Professional Documents

Culture Documents

Adrian James Abayata - Itr

Adrian James Abayata - Itr

Uploaded by

DOLE West Leyte Field Office0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

ADRIAN JAMES ABAYATA_ITR

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageAdrian James Abayata - Itr

Adrian James Abayata - Itr

Uploaded by

DOLE West Leyte Field OfficeCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

BIDS RCRA

TO106/ISENCSPS

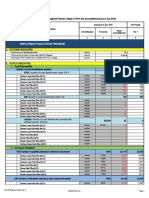

Annual Income Tax Return eae

@ ror Sltmplyed indian, Entaten a Tata 1701

Kevaninan ng Rents Interns | crxoralequrod format i CAPITAL LETTERS ving LACK in. ark pptcabio | June 2013 (ENCS)

| coe tn Tes copie MUST bof we I od ne hat by fox Per. |” bu

anor 720CL) |? Rtume” C1 ¥es L_INo 3 Short Period Return? [J Yes [] No

“ nbtanimers Taro IATC) | WOT Compensation incane | [W072 Bushess cone income tom Protein |_| 0078 od came

Part T= Background information on TAXPAVERTFILER,

'5 Taxpayer Identification Number (TIN) : _e -[0[0]0]0]0|@RDOGode| | |

Tax Fler Type Tingle Proprietor Professional Estate Trust

B Tax Filer's Name (authors Fetnane wate ave er iavaie) / ESTATE of (i vions tase nar, x nane)/ TRUST FAO rans ioe Nae. a

SUB AM ATR: DID MIVA GOR Mes GViv MZON, | yy 1

‘9 Trade Name

i a a a

70 Ragstored Address (clea complete regtered adress)

[TAD We, SW Bigs ITA BAN GF, EK TE, |p ypyiririis

PR A

11 Date of Sith (aMDOVYYY) — [12 Email Adaress.

0:7 fA] 2) [11191 414 | ym ye ys AAT AHO 6 2 IMAL I. Cioim

43 Conlact Number 44 Givi Status

OFA AA was) | x | Single Married Legally Separated | widowier

451f Marie, indicate whether spouse has income [__] with income [_] WithNo Income | 16 ing Status [_] Joint Fiing [_] Separate Fling

47 Maine of)

eorm | | tt tt ttt tt Laalatealea uoreee| |i

cir rd Deduction (OSD) a ore sam

‘20 Method of Deduction [_] ltemized Deduc in oO ‘Optional Standard De¢ action ( ) eae

21 Method of Accounting Cash Accrual a

‘22 income Exempt from income Tax? [_] Yes No ‘23 income subject to Special/Preferential Rate? [] Yes [] No

{Pion tape Manat Aachnens PERTETWETY F330 an it ap sce Monastry vacant PER ACTIVITY P5713)

24 Claiming Additonal Exemptions? [ves [_JNo | 2 HYES, ener number of uaiied Dependent Chisren

tan ope te oad

Part il — Total Tax Payable (Do NOT enter Centavos)

726 Total Income Tax Due (Overpayment) for Tax Filer and Spouse (Sum of lems T2A & 726) F

27 Less: Total Tax Credits / Payments (Sum of ltems 76A & 76B) i

‘28 Net Tax Payable (Overpayment) (Item 26 Less item 27) :

129. Less: Porton of Tax Payable Allowed for 7 instalment to be paid on or before July 15 norte Tan somo toma |

30 Total Tax Payable (item 28 Less item 29) :

31 Add: Total Penalties (From item 84) :

32 TOTAL AMOUNT PAYABLE Upon Filing (Overpayment) Sum offems 30 831)

if Overpayment, mark one box only (Once the choice is made, the same is revocable)

To be refunded “To be issued a Tax Credit Certtate (TCC) “Fo be carried over as a ax credit for next year/quarier

Tesi onder Fo penalize ol pony Tal is anal an Pas been ade good ih veodby es arate fe bec oly Wowhead Dee hue and core pursuant toe

[porisans oe National ronal avenue Code se sanded onde ote sued unde’ auarly Rete. AuPrzes Reprsenaive, afc auftzaton ite and inde

1

ei

messy

1

rz

4

4

lt all

ca

Oem. dees, & Seas | 3 Number of ages fe

Signatrs ora pins rar t Tax Piet [Sgr na prd rr a aren Rape

Conny Tx cetesta ‘Bae aoe 7 1

(Cronos | 1 1 LL yy | nip | L J fl

36 Place of esve eno 1, | stamawaverc] y I

Parte oe Number Date (mm/oo/vvvy) Amount

eceneeeee Lt piitisfi fil Fer iar rae ere

38.Check 7 1

per 1 Lt ae ae ae

| ao oihers pea Beton) = :

Lite ee td Le bt i ed ht ee

acne Valaion Revere Oficial Revol Data na od ih an Ate Age Bank) ‘Sap Rec OFEAAAE nd DE eee

(RO's SignatureBank Teler's Intl)

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- TUPAD (STREET SWEEPING) Orientation AttendanceDocument3 pagesTUPAD (STREET SWEEPING) Orientation AttendanceDOLE West Leyte Field OfficeNo ratings yet

- PassportDocument2 pagesPassportDOLE West Leyte Field OfficeNo ratings yet

- 1 - .B" F./ RT: (-+rmso HTSSDDocument3 pages1 - .B" F./ RT: (-+rmso HTSSDDOLE West Leyte Field OfficeNo ratings yet

- PESO Incentive ChecklistDocument13 pagesPESO Incentive ChecklistDOLE West Leyte Field OfficeNo ratings yet

- ALLOCATION OF OFFICE 365 LICENSES For OURSDocument1 pageALLOCATION OF OFFICE 365 LICENSES For OURSDOLE West Leyte Field OfficeNo ratings yet

- Municipality of Tabang0: Pobhaciori Tabangq, Leyte - 6536Document1 pageMunicipality of Tabang0: Pobhaciori Tabangq, Leyte - 6536DOLE West Leyte Field OfficeNo ratings yet

- Certification: Department of Labor and EmploymentDocument21 pagesCertification: Department of Labor and EmploymentDOLE West Leyte Field OfficeNo ratings yet

- Employers DirectoryDocument4 pagesEmployers DirectoryDOLE West Leyte Field OfficeNo ratings yet

- DOLE RO8 CHECKS ISSUED AS OF March 16, 2018Document94 pagesDOLE RO8 CHECKS ISSUED AS OF March 16, 2018DOLE West Leyte Field OfficeNo ratings yet

- Employers DirectoryDocument4 pagesEmployers DirectoryDOLE West Leyte Field OfficeNo ratings yet

- Page 3 BLRDocument190 pagesPage 3 BLRDOLE West Leyte Field OfficeNo ratings yet

- List of AP (Sorted) 2017 - DOLE RO8Document4 pagesList of AP (Sorted) 2017 - DOLE RO8DOLE West Leyte Field OfficeNo ratings yet

- Page 2 BLEDocument182 pagesPage 2 BLEDOLE West Leyte Field OfficeNo ratings yet

- DOLE RO8 CHECKS ISSUED AS OF March 21-26, 2018Document142 pagesDOLE RO8 CHECKS ISSUED AS OF March 21-26, 2018DOLE West Leyte Field OfficeNo ratings yet

- Cristine Joyce Price QuotationDocument2 pagesCristine Joyce Price QuotationDOLE West Leyte Field OfficeNo ratings yet

- Dole Ro8 Checks Issued As of August 27-28, 2019Document161 pagesDole Ro8 Checks Issued As of August 27-28, 2019DOLE West Leyte Field OfficeNo ratings yet

- 8 COA Actions Taken FinalDocument4 pages8 COA Actions Taken FinalDOLE West Leyte Field OfficeNo ratings yet

- RO8-2019 PAP Targets and Accomp As of JulyDocument7 pagesRO8-2019 PAP Targets and Accomp As of JulyDOLE West Leyte Field OfficeNo ratings yet

- Dole Ro 8: Key Frontline Services:: KFS PCT Within PCT Per Validation RemarksDocument3 pagesDole Ro 8: Key Frontline Services:: KFS PCT Within PCT Per Validation RemarksDOLE West Leyte Field OfficeNo ratings yet