Professional Documents

Culture Documents

Casualty Losses Tax Relief

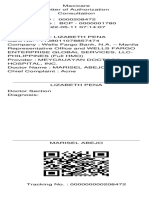

Uploaded by

Lizabeth PeñaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Casualty Losses Tax Relief

Uploaded by

Lizabeth PeñaCopyright:

Available Formats

CASUALTY LOSSES TAX RELIEF

In light of the recent typhoons which struck and devastated the different parts of the

country, most Filipinos and businesses are faced with tremendous losses to properties,

infrastructures, inventories, livestock, and worst lives.

But did you know that these casualty losses (properties used in business) may be

deducted as a valid expense from the gross income? To be considered valid, of course,

it has to comply with the BIR requirements.

Casualty losses is defined by the BIR regulations as a complete or partial destruction of

property resulting from an identifiable event of a sudden, unexpected, or unusual

nature. Our Tax Code allows the deduction of casualty losses from damage to or loss of

property used in business, to the extent that these are not compensated for by

insurance or other forms of indemnity, and subject to compliance with certain

requirements under Revenue Memorandum Order (RMO) No. 31-09.

Under the said RMO, within 45 days from the date of the event causing the loss, a

Sworn Declaration, together with other proof of loss, must be filed with the nearest BIR

RDO. Failure to submit such documentary requirements within the prescribed period

may result in the disallowance of the loss claimed.

Considering that most of us are still recovering from the aftermath of the typhoons,

complying to these requirements may be burdensome. Burdensome though it may be,

taxpayers should take advantage of this tax relief, especially that under the Bayanihan

to Recover as One Act, losses incurred from 2020 until 2021 may be carried over as

deduction in the next five (5) years.

So, let’s try to pick up ourselves from 2020’s disasters and pray that the rest of the year

will be better as we celebrate Christmas.

#TaxBreak with #VPA

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Annex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsDocument1 pageAnnex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsEliza Corpuz Gadon89% (19)

- Revenue Regulation No. 16-2005Document0 pagesRevenue Regulation No. 16-2005Kaye MendozaNo ratings yet

- L-208472 1168011078857474Document1 pageL-208472 1168011078857474Lizabeth PeñaNo ratings yet

- Taxation of Separation PayDocument1 pageTaxation of Separation PayLizabeth PeñaNo ratings yet

- Professional Tax ReceiptDocument1 pageProfessional Tax ReceiptLizabeth PeñaNo ratings yet

- 5gBJECT:: Regulations BIR ofDocument6 pages5gBJECT:: Regulations BIR ofErica CaliuagNo ratings yet

- RR 2-2013 PDFDocument23 pagesRR 2-2013 PDFnaldsdomingoNo ratings yet

- Tax Advisory - Withholding TaxesDocument1 pageTax Advisory - Withholding TaxesRalph AñesNo ratings yet

- RMC No. 03-2006 (Guidelines On Attachments)Document2 pagesRMC No. 03-2006 (Guidelines On Attachments)Marco RvsNo ratings yet

- RMC No. 44-2005Document8 pagesRMC No. 44-2005Dorothy PuguonNo ratings yet

- RR 11 2018 - Annex C - Withholding Agent Sworn DeclarationDocument1 pageRR 11 2018 - Annex C - Withholding Agent Sworn DeclarationLizabeth PeñaNo ratings yet

- Stockholders' Equity - Accounting ExamplesDocument5 pagesStockholders' Equity - Accounting ExamplesdavidinmexicoNo ratings yet