Professional Documents

Culture Documents

Basic Principles of Taxation

Uploaded by

Yamate0 ratings0% found this document useful (0 votes)

16 views2 pagesOriginal Title

BASIC PRINCIPLES OF TAXATION

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesBasic Principles of Taxation

Uploaded by

YamateCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

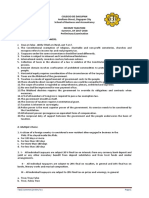

TAXATION 1

Basic Principles Of Taxation

PROBLEM 1 – Enumeration

1. Essentials characteristics of a tax – 5

2. Classification of taxes

a. As to subject matter – 3

b. As to who bears the burdern – 2

c. As to determination of amount – 2

d. As to purpose – 2

e. As to authority imposing the tax – 2

f. As to graduation or rate – 3

3. Sources of tax laws – 5

4. Examples of national taxes – 5

5. Examples of local taxes – 5

6. Classification of individual taxpayers – 6

7. Requirements by which a child may be considered as dependent of a head of family – 6

PROBLEM 2 – Identify or fill in the blanks

1. The process by which the state, through its lawmaking body, raises income to defray its

necessary expenses.

2. These are enforced proportional contribution from persons and property levied by the

lawmaking body of the state by virtue of its sovereignty for the support of the

government and all public needs.

3. Tax imposed upon the performance of an act, the enjoyment of a privilege or the

engaging in an occupation.

4. Tax which the taxpayer can shift to another.

5. Tax imposed based on a physical unit of measurement.

6. Tax proportionate to the value of the property.

7. Tax imposed by the national government.

8. Tax rate increases as the tax base increases.

9. The place of taxation.

10. Any sanction imposed as a punishment for violation of law or acts deemed injurious..

11. Taxes imposed on goods exported to or imported from a country.

12. This happens when the taxpayer minimizes his tax liability by taking advantage of

legally available tax planning opportunities.

13. This happens when a taxpayer resorts to unlawful means to lessen or to get away with

his tax liability.

14. In its broad sense, means all wealth, which flows into the taxpayer other than a mere

return of capital.

15. A tax on all yearly profits arising from property, profession, trade or business.

16. A Filipino citizen permanently residing in the Philippines.

17. An individual whose residence is not within the Philippines and who is not a citizen

thereof.

18. Income subject to a separate and final tax at fixed rates ranging from 5% to 25%.

19. Arbitrary amounts allowed as deductions from gross income of the individual taxpayer

from compensation , business or practice of profession. They represent the personal,

living or family expenses of the taxpayer.

20. The amount of basic personal exemption for the following taxpayers:

a. Single b. Married c. Head of the family

d. Widow with minor children e. Legally separated wife with no children

PROBLEM 3

Indicate the tax rate if the taxpayer is a resident citizen and non-resident alien engaged in

trade or business in the Philippines for the following passive income:

1. Interest income on time deposit from RCBC

2. Royalty on the musical composition of Mr. C

3. First prize in PCSO draw

4. Cash dividend from Smart Corporation received in 2004

5. Interest income from 5-year individual trust fund

6. Interest income on dollar deposit from Metrobank under FCDS

7. P1,000,000 prize from Philippine Idol

8. P5,000 prize from amateur singing contest

9. Royalty on patent for a machinery

10. Winnings from horse racing

You might also like

- Black Panther Notes Income Taxation Part1Document27 pagesBlack Panther Notes Income Taxation Part1Malvin Aragon BalletaNo ratings yet

- Tax Avoidance and Tax EvasionDocument6 pagesTax Avoidance and Tax EvasionBhavanaNo ratings yet

- UntitledDocument10 pagesUntitledJosh SofferNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Tax Invoice: Gift From: Gift To: Customer CommentsDocument1 pageTax Invoice: Gift From: Gift To: Customer CommentsShaik NoorNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 01 Taxation Law OutlineDocument58 pages01 Taxation Law OutlineDrew RodriguezNo ratings yet

- Week 1 Assignment Fundamental Principles in TaxationDocument5 pagesWeek 1 Assignment Fundamental Principles in TaxationIan Paolo CaylanNo ratings yet

- Tax1 Prelim Summer 17Document5 pagesTax1 Prelim Summer 17Sheena CalderonNo ratings yet

- Income Taxation Last PartDocument12 pagesIncome Taxation Last PartRienalyn Dumlao Duldulao-DaligconNo ratings yet

- Income TaxationDocument211 pagesIncome Taxationfritz100% (5)

- TAX-Chap 2-3 Question and AnswerDocument9 pagesTAX-Chap 2-3 Question and AnswerPoison Ivy0% (1)

- Income TaxationDocument211 pagesIncome Taxationfritz100% (2)

- Fundamentals of TaxationDocument36 pagesFundamentals of TaxationAyesha Pahm100% (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Quicknotes in Income TaxDocument13 pagesQuicknotes in Income TaxTrelle DiazNo ratings yet

- Income TaxationDocument220 pagesIncome TaxationJoanna RojoNo ratings yet

- Definition or Concept of TaxationDocument24 pagesDefinition or Concept of TaxationJustine DagdagNo ratings yet

- Tax Pre-Week ReviewerDocument29 pagesTax Pre-Week ReviewerJuris TantumNo ratings yet

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- Code of Etichs of Professional AccountantsDocument40 pagesCode of Etichs of Professional AccountantsYamateNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Taxation ExamDocument7 pagesTaxation ExamJean PaladaNo ratings yet

- Polytechnic University of The PhilippinesDocument7 pagesPolytechnic University of The PhilippinesTwinie Mendoza100% (1)

- The Philippine Accountancy Act of 2004Document74 pagesThe Philippine Accountancy Act of 2004YamateNo ratings yet

- Tax by DimaampaoDocument90 pagesTax by Dimaampaoamun din100% (5)

- Bam 031 CfeDocument43 pagesBam 031 CfeMs VampireNo ratings yet

- Final Exam - Comprehensive - 10.24.16Document5 pagesFinal Exam - Comprehensive - 10.24.16YamateNo ratings yet

- SAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Document1 pageSAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Mharck AtienzaNo ratings yet

- RA 9298 Accountancy LawDocument15 pagesRA 9298 Accountancy LawniqdelrosarioNo ratings yet

- Basic Principles of TaxationDocument33 pagesBasic Principles of TaxationHenicel Diones San Juan100% (1)

- Scope and Limitation of TaxationDocument2 pagesScope and Limitation of TaxationBianca Viel Tombo CaligaganNo ratings yet

- Tax 1 ReviewerDocument16 pagesTax 1 ReviewerverkieNo ratings yet

- Reminders in Taxation DimaampaoDocument7 pagesReminders in Taxation DimaampaoMaan Badua100% (1)

- Theories On TaxationDocument3 pagesTheories On TaxationYamateNo ratings yet

- Income Taxation: Basic Priciples: 1. As To Subject Matter or ObjectDocument8 pagesIncome Taxation: Basic Priciples: 1. As To Subject Matter or ObjectcesalyncorillaNo ratings yet

- 111Document5 pages111Din Rose GonzalesNo ratings yet

- Income Tax ExamDocument4 pagesIncome Tax ExamErwin Labayog Medina0% (1)

- Income Taxation - LAV Notes122621Document13 pagesIncome Taxation - LAV Notes122621Mil Roilo B EspirituNo ratings yet

- Provided, That Taxes Allowed Under This Subsection, When Refunded or Credited, Shall Be Included As PartDocument6 pagesProvided, That Taxes Allowed Under This Subsection, When Refunded or Credited, Shall Be Included As Partchuga102No ratings yet

- Taxation Chapter 5Document7 pagesTaxation Chapter 5Laurence RomeroNo ratings yet

- Income Taxation T or F ReviewerDocument13 pagesIncome Taxation T or F ReviewerZalaR0cksNo ratings yet

- Taxation LawDocument107 pagesTaxation LawDave A ValcarcelNo ratings yet

- Testbank Finals 2021 Income TaxDocument11 pagesTestbank Finals 2021 Income Taxynasings.21No ratings yet

- AMBOL-TR Assignment 1Document8 pagesAMBOL-TR Assignment 1Cetacean HumpbackNo ratings yet

- TaxationDocument23 pagesTaxationJULIA MARIE DUCUTNo ratings yet

- Taxation ReportDocument79 pagesTaxation ReportkimNo ratings yet

- Income TaxationDocument6 pagesIncome TaxationJahz Aira GamboaNo ratings yet

- Income TaxationDocument22 pagesIncome TaxationMorano, Angeline G.No ratings yet

- Legal GroundDocument92 pagesLegal GroundSteve FervorNo ratings yet

- Principles of TaxDocument46 pagesPrinciples of TaxPASCUA, ROWENA V.No ratings yet

- Part III. Income Taxation: Nirc)Document10 pagesPart III. Income Taxation: Nirc)paul_jurado18No ratings yet

- National TaxDocument6 pagesNational TaxRoi RimasNo ratings yet

- Chapter 1: Fundamental Principles of TaxationDocument22 pagesChapter 1: Fundamental Principles of TaxationChira Rose Fejedero NeriNo ratings yet

- Taxes Serve As The Engine For Economic DevelopmentDocument25 pagesTaxes Serve As The Engine For Economic Developmentmark lordaNo ratings yet

- A. General Concepts and Principles of TaxationDocument25 pagesA. General Concepts and Principles of TaxationMarinella GonzalesNo ratings yet

- Taxation 1Document11 pagesTaxation 1graciaNo ratings yet

- Taxing Powers, Scope and Limitations of Nga and LguDocument7 pagesTaxing Powers, Scope and Limitations of Nga and LguArthur MericoNo ratings yet

- Basic Principles - Taxn01bDocument28 pagesBasic Principles - Taxn01bJericho PedragosaNo ratings yet

- Acct183 FinalsDocument7 pagesAcct183 FinalsPRINCESS AYAH L. CayongcatNo ratings yet

- SAUCE (Phil - Tax)Document9 pagesSAUCE (Phil - Tax)Darren GreNo ratings yet

- Tax Law Summary TopicDocument3 pagesTax Law Summary Topicjuldan ordestaNo ratings yet

- A and B Are IncorrectDocument6 pagesA and B Are IncorrectdgdeguzmanNo ratings yet

- Digested (Income Tax)Document8 pagesDigested (Income Tax)DutchsMoin MohammadNo ratings yet

- Rizza-Acsat Income TaxationDocument6 pagesRizza-Acsat Income TaxationRizza CasipongNo ratings yet

- Computation of Gross IncomeDocument10 pagesComputation of Gross IncomemysterymieNo ratings yet

- Pointers - TaxDocument11 pagesPointers - Taxjulius art maputiNo ratings yet

- Lesson 11 Income and Business TaxationDocument51 pagesLesson 11 Income and Business TaxationGelai BatadNo ratings yet

- Polytechnic University of The Philippines: ST NDDocument10 pagesPolytechnic University of The Philippines: ST NDShania BuenaventuraNo ratings yet

- Tax PrelimDocument23 pagesTax PrelimJames C. ZernaNo ratings yet

- Over View OFF S AUD It PR OcesDocument47 pagesOver View OFF S AUD It PR OcesYamateNo ratings yet

- Code of Ethics of Professional Accountants in The PhilippinesDocument9 pagesCode of Ethics of Professional Accountants in The PhilippinesYamateNo ratings yet

- Code of Ethics of Professional AccountantsDocument3 pagesCode of Ethics of Professional AccountantsYamateNo ratings yet

- 02 - Code of Ethics of ProfessionalDocument22 pages02 - Code of Ethics of ProfessionalYamateNo ratings yet

- AUD It - A N Over ViewDocument27 pagesAUD It - A N Over ViewYamateNo ratings yet

- Over View OFF S AUD It PR Oces SDocument39 pagesOver View OFF S AUD It PR Oces SYamateNo ratings yet

- Auditing and Assurance EngagementDocument46 pagesAuditing and Assurance EngagementYamateNo ratings yet

- Focus Notes Code of EthicsDocument9 pagesFocus Notes Code of EthicsYamateNo ratings yet

- Allowable Deductions ExercisesDocument3 pagesAllowable Deductions ExercisesYamateNo ratings yet

- Deductions From Gross IncomeDocument3 pagesDeductions From Gross IncomeYamateNo ratings yet

- Adjusting Entries Per Data For Adjustments in PSDocument1 pageAdjusting Entries Per Data For Adjustments in PSYamateNo ratings yet

- Adjusting Enries Discussion - AbmDocument2 pagesAdjusting Enries Discussion - AbmYamateNo ratings yet

- Accounting For DiscountsDocument2 pagesAccounting For DiscountsYamateNo ratings yet

- Capital Gains & LossesDocument4 pagesCapital Gains & LossesYamateNo ratings yet

- Estates & Trust, Fringe BenefitDocument3 pagesEstates & Trust, Fringe BenefitYamateNo ratings yet

- TAX REFORM LAW - Are You Ready For Simplified Bookkeeping and e InvoicingDocument3 pagesTAX REFORM LAW - Are You Ready For Simplified Bookkeeping and e InvoicingYamateNo ratings yet

- Analysis of Financial Statements TheoriesDocument2 pagesAnalysis of Financial Statements TheoriesYamateNo ratings yet

- Accountancy in The PhilippinesDocument1 pageAccountancy in The PhilippinesYamateNo ratings yet

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- Review of Accounting 1Document2 pagesReview of Accounting 1YamateNo ratings yet

- Accounting For Purchases and Sales of Merchandise For AbmDocument1 pageAccounting For Purchases and Sales of Merchandise For AbmYamateNo ratings yet

- Accounting For Value Added TaxDocument2 pagesAccounting For Value Added TaxYamateNo ratings yet

- The Accounting Equation Special Quiz - 1.7.16Document2 pagesThe Accounting Equation Special Quiz - 1.7.16YamateNo ratings yet

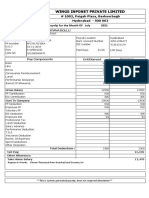

- Wings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Document1 pageWings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Venkatanarayana BolluNo ratings yet

- Computation - Computation (23-24)Document2 pagesComputation - Computation (23-24)BIKASH KUMARNo ratings yet

- Surfside Beach PPP DataDocument4 pagesSurfside Beach PPP DataWMBF NewsNo ratings yet

- New Tax CalculatorDocument5 pagesNew Tax CalculatorDJNo ratings yet

- ACFrOgBfcDc4ZkmRxDGfX36N bCUJVh - 6PwtZDXRz4ogV8C6WoSxUxvyYTthYmFqClgsElasl Q lzKNI92cfkyz0geGUBwq4L2Df23OEi1ME67J3fWfKFP7SuPF0RADocument1 pageACFrOgBfcDc4ZkmRxDGfX36N bCUJVh - 6PwtZDXRz4ogV8C6WoSxUxvyYTthYmFqClgsElasl Q lzKNI92cfkyz0geGUBwq4L2Df23OEi1ME67J3fWfKFP7SuPF0RAKishor HansoraNo ratings yet

- GST Exempt Car PartsDocument2 pagesGST Exempt Car Parts3CSRMuseumNo ratings yet

- Self-Certification For Individual: FATCA/CRS Declaration FormDocument2 pagesSelf-Certification For Individual: FATCA/CRS Declaration FormLeo DennisNo ratings yet

- Total Sales 1,120 Less: 20% Discount (224) Total Sales Net of Discount 896Document2 pagesTotal Sales 1,120 Less: 20% Discount (224) Total Sales Net of Discount 896Dianne LontacNo ratings yet

- Samrat PDFDocument2 pagesSamrat PDFCHIRAYU PHARMACEUTICALSNo ratings yet

- Preliminary ExaminationDocument2 pagesPreliminary ExaminationNita Costillas De MattaNo ratings yet

- Form CST Errors Sno Error Box Description Error Line No Error Box NoDocument12 pagesForm CST Errors Sno Error Box Description Error Line No Error Box NoVivek PatilNo ratings yet

- Сorporate Income Tax (Cit) : Dinara Mukhiyayeva, PhdDocument24 pagesСorporate Income Tax (Cit) : Dinara Mukhiyayeva, PhdAruzhan BekbaevaNo ratings yet

- Tax Invoice: Taxable Amount 58,900.00 Total Tax 10,602.00Document1 pageTax Invoice: Taxable Amount 58,900.00 Total Tax 10,602.00Ashish AgarwalNo ratings yet

- Salary Slip & Transfer Confirmation: Date: Period: Bank: Account # Name: Title: Dept: Emp #Document2 pagesSalary Slip & Transfer Confirmation: Date: Period: Bank: Account # Name: Title: Dept: Emp #Adheesh SanthoshNo ratings yet

- Input - Output TaxDocument23 pagesInput - Output TaxLipu MohapatraNo ratings yet

- TDS ChallanDocument2 pagesTDS ChallanRamachandran Mahendran60% (5)

- De La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentDocument2 pagesDe La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentGurong MNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountlakshayNo ratings yet

- 1 OverviewDocument14 pages1 OverviewMobile LegendsNo ratings yet

- Nov 2017 - PDFDocument4 pagesNov 2017 - PDFSam MaulanaNo ratings yet

- Vat 213Document2 pagesVat 213Sridhar EluvakaNo ratings yet

- WA Payroll Tax 22-23Document1 pageWA Payroll Tax 22-23JMLNo ratings yet

- AprilDocument6 pagesAprilcindy pecañaNo ratings yet

- DG - 0015 PDFDocument1 pageDG - 0015 PDFGasBuddyNo ratings yet