Professional Documents

Culture Documents

Zero-Rated Sales PDF

Uploaded by

NEstanda0 ratings0% found this document useful (0 votes)

75 views24 pagesOriginal Title

Zero-Rated Sales.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

75 views24 pagesZero-Rated Sales PDF

Uploaded by

NEstandaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 24

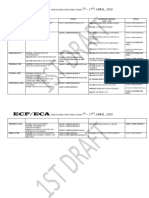

ZERO-RATED SALES

Sec 106 (A)(2)(a) of the Tax Code as amended by RA No.

10963 otherwise known as the TRAIN Law

ZERO-RATED SALE OF GOODS

A.Actual Export Sales

1. Sale and actual shipment of goods from the

Philippines to a foreign country.

● Irrespective of any shipping

arrangement that may be agreed upon

which may influence or determine the

transfer of ownership

● Paid for in acceptable foreign

currency or its equivalent in goods or

services

● Accounted for in accordance with

rules and regulations of the Bangko

Sentral ng Pilipinas

B. Deemed Export

Sales

1. Sale and delivery of goods to:

a. Registered enterprises within a

separate customs territory as

provided under special laws; and

a. Registered enterprises within tourism

enterprise zones as declared by the

Tourism Infrastructure and

Enterprise Zone Authority (TIEZA)

subject to the provisions under

Republic Act No. 9593 or The

Tourism Act of 2009.

2. Sale of raw materials or packaging

materials to a non-resident buyer for delivery

to a resident local export-oriented enterprise

to be used in manufacturing, processing,

packing or repacking in the Philippines of the

said buyer’s goods and paid for in acceptable

foreign currency and accounted for in

accordance with the rules and regulations of

the Bangko Sentral ng Pilipinas (BSP)

3. Sale of raw materials or

packaging materials to export-

oriented enterprise whose export

sales exceed seventy percent (70%)

of total annual production

4. Those considered export sales

under Executive Order No. 226,

otherwise known as the Omnibus

Investment Code of 1987, and

other special laws

5. The sale of goods, supplies,

equipment and fuel to persons

engaged in international shipping or

international air transport

operations: Provided, That the

goods, supplies, equipment and fuel

shall be used for international

shipping or air transport operations

NOTE: Numbers 2, 3 and 4 shall be subject to the twelve percent

(12%) value-added tax and no longer be considered export sales subject to

zero percent (0%) VAT rate upon satisfaction of the following conditions:

a. The successful establishment and implementation

of an enhanced VAT refund system that grants

refunds of creditable input tax within ninety (90)

days from the filing of the VAT refund

application with the Bureau: Provided, That, to

determine the effectivity of item no. 1, all

applications filed from January 1, 2018 shall be

processed and must be decided within ninety (90)

days from the filing of the VAT refund

application; and

b. All pending VAT refund claims as of

December 31, 2017 shall be fully paid in cash by

December 31, 2019.

C. Effectively Zero

Rated Sales

Sales to persons or entities whose

exemption under special laws or

international agreements to which

the Philippines is a signatory

effectively subjects such sales to

zero rate.

ZERO-RATED SALE OF

SERVICES

1. Processing, manufacturing or

repacking goods for other

persons doing business outside

the Philippines which goods are

subsequently exported, where

the services are paid for in

acceptable foreign currency and

accounted for in accordance with

the rules and regulations of the

Bangko Sentral ng Pilipinas

(BSP)

2. Services other than those mentioned

in the preceding paragraph, rendered to

a person engaged in business conducted

outside the Philippines or to a

nonresident person not engaged in

business who is outside the Philippines

when the services are performed, the

consideration for which is paid for in

acceptable foreign currency and

accounted for in accordance with the

rules and regulations of the Bangko

Sentral ng Pilipinas (BSP)

3. Services rendered to persons or

entities whose exemption under

special laws or international

agreements to which the

Philippines is a signatory

effectively subjects the supply of

such services to zero percent (0%)

rate;

4. Services rendered to persons

engaged in international shipping or

international air transport operations,

including leases of property for use

thereof: Provided, That these services

shall be exclusive for international

shipping or air transport operations

5. Services performed by

subcontractors and/or contractors

in processing, converting, or

manufacturing goods for an

enterprise whose export sales

exceed seventy percent (70%) of

total annual production

6. Transport of passengers and cargo

by domestic air or sea vessels from the

Philippines to a foreign country

7. Sale of power or fuel generated

through renewable sources of

energy such as, but not limited to,

biomass, solar, wind, hydropower,

geothermal, ocean energy, and

other emerging energy sources

using technologies such as fuel cells

and hydrogen fuels.

8. Services rendered to:

"(i) Registered enterprises within a

separate customs territory as provided

under special law; and

"(ii) Registered enterprises within

tourism enterprise zones as declared

by the TIEZA subject to the

provisions under Republic Act No.

9593 or The Tourism Act of 2009.

NOTE: Numbers 1 and 5 shall be subject to the twelve percent

(12%) value-added tax and no longer be subject to zero percent

(0%) VAT rate upon satisfaction of the following conditions:

a. The successful establishment and implementation of an enhanced

VAT refund system that grants refunds of creditable input tax

within ninety (90) days from the filing of the VAT refund

application with the Bureau: Provided, That, to determine the

effectivity of item no. 1, all applications filed from January 1,

2018 shall be processed and must be decided within ninety (90)

days from the filing of the VAT refund application; and

a. All pending VAT refund claims as of December 31, 2017

shall be fully paid in cash by December 31, 2019.

You might also like

- Philippines Tax Services BIR Issues Rules TRAIN Law VAT ProvisionsDocument6 pagesPhilippines Tax Services BIR Issues Rules TRAIN Law VAT ProvisionsWilmar AbriolNo ratings yet

- Digest RR 13-2018Document9 pagesDigest RR 13-2018Maria Rose Ann BacilloteNo ratings yet

- RR No. 13-2018 CorrectedDocument20 pagesRR No. 13-2018 CorrectedRap BaguioNo ratings yet

- VAT Regulations AmendedDocument20 pagesVAT Regulations AmendedNikka Bianca Remulla-IcallaNo ratings yet

- Value Added Tax 3Document8 pagesValue Added Tax 3Nerish PlazaNo ratings yet

- Value Added TaxDocument14 pagesValue Added TaxWyndell AlajenoNo ratings yet

- Revenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Document17 pagesRevenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Lance MorilloNo ratings yet

- Secret Files For TXDocument118 pagesSecret Files For TXGrace EnriquezNo ratings yet

- VAT ModuleDocument50 pagesVAT ModuleRovi Anne IgoyNo ratings yet

- Business Taxation 3Document47 pagesBusiness Taxation 3Prince Isaiah JacobNo ratings yet

- SUMMARY OF TAX TABLES AND RATES Train LawDocument5 pagesSUMMARY OF TAX TABLES AND RATES Train LawErnest Christopher Viray GonzaludoNo ratings yet

- REVENUE REGULATIONS NO. 9-2021 Issued On June 11, 2021 Amends CertainDocument3 pagesREVENUE REGULATIONS NO. 9-2021 Issued On June 11, 2021 Amends CertainLady Paul SyNo ratings yet

- VAT Codal and RegulationsDocument6 pagesVAT Codal and RegulationsVictor LimNo ratings yet

- RR No. 13-2018 (VAT Refund)Document23 pagesRR No. 13-2018 (VAT Refund)Hailin QuintosNo ratings yet

- 1) 7.22.19 VAT DiscussionsDocument30 pages1) 7.22.19 VAT DiscussionsJanarie Bosco OrofilNo ratings yet

- DomondonDocument40 pagesDomondonCharles TamNo ratings yet

- VAT ReviewerDocument72 pagesVAT ReviewerJohn Kenneth AcostaNo ratings yet

- Application For VAT Zero RatingDocument9 pagesApplication For VAT Zero RatingHanabishi RekkaNo ratings yet

- Feb 23 Class VATDocument58 pagesFeb 23 Class VATybun100% (1)

- Reviewer BTTDocument14 pagesReviewer BTTAlthea Frances VasalloNo ratings yet

- Joan REPORTING TAX 1Document6 pagesJoan REPORTING TAX 1Jasmin CaoileNo ratings yet

- Zero-Rated and Effectively Zero-Rated Sales of Goods or Properties, and ServicesDocument2 pagesZero-Rated and Effectively Zero-Rated Sales of Goods or Properties, and ServicesBea BangcolaNo ratings yet

- Value Added TaxDocument11 pagesValue Added TaxYvette Pauline JovenNo ratings yet

- Lesson 5 BtaxDocument6 pagesLesson 5 Btaxdin matanguihanNo ratings yet

- Domondon Reviewer - Tax 2Document38 pagesDomondon Reviewer - Tax 2Mar DevelosNo ratings yet

- Antonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenDocument22 pagesAntonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenJayvee FelipeNo ratings yet

- 2019 BAR Exam Tax Supplement by R.G. Manabat & CoDocument48 pages2019 BAR Exam Tax Supplement by R.G. Manabat & CoQueenie ValleNo ratings yet

- Train Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsDocument2 pagesTrain Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsReynaldo YuNo ratings yet

- Chapter I - Imposition of Tax: Title Iv Value-Added TaxDocument8 pagesChapter I - Imposition of Tax: Title Iv Value-Added TaxCher TantiadoNo ratings yet

- Title Iv Value-Added Tax: Chapter I - Imposition of TaxDocument3 pagesTitle Iv Value-Added Tax: Chapter I - Imposition of TaxNickNo ratings yet

- Felipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)Document5 pagesFelipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)AustinNo ratings yet

- BUSINESS-TAXATION-group 5Document22 pagesBUSINESS-TAXATION-group 5jheanniver nabloNo ratings yet

- VAT Guide: Understanding Value-Added Tax PrinciplesDocument32 pagesVAT Guide: Understanding Value-Added Tax Principlessei1davidNo ratings yet

- VAT Zero Rated Transactions PhilippinesDocument8 pagesVAT Zero Rated Transactions PhilippineskmoNo ratings yet

- VAT Explained: A Guide to Value-Added Tax in the PhilippinesDocument28 pagesVAT Explained: A Guide to Value-Added Tax in the PhilippinesJeser JavierNo ratings yet

- Imposition of TaxDocument12 pagesImposition of TaxchriskhoNo ratings yet

- TAX-302 (VAT-Exempt Transactions)Document7 pagesTAX-302 (VAT-Exempt Transactions)Edith DalidaNo ratings yet

- Tax Feb 17Document103 pagesTax Feb 17Lolit CarlosNo ratings yet

- Value Added TaxDocument13 pagesValue Added TaxKatrina FregillanaNo ratings yet

- Bir Train Vat 20180418Document54 pagesBir Train Vat 20180418DanaNo ratings yet

- TAX-302 (VAT-Exempt Transactions) PDFDocument5 pagesTAX-302 (VAT-Exempt Transactions) PDFclara san miguelNo ratings yet

- Tax Booklet As of 10 November 2016Document20 pagesTax Booklet As of 10 November 2016Trixy ComiaNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesMacatol KristineNo ratings yet

- VAT Summary of Changes Under The TRAIN LawDocument4 pagesVAT Summary of Changes Under The TRAIN LawrafastilNo ratings yet

- Excise Tax Provisions for Certain Goods and ServicesDocument4 pagesExcise Tax Provisions for Certain Goods and ServicesshakiraNo ratings yet

- Zero-rated VAT transactions guideDocument2 pagesZero-rated VAT transactions guideValerie Kaye BinayasNo ratings yet

- VALUE Added TaxDocument20 pagesVALUE Added TaxMadz Rj MangorobongNo ratings yet

- Title ViDocument30 pagesTitle Vimiss independentNo ratings yet

- Tax 30222Document5 pagesTax 30222Ronariza BondocNo ratings yet

- TAX 302 VAT Exempt Transactions 1Document6 pagesTAX 302 VAT Exempt Transactions 1Jeen JeenNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesSunny DaeNo ratings yet

- Value-Added TaxDocument30 pagesValue-Added TaxmeriiNo ratings yet

- CIR vs American Express Tax Refund RulingDocument3 pagesCIR vs American Express Tax Refund RulingRepolyo Ket CabbageNo ratings yet

- CIR V BurmeisterDocument3 pagesCIR V BurmeisterGenevieve Kristine Manalac100% (1)

- Title IvDocument9 pagesTitle IvErica Mae GuzmanNo ratings yet

- Business Tax IntroductionDocument5 pagesBusiness Tax IntroductionJessica MalijanNo ratings yet

- TRAIN (Changes) ???? Pages 12, 14, 16, 17Document4 pagesTRAIN (Changes) ???? Pages 12, 14, 16, 17blackmail1No ratings yet

- Tax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Document5 pagesTax Particulars National Internal Revenue Code of 1997 R. A. No. 10963blackmail1No ratings yet

- Audit Prior Errors Accounting ChangesDocument3 pagesAudit Prior Errors Accounting ChangesNEstandaNo ratings yet

- Audit of Current AssetsDocument3 pagesAudit of Current AssetsNEstandaNo ratings yet

- Audit of Bonds and LoansDocument5 pagesAudit of Bonds and LoansNEstandaNo ratings yet

- Audit of ReceivablesDocument16 pagesAudit of ReceivablesNEstandaNo ratings yet

- Final Exam For Accounting 13 Applied AuditingDocument3 pagesFinal Exam For Accounting 13 Applied AuditingNEstandaNo ratings yet

- Lesson 4Document1 pageLesson 4NEstandaNo ratings yet

- Lesson 1Document1 pageLesson 1NEstandaNo ratings yet

- Lesson 2Document1 pageLesson 2NEstandaNo ratings yet

- Lesson 3Document1 pageLesson 3NEstandaNo ratings yet

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- VAT On Sale of Goods and PropertiesDocument55 pagesVAT On Sale of Goods and PropertiesNEstanda100% (1)

- ACCTG 13 - Quiz 1Document3 pagesACCTG 13 - Quiz 1NEstandaNo ratings yet

- VAT Exempt SalesDocument29 pagesVAT Exempt SalesNEstandaNo ratings yet

- Introduction To Business Taxes: September 4, 2020Document20 pagesIntroduction To Business Taxes: September 4, 2020Bancas YvonNo ratings yet

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesNEstandaNo ratings yet

- Web Order Acknowledgement: Adjusted Tax and Freight Will Appear On Invoice Based On Items ShippedDocument1 pageWeb Order Acknowledgement: Adjusted Tax and Freight Will Appear On Invoice Based On Items ShippedJackNo ratings yet

- InvoiceDocument1 pageInvoice10-XII-Sci-A Saima ChoudharyNo ratings yet

- Ahmedabad: Drive India Enterprise Solution LTDDocument5 pagesAhmedabad: Drive India Enterprise Solution LTDshah_rahul1981No ratings yet

- Presentation - HDFC Dividend Yield FundDocument27 pagesPresentation - HDFC Dividend Yield FundRitesh ChatterjeeNo ratings yet

- Case Study ChicoryDocument2 pagesCase Study ChicoryUmar KhattakNo ratings yet

- CMHA Presentation - January 19, 2022Document47 pagesCMHA Presentation - January 19, 2022WVXU NewsNo ratings yet

- Resources, Conservation and RecyclingDocument9 pagesResources, Conservation and RecyclingAsma Hairulla JaafarNo ratings yet

- IPSAS IFRS Alignment Dashboard - June 2018Document16 pagesIPSAS IFRS Alignment Dashboard - June 2018sarfraz ahmedNo ratings yet

- Ca Covid Tenant Relief Act Info 10-1-21Document2 pagesCa Covid Tenant Relief Act Info 10-1-21Darlene GoldmanNo ratings yet

- SampleDocument32 pagesSampleA. NurfauziahNo ratings yet

- GEX GuideDocument2 pagesGEX GuideasapbellemareNo ratings yet

- Terotechnology SummaryDocument9 pagesTerotechnology SummaryWichard BendixNo ratings yet

- Banks and Development (2016)Document19 pagesBanks and Development (2016)José Benito RuizNo ratings yet

- Business Law ExamDocument3 pagesBusiness Law ExamBarzala CarcarNo ratings yet

- Inventory Mgt: Concepts, Motives & ObjectivesDocument5 pagesInventory Mgt: Concepts, Motives & ObjectivesEKANSH DANGAYACH 20212619No ratings yet

- Course Overview: CME Group Courses Module 3Document8 pagesCourse Overview: CME Group Courses Module 3Darren FNo ratings yet

- Chapter 2 Company and Marketing StrategyDocument29 pagesChapter 2 Company and Marketing StrategyVy NguyenNo ratings yet

- BCG Matrix of Nestle PDFDocument34 pagesBCG Matrix of Nestle PDFVishakha RathodNo ratings yet

- Term 2, Academic Year 2020-2021: Management Accounting Group Business Case AnalysisDocument3 pagesTerm 2, Academic Year 2020-2021: Management Accounting Group Business Case AnalysisNevan NovaNo ratings yet

- Test Bank For Western Civilization Ideas Politics and Society Volume II From 1600 11th Edition DownloadDocument17 pagesTest Bank For Western Civilization Ideas Politics and Society Volume II From 1600 11th Edition Downloadadrienneturnerkpqowgcymz100% (16)

- ATP 18-001 Restricted CountriesDocument2 pagesATP 18-001 Restricted Countriesseaforte03No ratings yet

- Asc Coc Certificate: Controun ODocument3 pagesAsc Coc Certificate: Controun Oaktaruzzaman bethuNo ratings yet

- MBA Multiple Choice Assessment 1Document18 pagesMBA Multiple Choice Assessment 1Yasiru MahindaratneNo ratings yet

- Economics and Finance PDFDocument2 pagesEconomics and Finance PDFApolloniousNo ratings yet

- Setti Andrea-2014-Export PricingDocument123 pagesSetti Andrea-2014-Export PricingNguyễn HàNo ratings yet

- Taxguru - in-GST Audit GSTR-9C Practical Checklist Alongwith Audit ProcessDocument3 pagesTaxguru - in-GST Audit GSTR-9C Practical Checklist Alongwith Audit ProcesschetudaveNo ratings yet

- Kajian Kadar Batas Optimum Optimum Cut-Off Grade Pada Penambangan Nikel Laterit-with-cover-page-V2Document7 pagesKajian Kadar Batas Optimum Optimum Cut-Off Grade Pada Penambangan Nikel Laterit-with-cover-page-V2Frek.3klp5.0195 Ariestasyariah C satuNo ratings yet

- Barriers To EntrepreneurshipDocument7 pagesBarriers To EntrepreneurshipAmanDeep SinghNo ratings yet

- Godawari AryaDocument1 pageGodawari AryaGodavari AryaNo ratings yet

- Super Procure - Company IntroductionDocument14 pagesSuper Procure - Company IntroductionshadabhashimNo ratings yet