Professional Documents

Culture Documents

Why Highest Price Is Not The Best Price

Uploaded by

Sree DattaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Why Highest Price Is Not The Best Price

Uploaded by

Sree DattaCopyright:

Available Formats

WINTER 2010 V O L . 5 1 N O.

James C. Anderson, Marc Wouters

and Wouter van Rossum

Why the Highest Price

Isn’t the Best Price

REPRINT NUMBER 51212

P R I C I N G S T R AT E G Y

Why the Highest

Price Isn’t the THE LEADING

QUESTION

Best Price

If charging

the highest

price isn’t the

best strategy,

what is?

How to practice value-based pricing that boosts profits

and promotes better relationships with customers. FINDINGS

Customers give

BY JAMES C. ANDERSON, MARC WOUTERS AND WOUTER VAN ROSSUM suppliers they feel

good about doing

business with a big-

ger share and mix

of their business.

“CHARGE WHAT THE MARKET WILL BEAR” pretty well summarizes the pricing Best practice suppli-

ers use pricing

strategy of many suppliers serving business markets. They believe that practicing value-based pric- tactics that motivate

the customer to take

ing means finding out what the value of their offering is relative to alternatives for their customers action that benefits

the supplier.

and then charging as high a price as they can. If they think their offering is superior, they include in

Suppliers that

their pricing the full premium that they think the superiority earns. practice value-based

But pursuing value-based pricing in that way is usually shortsighted in two respects. First, it pricing increase

short- and long-term

neglects other potential means of profiting from delivering superior value that may result in greater profits.

overall profitability to a supplier. Second,

it weakens customer relations rather than

strengthening them, which a more progres-

sive and comprehensive approach to

value-based pricing can accomplish. We’ll

propose a framework for practicing value-

based pricing in this more nuanced, strategic

way. But consider first a recent case that dem-

onstrates how the shortsighted pursuit of

value-based pricing can go wrong.

Electron Instruments (a fictionalized

name) manufactures and markets scanning

electron microscopes. It has focused on the

upper end of the market for SEMs, which

ranges from $500,000 to $1.5 million per mi-

croscope. Even the low end of electron

microscopes ranges from $100,000 to

$250,000. In 2007, as a new initiative, Electron

Instruments developed and introduced a

desktop SEM that was intended to compete in

When customers’ expectations of a fair price are met,

their relationships with suppliers are strengthened,

often leading to broader and deeper commitments.

SLOANREVIEW.MIT.EDU WINTER 2010 MIT SLOAN MANAGEMENT REVIEW 69

P R I C I N G S T R AT E G Y

the low end of the market and even attract some Prospective customers upgrading from optical

sales from customers that would upgrade from op- instruments did not find Electron Instruments’

tical microscopes. desktop SEM easy to use. The image produced by

Electron Instruments believed that its desktop Electron Instruments’ SEM was technically supe-

SEM was vastly superior to the next best alterna- rior, but the new customers and prospects were so

tive, a desktop SEM from a Japanese competitor. unaccustomed to the difference that they didn’t

Electron Instruments did not, however, conduct value it as highly as Electron had predicted. Given

any formal customer value research to validate that that an SEM cost more than they were used to pay-

belief. Instead, it relied on its engineers’ assessments ing, they judged the image of the competing

and marketing’s judgment based on qualitative offering to be “good enough,” especially consider-

feedback it received from a few beta test customers. ing the substantial price difference.

Critically, though, these beta test customers were Based upon what it had learned, Electron Instru-

familiar with SEM technology, and most were users ments decided to test its pricing with selected

of the company’s top-end, expensive SEMs. customers that were having trouble deciding. Reduc-

Electron Instruments’ management and market- ing its premium to only 5% over its competitor’s

ing concluded that its desktop SEM was easier to use price, Electron found, accelerated the purchase deci-

and had technical superiority to the Japanese desk- sions of these customers. Electron Instruments was

top SEM. Convinced of superior value, management now left with the challenging task of relaunching its

asked marketing what price the market would bear. offering at a lower, yet to be determined price.

Management and marketing’s intent was to get Over the last three years, we have been conduct-

maximum revenue without limiting Electron In- ing management practice research with businesses

struments’ ability to sell the desktop SEMs. They that routinely practice value-based pricing. (See

decided to price the desktop SEM at a 25% premium “About the Research.”) We draw on their collective

to the next best alternative. experience to provide a six-question framework for

Sales for its desktop SEM were not as good as accomplishing value-based pricing that boosts

Electron Instruments had expected, with certain profits as well as customer relations. (See “How to

target customers much slower to purchase the tool Practice Value-Based Pricing: A Framework,” p. 72.)

than forecasted. In one target country, for example, Here we’ll discuss each of the six considerations in

Electron Instruments’ distributor was unable to sell greater detail. Notably, we have found that the first

any of the desktop SEMs. and last questions — about market strategy and

Reacting to these unexpectedly poor market re- customer expectations of a fair price — are often

sults, Electron Instruments began to investigate the neglected, leading to poor results.

cause. Marketing discovered that even though Elec-

tron wasn’t wrong from its perspective about the ease

of use and technical superiority of its desktop SEM

(relative to the next best alternative), its prospective

1 What is the market strategy for the seg-

ment? By market strategy, we mean what does

the supplier want to accomplish in this segment?

customers didn’t evaluate the product the same way. What would the supplier like to have happen? Un-

Electron’s beta test customers’ experiences did not fortunately, when stripped of jargon and wordspeak,

transfer to the actual target customers — the “market strategy” for many businesses is simply

especially those potential customers that had not “Sell more!” We contend that that is not a suffi-

previously experienced an SEM. Further, marketing ciently well-articulated strategy. In such cases,

discovered that the closed-system design of its desk- pricing begins to substitute for actual market strat-

top SEM was a substantial negative point of egy, with price concessions and “special” pricing

difference for customers that were experienced desk- frequently being used to gain business.

top SEM users. These prospective customers were Although it is natural for supplier managers to

attracted to the Japanese competitor’s more tradi- think first of price premiums as a way to profit from

tional SEM design, which allowed for upgrades, such superior value, that is just one of several ways for

as adding a key analytical system. suppliers to have value-based pricing that supports

70 MIT SLOAN MANAGEMENT REVIEW WINTER 2010 SLOANREVIEW.MIT.EDU

the market strategy. Obtaining a larger share of the ABOUT THE RESEARCH

customer’s purchase requirements or a more profit- We began our research by seeking businesses from a variety of industries that

were progressively practicing value-based pricing. We learned of these busi-

able mix of the customer’s business may be alternative

nesses from several sources. First, at the end of his keynote presentation on his

ways for a supplier to exploit superior value without book, Value Merchants, at the 14th Winter Conference of the Institute for the

necessarily pursuing a price premium.1 Study of Business Markets, James Anderson invited the approximately 150

At Electron Instruments, the market strategy managers from member and guest companies attending the conference to par-

was neglected in determining the price. Targeting ticipate in the research on value-based pricing. Second, managers participating in

the Business Marketing Strategy program held at the Kellogg School of Manage-

customers in the desktop SEM market — a segment ment at Northwestern University three times each year shared practices from

that Electron Instruments previously had not their companies and indicated their interest in participating in the research. Third,

served — the company should have expected that it we looked for European-based businesses that developed new technologies as

would have to give these prospective customers a the base of their market offerings and that analyzed the cost and value of market

offerings either as suppliers or purchasers. We contacted businesses that were

greater portion of the value as an incentive to do

identified by university experts on innovation and asked these businesses to iden-

business with a new supplier. tify suppliers that they believed were progressively practicing value-based pricing.

Furthermore, the product design went against These efforts led 24 companies to participate in our management practice

the requirements and preferences of experienced research. These companies, based in the United States, Europe and Asia, are

in a broad range of industries, including agricultural products, bearings, cut-

desktop SEM users. And when targeting present

ting tools, digital printing, drug discovery, electron microscopes, emissions

optical microscope users, Electron Instruments control systems, health care, lithographic equipment, process engineering,

should have expected that it also would have to give specialty chemicals and steel.

these prospective customers a larger inducement to We conducted telephone interviews and, most often, field interviews with

convert to the new technology. In each case, more key managers at each of these 24 companies. We also frequently conducted

follow-up interviews to learn of the progress that they were making in their

thought about market strategy, which aimed to

value-based pricing initiatives. As is often the case with inductive management

enter and secure a profitable position in two new practice research, we found few businesses that excelled in all of the consider-

customer segments, would have led to a lower price ations in practicing value-based pricing. Instead, we collectively drew on the

premium and a more flexible product that would best practices of these 24 companies to put together the framework and man-

agerial guidance that we offer in this article.

have enabled later sales of value-adding (and prof-

itable) upgrades to customers in both segments.

In contrast, consider the recent experience of target price for the base system that was 30% lower

Bayer MaterialScience AG of Germany in entering than the price EnviroSystems initially proposed.

the coatings market for high-end residential garage Working cooperatively, though, EnviroSystems

floors. Bayer’s materials enable a coating system to successively proposed design changes and addi-

deliver superior value through faster curing and tional components that went beyond the base

lower costs for the applicator and through quicker system, to provide an enhanced system that low-

turnaround, less nuisance and improved durability ered the customer’s installation costs, eliminated

for the garage owner. When Bayer pursues market certain components and made end-of-line valida-

entry, an explicit part of its market strategy is tion unnecessary.

greater openness to sharing a larger portion of its The customer accepted a price for this enhanced

offerings’ superior value with its prospective cus- system that was twice the price that EnviroSystems

tomers. To secure its position in a new market, it had initially proposed because the demonstrable

asks for a lower price premium in return for a com- cost savings to the customer rose disproportion-

mitment from the customer to purchase its ately. Nevertheless, EnviroSystems did not price

materials for a period of years. this enhanced system as highly as it might have for

The recent experience of EnviroSystems (a dis- three market strategy reasons. First, through its

guised name) in working with a European-based provision of more parts in the enhanced system,

truck manufacturer in North America nicely illus- EnviroSystems was able to achieve a gross margin

trates market strategy considerations in value-based 33% higher than the standard gross margin for its

pricing. EnviroSystems worked with this customer participation in the initial base system. Second,

to develop a superior emissions control system to EnviroSystems knew that the customer’s adoption

reduce greenhouse gases. The customer had set a of the system in North America would enable it to

SLOANREVIEW.MIT.EDU WINTER 2010 MIT SLOAN MANAGEMENT REVIEW 71

P R I C I N G S T R AT E G Y

expand its business geographically to Europe, model enables growers to plug in their own historic

where the potential business for this system was orchard data to calculate potential returns from

several times greater. Finally, EnviroSystems wanted using ReTain in different scenarios. Further, VBC

to be the first company that the customer would makes ReTain’s superior value transparent by spon-

call for its next project. soring studies in the major global apple growing

regions, conducted by agricultural specialists who

2 What is the differential value that is trans-

parent to target customers? By “transparent”

we mean that target customers easily understand

are recognized within the region as being unbiased,

reputable researchers.

how the supplier is calculating the differential value

(between its offering and the next best alternative)

and that the differential value can be verified with

3 What is the price of the next best alterna-

tive offering? When pressed for details, it

turns out that most suppliers’ understanding of the

the customer’s own data. Each of these factors makes pricing of their competitors’ offerings is more

the estimate of differential value persuasive to the sketchy and anecdotal than it is portrayed initially.

customer. Suppliers cannot expect a fair return on While some industries supplying raw and processed

their superior value if they cannot persuasively materials, such as steel, have widely used industry

prove it to the customer’s own satisfaction.2 sources that track and report prices for standard

products by market, that is rare in business mar-

kets. Moreover, such “commodity” pricing

HOW TO PRACTICE VALUE-BASED knowledge provides little guidance in making deci-

PRICING: A FRAMEWORK

sions about value-based pricing, because it neglects

Setting the price of a market offering based on its value to a target customer requires

more than simply knowing its value to that customer. Rather, there are six consider- other ways in which specific competitors add value

ations to determine value-based pricing: to their offerings, such as supplementary services.

■ What is the market strategy for the segment? (What does the supplier want to Best practice suppliers make a more methodical,

accomplish? What would the supplier like to have happen?) systematic effort to understand the pricing of the

■ What is the differential value that is transparent to target customers? (“Transpar- next best alternative offering.3

ent” means that target customers easily understand how the supplier calculates As part of its process for developing new offer-

the differential value between its offering and the next best alternative, and that ings, bearings manufacturer AB SKF of Göteborg,

the differential value can be verified with the customer’s own data.)

Sweden, has a team of applications engineers and

■ What is the price of the next best alternative offering?

sales engineers engage pilot customers to gain a

■ What is the cost of the supplier’s market offering? clear understanding of the next best alternative

■ What pricing tactics will be used initially or eventually? (“Pricing tactics” are competitor’s performance and pricing. When SKF

changes from the price that a supplier has set for its market offering — such as

recently developed its new Agri Hub, a rotating

discounts — that motivate customers to take actions that benefit the supplier.)

bearing unit mounted on an independent disc for

■ What is the customer’s expectation of a “fair” price?

plowing/tilling the soil, its team engaged five tillage

machine manufacturers as pilot customers. Each

Valent BioSciences Corp. is a leading supplier of pilot customer produced several prototype ma-

plant growth regulators for agricultural and horti- chines, which it first tested “in lab” on farmland

cultural markets based in Libertyville, Illinois. that it owns, and then with some of its own cus-

These PGRs modify plant growth, enabling grow- tomers, with whom it has close relationships.

ers to lower production costs significantly (e.g., Through this pilot program, SKF demonstrated the

harvest costs) and improve fruit quality, grade and superior performance of Agri Hub and learned what

size, leading to higher marketable yields. VBC it would be worth in monetary terms to customers. It

makes the superior value of its offerings transpar- also learned from the pilot customers that the price

ent to growers. In South Africa, for example, VBC of the next best alternative offering was about 27.

worked with the agricultural economist from the Although SKF could have asked for a higher price

largest apple cooperative to develop a customer premium based on its superior value, it decided to

value model for its ReTain PGR for apples. That introduce its new Agri Hub at about 33 instead,

72 MIT SLOAN MANAGEMENT REVIEW WINTER 2010 SLOANREVIEW.MIT.EDU

because its market strategy was to gain the business

rapidly and not leave an opening for its competitor.

SKF’s market introduction of Agri Hub has been a

5 What pricing tactics will be used initially or

eventually? Pricing tactics are changes from

the price that a supplier has set for its market offer-

success, with sales on a pace that is one year ahead ing. Although pricing tactics sometimes result in

of what was forecast. price increases, as in surcharges, they more often

result in price decreases, as in discounts. Best prac-

4 What is the cost of the supplier’s market

offering? Supplier managers must strive to

understand the cost of the market offering, not

tice suppliers use pricing tactics in ways that

motivate customers to take actions that benefit the

supplier. Volume discounts, for example, are fre-

simply the cost of the core product or service. That quently used to motivate customers to purchase in

will entail understanding the costs of services, pro- cost-advantageous quantities, such as pallet, truck

grams and systems that the supplier will need to or rail car loads. Best practice suppliers give price

offer initially and eventually. Even when suppliers discounts only when they will benefit them in some

practice value-based pricing, there is often a cost- demonstrable way, not simply to win the same busi-

plus constraint. To that understanding of cost, ness at a lower price.5

managers add senior management’s margin expec- EnviroSystems finds that the customer’s response

tation to establish the price threshold for value to whatever price it initially quotes is “It’s too high.”

sharing. The product manager is given consider- EnviroSystems responds by specifying a few reduc-

able latitude in deciding what price to set, as long as tions that it could make in the proposed offering to

it passes this threshold. lower the price, but it makes clear what the adverse

The digital printing business demonstrates consequences on performance and functionality

that understanding costs, and not just value, is would be. EnviroSystems’ engineers also have been

critical in practicing value-based pricing. To dif- taught to respond to customer pressure by asking,

ferentiate themselves from competitors and “How can we work with you on this?” It does not grant Bayer Materials, whose

products include a line of

improve profitability, progressive printing com- a price concession without some reduction in its of- environmentally friendly

polyurethanes specifically

panies increasingly offer value-added services to fering or getting some additional business. designed for the cosmetics

their customers, such as creative design, personal- Pilot customer discounts encourage customers industry, often conducts

pilot tests to determine fair

ized printing and project management. The work to test early versions of new offerings and provide prices for its products.

flows for delivering these new services are more feedback on their use to suppliers. When Quaker

complicated and variable than traditional print- Chemical Corp. of Conshohocken, Pennsylvania,

ing and require special investments in software, was developing its RapidShield ultraviolet curing

servers and staff training. To learn how to build floor coating system, it engaged a General Motors

out cost sheets accurately for these services, many Co. plant as a pilot customer. In return for a Quaker

printing companies rely on research, guides and promise to discount the price, the GM plant al-

tools developed by their equipment supplier, lowed Quaker to put down a 200-square-foot floor

Xerox Corp., that also provide benchmarks for the “test bed,” and plant personnel worked with Quaker

average time and cost needed to complete each to gather performance data. Following its initial

step in a work flow. These resources for more ac- success, RapidShield was applied in other areas of

curately understanding and managing costs the plant. Not only has this GM plant helped

complement guidance for value pricing, which Quaker develop the RapidShield offering, but its

helps printers understand how customers perceive staff has taken time to give testimonials to visiting

the value of these services. As a result, printers prospects, which Quaker finds extraordinarily

think about, for example, what other kinds of sup- helpful in securing business from those prospects.

pliers (an advertising agency) would charge for After market introduction of an offering, a sup-

performing a similar service, and the incremental plier may suggest an initial use discount to stimulate

revenues and profits that customers could earn customers to try the offering. Initial use discounts

from the value-added services (greater response are implemented as invoice line reductions, so that

due to a personalized mailing).4 the market price is set as the reference point. The

COURTESY OF BAYER WINTER 2010 MIT SLOAN MANAGEMENT REVIEW 73

P R I C I N G S T R AT E G Y

notation on this line would indicate the event or lim- Consider the strategic alliances between Belgium-

ited time period for which the discount applies. That based Galapagos and pharmaceutical companies

kind of pricing tactic provides a temporary induce- such as Merck and Johnson & Johnson. Galapa-

ment to overcome customer reluctance to try an gos’s comparative strength is in drug discovery and

offering or to compensate for costs that the customer early clinical trials, while its partners are better

will incur only initially in its use of the offering. at conducting later clinical trials, obtaining regu-

Finally, suppliers should consider the kinds of lator y approval and marketing new drugs.

pricing tactics that they likely will use eventually. Considerable uncertainty in this process makes es-

When an offering’s sales are at their zenith, the cus- timating value and setting Galapagos’s price

tomers that are purchasing extraordinarily large impractical. Instead, Galapagos and its partners

quantities may expect the supplier to offer addi- specify performance milestones and procedures

tional levels of volume discounts that reward this for determining their fulfillment, triggering fixed

relatively large usage. When competitors’ offerings and/or variable payments. Through these value-

eventually begin to close the gap in value delivered pricing mechanisms, Galapagos is eligible to

by a supplier’s offering, that supplier may offer receive in excess of 2 billion in success-dependent

price discounts to customers willing to make a milestone payments and up to double-digit royal-

ties on sales of new medicines.

Managing customer expectations of a

Customers are always happier to pay a lower price. fair price begins by demonstrating to cus-

Best practice suppliers actively manage customer tomers in a way they can easily understand

expectations of what is a “fair” price. how the supplier is calculating the differ-

ential value (between its offering and the

next best alternative) and then helping

commitment to continue purchasing a certain per- them to verify the differential using their own data.

centage of their requirements from the supplier. To Suppliers can still innovatively practice value-based

anticipate what will be needed eventually, supplier pricing in situations where the value will become

managers can review what has happened in the past known only later by reaching agreement with cus-

with similar offerings. tomers on a value pricing mechanism.6

Managing customer expectations of a fair price

6 What is the customer’s expectation of a

“fair” price? Customers are always happier to

pay a lower price. Best practice suppliers, though,

also requires gaining an understanding of the range

of potential prices that customers would regard as

“fair.” Bayer MaterialScience gains this understand-

actively manage customer expectations of what is ing by first reaching agreement with pilot

a “fair” price. One manager in our research as- customers on the differential value and assump-

tutely captured what the intent of a supplier ought tions, and then asking them: “Based on this, we

to be: “You want the customer to absolutely feel think a fair price would be x to y. Do you agree?”

good about the price.” What she meant is that her Health Informatics (a disguised name) recently

counterparts at the customer must be able to jus- conducted market research with its target custom-

tify to themselves and to others in their businesses ers to study their price expectations systematically

why they are paying the price they are when it is for an innovative inpatient disease management of-

higher than that of the next best alternative. Her fering. They asked target customers questions

business routinely seeks to make the customer en- including:

gineers it works with heroes in their own ■ At what price do you perceive the system to be a

companies. As evidence of this, one of Ford Motor bargain — a great buy for the money?

Co.’s engineers recently received the prestigious ■ At what price do you perceive the system as be-

Henry Ford II Distinguished Award for Excellence ginning to get expensive, so that it is not out of

in Automotive Engineering for his work on a proj- the question, but you would have to give some

ect with her business. thought to it?

74 MIT SLOAN MANAGEMENT REVIEW WINTER 2010 SLOANREVIEW.MIT.EDU

■ At what price do you begin to perceive the system as

so expensive that you would not consider buying it?

The results from that market research enabled

Health Informatics to decide on a price for its offer-

ing that target customers would find fair, even

though it was priced at a premium over that of the

next best alternative.

What sharing of the demonstrated superior

value of an offering seems fair? While our research

reveals varying answers, a “50/50” sharing rule was

mentioned more than any other split. Yet in prob-

ing that, we found that when the “50/50” rule was

expressed, the sharing most often was applied only

to the demonstrated “hard” cost savings, with any

“soft” cost savings going to the customers. Even

though soft savings typically require assumptions

to express them as monetary estimates, they are

nonetheless substantial, with the result that in prac-

tice the customer receives more than 50% of the functionality, it resists doing that. It recognizes that its ASML calculates the

value of its enhancement

total savings in a “50/50” sharing. customers would not find price premiums calculated packages as a conservative

A related issue is whether or when to specify the in that way to be fair. After all, it is not simply its en- percentage of the increase

in output its customers

superior performance of an offering as cost savings hancement packages but the customer’s product achieve.

or incremental profit from additional revenue. ASML design, brand and marketing and sales efforts that to-

Netherlands BV is a Netherlands-based supplier of gether cause the incremental revenue and profit.

lithographic equipment to the semiconductor indus- When the superior performance of a supplier’s

try. Because lithographic equipment is the most offering does enable customers to earn greater reve-

expensive equipment in a wafer fab, the production nue and profit for its offerings, the supplier must be

processes are designed around them to optimize their able to demonstrate that persuasively. Further, sup-

productivity. ASML sells enhancement packages pliers accomplishing that still often provide the

(software and hardware improvements) that enable customers with a greater proportion so that custom-

customers to increase the output of its lithographic ers find it fair. VBC’s offerings make good fruit great.

equipment, which leads to more output of the entire So while they do provide significant harvest cost sav-

wafer fab. Furthermore, some enhancement packages ings, the greater proportion of the superior value

also allow the customer to reduce the size of chips and they provide comes from enabling growers to earn in-

to improve their functionality. cremental profits through superior fruit quality, grade

The improved output is measured after installa- and size. To meet or exceed grower expectations of

tion of the upgrade under standardized test conditions. what is fair, VBC has established an internal bench-

ASML then conservatively calculates the value of its mark, where it looks for potential offerings to provide

enhancement packages as a percentage of the equip- growers with a 3:1 or greater return. That is, if a VBC

ment price. For example, a 10% increase in output is offering has a price premium of $100 per acre relative

valued at 10% of the investment in that equipment. to the price of the next best alternative, the grower

Typically, that is shared “50/50” with the customer. So would earn a $300 or more incremental profit per

if the investment was $12 million, the price of this en- acre from its use. Finally, to manage grower expecta-

hancement package would be $600,000. tions, VBC encourages growers to think of its offering

Although it would be tempting for ASML to claim not as part of their total spray program, where it

the incremental revenue and profit that its customers would be a relatively large percentage, but instead as

can earn from turning out more wafers, more chips an investment in lowering operating costs and im-

per wafer and/or higher prices for chips having better proving the price their customers paid for the fruit.

COURTESY OF ASML WINTER 2010 MIT SLOAN MANAGEMENT REVIEW 75

P R I C I N G S T R AT E G Y

A final aspect of managing the customer’s ex- offerings that will deliver superior value. Suppli-

pectation of a fair price is to have price transparency. ers that practice the kind of value-based pricing

By “transparent” we mean that the customers un- we have discussed not only boost profits in the

derstand how the pricing systematically varies present quarter, but they also set themselves up to

across different ways of doing business with the profit over the long term.

supplier and that they know that every customer

doing business with the supplier in the same James C. Anderson is the William L. Ford Professor

of Marketing and Wholesale Distribution at the

way pays the same price. As we discussed earlier Kellogg School of Management, Northwestern

with pricing tactics, suppliers need to vary their University. He is the Irwin Gross research fellow at

the Institute for the Study of Business Markets at

prices to motivate various customer actions, but

Pennsylvania State University and a visiting re-

it must be managed variation, not ad hoc. search professor at the University of Twente, the

Health Informatics practices transparent pric- Netherlands. Marc Wouters is a professor of man-

agement accounting at the School of Management

ing for its market offerings. It uses a pricing

and Governance, University of Twente. Wouter van

schedule that details the pricing for various usage Rossum is dean of the faculty of military science at

situations. Thus, although different group purchas- Netherlands Defense Academy, Breda, the Nether-

lands, and a professor of innovation, Faculty of

ing organizations for hospitals may receive different

Engineering Technology, University of Twente.

pricing based on different volume and compliance

levels, everyone sees the same pricing schedule, and ACKNOWLEDGMENTS

if different GPOs decide to do business in the same

The authors gratefully acknowledge the financial support

way with Health Informatics, they get the same of the Institute for the Study of Business Markets at

pricing. IV Therapy, Nutrition Baxter Healthcare is Pennsylvania State University.

another noteworthy supplier that strives to practice

REFERENCES

transparent pricing. Health Informatics and IV

Therapy managers stress that to achieve transpar- 1. J.C. Anderson, N. Kumar and J.A. Narus, “Profit From

Value Provided: Earning an Equitable Return,” chap. 7 in

ent pricing, the pricing schedule must be

“Value Merchants: Demonstrating and Documenting

explainable to customers and implemented consis- Superior Value in Business Markets” (Boston: Harvard

tently. Supplier managers might believe that they Business School Press, 2007), 135-164; J.C. Anderson

and J.A. Narus, “Selectively Pursuing More of Your Cus-

are being responsive or “customer oriented” when

tomer’s Business,” MIT Sloan Management Review 44,

they give ad hoc price concessions, but they are no. 3 (spring 2003): 42-49.

clouding customer expectations of what price is 2. J.C. Anderson, J.A. Narus and W. van Rossum, “Cus-

“fair” for the value their offering provides. tomer Value Propositions in Business Markets,” Harvard

Business Review 84, no. 3 (March 2006): 90-99.

3. S. Dutta, M. Bergen, D. Levy, M. Ritson and M. Zbaracki,

Conclusion “Pricing as a Strategic Capability,” MIT Sloan Manage-

Getting a price premium for providing superior ment Review, 43, no. 3 (spring 2002): 61-66.

value is fine so long as customers feel that it is fair. 4. R. Cooper and R. Slagmulder, “Achieving Full-Cycle

As a senior manager in our research sagely con- Cost Management,” MIT Sloan Management Review 46,

no. 1 (fall 2004): 45-52; R. Kaplan and S.R. Anderson,

cluded: “Value-based pricing is not about squeezing

“Time-Driven Activity-Based Costing,” Harvard Business

as much money out of customers as you can, but Review 82, no. 11 (November 2004): 131-138.

building customer relationships.” Customers that 5. A recent review of research investigating how pricing

feel good about doing business with a supplier are may benefit the supplier’s operations and reduce its costs

is provided in M. Fleischmann, J.M. Hall and D.F. Pyke,

more willing to give that supplier a larger share

“Smart Pricing,” MIT Sloan Management Review 45, no.

and a more profitable mix of their business. They 2 (winter 2004): 9-13.

are more willing to collaborate with the supplier, 6. M.H. Bazerman and J.J. Gillespie, “Betting on the Future:

to generate and share data on the performance of The Virtues of Contingent Contracts,” Harvard Business

Review 77, no. 5 (September-October 1999): 155-160.

its offerings relative to the alternatives and what

that is worth in monetary terms. They are more

Reprint 51212.

willing to work together to “tweak” present offer- Copyright © Massachusetts Institute of Technology, 2010.

ings to enhance their value and to develop new All rights reserved.

76 MIT SLOAN MANAGEMENT REVIEW WINTER 2010 SLOANREVIEW.MIT.EDU

PDFs ■ Permission to Copy ■ Back Issues ■ Reprints

Articles published in MIT Sloan Management Review are

copyrighted by the Massachusetts Institute of Technology

unless otherwise specified at the end of an article.

MIT Sloan Management Review articles, permissions,

and back issues can be purchased on our Web site:

www.pubservice.com/msstore or you may order through

our Business Service Center (9 a.m.-7 p.m. ET) at the

phone numbers listed below. Paper reprints are available

in quantities of 250 or more.

To reproduce or transmit one or more MIT Sloan

Management Review articles by electronic or

mechanical means (including photocopying or archiving

in any information storage or retrieval system) requires

written permission. To request permission, use our Web site

(www.pubservice.com/msstore), call or e-mail:

Toll-free: 800-876-5764 (US and Canada)

International: 818-487-2064

Fax: 818-487-4550

E-mail: MITSMR@pubservice.com

Posting of full-text SMR articles on publicly accessible

Internet sites is prohibited. To obtain permission to post

articles on secure and/or password-protected intranet sites,

e-mail your request to MITSMR@pubservice.com

Customer Service

MIT Sloan Management Review

PO Box 15955

North Hollywood, CA 91615

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- TVM Class Problems MKT A, OM IBDocument3 pagesTVM Class Problems MKT A, OM IBSree DattaNo ratings yet

- Design A Marketing Experiment Sample DesignDocument2 pagesDesign A Marketing Experiment Sample DesignSree DattaNo ratings yet

- The Consumer Decision Journey - McKinsey PDFDocument7 pagesThe Consumer Decision Journey - McKinsey PDFSree DattaNo ratings yet

- Weekly Report6Document6 pagesWeekly Report6Sree DattaNo ratings yet

- Hair Color Questionnaire (Responses) PDFDocument1 pageHair Color Questionnaire (Responses) PDFSree DattaNo ratings yet

- Loyality To Brands (Responses)Document1 pageLoyality To Brands (Responses)Sree DattaNo ratings yet

- Brand Loyalty - Hair Oil - College StudentsDocument6 pagesBrand Loyalty - Hair Oil - College Studentshimanshu111992No ratings yet

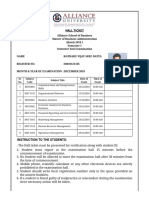

- Hall Ticket: Instruction To The StudentsDocument2 pagesHall Ticket: Instruction To The StudentsSree DattaNo ratings yet

- Stock Split and Reverse Split-Evidence From IndiaDocument16 pagesStock Split and Reverse Split-Evidence From IndiaSree DattaNo ratings yet

- IRDocument6 pagesIRSree DattaNo ratings yet

- ANOVA ExampleDocument6 pagesANOVA ExampleLuis ValensNo ratings yet

- Introduction To Macroeconomics: IS-LM ModelDocument45 pagesIntroduction To Macroeconomics: IS-LM ModelAlbert Eka SaputraNo ratings yet

- Topic Students List Date For PPT TimeDocument2 pagesTopic Students List Date For PPT TimeSree DattaNo ratings yet

- Chapter 4. ProductDocument32 pagesChapter 4. ProductSree DattaNo ratings yet

- Global Human Capital Trends 2015 - Leading in The New World of Work9708Document106 pagesGlobal Human Capital Trends 2015 - Leading in The New World of Work9708Sree DattaNo ratings yet

- 4weeks2shred eBOOK PDFDocument57 pages4weeks2shred eBOOK PDFMitu Laurentiu Ionut80% (5)

- onqROVWRIeoHuyg1np9Q - Bonus New Workout PDFDocument8 pagesonqROVWRIeoHuyg1np9Q - Bonus New Workout PDFSree Datta100% (1)

- Summer ShreddingDocument48 pagesSummer ShreddingPhilip Jourdan Olimpiada100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Jurnal Dan Resume Modifikasi Pati - Oktariananda - E1G020085Document8 pagesJurnal Dan Resume Modifikasi Pati - Oktariananda - E1G020085Oktarian NandaNo ratings yet

- Scanning Electron Microscopy and X-Ray Microanalysis: Third EditionDocument18 pagesScanning Electron Microscopy and X-Ray Microanalysis: Third EditionHugo SanzanaNo ratings yet

- S7 17 30 UGMs Vs MGMB Procenin Geomet 2017 ChileDocument22 pagesS7 17 30 UGMs Vs MGMB Procenin Geomet 2017 Chileosden515100% (1)

- Biochar Characterization and Evaluation For Their Application As A Soil AmendmentsDocument22 pagesBiochar Characterization and Evaluation For Their Application As A Soil Amendmentspebrian sahputraNo ratings yet

- Solidification and Crystalline ImperfectionsDocument61 pagesSolidification and Crystalline ImperfectionsstdphdNo ratings yet

- IB Biology TextbookDocument69 pagesIB Biology TextbookEduardo Panadero Cuartero67% (6)

- Koch - 2008 - Diversity of Structure, Morphology and Wetting of Plant SurfacesDocument21 pagesKoch - 2008 - Diversity of Structure, Morphology and Wetting of Plant SurfacesCarolina Solano CáceresNo ratings yet

- Journal of Advanced Research: Muhammad Bilal, Masatoshi SakairiDocument9 pagesJournal of Advanced Research: Muhammad Bilal, Masatoshi SakairiSarras InfoNo ratings yet

- ScanningElectronMicros PDFDocument13 pagesScanningElectronMicros PDFAbhishek GaurNo ratings yet

- Effect of Impurities On The Corrosion Behavior of CO Transmission Pipeline Steel in Supercritical CO Water EnvironmentsDocument6 pagesEffect of Impurities On The Corrosion Behavior of CO Transmission Pipeline Steel in Supercritical CO Water EnvironmentsAndy ChoNo ratings yet

- Chemik 2011 10 03Document5 pagesChemik 2011 10 03Adara Afifah FadhilahNo ratings yet

- ResumeDocument7 pagesResumeKamal YadavNo ratings yet

- Nano Energy: Fei Li, Li Zhang, Jincheng Tong, Yingliang Liu, Shengang Xu, Yan Cao, Shaokui CaoDocument10 pagesNano Energy: Fei Li, Li Zhang, Jincheng Tong, Yingliang Liu, Shengang Xu, Yan Cao, Shaokui CaoDina PradinaNo ratings yet

- Green Adeptness in The Synthesis and Stabilization of Copper Nanoparticles: Catalytic, Antibacterial, Cytotoxicity, and Antioxidant ActivitiesDocument15 pagesGreen Adeptness in The Synthesis and Stabilization of Copper Nanoparticles: Catalytic, Antibacterial, Cytotoxicity, and Antioxidant ActivitiesWindah AnisyahNo ratings yet

- Electrodeposition of Cu - SWCNT CompositesDocument14 pagesElectrodeposition of Cu - SWCNT CompositesSorina gNo ratings yet

- LWT - Food Science and Technology: Deba Krishna Das, Himjyoti Dutta, Charu Lata MahantaDocument7 pagesLWT - Food Science and Technology: Deba Krishna Das, Himjyoti Dutta, Charu Lata Mahantaelisa1027No ratings yet

- Anke Rienhar Saputra, Alimuddin, R. R Dirgarini Julia. NDocument5 pagesAnke Rienhar Saputra, Alimuddin, R. R Dirgarini Julia. NIslamiyah TamrinNo ratings yet

- Tribological Behavior of AZ91-Al O Composites by Powder MetallurgyDocument9 pagesTribological Behavior of AZ91-Al O Composites by Powder MetallurgykeerthivasanNo ratings yet

- CVZIsraZUniZwithZreferences 1 6 PDFDocument6 pagesCVZIsraZUniZwithZreferences 1 6 PDFD Ismail HdaibNo ratings yet

- Synthesis of CNTsDocument9 pagesSynthesis of CNTsBaoBao Suparat SasrimuangNo ratings yet

- Journal of Bioprocessing and Chemical EngineeringDocument10 pagesJournal of Bioprocessing and Chemical EngineeringNatsu OricaNo ratings yet

- Mineral Traps For Greenhouse Gases in Mine TailingsDocument336 pagesMineral Traps For Greenhouse Gases in Mine Tailingsjsotofmet4918No ratings yet

- Xu R. Particle Characterization.. Light Scattering Methods (Kluwer, 2002) (T) (410s)Document410 pagesXu R. Particle Characterization.. Light Scattering Methods (Kluwer, 2002) (T) (410s)Omar Canseco JordaNo ratings yet

- Euca PDFDocument13 pagesEuca PDFAgnes de RogheimNo ratings yet

- Mathew Et Al. - 2015 - PHYSIOLOGICAL IMPACT OF PHYTO-SYNTHESIZED ANANAS CDocument17 pagesMathew Et Al. - 2015 - PHYSIOLOGICAL IMPACT OF PHYTO-SYNTHESIZED ANANAS CNithin VijayakumarNo ratings yet

- Hafsah 2001 Some Factors AffectingDocument14 pagesHafsah 2001 Some Factors Affectingtrader123No ratings yet

- Central Instrumentation Facility B.I.T., Mesra Requisition Form For SEM/EDXDocument1 pageCentral Instrumentation Facility B.I.T., Mesra Requisition Form For SEM/EDXGULSHAN MADHURNo ratings yet

- Focused Ion BeamDocument9 pagesFocused Ion BeamnitheshsharmaNo ratings yet

- Selective Oxidn Glucose To Lactic Acid C3N4Document13 pagesSelective Oxidn Glucose To Lactic Acid C3N4GRagaNo ratings yet

- Image Formation and InterpretationDocument35 pagesImage Formation and InterpretationRohith VarunNo ratings yet