Professional Documents

Culture Documents

NeedlesPOA12e - P 16-05

NeedlesPOA12e - P 16-05

Uploaded by

SamerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NeedlesPOA12e - P 16-05

NeedlesPOA12e - P 16-05

Uploaded by

SamerCopyright:

Available Formats

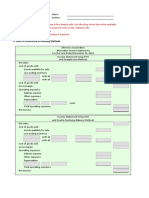

P-16-05 Name:

Section:

Enter the appropriate amount or item in the shaded cells. Use the drop-down lists when available.

An asterisk (*) will appear next to an incorrect entry in the outlined cells.

Enter all values as positive numbers.

Round your answers to one decimal place if required.

1. Effect of Alternative Accounting Methods

Furlong Corporation

Alternative Income Statements

For the Year Ended December 31, 2014

Income Statement Using FIFO

and Straight-Line Methods

Net sales

Cost of goods sold:

Goods available for sale

Less ending inventory

units at

units at

Cost of goods sold

Gross margin

Operating expenses:

Salaries expense

Other expenses

Depreciation

Years

Total operating expenses

Net income

Income Statement Using LIFO

and Double-Declining-Balance Methods

Net sales

Cost of goods sold:

Goods available for sale

Less ending inventory

units at

units at

Cost of goods sold

Gross margin

Operating expenses:

Salaries expense

Other expenses

Depreciation

Total operating expenses

Net income

2.

Furlong Corporation

Schedule of Differences in Net Income

For the Year Ended December 31, 2014

Difference in net income:

Net income using FIFO and straight-line methods

Net income using LIFO and double-declining-

balance methods

Difference in net income

Differences resulting from alternative methods:

Cost of goods sold:

FIFO

LIFO

Depreciation:

Straight-line method

Double-declining-balance method

Difference in net income

3.

Inventory Turnover

Cost of Goods Sold Ending Inventory

FIFO Method: = times

LIFO Method: = times

4.

Return on Assets

Net Income Total Assets

FIFO/Straight-Line Methods =

LIFO/Double-Decl.-Balance =

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Financial Statements Answers FFFFFFFFFFF PDFDocument27 pagesFinancial Statements Answers FFFFFFFFFFF PDFJHEYNo ratings yet

- How To Start A Business Ultimate GuideDocument31 pagesHow To Start A Business Ultimate GuideJean Fajardo BadilloNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cost AccountingDocument27 pagesCost AccountingRamesh Shanmugam25% (4)

- Teresita Buenaflor ShoesDocument23 pagesTeresita Buenaflor ShoesRonnie Lloyd Javier78% (32)

- Retailing Management Canadian 5th Edition Levy Test BankDocument23 pagesRetailing Management Canadian 5th Edition Levy Test Bankneilbrown19092003fsd100% (24)

- Cost Accounting Hilton 13Document10 pagesCost Accounting Hilton 13Vin TenNo ratings yet

- Ent530 - Business Plan - Guidelines & TemplateDocument16 pagesEnt530 - Business Plan - Guidelines & Templateafiqah100% (1)

- Direct and Indirect MaterialsDocument19 pagesDirect and Indirect MaterialsKraziegyrl LovesUtoomuch0% (1)

- Agency, Home-Office Branch Accounting JLM Agency Accounting: Page 1 of 1Document1 pageAgency, Home-Office Branch Accounting JLM Agency Accounting: Page 1 of 1Pam CayabyabNo ratings yet

- Process Costing TestbankDocument46 pagesProcess Costing TestbankDaniel Ong100% (10)

- Anscombe's Data WorkbookDocument5 pagesAnscombe's Data WorkbookSamerNo ratings yet

- Example Selecting Cases in SPSSDocument1 pageExample Selecting Cases in SPSSSamerNo ratings yet

- Example One Sample T TestDocument1 pageExample One Sample T TestSamerNo ratings yet

- Needles POA 12e - P 12-07Document4 pagesNeedles POA 12e - P 12-07SamerNo ratings yet

- NeedlesPOA12e - P 02-05Document9 pagesNeedlesPOA12e - P 02-05SamerNo ratings yet

- NeedlesPOA12e - P 05-06Document4 pagesNeedlesPOA12e - P 05-06SamerNo ratings yet

- NeedlesPOA 12e - P 07-02Document6 pagesNeedlesPOA 12e - P 07-02SamerNo ratings yet

- NeedlesPOA12e - P 05-03Document6 pagesNeedlesPOA12e - P 05-03SamerNo ratings yet

- NeedlesPOA12e - P 16-11Document2 pagesNeedlesPOA12e - P 16-11SamerNo ratings yet

- NeedlesPOA12e - P 16-01Document3 pagesNeedlesPOA12e - P 16-01SamerNo ratings yet

- NeedlesPOA12e - P 02-08Document8 pagesNeedlesPOA12e - P 02-08SamerNo ratings yet

- Needles POA 12e - P 12-03Document2 pagesNeedles POA 12e - P 12-03SamerNo ratings yet

- NeedlesPOA12e - P 08-04Document2 pagesNeedlesPOA12e - P 08-04SamerNo ratings yet

- NeedlesPOA12e - P 02-03Document8 pagesNeedlesPOA12e - P 02-03SamerNo ratings yet

- NeedlesPOA 12e - P 06-04Document3 pagesNeedlesPOA 12e - P 06-04SamerNo ratings yet

- Accounting Principles Manual Chapter 5 (Brief Exercises)Document5 pagesAccounting Principles Manual Chapter 5 (Brief Exercises)Dani SaputraNo ratings yet

- A211 MC4 MFRS108 Mfrs110-StudentDocument6 pagesA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingNo ratings yet

- CHAPTER 4 Product and Service Costing: Overhead Application and Job-Order SystemDocument28 pagesCHAPTER 4 Product and Service Costing: Overhead Application and Job-Order SystemMudassar Hassan100% (1)

- A Study On Inventry of HSC Silk PlastDocument62 pagesA Study On Inventry of HSC Silk PlastKeleti SanthoshNo ratings yet

- Chapter 1 Cost Accounting 2020Document21 pagesChapter 1 Cost Accounting 2020magdy kamelNo ratings yet

- Cost Sheet NewDocument25 pagesCost Sheet Newnagesh dashNo ratings yet

- Asistensi Akmen Ch.8Document12 pagesAsistensi Akmen Ch.8Irham SistiasyaNo ratings yet

- Practical Accounting Part 1Document18 pagesPractical Accounting Part 1Jonacress Callo CagatinNo ratings yet

- Acc 211B Job Order Costing - ActivityDocument5 pagesAcc 211B Job Order Costing - Activityjr centenoNo ratings yet

- AFAR - Standard and PRocess AssessmentDocument7 pagesAFAR - Standard and PRocess AssessmentMary Grace NaragNo ratings yet

- RR No. 13-94Document13 pagesRR No. 13-94Jerwin DaveNo ratings yet

- Chapter 35Document30 pagesChapter 35Mike SerafinoNo ratings yet

- Intermediate Accounting: Prepared by University of California, Santa BarbaraDocument69 pagesIntermediate Accounting: Prepared by University of California, Santa BarbaraHenry BarlowNo ratings yet

- Ma Am+saira s+Tutorial+Slides-Chap+6+-+Inventories PDFDocument17 pagesMa Am+saira s+Tutorial+Slides-Chap+6+-+Inventories PDFAli Zain ParharNo ratings yet

- Finals PDFDocument6 pagesFinals PDFlapNo ratings yet

- Cyril Grace Booc - PRELIM-EXAM-2022Document6 pagesCyril Grace Booc - PRELIM-EXAM-2022Cyril Grace BoocNo ratings yet

- Finacc AnaDocument8 pagesFinacc AnaKonjiki Ashisogi JizōNo ratings yet

- Small Business Income and Expenses TemplateDocument3 pagesSmall Business Income and Expenses TemplateMETANOIANo ratings yet

- Chap.15 - Probs - Ia3 Odd and EvenDocument11 pagesChap.15 - Probs - Ia3 Odd and EvenMae Ann AvenidoNo ratings yet

- Sales Report D13236Document18 pagesSales Report D13236charles bautistaNo ratings yet