Professional Documents

Culture Documents

CFA Level II Mock Exam 3 - Solutions (PM)

CFA Level II Mock Exam 3 - Solutions (PM)

Uploaded by

Sardonna FongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFA Level II Mock Exam 3 - Solutions (PM)

CFA Level II Mock Exam 3 - Solutions (PM)

Uploaded by

Sardonna FongCopyright:

Available Formats

CFA Level II Mock Exam 3 – Solutions (PM)

FinQuiz.com

CFA Level II Mock Exam 3

June, 2016

Revision 1

Copyright © 2010-2016. FinQuiz.com. All rights reserved. Copying, reproduction

or redistribution of this material is strictly prohibited. info@finquiz.com.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

FinQuiz.com – 3rd Mock Exam 2016 (PM Session)

Questions Topic Minutes

1-6 Ethical and Professional Standards 18

7-18 Corporate Finance 36

19-30 Financial Reporting and Analysis 36

31-42 Equity Investments 36

43-48 Fixed Income 18

49-54 Alternative Investments 18

55-60 Portfolio Management 18

Total 180

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 1 through 6 relate to Ethical and Professional Standards

Ken Ortega Case Scenario

Ken Ortega is a senior asset manager at Darryl Associates, an asset management firm in

Belgium. Ortega is undertaking interviews for a research assistant on behalf of his firm.

Ortega comes across two potential candidates, Piet Siemen and Anne Fleur; both are also

CFA Program candidates. The experience section of their resumes reads as follows:

Siemen: “I am a CFA Level III candidate. I have passed the first two levels in

consecutive attempts and will be appearing for the Level III exam in

June.”

Fleur: “I have passed all three levels of the CFA program and will receive my

charter in a year’s time.”

Three weeks after conducting interviews, Ortega hires Fleur as his research assistant.

Fleur’s first task involves analyzing the stock of Eternal, a multi-national semi-precious

jewelry maker.

Prior to conducting her analysis Ortega is invited to attend a dinner where executives of

global multinationals will be present. Due to a busy schedule, Ortega sends Fleur on his

behalf. At the event, Fleur joins a conversation involving Eternal’s CEO and two

company executives. She identifies herself as a middle manager working at the

company’s Dutch branch. The CEO reveals, in a series of private negotiations, Eternal

has received approval from North African authorities to initiate operations involving the

extraction of rare stones.

Upon returning to Darryl, Fleur requests Ortega to reassign her to another stock by

providing a statement in writing, ‘I am no longer able to maintain a neutral view on the

stock’. After being pressed by Ortega to share what her opinion would have been on the

stock, Fleur replies by stating that Eternal’s future outlook is ‘promising’.

Ortega reassigns Fleur to cover the stock of Ricardole, a pharmaceutical firm. Fleur has

little experience with the pharmaceutical sector and so requests her uncle and renowned

industry analyst, Cobus Wouter, for assistance. Wouter uses his personally designed

model to analyze Ricardole and recommends a buy rating. The following day Fleur issues

a report on Ricardole with the same rating. She identifies her relationship with her uncle

and his involvement in small font at the end of the report. In a disclosure she mentions

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

that an in-house firm model was used to generate the recommendation as well as

describes the model in detail.

After completing her assignment, Fleur decides to apply for an associate position at a

research firm. She attends the interview and is offered the position. She has not yet

accepted the offer as she is negotiating a position in the branch closer to her home. She

has not yet revealed details of the offer to Ortega.

The current year has been fruitful for Ortega who has delivered above-average portfolio

results. His clients are extremely pleased and one of his clients, Richard Hugo, has

mailed him two tickets to a soccer club match and promises to put a word in for Ortega at

the club. Hugo shares with club members and staff, “Ortega is an extraordinary asset

manager. He has the ability to transform an average portfolio into one which generates

assured above-average results.” When disclosing this to Ortega, the manager expresses

his gratitude and requests his client to continue his promotional efforts. Ortega accepts

the match tickets and discloses the offer to his supervisor after attending the match.

During his spare time Ortega volunteers at a charity organization. When performing his

duties he is asked by a volunteer about his duties at Darryl. He replies by stating, “I

manage the accounts of several high-profile clients. Many of these clients are business

entrepreneurs from the local Belgian business community.”

1. Which individual’s resume statement is most likely in violation of the CFA

Institute Standards of Professional Conduct?

A. Fleur

B. Siemen

C. Both Siemen and Fleur.

Correct Answer: A

Reference:

CFA Level II, Volume 1, Study Session 1, Reading 2, LOS a

Fluer’s statement is in violation of Standard VII(B) Reference to the CFA

Institute, CFA Designation, and the CFA Program because the final award of the

charter is subject to meeting the CFA Program requirements and approval by the

CFA Institute Board of Governors. She cannot cite an expected date of receiving

the charter.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

2. With respect to the Eternal stock, Fleur is in violation of the CFA Institute

Standards of Professional Conduct relating to:

A. misconduct.

B. material nonpublic information.

C. diligence and reasonable basis.

Correct Answer: A

Reference:

CFA Level II, Volume 1, Study Session 1, Reading 2, LOS a

Fleur is in violation of the standard relating to misconduct as she has been

dishonest with Eternal’s CEO and executives regarding her true occupation.

Fleur is not in violation of the standard concerning material nonpublic

information. She has not acted or caused others to act on the material nonpublic

information received (the expansion of Eternal’s extraction operations into

Africa). The standard recommends members and candidates to communicate the

information to their supervisor if public disclosure is not possible. Merely sharing

Eternal’s outlook, who is her supervisor, does not constitute a violation of this

standard.

Fleur is not in violation of the standard relating to diligence and reasonable basis.

She has not made any formal recommendation. Therefore, this standard does not

cover Fleur’s actions.

3. By issuing the research report on Ricardole, Fleur is in violation of the CFA

Institute Standards of Professional Conduct relating to:

A. misrepresentation.

B. disclosure of conflicts.

C. communication with clients and prospects.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: A

Reference:

CFA Level II, Volume 1, Study Session 1, Reading 2, LOS a

Fleur is in violation of the standard relating to misrepresentation. This is because

she has incorrectly identified her uncle’s model as the firm’s.

Fleur is not in violation of the disclosure of conflicts standard. This is because she

has attempted to avoid any conflict of interest by disclosing her relationship with

her uncle.

By disclosing the details of the model used, Fleur has complied with the standard

relating to communication with clients and prospects.

4. By applying for the associate position at the research firm, is Fleur in violation of

the CFA Institute Standards of Professional Conduct relating to Duties to

Employer?

A. No.

B. Yes, by not disclosing details of the negotiations.

C. Yes, by not disclosing her attendance at the interview.

Correct Answer: A

Reference:

CFA Level II, Volume 1, Study Session 1, Reading 2, LOS a

By not disclosing her attendance at the interview or details of the negotiations,

Fleur is not in violation of any professional conduct standards. Her preparations to

leave work have not interfered with her research assignments.

5. Are Ortega’s actions in violation of any CFA Institute Standards of Professional

Conduct?

A. No.

B. Yes, by accepting the match tickets.

C. Yes, by misrepresenting his performance as asset manager.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: C

Reference:

CFA Level II, Volume 1, Study Session 1, Reading 2, LOS a

Ortega is in violation of the standard relating to misrepresentation. This is because

he is fully aware that Hugo is making guarantees with respect to his potential

performance as an asset manager. By allowing and encouraging him to continue

misrepresenting his performance, Ortega is in violation of this standard.

By accepting the match tickets and disclosing details of the offer to his employer,

Ortega has fully complied with the CFA Institute Standards of Professional

Conduct.

6. In context of his conversation with the volunteer, is Ortega’s statement is in

violation of the CFA Institute Standards of Professional Conduct relating to client

confidentiality?

A. Yes, with respect to his complete statement.

B. Only with respect to the portion, “I manage the accounts of several high-

profile clients.”

C. Only with respect to the portion, “Many of these clients are business

entrepreneurs from the local Belgian business community.”

Correct Answer: C

Reference:

CFA Level II, Volume 1, Study Session 1, Reading 2, LOS a

Standard III(E) Preservation of Confidentiality requires members and candidates

to keep information about clients confidential (with certain exemptions).

By simply stating that he manages the portfolios of ‘high profile clients’ does not

constitute a violation. This is because the statement does not reveal any specific

client details and is general in nature.

However, he has violated the confidentiality standard by stating that his clients

are Belgian-based and are wealthy entrepreneurs. This is because he is revealing

the identity of his clients by providing specific details.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 7 through 12 relate to Corporate Finance

Locha, Inc. Case Scenario

Locha, Inc. is a pharmaceutical company specializing in cancer-related research and

production of related medications. Last week Locha’s management made a purchase offer

to Trica, a small-scale over-the-counter and prescription drug manufacturer. If the offer is

successful the newly merged company will be identified as Lyre. Presently Trica lacks

quality management. By acquiring Trica Locha’s management wishes to expand its area

of expertise and be in a better position to influence industry product pricing.

Vahan Stepan is a senior manager at Locha. During a senior management meeting Stepan

states,

“One of the benefits of merging with a company with a low EPS measure is that the post-

merger EPS and stock price should increase if Locha’s stock is used as the currency of

purchase.”

Stepan collects pre-merger EPS, price-earnings (P/E), and common stock data with

respect to Locha and Trica to justify his claims (Exhibit 1).

Exhibit 1

Pre-merger Data Concerning Locha, Inc. and Trica

Locha, Inc. Trica

Stock price $65.0 $20.0

EPS 2.5 1.5

P/E 26.0 13.3

Total shares outstanding 4,000,000 650,000

The purchase offer made to Trica is met with stiff resistance from its management.

Trica’s management responds by implementing three measures, either of which will be

implemented if a takeover attempt is made.

Measure 1: Trica’s shareholders have been granted the right to purchase company

shares at a significant discount to market price.

Measure 2: Any shareholder holding more than 16% of Trica’s outstanding stock will

not be allowed to exercise their voting rights.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Measure 3: Invite Fleet Distributors, a distributor of Trica’s products, to submit a

purchase bid for acquiring the pharmaceutical company.

Following the response of Trica’s management, Stepan decides to change Locha’s tactic

by submitting an acquisition offer to the target’s shareholders. Included in this offer is a

proposed list of Locha directors developed by Stepan (Exhibit 2). This list has been put to

shareholder vote. The proposed directors will be members of Lyre’s board if the merger

is successful. Stepan will assume the role of CEO at Lyre.

Stepan feels it is important to ensure that the price paid for Trica’s shares does not

significantly exceed its fair value. As a starting point, he collects the necessary details for

establishing fair value (Exhibit 3). Stepan intends to use the discounted cash flow

technique and a forecast period of four years, 2012 to 2016. At the end of 2016, free cash

flows will grow at a constant rate of 3%.

Exhibit 2

Proposed List of Directors for Lyre

Rodney Clab, a health regulatory consultant to Locha

Virginia Gayle, Stepan’s niece and a pharmacist with an MBA degree

Joseph Icke, the CEO of a former equipment supplier to Trica

Linda Brown, a self-employed pharmaceutical industry analyst

Exhibit 3

Information Concerning Trica, Discounted Cash Flow Technique

(2013-2016)

$’000, where applicable 2013 2014 2015 2016

NOPLAT 10,000 11,500 11,800 12,250

Depreciation 5,000 7,500 7,900 8,350

Net interest income 450 510 620 700

Change in working capital 220 380 470 560

Change in deferred taxes 57 60 82 48

WACC (%) 12.3

Tax rate (%) 30.0

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

7. Which of the following reasons is most likely a motivation behind Locha’s

decision to purchase Trica?

A. Lock in key suppliers

B. Increase market power

C. Acquire unique capabilities and/or resources

Correct Answer: B

Reference:

CFA Level II, Volume 3, Study Session 9, Reading 28, LOS b

Locha’s management wishes to increase their ability to influence market pricing.

In this way, they aim to increase market power.

C is incorrect. With Trica lacking a quality management team as well as there

being no identifiable unique capabilities and resources, this factor is not a

motivating force behind Locha’s purchase decision.

A is incorrect. The proposed merger between Locha and Trica is an example of a

horizontal merger. Had the merger been an example of vertical integration,

locking in key suppliers could have been a motivating force behind Trica’s

purchase decision.

8. The proposed offer is most likely an example of a:

A. statutory merger.

B. horizontal merger.

C. conglomerate merger.

Correct Answer: B

Reference:

CFA Level II, Volume 3, Study Session 9, Reading 28, LOS a

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Apart from the minor differences, Locha and Trica are in the same industry; they

both are pharmaceuticals producing drugs.

A is incorrect. The proposed merger cannot be classified as a statutory merger.

This is because both Locha and Trica will terminate their legal existence and will

be identified as Lyre, a newly formed company. In a statutory merger, one of the

companies ceases to exist as an identifiable entity and its assets and liabilities

become part of the purchasing company.

C is incorrect. Because Locha and Trica are in the same industry, the proposed

merger cannot be classified as consolidation.

9. Using the information in Exhibit 1, if the bootstrapping process works Trica’s

stock price should:

A. rise to $67.86.

B. rise to $153.41.

C. remain the same.

Correct Answer: A

Reference:

CFA Level II, Volume 3, Study Session 9, Reading 28, LOS c.

With its stock price at $65, Locha can issue 200,000 [(650,000 × $20.0)/$65] of

its shares and use the proceeds to purchase the target. Total shares outstanding of

the merged company, including Locha’s initial shares, amount to 4,200,000. The

combined earnings of the merged company will equal $10,975,000 [(2.5 ×

4,000,000) + (1.5 × 650,000)]. Thus, post-merger EPS is 2.61

($10,975,000/4,200,000).

If the bootstrapping process is successful, Locha’s management will be able to

bootstrap earnings to the higher post-merger EPS of $2.61 per share. Applying the

pre-merger P/E ratio, the share price should rise to $67.86 (26.0 × $2.61).

10. Which of the following statements is an accurate description of the measures

listed?

Measure Description

A. 1 dead-hand provision

B. 2 supermajority voting provision

C. 3 white knight defense mechanism

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: C

Reference:

CFA Level II, Volume 3, Study Session 9, Reading 28, LOS f

Measure 3 is an example of a white knight defense mechanism. Fleet Distributors

is a third party who has been offered to purchase Trica. A white knight defense

mechanism involves the target seeking a third party to purchase the company in

lieu of the acquirer. The target will seek a third party which has a good strategic

fit with it.

Measure 1 is an example of a poison pill (flip-in) defense mechanism. This

provision grants target shareholders the right to purchase its company shares at a

discount.

Measure 2 is an example of a restricted voting rights provision. This provision

restricts stockholders who have recently acquired large blocks of stock from

voting their shares. Usually, there is a triggering stockholding level, such as 15 to

20 percent.

11. How many of the proposed members lack independence?

A. 2

B. 3

C. 4

Correct Answer: B

Reference:

CFA Level II, Volume 3, Study Session 9, Reading 27, LOS e.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Of the four proposed directors three lack independence, Rodney Clab, Virginia

Gayle, and Joseph Icke.

Clab has an important and current business relationship with Locha even if he is

not an employee of the company. Thus his business relationship may compromise

his independence.

Gayle has a personal relationship with Stepan. Given that Stepan will continue to

assume his role at Lyre, the relationship may compromise her independent

judgment.

Icke is a former employee of Trica and his former employment with Trica may

compromise his independence and objectivity. At Lyre, Icke may be inclined to

favor Trica employees over Locha’s employees because of his past relationship.

Brown is an independent individual with no current or past association with the

either of the two companies. Thus she is the only proposed member who does not

lack independence.

12. Basing the terminal value on the discounted cash flow approach, the current

enterprise value of Trica is closest to (in 000s):

A. $141,856.

B. $187,618.

C. $193,655.

Correct Answer: C

Reference:

CFA Level II, Volume 3, Study Session 9, Reading 28, LOS i.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

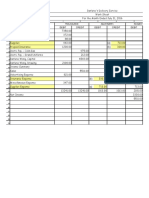

All calculations are in 000s.

$’000, where 2013 2014 2015 2016

applicable

NOPLAT 10,000.00 11,500.00 11,800.00 12,250.00

Plus: Depreciation 5,000.00 7,500.00 7,900.00 8,350.00

Less: Change in working 220.00 380.00 470.00 560.00

capital

Free cash flow 14,780.00 18,620.00 19,230.00 20,040.00

Present value @12.3% 13,161.18 14,764.55 13,578.13 12,600.24

Terminal value, 2016* $221,948.39

Terminal value, 2012** $139,551.00

$"#,#%#×'.#)

*Terminal value, 2016 = = $221,948.39

#.'")*#.#)

$""',2%3.)2

** Terminal value, 2012 = = $139,551.00

'.'")4

Total present value = $(13,161.18 + 14,764.55 + 13,578.13 + 12,600.24 +

139,551.00)

= $193,655.10

$’000, where applicable 2013 2014 2015 2016

NOPLAT 10,000 11,500 11,800 12,250

Depreciation 5,000 7,500 7,900 8,350

Net interest income 450 510 620 700

Change in working capital 220 380 470 560

Change in deferred taxes 57 60 82 48

WACC (%) 12.3

Tax rate (%) 30.0

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 13 through 18 relate to Corporate Finance

Robert Somers and John Yildiz Case Scenario

Robert Somers and John Yildiz are developing a dividend policy for their firm, Rocha

Tech. During their initial meeting Somers brings forth the following argument:

Argument 1: “The design of the dividend policy should have no impact on

shareholders’ wealth, particularly those individuals who are able to

customize dividend policy to meet their liquidity needs.”

Yildiz objects to Somers’ argument by presenting the following counter-argument:

Argument 2: “The clientele effect suggests that the design of the dividend policy does

matter. A company’s decision to initiate, increase or cut dividend conveys

credible information concerning management intentions.”

To justify his argument Yildiz goes on to identify two factors, which he believes may

affect dividend policy.

Factor 1: Rapidly developing companies design their dividend policy to provide

them with the flexibility to respond to developments and profitable

investment opportunities.

Factor 2: The dividend policy may be subject to certain limitations, one of them

being impairment of capital rule.

Next, Somers and Yildiz analyze the dividend payment history of Marshal Solutions, a

competitor with an identical operating nature and financing structure to Rocha (Exhibit).

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Exhibit

Marshal Solutions’ Dividend

Payment History

Year EPS Dividends

(adjusted) per share

(DPS)

2012 $7.66 $2.45

2011 6.89 2.06

2010 8.20 2.46

2009 7.95 2.39

2008 8.00 2.39

Somers proposes that they should consider a share repurchase program for Rocha. He

justifies his suggestion by claiming that the net impact on shareholders’ wealth will

remain the same under either a repurchase or regular dividend paying program. Rocha

currently carries debt of $30 million and holds equity with a market value of $120

million. He further determines that the company should maintain a repurchase involving

$10 million of the market of value of its common shares. Somers concludes his analysis

by stating,

Statement: “Holding all else equal, compared to issuing new debt for the repurchase

program, the increase in total debt ratio will be greater under a cash

repurchase transaction.”

13. Which of the following assumptions most likely underlie Argument 1?

A. Transaction taxes do not exist

B. Dividends do not influence share value

C. Asymmetric information exists among all investors

Correct Answer: A

Reference:

CFA Level II, Volume 3, Study Session 8, Reading 25, LOS a

The dividend irrelevance proposition is based on the assumption that capital

markets are perfect. That is, transaction costs and taxes do not exist and there is

equal (symmetric) information among all investors.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

14. Is Yildiz correct with respect to his counter-argument?

A. Yes.

B. No, the clientele effect supports the dividend irrelevance proposition.

C. No, his argument highlights the information content of dividend actions.

Correct Answer: C

Reference:

CFA Level II, Volume 3, Study Session 8, Reading 25, LOS a &b.

Yildiz’s argument highlights the information content of dividend actions

(signaling). This argument rejects the notion that there is symmetric information

among all investors. Also the argument suggests that board of directors and

management, having more information about the company, may use dividends to

signal to investors how the company is doing. This is why a company’s decision

to maintain, initiate or cut dividend conveys credible information regarding

management’s intentions.

15. Factor 1 most likely illustrates:

A. financial flexibility only.

B. investment opportunities only.

C. both financial flexibility and investment opportunities.

Correct Answer: C

Reference:

CFA Level II, Volume 3, Study Session 8, Reading 25, LOS d.

Factor 1 highlights investment opportunities and financial flexibility. All else

equal, a company with more profitable investment opportunities will pay out less

in dividends than a company with fewer investment opportunities. Since

internally generated cash flow is a cheaper source of capital, companies

undergoing rapid change and/or those with profitable investment opportunities

will modify their dividend policy to meet their needs.

Companies may reduce or omit dividends to obtain the financial flexibility

associated with having cash on hand. All else equal, a company with greater

financial capital is in a stronger position to exploit profitable investment

opportunities with minimum delay.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

16. The impairment of capital rule is most likely a component of:

A. tax considerations.

B. future earnings volatility.

C. contractual and legal restrictions.

Correct Answer: C

Reference:

CFA Level II, Volume 3, Study Session 8, Reading 25, LOS d.

The impairment of capital rule may restrict the payment of non-liquidating

dividends.

17. Using the information in the Exhibit, Marshal’s dividend policy can most likely be

characterized as:

A. stable.

B. residual.

C. constant dividend payout ratio.

Correct Answer: C

Reference:

CFA Level II, Volume 3, Study Session 8, Reading 25, LOS f

Marshal Solutions’ dividend payout policy is an example of a constant dividend

payout ratio policy. Over the five years presented, the payout ratio is constant is at

around 30%, as shown below:

Year EPS Dividends Payout

(adjusted) per share ratio

(DPS) (DPS/EPS)

2012 $7.66 $2.45 32%

2011 6.89 2.06 30%

2010 8.20 2.46 30%

2009 7.95 2.39 30%

2008 8.00 2.39 30%

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

18. Is Somers correct with respect to his statement concerning the share repurchase

program?

A. Yes

B. No, the increase in total debt ratio is greater when repurchase is made by

issuing new debt

C. No, the total debt ratio is equal regardless of whether debt or cash is used

for repurchase

Correct Answer: B

Reference:

CFA Level II, Volume 3, Study Session 8, Reading 25, LOS g

Rocha’s beginning debt ratio is 25% ($30 million/$120 million).

Following a share repurchase using cash on hand, equity should decrease by $10

million to $110 million and the debt amount should not be affected. Thus the total

debt ratio should increase to 27.3% ($30 million/$110 million).

Following a share repurchase by issuing new debt, total debt will increase by $10

million to $40 million and total equity will decrease by $10 million to $110

million. Thus the total debt ratio should increase to 36.4% ($40 million/$110

million).

Thus the increase in total debt ratio is greater when the repurchase is made by

issuing new debt.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 19 through 24 relate to Financial Reporting and Analysis

Bruce Slater, CFA, Case Scenario

Bruce Slater, CFA, is an equity analyst analyzing Howard Corp, a U.S. based

manufacturer of steel pipes. On January 1, 2011 Howard acquired an 80% stake in Flake

Interiors, a U.S. based furniture maker and a 30% stake in Graze, a U.S. farming

equipment maker.

Flake Interiors is operating in a highly competitive environment and has been forced to

reduce inventory levels to cut down production costs. Flake is finding it difficult to cope

in this extreme environment and has determined that it will need to redesign its

production process to keep up with evolving production techniques. Furthermore, input

wood prices are rapidly rising due to environmental regulations limiting deforestation

activities. The applicable tax rate is 30% and is forecasted to rise to 35% next year (in

2013). Selective financial information on the company is presented in Exhibit 1.

Flake Interiors uses the LIFO method of inventory accounting and prepares and presents

its financial statements in accordance with U.S. GAAP. If the FIFO method had been

used inventory would have been higher by $0.9 million, $1.1 million, and $1.2 million

than reported on December 31, 2010, 2011 and 2012, respectively. The breakdown of

Flake’s inventory is presented in Exhibit 2.

Graze capitalized expenditures related to software it developed in early 2008. The

software is used to build custom farming equipment based on specifications made by its

customers. The feasibility of the software was established in 2009 and the company

capitalized development costs of $6.40 million and $8.00 million in 2009 and 2010,

respectively. Amortization expense related to costs capitalized was $0.88 million and

$1.60 million in the two years, respectively. Selective financial information related to the

company is summarized in Exhibit 3. Slater aims to:

Objective 1: compare Graze’s financial results to a competitor which expenses software

development costs and

Objective 2: determine the condition required for reported net income to be higher in

current and future periods for companies which capitalize development

costs.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Slater would like to compare the impact of the pooling of interest to the acquisition

method on the consolidated financial statements of Howard and Graze. Howard’s 80%

equity stake in Graze was purchased by issuing 2,000,000 of its shares at the current

market price of $20. Balance sheet information immediately prior to the acquisition is

presented in Exhibit 4.

Exhibit 1

Selective Financial Information Concerning

Flake, Fiscal Years 2011-2012

In $’000 2012 2011

Sales 3,300 2,250

Cost of sales 990 800

Gross profit 2,310 1,450

Net profit 2,000 1,080

Inventories 3,300 2,150

Total liabilities 5,200 3,000

Total equity 1,220 1,000

Exhibit 2

Flake’s Inventory Breakdown,

Fiscal Years 2011-2012

In $’000 2012 2011

Raw materials 390 500

Work-in-progress 790 880

Finished goods inventory 2,120 770

Total 3,300 2,150

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Exhibit 3

Selective Financial Information Concerning

Graze, Fiscal Years 2009-2010

In $’000 2010 2009

Operating income 22,500 18,000

Depreciation and amortization 2,400 1,850

Net income 14,560 12,550

Shares of common stock outstanding 10,000 10,000

Market value of outstanding debt 25,000 22,000

Market price per share 45.60 25.00

Exhibit 4

Balance Sheet Information for Howard Corp and Graze

As at January 1, 2011

Howard Corp, Graze, Book

Book Value ($’000) Value*

($’000)

Total liabilities 330,000 110,000

Shareholder’s equity:

Common stock per $1 100,000 10,000

par value

Additional paid in capital 120,000 8,000

Retained earnings 15,000 7,000

*Fair value of assets and liabilities is equal to their book values

19. Using Exhibit 1 and tax rate information, if the FIFO method had been used, total-

liabilities-to-equity in 2012 would be closest to (ignoring the impact of deferred

taxes):

A. 2.52.

B. 3.64.

C. 3.94.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: A

Reference:

CFA Level II, Volume 2, Study Session 5, Reading 16, LOS e

Ignoring the impact of deferred taxes, liabilities will be unaffected by the choice

of inventory valuation method. However, the equity balance will be affected

through the retained earnings account as follows:

• Retained earnings will increase by the cumulative increase in operating profit

due to a decrease in cost of goods sold less the taxes on that profit.

Cumulative increase in cost of goods sold less taxes = $1.2 million × 0.7

= $840,000

Liabilities-to-equity = $5,200,000/($1,220,000 + $840,000)

= 2.52

20. Using the information in Exhibits 1 and 2, which of the following statements most

accurately justifies the change in inventory balance between 2011 and 2012?

A. Flake anticipates an increase in future sales

B. Flake anticipates a decline in future demand

C. Higher wood prices have raised inventory unit prices

Correct Answer: B

Reference:

CFA Level II, Volume 2, Study Session 5, Reading 16, LOS f

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Flake anticipates a decrease in future demand, earnings and sales. This is evident

from the following:

• Raw material and work-in progress are declining while finished goods

inventory has increased significantly, by 175%, signaling a possible decrease

in demand for products and lower future sales and profit.

• Growth rate of sales (47%) is lower than the growth rate of finished goods

inventory (175%); this could indicate a decline in demand and decrease in

future earnings of the company.

A is incorrect (see above).

C is incorrect. The effect of an increase in input prices has been more than offset

by the decline in raw material inventory. This also signals a potential decrease in

demand for the company’s products.

21. Based on objective 1, Graze’s adjusted EV/EBITDA ratio for the year 2010 is

closest to:

A. 14.62.

B. 15.37.

C. 28.46.

Correct Answer: C

Reference:

CFA Level II, Volume 2, Study Session 5, Reading 17, LOS a

All calculations are in $’000.

The adjusted EV/EBITDA ratio is calculated by removing the effects of

capitalization from the company’s balance sheet and expensing the costs. While

EV will require no adjustments, EBITDA will need to be adjusted to include the

effects of software development expenditures and remove amortization expense.

EV = Market of equity + Market value of outstanding debt

EBITDA = EBIT or operating income + depreciation + amortization

EV = (10,000 × $45.6) + $25,000 = $481,000

Unadjusted EBITDA = $22,500 + $2,400 = $24,900

Adjusted EBITDA = $24,900 – $8,000 = $16,900

Adjusted EV/EBITDA = $481,000/$16,900 = 28.46

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

22. Based on objective 1, Graze’s cash flow from operations in 2009 would need to

be:

A. reduced by $5.52million.

B. need to be reduced by $6.40 million.

C. need to be increased by $6.40 million.

Correct Answer: B

Reference:

CFA Level II, Volume 2, Study Session 5, Reading 17, LOS a

Since Graze was capitalizing software development costs, all expenditures

incurred would have reduced investing cash flows. However, when expensing

these costs an analyst will need to record the expenditure as an operating cash

outflow and will thus reduce 2009’s operating cash flows by $6.40 million.

23. The condition which Slater is attempting to determine most likely is that:

A. the level of inflation is low.

B. Graze should be a profitable company.

C. Graze’s development costs are increasing.

Correct Answer: C

Reference:

CFA Level II, Volume 2, Study Session 5, Reading 17, LOS a

If Graze chooses to capitalize software development costs, it will report higher net

income as long as the expense that would have resulted from amortizing prior

periods capitalized development costs is lower than the amount of current period

development costs; this will occur when the company’s development costs are

increasing.

24. Comparing the impact of the pooling method relative to the acquisition method on

the consolidated financial statements of Howard and Graze, debt-to-equity ratio is

most likely:

A. unaffected by the choice of method.

B. 0.1775 times lower when using the pooling method.

C. 0.079 times higher when using the pooling method.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: C

Reference:

CFA Level II, Volume 2, Study Session 6, Reading 18, LOS c

All $ calculations are in thousands.

Under the pooling method, the shares issued by Howard will be measured at par

value and the retained earnings of Graze would be combined with that of Howard

on the consolidated balance sheet.

Under the acquisition method, only Howard’s common stock and paid in capital

will be reported on the consolidated balance sheet and the shares issues by

Howard are measured at fair value. The retained earnings of Graze will be

included in the consolidated balance sheet post-acquisition.

Debt-to-equity ratio (pooling method):

$330,000 + $110,000

$ 100,000 + 10,000 + 2,000 ∗ +120,000 + 8,000 + 15,000 + 7,000

$440,000

= 1.679

$262,000

Debt-to-equity ratio (acquisition method):

$330,000 + $110,000

$ 100,000 + 2,000 ∗ +120,000 + 38,000 ∗∗ +15,000

$440,000

= = 1.600

$275,000

*Par value of shares issued = 2,000 × $1 = $2,000

**Additional paid in capital resulting from shares issued = (2,000 × $20) – $2,000

= $38,000

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

The debt-to-equity ratio reported under the pooling method is higher by 0.079

times higher.

Howard Corp, Graze,

Book Value Book Value*

($’000) ($’000)

Total liabilities 330,000 110,000

Shareholder’s equity:

Common stock 100,000 10,000

per $1 par value

Additional paid 120,000 8,000

in capital

Retained earnings 15,000 7,000

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 25 through 30 relate to Financial Reporting and Analysis

Caroline Forbes Case Scenario

Caroline Forbes is the chief accountant at HuberLow Corp. located in Austin, Texas.

HuberLow Corp. is the global leader in vacuum technology, earning its products the

nickname ‘Dustbusters’. With ever growing international demand, HuberLow is vigilant

in personnel management affairs as it operates on the philosophy of employees being an

entity’s most valuable asset.

The entity currently has a 200,000 workforce spread over 12 countries. The vesting

conditions have already been met by 25,000 employees and 125,000 additional

employees are expected to meet this requirement within the next ten years. Exhibit 1

provides the summarized pension data available on 31st December, 2011.

Exhibit 1

Summarized Pension Data

Available on December 31, 2011

Opening Pension Liability $48,000,000

Interest Rate 9%

Past Service Costs $780,000

Actuarial Gains and Losses $269,000

Closing Pension Liability $53,000,000

A meeting on pension management was setup by the CFO of HuberLow Corp. as the

most recent 5 years of operations have seen a significant drop in turnover rate. During a

meeting, Forbes made the following statements:

Statement 1: Prior to the vesting date, employee service is considered an asset on the

balance sheet.

Statement 2: The return on plan assets decreases the projected benefit obligation.

Statement 3: Curtailment is the reduction in the number of employees currently covered

by the existing plan.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

25. The number of employees relevant for the calculation of the accumulated benefit

obligation for ten years is closest to:

A. 125,000.

B. 150,000.

C. 200,000.

Correct Answer: B

Reference:

CFA Level II, Volume 2, Study Session 6, Reading 19, LOS b

The number of employees relevant for an accumulated benefit obligation

calculation for 10 years = Currently Vested + Expected to meet Vesting

Conditions in the next ten years= 25,000 + 125,000= 150,000.

26. Which measure of pension obligation estimation is based on the going concern

assumption?

A. Vested Benefit Obligation

B. Accumulated Benefit Obligation

C. Projected Benefit Obligation

Correct Answer: C

Reference:

CFA Level II, Volume 2, Study Session 6, Reading 19, Section 2.2

The projected benefit obligation is based on the going concern assumption as it

assumes the business to maintain its operations for the foreseeable futures.

Calculations are made using the assumed turnover rates and salary increases in

future periods.

27. The interest cost for the year ended 31st December, 2011 is closest to:

A. $4,320,000.

B. $4,390,000.

C. $4,770,000.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: A

Reference:

CFA Level II, Volume 2, Study Session 6, Reading 19, LOS c

Interest Cost= Discount rate × Beginning pension obligation=9% × $48

million=$4.32 million.

28. The first statement made by Forbes is most likely:

A. correct.

B. incorrect, prior to the vesting date, employee service is considered an

obligation on the balance sheet.

C. incorrect, prior to the vesting date, employee service is considered an

expense on the balance sheet.

Correct Answer: B

Reference:

CFA Level II, Volume 2, Study Session 6, Reading 19, LOS b

Until the vesting conditions are met and the retirement plan is exercised, the

company accrues the employees’ services rendered as an obligation to be paid off

in the future.

29. The second statement made by Forbes is most likely:

A. correct.

B. incorrect, the return on plan assets increases the projected benefit

obligation.

C. incorrect, the return on plan assets does not affect the projected benefit

obligation.

Correct Answer: C

Reference:

CFA Level II, Volume 2, Study Session 6, Reading 19, LOS d

The return on plan assets does not have any effect on the benefit obligation. The

return increases the fair value of the plan assets.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

30. The third statement made by Forbes is most likely:

A. correct.

B. incorrect, curtailment is the change in any of the assumptions in the

existing plan.

C. incorrect, curtailment is the lump-sum payoff to the plan participants.

Correct Answer: A

Reference:

CFA Level II, Volume 2, Study Session 6, Reading 19, LOS c

Curtailment occurs when the number of employees covered by the existing plan is

reduced. This reduction may be due to any number of reasons i.e. redundancy,

restructuring etc.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 31 through 36 relate to Equity Investments

Richard Boyle Case Scenario

Rachel Boyle is an equity portfolio manager at Bridge Associates, a U.S. based asset

management firm. Dennis Thorpe is a junior analyst who has been assigned to Boyle. He

will be responsible for valuing two equity stocks, Lighthouse and Wood Deck. Both

stocks are being considered for client portfolios. Thorpe begins his analysis by collecting

information on Lighthouse (Exhibit 1).

Exhibit 1

Information Concerning Lighthouse Stock

Purchase price, paid at the beginning of the year $40.80

Expected dividend per share 1.20

Actual dividend per share 1.50

Expected selling price at the end of the year 42.50

Actual selling price at the end of the year 41.00

Cost of equity* 10.80%

*This is equal to the contemporaneous required return

For the Wood Deck stock, Boyle recommends Thorpe employ two alternative

approaches. Upon Boyle’s recommendation, Thorpe selects the Fama-French model and

the Ibbotson-Chen model to develop a forward looking estimate. He collects the relevant

data in Exhibits 2 and 3, respectively.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Exhibit 2

Data for the Fama-French Model

Return on the S&P 500 index 8.8%

10-year Treasury bond rate 2.5%

1-month Treasury bill rate 1.4%

Average return on 3 small-cap portfolios 12.5%

Average return on 3 large-cap portfolios 9.3%

Average return on 2 high book-to-market portfolios 8.5%

Average return on 2 low book-to-market portfolios 9.8%

Market beta 1.2

Size beta 0.4

Value beta –0.6

Exhibit 3

Data for the Ibbotson-Chen Model

Risk-free rate 2.5%

Real GDP growth rate 5.5%

Expected growth in P/E ratio 2.8%

Forward expected dividend yield 1.1%

Reinvestment return 120 basis points

Inflation forecast 4.5%

Sensitivity to inflation forecast 1.3

Business cycle risk 3.5%

Sensitivity to business cycle risk 2.5

31. Based on the information presented in Exhibit 1, the Lighthouse stock is most

likely:

A. overvalued.

B. fairly valued.

C. undervalued.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: A

Reference:

CFA Level II, Volume 4, Study Session 10, Reading 30, LOS a

In order to determine whether the Lighthouse stock is mispriced, it is necessary to

compare the required return (cost of equity, 10.8%) with the expected holding-

period return (calculated below).

;<=>?@>A >CADCE F>GGDCE =HD?>I;<=>?@>A ADJDA>CAF

Expected holding-period return = –1

KLH?MNF> =HD?>

$42.50 + $1.20

− 1 = 0.0711

$40.80

Since the expected return is lower than the required return, the stock is

overvalued. This implies that the price of the stock is above its perceived value.

32. Using Exhibit 1, the ex post alpha on the Lighthouse stock is closest to:

A. –6.63%.

B. –3.69%.

C. –2.96%.

Correct Answer: A

Reference:

CFA Level II, Volume 4, Study Session 10, Reading 30, LOS a

Realized alpha = Actual (realized) return – required return

P?@LNG >CADCE F>GGDCE =HD?> I P?@LNG ADJDA>CAF

Actual holding-period return = -1

KLH?MNF> =HD?>

$41.00 + $1.50

− 1 = 0.04167

$40.80

Realized alpha = 0.04167 – 0.108

= – 0.0663 or – 6.63%

33. Using Exhibit 2, the Work Deck stock can most likely be classified as a:

A. small-cap value stock.

B. small-cap growth stock.

C. large-cap growth stock.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: B

Reference:

CFA Level II, Volume 4, Study Session 10, Reading 30, LOS c

Given a positive size beta, the Wood Deck stock is classified as a small-cap stock.

Furthermore, a negative value beta suggests that the stock is a growth oriented.

34. Using the information in Exhibit 2, the Fama-French estimate of required return is

closest to:

A. 10.94%.

B. 12.34%.

C. 13.44%.

Correct Answer: B

Reference:

CFA Level II, Volume 4, Study Session 10, Reading 30, Los c.

The Fama-French model for calculating required return is presented below:

mkt size value

ri = RF + Bi RMRF + Bi SMB + Bi HML

= 1.4% + 1.2(8.8% – 1.4%) + 0.4(12.5% – 9.3%) + (– 0.6)(8.5% – 9.8%)

= 12.34%

35. Using the information in Exhibit 3, the Ibbotson-Chen model’s estimate of

required return is closest to:

A. 9.7%.

B. 14.6%.

C. 15.6%.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: C

Reference:

CFA Level II, Volume 4, Study Session 10, Reading 30, LOS b

The Ibbotson-Chen model for deriving the required return estimate is as follows:

Required rate of return = {[[1 + EINFL](1 + EGREPS*)(1 + EGPE) – 1.0] +

EINC}

= {[1 + 4.5%][1 + 5.5%][1 + 2.8%] – 1.0 + [1.1% + 1.2%]

= 15.63%

*This quantity should approximately track the real GDP growth rate.

36. A limitation of using a model which generates forward-looking estimates is that:

A. it may suffer from data mining bias.

B. it is subject to behavioral biases in forecasting.

C. nonstationarity may render the estimates less useful.

Correct Answer: B

Reference:

CFA Level II, Volume 4, Study Session 10, Reading 30, LOS e

The Ibbotson-Chen model is an example of a macroeconomic model. Forward-

looking estimates generated by such a model are subject to behavioral biases in

forecasting.

A and C are incorrect. Models which generate forward-looking estimates are less

subject to nonstationarity or data biases (such as data mining) than historical

estimates.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 37 through 42 relate to Equity Investments

Guinness Associates Case Scenario

Guinness Associates is an equity research firm providing stock valuation among other

services. Yuzuki Iwate is the chief valuator at Guinness. She is valuing the stock of two

manufacturing concerns, Cable and Rightmore; both corporations operate in different

industries.

Cable installs electric cables in homes and offices. The company is currently undergoing

a rough period which has put its survival in jeopardy. Although the company has

managed to generate positive EPS to present date, predictability of future earnings has

become highly uncertain. Iwate determines that the price-to-book-value (P/BV) ratio is

most appropriate for valuing Cable by providing the following justifications:

Justification 1: Book value is a useful valuation measure for companies which are not

expected to continue as a going concern.

Justification 2: Book value is an appropriate measure for companies which are primarily

composed of liquid assets.

Justification 3: Book value is less subject to manipulation than earnings.

Iwate summarizes selective financial information for valuing Cable (Exhibit 1).

Exhibit 1: Selective Financial Information Concerning Cable

Current market price $42.92

EPS over most recent four quarters 14.70

Current dividend per share $5.00

Growth rate 3%

Required rate of return 15%

Total shareholder’s equity $1,200,000

Preference shares $250,000

Number of common shares outstanding 800,000

Number of preference shares outstanding 125,000

Industry median P/BV 40.80

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Rightmore is a chip manufacturer which has been in operation for almost six years. Iwate

will be valuing Rightmore using the P/CF multiple. Using this technique she is

attempting to ascertain the relative valuation of the Rightmore stock. Iwate will conduct

her analysis by comparing the manufacturer to a competitor, Gadget, Inc. The necessary

information for performing P/CF analysis is summarized in Exhibit 2. Furthermore, Iwate

will also determine Gadget, Inc.’s P/S ratio and has collected the necessary information

in Exhibit 3.

Iwate concludes her analysis by determining that the most ideal cash flow measure is one

which is closely related to valuation theory and reflects the amount of required capital

expenditures.

Exhibit 2

Information Concerning Rightmore and

Gadget, Inc. – P/CF Analysis

P/CF 5-Year Consensus

Growth Rate (%)

Rightmore 12.5 6.7

Gadget, Inc. 16.5 5.2

Exhibit 3

Information Concerning

Gadget, Inc. – P/S Calculation

$’000

Sales 550

Total assets 1,295

Total liabilities 360

Net profit 100

Dividend payout ratio (%) 35

Required rate of return (%) 12.5

37. The most appropriate justified P/E ratio for Cable is closest to:

A. 2.83.

B. 2.92.

C. 3.01.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Correct Answer: B

Reference:

CFA Level II, Volume 4, Study Session 12, Reading 36, LOS b & c

The most appropriate P/E multiple is the trailing P/E multiple. This is because

future earnings cannot be predicted with certainty. In this scenario, it will be

necessary for Iwate to rely on past earnings.

KQ $%".2"

Justified trailing P/E = = = 2.92

;Q $'%.R#

38. Based on the P/BV approach and the information in Exhibit 1, Cable is:

A. overvalued.

B. fairly valued.

C. undervalued.

Correct Answer: C

Reference:

CFA Level II, Volume 4, Study Session 12, Reading 36, LOS r.

Cable stock’s book value per share = Common shareholders’ equity/number of

common shares outstanding.

Common shareholders’ equity = Shareholders’ equity – total value of equity

claims that are senior to common stock

Common shareholders’ equity = $1,200,000 – $250,000

= $950,000

Book value per share = $950,000/800,000 = 1.1875

Cable stock’s price-to-book value = 42.92/1.1875 = 36.14

Compared to the industry median P/BV ratio (40.80), Cable appears to be

relatively undervalued.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

39. Which of Iwate’s justifications support the use of the P/BV approach for valuing

the Cable stock?

A. Justification 1

B. Justification 2

C. Justification 3

Correct Answer: A

Reference:

CFA Level II, Volume 4, Study Session 12, Reading 36, LOS c

Justification 1 most appropriately supports the use of the P/BV multiple for

valuing Cable. Cable’s going concern status is highly uncertain and thus book

value is appropriate for companies that are not expected to continue in this

manner in the foreseeable future.

Justification 2 does not support the use of the P/BV multiple for valuing Cable.

Cable is a manufacturing concern. Companies chiefly comprising of liquid assets

include finance, investment, insurance and banking institutions.

Justification 3 does not support the use of the P/BV multiple for valuing Cable.

With respect to manipulation book value and earnings are almost equal; that is,

both are subject to manipulation.

40. Based on the information in Exhibit 2, Rightmore is most likely:

A. overvalued.

B. fairly valued.

C. undervalued.

Correct Answer: C

Reference:

CFA Level II, Volume 4, Study Session 12, Reading 36, LOS r

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Rightmore’s P/CF ratio is lower than Gadget, Inc.’s ratio (12.5 vs. 16.5,

respectively). This suggests that Rightmore is undervalued based on the P/CF

ratio. All else equal, it is expected that investors would expect a higher growth

rate for Gadget, Inc. However, based on the consensus 5-year growth rate,

Rightmore’s growth rate is 1.5% higher.

In conclusion, Rightmore is relatively undervalued based on the P/CF ratio and

expected growth rate.

41. Using the information in Exhibit 3, the justified P/S multiple based on the Gordon

growth model for the Gadget, Inc. stock is closest to:

A. 1.23.

B. 2.28.

C. 6.95.

Correct Answer: A

Reference:

CFA Level II, Volume 4, Study Session 12, Reading 36, LOS h

Based on the Gordon growth model, P/S is stated as:

P0 (E0 S 0 )(1 − b)(1 + g )

=

S0 r−g

g =𝑏×𝑅𝑂𝐸

= (1 – 0.35) × $100,000/($1,295,000 – $360,000)

= 6.95%

P0 ($100,000 $550,000)(0.35)(1 + 0.0695)

= = 1.2263 or 1.23

S0 0.125 − 0.0695

42. The cash flow measure which Iwate is referring to is most likely known as:

A. CFO.

B. FCFF.

C. EBITDA.

Correct Answer: B

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Reference:

CFA Level II, Volume 4, Study Session 12, Reading 36, LOS m

Iwate is referring to the FCFF measure. FCFF directly reflects the amount of a

company’s required capital expenditures and has a stronger link to valuation

theory than EBITDA.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 43 through 48 relate to Fixed Income

East Side Analytics Case Scenario

East Side Analytics (EA) is a market research firm based in the U.S. Sergio Marcus is

one of the firm’s research analysts and specializes in fixed income securities. Marcus is

preparing a research report on how credit risk in the fixed income market has evolved

calling for credit analysis models which explore correlated default risk based on

macroeconomic factors.

Marcus begins his study by attempting to address the following question, “Why are

traditional approaches limited in their ability to manage credit risk?”

To answer this question, Marcus draws three limitations of traditional credit analysis

techniques.

Limitation 1: Credit scores are insensitive to economic conditions; a deteriorating

economy will have little to no effect on a borrower’s credit riskiness.

Limitation 2: Credit ratings represent a complex statistical technique for analyzing the

credit risk of a borrower.

Limitation 3: Credit ratings and credit scores tend to be highly volatile over the business

cycle.

Following his analysis of traditional credit risk measures, Marcus proceeds to explore

structural and reduced form models. For this task he pairs with Lisa Fernandez, his

subordinate. During a meeting between the two Fernandez states, “The structural model

makes an assumption regarding the distribution of asset prices which has implications for

a company’s loss distribution.”

With respect to the reduced form model, Fernandez and Marcus arrive at the following

conclusions which will be included in the report:

Conclusion 1: The estimation procedure used by the reduced form model is flexible

allowing for default probabilities to vary with the state of the economy.

Conclusion 2: The parameters, default probabilities and loss given default, used to value

debt are subject to model assumptions.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Conclusion 3: The decomposition of credit spread in the reduced form model reveals an

absence of liquidity risk.

Marcus believes that their analysis is incomplete without an illustration of how credit risk

measures are derived using the reduced form model. He collects data with respect to a

two-year zero-coupon bond issue (Exhibit). He has assumed a constant default

probability and loss given default for his analysis.

Exhibit: Data Concerning a Two-

Year Zero-Coupon Bond Issue

Face value $895

Time to maturity 1.5 years

Default intensity 0.03

Loss given default 0.55

43. With regards to the limitations of traditional credit measures, Marcus is most

accurate with respect to Limitation:

A. 1.

B. 2.

C. 3.

Correct Answer: A

Reference:

CFA Level II, Volume 5, Study Session 15, Reading 46, LOS b & c

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Marcus is accurate with respect to Limitation 1 only. Credit scores do not

explicitly depend on the external business cycle or macroeconomic conditions.

These credit measures are subject to adjustment if the borrower’s behavioral or

financial circumstances change.

Marcus is inaccurate with respect to Limitation 2. Credit ratings represent a

simple statistic that summarizes a complex credit analysis of a potential borrower.

Marcus is inaccurate with respect to Limitation 3. Credit rating agencies aim to

keep ratings stable over time in order to reduce unnecessary volatility of debt

prices. In addition, many lenders prefers stability in credit scores over accuracy

and so there may be pressure on credit rating agencies when generating credit

scores.

44. The implication of the return distribution which Fernandez is referring to in her

statement is that the loss distribution will becharacterized by:

A. fat tails.

B. thin tails.

C. symmetry.

Correct Answer: B

Reference:

CFA Level II, Volume 5, Study Session 15, Reading 46, LOS f

The structural model assumes that the return distribution of asset prices is

lognormal; this assumption implies a thin tail for the company’s loss distribution.

However, there is evidence that the loss distribution is in fact characterized by

tails which are fatter than those implied by a lognormal distribution.

45. The estimation procedure discussed in Conclusion 1 is most likely known as:

A. implicit.

B. lognormal.

C. hazard rate.

Correct Answer: C

Reference:

CFA Level II, Volume 5, Study Session 15, Reading 46, LOS e

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

C is correct. The reduced form model uses historical estimation for estimating the

parameters. This approach is an application of hazard rate estimation.

A is incorrect. Implicit estimation is not typically used because the technique

unrealistically assumes that default probability and loss given default do not

depend on the macroeconomic state of the economy. An unrealistic model

produces biased estimates which are inconsistent with the market structure.

46. In context of Conclusion 2, default probabilities in a reduced form model are least

likely subject to the assumption of:

A. systemic risk.

B. going concern.

C. idiosnycratic risk.

Correct Answer: B

Reference:

CFA Level II, Volume 5, Study Session 15, Reading 46, LOS f

Based on model assumptions, default probabilities depend on the business cycle

through macroeconomic state variables. This allows for the probability of default

to increase during a recession and decline during expansions. This leads to

probabilities being subject to the assumption of systemic risk.

In addition, whether a particular company defaults will depend on company-

specific considerations. This assumption will result in default probabilities being

subject to company-specific factors which are unrelated to the economy.

47. Conclusion 3 is accurately stated because the reduced form model assumes that:

A. assets trade in frictionless markets.

B. the riskless rate of interest is stochastic.

C. a company’s zero-coupon bond trades in frictionless markets.

Correct Answer: C

Reference:

CFA Level II, Volume 5, Study Session 15, Reading 46, LOS f & g

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

The assumption that a company’s zero-coupon bond trades in frictionless markets

implies that there is no quantity impact of a sale or purchase transaction on the

price of a security. The presence of such a quantity impact introduces liquidity

risk. Therefore, the assumption of frictionless markets is equivalent to that of an

absence of liquidity risk. Therefore, the credit spread in reduced form models is

entirely due to credit risk.

A is incorrect. The reduced form model does make assumptions about the assets

of a company as the only security required to be traded is the zero-coupon bond.

C is incorrect. The interest rate pattern does not have any implications for market

liquidity.

48. Using the data in the Exhibit, the maximum amount a bondholder would be

willing to pay to remove credit risk of the bond is:

A. $7.35.

B. $21.88.

C. $26.45.

Correct Answer: B

Reference:

CFA Level II, Volume 5, Study Session 15, Reading 46, LOS e

The maximum amount a bondholder would be willing to pay to insurer to remove

the credit risk from the bond is $21.88 and is measured by the expected loss (see

below).

[ ] [

Expected loss = K 1 − e −λγ (T −t ) = 895 1 − e −0.55(0.03)(1.5) = $21.8794 ]

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 49 through 54 relate to Alternative Investments

Walter Associates (WALAS) Case Scenario

Walter Associates (WALAS) is a U.S. based asset management firm operating several

autonomous subsidiaries in America. Ellen Grant works for the Chicago subsidiary, one

of WALAS’s largest independent bodies responsible for the management of funds of

private wealth clients. Grant is part of the research department at the subsidiary and is an

expert in the valuation of private real estate investments. Grant just wrote an article about

real estate valuation that got published in the ‘Financial Universe’, a well-known

financial magazine. In the article, Grant mentioned the use of real estate indices as

investor benchmarks and also stated limitations in their construction. Grant made the

following comments about the two major types of indices—appraisal-based and

transaction-based.

Appraisal-based: “The return on the index is calculated as the sum of the income

return and the capital return. This is equivalent to the sum of the

cash return and the change in value of the index.”

Transaction-based: “A repeat sales index relies on sales of the same property and

hence, the change in value indicates how market conditions have

changed over time. On the other hand, a hedonic index includes

more than one property and hence, the change in value reflects the

differences in property characteristics and changes in market

conditions.”

Grant also explained the use of the cost approach to real estate valuation, and used the

example of a 15-year old industrial property to elucidate the methodology. The article

described the following property characteristics:

“The property has an effective age of 20 years. Although it was constructed in

accordance with appropriate construction standards, it has a smaller storage space than is

required by current standards. To construct a factory with the same storage space would

cost $25 million, but to construct one with a bigger storage space in accordance with

current standards would cost $28 million. The floor needs to be replaced at a cost of

$500,000, and some leakage repairs would cost $70,000. All these repairs will increase

the value of the factory by at least the amount they cost. The small storage space has

increased inventory storage costs by $30,000 per year. The remaining economic life of

the factory is 70 years, and the cap rate that appraisers use to value the property is 15%.

Also, based on comparable sales of land, the land is estimated to be worth $10 million.”

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Grant is evaluating investment in a property that is expected to generate an NOI of

$1,000,000 next year. The property has an appraised value of $10 million and is 60%

financed by an interest-only loan at a 9% interest rate. If Grant plans to invest, he expects

to sell the property for $12 million after seven years. After his evaluation, Grant made the

following conclusions.

Conclusion 1: “The IRR that would be earned over the holding period is 11.5%.”

Conclusion 2: “The loan has increased the IRR that an equity investor would receive.

This reflects positive financial leverage.”

To corroborate his conclusions, Grant read a research article written by Jim Right, his

boss and a real estate analyst at the firm. Right had mentioned a number of commercial

and industrial properties in his paper, including a fully let property with a rent of $75,000

per year. The property was expected to generate an NOI of $50,000 per year. Right stated

that based on recent sales of comparable properties, the current value of the property was

$3 million. After reading the article, Grant approached Right and made the following

comment:

“I believe that the total return that an investor might expect to get from investment in this

property is 2.5%. This is equivalent to the all risks yield as well as the IRR or yield to

maturity of the investment.”

Grant is planning to invest some money in publicly traded real estate securities. When

talking to Right about it, Grant stated the following objectives that he wished to achieve

with the invested capital:

Objective 1: “Since most of my capital is invested in high-risk investments, I wish to

invest this money in a public equity real estate investment that has the

highest income yield and income growth potential.”

Objective 2: “Also, I would want to minimize taxes paid and increase the predictability

of my income.”

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

49. With respect to the comments in her article, Grant is most accurate with respect

to:

A. Statement 1 only.

B. Statement 2 only.

C. both statements 1 and 2.

Correct Answer: A

Reference:

CFA Level II, Volume 5, Study Session 13, Reading 39, LOS k

Statement 1 is correct. The return on the index is calculated as the sum of the

index return and the capital return. The total return can also be thought of as

measuring the cash flow plus the change in value.

Statement 2 is incorrect. A repeat sales index relies on repeat sales of the same

property and hence, change in value between two dates indicates how market

conditions have changed over time. On the other hand, a hedonic index requires

only one sale. However, the way it controls for the fact that different properties

are selling each quarter is to include variables in the regression that control for

differences in the characteristics of the property. Since the index controls for these

differences, the change in value reflects changing market conditions only.

50. The value of the industrial property mentioned in Grant’s article using the cost

approach is closest to:

A. $28,134,446.

B. $29,392,857.

C. $31,134,445.

Correct Answer: C

Reference:

CFA Level II, Volume 5, Study Session 13, Reading 39, LOS e

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Replacement cost: $28 million

Curable Physical Depreciation:

Floor: $500,000

Leakage repair: $70,000

Total: $570,000

Incurable Physical Depreciation:

20/90 = 0.222 × ($28 million – $570,000) = $6,095,555.495

Incurable functional obsolescence:

$30,000/0.15 = $200,000

Hence, value is:

$28,000,000 – 570,000 – 6,095,555 – 200,000 = $21,134,445

Plus the value of land of $10 million: $31,134,445.

51. Grant is most accurate with respect to:

A. Conclusion 1 only.

B. Conclusion 2 only.

C. both conclusions 1 and 2.

Correct Answer: B

Reference:

CFA Level II, Volume 5, Study Session 13, Reading 39, LOS m

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Conclusion 1 is incorrect. 11.5% is the cash return, not the IRR.

Conclusion 2 is correct. The IRR based on an unleveraged investment in the

property is 11.98%.

FV: 12 million

PV: –10 million

PMT: 1 million

N=7

CPT I/Y: 11.98%

Hence, the property earns 11.98% before adding the loan, and the loan is at 9%,

so the investor benefits from the spread between the two rates.

52. With regards to the comment about the article that Right wrote, Grant is most

accurate with respect to the:

A. all risks yield only.

B. total return and the all risks yield only.

C. total return, all risks yield, IRR and yield to maturity.

Correct Answer: C

Reference:

CFA Level II, Volume 5, Study Session 13, Reading 39, LOS f

For a fully let property, the capitalization rate is applied to the rent not the NOI.

The cap rate, also called the all risks yield is: 75,000/3,000,000 = 2.5% Since rent

is expected to be $75,000 per year (like a perpetuity) the cap rate will be the same

as the total return and the all risks yield will be an internal rate of return (IRR) or

yield to maturity.

53. With regards to objective 1, which of the following would be the most appropriate

real estate investment for Grant?

A. REIT

B. REOC

C. Neither REIT nor REOC.

Correct Answer: C

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Reference:

CFA Level II, Volume 5, Study Session 13, Reading 39, LOS b

REITs have the highest income yields and payout ratios, but since they cannot

retain significant cash flows (to meet tax requirements) income growth potential

may be low to moderate.

A REOC does not have the highest income yield but it may have high income

growth potential because REOCs are free to reinvest as much of their income as

they believe is appropriate to achieve growth.

54. With regards to objective 2, which of the following would be the most appropriate

real estate investment for Grant?

A. REIT

B. ROEC

C. Either REIT or REOC.

Correct Answer: A

Reference:

CFA Level II, Volume 5, Study Session 13, Reading 39, LOS b

If REITs meet certain criteria (regarding distributions) they are exempt from

double taxation of income. Also, due to the contractual nature of REITs’ rental

income, earnings predictability is an advantage of investing in REITs.

FinQuiz.com © 2016 - All rights reserved.

CFA Level II Mock Exam 3 – Solutions (PM)

Questions 55 through 60 relate to Portfolio Management

Star Capital Investment (Star-Cap) Case Scenario

Star Capital Investments (Star-Cap) is a leading investment management firm that offers

financial advice and portfolio management services to private wealth clients. Most of the

portfolio managers at Star-Cap follow active portfolio management strategies, and try to

add value through superior stock-selection. Craig Connolly is one of the most senior

investment advisors at the firm. Connolly has made several media appearances, and has

attended a number of financial conferences. During one such financial discussion held at

Comprehensive Investments, a financial firm, Connolly made the following comments:

Statement 1: “An investor with a long term horizon has the ability to take greater risk