Professional Documents

Culture Documents

Agatha Is Planning To Start A New Business Venture and PDF

Uploaded by

DoreenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agatha Is Planning To Start A New Business Venture and PDF

Uploaded by

DoreenCopyright:

Available Formats

(answered) Agatha is planning to start a new business

venture and

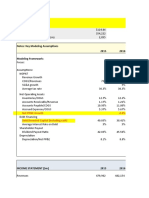

Agatha is planning to start a new business venture and must decide whether to operate as a

sole proprietorship or incorporate. She projects that the business will gener

GET THE ANSWER>> https://solutionlly.com/downloads/agatha-is-planning-to-start-a-new-

business-venture-and

Agatha is planning to start a new business venture and must decide whether to operate as a

sole proprietorship or incorporate. She projects that the business will generate annual cash flow

and taxable income of $100,000. Agatha’s personal marginal tax rate, given her other sources

of income, is 39.6 percent.

a. If Agatha operates the business as a sole proprietorship, calculate the annual after-tax cash

flow available for reinvestment in the business venture.

b. If Agatha operates the business as a regular (C) corporation that makes no dividend

distributions, calculate the annual after-tax cash flow available for reinvestment in the business.

c. Now suppose that Agatha wishes to withdraw $20,000 per year from the business, and will

reinvest any remaining after-tax earnings.

What are the tax consequences to Agatha and the business of such a withdrawal if the business

is operated as a sole proprietorship? How much after-tax cash flow will remain for reinvestment

in the business? How much after-tax cash flow will Agatha have from the withdrawal?

d. What are the tax consequences to Agatha and the business of a $20,000 withdrawal in the

form of a dividend if the business is operated as a C corporation? How much after-tax cash flow

will remain for reinvestment in the business? How much after-tax cash flow will Agatha retain

from the dividend?

e. If Agatha wishes to operate the business as a corporation but also wishes to receive cash

flow from the business each year, what would you recommend to get a better tax result?

GET THE ANSWER>> https://solutionlly.com/downloads/agatha-is-planning-to-start-a-new-

business-venture-and

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Module 4 Companies SlidesDocument77 pagesModule 4 Companies SlidesChua Rui TingNo ratings yet

- AYB320 0122 Week3Document40 pagesAYB320 0122 Week3Linh ĐanNo ratings yet

- Chapter 09, Modern Advanced Accounting-Review Q & ExrDocument28 pagesChapter 09, Modern Advanced Accounting-Review Q & Exrrlg481467% (3)

- Solved Firm L Has 500 000 To Invest and Is Considering TwoDocument1 pageSolved Firm L Has 500 000 To Invest and Is Considering TwoAnbu jaromiaNo ratings yet

- Principles of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFDocument21 pagesPrinciples of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (8)

- Chapter 14 Pre-Built Problems6Document2 pagesChapter 14 Pre-Built Problems6yacapinburgosNo ratings yet

- Tax Planing With Reference To Form of OrganizationDocument4 pagesTax Planing With Reference To Form of Organizationsb_jainNo ratings yet

- Full Download Finance Applications and Theory 4th Edition Cornett Test Bank PDF Full ChapterDocument36 pagesFull Download Finance Applications and Theory 4th Edition Cornett Test Bank PDF Full Chaptercategory.torskhwbgd100% (18)

- Finance Applications and Theory 4th Edition Cornett Test BankDocument21 pagesFinance Applications and Theory 4th Edition Cornett Test Bankkilter.murk0nj3mx100% (35)

- Tax Planning Setting Up of A New BusinesDocument20 pagesTax Planning Setting Up of A New Businesnagesh yadavNo ratings yet

- Finance Chapter 20Document21 pagesFinance Chapter 20courtdubs100% (3)

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsTinku SNo ratings yet

- Deduct From Book Income: - B - T F Dul - .Document2 pagesDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNo ratings yet

- Singapore SME Cash Grant and Corporate Income Tax Rebate Presented by Tax Accountants Pte LTDDocument2 pagesSingapore SME Cash Grant and Corporate Income Tax Rebate Presented by Tax Accountants Pte LTDTax AccountantsNo ratings yet

- Now To Develop An Example That Can Be Presented ToDocument1 pageNow To Develop An Example That Can Be Presented ToAmit PandeyNo ratings yet

- Quiz 1Document5 pagesQuiz 1gabie stgNo ratings yet

- Adobe Trading CompanyDocument6 pagesAdobe Trading CompanyTeodoro QuijanoNo ratings yet

- Canadian Income Taxation Canadian 20th Edition Buckwold ISBN Test BankDocument11 pagesCanadian Income Taxation Canadian 20th Edition Buckwold ISBN Test Bankbennie100% (23)

- Pearsons Federal Taxation 2018 Individuals 31st Edition Rupert Solutions ManualDocument30 pagesPearsons Federal Taxation 2018 Individuals 31st Edition Rupert Solutions Manualsilingvolumedvh2myq100% (23)

- Activity Sheets in Fundamentals of Accountanc4Document8 pagesActivity Sheets in Fundamentals of Accountanc4Irish NicolasNo ratings yet

- 8.special Tax Rates of Companies & MATDocument22 pages8.special Tax Rates of Companies & MATMuthu nayagamNo ratings yet

- Pearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Solutions Manual Full Chapter PDFDocument51 pagesPearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Solutions Manual Full Chapter PDFWilliamDanielsezgj100% (9)

- My TestDocument7 pagesMy TestZaira HuzaimiNo ratings yet

- Solved in Each of The Following Independent Situations Determine The Corporation SDocument1 pageSolved in Each of The Following Independent Situations Determine The Corporation SAnbu jaromiaNo ratings yet

- 93-04 - Partnership TaxDocument8 pages93-04 - Partnership TaxJuan Miguel UngsodNo ratings yet

- Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111Document36 pagesSolutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111epha.thialol.lqoc100% (50)

- Full Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full ChapterDocument36 pagesFull Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full Chapterurocelespinningnuyu100% (19)

- Taxation & Fiscal PolicyDocument17 pagesTaxation & Fiscal PolicySEGEBUNo ratings yet

- Pearsons Federal Taxation 2018 Comprehensive 31st Edition Rupert Solutions ManualDocument30 pagesPearsons Federal Taxation 2018 Comprehensive 31st Edition Rupert Solutions Manualalyssahoffmantbqfyjwszi100% (27)

- Canadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test BankDocument13 pagesCanadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test Bankalisonfernandezmerzigfkap100% (15)

- Solutions Manual: Introducing Corporate Finance 2eDocument10 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- Test Bank For Canadian Income Taxation 2017 2018 Canadian 20Th Edition Buckwold Isbn 1259275809 9781259275807 Full Chapter PDFDocument32 pagesTest Bank For Canadian Income Taxation 2017 2018 Canadian 20Th Edition Buckwold Isbn 1259275809 9781259275807 Full Chapter PDFcarl.ramos277100% (12)

- Canadian Income Taxation Canadian 20th Edition Buckwold ISBN Test BankDocument11 pagesCanadian Income Taxation Canadian 20th Edition Buckwold ISBN Test Bankbennie100% (27)

- Concepts in Federal Taxation 2013 20th Edition Murphy Test Bank 1Document36 pagesConcepts in Federal Taxation 2013 20th Edition Murphy Test Bank 1dianabrowncgmkxyerfn100% (27)

- Midterm Exam GFGB 6005 003 Fall 2019 Answer Doc FileDocument13 pagesMidterm Exam GFGB 6005 003 Fall 2019 Answer Doc FileGel viraNo ratings yet

- Tax Ch02Document10 pagesTax Ch02GabriellaNo ratings yet

- Principles of Taxation For Business and Investment Planning 14th Edition Jones Solutions ManualDocument18 pagesPrinciples of Taxation For Business and Investment Planning 14th Edition Jones Solutions Manualelmerthuy6ns76100% (26)

- Principles of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions ManualDocument23 pagesPrinciples of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions Manualbosomdegerml971yf100% (19)

- Accounting-Financial Statements of Companies-1653399167327513Document37 pagesAccounting-Financial Statements of Companies-1653399167327513Badhrinath ShanmugamNo ratings yet

- Singapore Tax GuideDocument20 pagesSingapore Tax GuideTaccad ReydennNo ratings yet

- Solved Teal Inc Owns Total Assets of 100 Million and ItDocument1 pageSolved Teal Inc Owns Total Assets of 100 Million and ItAnbu jaromiaNo ratings yet

- Solved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingDocument1 pageSolved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingAnbu jaromiaNo ratings yet

- Havaci Company Reports Pretax Financial Income of 80 000 For PDFDocument1 pageHavaci Company Reports Pretax Financial Income of 80 000 For PDFAnbu jaromiaNo ratings yet

- Kitchen Appliances Inc Is A Multi Division Company With Each PDFDocument1 pageKitchen Appliances Inc Is A Multi Division Company With Each PDFDoreenNo ratings yet

- Fundamental Accounting Principles Wild 19th Edition Solutions ManualDocument43 pagesFundamental Accounting Principles Wild 19th Edition Solutions ManualCarolineAndersoneacmg100% (39)

- Canadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test BankDocument15 pagesCanadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test Bankbennie100% (21)

- Tax ConsiderationsDocument8 pagesTax Considerationspkgarg_iitkgpNo ratings yet

- Investor Plan SampleDocument30 pagesInvestor Plan SampleAbeer AbdullahNo ratings yet

- Initial Investment: Initial Investment Means Cash Outflow For A Proposed Project (Machine) atDocument4 pagesInitial Investment: Initial Investment Means Cash Outflow For A Proposed Project (Machine) atRahat KhanNo ratings yet

- Tugas Studi Kasus AKM1 Kelompok 4Document4 pagesTugas Studi Kasus AKM1 Kelompok 4Marchelino GirothNo ratings yet

- Assignment 1Document17 pagesAssignment 1kerttanaNo ratings yet

- Cookie Ch3Document2 pagesCookie Ch3Charmaine Bernados Brucal100% (1)

- Hobby vs. Business 2021Document2 pagesHobby vs. Business 2021Finn KevinNo ratings yet

- Solved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFDocument1 pageSolved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFAnbu jaromiaNo ratings yet

- Hasmine Lopez & Peter Rosales GR 11 - IntegrityDocument37 pagesHasmine Lopez & Peter Rosales GR 11 - IntegrityMaria AngelaNo ratings yet

- Lanestar Inc Reported Income From Continuing Operations Before Tax of 1 790 000 PDFDocument1 pageLanestar Inc Reported Income From Continuing Operations Before Tax of 1 790 000 PDFFreelance WorkerNo ratings yet

- CH09Document62 pagesCH09Lê Chấn PhongNo ratings yet

- ACC 430 Chapter 10Document20 pagesACC 430 Chapter 10vikkiNo ratings yet

- CH 13 NotesDocument19 pagesCH 13 NotesBec barron100% (1)

- DNP800 Assignment BENCHMARK Assessment, Implementation, and ReviewDocument1 pageDNP800 Assignment BENCHMARK Assessment, Implementation, and ReviewDoreenNo ratings yet

- DNP835 Healthcare Challenges Have Changed Dramatically in The LastDocument1 pageDNP835 Healthcare Challenges Have Changed Dramatically in The LastDoreenNo ratings yet

- DNP805 Module 2 AssignmentDocument3 pagesDNP805 Module 2 AssignmentDoreenNo ratings yet

- DNP825 How Are EthicalDocument2 pagesDNP825 How Are EthicalDoreenNo ratings yet

- DNP830 Module 6 AssignmentDocument3 pagesDNP830 Module 6 AssignmentDoreenNo ratings yet

- DNP830 Module 1 AssignmentDocument2 pagesDNP830 Module 1 AssignmentDoreenNo ratings yet

- DNP800 Assignment Successful Data Collection ToolsDocument1 pageDNP800 Assignment Successful Data Collection ToolsDoreenNo ratings yet

- DNP830 Module 3 AssignmentDocument2 pagesDNP830 Module 3 AssignmentDoreenNo ratings yet

- DNP820 Module 5 AssignmentDocument2 pagesDNP820 Module 5 AssignmentDoreenNo ratings yet

- DNP800 4 DiscussionsDocument1 pageDNP800 4 DiscussionsDoreenNo ratings yet

- DNP810 Module 5 AssignmentDocument4 pagesDNP810 Module 5 AssignmentDoreenNo ratings yet

- DNP805 Module 4 AssignmentDocument3 pagesDNP805 Module 4 AssignmentDoreenNo ratings yet

- DNP805 Module 3 DiscussionDocument1 pageDNP805 Module 3 DiscussionDoreenNo ratings yet

- DNP810 Module 7 AssignmentDocument4 pagesDNP810 Module 7 AssignmentDoreenNo ratings yet

- DNP805 Module 6 AssignmentDocument2 pagesDNP805 Module 6 AssignmentDoreenNo ratings yet

- DNP825 What Information Is The ECQM LibraryDocument2 pagesDNP825 What Information Is The ECQM LibraryDoreenNo ratings yet

- DNP830 Module 7 AssignmentDocument3 pagesDNP830 Module 7 AssignmentDoreenNo ratings yet

- DNP820 Module 6 AssignmentDocument1 pageDNP820 Module 6 AssignmentDoreenNo ratings yet

- DNP805 Module 1 AssignmentDocument4 pagesDNP805 Module 1 AssignmentDoreenNo ratings yet

- DNP800 Assignment Sharing KnowledgeDocument1 pageDNP800 Assignment Sharing KnowledgeDoreenNo ratings yet

- DNP820 Module 4 AssignmentDocument2 pagesDNP820 Module 4 AssignmentDoreenNo ratings yet

- DNP830 Module 4 AssignmentDocument2 pagesDNP830 Module 4 AssignmentDoreenNo ratings yet

- DNP840 Describe The Strategic Planning Process For andDocument1 pageDNP840 Describe The Strategic Planning Process For andDoreenNo ratings yet

- DNP835 Using Concepts and Ideas That You Have Learned in ThisDocument2 pagesDNP835 Using Concepts and Ideas That You Have Learned in ThisDoreenNo ratings yet

- DNP810 Module 4 AssignmentDocument2 pagesDNP810 Module 4 AssignmentDoreenNo ratings yet

- DNP820 Module 3 AssignmentDocument1 pageDNP820 Module 3 AssignmentDoreenNo ratings yet

- Consider A Setting Where We Have A Faulty Device Assume That The Failure Can Be Caused by ADocument1 pageConsider A Setting Where We Have A Faulty Device Assume That The Failure Can Be Caused by ACharlotteNo ratings yet

- DNP840 Interview A Nursing Leader. Develop Questions That RevealDocument1 pageDNP840 Interview A Nursing Leader. Develop Questions That RevealDoreenNo ratings yet

- DNP820 Module 8 AssignmentDocument3 pagesDNP820 Module 8 AssignmentDoreenNo ratings yet

- Consider A Two Layer Network of The Form Shown in Figure 5 1 With The Addition of ExtraDocument1 pageConsider A Two Layer Network of The Form Shown in Figure 5 1 With The Addition of ExtraCharlotteNo ratings yet

- FAR04-13.2 - SBPT BVPS EPS - RevisedDocument12 pagesFAR04-13.2 - SBPT BVPS EPS - RevisedAi NatangcopNo ratings yet

- Astra Account September 2021Document119 pagesAstra Account September 2021Risyep HidayatullahNo ratings yet

- SEC VAL AssignmentDocument2 pagesSEC VAL Assignmentharsh7mmNo ratings yet

- Chapter 3 - Fundamentals of Corporate Finance 9th Edition - Test BankDocument24 pagesChapter 3 - Fundamentals of Corporate Finance 9th Edition - Test BankKellyGibbons100% (4)

- Adjustments For Financial Statements: Chapter One Capital Expenditure and Revenue Expenditure Capital ExpenditureDocument24 pagesAdjustments For Financial Statements: Chapter One Capital Expenditure and Revenue Expenditure Capital ExpenditurestevenNo ratings yet

- Investment & Security AnalysisDocument50 pagesInvestment & Security AnalysisAamir RazaNo ratings yet

- "Financial Analysis of Kilburn Chemicals": Case Study OnDocument20 pages"Financial Analysis of Kilburn Chemicals": Case Study Onshraddha mehtaNo ratings yet

- National University of Science and TechnologyDocument5 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- Sample Question PaperDocument16 pagesSample Question PaperAmit GhodekarNo ratings yet

- Case Study FaDocument5 pagesCase Study Faabhishek ladhaniNo ratings yet

- Walmart Valuation ModelDocument179 pagesWalmart Valuation ModelHiếu Nguyễn Minh HoàngNo ratings yet

- Statement of Financial Condition and Other InformationDocument8 pagesStatement of Financial Condition and Other Informationvikas_ojha54706No ratings yet

- FM MCQ Module - 4Document2 pagesFM MCQ Module - 4Keyur Popat100% (1)

- Annual Report 2019 Kattali Textile LTD PDFDocument78 pagesAnnual Report 2019 Kattali Textile LTD PDFRabib Ahmed100% (1)

- SFM May 2015Document25 pagesSFM May 2015Prasanna SharmaNo ratings yet

- Balance Sheet of Kansai Nerolac PaintsDocument5 pagesBalance Sheet of Kansai Nerolac Paintssunilkumar978No ratings yet

- Stock ValuationDocument34 pagesStock ValuationCzarina Panganiban100% (1)

- Canfin Annual Report FY 2022-23Document320 pagesCanfin Annual Report FY 2022-23OneappNo ratings yet

- Chapter 9 KDocument38 pagesChapter 9 KPauline DacirNo ratings yet

- Chapter 1: A Framework For Financial AccountingDocument22 pagesChapter 1: A Framework For Financial AccountingGenevieve SaldanhaNo ratings yet

- HLP 0910Document226 pagesHLP 0910Li Hei EltNo ratings yet

- Dividend StrippingDocument3 pagesDividend StrippingThadakamadla RajanandNo ratings yet

- Fy23q4presentations eDocument33 pagesFy23q4presentations e富美徐No ratings yet

- Cash Flow Analysis: ReviewDocument50 pagesCash Flow Analysis: ReviewDiich Tiari RachmadaniNo ratings yet

- Lecture On Shareholders' EquityDocument3 pagesLecture On Shareholders' EquityevaNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions ManualDocument39 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manualrebeccagomezearndpsjkc100% (30)

- CESCDocument39 pagesCESCSumon GhoshNo ratings yet

- Midland Case CalculationsDocument13 pagesMidland Case CalculationsGurupreet MathaduNo ratings yet

- MCQ of Corporate Finance PDFDocument11 pagesMCQ of Corporate Finance PDFsinghsanjNo ratings yet

- Fsav 6e Test Bank Mod14 TF MC 101520Document10 pagesFsav 6e Test Bank Mod14 TF MC 101520pauline leNo ratings yet

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (58)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (88)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyFrom EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyRating: 5 out of 5 stars5/5 (22)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyFrom EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyRating: 4.5 out of 5 stars4.5/5 (300)

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchFrom EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchRating: 4 out of 5 stars4/5 (114)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (799)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (709)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizFrom EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizRating: 4.5 out of 5 stars4.5/5 (112)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayFrom EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayRating: 5 out of 5 stars5/5 (42)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- Faith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateFrom EverandFaith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateRating: 5 out of 5 stars5/5 (33)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 5 out of 5 stars5/5 (24)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Amazon Unbound: Jeff Bezos and the Invention of a Global EmpireFrom EverandAmazon Unbound: Jeff Bezos and the Invention of a Global EmpireRating: 4.5 out of 5 stars4.5/5 (72)