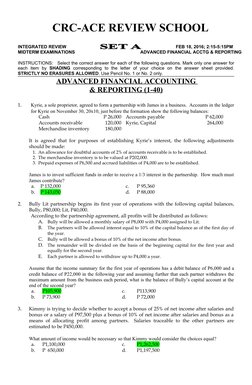

CRC-ACE REVIEW SCHOOL

INTEGRATED REVIEW FEB 18, 2016; 2:15-5:15PM

MIDTERM EXAMINATIONS ADVANCED FINANCIAL ACCTG & REPORTING

INSTRUCTIONS: Select the correct answer for each of the following questions. Mark only one answer for

each item by SHADING corresponding to the letter of your choice on the answer sheet provided.

STRICTLY NO ERASURES ALLOWED. Use Pencil No. 1 or No. 2 only.

ADVANCED FINANCIAL ACCOUNTING

& REPORTING (1-40)

1. Kyrie, a sole proprietor, agreed to form a partnership with James in a business. Accounts in the ledger

for Kyrie on November 30, 20x10, just before the formation show the following balances:

Cash P 26,000 Accounts payable P 62,000

Accounts receivable 120,000 Kyrie, Capital 264,000

Merchandise inventory 180,000

It is agreed that for purposes of establishing Kyrie’s interest, the following adjustments

should be made:

1. An allowance for doubtful accounts of 2% of accounts receivable is to be established.

2. The merchandise inventory is to be valued at P202,000.

3. Prepaid expenses of P6,500 and accrued liabilities of P4,000 are to be established.

James is to invest sufficient funds in order to receive a 1/3 interest in the partnership. How much must

James contribute?

a. P 132,000 c. P 95,360

b. P 143,050 d. P 88,000

2. Bully Lit partnership begins its first year of operations with the following capital balances,

Bully, P80,000; Lit, P40,000.

According to the partnership agreement, all profits will be distributed as follows:

A. Bully will be allowed a monthly salary of P8,000 with P4,000 assigned to Lit.

B. The partners will be allowed interest equal to 10% of the capital balance as of the first day of

the year.

C. Bully will be allowed a bonus of 10% of the net income after bonus.

D. The remainder will be divided on the basis of the beginning capital for the first year and

equally for the second year.

E. Each partner is allowed to withdraw up to P4,000 a year.

Assume that the income summary for the first year of operations has a debit balance of P6,000 and a

credit balance of P22,000 in the following year and assuming further that each partner withdraws the

maximum amount from the business each period, what is the balance of Bully’s capital account at the

end of the second year?

a. P105,900 c. P113,900

b. P 73,900 d. P 72,000

3. Kimmy is trying to decide whether to accept a bonus of 25% of net income after salaries and

bonus or a salary of P97,500 plus a bonus of 10% of net income after salaries and bonus as a

means of allocating profit among partners. Salaries traceable to the other partners are

estimated to be P450,000.

What amount of income would be necessary so that Kimmy would consider the choices equal?

a. P1,100,000 c. P1,262,500

b. P 650,000 d. P1,197,500

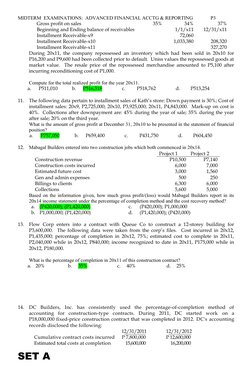

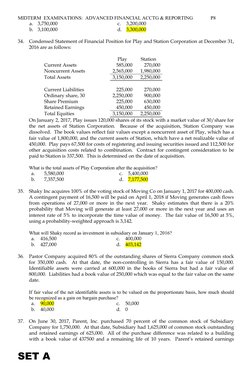

�MIDTERM EXAMINATIONS: ADVANCED FINANCIAL ACCTG & REPORTING P2

4. Batman and Robin agrees to form a partnership. Batman is to contribute 135,600 cash and an

equipment that has a carrying value of 135,000 and a fair value of 115,000. The equipment

however, has a mortgage attached to it and it is agreed by the partners that they will assume

it. Robin, on the other hand contributed 240,000 cash. They share profits and losses in the

ratio of 4:5. Furthermore, part of their agreement is top bring their initial capital in

conformity with their profit and loss ratio.

How much is the mortgage of the equipment?

a. 58,600 c. 10,600

b. 78,600 d. 34,600

5. Partners King and Queen have capital balances of 358,500 and 300,000 respectively before

admitting Jack. King and Queen share profits and losses in the ratio of 6:4. Jack paid 225,000

in exchange for 30% interest in the partnership as well as the profits and losses.

How much is debited from the capital of partner Queen upon Jack’s admission?

a. 120,000 c. 79,020

b. 90,000 d. 105,360

6. Assume that an equipment is undervalued, how much is the undervaluation of the equipment and the

capital balance of partner Queen after admission of Jack respectively?

a. 85,000 and 336,600 c. 91,500 and 336,600

b. 100,980 and 235,620 d. 91,500 and 235,620

7. Due to financial difficulty partners G, H and I decided to liquidate. The following balances

are before liquidation: Capital balances of G, H and I are 10,000, 25,000 and 20,000

respectively; Loan from G is 25,000; Cash, 25,000; Profit and loss ratio [Link] respectively.

Partner H received 10,650 upon liquidation and the share of the liquidation expense of

partner G is 1,800. Meanwhile the cash after realizing the non-cash asset and paying the

liquidation expenses is 69,000.

How much is the book value of the non-cash asset sold?

a. 85,000 c. 86,000

b. 80,000 d. 85,500

8. Capital balances of partners Q, R and S are the following before liquidation: 87,000, 95,500

and 106,250 each respectively. The partnership has a loan from partner Q in the amount of

8,000; loan to partner R in the amount of 4,500, advances to partner S in the amount of 6,500.

The partners’ profit and loss ratio is [Link] each respectively.

In the first installment sale, the total cash paid to partners is 57,000, how much did partner S receive?

a. 0 c. 13,854

b. 19,396 d. 20,125

9. If partner Q received 20,000 in the first installment and partner S received 12,396 in the second

installment, how much is received by partner Q as of the second installment and how much is the total

cash paid to the partners in the second installment?

a. 12,604 and 25,000 c. 23,750 and 30,000

b. 8,854 and 30,000 d. 32,604 and 25,000

10. Uniss Corporation sells on installment basis and accounts for it using the installment method. Some

information related to its operations are summarized as follows:

20x9 20x10 20x11

Cost of Sales P370,500 P855,360 P568,890

SET A

�MIDTERM EXAMINATIONS: ADVANCED FINANCIAL ACCTG & REPORTING P3

Gross profit on sales 35% 34% 37%

Beginning and Ending balance of receivables 1/1/x11 12/31/x11

Installment Receivable-x9 72,060

Installment Receivable-x10 1,033,380 208,320

Installment Receivable-x11 327,270

During 20x11, the company repossessed an inventory which had been sold in 20x10 for

P16,200 and P9,600 had been collected prior to default. Uniss values the repossessed goods at

market value. The resale price of the repossessed merchandise amounted to P5,100 after

incurring reconditioning cost of P1,000.

Compute for the total realized profit for the year 20x11.

a. P511,010 b. P516,518 c. P518,762 d. P513,254

11. The following data pertain to installment sales of Kath’s store: Down payment is 30%; Cost of

installment sales: 20x9, P2,725,000; 20x10, P3,925,000; 20x11, P4,843,000. Mark-up on cost is

40%. Collections after downpayment are: 45% during the year of sale; 35% during the year

after sale; 20% on the third year.

What is the amount of gross profit at December 31, 20x10 to be presented in the statement of financial

position?

a. P757,050 b. P659,400 c. P431,750 d. P604,450

12. Mabagal Builders entered into two construction jobs which both commenced in 20x14.

Project 1 Project 2

Construction revenue P10,500 P7,140

Construction costs incurred 6,000 7,000

Estimated future cost 3,000 1,560

Gen and admin expenses 500 250

Billings to clients 6,300 6,000

Collections 5,600 5,000

Based on the information given, how much gross profit/(loss) would Mabagal Builders report in its

20x14 income statement under the percentage of completion method and the cost recovery method?

a. (P420,000); (P1,420,000) c. (P420,000); P1,000,000

b. P1,000,000; (P1,420,000) d. (P1,420,000); (P420,000)

13. Flow Corp enters into a contract with Queue Co to construct a 12-storey building for

P3,600,000. The following data were taken from the corp’s files. Cost incurred in 20x12,

P1,435,000; percentage of completion in 20x12, 75%; estimated cost to complete in 20x11,

P2,040,000 while in 20x12, P840,000; income recognized to date in 20x11, P175,000 while in

20x12, P180,000.

What is the percentage of completion in 20x11 of this construction contract?

a. 20% b. 35% c. 40% d. 25%

14. DC Builders, Inc. has consistently used the percentage-of-completion method of

accounting for construction-type contracts. During 2011, DC started work on a

P18,000,000 fixed-price construction contract that was completed in 2012. DC's accounting

records disclosed the following:

12/31/2011 12/31/2012

Cumulative contract costs incurred P 7,800,000 P 12,600,000

Estimated total costs at completion 15,600,000 16,200,000

SET A

�MIDTERM EXAMINATIONS: ADVANCED FINANCIAL ACCTG & REPORTING P4

How much income would DC have recognized on this contract for the year ended

December 31, 2012?

a. P1,400,000 c. P600,000

b. 1 , 2 0 0 , 0 0 0 d. 200,000

15. Bang Construction Company has consistently used the percentage-of- completion

method of recognizing income. During 2011, Bang started work on a P6,000,000

construction contract which was completed in 2012. The accounting records provided the

following data:

2011 2012

Progress billings ................................. P2,200,000 P3,800,000

Costs incurred each year................. 1,800,000 3,600,000

Collections.......................................... 1,400,000 4,600,000

Estimated cost to complete ........... 3,600,000

How much income should Bang have recognized in 2012?

a. P 400,000 a. c. P220,000

b. 300,000 b. d. 200,000

16. United Construction Company has consistently used the percentage-of-completion method. On

January 10, 2011, United began work on a P12,000,000 construction contract. At the inception

date, the estimated cost of construction was P9,000,000. The following data relate to the

progress of the contract:

Income recognized at 12/31/2011 .................................... P 1,200,000

Cost incurred 1/10/2011 through 12/31/2012 7,200,000

Estimated cost to complete at 12/31/2012 2,400,000

How much income should United recognize for the year ended December 31, 2012?

a. P600,000 c. P1,200,000

b. 1,050,000 d. 1,800,000

17. Top Builders is in the business of constructing apartment buildings. Two buildings were in

progress at the beginning of 2011. The status of these buildings at the beginning of the

year were as follows:

Contract Contract Costs incurred Estimated costs to

price to 1/1/2011 complete 1/1/2011

Apartment - Cubao P 1,620,000 P 600,000 P840,000

Apartment – Marikina 2,520,000 1,560,000 690,000

During 2011, the following costs were incurred:

Apartment – Cubao …. P600,000 (estimated cost to complete as of 12/31/2011, P240,000)

Apartment - Marikina P750,000 (job completed)

How much is the gross profit in 2011 if Top uses the percentage-of- completion method?

A. P 360,000 C. 210,000

B. 262,200 D. 97,800

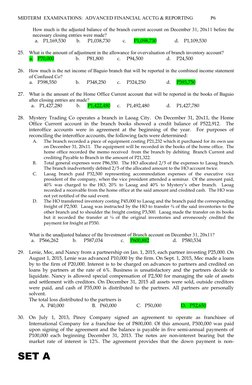

18. Home office bills its branch fro merchandise shipments at 30% above cost. The following are some of

the account balances on the books of home office and its branch as of December 31, 20x14.

Home Office Books Branch Books

Inventory, January 1 P 5,000 P 14,500

Shipments from Home Office 37,700

Purchases 225,000 50,000

Shipments to branch 36,250

Branch inventory allowance 13,125

Sales 300,000 180,000

Operating expenses 72,500 27,500

SET A

�MIDTERM EXAMINATIONS: ADVANCED FINANCIAL ACCTG & REPORTING P5

Per physical count, the ending inventory of the branch is P10,500 including goods from

outside purchases of P6,925; the ending inventory of the home office is P30,000.

What is the amount of the unrealized profit in the separate books of the home office on January 1,

20x14?

a. P3,050 c. P2,250

b. P3,000 d. P2,150

19. What is the amount of the beginning inventory in 20x14 that came from outside purchases?

a. P4,750 c. P4,350

b. P6,925 d. P6,225

20. What is the amount of the cost of goods available for sale of the branch?

a. P100,200 c. P110,625

b. P111,625 d. P102,200

21. What is the total ending inventory to be shown on the combined financial statements?

a. P39,675 c. P46,925

b. P19,838 d. P23,463

22. What is the combined net income for the year?

a. P136,850 c. P67,338

b. P134,675 d. P136,350

23. Queen Squid, Inc. Franchisor, entered into a franchise agreement with King, Franchise, on

July 1,2015. The total franchise fees agreed upon is P1,100,000, of which P100,000 is payable

upon signing and the balance payable in four equal annual installments. It was agreed that

the down payment is not refundable, notwithstanding lack of substantial performance of

services by franchisor.

When Queen Squid prepares its financial statements on July 31, 2015, the unearned franchise

fees to be reported is:

A. 0 C. 1,000,000

B. 100,000 D. 1,100,000

24. The following transactions were entered in the branch current account of Confused Co for the year

20x11.

Branch Current - Baguio

Beg. Balance 1/1/11 P765,430 Collection of AR, 9/12/11 P55,500

Shipments to branch 354,000

Cash forwarded, 6/1/11 25,000

Operating expenses charged

To branch 12/31/11 4,800

Shipments to the branch during the year were made at 20% above cost. The balance of the

Allowance for Overvaluation of Branch Inventory account was P35,500 at the beginning,

and the allowance was written down to P24,500 at year-end. On December 10, 20x11, the

home office purchased a piece of equipment amounting to P60,000 for its branch in Baguio.

The said equipment has a useful life of five years and will be carried in the books of the

branch, but the home office recorded the purchase by debiting Equipment. The branch

recorded the depreciation of the equipment by debiting the Home Office Current account

and crediting Accumulated Depreciation. Debit memo regarding the allocation of operating

expenses to the Baguio branch was received by the branch on January 2, 20x12.

The Baguio branch reported net income of P329,550. It also remitted cash to the home office

on December 31, 20x11 amounting to P55,000 which the home office received and recorded

on January 1, 20x12. The interoffice accounts were in agreement at the beginning of the

year.

SET A

�MIDTERM EXAMINATIONS: ADVANCED FINANCIAL ACCTG & REPORTING P6

How much is the adjusted balance of the branch current account on December 31, 20x11 before the

necessary closing entries were made?

a. P1,169,530 b. P1,038,730 c. P1,098,730 d. P1,109,530

25. What is the amount of adjustment in the allowance for overvaluation of branch inventory account?

a. P70,000 b. P81,800 c. P94,500 d. P24,500

26. How much is the net income of Baguio branch that will be reported in the combined income statement

of Confused Co?

a. P398,550 b. P348,250 c. P324,250 d. P393,750

27. What is the amount of the Home Office Current account that will be reported in the books of Baguio

after closing entries are made?

a. P1,427,280 b. P1,422,480 c. P1,492,480 d. P1,427,780

28. Mystery Trading Co operates a branch in Laoag City. On December 31, 20x11, the Home

Office Current account in the branch books showed a credit balance of P522,912. The

interoffice accounts were in agreement at the beginning of the year. For purposes of

reconciling the interoffice accounts, the following facts were determined:

A. The branch recorded a piece of equipment costing P21,232 which it purchased for its own use

on December 31, 20x11. The equipment will be recorded in the books of the home office. The

home office recorded the memo received from the branch by debiting Branch Current and

crediting Payable to Branch in the amount of P21,322.

B. Total general expenses were P86,550. The HO allocated 2/5 of the expenses to Laoag branch.

The branch inadvertently debited 2/5 of the allocated amount to the HO account twice.

C. Laoag branch paid P32,500 representing accommodation expenses of the executive vice

president of the company, when the vice president attended a seminar. Of the amount paid,

40% was charged to the HO, 20% to Laoag and 40% to Mystery’s other branch. Laoag

recorded a receivable from the home office at the said amount and credited cash. The HO was

not yet notified of the said event.

D. The HO transferred inventory costing P45,000 to Laoag and the branch paid the corresponding

freight of P2,500. Laoag was instructed by the HO to transfer ¾ of the said inventories to the

other branch and to shoulder the freight costing P3,500. Laoag made the transfer on its books

but it recorded the transfer at ¼ of the original inventories and erroneously credited the

payment for freight at P350.

What is the unadjusted balance of the Investment of Branch account on December 31, 20x11?

a. P566,262 b. P587,034 c. P600,882 d. P580,534

29. Lenie, Mec, and Nancy from a partnership on Jan. 1, 2015, each partner investing P25,000. On

August 1, 2015, Lenie was advanced P10,000 by the firm. On Sept. 1, 2015, Mec made a loans

by to the firm of P20,000. Interest is to be charged on advances to partners and credited on

loans by partners at the rate of 6%. Business is unsatisfactory and the partners decide to

liquidate. Nancy is allowed special compensation of P2,500 for managing the sale of assets

and settlement with creditors. On December 31, 2015 all assets were sold, outside creditors

were paid, and cash of P35,000 is distributed to the partners. All partners are personally

solvent.

The total loss distributed to the partners is

A. P40,000 B. P60,000 C. P50,000 D. P52,650

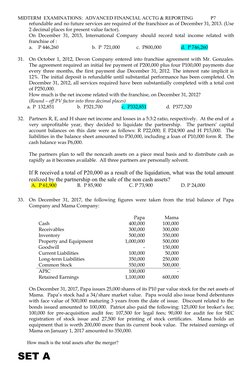

30. On July 1, 2013, Pinoy Company signed an agreement to operate as franchisee of

International Company for a franchise fee of P800,000. Of this amount, P300,000 was paid

upon signing of the agreement and the balance is payable in five semi-annual payments of

P100,000 each beginning December 31, 2013. The notes are non-interest bearing but the

market rate of interest is 12%. The agreement provides that the down payment is non-

SET A

�MIDTERM EXAMINATIONS: ADVANCED FINANCIAL ACCTG & REPORTING P7

refundable and no future services are required of the franchisor as of December 31, 2013. (Use

2 decimal places for present value factor).

On December 31, 2013, International Company should record total income related with

franchise of :

a. P 446,260 b. P 721,000 c. P800,000 d. P 746,260

31. On October 1, 2012, Devon Company entered into franchise agreement with Mr. Gonzales.

The agreement required an initial fee payment of P200,000 plus four P100,000 payments due

every three months, the first payment due December 31, 2012. The interest rate implicit is

12%. The initial deposit is refundable until substantial performance has been completed. On

December 31, 2012, all services required have been substantially completed with a total cost

of P250,000.

How much is the net income related with the franchise, on December 31, 2012?

(Round – off PV factor into three decimal places)

a. P 132,851 b. P321,700 c. P332,851 d. P377,520

32. Partners R, E, and H share net income and losses in a [Link] ratio, respectively. At the end of a

very unprofitable year, they decided to liquidate the partnership. The partners’ capital

account balances on this date were as follows: R P22,000; E P24,900 and H P15,000. The

liabilities in the balance sheet amounted to P30,000, including a loan of P10,000 form R. The

cash balance was P6,000.

The partners plan to sell the noncash assets on a piece meal basis and to distribute cash as

rapidly as it becomes available. All three partners are personally solvent.

If R received a total of P20,000 as a result of the liquidation, what was the total amount

realized by the partnership on the sale of the non cash assets?

A. P 61,900 B. P 85,900 C. P 73,900 D. P 24,000

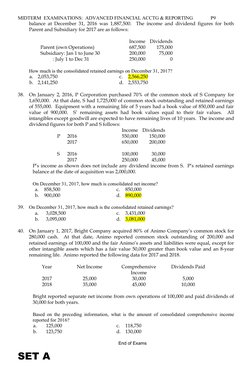

33. On December 31, 2017, the following figures were taken from the trial balance of Papa

Company and Mama Company:

Papa Mama

Cash 400,000 100,000

Receivables 300,000 300,000

Inventory 500,000 350,000

Property and Equipment 1,000,000 500,000

Goodwill - 150,000

Current Liabilities 100,000 50,000

Long-term Liabilities 350,000 250,000

Common Stock 550,000 500,000

APIC 100,000 -

Retained Earnings 1,100,000 600,000

On December 31, 2017, Papa issues 25,000 shares of its P10 par value stock for the net assets of

Mama. Papa’s stock had a 34/share market value. Papa would also issue bond debentures

with face value of 500,000 maturing 3 years from the date of issue. Discount related to the

bonds issued amounted to 100,000. Patriot also paid the following: 125,000 for broker’s fee;

100,000 for pre-acquisition audit fee; 107,500 for legal fees; 90,000 for audit fee for SEC

registration of stock issue and 27,500 for printing of stock certificates. Mama holds an

equipment that is worth 200,000 more than its current book value. The retained earnings of

Mama on January 1, 2017 amounted to 350,000.

How much is the total assets after the merger?

SET A

�MIDTERM EXAMINATIONS: ADVANCED FINANCIAL ACCTG & REPORTING P8

a. 3,750,000 c. 3,200,000

b. 3,100,000 d. 3,300,000

34. Condensed Statement of Financial Position for Play and Station Corporation at December 31,

2016 are as follows:

Play Station

Current Assets 585,000 270,000

Noncurrent Assets 2,565,000 1,980,000

Total Assets 3,150,000 2,250,000

Current Liabilities 225,000 270,000

Ordinary share, 30 2,250,000 900,000

Share Premium 225,000 630,000

Retained Earnings 450,000 450,000

Total Equities 3,150,000 2,250,000

On January 2, 2017, Play issues 120,000 shares of its stock with a market value of 30/share for

the net assets of Station Corporation. Because of the acquisition, Station Company was

dissolved. The book values reflect fair values except a noncurrent asset of Play, which has a

fair value of 1,800,000, and the current assets of Station, which have a net realizable value of

450,000. Play pays 67,500 for costs of registering and issuing securities issued and 112,500 for

other acquisition costs related to combination. Contract for contingent consideration to be

paid to Station is 337,500. This is determined on the date of acquisition.

What is the total assets of Play Corporation after the acquisition?

a. 5,580,000 c. 5,400,000

b. 7,357,500 d. 7,177,500

35. Shaky Inc acquires 100% of the voting stock of Moving Co on January 1, 2017 for 400,000 cash.

A contingent payment of 16,500 will be paid on April 1, 2018 if Moving generates cash flows

from operations of 27,000 or more in the next year. Shaky estimates that there is a 20%

probability that Moving will generate at least 27,000 or more in the next year and uses an

interest rate of 5% to incorporate the time value of money. The fair value of 16,500 at 5%,

using a probability-weighted approach is 3,142.

What will Shaky record as investment in subsidiary on January 1, 2016?

a. 416,500 c. 400,000

b. 427,000 d. 403,142

36. Pastor Company acquired 80% of the outstanding shares of Sierra Company common stock

for 350,000 cash. At that date, the non-controlling in Sierra has a fair value of 150,000.

Identifiable assets were carried at 600,000 in the books of Sierra but had a fair value of

800,000. Liabilities had a book value of 250,000 which was equal to the fair value on the same

date.

If fair value of the net identifiable assets is to be valued on the proportionate basis, how much should

be recognized as a gain on bargain purchase?

a. 90,000 c. 50,000

b. 40,000 d. 0

37. On June 30, 2017, Parent, Inc. purchased 70 percent of the common stock of Subsidiary

Company for 1,750,000. At that date, Subsidiary had 1,625,000 of common stock outstanding

and retained earnings of 625,000. All of the purchase difference was related to a building

with a book value of 437500 and a remaining life of 10 years. Parent’s retained earnings

SET A

�MIDTERM EXAMINATIONS: ADVANCED FINANCIAL ACCTG & REPORTING P9

balance at December 31, 2016 was 1,887,500. The income and dividend figures for both

Parent and Subsidiary for 2017 are as follows:

Income Dividends

Parent (own Operations) 687,500 175,000

Subsidiary: Jan 1 to June 30 200,000 75,000

: July 1 to Dec 31 250,000 0

How much is the consolidated retained earnings on December 31, 2017?

a. 2,053,750 c. 2,566,250

b. 2,141,250 d. 2,553,750

38. On January 2, 2016, P Corporation purchased 70% of the common stock of S Company for

1,650,000. At that date, S had 1,725,000 of common stock outstanding and retained earnings

of 555,000. Equipment with a remaining life of 5 years had a book value of 850,000 and fair

value of 900,000. S’ remaining assets had book values equal to their fair values. All

intangibles except goodwill are expected to have remaining lives of 10 years. The income and

dividend figures for both P and S follows:

Income Dividends

P 2016 550,000 150,000

2017 650,000 200,000

S 2016 100,000 30,000

2017 250,000 45,000

P’s income as shown does not include any dividend income from S. P’s retained earnings

balance at the date of acquisition was 2,000,000.

On December 31, 2017, how much is consolidated net income?

a. 858,500 c. 850,000

b. 900,000 d. 890,000

39. On December 31, 2017, how much is the consolidated retained earnings?

a. 3,028,500 c. 3,431,000

b. 3,095,000 d. 3,081,000

40. On January 1, 2017, Bright Company acquired 80% of Animo Company’s common stock for

280,000 cash. At that date, Animo reported common stock outstanding of 200,000 and

retained earnings of 100,000 and the fair Animo’s assets and liabilities were equal, except for

other intangible assets which has a fair value 50,000 greater than book value and an 8-year

remaining life. Animo reported the following data for 2017 and 2018.

Year Net Income Comprehensive Dividends Paid

Income

2017 25,000 30,000 5,000

2018 35,000 45,000 10,000

Bright reported separate net income from own operations of 100,000 and paid dividends of

30,000 for both years.

Based on the preceding information, what is the amount of consolidated comprehensive income

reported for 2016?

a. 125,000 c. 118,750

b. 123,750 d. 130,000

End of Exams

SET A