Professional Documents

Culture Documents

Rifqa Aulia Nabyla - TM 10

Rifqa Aulia Nabyla - TM 10

Uploaded by

Rifqa Aulia Nabyla0 ratings0% found this document useful (0 votes)

25 views3 pagesOriginal Title

1810112172_Rifqa Aulia Nabyla_TM 10.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views3 pagesRifqa Aulia Nabyla - TM 10

Rifqa Aulia Nabyla - TM 10

Uploaded by

Rifqa Aulia NabylaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

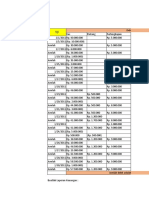

50% dari Penghasilan Penghasilan Kena

Bulan Penghasilan Bruto PTKP

Bruto Pajak

Januari Rp 45,000,000.00 Rp 22,500,000 Rp 4,500,000 Rp 18,000,000

Februari Rp 49,000,000.00 Rp 24,500,000 Rp 4,500,000 Rp 20,000,000

Rp 12,000,000

Maret Rp 47,000,000.00 Rp 23,500,000 Rp 4,500,000

Rp 7,000,000

April Rp 40,000,000.00 Rp 20,000,000 Rp 4,500,000 Rp 15,500,000

Mei Rp 44,000,000.00 Rp 22,000,000 Rp 4,500,000 Rp 17,500,000

Juni Rp 52,000,000.00 Rp 26,000,000 Rp 4,500,000 Rp 21,500,000

Juli Rp 40,000,000.00 Rp 20,000,000 Rp 4,500,000 Rp 15,500,000

Agustus Rp 35,000,000.00 Rp 17,500,000 Rp 4,500,000 Rp 13,000,000

September Rp 45,000,000.00 Rp 22,500,000 Rp 4,500,000 Rp 18,000,000

Oktober Rp 44,000,000.00 Rp 22,000,000 Rp 4,500,000 Rp 17,500,000

November Rp 43,000,000.00 Rp 21,500,000 Rp 4,500,000 Rp 17,000,000

Desember Rp 40,000,000.00 Rp 20,000,000 Rp 4,500,000 Rp 15,500,000

Jumlah Rp 524,000,000.00 Rp 262,000,000

Penghasilan Kena Pajak PPh Pasal 21

Tarif Pasal 17

Kumulatif Terutang

Rp 18,000,000 5% Rp 900,000

Rp 38,000,000 5% Rp 1,000,000

Rp 50,000,000 5% Rp 600,000

Rp 57,000,000 15% Rp 1,050,000

Rp 72,500,000 15% Rp 2,325,000

Rp 90,000,000 15% Rp 2,625,000

Rp 111,500,000 15% Rp 3,225,000

Rp 127,000,000 15% Rp 2,325,000

Rp 140,000,000 15% Rp 1,950,000

Rp 158,000,000 15% Rp 2,700,000

Rp 175,500,000 15% Rp 2,625,000

Rp 192,500,000 15% Rp 2,550,000

Rp 208,000,000 15% Rp 2,325,000

Rp 26,200,000

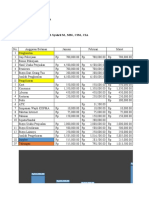

2 Dasar Pengenaan Pajak

Rp250,000,000 - Rp100,000,000 - Rp50,000,000 = Rp 100,000,000

Rp100,000,000 x 50% = Rp 50,000,000

PPh 21 yang Dipotong PT UPN

120% x 5% x Rp50,000,000 = Rp 3,000,000

3 PPh Pasal 21 yang Dipotong UPN

(Karena wajib pajak luar negeri) Tidak ada

PPh Pasal 26 yang Dipotong UPN

Rp100,000,000 x 15% = Rp 15,000,000

4 PPh Pasal 21 yang Harus Dipotong

Rp1,000,000 x 5% = Rp 50,000

You might also like

- Praktikum PerpajakanDocument12 pagesPraktikum PerpajakanJanni Mellian Fitri88% (16)

- Latihan Pajak 2Document4 pagesLatihan Pajak 2Marisa SabarilaNo ratings yet

- NPPN PPH Op SeninDocument1 pageNPPN PPH Op SeninBagus MaulanaNo ratings yet

- Book 16Document2 pagesBook 16Hasna fairuzNo ratings yet

- CASHFLOWDocument5 pagesCASHFLOWnisa alfrilianiNo ratings yet

- Brevet Pajak Jawaban Ujian OpDocument3 pagesBrevet Pajak Jawaban Ujian OpTiara Maulina ZhiNo ratings yet

- Latihan Soal Excel BungaDocument3 pagesLatihan Soal Excel BungaRita RustiNo ratings yet

- Book 1Document6 pagesBook 1ZULKARNAEN ZURIATNo ratings yet

- Usahatani Budidaya Melon1Document10 pagesUsahatani Budidaya Melon1giaaNo ratings yet

- AP2 - 01 - Gede Kurniawan Danuarta Santosa Suryadi - 1807521042 - Latihan Anggaran PiutangDocument4 pagesAP2 - 01 - Gede Kurniawan Danuarta Santosa Suryadi - 1807521042 - Latihan Anggaran Piutangdewi auryaningrumNo ratings yet

- Nurfaiza Akpajak Tugaspert13Document41 pagesNurfaiza Akpajak Tugaspert13NurfaizaNo ratings yet

- Tabel Excel Tugas PajakDocument16 pagesTabel Excel Tugas Pajak22C100Ardi TauladanNo ratings yet

- 4A026000Document12 pages4A026000rahmaalia reiputriNo ratings yet

- Copy - of - Usahatani - Budidaya - Melon1Document11 pagesCopy - of - Usahatani - Budidaya - Melon1giaaNo ratings yet

- Tugas Kamis 02-02-2023Document4 pagesTugas Kamis 02-02-2023Chika AngelineNo ratings yet

- Jawaban Pre TestDocument3 pagesJawaban Pre TestAnjelina InaNo ratings yet

- Lat Bab 3 Hal 65Document5 pagesLat Bab 3 Hal 65Irma RullydaNo ratings yet

- Jawaban Kompre AkhirDocument3 pagesJawaban Kompre AkhirSuntarno PlentetNo ratings yet

- PengeluaranDocument8 pagesPengeluaranAmggoro RoNo ratings yet

- Spreadsheet 1 (Tsalitsa Al Birra X-AKL)Document3 pagesSpreadsheet 1 (Tsalitsa Al Birra X-AKL)FaturNo ratings yet

- Tugas Akhir, Riswan ASP-08Document12 pagesTugas Akhir, Riswan ASP-08Lord GamingNo ratings yet

- Praktikum PerpajakanDocument105 pagesPraktikum PerpajakanSartika TariganNo ratings yet

- Femin Lovitasari AK 1Document7 pagesFemin Lovitasari AK 1TiaraAngelNo ratings yet

- Nur Maulidyah Azizah - 08Document12 pagesNur Maulidyah Azizah - 08Nur Maulidyah AzizahNo ratings yet

- Spreadsheet 1 (Tsalitsa Al Birra X-Akl)Document3 pagesSpreadsheet 1 (Tsalitsa Al Birra X-Akl)FaturNo ratings yet

- Rincian PinjamanDocument20 pagesRincian Pinjamanmaliktaufik22No ratings yet

- PT Athaillah Print 2Document3 pagesPT Athaillah Print 2Asrie DyahNo ratings yet

- Muhammad Ridho S - Ekonomi TeknikDocument5 pagesMuhammad Ridho S - Ekonomi TeknikAkun HokiNo ratings yet

- Penilaian Pengetahuan Spreadsheet Hal 92 Bye FaraDocument20 pagesPenilaian Pengetahuan Spreadsheet Hal 92 Bye FaraNabilah khoirunisaNo ratings yet

- RioDocument1 pageRioProtokol Pamera Pameran5No ratings yet

- Laporan Omset Klinik Area Bandung 2022Document1 pageLaporan Omset Klinik Area Bandung 2022Fahmi Nur'AfifNo ratings yet

- Rheznanda Rizki Saputra - 023002001080 - Lembar KerjaDocument13 pagesRheznanda Rizki Saputra - 023002001080 - Lembar KerjananaNo ratings yet

- AkuntansiDocument2 pagesAkuntansiFauziyyah LaylaNo ratings yet

- Daily Food Feb 2024 ADINDocument5 pagesDaily Food Feb 2024 ADINrenazNo ratings yet

- ORAKOREKDocument8 pagesORAKOREKACCOUNTING BUPDANo ratings yet

- Tugas DadakanDocument4 pagesTugas Dadakan029Achmad ArdanuNo ratings yet

- Jawaban Contoh Soal Rekonsiliasi FiskalDocument4 pagesJawaban Contoh Soal Rekonsiliasi FiskalGreysia Liona A.No ratings yet

- Laporan Laba RugiDocument5 pagesLaporan Laba Rugiita100% (1)

- Neraca Lajur MikitaDocument8 pagesNeraca Lajur MikitaPutri100% (1)

- Bella Amelia (2311102431433) UTS AkutansiDocument12 pagesBella Amelia (2311102431433) UTS Akutansibellaamelia051999No ratings yet

- Pemeriksaan Kas - BankDocument3 pagesPemeriksaan Kas - BankCorry Lucky Br.Pangaribuan 17510208No ratings yet

- Data Keuangan Sementara Bulan Maret 2022-1Document1 pageData Keuangan Sementara Bulan Maret 2022-1Lilis HumaerohNo ratings yet

- Anggaran Harga Pokok ProduksiDocument2 pagesAnggaran Harga Pokok ProduksiBENNY WAHYUDINo ratings yet

- Praktek AplikomDocument7 pagesPraktek AplikomAdit SetiawanNo ratings yet

- Maulana MDocument3 pagesMaulana MMaulana MahgribiNo ratings yet

- Akuntansi Pert 12-Errin VallelyDocument14 pagesAkuntansi Pert 12-Errin VallelyInggil Rizky NingtiyasNo ratings yet

- LAT2Document19 pagesLAT2Angel WingzzNo ratings yet

- Evapro FarlyFahreza 008Document13 pagesEvapro FarlyFahreza 008hexsbayNo ratings yet

- RP 163.870.000 RP 168.816.000 RP 175.207.000 3% 3%: Total AktivaDocument1 pageRP 163.870.000 RP 168.816.000 RP 175.207.000 3% 3%: Total AktivaFaqih UtsmanNo ratings yet

- Rekapan GrafikDocument6 pagesRekapan GrafikAnggur LilacNo ratings yet

- GAAAADocument2 pagesGAAAAZiga Aura afrilizaNo ratings yet

- Pengantar Akuntansi 2 Persediaan Barang DagangDocument3 pagesPengantar Akuntansi 2 Persediaan Barang DagangJunior DinathaNo ratings yet

- Diskusi 2 Akuntansi BiayaDocument4 pagesDiskusi 2 Akuntansi BiayaSania AngelyNo ratings yet

- Simulasi KPR KPA Zero - ACP (November)Document2 pagesSimulasi KPR KPA Zero - ACP (November)Adinda PutriNo ratings yet

- Hitungan Laba Kotor 2024Document2 pagesHitungan Laba Kotor 2024Seno Ilham MaulanaNo ratings yet

- Laporan Laba Rugi Dan Lap. NeracaDocument7 pagesLaporan Laba Rugi Dan Lap. NeracaMRX GAMINGNo ratings yet

- Dilla Putri S - Tugas PersediaanDocument14 pagesDilla Putri S - Tugas PersediaanPutri DilaNo ratings yet

- Tugas Kakak Kur 2Document4 pagesTugas Kakak Kur 2hery ardiansyahNo ratings yet