RoseDeco. The bond pays semiannually and is expected to return

the $1,000 principal and the last coupon payment in five years. The risk-free zero-coupon

yield on U.S. bonds is 0.672%. Curtis has determined that the credit spread for this

payment equals 0.476%. Curtis is using this data to estimate the expected loss with

respect to the last payment on this bond.

After completing the research report, Curtis met with Ryan White, a close friend from

college. White was now a renowned financial analyst in the U.S. working for a well-

established investment firm. Curtis talked about credit analysis models and their strengths

and limitations. When White analyzed Curtis’s workings of credit risk measures he made

the following comment:

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

“The decomposition of the credit spread in either the structural or reduced form models

assumes that markets are frictionless. This means that in most practical applications, the

expected percentage loss, as measured by the models, will be less than the credit spread.”

White continued the conversation about credit risk with an elaboration of the credit

quality of structured bonds. He made the following comments:

“For an asset-backed security, if there is a default in the collateral pool, the probability of

default can be estimated using either a structural model or a reduced form model.

However, the calculations are much more complex.”

Mentioning his current assignments, White stated that he was analyzing a convertible

bond issued by Magneto Enterprises (MAGEN), a large-cap U.S. firm. Exhibit 2 displays

key facts about the bond.

Exhibit 2

Magneto Enterprises Convertible Bond

Current market price $1,135.4

Conversion ratio 33.67

Current dividend yield 4.50%

Coupon rate 9.89%

Stock price $28.5

White knew that a convertible bond could be viewed as having an embedded call option

on the stock of the issuing firm. When he talked about this option with Curtis, Curtis

posed the following question:

“I believe that the theoretical value of this call option could be determined using the

Black Scholes option pricing model. However, if I want to estimate a price for this option

without using complicated models, how can I achieve my goal?”

While reviewing White’s analysis, Curtis disagreed with a few of his estimations based

on the traditional analysis of the bond. He was especially concerned with White’s

estimate of downside risk. Curtis believed that, although White’s calculations were

accurate, his forecasts overstated this risk measure. To illustrate his calculations, Curtis

cited the example of W&E Corporation’s convertible bond that had a market price of

$122.67. The bond was an annual pay, 6.0% coupon bond with 7 years to maturity. The

bond was not callable but was putable and had a YTM equal to 4.5%. Curtis stated the

market provided key information about the value of this bond.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

49. Using the information provided in Exhibit 1, the one-year probability of default

for RoseDeco is closest to:

A. 2.3%.

B. 3.9%.

C. 9.5%.

50. Assuming that today is January 1 2010, Curtis’s estimate of the present value of

the expected loss due to credit risk for RoseDeco’s five year bond should be

closest to:

A. $23.67.

B. $24.79.

C. $27.05.

51. With respect to his comments about credit spread and asset-backed securities, is

White most likely correct?

A. Yes.

B. Only with respect to credit spreads.

C. Only with respect to asset-backed securities.

52. The best response to Curtis’s question about the convertible bond is that the price

of the call option will be closest to:

A. $5.22.

B. $0.18.

C. $3.37.

53. Which of the following can be a possible explanation of Curtis’s belief of an

overstatement of White’s downside risk estimate with respect to Magneto’s

convertible bond?

A. Overestimating the rise in interest rates and issuer’s credit spread.

B. Underestimating the decline in interest rates and overestimating the

issuer’s credit spread.

C. Underestimating the decline in interest rates and issuer’s credit spread.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

54. Using traditional analysis, which of the following is most accurate about W&E

Corporation’s convertible bond?

A. The market estimates the value of the embedded options to equal $17.89.

B. The value of the embedded options is approximately equal to $13.83,

given that interest rates remain constant.

C. Due to the conflicting effects of the embedded options, market

information cannot be used to determine an estimate of their value.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

Questions 55 through 60 relate to Derivatives

Comfort Beddings and Furnishers Case Scenario

Justin Martinez is the corporate head of the risk management department at Comfort

Beddings and Furnishers (CB&F), a multinational chain with headquarters in Houston,

Texas. Under Martinez’s instructions, CB&F has engaged in a number of forward

contracts and commodity futures to hedge against rising raw material prices and changing

market conditions. Following the advice of his second in command, Peter Rabel,

Martinez is now planning to use options for risk management purposes. However, since

the workings of the options market is new to him, Martinez would like to understand how

options are valued using the binomial model. Rabel obtained information on two options

and presented it to Martinez for review. The exhibit below displays this information.

Exhibit

Option Contract Information

Market

Underlying Price of

Exercise Price at Up Down Risk-free Option at

Option Price ($) T = 0 ($) Movement Movement Rate (%) T= 0 ($)

Call 55.00 55.00 +20% - 25% 2.00 $10

Put 50.00 50.00 +30% - 55% 2.00 $8

Martinez was skeptical of the quoted prices of the abovementioned options. He decided

to utilize his knowledge of option-pricing to obtain a minimum price for each of the

options under analysis. For this, Martinez used a risk-free rate of 5.0% and assumed no

cash payments during the life of the options.

While conversing with Rabel about the estimates he generated, Martinez talked about the

time value inherent in each option. Knowing that options expire in the future, Martinez

was sure that each option holder held value in terms of the chances that the underlying

price would move in their favor over the life of the option. However, he was not sure how

this value differed for European and American options. Martinez used the options under

analysis to calculate the approximate difference in time value inherent in American

options versus European option.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

When Martinez presented his results to Rabel for elaboration, Rabel agreed with most of

the conceptual underpinnings underlying his evaluation. However, Rabel stated that

assuming no cash flows during the options’ lives was a somewhat unrealistic assumption.

Rabel advised Martinez to alter this assumption and recalculate the option prices. After

the necessary modifications, Martinez formulated the following conclusions:

Conclusion 1: “The minimum prices for the European options would decrease but those

for American options would remain unchanged.”

Conclusion 2: “With cash flows, the value of an American call option will be greater

than the value of an identical European call option. However, the

relationship between a European put option and an identical American

put option will not change with the existence of cash flows.”

In addition to the above change, Rabel also expected the following changes in interest

rates and volatility trends:

• Interest rates were expected to increase significantly in the near future.

• Volatility in security prices was also expected to rise over the coming fiscal

year.

Intrigued with the results to his analysis, Martinez extended his research by including the

following options for further clarification:

Option: 1: “An embedded put option with a price of $9.07.”

Option 2: “A call option on a stock with a price of $7.05.”

Option 3: “A European put option on a stock with a price of $3.09.”

Martinez would like to expand his knowledge on options valuation and for this he has

undertaken a study of the Black-Scholes-Merton option pricing model. He begins his

study by taking the risk-free rates and underlying prices collected in the Exhibit and

assumes the following scenarios on T = 0 holding all else constant.

Assumption 1: The price of the stock underlying the call and put option increases to $56

and $53 respectively.

Assumption 2: The risk-free rate declines to 1.5%.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

55. Which of the following statements is most likely accurate regarding the model

being used by Rabel and Martinez for call and put options?

A. The model is a complex model.

B. The model can be extended to price American options.

C. Underlying prices are assumed to follow a lognormal distribution.

56. Using a one-period binomial model, the call option (Exhibit) should sell for a

current price of:

A. $6.47.

B. $11.00.

C. $11.86.

57. Based on the information presented in the exhibit regarding the put option and

using a one-period binomial model, does an arbitrage opportunity exist to earn

riskless profits at T = 0 (assumeπu= 67% and πd= 33%)?

A. No.

B. Yes, the put option can be purchased in the market today.

C. Yes, the put option can be sold short in the market today.

58. Are Martinez’s conclusions most likely consistent with sound option pricing

theory?

A. Yes.

B. Only conclusion 1 is consistent.

C. Only conclusion 2 is consistent.

59. With respect to the additional options analyzed by Martinez, under the interest

rate assumption, the price increase will be highest for:

A. Option 1 and price decrease will be highest for Option 3.

B. Option 2 and the price decrease will be highest for either Option 1 or

Option 3.

C. Option 1 or Option 2, and the price decrease will be highest for Option 3.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 5 – Questions (AM)

60. Considering Assumption 1, which of the following scenarios is most likely correct

with respect to option deltas?

A. The call delta will move towards 0.0.

B. The call delta will increase towards 1.0.

C. The put delta will decrease towards –1.0.

FinQuiz.com © 2016 - All rights reserved.

You might also like

- CFA Level1 2017 Mock Exam PDFDocument75 pagesCFA Level1 2017 Mock Exam PDFHéctor GarcíaNo ratings yet

- 2019 Mock Exam A - Morning Session (With Solutions) PDFDocument63 pages2019 Mock Exam A - Morning Session (With Solutions) PDFHielosur Fábrica de HieloNo ratings yet

- CFA Mock Exam Lvl1Document38 pagesCFA Mock Exam Lvl1Christopher Diamantopoulos100% (1)

- 2020 Mock Exam A - Morning SessionDocument22 pages2020 Mock Exam A - Morning SessionTaha TinwalaNo ratings yet

- CFA Level 1 Practice Test 1 - 300hoursDocument21 pagesCFA Level 1 Practice Test 1 - 300hoursEstefany MariáteguiNo ratings yet

- 01 Capital Budgeting PDFDocument33 pages01 Capital Budgeting PDFSardonna FongNo ratings yet

- 2019 Li Mock B-Am-Solutions PDFDocument62 pages2019 Li Mock B-Am-Solutions PDFLucky Sky100% (2)

- Mock Exam A - Afternoon Session (With Solutions) PDFDocument65 pagesMock Exam A - Afternoon Session (With Solutions) PDFJainn SNo ratings yet

- 2019 Mock Exam A - Morning SessionDocument21 pages2019 Mock Exam A - Morning SessionYash DoshiNo ratings yet

- 2019 Mock Exam A - Morning Session (With Solutions)Document63 pages2019 Mock Exam A - Morning Session (With Solutions)LU GenNo ratings yet

- CFA Level III Mock Exam 1 - Questions (PM)Document41 pagesCFA Level III Mock Exam 1 - Questions (PM)Munkhbaatar SanjaasurenNo ratings yet

- Finquiz Mock 2018 QuestionsDocument34 pagesFinquiz Mock 2018 QuestionsEdgar Lay100% (1)

- 01 Alternative InvestmentsDocument61 pages01 Alternative InvestmentsSardonna Fong0% (1)

- Mock Exam QuestionsDocument43 pagesMock Exam QuestionsFerran Mola ReverteNo ratings yet

- 2019 Level I Mock C (PM) QuestionsDocument21 pages2019 Level I Mock C (PM) QuestionsshNo ratings yet

- FinQuiz Level1Mock2018Version2JuneAMSolutionsDocument79 pagesFinQuiz Level1Mock2018Version2JuneAMSolutionsYash Joglekar100% (2)

- Level III of CFA Program Mock Exam 1 - Solutions (PM)Document46 pagesLevel III of CFA Program Mock Exam 1 - Solutions (PM)Lê Chấn PhongNo ratings yet

- Level I of CFA Program 1 Mock Exam June 2020 Revision 1Document76 pagesLevel I of CFA Program 1 Mock Exam June 2020 Revision 1Jason100% (1)

- Cash SweepDocument5 pagesCash SweepWild FlowerNo ratings yet

- 02 Capital StructureDocument28 pages02 Capital StructureSardonna FongNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Level I of CFA Program 6 Mock Exam June 2020 Revision 1Document43 pagesLevel I of CFA Program 6 Mock Exam June 2020 Revision 1JasonNo ratings yet

- 2019 Mock Exam B - Afternoon SessionDocument21 pages2019 Mock Exam B - Afternoon SessionBurhan Ahmed Mayo100% (2)

- CFA Level I 1 Mock Exam June, 2018 Revision 1Document74 pagesCFA Level I 1 Mock Exam June, 2018 Revision 1pier AcostaNo ratings yet

- Level I of CFA Program 5 Mock Exam December 2020 Revision 2Document45 pagesLevel I of CFA Program 5 Mock Exam December 2020 Revision 2JasonNo ratings yet

- CFA Level II Mock Exam 4 - Solutions (AM)Document61 pagesCFA Level II Mock Exam 4 - Solutions (AM)Sardonna FongNo ratings yet

- Level III of CFA Program Mock Exam 1 - Solutions (PM)Document60 pagesLevel III of CFA Program Mock Exam 1 - Solutions (PM)Elizabeth Espinosa ManilagNo ratings yet

- SolsDocument59 pagesSolsSumit Kumar100% (1)

- Level II of CFA Program Mock Exam 1 - Solutions (AM)Document56 pagesLevel II of CFA Program Mock Exam 1 - Solutions (AM)Faizan UllahNo ratings yet

- 2019 Mock Exam A - Afternoon Session PDFDocument23 pages2019 Mock Exam A - Afternoon Session PDFDhruva Sareen Consultancy100% (1)

- June 2017 'Document57 pagesJune 2017 'Umer VaqarNo ratings yet

- Level III of CFA Program Mock Exam 1 - Questions (PM)Document32 pagesLevel III of CFA Program Mock Exam 1 - Questions (PM)Lê Chấn Phong100% (1)

- Level I of CFA Program 6 Mock Exam December 2020 Revision 1Document82 pagesLevel I of CFA Program 6 Mock Exam December 2020 Revision 1JasonNo ratings yet

- 2019 Level I Mock C (AM) QuestionsDocument22 pages2019 Level I Mock C (AM) QuestionsshNo ratings yet

- FinQuiz Level2Mock2016Version6JunePMSolutionsDocument57 pagesFinQuiz Level2Mock2016Version6JunePMSolutionsAjoy RamananNo ratings yet

- FinQuiz Level1Mock2018Version2JuneAMSolutions PDFDocument79 pagesFinQuiz Level1Mock2018Version2JuneAMSolutions PDFNitinNo ratings yet

- FinQuiz Level2Mock2016Version1JuneAMQuestionsDocument33 pagesFinQuiz Level2Mock2016Version1JuneAMQuestionsDavid LêNo ratings yet

- C FSPPs RK Y4 e ARq RIDocument7 pagesC FSPPs RK Y4 e ARq RIMD RafiqNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Math1 (BSOA1A)Document60 pagesMath1 (BSOA1A)Angelika Cambalon0% (1)

- 06 Standards of Professional Conduct & Guidance-Investment Analysis, Recommendations, and Actions PDFDocument19 pages06 Standards of Professional Conduct & Guidance-Investment Analysis, Recommendations, and Actions PDFSardonna FongNo ratings yet

- Level I of CFA Program 1 Mock Exam December 2019 Revision 1Document76 pagesLevel I of CFA Program 1 Mock Exam December 2019 Revision 1millytan_No ratings yet

- CFA Level II Mock Exam 5 - Solutions (AM)Document60 pagesCFA Level II Mock Exam 5 - Solutions (AM)Sardonna FongNo ratings yet

- 2010 CFA Level 1 Mock Exam MorningDocument39 pages2010 CFA Level 1 Mock Exam MorningNghiem Nguyen VinhNo ratings yet

- 2019 CFA LIII MockExamA-AM (With Solution)Document63 pages2019 CFA LIII MockExamA-AM (With Solution)Joseph MakNo ratings yet

- CFA Level II Mock Exam 5 - Solutions (PM)Document61 pagesCFA Level II Mock Exam 5 - Solutions (PM)Sardonna FongNo ratings yet

- Level1 - CFA - Mock 2016 - Version1 - JunePM - QuestionsDocument39 pagesLevel1 - CFA - Mock 2016 - Version1 - JunePM - QuestionsaNo ratings yet

- FinQuiz Level2Mock2016Version6JuneAMSolutionsDocument61 pagesFinQuiz Level2Mock2016Version6JuneAMSolutionsAjoy RamananNo ratings yet

- Dokumen - Tips Finquiz Cfa Level I Mock Exam 1 Solutions Am Questions Topic MinutesDocument76 pagesDokumen - Tips Finquiz Cfa Level I Mock Exam 1 Solutions Am Questions Topic MinutesНаталия МорзаNo ratings yet

- CFA Level III Mock Exam 1 - Solutions (PM)Document63 pagesCFA Level III Mock Exam 1 - Solutions (PM)Munkhbaatar SanjaasurenNo ratings yet

- CFA Level II Mock Exam 6 - Questions (PM)Document32 pagesCFA Level II Mock Exam 6 - Questions (PM)Sardonna FongNo ratings yet

- Morning Session Q&ADocument50 pagesMorning Session Q&AGANESH MENONNo ratings yet

- CFA Level II Mock Exam 6 - Questions (AM)Document32 pagesCFA Level II Mock Exam 6 - Questions (AM)Sardonna FongNo ratings yet

- L 1 Mockv 12020 JuneamquestionsDocument38 pagesL 1 Mockv 12020 JuneamquestionsVivek Singh100% (1)

- FinQuiz Level2Mock2016Version2JuneAMQuestionsDocument37 pagesFinQuiz Level2Mock2016Version2JuneAMQuestionsDavid LêNo ratings yet

- Morning Session QuestionsDocument30 pagesMorning Session QuestionsGANESH MENONNo ratings yet

- PM Mock1Document40 pagesPM Mock1anuNo ratings yet

- Level I of CFA Program 2 Mock Exam June 2020 Revision 1Document40 pagesLevel I of CFA Program 2 Mock Exam June 2020 Revision 1JasonNo ratings yet

- FinQuiz Level2Mock2016Version1JunePMQuestionsDocument35 pagesFinQuiz Level2Mock2016Version1JunePMQuestionsDavid LêNo ratings yet

- Wiley CMA Learning System Exam Review 2013, Financial Decision Making, Online Intensive Review + Test BankFrom EverandWiley CMA Learning System Exam Review 2013, Financial Decision Making, Online Intensive Review + Test BankNo ratings yet

- Wiley CMA Learning System Exam Review 2013, Financial Decision Making, + Test BankFrom EverandWiley CMA Learning System Exam Review 2013, Financial Decision Making, + Test BankRating: 5 out of 5 stars5/5 (1)

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingNo ratings yet

- 04 Standards of Professional Conduct & Guidance-Duties To Clients PDFDocument15 pages04 Standards of Professional Conduct & Guidance-Duties To Clients PDFSardonna FongNo ratings yet

- 02 Standards of Professional Conduct & Guidance Professionalism PDFDocument20 pages02 Standards of Professional Conduct & Guidance Professionalism PDFSardonna FongNo ratings yet

- 11 Reading 4 To 8 Ethical and Professional Standards PDFDocument23 pages11 Reading 4 To 8 Ethical and Professional Standards PDFSardonna FongNo ratings yet

- 07 Standards of Professional Conduct & Guidance-Conflicts of Interest PDFDocument11 pages07 Standards of Professional Conduct & Guidance-Conflicts of Interest PDFSardonna FongNo ratings yet

- 03 Standards of Professional Conduct & Guidance-Integrity of Capital Markets PDFDocument11 pages03 Standards of Professional Conduct & Guidance-Integrity of Capital Markets PDFSardonna FongNo ratings yet

- 01 Code of Ethics and Standards of Professional Conduct PDFDocument8 pages01 Code of Ethics and Standards of Professional Conduct PDFSardonna FongNo ratings yet

- 09 Guidance For Standards I-VII PDFDocument75 pages09 Guidance For Standards I-VII PDFSardonna FongNo ratings yet

- 10 CFA Institute Research Objectivity Standards PDFDocument5 pages10 CFA Institute Research Objectivity Standards PDFSardonna FongNo ratings yet

- Level Ii, Question 1: Topic: Minutes: Reading ReferenceDocument28 pagesLevel Ii, Question 1: Topic: Minutes: Reading ReferenceSardonna FongNo ratings yet

- 03 Dividends and Share Repurchases - AnalysisDocument20 pages03 Dividends and Share Repurchases - AnalysisSardonna FongNo ratings yet

- 2002 CFA Level II Examination Morning Session - Essay: Candidate NumberDocument30 pages2002 CFA Level II Examination Morning Session - Essay: Candidate NumberSardonna FongNo ratings yet

- Ration AnalysisDocument35 pagesRation AnalysisMuhammad EjazNo ratings yet

- FY22 SingleAudit WBDocument79 pagesFY22 SingleAudit WBDUSHIME Jean claudeNo ratings yet

- FAR 04: Trade Accounts Receivable: J. CayetanoDocument58 pagesFAR 04: Trade Accounts Receivable: J. CayetanoCherrylane EdicaNo ratings yet

- Solved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesDocument1 pageSolved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesM Bilal SaleemNo ratings yet

- Module 7Document7 pagesModule 7jovelyn AlejandroNo ratings yet