Professional Documents

Culture Documents

Semifinal - Quiz No. 1 (Stud's Copy)

Uploaded by

Janessa EngengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Semifinal - Quiz No. 1 (Stud's Copy)

Uploaded by

Janessa EngengCopyright:

Available Formats

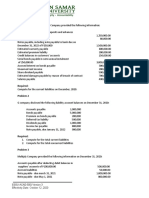

PROBLEM 1

Complete the table:

Amount of Final Tax BIR Form to

Date of Transaction Nature of Final Income Final Tax Deadline of Filing

Income Rate be Filed

1 March 7, 2018 Royalty on literary works paid to individual 62,500.00

Interest income under the foreign currency deposit system given to

2 June 11, 2018 150,000.00

a non-resident alien not engaged in trade or business

3 February 21, 2019 Share of profits of a partner 78,000.00

4 December 14, 2019 Lotto winnings 12,000,000.00

Dividend received by a non-resident foreign corporation from a

5 August 26, 2020 850,000.00

domestic corporation

6 September 13, 2020 2,500,000.00

PCSO lotto winnings given to the non-resident foreign corporation

7 October 29, 2020 Singing contest prize of an individual 8,300.00

PROBLEM 2

A taxpayer earned the following interest income from various time deposits:

6-month time deposit 6,000.00

2-year time deposit 18,000.00

5-year time deposit 62,000.00

Total 86,000.00

Required: Compute the final tax if the taxpayer is an (a) individual and if a (b) corporation.

PROBLEM 3

In reviewing its tax compliance, Jay Bank noted that it failed to remit the P 90,000.00 final taxes it withheld for the month of February 2017. Compute the total amount

of taxes due including the penalties (except for compromise penalty) if Jay Bank settles the obligation on March 20, 2017.

PROBLEM 4

Mr. Realtalk submitted a sworn statement regarding the alleged tax evasion practices of Daya Corporation. This led the BIR to recover P20,000,000.00 unpaid taxes.

How much net tax infomer's reward shall be paid to Mr. Realtalk?

You might also like

- Cea - Notes ReceivableDocument10 pagesCea - Notes ReceivableAnaluz Cristine B. CeaNo ratings yet

- TAX RefExamDocument16 pagesTAX RefExamjeralyn juditNo ratings yet

- Practice Question For Midterm Test - FA - 28.03Document4 pagesPractice Question For Midterm Test - FA - 28.03TRANG NGUYỄN THỊ HÀNo ratings yet

- Liabilities - ManuDocument7 pagesLiabilities - ManuClara MacallingNo ratings yet

- 20th Regional Mid Year Convention Cup 6 Easy RoundDocument18 pages20th Regional Mid Year Convention Cup 6 Easy RoundSophia De GuzmanNo ratings yet

- Intermediate AccountingDocument6 pagesIntermediate AccountingHarvy ReyesNo ratings yet

- Lecture 5 - Ss Q1 Q2 Q3Document4 pagesLecture 5 - Ss Q1 Q2 Q3Esther FanNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Bsa Quiz 2.0 - Pure ProbsDocument4 pagesBsa Quiz 2.0 - Pure ProbsCyrss BaldemosNo ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- Aje 1bsa Abm1Document7 pagesAje 1bsa Abm1Ej UlangNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- Test Bank Notes ReceivableDocument9 pagesTest Bank Notes ReceivableErrold john DulatreNo ratings yet

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Chapter 1 Liabilities ExercisesDocument3 pagesChapter 1 Liabilities ExercisesAwish FernNo ratings yet

- Preparation of Income Tax Return IndividualDocument2 pagesPreparation of Income Tax Return IndividualFRAULIEN GLINKA FANUGAONo ratings yet

- Classification & Accounts PayableDocument4 pagesClassification & Accounts PayableRodolfo Jr. LasquiteNo ratings yet

- Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Document9 pagesAma Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Meg CruzNo ratings yet

- Purchase 66,000 Freight-In 1,400 Accounts Payable 67,400Document7 pagesPurchase 66,000 Freight-In 1,400 Accounts Payable 67,400Rhea OraaNo ratings yet

- FinalroundDocument35 pagesFinalroundJenny Keece RaquelNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesJhaybie San BuenaventuraNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- San Beda University: Department of Accountancy and TaxationDocument11 pagesSan Beda University: Department of Accountancy and TaxationOG FAMNo ratings yet

- Assignment-Code 438Document5 pagesAssignment-Code 438Alice JasperNo ratings yet

- Seatwork 3-Liabilities 22Aug2019JMDocument3 pagesSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaNo ratings yet

- Problem 3Document11 pagesProblem 3Charmaine Kaye OndoyNo ratings yet

- Bsa 2105 Atty. F. R. Soriano Value-Added TaxDocument2 pagesBsa 2105 Atty. F. R. Soriano Value-Added Taxela kikayNo ratings yet

- Module 7 - Notes ReceivableDocument5 pagesModule 7 - Notes Receivablejustine cabanaNo ratings yet

- Recording Adjustments For Revenues & Recording EquityDocument7 pagesRecording Adjustments For Revenues & Recording Equitypratibha jaggan martinNo ratings yet

- Problem Set 7. Contingencies and Other LiabilitiesDocument3 pagesProblem Set 7. Contingencies and Other LiabilitiesAngeline Gonzales PaneloNo ratings yet

- ACCT2014 Final Exam 2021-2022 - K.Ashman v2Document9 pagesACCT2014 Final Exam 2021-2022 - K.Ashman v2Christina StephensonNo ratings yet

- Income Taxation On Corporations Exercise Problems BSADocument2 pagesIncome Taxation On Corporations Exercise Problems BSARico, Jalaica B.No ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Uts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFDocument4 pagesUts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFSuci Purnama Devi100% (1)

- Nov 19 Q PDFDocument9 pagesNov 19 Q PDFTenywa SalimNo ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- Division B - Descriptive Questions Question No. 1 Is CompulsoryDocument5 pagesDivision B - Descriptive Questions Question No. 1 Is CompulsoryUrvashi RNo ratings yet

- AP-5906 ReceivablesDocument5 pagesAP-5906 ReceivablesAngelieNo ratings yet

- Statement of Financial PositionDocument3 pagesStatement of Financial PositionDJ NicartNo ratings yet

- FAR 1 Chapter - 6Document13 pagesFAR 1 Chapter - 6Klaus DoNo ratings yet

- Note Payable: Feu - IabfDocument5 pagesNote Payable: Feu - IabfDonise Ronadel SantosNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- Auditing Problems MidtermDocument20 pagesAuditing Problems MidtermjasfNo ratings yet

- Correction of Errors IllustrationsDocument3 pagesCorrection of Errors IllustrationsBrian NaderaNo ratings yet

- Project Information Project 1Document8 pagesProject Information Project 1biniamNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- Cash and Accrual Basis - ExercisesDocument2 pagesCash and Accrual Basis - ExercisesTrisha Mae AlburoNo ratings yet

- Name: Date: Score:: Property of STIDocument2 pagesName: Date: Score:: Property of STIZeniah LouiseNo ratings yet

- Group Assignment OneDocument2 pagesGroup Assignment Oneehitemariam berhanu100% (2)

- Abbie Merry VecinaBSA 6011Document7 pagesAbbie Merry VecinaBSA 6011elleeeewoodssssNo ratings yet

- FAR Vol 2 Chapter 16 18Document14 pagesFAR Vol 2 Chapter 16 18Allen Fey De Jesus100% (1)

- B-BTAX313 Module 3 (Revenue Cycle) - Case StudyDocument5 pagesB-BTAX313 Module 3 (Revenue Cycle) - Case Studywill passNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Quiz - Chapter 1 - The Accounting ProcessDocument4 pagesQuiz - Chapter 1 - The Accounting ProcessJoseph Docto100% (2)

- DRAFT 2 of SCRIPT MALUNGON TEACHERS DAY 1Document22 pagesDRAFT 2 of SCRIPT MALUNGON TEACHERS DAY 1Janessa EngengNo ratings yet

- Bba 104Document418 pagesBba 104Alma Landero100% (1)

- CLOSING CREDITS-When You Believe With LykaDocument3 pagesCLOSING CREDITS-When You Believe With LykaJanessa EngengNo ratings yet

- Shooting SequenceDocument2 pagesShooting SequenceJanessa EngengNo ratings yet

- Instruction For Lykas in This MomentDocument2 pagesInstruction For Lykas in This MomentJanessa EngengNo ratings yet

- Cash Disbursement CycleDocument7 pagesCash Disbursement CycleJanessa EngengNo ratings yet

- DRAFT 2 of SCRIPT MALUNGON TEACHERS DAY 1Document22 pagesDRAFT 2 of SCRIPT MALUNGON TEACHERS DAY 1Janessa EngengNo ratings yet

- Power of The Dream Detailed InstructionDocument2 pagesPower of The Dream Detailed InstructionJanessa EngengNo ratings yet

- The Concept of Positive Risk: Group 5Document14 pagesThe Concept of Positive Risk: Group 5Janessa EngengNo ratings yet

- The Concept of Positive Risk: Group 5Document14 pagesThe Concept of Positive Risk: Group 5Janessa EngengNo ratings yet

- AquinoDocument4 pagesAquinoJanessa EngengNo ratings yet

- Financial Instruments and Associated RisksDocument4 pagesFinancial Instruments and Associated RisksDhruv Ratan DeyNo ratings yet

- Module 1 - AISDocument13 pagesModule 1 - AISJanessa EngengNo ratings yet

- Euro Credit Risk - Company Presentation - ENDocument22 pagesEuro Credit Risk - Company Presentation - ENRoberto Di DomenicoNo ratings yet

- Construction EconomicsDocument39 pagesConstruction EconomicsAshok Amara100% (1)

- Film&TvCrew Alliance ContractDocument4 pagesFilm&TvCrew Alliance ContractAvon PsicorpsNo ratings yet

- RT MDocument6 pagesRT MShikhar NigamNo ratings yet

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesaadonNo ratings yet

- NEGOTIABLE INSTRUMENTonlyDocument97 pagesNEGOTIABLE INSTRUMENTonlyTomSeddyNo ratings yet

- Got Milk Case Study QuestionsDocument6 pagesGot Milk Case Study QuestionsSalman Naseer Ahmad Khan100% (1)

- Nov 2018 RTP PDFDocument21 pagesNov 2018 RTP PDFManasa SureshNo ratings yet

- CDP Problem Solving Matrix WorkshopDocument3 pagesCDP Problem Solving Matrix WorkshopAmbosLinderoAllanChristopher100% (1)

- Certified Trade Finance SpecialistDocument4 pagesCertified Trade Finance SpecialistKeith Parker100% (2)

- Quizzers On Percentage TaxationDocument10 pagesQuizzers On Percentage Taxation?????No ratings yet

- MGT420 - Chapter 3Document44 pagesMGT420 - Chapter 32023813994No ratings yet

- Toate Subiectele Sunt Obligatorii. Se Acord Timpul Efectiv de Lucru Este de 3 OreDocument2 pagesToate Subiectele Sunt Obligatorii. Se Acord Timpul Efectiv de Lucru Este de 3 OreOliviu ArsenieNo ratings yet

- Final Report HRMDocument7 pagesFinal Report HRMpreet bainsNo ratings yet

- Final MR Notes (2Document155 pagesFinal MR Notes (2namrocksNo ratings yet

- Microeconomics 19th Edition Samuelson Test BankDocument25 pagesMicroeconomics 19th Edition Samuelson Test BankRobertFordicwr100% (55)

- CTS Marketing Executive - CTS - NSQF-4Document40 pagesCTS Marketing Executive - CTS - NSQF-4H RakshitNo ratings yet

- MBA 652 - Southwest AirlinesDocument6 pagesMBA 652 - Southwest AirlinesmeirocruzNo ratings yet

- Benefits of NEC ContractsDocument3 pagesBenefits of NEC ContractsAkaninyeneNo ratings yet

- FY2019-2021 GovernorsExecutiveBudgetDocument3,098 pagesFY2019-2021 GovernorsExecutiveBudgetReno Gazette JournalNo ratings yet

- CHAPTER 1 ENTREPRENEURIAL PROCESS NewDocument16 pagesCHAPTER 1 ENTREPRENEURIAL PROCESS NewNurul Wahida Binti Safiyudin C19A0696No ratings yet

- Abeel V Bank of America Etal Trillions 4 12Document390 pagesAbeel V Bank of America Etal Trillions 4 12James SempseyNo ratings yet

- Exhibit 1 Unitary Sec. Cert. - Domestic CorporationDocument2 pagesExhibit 1 Unitary Sec. Cert. - Domestic Corporationthesupersecretsecret40% (5)

- BPME3073 Group Assignment RP (A131) GuidelinesDocument10 pagesBPME3073 Group Assignment RP (A131) GuidelinesTeguh HardiNo ratings yet

- Inventories, Biological Assets, Etc.Document3 pagesInventories, Biological Assets, Etc.Jobelle Candace Flores AbreraNo ratings yet

- Broker Commission Schedule-EDocument19 pagesBroker Commission Schedule-EErvin Fong ObilloNo ratings yet

- Budgetary Control & Responsibility AccountingDocument61 pagesBudgetary Control & Responsibility AccountingLouris NuquiNo ratings yet

- Industrialization and Political Development in Nigeria (A Case Study of Rivers State (2007-2014) 3B.1Document41 pagesIndustrialization and Political Development in Nigeria (A Case Study of Rivers State (2007-2014) 3B.1Newman EnyiokoNo ratings yet

- Sahil Kumar Resumef PDFDocument1 pageSahil Kumar Resumef PDFSahil KumarNo ratings yet

- Key Partners (Wrong)Document8 pagesKey Partners (Wrong)Gail CuaresmaNo ratings yet