Professional Documents

Culture Documents

CamScanner 10-16-2020 20.43.05 PDF

CamScanner 10-16-2020 20.43.05 PDF

Uploaded by

Vinay Jain0 ratings0% found this document useful (0 votes)

6 views3 pagesOriginal Title

CamScanner 10-16-2020 20.43.05.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesCamScanner 10-16-2020 20.43.05 PDF

CamScanner 10-16-2020 20.43.05 PDF

Uploaded by

Vinay JainCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

FORM NO. 16

See nie HOGOL

FARIA

aman nal TNR le seton 208 ot he tome At 196 for Tax deed at oes om ely

tsa No | ost Upsated On

[Nac ates phy Fran designation of he employee

OCK EDUCATION OFFICER

MADHO SINGH RAJPUT

Be OSHIVPURI, SHIVPURL, SHIVPURL, MADHYA PRADESH |

PAN No. of the Deductor | 1

WAN No, ofthe Ded [TAN ot the Deductor PAN No. ofthe Employee |

REQD | PL nnansc BRSPSSESHA 1 —

| mnont year | Period with the Employer

Adkress: The Commissioner af Income tax (FDS),Aayakan

shawn,

| cians) fe

Hoshanvabid Rod, shopal

igo vin Codess2014 | aaa

; Summary of amount paileretited an i deducted at source thereon in respeet ofthe employee ——_——

{anes Hct Nuntcsot | Amant panded, [Arount of ix degued (Amount fox depos

original quarterly | Rs.) | ae

nents of LDS under | |

tion (3) of setion} | |

\ 200 | |

Quarter 1 | a}

[anata | | af

{Quarter 3 | | st =

Quarter 4 | | 9

real 0 ae

a

} “LortansSor vax brbvci axp pc vos itn TL CENIRAT GOUurRSS¥ENT ACCOUNT THROUGH BOOK

ADIUSIMEN

‘he dedactor to provide payinont wise detail of tix deducted aed deere with respect te the des

S.No [Tax Deposited in| hook identification number (BIN)

espection of the | \

deductec (Ks.) | ee : \

t——}* Feccpe ners [PDOSeqia Sune] acolFanser Saws oti 6

| {Storm Nobic." in rnm No, 246 | Vougher damm) |__towm’ 2

| a 1

[torat _ ol | a ==

T-THROUGH CHALLAN

the deductee)

IN THE CENTRAL GOYERNMENT ACCC

J of tay deducted and deposited with respes

tification number (CIN)

DUCTED AND DEPOSITED.

IL. DETAILS OF TAX DI

ment wise detail

(The deductor 10 f ie pi

Challan id

S.No. } Tax Deposited in

respect on of the |

employee (RS) | -

- Pate on which fax) Challan Serial Number | Status of matching wit

BSR Code of the Bank |

| depositedtdd em yy yy) A OLTAS

| Branch |

Verification So

P_NIGAMworking in the capacity of. F.. O.(designation) do hereby cert

‘and paid to the eredit of the Central Government, | further certify tha

ailable records.

|

I

|

[or

i

[MANOJ KUMAR NIGAM, son‘danghter of SHRI A,

Only) has been deduetedat source

and correct based on the book’ of account, documents and other

{iat a sum of Rs 0.0002

Yinormation given above fs

Mace

in ohor2020 (Sisrmtere of person responsible for deduction of tax)

vivaion BELO, Fuil Name MANOJ KUMAR NIGAM

ne xs to fill information in item Tif ts is paid without production of income-tax cl mand Os Men

‘Scanned wih CamScanner

‘The deductor shall furnish the address of the Commissioner of Income-tax (TDS)

statements of the assessee,

4. Han assessee is employed under one employer only during the year, certificate in Form No. 16 issued

31st March of the financial year shall contain the details of tax deducted and deposited for all the quart

5, Han assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the

certificate in Form No. 16 pertaining to the period for which such assessee was employed with each of the employers. Part B

(Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the

assessee,

) having jurisdiction as regards TDS

for the quarter ending on

fers ofthe financial year,

6. __tn items | and Il in column for tax deposited in respect of deductee. furnish total amount of TDS and education cess.

PART B (Annexure)

Details of Salary paid and any other income and tax deducted

1 Gross Salary

\ (a)_ Salary as per provisions contained in section 17(1) a

\ (b) Value of perquisites under section 17(2) (as per Form No. 12BA, wherever 0

applicable)

(©) Profits in lieu of salary under section 17(3) (as per Form No. 12BA, 9

| ‘wherever applicable)

|) Total 595603;

| (e)_ Reported total amount of salary received from other employer(s) 9

L.ess: Allowance tothe extent exempt un 0 10 0

Allowance a Rs.

(@) [Travel concession or assistance under section | 0 0 0

1045) ze)

‘ ) a ‘gratuity under section 0 0 9

100)

- (©) [Commuted valve of pension under section 0 ol

hrocioay _ 1

@ [Cash equivatent of eave salary encashient [ 0 ° °

under section 10(10AA)

© [House rent allowance under section TOCI3A) @ 2 °

(8, [Amount of any other exemption under section

Lio =

(@ |Total amount of any other exemption under | o oO o

section 10

Total amount of salary received from eurrent employer [1(4)-2(h)] 595603

Less: Deductions under section 16

(@)_ Standard deduction under section 16(ia) 0000]

| (6) Entertainment allowance under section 16) 0

(€) Tax on employment under section 16ii) 2500)

Total amount of deductions under section 16 [4(a)+4(b}+4(e)] 52500]

ocome chargeable under the head "Salaries" [(3+1(e)-5] 543103

Add: Any other income reported by the employee under as per section 192 2B)

Income Rs

(2) |Income (or admissible loss) from house property reported by 0

‘employee offered for TDS |

(b) |Income under the head Other Sources offered for TDS 0

8. Total amount of other income reported by the employee [7(a)+7(b)] 0

9. Gross total income(6+8) 543103

10, Deduction under Chapter VIA

|Gross Deductible

Amount — | Amount

(2) Deduction in of fife insura i i

fad oe a eaPet of ie insurance prema, contbution io provident

up

84935

Developed By Compas

‘Scanned wih CamScanner

peduction in respect OF COMET

or Deduction

Daduetion in vespect oF COnHETBUTON

sestion SOCCD (1)

eduction minder section

Total deductio

WED IBY

1) Deduction in es

2) Dedtstion in respect of

(hy Deda

1 in respect of int

rest on oan taken for bi

sestion SOF

Tora Deduction in re

ext of d

SOTTA

1) Amount deductible under any other provision(s) of ehapter VIN

fo certain pension funds under se

set of contribution by Employ et t0 Pet

health insurance premia und

on scheme under

by taypayer to pension seh

0 $0CCC and S0CCD

i ed pension scheme

He ota pa posite 6 noted Pe

nsion scheme under

Jer section SOD

education under

tain funds.charitable

Jct section

Aggregate of deductible amount under Chapter VI

{iowa

wey BOAT) HOKE) LOKI): 10

otal taste income 11)

Tax on Total Income

under sextion 87H appticable

ge, wherever anplical

Health and education cess

MANOJ KUMAR NIGAM. so

hat the information

and other available ree

aughter of SURE A, P. NIGAM working

ature of the pe

Verification

and is b

wrson responsible for de

ume MANOJ KUMAR NIGAM

‘Scanned wih CamScanner

in the capacity of B. E

ton darcy

duction of tax.

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Annual Pay Slip: Month: September 2020 April 2019 ToDocument2 pagesAnnual Pay Slip: Month: September 2020 April 2019 ToVinay JainNo ratings yet

- Economics Project Report: Guided by Submitted byDocument1 pageEconomics Project Report: Guided by Submitted byVinay JainNo ratings yet

- Conveyance Expense Statement of FA/CA: Arpit Dhaker SHIVPURI (Madhya Pradesh)Document4 pagesConveyance Expense Statement of FA/CA: Arpit Dhaker SHIVPURI (Madhya Pradesh)Vinay JainNo ratings yet

- VBDocument2 pagesVBVinay JainNo ratings yet

- District Tehsil Village Type Distance From DistributorshipDocument13 pagesDistrict Tehsil Village Type Distance From DistributorshipVinay JainNo ratings yet

- IT ExpertgbilDocument1 pageIT ExpertgbilVinay JainNo ratings yet

- Resion Health Care Pvt. Ltd. Delhi: Add.: A.O. WP/141 - Pittampura New DelhiDocument1 pageResion Health Care Pvt. Ltd. Delhi: Add.: A.O. WP/141 - Pittampura New DelhiVinay JainNo ratings yet

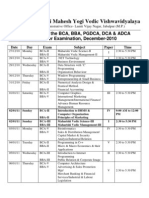

- Time Table December 2010Document3 pagesTime Table December 2010Vinay JainNo ratings yet

- Certificate of MeritDocument1 pageCertificate of MeritVinay JainNo ratings yet

- Tea Stoll/Dhaba Name Pro - Name Address Mobil RemarkDocument5 pagesTea Stoll/Dhaba Name Pro - Name Address Mobil RemarkVinay JainNo ratings yet