Professional Documents

Culture Documents

19 Deferredincometax0001

19 Deferredincometax0001

Uploaded by

badette Paningbatan0 ratings0% found this document useful (0 votes)

5 views7 pagesOriginal Title

19-deferredincometax0001

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views7 pages19 Deferredincometax0001

19 Deferredincometax0001

Uploaded by

badette PaningbatanCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

SyCip. Gorres, Velayo & Co

6760 Ayala Avenue

Makati, Rizal

MEMO TO AUDIT STAFE

ACCOUNTING FOR TIMING DIFFERENCES

ARISING FROM INCOME TAX COMPUTATIONS

‘The APB of the AICPA has recently released Opinion No. 11 entitled |

"Accounting for Income Taxes.” The sections of this Opinion on “timing \

differences" and “tax allocation within a period" are applicable to local

situations and therefore must be considered in preparing financial statements

for use in the United states (c.g., subsidiaries and branches of U.S. firms),

in which adoption of the Opinion is a must for those with fiseal periods

beginning after December 31, 1967, However, as in the case of all other

Opinions, APB No, 11 is not intended to apply to immaterial items, The

staff is also reminded that the partner or manager in charge of the job be

Informed of the applicability of the APB before such is discussed with the

client, Likewise, if a locel client wishes to apply the Opinion, the matter

should first be referred to the partner or manager in-charge.

Timing Differences

By “timing differences” is meant the differences between the periods

in which transactions affect taxable income and the periods in which they

enter into the determination of pretax accounting income. Some timing

differences reduce income taxes thar would otherwise be payable currently;

others increase income taxes that would otherwise be payable currently.

Four types of transactions are identifiable which give rise co timing

differences.

Revenues of gains are included in taxable income later than they

Included in pretax accounting income.

Example: Gross profits on installment sales recognized for

accounting purposes in the period of sale but reported for

tax purposes in the period the installments are collected.

2, Expenses of losses are deducted in determining taxable income

later than they are deducted in determining pretax accounting

Income.

Example: Estimated costs of guarantees and of product

wartanty contracts are recognized for accounting purposes

tn the current period but reported for tax purposes in the

petiod paid or in which the Ifability becomes fixed

In the Philippines the more typical example is provision for

doubtful accounts recorded for accounting purposes in the current

period but reported for tax purposes in the perlod losses are ac-

tually sustained,

(This bulletin ts for the use of SGV staff members only;

At should not be shown to persons not associated with the Firm.)

Kogust 13, 1968 Audit Bulletin No. 118-68

-2-

4. Revenues or gains are included in taxable income earlier than they

are included in pretax accounting income. |

Example: Rents collected in advance are reported for tax pure

pores in the period in which they are received but are deferred

for accounting purposes until later periods when they are earned.

4. Expenses of losses ace deducted in determining taxable income

safle than they are deducted in determining pretax accounting

Trample: Depreciation reported on an accelerated basis for

tan perposer but reported on a steaight-line basis for account

ing purposes.

Additional examples of each type of timing difference are presented ta

Appendix A of APB No. 11, These have also been reproduced in The SGV

Research Newsletter dated February 1968.

Treatment of Timing Differences

The process of spportioning income taxes among periods (termed

sinterperiod tax allocation") {s done by means of the deferred methods that

In, the tax effects of current timing differences are deferred and are allocated

tovincome tax expense of future periods when the timing differences tever

The deferred taxes are determined on the basis of the tax races in effect a

the time the timing differences originate and are nor adjusted for subsequent

Changes In tax rates of to teflect the imposition of new taxes, The tax effects

Sf trensactions which reduce taxes currently payable are treated as deferced

Credits, the tax effects of transactions which increase taxes currently payable

are treated as deferred charge

Thus, income tax expense should include the tax effects of revenue and

expense transactions included in the determination of pretax accounting in=

Come. The tax effects of transactions which enter into the determination of

pretax accounting income (cither earlier or later than they enter into the de~

Termination of taxable income) should be recognized

First, in the periods in which the differences between pretax account

ing Income and taxable income arise: and

Second, in the periods in which the differences reverie,

Computation of the Tax Effect of &

Timlag Difference

The tax effect of a timing difference is measured by the differential

between income taxes computed with and Income taxes computed without ine

Clusion of the transaction creating the difference between taxable Income

and pretax accounting income. The resulting income tax expense for the

period includes the tax effects of transactions entering Into the determination

of results of operations for the period, The resulting deferred tax amounts

reflect the tax effects which will reverse in future periods,

August 18, 1968 Audit Bulletin No. 22

ane

Measurement of tax effects is bared om parallel of dual com Pulst’ as.

The first computation shows the amount of taxes that would have been payable

Te ihe yeat on the income shown io the tax return. The second computation

iran the amount of taxes that would have been payable for the year based on

pretax accounting income adjusted for any perme differences. "* The

PT iicrenccloetmben) distamauate(to) com pelea eine cata of the tax effects

(See Illustrative computations, last part of this bulletin.)

‘Tax Allocation Within a Perled

tax allocation within a period ts applied in order to obtain £8 appro-

priate relationship between income sax expense and

1, income before extraordinary items,

2, extraordinary items,

4, adjustments of prior periods of of the opening balance of retained

earnings, and

4 direct entries to other stockholders’ equity accountty

the income tax expense attributable to income before extiserdinery

ttems is computed by determining the income tax expense related to revenue

LM peace transnctions entering into the determination of ¢uch income,

Nithour giving effect to the tax consequences of the treme excluded from the

wirbent Eiiomof income before extraordinary items, The income 0% Stent

dere rm iaple co other items i determined by the tax consequences of L’Att”

seeesbuiable ving chese items. If an operating lost exists befoce extrscrsnaly

setlent lhe vax consequences of such loss should be associated with (he loss.

fu Reportin

Following are guidelines for balance sheer aad Income statement Pi

sentation of the tax effects of timing differences.

Balance Sheet

Deferred charges and deferred credits relating to timing differ

cancer should be classified in two categories - one for the net

Current amount and the other for the net noncurrent amounts

This preventation is consistent with the customary distinction

between current and noncurrent categories and also recognizes

“Defined a1 differences between taxable income and pretax accounting income

arising from tranractions that, under applicable tx laws and regulations, will

fot be offaet BY corresponding difference or “turn amound™ 48 that period

tnamplen: 18% of dividends received by a domestic corfarsiion from another

Mlomestic corporation, ineeat recelved an government bands,

August 19, 1968 Audit Bulletin No, 128-68

the close relationship among the various deferred .ax accounth,

dil of which bear upon the determination of income tax expense.

The current portions of such deferted charges and credits should

re thove amounts which relate to assets and liabilities classified

ts current, Thus, if installment receivables are a current asset.

tne deferred credits representing the tax effects of uncollected

Installment sales should be a current item; if an estimated proe

vision for warranties is a current liability, the deferred charge

Tepresencing the tax effect of such provision should be # current

item.

Deferred taxes represent tax effects recognized in the determina”

tion of income tax expense in current and prior periods, and they

[nould, therefore, be excluded from retained earnings of from any

Sther account in the stockholders’ equity section of the basance

sheet.

Income Statement

w

2

Avguer 18, 1968 Audit Bulletin No. 32

In reporting the results of operations the components of Income

tax expente for the period should be disclosed, for example.

. Taxes estimated to be payable

b. Tax effects of timing differences

‘These amounts should be allocated to (a) Income before extra~

Grdinaty items and (b) extraordinary items and may be presented

ai separate items in the Income statement or, alternatively, a1

fombined amounts with disclosure of the components parenthe-

tically of in & note to the financial stacements,

‘Tax effects attributable to adjustments of prior periods (or of the

Opening balance of retained earnings) and direct entries to other

ceoeuneldert’ equity accounts should be presented as adjustments

of auch items with disclosure of the amounts of the tax effects,

The nature of significant differences between pretax accounting

Income and taxable income should be disclosed.

‘The “net of tax" form of presentation (in which the tex effects

are considered to be valuation adjustments to the assets or Liable

Litter giving rise to the adjustments) should not be used for fi-

nancial reporting. The tax effects of transactions entering into

the determination of pretax accounting income for one period but

Affecting the determination of taxable income aa different pes

tiod should be reported in the income statement as elements of

income tax expense and in the balance sheet as tax allocation

accounts (deferred taxes) and not as elements of valuation of

assets of Iabilities,

General

1. If destred, the foregoing recommendations on income tax account~

ing may be applied revsoactively to periods prior to the effective

dave in order to obtain comparability in financial presentations

for the cuctent and future periods, If the procedures are applied

retroactively, they should be applied to all material items of

those periods insofar as the recognition of prior period tax effects

of timing differences and other deductions of credits Is concerned.

2, Any adjustments made to give retroactive effect to the conclusions

atated in this Opinion should be considered adjustments of prior

periods and treated accordingly.

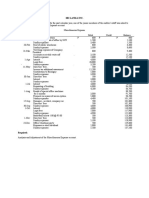

Wusteative Computation - Timing Differences

Following are {Llustrations of the dual computation of timing differenc

for three consecutive years. Assumed data in all cases are pretax accounting

income of P120,000 and income tax rate of 30%

Fist Year

Pretax accounting income (per Statement

of Income)

Initial timing difference + Provision for

doubtful account

Permanent difference + Interest received

‘on DBP bonds

‘Taxable Income

‘Tax (assumed at 90%

Difference = Income tax expeme

applicable to furure years, wlien

bad debts are actually written off

land deducted for tax purposes

ery

Provision for income tax + P35, 400

Deferred income tax - 1,500

Income tax payable - 738,900,

‘The deferred income tax in this case will be shown in the balance

August 13, 1968 Audis Bulletin No, 328-68

55 i

. sheet as a current asset since it relates to accounts receivable which {s ;

current asset. t

Second Ye :

Income Tax Statement of

ee eee

Pretax accounting income (per Statement

of Income) 120,000, 120,000

¢ Initial timing difference ~ Provision for

doubtful accounts 6,000

Reversal of timing difference - Bad debur

written off charged against allowance

for doubrful accounts 3,000)

: Permanent difference - Interest received .

‘on DBP bonds 12,900) 2,000)

‘Taxable Income 123,000 £218,000

‘Tax (assumed at 30% 236,300 35,400

Difference + Income tax expense

applicable to future years, when

bad debus are actually writen off

and deducted for tax purposes 200

Book entry:

Provision for income t. - 735,400

Deferred income tax - 900

Income tax payable

Balance of deferred income tax in the balance sheet at this time will

be P2,400 (P1,500 last year plus P900 this year) representing 30% of total

provision for doubtful accounts of P8,000 (PS, 000 Last year plus P3,000 -

net this yeas) not yet charged with actual accounts written off.

‘Thicd Year

Pretax accounting income (per Statement

of Income) 120, 000 P120,000

Initial timing difference - Provision for

doubtful accounts

4,000 4

(Forward)

Augu

1s,

168

Audit Bulletin No. 118-68

-1-

: tncome Tax suaemest of

a ome

fever of timing difference ~ Bad debu

‘ten of charged again allowance

for doubeful accounts © 6,000

Permanent difference ~ Inert received os

2 Dpe bonds 2,000) 2,000)

‘op of dividends received from another :

domestic corporation 0 (2,000

Taxable come 5,000 211,000

Tax (asumed at 30%) 34,00 £25,200

Difference ~ Reduction in tax payable :

forthe euent yea, repretnting

txcea of amounts actually weiten

off over entimated provision for

doubt accounts £300

Book entry:

e@ provision for income tax = 35, 100

Deferred income tax = 300

Tacome tax payable ~ 34,800

‘At this time the balance of deferred income tax in the balance sheet

Will be P2,100 (P2, 400 last year less P3900 this year) representing 30% of

total provision for doubtful accounts of 7,000 (8,000 last year reduced

this year by P1,000, excess of bad debt write-offs over provision for doubtful

decounts).

lu n dh

(This bultecia ty for the use of SGV staff members only:

e@ in mould not be shown to persons nor associated with the Firm.)

Nogust 18, 1968 Audie Bulletia No, 116-68

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- "Avoid Surprises On Deferred Income Taxes" by Lucy L. Chan and Armin F. Tulio (October 24, 2011)Document3 pages"Avoid Surprises On Deferred Income Taxes" by Lucy L. Chan and Armin F. Tulio (October 24, 2011)badette PaningbatanNo ratings yet

- Session 22 - Study GuideDocument2 pagesSession 22 - Study Guidebadette PaningbatanNo ratings yet

- Aqueduct - 2018-fs - For Discussion and AdjustentDocument553 pagesAqueduct - 2018-fs - For Discussion and Adjustentbadette PaningbatanNo ratings yet

- Mgt-Letter - Illustrative MGT LetterDocument3 pagesMgt-Letter - Illustrative MGT Letterbadette PaningbatanNo ratings yet

- 2016-Recon Retained EarningsDocument4 pages2016-Recon Retained Earningsbadette PaningbatanNo ratings yet

- Session 21. Study GuideDocument2 pagesSession 21. Study Guidebadette PaningbatanNo ratings yet

- 2016-Recon Retained EarningsDocument1 page2016-Recon Retained Earningsbadette PaningbatanNo ratings yet

- ACCADocument12 pagesACCAbadette PaningbatanNo ratings yet

- 2016 CoverDocument1 page2016 Coverbadette PaningbatanNo ratings yet

- Josefa de La Cruz: 0210 Dimapakali Road, Ututan Village Mabantut, Cavite CityDocument2 pagesJosefa de La Cruz: 0210 Dimapakali Road, Ututan Village Mabantut, Cavite Citybadette PaningbatanNo ratings yet

- Notes To Financial StatementsDocument17 pagesNotes To Financial Statementsbadette Paningbatan100% (1)

- Cover Sheet: For Audited Financial StatementsDocument2 pagesCover Sheet: For Audited Financial Statementsbadette PaningbatanNo ratings yet

- 2016 CoverDocument1 page2016 Coverbadette PaningbatanNo ratings yet

- Sinabalbalan Company Working Papers - Patent December 31, 2015Document2 pagesSinabalbalan Company Working Papers - Patent December 31, 2015badette PaningbatanNo ratings yet

- Business Ethics Chapter 22Document5 pagesBusiness Ethics Chapter 22badette PaningbatanNo ratings yet

- Able Company Reconciliation With Supplier's Account December 31, 2015 Voucher Accounts Payable Receivable Particulars Per Client Per SupplierDocument1 pageAble Company Reconciliation With Supplier's Account December 31, 2015 Voucher Accounts Payable Receivable Particulars Per Client Per Supplierbadette PaningbatanNo ratings yet

- Business Ethics Chapter 21 PDFDocument3 pagesBusiness Ethics Chapter 21 PDFbadette PaningbatanNo ratings yet

- Business Ethics Chapter 21 PDFDocument3 pagesBusiness Ethics Chapter 21 PDFbadette PaningbatanNo ratings yet

- Benjamin Yu vs. NLRC and Jade Mountain Products Company Limited, Et - AlDocument15 pagesBenjamin Yu vs. NLRC and Jade Mountain Products Company Limited, Et - Albadette PaningbatanNo ratings yet

- Sri LankaDocument1 pageSri Lankabadette PaningbatanNo ratings yet