Professional Documents

Culture Documents

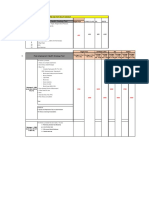

MF Industry

Uploaded by

hiteshCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MF Industry

Uploaded by

hiteshCopyright:

Available Formats

gross premium at 9.71 per cent is within striking distance of Oriental's 10.

09

per cent. Another state-owned giant United India, at 13.75 per cent, is also

within reach of ICICI Bank's general insurance subsidiary. So, while all the

four top spots, in terms of market share, are still occupied by the public sector

companies, they are finding it tough to keep the private companies at bay.

But if LIC has managed to hold on to its market share, why are the state-

owned general insurance companies losing ground? "The transactional nature

(selling one-year policies) with high service intensity makes this industry more

competitive," reasons Sanjay Kedia, Country Head and CEO of Marsh India

Insurance Brokers, a leading insurance broker and risk advisor. G. Srinivasan,

CMD of New India Assurance Company, explains that LIC has managed to

hold on to its market share because of the long-term nature of its products.

"Any individual will prefer to go to a government undertaking for his long-

term savings. Ours is an annual business where customers don't mind dealing

with the private sector," explains Srinivasan. The other public sector general

insurance companies refused to comment.

"Whenever a new entrant comes to the market, they also capture market

share. We saw a similar trend in banking when new generation private banks

were allowed in," says Tapan Singhel, Managing Director and CEO of Bajaj

Allianz General Insurance, the secondlargest private player. But flexibility of

operations and the right business model, with an initial focus on corporate

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mutual Fund InsightDocument3 pagesMutual Fund InsighthiteshNo ratings yet

- PPF Investment AdviseDocument1 pagePPF Investment AdvisehiteshNo ratings yet

- Life Insurance Corporation (LIC) : Ads by ZINCDocument1 pageLife Insurance Corporation (LIC) : Ads by ZINChiteshNo ratings yet

- Discount DetailsDocument2 pagesDiscount DetailshiteshNo ratings yet

- Provider ListDocument24 pagesProvider ListhiteshNo ratings yet

- Member DataDocument32 pagesMember DatahiteshNo ratings yet

- Employee Data3Document26 pagesEmployee Data3hiteshNo ratings yet

- Faqs For Top-Up Facility Under Sail Mediclaim Scheme (2020-21)Document2 pagesFaqs For Top-Up Facility Under Sail Mediclaim Scheme (2020-21)hiteshNo ratings yet

- English Worksheet CLASS: VII (2020-2021) Topic-Subject & Predicate + Question TagsDocument10 pagesEnglish Worksheet CLASS: VII (2020-2021) Topic-Subject & Predicate + Question TagshiteshNo ratings yet

- Discount Card ListDocument795 pagesDiscount Card ListhiteshNo ratings yet

- Listof IRPsDocument1 pageListof IRPshiteshNo ratings yet

- Wellness CalendarDocument3 pagesWellness CalendarhiteshNo ratings yet

- Sail Payment PDFDocument2 pagesSail Payment PDFhiteshNo ratings yet

- HC - E-MeditakeDocument5 pagesHC - E-MeditakehiteshNo ratings yet

- Marine QuoteDocument9 pagesMarine QuotehiteshNo ratings yet

- Anand Singh Negi Mohit Chauhan Date Bo/Do Policies Claims Bo/Do PoliciesDocument8 pagesAnand Singh Negi Mohit Chauhan Date Bo/Do Policies Claims Bo/Do PolicieshiteshNo ratings yet

- Doosan Data With Email Id and SIDocument126 pagesDoosan Data With Email Id and SIhiteshNo ratings yet

- Mandate LetterDocument1 pageMandate LetterhiteshNo ratings yet