Professional Documents

Culture Documents

ACT1205 - Module 3 - Audit of Investments

Uploaded by

Io AyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACT1205 - Module 3 - Audit of Investments

Uploaded by

Io AyaCopyright:

Available Formats

Since 1977

AUDITING PROBLEMS OCAMPO/SOLIMAN/OCAMPO

AP.2906 - Audit of Investments OCTOBER 2020

SUBSTANTIVE AUDIT OF INVESTMENTS

Investments and Investment Income

Existence or occurrence: Recorded investments and Valuation and allocation: Investments are valued in

investment exist accordance with GAAP and investments and investment

income are mathematically accurate

1. Inspect securities on hand and trace to list.

6. Reconcile the investment list to the subsidiary ledger

2. Confirm securities held by others. and general ledger account.

7. Recalculate interest income and verify dividend income

Completeness: All investments and investment income are by reference to published reports of dividends.

recorded

3. Apply analytical procedures. Presentation and disclosure: Investments and investment

income are presented and disclosed in accordance with

GAAP

Rights and obligations: Investments and investment

income are owned by the entity 8. Review financial statements and perform analytical

procedures to whether accounts are classified and

4. Examine supporting brokers’ advices and paid checks disclosed in the financial statements in accordance

for investments acquired during the period. with GAAP.

5. Examine remittance advices for dividends, interest and

disposals of investments.

INTERNAL CONTROL MEASURES

1. Purchases and sales of investments should be properly authorized (normally by the board of directors or investment

committee of the board of directors).

2. Access to securities should not be vested in one person only.

3. Custodianship of investment securities and the accounting for them should be segregated.

4. Securities must be physically controlled in order to prevent unauthorized usage and they must be registered in the

name of the entity.

5. Income received from investments should be reconciled periodically with amounts that should be received.

- end -

Page 1 of 6 www.teamprtc.com.ph AP.2906

EXCEL PROFESSIONAL SERVICES, INC.

PROBLEM NO. 1 5. How much is the net amount to be recognized in I Will

Corporation’s 2020 profit or loss related to these

You were able to obtain the following ledger details of

investments?

Equity investment-FVTPL in connection with your audit of

a. P 48,000 c. P204,000

the I Will Corporation for the year ended December 31,

b. P198,000 d. P246,000

2020:

Date Particulars DR CR 6. Which of the following is not one of the auditor’s

Jan. 10 Purchase of Emong primary objectives in an audit of trading securities?

Co. – 6,000 shares P1,440,000 a. To determine whether securities are authentic.

Feb. 20 Purchase of Bobads b. To determine whether securities are the property

Co. – 7,200 shares 1,800,000 of the client.

Mar. 1 Sale of Bobads Co. – c. To determine whether securities actually exist.

2,400 shares 540,000 d. To determine whether securities are properly

May 31 Receipt of Emong classified on the statement of financial position.

share dividend–

Offsetting Credit to 132,000 7. A client has a large and active investment portfolio

retained earnings that is kept in a bank safe-deposit box. If the auditor

Aug. 15 Sale of Emong – is unable to count the securities at the end of the

4,800 shares 1,176,000 reporting period, the auditor most likely will

Sept. 1 Sale of Emong – a. Request the bank to confirm to the auditor the

1,200 shares 276,000 contents of the safe deposit box at the end of the

reporting period.

The following information was obtained during your b. Examine supporting evidence for transactions

examination: occurring during the year.

c. Count the securities at a subsequent date and

From independent sources, you determine the following confirm with bank whether securities were added

dividend information for 2020: or removed since the end of the reporting period.

Nature Declared Record Payment Rate d. Request the client to have a bank seal the safe-

Cash 01/02 01/15 01/31 P20/share deposit box until the auditor can count the

Share 05/02 05/15 05/31 10% securities at a subsequent date.

Cash 08/01 08/30 09/15 P30/share

8. In establishing the existence and ownership of an

Closing market quotation as at December 31, 2020: investment held by a corporation in the form of

publicly traded shares an auditor should inspect the

Bid Ask

securities or

Emong shares P210 P220

a. Obtain written representations from management

Bobads shares 240 250

confirming that the securities are properly

classified as trading securities.

QUESTIONS:

b. Inspect the audited financial statements of the

Based on the above and the result of your audit, answer investee company.

the following: c. Confirm the number of shares held by an

independent custodian.

1. In relation to March 1 transaction, the necessary

d. Determine that the investment is carried at the

adjusting journal entry includes

lower of cost or market.

a. A debit to Loss of P60,000

b. A credit to Equity investment-FVTPL of P600,000 9. Which of the following is the least effective audit

c. Both a and b procedure regarding the existence assertion for the

d. Neither a nor b securities held by the auditee?

2. In relation to August 15 transaction, the necessary a. Examination of paid checks issued in payment of

adjusting journal entry includes securities purchased.

a. A debit to Equity investment-FVTPL of P216,000 b. Vouching all changes during the year to supporting

b. A debit to Loss of P15,300 documents.

c. A credit to Gain of P216,000 c. Simultaneous count of liquid assets.

d. A credit to Equity investment-FVTPL of P15,300 d. Confirmation from the custodian.

3. In relation to September 1 transaction, the necessary 10. In performing tests of the carrying amount of trading

adjusting journal entry includes securities, the auditor would usually:

a. A debit to Equity investment-FVTPL of P36,000 a. Ask management to estimate the market value of

b. A credit to Gain of P36,000 the securities.

c. Both a and b b. Refer to the quoted market prices of the securities.

d. Neither a nor b c. Value the securities at cost regardless of their

market prices.

4. The carrying amount of Equity investment-FVTPL as of

d. Count the securities.

December 31, 2020 is overstated by

a. P228,000 c. P60,000

b. P102,000 d. P 0

PROBLEM NO. 2

The LEE BUYS COMPANY had acquired interest in a promising local company, the Silver Tab Company. During your

audit of the company’s accounts for the year 2020, which was a first audit, you obtained the following:

Page 2 of 6 www.teamprtc.com.ph AP.2906

EXCEL PROFESSIONAL SERVICES, INC.

Investment in Silver Tab Company

2018–Jan. 2 30,000 sh @35 P1,050,000 2020–Jul. 15 50,000 sh @40 P2,000,000

2019–Jul. 2 90,000 sh @60 5,400,000

2020–Mar. 2 30,000 sh @70 2,100,000

Investment in Red Tab Company

2020 - Aug. 10 P10,000

Dividend Income

2020 January. 2 P120,000

April 1 150,000

August 10 10,000

December 20 100,000

The transactions pertaining to the foregoing for 2020 were SOLUTION GUIDE:

as follows:

Jan. 2 Received cash dividend (declared on December

1) of P1 per share.

Mar. 2 Bought 30,000 shares at P70 per share.

Apr. 1 Received cash dividend (declared on March 1 to

shareholders of record as of March 10) of P1

per share.

July 15 Sold 50,000 shares at P40 per share.

Aug. 10 Received an “extra” dividend in shares of one

share of Red Tab Company for every ten shares

of Silver Tab Company. The share dividend had

a market value of P3 per share and its book

value on the ledger of Silver Tab Company was

P1 per share.

Dec.20 Received cash dividend of P1 per share,

declared December 1, out of Silver Tab

Company’s “Reserve for Depletion”.

29 Sold 10,000 Silver Tab Company shares at P90.

Cash was received on January 5, 2021.

QUESTIONS:

Based on the above and the result of your audit, determine

the following:

PROBLEM NO. 3

1. Loss on sale of 50,000 Silver Tab Company shares on

July 15 Your audit of the Norte Corp. disclosed that the company

a. P250,000 c. P1,300,000 owned the following securities on December 31, 2019:

b. P850,000 d. P0 FA@FVTPL

2. Gain on sale of 10,000 Silver Tab Company shares on Security Shares Cost Fair value

December 29 Vigan, Inc. 9,600 P144,000 P184,000

a. P330,000 c. P300,000 Laoag, Inc. 16,000 432,000 288,000

b. P310,000 d. P0 10% , P200,000 face

value , Santiago

3. Adjusted balance of Investment in Silver Tab Company bonds (interest

as of December 31, 2020 payable every

a. P5,130,000 c. P5,580,000 Jan. 1 and Jul. 1) 158,400 163,440

b. P5,570,000 d. P5,640,000 Total P734,400 P635,440

4. Dividend income for the year ended Dec. 31, 2020

FA@FVTOCI

a. P150,000 c. P180,000

Security Shares Cost Fair value

b. P160,000 d. P280,000

Candon Products 32,000 P1,376,000 P1,540,000

5. Which of the following is the most effective audit Pagudpud, Inc. 240,000 6,240,000 5,840,000

procedure for verification of dividends earned on Batac, Inc. 80,000 960,000 1,280,000

investments in equity securities? Total P8,576,000 P8,660,000

a. Tracing deposited dividend checks to the cash

receipts book. FA@AC

b. Reconciling amount received with published Amortized

dividend records. Cost Fair value

c. Comparing the amounts received with preceding 12%, 2,000,000 face

year dividends received. value, Ilocos bonds

d. Recomputing selected extensions and footings of (interest payable

dividend schedules and comparing totals to the annually every Dec. 31) P1,926,000 P1,900,000

general ledger.

Page 3 of 6 www.teamprtc.com.ph AP.2906

EXCEL PROFESSIONAL SERVICES, INC.

During 2020, the following transactions occurred: PROBLEM NO. 4

Jan. 1 Receive interest on the Santiago bonds. Assassin Corporation’s accounting records included the

following investments:

Mar. 1 Sold 8,000 shares of Laoag Inc. for

P152,000, net of transaction cost of P7,600. Investment in Ordinary Shares

1/1/18 P1,000,000 7/1/20 P800,000

May 15 Sold 3,200 shares of Batac, Inc. at fair value 12/31/18 200,000

of P17 per share. The entity paid transaction 12/31/19 300,000

cost of P2,400.

July 1 Received interest on the Santiago bonds. Investment in Bonds

Dec. 31 Received interest on the Ilocos bonds. 1/1/20 P1,051,510

31 Because of the change in business model,

the entity transferred the Ilocos bonds to During the course of your audit, you noted the following.

FA@FVTOCI. The bonds were selling at 101

on this date. The bonds were originally Investment in Ordinary Shares

purchased at an effective rate of 14%. The investment is not designated at FVTOCI.

Acquired on January 1, 2018 at P950,000 plus

The fair values of the shares and bonds on December 31, transaction costs of P50,000.

2020, are as follows: On July 1, 2020, the entity sold half of the investment

Vigan, Inc. P22 per share for its fair value of P800,000.

Laoag, Inc. P15 per share Fair value of the investment: December 31, 2018,

10% Santiago bonds P151,200 P1,200,000; December 31, 2019, P1,500,000;

Candon Products P42 per share December 31, 2020, P900,000.

Pagudpud, Inc. P28 per share

Batac, Inc. P18 per share Investment in Bonds

The entity uses the ‘held for collection’ business model

The company’s accounting policy is that when an equity for acquired and originated debt instruments.

investment classified as FVTOCI is sold, the accumulated P1,000,000, 10% bonds, purchased for P1,051,510

OCI amount is transferred to retained earnings. including transaction costs of P20,000. Interest is

payable annually every December 31. The bonds

QUESTIONS: mature on December 31, 2022. The effective interest

rate is 8%.

Based on the above and the result of your audit, determine The prevailing market rate for the bonds is 9% at

the following: December 31, 2020.

1. Total interest income for the year 2020

QUESTIONS:

a. P251,120 c. P286,000

b. P260,000 d. P289,640 Based on the above and the result of your audit, answer

the following:

2. On ‘reclassification date’, the amount to be recognized

in other comprehensive income on the reclassification

1. The carrying amount of Investment in Ordinary Shares

of Ilocos bonds

as of December 31, 2020 is misstated by

a. P123,640 c. P64,360

a. P200,000 over c. P50,000 over

b. P 94,000 d. Nil

b. P200,000 under d. P50,000 under

3. Gain or loss on sale of 8,000 Laoag, Inc. shares on

2. The carrying amount of Investment in Bonds as of

March 1

December 31, 2020 is overstated by

a. P8,000 gain c. P64,000 loss

a. P13,900 c. P18,020

b. P8,000 loss d. P64,000 gain

b. P15,880 d. P33,900

4. In relation to the sale of 3,200 Batac, Inc. shares on

3. The net amount to be recognized in 2020 profit or loss

May 15, the net amount to be recognized in profit or

related to these investments is

loss

a. P384,121 c. P134,121

a. P13,600 c. P800

b. P284,121 d. P114,121

b. P 2,400 d. Nil

4. If the investment in bonds is FVTOCI, the carrying

5. Adjusted carrying amount of investments as of

amount as of December 31, 2020 is overstated by

December 31, 2020

a. P15,880 c. P33,900

FA@FVTPL FA@FVTOCI

b. P18,020 d. P38,020

a. P602,400 P 9,446,400

b. P482,400 P 9,446,400 5. An audit procedure that provides evidence about

c. P602,400 P11,466,400 proper valuation of equity securities classified as

d. P482,400 P11,466,400 FA@FVTPL is

a. Confirmation of securities held by broker.

6. The accumulated OCI to be reported as separate

b. Calculation of premium or discount amortization.

component of equity at December 31, 2020

c. Recalculation of investment carrying amount by

a. P840,800 c. P908,800

applying the equity method.

b. P892,800 d. P924,800

d. Comparison of carrying amount with current

7. The amount to be recognized in 2020 OCI market quotations.

a. P840,800 c. P908,800

b. P892,800 d. P924,800

Page 4 of 6 www.teamprtc.com.ph AP.2906

EXCEL PROFESSIONAL SERVICES, INC.

PROBLEM NO. 5 a. P15,000 c. P 85,000

b. P70,000 d. P120,000

On January 3, 2018, JR Company purchased for P500,000

cash a 10% interest in Judi Corp. On that date the net 2. The net amount to be recognized in 2019

assets of Judi had a book value of P3,750,000. The excess comprehensive income related to this investment?

of cost over the underlying equity in net assets is a. P20,000 c. (P25,000)

attributable to undervalued depreciable assets having a b. (P45,000) d. P15,000

remaining life of 10 years from the date of JR's purchase.

3. If the entity used the ‘fair value as deemed cost

The investment in Judi Corp. was designated as FVTOCI.

approach’ in accordance with PIC Q&A No. 2019-06,

the carrying amount of the investment in Judi Corp. as

The fair value of JR's investment in Judi securities is as

of December 31, 2020 is

follows: December 31, 2018, P570,000; December 31,

a. P2,200,000 c. P2,190,000

2019, P525,000; December 31, 2020, P2,200,000.

b. P2,195,000 d. P2,100,000

On January 2, 2020, JR purchased an additional 30% of 4. If the entity used the ‘accumulated cost approach’ in

Judi's stock for P1,575,000 cash when the book value of accordance with PIC Q&A No. 2019-06, the carrying

Judi's net assets was P4,150,000. The excess was amount of the investment in Judi Corp. as of December

attributable to depreciable assets having a remaining life of 31, 2020 is

8 years. a. P2,200,000 c. P2,195,000

b. P2,198,125 d. P2,173,125

During 2018, 2019, and 2020 the following occurred:

5. Which of the following provides the best form of

Judi Dividends Paid by evidence pertaining to the annual valuation of an

Net Income Judi to JR investment in which the independent auditor’s client

2018 P350,000 P15,000 owns a 30% voting interest?

2019 400,000 20,000 a. Market quotations of the investee company’s stock.

2020 550,000 70,000 b. Current fair value of the investee company’s

assets.

QUESTIONS: c. Historical cost of the investee company’s assets.

Based on the above and the result of your audit, answer d. Audited financial statements of the investee

the following: company.

1. The net amount to be recognized in 2018 - now do the DIY drill -

comprehensive income related to this investment?

DO-IT-YOURSELF (DIY) DRILL

PROBLEM NO. 1 Type of Date Date of Date of

Dividend Declared Record Payment Rate

In connection with your audit of the financial statements of

Share 03/15/20 04/01/20 04/30/20 50%

the Pin Shop Company for the year 2020, the following

Cash 11/01/20 11/15/20 11/28/20 P5/share

Investment in Ordinary Shares and Dividend Income

Cash 12/01/20 12/15/20 01/02/21 20%

accounts were presented to you:

Investment in Ordinary Shares

2. Closing market quotation as at December 31, 2020:

Date Description Ref. Debit Credit

01/15 10,000 ordinary Bid Ask

shares, par SPIKES Company ordinary 13-3/4 16-1/2

value P50, VR-

SPIKES Co. 18 390,000 QUESTIONS:

04/30 5,000 shares Based on the above and the result of your audit, answer

SPIKES Co. the following:

received as

share dividend CJ-7 250,000 1. How much is the gain (loss) on the May 20 sale?

05/20 Sold 5,000 CR- a. (P5,000) c. (P70,000)

shares @ P25 21 125,000 b. P5,000 d. P0

12/10 Sold 2,000 CR-

2. How much is the gain on the December 10 sale?

shares @ P60 S2 120,000

a. P68,000 c. P42,000

Dividend Income b. P48,000 d. P0

Date Description Ref. Debit Credit

3. How much is the total dividend income for the year?

04/30 Share dividend SJ-7 250,000

a. P300,000 c. P 50,000

11/30 SPIKES Company CR-

b. P400,000 d. P150,000

ordinary 22 50,000

4. How much is the adjusted carrying amount of

The following information was obtained during your Investment in Ordinary Shares as of December 31,

examination: 2020?

a. P145,000 c. P110,000

1. From independent sources, you determine the

b. P132,000 d. P208,000

following dividend information:

5. How much is the fair value adjustment loss for the

year ended December 31, 2020?

a. P98,000 c. P76,000

b. P35,000 d. P0

Page 5 of 6 www.teamprtc.com.ph AP.2906

EXCEL PROFESSIONAL SERVICES, INC.

PROBLEM NO. 2 10. Which statement is correct regarding audit of

investment securities?

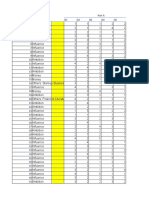

The following subsidiary ledger reflects the trading

a. An auditor’s audit objective is to determine

securities of Gateway Company for the year 2020:

whether the securities are authentic.

TEMPLAR CORP. b. Examination of paid checks issued in payment of

Date Transactions Debit Credit securities purchased is the most effective

Sep. 05 Purchased P1,000,000 procedure to verify existence.

20,000 shares c. In performing tests of the carrying amount of

28 Cash dividends investments in equity securities, the auditor would

to stockholders usually refer to the quoted market prices of the

of record Sept. securities.

15, declared d. If a client has a large and active investment

Aug. 15 P 50,000 portfolio that is kept in a bank safe-deposit box

Oct. 01 Purchase 50,000 and the auditor is unable to count the securities at

shares 2,600,000 the end of the reporting period, the auditor most

05 Sold 20,000 likely will request the bank to confirm to the

shares at P65 1,000,000 auditor the contents of the safe deposit box at the

Nov.30 Cash collected end of the reporting period.

for sale of

20,000 shares

made on Nov. PROBLEM NO. 3

10, after a Nov.

On June 1, 2019, Panday Corporation purchased as a

1 declaration of

‘held for collection’ investment 6,000 of the P1,000 face

P5 cash

value, 8% bonds of Pira Corporation. Panday Corporation

dividend per

has the positive intention and ability to hold these bonds to

share to

maturity. The bonds were purchased to yield 10%

stockholders on

interest. Interest is payable semi-annually on December 1

record as of

and June 1. The bonds mature on June 1, 2025. On

December 1 3,300,000

November 1, 2020, Panday Corporation sold the bonds for

Dec.15 Cash dividend

a total consideration of P5,887,500.

received . 150,000

Totals P3,600,000 P4,500,000

QUESTIONS:

On January 2, 2020, Gateway Company purchased 39,000 Based on the above and the result of your audit, determine

ordinary shares of Dark Co.’s 200,000 ordinary shares the following: (Round off present value factors to four

outstanding for P1,170,000. On that date, the carrying decimal places)

amount of the acquired shares on Dark Co.’s books was

P810,000. Gateway attributed the excess of cost over 11. The purchase price of the bonds on June 1, 2019 is

carrying amount to goodwill. a. P5,467,992 c. P5,545,104

b. P5,536,698 d. P5,436,894

During 2020, Gateway’s president gained a seat on Dark’s

12. The carrying amount of the investment in bonds as of

board of directors. Dark reported profit of P800,000 for

December 31, 2019 is

the year ended December 31, 2020, and declared and paid

a. P5,588,878 c. P5,579,979

cash dividends of P200,000 during 2020.

b. P5,474,311 d. P5,507,237

Market values of the securities at December 31, 2020, are 13. The interest income for the year 2020 is

as follows: a. P459,911 c. P466,827

Templar Corp. P60 per share b. P466,073 d. P457,122

Dark Company P30 per share

14. The gain on sale of investment in bonds on November

QUESTIONS: 1, 2020 is

a. P 31,794 c. P 41,448

Based on the above and the result of your audit, answer b. P120,352 d. P156,068

the following:

15. When an auditor is unable to inspect and count a

6. The gain on sale of 20,000 shares of Templar Corp. client’s investment securities until after the end of the

October 5 is reporting period, the bank where the securities are

a. P350,000 c. P300,000 held in a safe deposit box should be asked to

b. P1,028,500 d. P314,300 a. Verify any differences between the contents of the

box and the balances in the client’s subsidiary

7. The gain on sale of 20,000 shares of Templar Corp. on

ledger.

November 10 is

b. Provide a list of securities added and removed

a. P2,260,000 c. P2,171,600

from the box between the end of the reporting

b. P2,185,800 d. P2,160,000

period and the security count date.

8. How much should be reported as unrealized gain on c. Count the securities in the box so that the auditor

trading securities? will have an independent direct verification.

a. P240,000 c. P257,400 d. Confirm that there has been no access to the box

b. P278,700 d. P 0 between the end of the reporting period and the

security-count date.

9. The adjusted balance of investment in Dark Company

at December 31, 2020 is

a. P1,326,000 c. P1,170,000

b. P1,287,000 d. P1,251,000

- end of AP.2906 -

Page 6 of 6 www.teamprtc.com.ph AP.2906

You might also like

- AP.2906 InvestmentsDocument6 pagesAP.2906 InvestmentsmoNo ratings yet

- ASSET 2019 Mock Boards - AFARDocument8 pagesASSET 2019 Mock Boards - AFARKenneth Christian Wilbur0% (1)

- Audit of Liabilities QuizDocument13 pagesAudit of Liabilities QuizAldrin DagamiNo ratings yet

- Internal Control Measures: Page 1 of 7Document7 pagesInternal Control Measures: Page 1 of 7Lucy HeartfiliaNo ratings yet

- ACCY 303 Midterm Exam ReviewDocument12 pagesACCY 303 Midterm Exam ReviewCORNADO, MERIJOY G.No ratings yet

- Auditing Problems Usl PDFDocument226 pagesAuditing Problems Usl PDFmusic niNo ratings yet

- PPE NotesDocument4 pagesPPE Notesaldric taclanNo ratings yet

- DocxDocument9 pagesDocxKez MaxNo ratings yet

- Mid PS3Document8 pagesMid PS3heyNo ratings yet

- 2023.02.01 Exercises - Audit of Expenditure and Disbursement CycleDocument4 pages2023.02.01 Exercises - Audit of Expenditure and Disbursement Cyclemisonim.eNo ratings yet

- Quiz 1. Special Revenue RecognitionDocument6 pagesQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.No ratings yet

- ACC 142-PeriodicalDocument11 pagesACC 142-PeriodicalRiezel PepitoNo ratings yet

- AACA Inventory Test BankDocument8 pagesAACA Inventory Test BankLiberty NovaNo ratings yet

- Quiz On Audit Report and DocumentationDocument6 pagesQuiz On Audit Report and DocumentationTrisha Mae AlburoNo ratings yet

- Internal controls for production cycleDocument39 pagesInternal controls for production cycleJane GavinoNo ratings yet

- 92 Final PB Aud Sep 2022 Solutions 2Document4 pages92 Final PB Aud Sep 2022 Solutions 2Alliah Mae AcostaNo ratings yet

- Intercom PDocument20 pagesIntercom PLanze Micheal LadrillonoNo ratings yet

- Pinnacle in House CPA Review Tuition Fee UpdatedDocument1 pagePinnacle in House CPA Review Tuition Fee UpdatedRaRa SantiagoNo ratings yet

- Activity 1 Home Office and Branch Accounting - General ProceduresDocument4 pagesActivity 1 Home Office and Branch Accounting - General ProceduresDaenielle EspinozaNo ratings yet

- First PreboardDocument5 pagesFirst PreboardRodmae VersonNo ratings yet

- Chapter 7: Audit of Intangibles and Other Assets: Internal Control Over IntangiblesDocument28 pagesChapter 7: Audit of Intangibles and Other Assets: Internal Control Over IntangiblesUn knownNo ratings yet

- COMPARING CAFÉS AND TEA HOUSES IN SAN JOSEDocument15 pagesCOMPARING CAFÉS AND TEA HOUSES IN SAN JOSEAngel Venus GuerreroNo ratings yet

- Accounting for Special Transactions ExamDocument8 pagesAccounting for Special Transactions ExamMariefel OrdanezNo ratings yet

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNo ratings yet

- Construction ContractttttDocument6 pagesConstruction ContractttttMARTINEZ, EmilynNo ratings yet

- Compre 3Document7 pagesCompre 3casio3627No ratings yet

- Bornasal - Audit of InvestmentsDocument15 pagesBornasal - Audit of Investmentsnena cabañesNo ratings yet

- AP03-03-Audit of Liabilities - EncryptedDocument7 pagesAP03-03-Audit of Liabilities - EncryptedMark Ehrolle S. SisonNo ratings yet

- 94-Final PB-AUD - UnlockedDocument13 pages94-Final PB-AUD - UnlockedJessaNo ratings yet

- Module 13 Other Professional ServicesDocument18 pagesModule 13 Other Professional ServicesYeobo DarlingNo ratings yet

- Forex - Transaction and TranslationDocument13 pagesForex - Transaction and TranslationJoyce Anne MananquilNo ratings yet

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- Sol ManDocument144 pagesSol ManShr Bn100% (1)

- Solution To Chapter 20Document46 pagesSolution To Chapter 20수지No ratings yet

- Auditor's Report on Financial StatementsDocument9 pagesAuditor's Report on Financial StatementsEm-em ValNo ratings yet

- CPA Review School Philippines Financial Accounting PreboardDocument18 pagesCPA Review School Philippines Financial Accounting PreboardAllyson VillalobosNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- This Study Resource Was: Saint Paul School of Business and LawDocument4 pagesThis Study Resource Was: Saint Paul School of Business and LawKim FloresNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- Auditing final preboard since 1977Document7 pagesAuditing final preboard since 1977Floriza Cuevas Ragudo100% (1)

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezNo ratings yet

- Ap-600S: Solutions To Quizzer On Investing Cycle - Audit of InvestmentsDocument8 pagesAp-600S: Solutions To Quizzer On Investing Cycle - Audit of InvestmentsChristine Jane AbangNo ratings yet

- Quiz Number 3Document3 pagesQuiz Number 3Lopez, Azzia M.No ratings yet

- Audit of Cash and Cash Equivalents Internal ControlsDocument7 pagesAudit of Cash and Cash Equivalents Internal ControlsRNo ratings yet

- AP Solutions 2016Document13 pagesAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- Toaz - Info Acc110 p2 Quiz 2 Answers Construction Contracts 1 PRDocument10 pagesToaz - Info Acc110 p2 Quiz 2 Answers Construction Contracts 1 PRKimberly Claire AtienzaNo ratings yet

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- Assignment: Assessment: Module 1: Banking and Other Financial InstitutionsDocument14 pagesAssignment: Assessment: Module 1: Banking and Other Financial InstitutionsMiredoNo ratings yet

- LTCC Quiz W AnsDocument4 pagesLTCC Quiz W AnsalyNo ratings yet

- Intacc2 - Assignment 4Document3 pagesIntacc2 - Assignment 4Gray JavierNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Final Examination Auditing and Assurance PrincipleDocument16 pagesColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Final Examination Auditing and Assurance PrincipleFeelingerang MAYoraNo ratings yet

- Book 9Document2 pagesBook 9Actg SolmanNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- Source: Auditing: A Risk Analysis Approach 5 Edition by Larry F. KonrathDocument19 pagesSource: Auditing: A Risk Analysis Approach 5 Edition by Larry F. KonrathMelanie SamsonaNo ratings yet

- AP.2806 Investments PDFDocument6 pagesAP.2806 Investments PDFMay Grethel Joy Perante0% (1)

- AP.3406 Audit of InvestmentsDocument5 pagesAP.3406 Audit of InvestmentsMonica GarciaNo ratings yet

- Rey Ocampo Online! Auditing Problems: Audit of InvestmentsDocument4 pagesRey Ocampo Online! Auditing Problems: Audit of InvestmentsSchool FilesNo ratings yet

- BPS Prelim Exam KADocument19 pagesBPS Prelim Exam KASheena Calderon100% (1)

- TallyDocument15 pagesTallyIo AyaNo ratings yet

- 01 Investment in Equity Securities - V2 With AnswersDocument17 pages01 Investment in Equity Securities - V2 With AnswersJEFFERSON CUTE71% (7)

- PDF Afar Week1 Compiled Questions CompressDocument78 pagesPDF Afar Week1 Compiled Questions CompressIo AyaNo ratings yet

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- PDF Afar Week1 Compiled Questions CompressDocument78 pagesPDF Afar Week1 Compiled Questions CompressIo AyaNo ratings yet

- Partnership Liquidation. Alynna Joy P. IbanezDocument32 pagesPartnership Liquidation. Alynna Joy P. IbanezAllynna Joy83% (6)

- 01 Investment in Equity Securities - V2 With AnswersDocument17 pages01 Investment in Equity Securities - V2 With AnswersJEFFERSON CUTE71% (7)

- X 3Document8 pagesX 3Max Dela Torre0% (1)

- Module 06business Combination PDF FreeDocument19 pagesModule 06business Combination PDF FreeCaptain ObviousNo ratings yet

- Partnership Liquidation. Alynna Joy P. IbanezDocument32 pagesPartnership Liquidation. Alynna Joy P. IbanezAllynna Joy83% (6)

- Ethical TheoriesDocument5 pagesEthical TheoriesRJ De JesusNo ratings yet

- Module 06business Combination PDF FreeDocument19 pagesModule 06business Combination PDF FreeCaptain ObviousNo ratings yet

- X 3Document8 pagesX 3Max Dela Torre0% (1)

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- Memes: Art or Non-ArtDocument2 pagesMemes: Art or Non-ArtIo AyaNo ratings yet

- Auditing Problems Since 1977Document7 pagesAuditing Problems Since 1977Io AyaNo ratings yet

- File 4 PDFDocument2 pagesFile 4 PDFIo AyaNo ratings yet

- GED0106 Graded Formative Assessment 1Document2 pagesGED0106 Graded Formative Assessment 1Io AyaNo ratings yet

- GED0106 Graded Formative Assessment 2Document2 pagesGED0106 Graded Formative Assessment 2Io AyaNo ratings yet

- CPA Ethics Chapter 4 Multiple-Choice QuestionsDocument23 pagesCPA Ethics Chapter 4 Multiple-Choice QuestionsYenny TorroNo ratings yet

- PAS 1 Presentation of FS: Intermediate Accounting Lecture 1Document3 pagesPAS 1 Presentation of FS: Intermediate Accounting Lecture 1Io AyaNo ratings yet

- GED0106 Graded Formative Assessment 1Document2 pagesGED0106 Graded Formative Assessment 1Io AyaNo ratings yet

- GED0106 Graded Formative Assessment 3Document2 pagesGED0106 Graded Formative Assessment 3Io AyaNo ratings yet

- Partnership Formation Exercise No. 1Document1 pagePartnership Formation Exercise No. 1Io AyaNo ratings yet

- Estate Tax Computation and DeductionsDocument14 pagesEstate Tax Computation and DeductionsHaidee Flavier SabidoNo ratings yet

- Auditing Theory Test BankDocument31 pagesAuditing Theory Test BankLyza96% (53)

- General Provisions and ReciprocityDocument29 pagesGeneral Provisions and ReciprocityIo AyaNo ratings yet

- File PDFDocument44 pagesFile PDFIo AyaNo ratings yet

- Error RegconitionDocument15 pagesError RegconitionNguyễn Trần Hoài ÂnNo ratings yet

- Pete 3036Document31 pagesPete 3036SeanNo ratings yet

- Reliance Dividend PolicyDocument3 pagesReliance Dividend PolicySharique AkhtarNo ratings yet

- NPP Sets Guidelines For Parliamentary and Presidential ElectionsDocument12 pagesNPP Sets Guidelines For Parliamentary and Presidential Electionsmyjoyonline.comNo ratings yet

- Topic 2Document9 pagesTopic 2swathi thotaNo ratings yet

- 1.1 Online Shopping Is The Process Whereby Consumers Directly Buy Goods Services Ete From ADocument5 pages1.1 Online Shopping Is The Process Whereby Consumers Directly Buy Goods Services Ete From Aഅർജുൻ പിണറായിNo ratings yet

- Akshay Controls & Automation - IndiaDocument40 pagesAkshay Controls & Automation - IndiaPAULNo ratings yet

- Abraca Cortina Ovelha-1 PDFDocument13 pagesAbraca Cortina Ovelha-1 PDFMarina Renata Mosella Tenorio100% (7)

- Cqi-8 LpaDocument32 pagesCqi-8 LpaMonica AvanuNo ratings yet

- Exam PaperDocument2 pagesExam PapersanggariNo ratings yet

- Emerald Garment VS CaDocument2 pagesEmerald Garment VS CaNorthern SummerNo ratings yet

- Message From The Chairman: Section On International and Comparative AdministrationDocument12 pagesMessage From The Chairman: Section On International and Comparative AdministrationBrittany KeeganNo ratings yet

- Free Fall LabDocument1 pageFree Fall Labapi-276596299No ratings yet

- When To Replace Your Ropes: Asme B30.30 Ropes For Details On The Requirements For Inspection and Removal CriteriaDocument2 pagesWhen To Replace Your Ropes: Asme B30.30 Ropes For Details On The Requirements For Inspection and Removal CriteriaMike PoseidonNo ratings yet

- Change-oriented leadership impacts team climate & potencyDocument17 pagesChange-oriented leadership impacts team climate & potencyAkhwand Abdur Raffi SaulatNo ratings yet

- Credit Role - Jai-KisanDocument2 pagesCredit Role - Jai-Kisan21-23 Shashi KumarNo ratings yet

- 5 Basic Model of PorterDocument6 pages5 Basic Model of PorterJahanvi PandyaNo ratings yet

- What Is Double Taxation PDFDocument3 pagesWhat Is Double Taxation PDFxyzNo ratings yet

- Case: Mcdonald'S - Are You Lovin' It? Mcdonald'S Ongoing Market ResearchDocument4 pagesCase: Mcdonald'S - Are You Lovin' It? Mcdonald'S Ongoing Market ResearchChandan ArunNo ratings yet

- SGLGB ImplementationDocument47 pagesSGLGB ImplementationDILG Maragondon CaviteNo ratings yet

- RC21 ServiceDocument32 pagesRC21 ServiceMuhammedNo ratings yet

- Navy Submarine Battery ManualDocument84 pagesNavy Submarine Battery ManualTrap CanterburyNo ratings yet

- Essay On Causes of Corruption and Its RemediesDocument30 pagesEssay On Causes of Corruption and Its Remediesanoos04100% (2)

- Mining Gate2021Document7 pagesMining Gate2021level threeNo ratings yet

- Form 16 - IT DEPT Part A - 20202021Document2 pagesForm 16 - IT DEPT Part A - 20202021Kritansh BindalNo ratings yet

- Complex Analysis, Gamelin, II.5 Problems and SolutionsDocument3 pagesComplex Analysis, Gamelin, II.5 Problems and SolutionsC. Ephrem StuyvesantNo ratings yet

- BCom Seminar Topics Professors Economics CommerceDocument3 pagesBCom Seminar Topics Professors Economics CommerceShaifali ChauhanNo ratings yet

- Ijcisim 20Document13 pagesIjcisim 20MashiroNo ratings yet

- Sgsoc Esia Oils Cameroon LimitedDocument299 pagesSgsoc Esia Oils Cameroon LimitedcameroonwebnewsNo ratings yet

- MSDS - SYCAMORE Spray PaintDocument6 pagesMSDS - SYCAMORE Spray PaintBatanNo ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Streetsmart Financial Basics for Nonprofit Managers: 4th EditionFrom EverandStreetsmart Financial Basics for Nonprofit Managers: 4th EditionRating: 3.5 out of 5 stars3.5/5 (3)

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Other People's Money: The Real Business of FinanceFrom EverandOther People's Money: The Real Business of FinanceRating: 4 out of 5 stars4/5 (34)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)