Professional Documents

Culture Documents

RemiVoucherPAYE PDF

Uploaded by

Gamil Pardhun0 ratings0% found this document useful (0 votes)

12 views2 pagesOriginal Title

RemiVoucherPAYE.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesRemiVoucherPAYE PDF

Uploaded by

Gamil PardhunCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

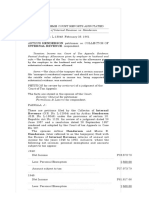

ORIGINAL

FOR USE BY MRA OFFICE

Date received

INCOME TAX - PAYE REMITTANCE VOUCHER

(The Income Tax Act - Section 93)

To be filled by an employer and forwarded to the Director-General, Mauritius Revenue

Authority, together with a remittance of the amount of tax withheld (plus any penalty and

interest) within 20 days from the end of the month in which the tax was withheld.

PARTICULARS OF EMPLOYER 1. PAYE Employer Registration No.

2. Full name of Employer ................................................................................................ Rupees only

M M Y Y

3. Tax withheld for the month of ... ... ... Amount

4. Penalty for late payment ... ... ... ... ... ... ...

M M Y Y M M Y Y

5. Interest on unpaid tax for the months to ...

6. Total remittance: cash / cheque * ... ... ... ... ... ...

7. NUMBER OF EMPLOYEES In respect of month specified at 3. above -

(a) Total number of persons employed ... ... ... ... ...

(b) Number of employees in respect of whom tax has been withheld ...

Date ............................................................. Signature ...........................................................................................

Full name of signatory ...................................................................

* Delete as appropriate Capacity in which acting................................................................

DUPLICATE (Employer's copy)

INCOME TAX - PAYE REMITTANCE VOUCHER

(The Income Tax Act - Section 93)

To be filled by an employer and forwarded to the Director-General, Mauritius Revenue Authority, together with a

remittance of the amount of tax withheld (plus any penalty and interest) within 20 days from the end of the month in

which the tax was withheld.

PARTICULARS OF EMPLOYER 1. PAYE Employer Registration No.

2. Full name of Employer ................................................................................................ Rupees only

M M Y Y

3. Tax withheld for the month of ... ... ... Amount

4. Penalty for late payment ... ... ... ... ... ... ...

M M Y Y M M Y Y

5. Interest on unpaid tax for the months to ...

6. Total remittance: cash / cheque * ... ... ... ... ... ...

7. NUMBER OF EMPLOYEES In respect of month specified at 3. above -

(a) Total number of persons employed ... ... ... ... ...

(b) Number of employees in respect of whom tax has been withheld ...

Date ............................................................. Signature ...........................................................................................

Full name of signatory ...................................................................

* Delete as appropriate Capacity in which acting................................................................

You might also like

- Revised PF Withdrawal Form-19Document3 pagesRevised PF Withdrawal Form-19Sukhveer SinghNo ratings yet

- Form 19Document3 pagesForm 1919CS224 Sarathy.RNo ratings yet

- PF Form 19Document2 pagesPF Form 19vasudevanNo ratings yet

- Caribbean Infrastructure Public Private Partnership RoadmapFrom EverandCaribbean Infrastructure Public Private Partnership RoadmapNo ratings yet

- Last Pay CertificateDocument2 pagesLast Pay CertificateMukesh KumarNo ratings yet

- American Credit Repair: Everything U Need to Know About Raising Your Credit ScoreFrom EverandAmerican Credit Repair: Everything U Need to Know About Raising Your Credit ScoreRating: 3 out of 5 stars3/5 (3)

- PFWITHDRAWALFORM-19Document2 pagesPFWITHDRAWALFORM-19rafiuddin623No ratings yet

- Institutional Investment in Infrastructure in Emerging Markets and Developing EconomiesFrom EverandInstitutional Investment in Infrastructure in Emerging Markets and Developing EconomiesNo ratings yet

- Retrenchment DocumentsDocument11 pagesRetrenchment DocumentsfizaNo ratings yet

- American Landlord Law: Everything U Need to Know About Landlord-Tenant LawsFrom EverandAmerican Landlord Law: Everything U Need to Know About Landlord-Tenant LawsNo ratings yet

- Employees' Provident Fund Scheme, 1952: Form-19Document9 pagesEmployees' Provident Fund Scheme, 1952: Form-19Rahul ModhNo ratings yet

- Employees' Provident Fund Scheme, 1952: Form-19Document2 pagesEmployees' Provident Fund Scheme, 1952: Form-19VamshiNo ratings yet

- Theoretical Foundations of Corporate FinanceFrom EverandTheoretical Foundations of Corporate FinanceRating: 5 out of 5 stars5/5 (1)

- EA Pin2021 2Document1 pageEA Pin2021 2AisyaNo ratings yet

- Marketing strategies of Chinese companies: Focus on Germany und EuropeFrom EverandMarketing strategies of Chinese companies: Focus on Germany und EuropeNo ratings yet

- LPC FormDocument2 pagesLPC FormRekib AhmedNo ratings yet

- Tax and Development: Solving Kenya�s Fiscal Crisis through Human RightsFrom EverandTax and Development: Solving Kenya�s Fiscal Crisis through Human RightsNo ratings yet

- Annual ReturnsDocument13 pagesAnnual ReturnszrqsjmvjftNo ratings yet

- Drafting Purchase Price Adjustment Clauses in M&A: Guarantees, retrospective and future oriented Purchase Price Adjustment ToolsFrom EverandDrafting Purchase Price Adjustment Clauses in M&A: Guarantees, retrospective and future oriented Purchase Price Adjustment ToolsNo ratings yet

- Form5 PTDocument2 pagesForm5 PTShilpa KapoorNo ratings yet

- Brokering Development?: The Private Sector and Unalleviated Poverty in Tanzania's Agricultural Growth CorridorsFrom EverandBrokering Development?: The Private Sector and Unalleviated Poverty in Tanzania's Agricultural Growth CorridorsNo ratings yet

- Esi 5Document2 pagesEsi 5msen_74No ratings yet

- Financial Risk Management: Management of Interest Risk from a Corporate Treasury Perspective in a Service EnterpriseFrom EverandFinancial Risk Management: Management of Interest Risk from a Corporate Treasury Perspective in a Service EnterpriseNo ratings yet

- Form 19 - Blank FormsDocument2 pagesForm 19 - Blank Formschetan dalviNo ratings yet

- Form 15 GDocument2 pagesForm 15 GAmit BhatiNo ratings yet

- Rent Receipt TemplateDocument1 pageRent Receipt TemplateShonai SaikatNo ratings yet

- Income Tax: Year of Assessment 2009 - 2010 Return of Income - CompanyDocument6 pagesIncome Tax: Year of Assessment 2009 - 2010 Return of Income - CompanyYogeeta RughooNo ratings yet

- Employees' Provident Fund Scheme, 1952: Form-19Document2 pagesEmployees' Provident Fund Scheme, 1952: Form-19Ajay KathuriaNo ratings yet

- Form 75 Liquidator's Account of Receipts and Payments and Statement of The Position in The Winding UpDocument4 pagesForm 75 Liquidator's Account of Receipts and Payments and Statement of The Position in The Winding UpolingirlNo ratings yet

- Audit Report Under Section 80HHA of The Income-Tax Act, 1961Document1 pageAudit Report Under Section 80HHA of The Income-Tax Act, 1961Amit BhatiNo ratings yet

- Lease Agreement Dows & 1034371 Ontario Inc.Document2 pagesLease Agreement Dows & 1034371 Ontario Inc.Betty Blair FannonNo ratings yet

- Employees' Provident Fund Scheme, 1952: Form-19Document2 pagesEmployees' Provident Fund Scheme, 1952: Form-19Anonymous vsiAEfSWNo ratings yet

- VAT Registration Application1Document3 pagesVAT Registration Application1Stephen Amachi ChisatiNo ratings yet

- Form 5 Annual ReturnDocument3 pagesForm 5 Annual ReturnBalakrishna HNo ratings yet

- Ea Form 2018 PDFDocument1 pageEa Form 2018 PDFSpeederz freakNo ratings yet

- US Internal Revenue Service: p15 - 1999Document64 pagesUS Internal Revenue Service: p15 - 1999IRSNo ratings yet

- Local Government Service Commission: Application FormDocument2 pagesLocal Government Service Commission: Application FormselvenNo ratings yet

- The Payment of Wages Act, 1936 Form Iv Annual Returns Wages and Deductions From WagesDocument5 pagesThe Payment of Wages Act, 1936 Form Iv Annual Returns Wages and Deductions From WagesSUDHIR KUMARNo ratings yet

- Notice Under Section 80, Code of Civil ProcedureDocument3 pagesNotice Under Section 80, Code of Civil ProcedurePradyumn SinghNo ratings yet

- Atlas Consolidated Mining Vs CIRDocument7 pagesAtlas Consolidated Mining Vs CIRMonaVargasNo ratings yet

- Form 5Document2 pagesForm 5hdpanchal86No ratings yet

- SF-HSE-ForM-2 - 01-4b COID - W.cl.3 - Notice of Accident and Claim For CompensationDocument2 pagesSF-HSE-ForM-2 - 01-4b COID - W.cl.3 - Notice of Accident and Claim For Compensationsjorgundson17No ratings yet

- Internal: Collector of Internal Revenue. vs. HendersonDocument14 pagesInternal: Collector of Internal Revenue. vs. HendersonJuris FormaranNo ratings yet

- FORM XIX-Wage SlipDocument1 pageFORM XIX-Wage SlipRITE/ HRNo ratings yet

- Earned LeaveDocument2 pagesEarned LeavebixoniNo ratings yet

- Last Pay CertificateDocument2 pagesLast Pay CertificateJayaprakash Vayakkoth Madham100% (3)

- Financial Track RecordDocument8 pagesFinancial Track RecordOtretemba Jean AISSAHNo ratings yet

- Form No. 15G: Signature of The DeclarantDocument2 pagesForm No. 15G: Signature of The DeclarantNineFinancialNo ratings yet

- Professional Tax Jan 2023 PDFDocument1 pageProfessional Tax Jan 2023 PDFRaghavendra GandodiNo ratings yet

- IRS Publication 15 - 2009Document70 pagesIRS Publication 15 - 2009Wayne Schulz100% (11)

- 2024 TD 59Document2 pages2024 TD 59Andreas Shikh MohammadNo ratings yet

- Final Return For TARA PDFDocument8 pagesFinal Return For TARA PDFAnonymous NaYWx2vJN100% (1)

- Form 63 Account of Receipts and Payments by Receiver or ManagerDocument2 pagesForm 63 Account of Receipts and Payments by Receiver or ManagerolingirlNo ratings yet

- GFR 12Document1 pageGFR 12Suanthansang suantakNo ratings yet

- Form 32 Return by Management CompanyDocument2 pagesForm 32 Return by Management CompanyolingirlNo ratings yet

- ITP No 979 English Version1Document93 pagesITP No 979 English Version1elias worku100% (3)

- Value Added Tax: Form Vat 3Document2 pagesValue Added Tax: Form Vat 3Gamil PardhunNo ratings yet

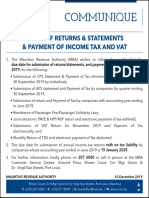

- Communique: Filing of Returns & Statements & Payment of Income Tax and VatDocument1 pageCommunique: Filing of Returns & Statements & Payment of Income Tax and VatGamil PardhunNo ratings yet

- Faq - Mra TDSDocument11 pagesFaq - Mra TDSGamil PardhunNo ratings yet

- Tax IT Form 2014 PDFDocument4 pagesTax IT Form 2014 PDFGamil PardhunNo ratings yet

- ITAConsolidated PDFDocument416 pagesITAConsolidated PDFAGATHE ELODIENo ratings yet

- MRA Important Dates: January AprilDocument3 pagesMRA Important Dates: January AprilGamil PardhunNo ratings yet

- Title (MR, MRS, Miss) Surname Other Names National Identity Card NumberDocument2 pagesTitle (MR, MRS, Miss) Surname Other Names National Identity Card NumberDylan RamasamyNo ratings yet

- The Covid-19 (Miscellaneous Provisions) Act 2020Document87 pagesThe Covid-19 (Miscellaneous Provisions) Act 2020Gamil PardhunNo ratings yet

- Consolidated Version of The Workers' Rights Act 2019 As at 7 September 2020 PDFDocument143 pagesConsolidated Version of The Workers' Rights Act 2019 As at 7 September 2020 PDFGamil PardhunNo ratings yet

- Vat Registration Form - VAT1ADocument1 pageVat Registration Form - VAT1AGamil PardhunNo ratings yet

- Communique Renewal - August 2020Document1 pageCommunique Renewal - August 2020Gamil PardhunNo ratings yet

- Notes To Company Tax 2016-2017Document2 pagesNotes To Company Tax 2016-2017Gamil PardhunNo ratings yet

- CommuniqueNPFNSF290720 PDFDocument1 pageCommuniqueNPFNSF290720 PDFGamil PardhunNo ratings yet

- Important Dates 2020Document8 pagesImportant Dates 2020Gamil PardhunNo ratings yet

- Important Dates 2015: JanuaryDocument7 pagesImportant Dates 2015: JanuaryGamil PardhunNo ratings yet

- Employer Registration Form (Erf) : DD MM YYDocument2 pagesEmployer Registration Form (Erf) : DD MM YYManisha D ShiblollNo ratings yet

- The Covid-19 (Miscellaneous Provisions) Act 2020Document87 pagesThe Covid-19 (Miscellaneous Provisions) Act 2020Gamil PardhunNo ratings yet

- Edf 2015-2016 PDFDocument2 pagesEdf 2015-2016 PDFGamil PardhunNo ratings yet

- ITAConsolidated PDFDocument416 pagesITAConsolidated PDFAGATHE ELODIENo ratings yet

- Pay As You Earn (Paye) Employee Declaration Form (EDF) Income Year 2013Document2 pagesPay As You Earn (Paye) Employee Declaration Form (EDF) Income Year 2013Tas Lee MahNo ratings yet

- P 1212Document17 pagesP 1212cusip1No ratings yet

- Limitations On The Exercise of Taxing Power A. Inherent LimitationsDocument12 pagesLimitations On The Exercise of Taxing Power A. Inherent LimitationsAngeliqueGiselleCNo ratings yet

- How To Handle Letter of Authority To Examine Cooperatives: Rhodora Garcia-IcaranomDocument42 pagesHow To Handle Letter of Authority To Examine Cooperatives: Rhodora Garcia-IcaranomJeanette LampitocNo ratings yet

- GNLD - International and Foster Sponsoring - NewDocument9 pagesGNLD - International and Foster Sponsoring - NewNishit KotakNo ratings yet

- Nota para Localização PDFDocument37 pagesNota para Localização PDFmarcosoliversilvaNo ratings yet

- Withholding TaxesDocument29 pagesWithholding TaxesJoshua NotaNo ratings yet

- Income Taxation Chapter 2Document5 pagesIncome Taxation Chapter 2Jasmine OlayNo ratings yet

- Year-End Adjustment NewDocument27 pagesYear-End Adjustment NewKyrzen Novilla0% (1)

- PLDTDocument2 pagesPLDTYvet KatNo ratings yet

- Acknowledgement: College of Management and AccountancyDocument28 pagesAcknowledgement: College of Management and AccountancyMonique FloresNo ratings yet

- AdjustmentsDocument78 pagesAdjustmentsKpGadaNo ratings yet

- Guide To Taxation of Employee Disability Benefits: Standard Insurance CompanyDocument26 pagesGuide To Taxation of Employee Disability Benefits: Standard Insurance CompanyJacen BondsNo ratings yet

- State of New Mexico Forty-Ninth Legislature Second Session, 2010 House of Representatives House CalendarDocument4 pagesState of New Mexico Forty-Ninth Legislature Second Session, 2010 House of Representatives House CalendarpsauthoffNo ratings yet

- Schedule CDocument22 pagesSchedule Cwangrui67% (3)

- Taxation - Singapore (TX - SGP) : Applied SkillsDocument19 pagesTaxation - Singapore (TX - SGP) : Applied SkillsLee WendyNo ratings yet

- Bcom ProjectDocument76 pagesBcom ProjectVictor Muto100% (1)

- Cta CasesDocument31 pagesCta CasesPmbNo ratings yet

- Case 2 Miguel J. Osorio Pension Foundation vs. CADocument2 pagesCase 2 Miguel J. Osorio Pension Foundation vs. CAlenvfNo ratings yet

- 674 - ICC Model International Transfer of Technology ContractDocument110 pages674 - ICC Model International Transfer of Technology ContractThierry AmalvyNo ratings yet

- CEO Bonus Plan Sample-Product ShippingDocument5 pagesCEO Bonus Plan Sample-Product Shippingexpertceo_productionNo ratings yet

- Income Tax ExamDocument4 pagesIncome Tax ExamErwin Labayog Medina0% (1)

- CIR V AlgueDocument13 pagesCIR V Alguejury jasonNo ratings yet

- Certificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseDocument4 pagesCertificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseMay MayNo ratings yet

- Oracle Financials-Operational Analysis Questionnaire 1.0 AP CEDocument12 pagesOracle Financials-Operational Analysis Questionnaire 1.0 AP CEjaldanaNo ratings yet

- Individuals Cq3bDocument2 pagesIndividuals Cq3bMohitNo ratings yet

- Bohol Limestone Corporation - Quick FactsDocument5 pagesBohol Limestone Corporation - Quick FactsJana Mae Catot AcabalNo ratings yet

- RMO No. 27-2016Document5 pagesRMO No. 27-2016Romer LesondatoNo ratings yet

- Instructions To Bidder (S) (Itb)Document101 pagesInstructions To Bidder (S) (Itb)pramodyad5810No ratings yet

- An Act Amending The National Internal Revenue Code, As Amended, and For Other PurposesDocument12 pagesAn Act Amending The National Internal Revenue Code, As Amended, and For Other PurposesVada De Villa RodriguezNo ratings yet

- E-Italian Tax Booklet 2018Document17 pagesE-Italian Tax Booklet 2018Sander Van RansbeeckNo ratings yet