Professional Documents

Culture Documents

Multi Purpose Loan Form Fillable

Uploaded by

Jeremiah Miko Lepasana0 ratings0% found this document useful (0 votes)

18 views2 pagesOriginal Title

20200929-Multi-Purpose-Loan-Form-fillable (1)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesMulti Purpose Loan Form Fillable

Uploaded by

Jeremiah Miko LepasanaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

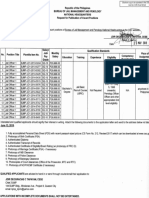

Fy GSIS MULTI-PURPOSE LOAN AND CONSOLIDATION OF DEBTS (MPL)

= Form No. 11192019-MPL-REV 0

IMPORTANT: Before applying for the GSIS Multi-Purpose Loan, please secure tentative computation of your proceeds.

‘Name of Applicant

Tast Name Fist Name Tiida Name

Birthdate BP No.

‘eCard/UMID Card No.

‘eCard/UMID Bank Account No.

Mailing/Residential Address

Brosent Office

Telephone No, Gell Phone No. Email Address

For DepEd Personnel

Division No “Salon No. ae

LOAN AMOUNT;FIees0 encircle yourchoic or inst prefered lan amour) TYPE OF LOAN

Basie Monthly Salary ;

TES ae eer ee ae ae] ew

Renewal

Proferred Loan AmountAny amount ower than th maximum oan) | Phy i

any a = (Pease check choice)

L undertake to pay the loan within years. (Please indicate applicable loan term.)

TERMS AND CONDITIONS

1. Loaw awouNT 2. CONSOLIDATION OF LOANS The GSIS:MPL shal consolidate the

following loans, inthis order

2. Minimum Loanable Amount. The minimum loanable amount sha a Salary Loan SL),

be based on indebtedness of the borower at the bme of application 1 Restrucred Salay Loan (RSL)

©. Enhanced Salary Loan (ESL)

eve of ndebieess | — Wim Conable Aout Emergency Loan Assistance (ELA)

No ssndog bats bbe ‘ous {© Summer One-Month Salary Laan (SOS)

conte ter MPL £ Conso-Loan Plus / Enhanced Gonso-Loan Pius

Wie_cunara ae @ Member's Cash Advance / eCard Cash Advance | eCard Phis

{OBAL) tobe amotdnnd ash Advance

err Emergency Loan (EML)

Bacal pete |. Home Emergency Loan Program (HELP)

“ 7 |, Educational Assistance Loan I and i (EAL 1/1)

tong snare 319% 0 Fly PAL Pay Later (FPPL)

coneciote te fms ad fone Stuy Now, Pay Later (SNPL)

‘aumpson aurea) and oer 1m, Stock Purchase Loan (SPL)

‘Si Wappen ‘The consolidation of the loans shall result in the ful liquidation of the

b MUA con, Setat 05% oe oustanding ‘utsiandng balances on the above loans. The outstanding balances of

aanes such loans, including penates (fany){o be waved, shall be computed up

to the date of granting of the MPL.

Maximum Loanable Amount

3. TERM

1) For Reauar Acive Members. The maximum loanable amount

shal depend onthe members: Period wth Paid Premiums (PPP) 0 See Seen ago er ca tea

ang computed Basie Monthy Salary (BMS) based on actual ant

promums posted Table indicates the maximum loanable vee wedtTeane | “Pome

orieceey a

able 1. Maximum Lounabie Amount a ‘aaa 20 os Baas | — Sys Ta

ree wn Te | Pan a 5 f

-bat20 os Bass | 3XBS | — 9B angen, | aa

than 3 yeas than yous

leas 3 buts cr BMS ‘inst 8 ats ya ae

than 8 years than 20s,

eae 5 but a TBS 7xBNS Te 25 ears a rr | TE sya

‘han 10 yore

‘east 10 bat as ToxeNe Toxo

shan 15 years ©, For Special Members wth MOA wh the GSIS. The lan term ofthe

Aiea 8b axBNS xNS oie eae

east 25 years and ovee | WBNS re

©. {fith exsina Home Emerency Loan Program (HELP) account. the

2) For Special Members. The loanable amount for Judges and een aoe naan

ustis Jona spacia eaters se existing] Memoranda at 4. The borrower shall be given the option to choose a shorter term in

SC eee eee Deac of () For Pertanentenpioyoes without Terenure 3 o

a 5 years. (i) For Non-Permanent and Permanent with Term/Tenure:2

3) The member can choose the amount of loan and the (i) For Special Members wih MOA withthe GSIS:3 or 5 years: (If

corresponding loan term based on hs or her PPP, but not 10 with existing HELP account: 3, 8 of 7 years.

exceed Php’ 000,000.00

2. Failure to inaicate payment term shall be interpreted as preference for

4) The member, both regular and special, has the option to choose. fhe longset torn ta wach the morroor a quater

2 lower loan amount provide thet the proceeds ofthe loan wil

be sulfcient to cover agaregate balance for the existng Ioan INTEREST. The interest rate shall be eight percent (8%) per annum

counts nea te eed Computed in advance for members wih PPP of less than 3 years, and

5) Failure to indicate the prefered loan amount shall mean thatthe ‘seven percent (7%) per annum computed in advance for members with

‘member is applying forthe maximum loan amount for which the PPP of atleast 3 years. The effective rte per annum that shall be used

‘members qualified to avail wil be 2s flows:

‘a. Permanent without TermyTenure

"aa mt eS

ee

arearegerr]| SSE" ||

amb ee| os sara

Se

ae | ye ‘amo

nee} Tye oo

neato | Tye —

1. Non-Permanent and Permanent with Term/Tenure

PPP Loan Term | inert | ctv intrest

inyears)_| “Rate | "Rat in)

Aus | 2yeas | 8% | 15 7087i%

Mies eaten | —2years | 7% | 73 70302%

‘leas bast | — 2 yeas 3.70802%

‘ina Oba | — Byes TST

‘eat Fide —Syeas TB 261

‘ae 5 yar 363} —§ yrs 13 24615%

For Special Members with MOA with GSIS

1s ‘Loan Term | terest

(inyears) | "Rate

‘Areast sons | Syeas | — 8%

‘years TS 076BT%

Tyears com

d._lfwith existing HELP account

(inyears) ato eR)

‘gear ar |S yous 15 35845%

"Aaa 0 ox Ba | 5 ars 15 07681%

ieee yer Dock

Aigsrities | Byeas T8246T3%

‘css bales —| 8 yoars T2415

hanya =

vale ats | —Toyears 12 33364%

‘al bes | —Toyears 1233368%

Toyears

TEIAK

‘The monthly interest on outstanding balance of the loan shall be computed

‘based on diminishing balance. Pro-ala intrest covering the days from

Joan granting upto the end ofthe month prior othe st due month shall

be deduced in advance fom the loan proceeds

DUE DATE OF FIRST MONTHLY AMORTIZATION. The remittance dus

date of the monthly amortzations shal be on or before the 10" day ofeach

‘month following the due month until the loan is uly paid

‘2. For loans granted on or before the 23° of the month, the fst due

‘month shall be the calendar month following the granting of the lean,

‘The loan amortization shal be remitied by the agency to GSIS on oF

before the 10" of the month folowing euch due month

'b. For loans granted afte the 23" of the month the fst due month shall,

be the 2* calendar month following the granting ofthe loan, and shall,

be remitted by the agency to GSIS on or before the 10” day af the

"month flowing such due month

PAYMENT MECHANISM, The monthly amortization shall be paid through

‘payroll deduction, However, the borrower shall itecty remit tothe GSIS,

for to its extemal payment service providers the loan Instaliment as they

fall due under any ofthe folowing instances

‘a. The name of a memberborrower is excluded from the monthly

collection ist

'b, The member-borrower is on secondment, on study leave without

pay or extended leave without pay

© The monthly amortization is not deducted andlor remitted by the

‘agency for anyother reason aside from tem 6b) above,

1d. The loan amortization deducted from the payrol ie not sufcient to

cover the ful amount du.

[REDEMPTION INSURANCE (RI). The MPL shall have Rito safeguard the

Interests ofboth the member and the GSIS in case ofthe formers untimely

«death curing the term ofthe loan, The R rate shal depend on the term of

oan, 0 wit

= ont RI Rate

(Per Pnpi.000 of Loan Amount)

Treas Bay ow.

Years 9 pay

years pay 0.36.

7 years 19 pay 40)

10 years to pay 046

To ensure that the member is covered with RI from the date of loan

granting, an advance RI premium shall be deducted from the loan

proceeds as flows

Date of Loan Granting Ri Premium to Be

Deducted

Equivalent to 1 month

Equivalent fo 2 months

Chor before the 23° ofthe me

‘Alter the 23° ofthe mo,

‘COMPUTATION OF FEES. The folowing fees shall be charged upon loan

granting

Service Fee ~ 2% ofthe gross loan amount (or ntal Ioanavaliment)

(oF incremental gross loan amount (or loan renewal). For this

purpose, the Incremental gros loan amount refers tothe lference,

‘between the loan amount and the outstanding balances ofthe existing

loans tebe consolidated. iis the amount that can be borrowed before

the imposition of insurance and other fees; and

b. _eProcessing Fee ~ Pnp50.00.

9, PRE-TERMINATION.The MPL may be pre-terminated by paying the

‘outstanding balance of the loan before the end ofthe loan term,

10. COMPULSORY PRE-TERMINATION. The loan agreement shall be

{deemed pre-erminated upon the death, resignation, permanent dsabity,

fetirerent or separation from service ofthe borrower in which ease, the

‘outstanding balance shall be due and demandable and shal be collected

by GSIS from the claims ofthe borrower or of his or her hers, or through

appropiate legal action. Rettig borrowers may opto aval ofthe Choice

‘f Laan Amorzaion Schecule for Pensioners (CLASP) subjectto existing

policies and procedures.

11. COLLECTION IN THE EVENT OF RESIGNATION, SEPARATION,

RETIREMENT, DEATH OR PERMANENT TOTAL DISABILITY. After the

date of execution of this loan application, the empioyeriagency shall

withhold the release of any or all benefits due to the borrower unt after

‘he requisite clearance andlor statement of account, ary, shall have been

duly secured from the GSIS, pursuant to GSIS Memorandum Circular No

(008, Series of 2018. The GSIS, upon receipt of he request, shal issue the

‘appropriate clearance andlor etatement of aocount tothe duly authorized

representative of the employeriagency. The employeriagency, upon

‘receipt of the statement of account ffom theGSIS, shall deduct andlor

withhold from any or all benefits that may accrue tothe borrower, the total

‘amount corresponding fo the outstanding loan accounts and arrearages,

‘any, and remit the same tothe GSIS to liquidate the loan

12. CANCELLATION. Borrowers. shall be allowed to cancel the loan

‘agreement within a perio of hry (30) calendar days fom the date ofan

Granting. In cases of cancellaton of the loan upon the behest of the

Borrower, the principal amount or the face value inthe loan contract), plus

the pro-rata interest covering the days fram loan granting Upto the

actual cancellation of the loan shall be paid in ful. The cancelation ofthe

oan shal reuit inthe reversal of all ioans previously consoldated under

the MPL, including waived penalties, if ary. These loans shall be re

ack to dcve status, and shall be computed corresponding interest

‘surenarges that have accrued from the ime they were hquidated under the

MPL.

18, DEFAULT. In the event of default the outstanding balance of the loan

becomes due and demandable without need of demand or futher notice,

all of which the member expressly waives n case of failure to pay the

‘utstancing balance declared in default, the oustanding balance shall be

Charged a penalty of 18% per annum compounded monthly (pam),

broken down as interest on the outstanding balance) of 123% pcm. and

Surcharge of 6% p acm. from the date of default unl the date of fll

payment, Accounts in default shallbe endorses for appropiate lagal action

‘thin tity (30) working days from default,

14, APPLICATION OF PAYMENTS. The order of prot for the application of

‘payment shall be as folows: Rl premium, surcharge (f any), inerest and

principal

16, RENEWAL. The MPL may be renewed anytime as long as there are net

proceeds on the loan renewal, after deducting the outstanding balances of

the previous MPL and other loans enumerated under item 2 of this

appiaton, withthe penalties if any. The maximum loanable amount and

‘applicable interest rate and loan term shall be determined based on the

PP of the member-bocrower atte Ume of application for lean renewal.

16, RECOVERY OF AMOUNT/S CREDITED IN THE @CARD. GSIS shall

have the right to recover any undue amount that i has credited in the

(eCard due fo aud. misrepresentation or err

17, REFUND OF OVERPAYMENTS AFTER END OF LOAN TERM. At the

fend ofthe loan term, any overpayment shall be trealedin accordance wit

the poley guidlines on the weatment of excess payment.

18, ATTORNEY'S FEES, Should the GSIS be compelled to refer the loan or

any potion thereof oan Atforney-at-Law for callection of to enforce any

Fight hereunder against he borrower of aval of any remedy under the law

for this Agreement, the borrower shall pay an amount equivalent to 25% of

allamounis outstanding and unpaid as an for attomey s fees andiigaton

expenses.

19. VENUE. Any legal action, sult or proceeding arising out or relating to this

‘Agreement, shall be brought or instituted Inthe appropriate cours in the

CC of Pasay or euch other venue atthe exclusive option of GSIS. In the

event the borrower initiates any legal action arising from or under this

‘Agreement, for whatever causes, the borrower agrees to iniiate such

‘action only in the City where the principal office of GSIS is located

20. NOTICES. All notices required under tis Agreement for its enforcement

hall be sent tothe Office Address or the Residential Address indicated

the Personal Data portion of this loan application, The notices sent fo the

said Office or Residental Addrese shall be valid and shall serve a

Sufficient notice to the borrower fr al legal intents and purposes.

| cain that | have read ard ful understood the GSIS MULTEPURPOSE LOAN AND

‘CONSOLIDATION OF DEBTS WITH LOWER INTEREST RATE (MPL) Tes and Consors

‘nd undeike to comply with them. Furthermore, | hereby auhore the GSIS,Peugh

-myemployer(owamient spe), ded fam my terminal ave aves any remaining

‘ustanng ean ablgatons | may have wi the GSS upon my spartan or rlvemert. |

understand that the emitance there! by my employer ote GSIS shal et be urdeiaken

‘befrehessuance ofa GSIS clearance fre eas ony remaining mia lave beets

Hany.

| confim my andestarang of the Privacy Potey ofthe GSS pursuant othe reqaements of

Fen et (4) No. 10172, anne dnown a he Data Pray At and concert oe

‘manner of coleton uso, access, dicosure and processing of my persona and senstve

persona data bythe GSS.

Final, pursuant to A. No 9510, arse koa 2th "Cred formation System At and

{5 Implementing Res and Repuetons (RR)! Peedy acknowedge and consent 1) he

regul stmissin and isos of my base cred dota and updates teen io te Cre

Inlematon Capoten CI} and 2) he sharing ny base ced data wth nes auharzed

bythe CC, an eee eprting agencies and csauced eno dy acceded by he CIC

siete provsonsaFR.A.Na 9510, IRR ar ce eva las and regulon,

EMBERIBORAOWER (Sigur ov Pred None)

DATE SIGNED BRIN

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Jo1Document2 pagesJo1Jeremiah Miko LepasanaNo ratings yet

- Tracer Study Survey ACSHSDocument2 pagesTracer Study Survey ACSHSJes Ramos100% (1)

- A1061 Field TripsDocument22 pagesA1061 Field TripsJeremiah Miko LepasanaNo ratings yet

- A Little Too Not Over YouDocument2 pagesA Little Too Not Over YouJeremiah Miko LepasanaNo ratings yet

- SCTP Nssa-Nsca Membership Application: Please Fill inDocument1 pageSCTP Nssa-Nsca Membership Application: Please Fill inJeremiah Miko LepasanaNo ratings yet

- Politicsand Governmentsof Latin America Spring 2015Document15 pagesPoliticsand Governmentsof Latin America Spring 2015Jeremiah Miko LepasanaNo ratings yet

- Authorization UMAK RafaelDocument3 pagesAuthorization UMAK RafaelJeremiah Miko LepasanaNo ratings yet

- Political Science 582: Quantitative Analysis in Political Science II, Fall 2011, Seigle Hall L016Document3 pagesPolitical Science 582: Quantitative Analysis in Political Science II, Fall 2011, Seigle Hall L016Jeremiah Miko LepasanaNo ratings yet

- Hague-Harrop-comparative-government-and-politics - An-Introduction-2001 - Ch. 5Document18 pagesHague-Harrop-comparative-government-and-politics - An-Introduction-2001 - Ch. 5Jeremiah Miko LepasanaNo ratings yet

- A Module in Preparing An Online Instruction Delivery Plan PDFDocument21 pagesA Module in Preparing An Online Instruction Delivery Plan PDFJeremiah Miko LepasanaNo ratings yet

- Politics Modules: Department of Politics Birkbeck, University of LondonDocument47 pagesPolitics Modules: Department of Politics Birkbeck, University of LondonJeremiah Miko LepasanaNo ratings yet

- PS 552: Quantitative Analysis of Political Data Spring 2009: Math CampDocument5 pagesPS 552: Quantitative Analysis of Political Data Spring 2009: Math CampJeremiah Miko LepasanaNo ratings yet

- IGAOHRA For The Period of State of Public Calamity Final Version 6 July3Document7 pagesIGAOHRA For The Period of State of Public Calamity Final Version 6 July3Jeremiah Miko LepasanaNo ratings yet

- Political Science 2053 Introduction To Comparative Politics Course SyllabusDocument5 pagesPolitical Science 2053 Introduction To Comparative Politics Course SyllabusJeremiah Miko LepasanaNo ratings yet

- Hague-Harrop-comparative-government-and-politics - An-Introduction-2001 - Ch. 5Document18 pagesHague-Harrop-comparative-government-and-politics - An-Introduction-2001 - Ch. 5Jeremiah Miko LepasanaNo ratings yet

- Nathaniel Lepasana: BP No.: Date of Birth: Email Address: ID No.: CRN No.: CellphoneDocument1 pageNathaniel Lepasana: BP No.: Date of Birth: Email Address: ID No.: CRN No.: CellphoneJeremiah Miko LepasanaNo ratings yet

- Reconciling Liberty and Equality: Justice As FairnessDocument38 pagesReconciling Liberty and Equality: Justice As FairnessJeremiah Miko LepasanaNo ratings yet

- Individual Members Application Form: EmailDocument1 pageIndividual Members Application Form: EmailJeremiah Miko LepasanaNo ratings yet

- Club/Association Application For Sporting Clays Year - January 1 - December 31, - Club NumberDocument1 pageClub/Association Application For Sporting Clays Year - January 1 - December 31, - Club NumberJeremiah Miko LepasanaNo ratings yet

- Recession: Presented By: Karla Jane L. EdepDocument11 pagesRecession: Presented By: Karla Jane L. EdepJeremiah Miko LepasanaNo ratings yet