Professional Documents

Culture Documents

Discussion Problems: FAR.2924-Other Investments OCTOBER 2020

Uploaded by

Wynona BalandraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discussion Problems: FAR.2924-Other Investments OCTOBER 2020

Uploaded by

Wynona BalandraCopyright:

Available Formats

Since 1977

FAR OCAMPO/CABARLES/SOLIMAN/OCAMPO

FAR.2924-Other Investments OCTOBER 2020

DISCUSSION PROBLEMS

1. Nueva Vizcaya Company has the following accounts 4. How should the sinking fund be reported in the

included in its December 31 trial balance: company’s balance sheet at December 31?

FA@FVTPL P1,000,000 a. The cash in the sinking fund should appear as a

FA@FVTOCI 2,000,000 current asset.

FA@AC 3,000,000 b. Only the accumulated deposits should appear as a

Investment in associate 4,000,000 noncurrent asset.

Interest rate swap receivable 100,000 c. The entire balance in the sinking fund account

Forward contract receivable 200,000 should appear as a current asset.

Futures contract receivable 250,000 d. The entire balance in the sinking fund account

Call option 150,000 should appear as a noncurrent asset.

Petty cash fund 50,000

Payroll cash fund 500,000 5. Following are selected transactions in chronological

Dividend cash fund 200,000 order of Bayombong Company and its trustee in

Interest fund 150,000 connection with a sinking fund.

Sinking fund 1,100,000 a. Cash contribution to the sinking fund, P1,000,000.

Plant expansion fund 2,000,000 b. Acquisition of securities at par by the trustee,

Stock redemption fund 1,800,000 P700,000.

Contingency fund 1,000,000 c. The trustee receives interest on the securities,

Insurance fund 1,000,000 P60,000.

Investment property 4,000,000 d. The trustee pays expenses of P30,000.

Prepaid rent 200,000 e. The trustee sells the securities for P800,000 plus

Cash surrender value of life insurance 100,000 accrued interest of P10,000.

f. The trustee pays bonds payable of P1,000,000 and

How much is the total amount normally considered as

interest of P100,000.

noncurrent investments?

g. The trustee remits the remaining cash to

a. P20,000,000 c. P17,900,000

Bayombong Company.

b. P18,000,000 d. P14,000,000

How much was remitted by the trustee to Bayombong

Company?

2. Which statement is incorrect regarding fund a. P150,000 c. P50,000

accounting? b. P140,000 d. P40,000

a. In essence, the fund is accounted for as an

individual set of books.

b. Fund refers to cash and other assets set aside to Use the following 8% interest factors for questions 6 to 13.

accomplish specific objectives.

FV of PV of

c. The purpose for which fund was established may

ordinary ordinary

be current or noncurrent.

annuity annuity

d. Funds that relate directly to current operations are

Periods FV of 1 PV of 1 of 1 of 1

ordinarily shown in the long-term investments

1 1.0800 0.9259 1.0000 0.9259

section of the statement of financial position or in a

2 1.1664 0.8573 2.0800 1.7833

separate section if relatively large in amount.

3 1.2597 0.7938 3.2464 2.5771

4 1.3605 0.7350 ? 3.3121

5 1.4693 0.6806 5.8666 3.9927

Use the following information for the next two questions.

7 1.7138 0.5835 8.9228 5.2064

The following information is available concerning the Mauro 8 1.8509 0.5403 10.6366 5.7466

Corporation's sinking fund transactions in the current 9 1.9990 0.5002 12.4876 6.2469

period. There is no trustee.

Jan. 1 Established a sinking fund to retire an 6. What amount should be deposited in a bank account

outstanding bond issue by contributing today to grow to P3,000,000 three years from today?

P425,000. a. P3,779,100 c. P9,739,200

Jan. 15 Purchased securities for P400,000. b. P2,381,400 d. P7,731,300

Jul. 30 Sold securities originally costing P48,000

for P45,000. 7. If P1,000,000 is put in a savings account today, what

Dec. 31 Collected dividends and interest on the amount will be available three years from today?

remaining securities in the amount of a. P1,259,700 c. P3,246,400

P49,000; the securities had a market b. P 793,800 d. P2,577,100

value of P360,000 at this time.

8. If P900,000 is put in a savings account today, what

3. The sinking fund balance at December 31 is amount will be available six years from now?

a. P479,000 c. P471,000 a. P900,000 x 0.6302

b. P474,000 d. P442,000 b. P900,000 x 1.08 x 1.4693

c. P900,000 x 0.6806 x 0.9259

d. P900,000 x (1.08 + 1.4693)

Page 1 of 3 www.facebook.com/excel.prtc FAR.2924

EXCEL PROFESSIONAL SERVICES, INC.

9. What amount will be in a bank account three years c. In the future value of an ordinary annuity, the last

from now if P500,000 is invested each year for four cash payment will not earn any interest.

years with the first investment to be made today? d. Other things being equal, the present value of an

a. P1,656,050 c. P2,433,300 annuity due will be less than the present value of

b. P1,788,534 d. P2,253,050 an ordinary annuity.

10. What amount should an individual have in a bank

account today before withdrawal if P200,000 is needed 17. Cash surrender value normally arises under the

each year for four years with the first withdrawal to be following circumstances:

made today and each subsequent withdrawal at one- a. The policy is a life policy.

year intervals? (The balance in the bank account b. Premiums for three full years must have been paid.

should be zero after the fourth withdrawal.) c. The policy is surrendered at the end of the third

a. P613,140 c. P715,400 year or anytime thereafter.

b. P662,420 d. P901,220 d. All of the above.

11. What will be the balance on September 1, 2027 in a

fund which is accumulated by making P100,000 annual 18. Which statement is incorrect regarding cash surrender

deposits each September 1 beginning in 2020, with the value of life insurance policy?

last deposit being made on September 1, 2027? The a. It is the amount of a life insurance premium that

fund pays interest at 8% compounded annually. exceeds basic insurance charges and is returnable

a. P1,063,660 c. P574,660 in the event that the policy is surrendered or

b. P1,148,750 d. P620,630 canceled.

b. It is not recognized if the beneficiary is other than

12. If P10,000 is deposited annually starting on January 1, the company and the premiums paid are treated as

2020 and it earns 8%, what will the balance be on an expense.

December 31, 2027? c. It is considered to be an investment if the

a. P106,366 c. P57,466 beneficiary is the company itself.

b. P114,875 d. P62,063 d. It is reported as a current asset on the statement

of financial position.

13. If a company wishes to accumulate P20,000,000 by

May 1, 2028 by making 8 equal annual deposits

beginning May 1, 2020 to a fund paying 8% interest

19. On January 1, 2015, Ball, Inc. purchased a P1,000,000

compounded annually. What is the required amount of

ordinary life insurance policy on its president. The

each deposit?

policy year and Ball’s accounting year coincide.

a. P1,880,300 c. P3,480,319

Additional data are available for the year ended

b. P1,741,023 d. P3,222,532

December 31, 2020:

14. On January 1, 2020, CDO Corporation created a special Annual premium paid on 1/1/2020 P20,000

building fund by depositing a single sum of P100,000 Dividend received 7/1/2020 3,000

with an independent trustee. The purpose of the fund Cash surrender value, 1/1/2020 43,500

is to provide resources to build an addition to the older Cash surrender value, 12/31/2020 54,000

office building during the latter part of 2024. The Ball, Inc., is the beneficiary under the life insurance

company anticipates a total construction cost of policy. How much should Ball report as life insurance

P500,000 and completion by January 1, 2025. The expense for 2020?

company plans to make equal annual deposit from a. P6,500 c. P17,000

December 31, 2020 through 2024, to accumulate the b. P9,500 d. P20,000

P500,000. The independent trustee will increase the

fund each December 31 at an interest rate of 10%.

The accounting periods of the company and the fund 20. Candle Park has life insurance policies on its officer's

end on December 31. lives. Annual premiums amount to P5,000. At the end

How much is the fund balance as of December 31, of 2020, cash surrender value of the policies totaled

2020? (Round off future value factors to five decimal P18,200. Dividends received by Candle from the

places) insurance company amounted to P500. The insurance

a. P165,519 c. P110,000 expense recognized by Candle Park in 2020 was

b. P155,519 d. P100,000 P3,500. What was the amount of cash surrender value

of these policies on January 1, 2020?

15. Which statement is correct regarding time value of a. P14,200 c. P16,200

money concepts? b. P17,200 d. P10,200

a. When interest is compounded, the stated rate of

interest exceeds the effective rate of interest.

b. The calculation of future value requires the 21. Villaverde Company insures the life of its president for

removal of interest. P8,000,000, the corporation being the beneficiary of an

c. With an ordinary annuity, a payment is made or ordinary life policy. The premium is P200,000. The

received on the date the agreement begins. cash surrender value on December 31, 2019 and 2020

d. Compound interest includes interest earned on are P60,000 and P80,000 respectively. The

interest. corporation follows the calendar year as its fiscal

period. The president dies on October 1, 2020 and the

16. Which statement is incorrect regarding time value of policy is collected on December 31, 2020. What is the

money concepts? gain on life insurance settlement?

a. The calculation of present value eliminates interest a. P7,875,000 c. P7,870,000

from future cash flows. b. P7,890,000 d. P7,800,000

b. An annuity is a series of equal periodic payments.

- now do the DIY drill -

Page 2 of 3 www.facebook.com/excel.prtc FAR.2924

EXCEL PROFESSIONAL SERVICES, INC.

DO-IT-YOURSELF (DIY) DRILL

1. The following information relates to noncurrent Periods PV of P1 Discounted at 10% per Period

investment that Maddela Corporation placed in trust as 1 0.909

required by the underwriter of its bonds: 2 0.826

Bonding sinking fund balance, 3 0.751

January 1, 2020 P4,500,000 4 0.683

2020 additional investment 900,000 5 0.621

Dividends on investment 150,000 What amount should an individual have in a bank

Interest income 300,000 account today before withdrawal if P20,000 is needed

Administration costs 100,000 each year for four years with the first withdrawal to be

Carrying amount of bonds payable 6,000,000 made today and each subsequent withdrawal at one-

What amount should Maddela report in its December year intervals? (The balance in the bank account

31, 2020 statement of financial position related to its should be zero after the fourth withdrawal.)

noncurrent investment for bond sinking fund a. P20,000 + (P20,000 × 0.909) + (P20,000 ×

requirements? 0.826) + (P20,000 × 0.751)

a. P5,750,000 c. P5,950,000 b. P20,000 ÷ 0.683 × 4

b. P5,850,000 d. P3,950,000 c. (P20,000 × 0.909) + (P20,000 × 0.826) +

(P20,000 × 0.751) + (P20,000 × 0.683)

2. An issuer of bonds uses a sinking fund for the d. P20,000 ÷ 0.909 × 4

retirement of the bonds. Cash was transferred to the

sinking fund and subsequently used to purchase 7. Loan A has the same original principal, interest rate,

investments. The sinking fund and payment amount as Loan B. However, Loan A is

a. Increases by income earned on the investments. structured as an annuity due, while Loan B is

b. Is not affected by income earned on the structured as an ordinary annuity. The maturity date of

investments. Loan A will be

c. Decreases when the investments are purchased. a. Earlier than Loan B.

d. None of the above. b. Later than Loan B.

c. The same as Loan B.

3. On January 1, 2020, Nagtipunan Company adopted a d. Indeterminate with respect to loan B.

plan to accumulate funds for a new building to be

erected beginning January 1, 2023 at an estimated 8. On January 2, 2017, Beal, Inc. acquired a P700,000

cost of P21,000,000. Nagtipunan Company intends to whole-life insurance policy on its president. The

make three equal annual deposits in a fund beginning annual premium is P20,000. The company is the

December 31, 2020 that will earn interest at 10% owner and beneficiary. Beal charged officer’s life

compounded annually. Future amount factors at 10% insurance expense as follows:

for three periods are: 2017 P20,000

Future value of 1 1.33 2018 18,000

Future value of an ordinary annuity of 1 3.31 2019 15,000

Future value of an annuity of 1 in advance 3.64 2020 11,000

Total P64,000

What is the annual deposit to the fund?

a. P7,000,000 c. P6,344,410 In Beal’s December 31, 2020 statement of financial

b. P5,769,230 d. P7,894,740 position, the investment in cash surrender value

should be

4. On March 1, 2020, Saguday Company adopted a plan a. P 0 c. P64,000

to accumulate P20,000,000 by September 1, 2024. b. P16,000 d. P80,000

Saguday plans to make four annual deposits to a fund

that will earn interest at 10% compounded annually. 9. During 2020, Stone Co. pays an insurance premium of

Saguday made the first deposit on September 1, 2020. P31,800 on a P900,000 life insurance policy covering

Future amount factors at 10% for 4 periods are: the president. The cash surrender value of the policy

will increase from P165,000 to P175,200 during 2020.

Ordinary annuity of 1 4.64

Dividends received from the insurance company during

Annuity of 1 in advance 5.11

2020 totaled P6,300. Insurance expense for 2020 is

Saguday should make four annual deposits of (rounded a. P31,800. c. P21,600.

to the nearest P100) b. P25,500. d. P15,300.

a. P5,000,000 c. P4,310,000

b. P3,913,900 d. P4,102,000 10. Casiguran Corp. took out a P5,000,000 insurance

policy on the life of its president on January 1, 2011.

5. On January 1, 2020, Carly Company decided to begin Given below are data on this policy:

accumulating a fund for asset replacement five years 2019 2020

later. The company plans to make five annual deposits Annual dividend P 3,880 P4,210

of P30,000 at 9% each January 1 beginning in 2020. Cash surrender value, 12/31 138,030 189,350

What will be the balance in the fund on January 1, Annual premium 121,040 121,040

2025?

a. P195,700 c. P179,540 The life insurance expense for Casiguran Corp. for

b. P163,500 d. P150,000 2020 would be

a. P64,100 c. P116,830

6. Given below are the present value factors for P1.00 b. P65,510 d. P121,040

discounted at 10% for one to five periods.

J - end of FAR.2924 - J

Page 3 of 3 www.facebook.com/excel.prtc FAR.2924

You might also like

- Prac One Final Pre BoardDocument7 pagesPrac One Final Pre BoardJose Stanley B. MendozaNo ratings yet

- Chapter 1 - Introduction To Cost AccountingDocument29 pagesChapter 1 - Introduction To Cost AccountingLala SalvatoreNo ratings yet

- Chapter 35Document7 pagesChapter 35loiseNo ratings yet

- Chapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceDocument32 pagesChapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceLeonardoNo ratings yet

- Global CompanyDocument1 pageGlobal Companydagohoy kennethNo ratings yet

- Phinma - University of Iloilo Bam 006: Midterm Exam: Amount UncollectibleDocument4 pagesPhinma - University of Iloilo Bam 006: Midterm Exam: Amount Uncollectiblehoneyjoy salapantanNo ratings yet

- Quizbowl 2Document10 pagesQuizbowl 2lorenceabad07No ratings yet

- Zakaria Ch4Document15 pagesZakaria Ch4Zakaria Hasaneen0% (2)

- Audit of InventoryDocument9 pagesAudit of InventoryEliyah JhonsonNo ratings yet

- Accounting - Inventory Test BankDocument3 pagesAccounting - Inventory Test BankAyesha RGNo ratings yet

- Review of Financial Accounting Theory and Practice: Related Standards: PAS 16, 20, 23 & 36Document7 pagesReview of Financial Accounting Theory and Practice: Related Standards: PAS 16, 20, 23 & 36jaymark canayaNo ratings yet

- Chapter 1 Acctg 5Document11 pagesChapter 1 Acctg 5Angelica MayNo ratings yet

- D2Document12 pagesD2neo14No ratings yet

- There May Be A Property Relationship of Conjugal PDocument6 pagesThere May Be A Property Relationship of Conjugal PJunho ChaNo ratings yet

- Investment in Equity SecuritiesDocument3 pagesInvestment in Equity SecuritiesNicole Galnayon100% (1)

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- FAR - PPE (Revaluation) - StudentDocument2 pagesFAR - PPE (Revaluation) - StudentPamela0% (1)

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaAljur SalamedaNo ratings yet

- 16 Investment Property Escolano LinsoDocument19 pages16 Investment Property Escolano LinsoAl-Rafzahir BandinganNo ratings yet

- Bank Reconciliation EditedDocument1 pageBank Reconciliation EditedNors PataytayNo ratings yet

- 25781306Document19 pages25781306GuinevereNo ratings yet

- MODULE 1 2 Bonds PayableDocument10 pagesMODULE 1 2 Bonds PayableFujoshi BeeNo ratings yet

- Q Manacc1 Bep 2019Document5 pagesQ Manacc1 Bep 2019Deniece RonquilloNo ratings yet

- Practical Accounting 1doc PDF FreeDocument6 pagesPractical Accounting 1doc PDF FreeRovern Keith Oro CuencaNo ratings yet

- Lanimfa T.dela Cruz BSA-3A: Partnership OperationDocument4 pagesLanimfa T.dela Cruz BSA-3A: Partnership Operationleonard dela cruzNo ratings yet

- Qualifying Examination: Financial Accounting 2Document11 pagesQualifying Examination: Financial Accounting 2Patricia ByunNo ratings yet

- CAT Challenge - Answers PDFDocument6 pagesCAT Challenge - Answers PDFnivea gumayagayNo ratings yet

- Quiz Recl FinancingDocument1 pageQuiz Recl FinancingLou Brad IgnacioNo ratings yet

- Quiz InvestmentsDocument2 pagesQuiz InvestmentsstillwinmsNo ratings yet

- Chapter 5Document11 pagesChapter 5Ro-Anne LozadaNo ratings yet

- CH 14Document53 pagesCH 14muthi'ah ulfahNo ratings yet

- Intangible AssetsDocument22 pagesIntangible AssetsKaye Choraine Naduma100% (1)

- RFBT q1q2Document11 pagesRFBT q1q2Mojan VianaNo ratings yet

- Investment in Associate-Mytha Isabel D. SalesDocument9 pagesInvestment in Associate-Mytha Isabel D. SalesMytha Isabel SalesNo ratings yet

- Strategic Cost ManagementDocument7 pagesStrategic Cost ManagementAngeline RamirezNo ratings yet

- PRTC Olympiad Reg 12Document14 pagesPRTC Olympiad Reg 12Vincent Larrie MoldezNo ratings yet

- Intermediate Accounting Exercise 2 FinalsDocument2 pagesIntermediate Accounting Exercise 2 FinalsJune Maylyn MarzoNo ratings yet

- Review Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicDocument34 pagesReview Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicWilson TanNo ratings yet

- Armhyla Olivar FM Taxation 8Document4 pagesArmhyla Olivar FM Taxation 8Grace Umbaña YangaNo ratings yet

- Auditing Problem 12-18-21Document23 pagesAuditing Problem 12-18-21Joebelle JamosoNo ratings yet

- Fund and Other InvestmentsDocument4 pagesFund and Other InvestmentslcNo ratings yet

- This Study Resource Was: C. P6,050,000 D. P53,900Document2 pagesThis Study Resource Was: C. P6,050,000 D. P53,900Nah HamzaNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Janet Wooster Owns A Retail Store That Sells New andDocument2 pagesJanet Wooster Owns A Retail Store That Sells New andAmit PandeyNo ratings yet

- Shareholder'S Equity Multiple Choice QuestionsDocument7 pagesShareholder'S Equity Multiple Choice QuestionsRachel Rivera50% (2)

- 6902 - Investment Property and Other InvestmentDocument3 pages6902 - Investment Property and Other InvestmentAljur SalamedaNo ratings yet

- Far JpiaDocument14 pagesFar JpiaJNo ratings yet

- Expenditures: V-Audit of Property, Plant and EquipmentDocument24 pagesExpenditures: V-Audit of Property, Plant and EquipmentKirstine DelegenciaNo ratings yet

- LiquiDocument3 pagesLiquiPremium Netflix0% (1)

- Final PreboardDocument10 pagesFinal PreboardJan Victor AdanNo ratings yet

- BACOSTMX Module 2 Learning Activity StudentsDocument8 pagesBACOSTMX Module 2 Learning Activity StudentsRodolfo Jr. LasquiteNo ratings yet

- Business Combination Q4Document2 pagesBusiness Combination Q4Sweet EmmeNo ratings yet

- Repair Cost Probabilit yDocument2 pagesRepair Cost Probabilit yNicole AguinaldoNo ratings yet

- Examination About Investment 4Document3 pagesExamination About Investment 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- AtcpDocument2 pagesAtcpnavie VNo ratings yet

- Far Eastern University - Makati: Discussion ProblemsDocument2 pagesFar Eastern University - Makati: Discussion ProblemsMarielle SidayonNo ratings yet

- FAR2Document8 pagesFAR2Kenneth DiabordoNo ratings yet

- Notes PayableDocument4 pagesNotes PayableShilla Mae BalanceNo ratings yet

- Afar 02: Corporate Liquidation: I. True or False - Theory of AccountsDocument5 pagesAfar 02: Corporate Liquidation: I. True or False - Theory of AccountsRoxell CaibogNo ratings yet

- ARC-FAR May 2022 Batch - 1st PreboardDocument11 pagesARC-FAR May 2022 Batch - 1st PreboardjoyhhazelNo ratings yet

- National Service Training Program (NSTP) RA 9163 & IRR UpdatesDocument86 pagesNational Service Training Program (NSTP) RA 9163 & IRR UpdatesWynona BalandraNo ratings yet

- Module 3 Gender Issues PDFDocument17 pagesModule 3 Gender Issues PDFWynona BalandraNo ratings yet

- Gender Stereotype FinalDocument31 pagesGender Stereotype FinalWynona BalandraNo ratings yet

- 3rd Meeting.4. ROLE OF THE YOUTH ON THE DRUG PREVENTION. October 10, 2020Document15 pages3rd Meeting.4. ROLE OF THE YOUTH ON THE DRUG PREVENTION. October 10, 2020Wynona Balandra50% (2)

- 3rd Meeting.4. ROLE OF THE YOUTH ON THE DRUG PREVENTION. October 10, 2020Document15 pages3rd Meeting.4. ROLE OF THE YOUTH ON THE DRUG PREVENTION. October 10, 2020Wynona Balandra50% (2)

- 3rd Meeting.3. Controlled Substances and Other Pertinent Laws. October 10, 2020Document36 pages3rd Meeting.3. Controlled Substances and Other Pertinent Laws. October 10, 2020Wynona BalandraNo ratings yet

- Test Bank Managerial Economics 7th Edition AllenDocument40 pagesTest Bank Managerial Economics 7th Edition AllenWynona BalandraNo ratings yet

- Environmental Protection: Forest Protection, Conservation and DevelopmentDocument55 pagesEnvironmental Protection: Forest Protection, Conservation and DevelopmentWynona Balandra100% (1)

- Cash and Cash EquivalentsDocument6 pagesCash and Cash EquivalentsPam LlanetaNo ratings yet

- Negros Oriental State University: Brett ClydeDocument4 pagesNegros Oriental State University: Brett ClydeCORNADO, MERIJOY G.No ratings yet

- Exercise, Sample Answer Test 1 - FIN546Document4 pagesExercise, Sample Answer Test 1 - FIN546intanNo ratings yet

- Bar Review Material No. 3 PDFDocument2 pagesBar Review Material No. 3 PDFScri Bid100% (1)

- SBI Life - Smart Platina Plus - Cr1 Handbill - SIBDocument1 pageSBI Life - Smart Platina Plus - Cr1 Handbill - SIBKiran JohnNo ratings yet

- Fm-Module II Word Document - Anjitha Jyothish Uvais PDFDocument17 pagesFm-Module II Word Document - Anjitha Jyothish Uvais PDFMuhammed HuvaisNo ratings yet

- Currentaccountstatement 18102023-S33iujDocument4 pagesCurrentaccountstatement 18102023-S33iujjuliaechardhqa85No ratings yet

- CFI - Tutorial 2 4Document19 pagesCFI - Tutorial 2 4Ninh Thị Ánh NgọcNo ratings yet

- Insolvency and Bankruptcy Code, 2016Document4 pagesInsolvency and Bankruptcy Code, 2016Ayush BhadauriaNo ratings yet

- U2A1 Balance Sheet TemplateDocument2 pagesU2A1 Balance Sheet Template최성우No ratings yet

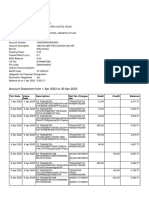

- Account Statement From 1 Apr 2023 To 30 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Apr 2023 To 30 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePunithNo ratings yet

- Income Tax Class NotesDocument2 pagesIncome Tax Class NotesMr. BachooNo ratings yet

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- A212 - Topic 3 - FV PV - Part I (Narration)Document31 pagesA212 - Topic 3 - FV PV - Part I (Narration)Teo ShengNo ratings yet

- Cash Cash Equivalents Reviewer2Document9 pagesCash Cash Equivalents Reviewer2anor.aquino.upNo ratings yet

- Real Estate Mortgage AgreementDocument3 pagesReal Estate Mortgage AgreementClint M. Maratas100% (4)

- Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Document2 pagesSebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Deborah Beth DarlingNo ratings yet

- ch1 Notes CfaDocument18 pagesch1 Notes Cfaashutosh JhaNo ratings yet

- Individual Assignment 1 Chapter 4 Time Value of Money Answer SchemaDocument3 pagesIndividual Assignment 1 Chapter 4 Time Value of Money Answer SchemaRizq ZaidiNo ratings yet

- Improvident Extension of CreditDocument31 pagesImprovident Extension of CreditAnthony RobertsNo ratings yet

- Multiple Choices Direction: Read Each Item Carefully and Write The Letter of The Appropriate AnswerDocument2 pagesMultiple Choices Direction: Read Each Item Carefully and Write The Letter of The Appropriate Answerabigail zipaganNo ratings yet

- CA Request For Beneficiary StatementDocument2 pagesCA Request For Beneficiary StatementbombdocNo ratings yet

- Credit Profile Authorization AgreementDocument2 pagesCredit Profile Authorization AgreementClayton StreeterNo ratings yet

- Case StudiesDocument2 pagesCase StudiespccrawdadsNo ratings yet

- InvLecture - W10-11 Capital BudgettingDocument264 pagesInvLecture - W10-11 Capital BudgettingJuan Camilo Gómez RobayoNo ratings yet

- SM-Personal Finance-Unit1to3Document176 pagesSM-Personal Finance-Unit1to3Priyanshu BhattNo ratings yet

- Personal FinanceDocument5 pagesPersonal FinanceFred Jaff Fryan RosalNo ratings yet

- KavitaDocument8 pagesKavitaSneha SharmaNo ratings yet

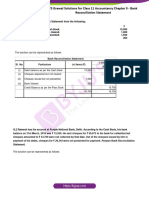

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Key Fact Statement: Product SummaryDocument15 pagesKey Fact Statement: Product SummaryJaideep SinghNo ratings yet