Professional Documents

Culture Documents

Revenue Regulations No. 08-20

Uploaded by

rajgonz0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

RR 8-2020

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesRevenue Regulations No. 08-20

Uploaded by

rajgonzCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

April 1, 2020

REVENUE REGULATIONS NO. 08-20

SUBJECT : Rules and Regulations Implementing Section 4 (aa) of

Republic Act No. 11469, Otherwise Known as the

"Bayanihan to Heal as One Act"

TO : All Internal Revenue Officers and Others Concerned

SECTION 1. Scope. — Pursuant to the provisions of Section 244 of the

National Internal Revenue Code (NIRC), as amended, the following Regulations are

hereby promulgated to implement Section 4 (aa) of R.A. No. 11469, otherwise known

as "Bayanihan to Heal as One Act," to wit:

(aa) Direct all banks, quasi-banks, nancing companies, lending

companies, and other nancial institutions, public and private, including the

Government Service Insurance System, Social Security System and Pag-Ibig

Fund, to implement a minimum of a thirty (30)-day grace period for the payment

of all loans, including but not limited to salary, personal housing, and motor

vehicle loans, as well as credit card payments, falling due within the period of

the Enhanced Community Quarantine without incurring interest, penalties, fees,

or other charges. Persons with multiple loans shall likewise be given the

minimum thirty (30)-day grace period for every loan;

In relation to Section 4 (n) thereof which provides:

(n) Ensure the availability of credit to the productive sectors of the economy

especially in the countryside through measures such as, but not limited to,

lowering the effective lending rates of interest and reserve requirements of

lending institutions.

SECTION 2. Coverage. — These regulations cover all extensions of payment

and/or maturity periods of all loans, including but not limited to salary, personal,

housing, and motor vehicle loans, as well as credit card payments, falling due within the

period of the Enhanced Community Quarantine (ECQ) contemplated by Section 4 (aa)

of R.A. No. 11469, including the extension of maturity periods that may result from the

grant of grace periods for these payments, whether or not such maturity periods

originally fall due within the ECQ. These regulations also cover credit restructuring,

micro-lending including those obtained from pawnshops and extensions thereof during

the ECQ Period.

SECTION 3. De nition of Terms. — For purposes of these Regulations and to

ensure effective implementation of Section 4 (n) of the Bayanihan to Heal as One Act,

the following words and phrases shall have the meaning indicated below:

3.1 Covered institutions shall mean all lenders, including but not limited to

banks, quasi-banks, non-stock savings and loan associations, credit card

issuers, pawnshops and other credit granting nancial institutions under

the supervision of the Bangko Sentral ng Pilipinas (BSP), Securities and

Exchange Commission (SEC), and Cooperative Development Authority,

public or private, including the Government Service Insurance System,

Social Security System and Pag-Ibig Fund.

CD Technologies Asia, Inc. © 2020 cdasiaonline.com

3.2 Loan Amortization means a scheduled periodic payment that is applied

to both loan principal and/or interest.

3.3 ECQ Period means the Enhanced Community Quarantine period from 17

March 2020 to 12 April 2020 cited in Proclamation No. 929 dated 16

March 2020.

3.4 Due Date means the maturity date of the principal and/or interest,

including amortizations falling within the ECQ Period.

SECTION 4. Exemption from Documentary Stamp Tax (DST) Pursuant to

Relief for Loans Falling Due within the ECQ Period. — No additional DST, including that

imposed under Sections 179, 195 and 198 of the NIRC, shall apply to credit extensions

and credit restructuring, micro-lending including those obtained from pawnshops and

extensions thereof during the ECQ Period.

SECTION 5. Repealing Clause. — All revenue rules and regulations and other

revenue issuances or parts thereof, which are inconsistent with these Regulations are

hereby repealed or modified accordingly.

SECTION 6. Effectivity. — These Regulations shall take effect upon its

publication in the Official Gazette or in a newspaper of general circulation.

(SGD.) CARLOS G. DOMINGUEZ III

Secretary of Finance

Recommending Approval:

(SGD.) CAESAR R. DULAY

Commissioner of Internal Revenue

CD Technologies Asia, Inc. © 2020 cdasiaonline.com

You might also like

- RMC 036-20Document3 pagesRMC 036-20rajgonzNo ratings yet

- RR No. 24-2020Document3 pagesRR No. 24-2020Dean Stephen CalisinNo ratings yet

- Insurance Companies Must Grant 60-Day Grace Period for Premium PaymentsDocument3 pagesInsurance Companies Must Grant 60-Day Grace Period for Premium PaymentsDanerosNo ratings yet

- Department of Education: Republic of The PhilippinesDocument11 pagesDepartment of Education: Republic of The PhilippinesCyril ForroNo ratings yet

- Bayanihan Act I v. Bayanihan Act IIDocument4 pagesBayanihan Act I v. Bayanihan Act IIN CNo ratings yet

- Ibc V SarfesiDocument24 pagesIbc V SarfesisahilNo ratings yet

- Frequently Asked Questions (Faqs)Document10 pagesFrequently Asked Questions (Faqs)chrstlllaoNo ratings yet

- 2020notice MECQ PDFDocument2 pages2020notice MECQ PDFJuris RazNo ratings yet

- Extend 30-day grace period loans MECQ GCQDocument2 pagesExtend 30-day grace period loans MECQ GCQZenaida LatorreNo ratings yet

- Loans and interest rates deregulatedDocument21 pagesLoans and interest rates deregulatedLouie Ray CagurongNo ratings yet

- Implementing of 4 (Aa) of Act No. Otherwise As The Bayanihan: Section 1.01Document3 pagesImplementing of 4 (Aa) of Act No. Otherwise As The Bayanihan: Section 1.01Jerry SerapionNo ratings yet

- Firstly, The Implementing Rules and Regulation (IRR) Cannot Unduly Limit TheDocument4 pagesFirstly, The Implementing Rules and Regulation (IRR) Cannot Unduly Limit TheedreaNo ratings yet

- Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (Sarfaesi) and Npa ManagementDocument20 pagesSecuritisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (Sarfaesi) and Npa ManagementShirsendu DasNo ratings yet

- Operational Guidelines-ECLGS - Updated As On 07.06.2021Document16 pagesOperational Guidelines-ECLGS - Updated As On 07.06.2021Gautam jainNo ratings yet

- Bayanihan Act Notes On Labor 2020Document27 pagesBayanihan Act Notes On Labor 2020TineNo ratings yet

- Compromise Settlements and Technical Write-OffsDocument5 pagesCompromise Settlements and Technical Write-OffsSaurabh MalooNo ratings yet

- ECLGS Guidelines for Credit Guarantee SchemeDocument17 pagesECLGS Guidelines for Credit Guarantee SchemeUSNo ratings yet

- M.C 2020 18 Regulatory Relief For Coops - Staggered Booking of Allowance For Loan LossesDocument10 pagesM.C 2020 18 Regulatory Relief For Coops - Staggered Booking of Allowance For Loan Lossesasdfjkl asddfNo ratings yet

- One Time Restructuring Circular - RBI - 6th Aug'20Document16 pagesOne Time Restructuring Circular - RBI - 6th Aug'20Mr. UnknownNo ratings yet

- CAS Credit Authorization SchemeDocument6 pagesCAS Credit Authorization SchemeNeeraj GuptaNo ratings yet

- Fixed Licence Fee To Revenue Sharing FeeDocument7 pagesFixed Licence Fee To Revenue Sharing FeemuskanNo ratings yet

- IRDAI Master Circular Unclaimed Amounts of Policyhol 002Document13 pagesIRDAI Master Circular Unclaimed Amounts of Policyhol 002Puran Singh LabanaNo ratings yet

- A Banking Law Presentation On SARFAESI ADocument23 pagesA Banking Law Presentation On SARFAESI AChandra RajanNo ratings yet

- Summary of Mortgage Related Provisions of The Dodd-Frank Wall Street Reform and Consumer Protection ActDocument16 pagesSummary of Mortgage Related Provisions of The Dodd-Frank Wall Street Reform and Consumer Protection ActPaula HillockNo ratings yet

- Policy For Buyers' Line of CreditDocument2 pagesPolicy For Buyers' Line of CreditAbhimaneu NairNo ratings yet

- 2023MC - SEC MC No. 5 S. of 2023 SEC Rules and Regulations of The Financial Products and Services Consumer Protection Act of 2022 2Document30 pages2023MC - SEC MC No. 5 S. of 2023 SEC Rules and Regulations of The Financial Products and Services Consumer Protection Act of 2022 2smurfer smurfetteNo ratings yet

- Letter To East West BankDocument3 pagesLetter To East West BankVanNo ratings yet

- Loan Agreement: Transaction Details ScheduleDocument14 pagesLoan Agreement: Transaction Details ScheduleDerekNo ratings yet

- IBC Amendments Simplify Insolvency ResolutionDocument4 pagesIBC Amendments Simplify Insolvency Resolutiontarun motianiNo ratings yet

- Professional Opportunities and Role That Can Be Served by Chartered Accountants Under Insolvency RegimeDocument25 pagesProfessional Opportunities and Role That Can Be Served by Chartered Accountants Under Insolvency RegimeCA. (Dr.) Rajkumar Satyanarayan AdukiaNo ratings yet

- RA 9238 GRT RegulationsDocument12 pagesRA 9238 GRT RegulationsmaeshachNo ratings yet

- Updated Operational Circular For Issue and Listing of Commercial Paper - April 13 2022Document120 pagesUpdated Operational Circular For Issue and Listing of Commercial Paper - April 13 2022Vani PattnaikNo ratings yet

- Central Bank Circular No. 905: General ProvisionsDocument6 pagesCentral Bank Circular No. 905: General ProvisionsRaezel Louise VelayoNo ratings yet

- Companies (Acceptance of Deposits) Rules 2014Document14 pagesCompanies (Acceptance of Deposits) Rules 2014PratyakshaNo ratings yet

- Role of insolvency resolution under IBCDocument24 pagesRole of insolvency resolution under IBCHemantPrajapatiNo ratings yet

- SBA Loan NoteDocument13 pagesSBA Loan NoteMARC ANDREWS WOLFFNo ratings yet

- Cameroon banking loan rulesDocument10 pagesCameroon banking loan rulesHenri KouamNo ratings yet

- DSAIDocument11 pagesDSAIkipkarNo ratings yet

- MBASummaryof Dodd FrankDocument17 pagesMBASummaryof Dodd FrankbplivecchiNo ratings yet

- Digital Lending in India - Analysis and ImplicationsDocument7 pagesDigital Lending in India - Analysis and Implicationsshailja singhNo ratings yet

- Bajaj Moratorium Policy v1Document5 pagesBajaj Moratorium Policy v1Vilas_123No ratings yet

- SEBI regulations tighten oversight of debenture trusteesDocument10 pagesSEBI regulations tighten oversight of debenture trusteesParth SabharwalNo ratings yet

- RR 09-2004 of The Bureau of Internal RevenueDocument13 pagesRR 09-2004 of The Bureau of Internal RevenuecompaddictNo ratings yet

- Tax Alert (April 2020) FinalDocument30 pagesTax Alert (April 2020) FinalRheneir MoraNo ratings yet

- Corporate Bond GuidelinesDocument12 pagesCorporate Bond GuidelinesnuhubinadamNo ratings yet

- BSP Circular 549Document4 pagesBSP Circular 549Miz09No ratings yet

- A Report On SarfaesiDocument63 pagesA Report On SarfaesiPradhyuman SainiNo ratings yet

- 7 - En-Policy and Procedures For Recovery of Arrears On Loans1Document27 pages7 - En-Policy and Procedures For Recovery of Arrears On Loans1Lovemore TshumaNo ratings yet

- IBC Part V Miscellaneous F2Document43 pagesIBC Part V Miscellaneous F2a.p.singh associatesNo ratings yet

- Non-Bank Sources of Short Term FinanceDocument16 pagesNon-Bank Sources of Short Term FinancePushpa RaniNo ratings yet

- IBC 2016 and IBC Amendment Bill, 2021Document5 pagesIBC 2016 and IBC Amendment Bill, 2021Keshav GuptaNo ratings yet

- Pre-Need Code Explained: Key Provisions and Supreme Court Case AnalysisDocument20 pagesPre-Need Code Explained: Key Provisions and Supreme Court Case AnalysisJoanNo ratings yet

- For ClosureDocument18 pagesFor Closuremau_cajipeNo ratings yet

- Trade LawDocument13 pagesTrade LawRajat MishraNo ratings yet

- CBP Circular Removes Interest Rate CeilingsDocument3 pagesCBP Circular Removes Interest Rate CeilingsSallyAndreaGaspiNo ratings yet

- Banking LawsDocument24 pagesBanking LawsPrankyJellyNo ratings yet

- Moratorium Clix Capital Services Pvt. Ltd.Document7 pagesMoratorium Clix Capital Services Pvt. Ltd.YogeshNo ratings yet

- Small Business Title COVID Package Section-By-Section 12.21.20Document10 pagesSmall Business Title COVID Package Section-By-Section 12.21.20Chad UrdahlNo ratings yet

- Banking Management: (Document Subtitle)Document14 pagesBanking Management: (Document Subtitle)RobinHood TiwariNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- Grounds For Revocation of NWRBDocument4 pagesGrounds For Revocation of NWRBMckent EntienzaNo ratings yet

- Technical Advisory No - 2 s2016Document1 pageTechnical Advisory No - 2 s2016rajgonzNo ratings yet

- Denr Ao 25-13Document31 pagesDenr Ao 25-13rajgonzNo ratings yet

- Annex GDocument5 pagesAnnex GrajgonzNo ratings yet

- Regulatory Advisory No 03 - 2019Document1 pageRegulatory Advisory No 03 - 2019rajgonzNo ratings yet

- Memo To ECs 2021-035Document18 pagesMemo To ECs 2021-035rajgonzNo ratings yet

- Peza MC 2021-051Document6 pagesPeza MC 2021-051rajgonzNo ratings yet

- Denr Ao 07-16Document44 pagesDenr Ao 07-16rajgonzNo ratings yet

- Denr Ao 07-16Document44 pagesDenr Ao 07-16rajgonzNo ratings yet

- Denr Ao 07-18Document2 pagesDenr Ao 07-18rajgonzNo ratings yet

- Denr Ao 07-18Document2 pagesDenr Ao 07-18rajgonzNo ratings yet

- Denr Ao 04-17Document2 pagesDenr Ao 04-17rajgonzNo ratings yet

- Denr Ao 28-16Document15 pagesDenr Ao 28-16rajgonzNo ratings yet

- Denr Ao 24-13Document16 pagesDenr Ao 24-13rajgonzNo ratings yet

- Denr Ao 02-14Document24 pagesDenr Ao 02-14rajgonzNo ratings yet

- Denr Ao 07-10Document7 pagesDenr Ao 07-10rajgonzNo ratings yet

- Denr Ao 04-17Document2 pagesDenr Ao 04-17rajgonzNo ratings yet

- ".) A"I1""V Hor: ",C, Ili - Atory CoDocument19 pages".) A"I1""V Hor: ",C, Ili - Atory CorajgonzNo ratings yet

- Denr Ao 07-10Document7 pagesDenr Ao 07-10rajgonzNo ratings yet

- Revenue Memorandum Circular No. 035-20Document1 pageRevenue Memorandum Circular No. 035-20rajgonzNo ratings yet

- Order,+ERC+Case+No +2015-021+MCDocument9 pagesOrder,+ERC+Case+No +2015-021+MCrajgonzNo ratings yet

- Appendix "A": 12.5 MW Biomass PP Roman Superhighway, Brgy. Gugo, Samal, BataanDocument5 pagesAppendix "A": 12.5 MW Biomass PP Roman Superhighway, Brgy. Gugo, Samal, BataanrajgonzNo ratings yet

- Published: Manila Bulletin and Business Mirror /august 23, 2018 Manila Standard /january 25, 2019Document14 pagesPublished: Manila Bulletin and Business Mirror /august 23, 2018 Manila Standard /january 25, 2019rajgonzNo ratings yet

- Revenue Memorandum Circular No. 077-12: CD Technologies Asia, Inc. © 2019Document3 pagesRevenue Memorandum Circular No. 077-12: CD Technologies Asia, Inc. © 2019rajgonzNo ratings yet

- Dao2006 01 PDFDocument1 pageDao2006 01 PDFLiezel NibresNo ratings yet

- DecisionERCCaseNo2015 055MCDocument16 pagesDecisionERCCaseNo2015 055MCrajgonzNo ratings yet

- Dao2006 01 PDFDocument1 pageDao2006 01 PDFLiezel NibresNo ratings yet

- DENR Administrative Order No. 98 appraisal rules summaryDocument8 pagesDENR Administrative Order No. 98 appraisal rules summaryKerwin LopezNo ratings yet

- HLF065 ChecklistOfRequirements Window1 V04Document2 pagesHLF065 ChecklistOfRequirements Window1 V04Alex Olivar, Jr.No ratings yet

- Income Tax Semifinals ExamDocument5 pagesIncome Tax Semifinals ExamFeelingerang MAYoraNo ratings yet

- Sri Sai Srinivasa Cotton Industries PVT LTDDocument36 pagesSri Sai Srinivasa Cotton Industries PVT LTDManisha NerellaNo ratings yet

- Martingales, Wiener Processes & Ito's LemmaDocument35 pagesMartingales, Wiener Processes & Ito's Lemmanischal mathurNo ratings yet

- Construction of Bridge Over Andermanik River With Related Works at Payra Port Under Payra Port's First Terminal ProjectDocument2 pagesConstruction of Bridge Over Andermanik River With Related Works at Payra Port Under Payra Port's First Terminal ProjectParvez Syed RafiNo ratings yet

- Distributor & Delaer Sample 1Document11 pagesDistributor & Delaer Sample 1Anonymous FUaym5kNo ratings yet

- 144A Vs RegSDocument1 page144A Vs RegSshrutias1989No ratings yet

- Capital MarketDocument16 pagesCapital Marketdeepika90236100% (1)

- Castrap Fast Start ManualDocument11 pagesCastrap Fast Start ManualSherry KalianNo ratings yet

- Consolidated statement of financial position for Hever group incorporating associateDocument2 pagesConsolidated statement of financial position for Hever group incorporating associateGueagen1969No ratings yet

- Invoice 1955484Document2 pagesInvoice 1955484Sundararajan JagannathanNo ratings yet

- Sample Resolution Transfer-SignatoriesDocument2 pagesSample Resolution Transfer-SignatoriesJaymart C. EstradaNo ratings yet

- Portfolio Construction at ING VYSYA BankDocument11 pagesPortfolio Construction at ING VYSYA BankMOHAMMED KHAYYUMNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Garuda Indonesia I.1 Garuda Indonesia at GlanceDocument14 pagesGaruda Indonesia I.1 Garuda Indonesia at GlanceveccoNo ratings yet

- ICB's Role in Capital MarketsDocument22 pagesICB's Role in Capital MarketsHabibur RahmanNo ratings yet

- Cendana - CITYZEN HILLS - 291123-1Document5 pagesCendana - CITYZEN HILLS - 291123-1Oky Arnol SunjayaNo ratings yet

- BHARATH Et Al-2013-The Journal of Finance PDFDocument33 pagesBHARATH Et Al-2013-The Journal of Finance PDFpraveena1787No ratings yet

- Problem Set: Capital Budgeting: RJW 4 Ed. Chapter 6Document1 pageProblem Set: Capital Budgeting: RJW 4 Ed. Chapter 6alan david melchor lopezNo ratings yet

- Business Studies Class 12 Project 2014-15Document15 pagesBusiness Studies Class 12 Project 2014-15Raghav Aggarwal17% (6)

- UBS Global Wealth Report 2018 enDocument60 pagesUBS Global Wealth Report 2018 enDavid KwokNo ratings yet

- SChedule VIDocument88 pagesSChedule VIbhushan2011No ratings yet

- Citibank SingaporeDocument8 pagesCitibank SingaporeYudis TiawanNo ratings yet

- Because or Due ToDocument9 pagesBecause or Due ToJiab PaodermNo ratings yet

- Business Studies Holiday Homework: Art Integration ProjectDocument13 pagesBusiness Studies Holiday Homework: Art Integration ProjectAayush KapoorNo ratings yet

- NIT31Document129 pagesNIT31abhishitewariNo ratings yet

- SAP BalanceSheetDocument1 pageSAP BalanceSheetBlesszie VillegasNo ratings yet

- CA Final SFM Very Short Formula Book Nov 2020Document36 pagesCA Final SFM Very Short Formula Book Nov 2020Romaric DjokoNo ratings yet

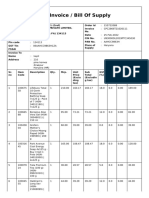

- Tax Invoice / Bill of SupplyDocument2 pagesTax Invoice / Bill of SupplyKapil SinglaNo ratings yet

- Material 1.1 Additional NotesDocument2 pagesMaterial 1.1 Additional NotesCristine Joy BenitezNo ratings yet