Professional Documents

Culture Documents

NeedlesPOA12e - P 15-05

NeedlesPOA12e - P 15-05

Uploaded by

SamerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NeedlesPOA12e - P 15-05

NeedlesPOA12e - P 15-05

Uploaded by

SamerCopyright:

Available Formats

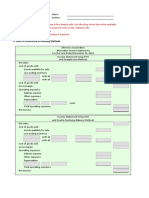

P-15-05 Name:

Section:

Enter the appropriate amount or item in the shaded cells. Use the drop-down lists when available.

An asterisk (*) will appear next to an incorrect entry in the outlined cells.

Enter any cash outflows and deductible values with minus sign.

1. Yong Company

Statement of Cash Flows

For the Year Ended December 31, 2014

Cash flows from operating activities:

Adjustments to reconcile net income to net

cash flows from operating activities:

Changes in current assets and current liabilities:

Net cash flows from operating activities

Cash flows from investing activities:

Net cash flows from investing activities

Cash flows from financing activities:

Net cash flows from financing activities

Net in cash

Schedule of Noncash Investing and Financing Transactions

3.

Cash Flow Yield =

= times

Free Cash Flow =

P-15-05_Sol. Name: Solution

Section:

Enter the appropriate amount or item in the shaded cells. Use the drop-down lists when available.

An asterisk (*) will appear next to an incorrect entry in the outlined cells.

Enter any cash outflows and deductible values with minus sign.

1. Yong Company

Statement of Cash Flows

For the Year Ended December 31, 2014

Cash flows from operating activities:

Net income $ 11,000

Adjustments to reconcile net income to net

cash flows from operating activities:

Depreciation $ 46,800

Gain on sale of furniture and fixtures (7,000)

Changes in current assets and current liabilities:

Decrease in accounts receivable 34,800

Decrease in merchandise inventory 100,000

Decrease in prepaid rent 1,000

Decrease in accounts payable (57,000)

Decrease in income taxes payable (3,000) 115,600

Net cash flows from operating activities $ 126,600

Cash flows from investing activities:

Sale of furniture and fixtures $ 13,800

Purchase of furniture and fixtures (39,600)

Net cash flows from investing activities (25,800)

Cash flows from financing activities:

Repayment of notes payable $ (20,000)

Issue of notes payable 40,000

Payment of dividends (6,000)

Net cash flows from financing activities 14,000

Net increase in cash $ 114,800

Cash at beginning of year 50,000

Cash at end of year $ 164,800

Schedule of Noncash Investing and Financing Transactions

Conversion of bonds into com. stock $ 100,000

3.

Cash Flow Yield =

$ 126,600 / $ 11,000 = 11.5 times

Free Cash Flow = $ 94,800

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Invoice 20154352Document2 pagesInvoice 20154352Milan NayekNo ratings yet

- Ap State Reorganisation Act PDFDocument39 pagesAp State Reorganisation Act PDFTrinadhTejaCheepurupalliNo ratings yet

- Contract To Sell: (Note: Terms and Conditions Below Are Sample Only, Please Revise)Document3 pagesContract To Sell: (Note: Terms and Conditions Below Are Sample Only, Please Revise)Louie SupapoNo ratings yet

- Local Governments DigestsDocument338 pagesLocal Governments DigestsMabs NebresNo ratings yet

- Opinion EssayDocument14 pagesOpinion EssayViet MaiNo ratings yet

- SAP Pocessing ClassesDocument30 pagesSAP Pocessing ClassesAlessandro Lincoln100% (2)

- Law Case DigestDocument7 pagesLaw Case DigestCesar CoNo ratings yet

- Example Selecting Cases in SPSSDocument1 pageExample Selecting Cases in SPSSSamerNo ratings yet

- Anscombe's Data WorkbookDocument5 pagesAnscombe's Data WorkbookSamerNo ratings yet

- Needles POA 12e - P 12-07Document4 pagesNeedles POA 12e - P 12-07SamerNo ratings yet

- Example One Sample T TestDocument1 pageExample One Sample T TestSamerNo ratings yet

- NeedlesPOA 12e - P 07-02Document6 pagesNeedlesPOA 12e - P 07-02SamerNo ratings yet

- NeedlesPOA12e - P 02-05Document9 pagesNeedlesPOA12e - P 02-05SamerNo ratings yet

- NeedlesPOA12e - P 05-03Document6 pagesNeedlesPOA12e - P 05-03SamerNo ratings yet

- NeedlesPOA12e - P 02-08Document8 pagesNeedlesPOA12e - P 02-08SamerNo ratings yet

- NeedlesPOA12e - P 16-11Document2 pagesNeedlesPOA12e - P 16-11SamerNo ratings yet

- NeedlesPOA12e - P 05-06Document4 pagesNeedlesPOA12e - P 05-06SamerNo ratings yet

- NeedlesPOA12e - P 02-03Document8 pagesNeedlesPOA12e - P 02-03SamerNo ratings yet

- NeedlesPOA 12e - P 06-04Document3 pagesNeedlesPOA 12e - P 06-04SamerNo ratings yet

- Needles POA 12e - P 12-03Document2 pagesNeedles POA 12e - P 12-03SamerNo ratings yet

- NeedlesPOA12e - P 16-01Document3 pagesNeedlesPOA12e - P 16-01SamerNo ratings yet

- NeedlesPOA12e - P 08-04Document2 pagesNeedlesPOA12e - P 08-04SamerNo ratings yet

- Soal Ujian Kelas 2 MaDocument6 pagesSoal Ujian Kelas 2 MaMuhammad Rifqi KhaerurrahmanNo ratings yet

- TAX3761 - Test 2 June 2022Document10 pagesTAX3761 - Test 2 June 2022lennoxhaniNo ratings yet

- Chandra Enterprises CRN-3Document1 pageChandra Enterprises CRN-3Aarvee FoodNo ratings yet

- Annual Report 2007Document52 pagesAnnual Report 2007rafayahmad02No ratings yet

- Amity Business School: MBA Class of 2010, Semester I Accounting For Managers Fund Flow Statement by Santosh KumarDocument16 pagesAmity Business School: MBA Class of 2010, Semester I Accounting For Managers Fund Flow Statement by Santosh Kumarkumaranil_1983No ratings yet

- JioMart Invoice 1700900421980Document1 pageJioMart Invoice 1700900421980shanky.scribdNo ratings yet

- Direct Tax Amendments May Nov 19 New by CA Siddartha SuranaDocument17 pagesDirect Tax Amendments May Nov 19 New by CA Siddartha SuranaKumar SwamyNo ratings yet

- New Microsoft Office Word DocumentDocument5 pagesNew Microsoft Office Word DocumentSupriya SahayNo ratings yet

- Cost Sheet Cosmos 3C-3104Document1 pageCost Sheet Cosmos 3C-3104Ajay RNo ratings yet

- Transfer Pricing Relevant Changes For 2022 in Mexico 1664516217Document4 pagesTransfer Pricing Relevant Changes For 2022 in Mexico 1664516217Arturo PachecoNo ratings yet

- The Johnson Chemical Company Has Just Received A Special SubcontractingDocument1 pageThe Johnson Chemical Company Has Just Received A Special SubcontractingLet's Talk With HassanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)vikash kumarNo ratings yet

- Times Leader 10-03-2012Document40 pagesTimes Leader 10-03-2012The Times LeaderNo ratings yet

- Listening 1Document4 pagesListening 1crazydownloaderNo ratings yet

- Warmaking and Statemaking As Organized CrimeDocument18 pagesWarmaking and Statemaking As Organized CrimejeffNo ratings yet

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesJustin Laraño RabagoNo ratings yet

- InstacartDocument18 pagesInstacartGeekWireNo ratings yet

- Invoice FormatDocument1 pageInvoice FormatudayNo ratings yet

- 610ba5b6e0e61 OLYMPIAD SAMPLE QUESTIONSDocument4 pages610ba5b6e0e61 OLYMPIAD SAMPLE QUESTIONSkaushikshreya1997No ratings yet

- 1111 PDFDocument14 pages1111 PDFKorode TaiwoNo ratings yet

- Untitled 1Document25 pagesUntitled 1Juncheng Wu0% (1)

- CapitalDocument5 pagesCapitalnarendravaidya18No ratings yet

- En Banc Commissioner OF Internal Revenue, G. R. No. 163653Document12 pagesEn Banc Commissioner OF Internal Revenue, G. R. No. 163653ecinue guirreisaNo ratings yet